2019 CBRE INVESTOR DAY Exhibit 99.2

Forward Looking Statements This presentation contains statements that are forward looking within the meaning of the Private Securities Litigation Reform Act of 1995. These include statements regarding CBRE’s future growth momentum, operations, market share, business outlook, and financial performance expectations. These statements are estimates only and actual results may ultimately differ from them. Except to the extent required by applicable securities laws, we undertake no obligation to update or publicly revise any of the forward-looking statements that you may hear today. Please refer to our most recent annual report filed on Form 10-K, and in particular any discussion of risk factors or forward-looking statements therein, which is available on the SEC’s website (www.sec.gov), for a full discussion of the risks and other factors that may impact any forward-looking statements that you may hear today.

2019 CBRE INVESTOR DAY Jim Groch Chief Financial Officer Chief Investment Officer FINANCIAL REVIEW & OUTLOOK

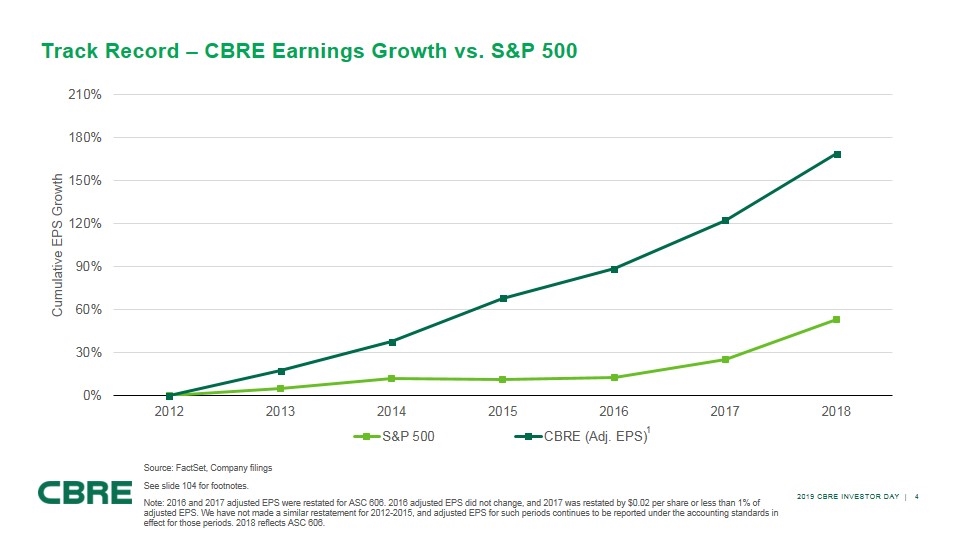

Track Record – CBRE Earnings Growth vs. S&P 500 Source: FactSet, Company filings See slide 104 for footnotes. Note: 2016 and 2017 adjusted EPS were restated for ASC 606. 2016 adjusted EPS did not change, and 2017 was restated by $0.02 per share or less than 1% of adjusted EPS. We have not made a similar restatement for 2012-2015, and adjusted EPS for such periods continues to be reported under the accounting standards in effect for those periods. 2018 reflects ASC 606. 1

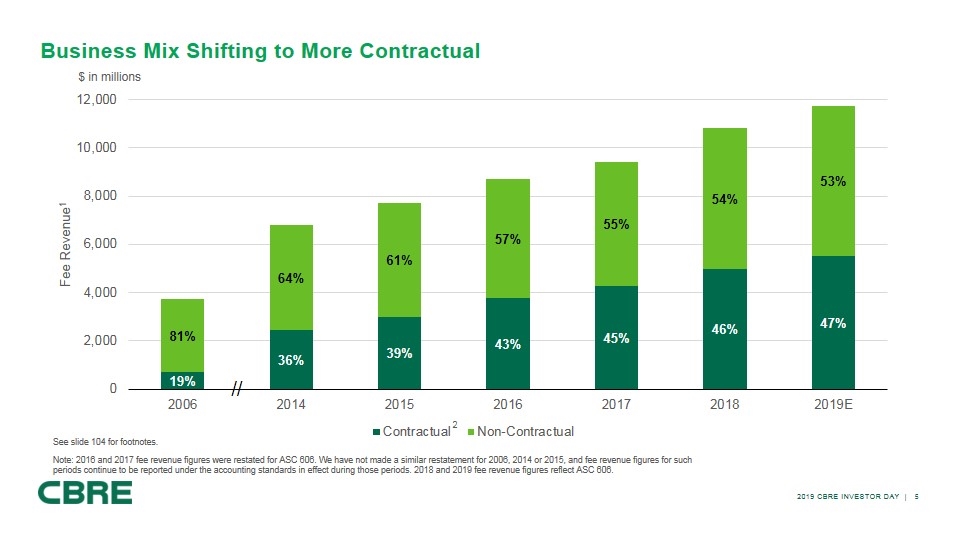

Business Mix Shifting to More Contractual $ in millions See slide 104 for footnotes. Note: 2016 and 2017 fee revenue figures were restated for ASC 606. We have not made a similar restatement for 2006, 2014 or 2015, and fee revenue figures for such periods continue to be reported under the accounting standards in effect during those periods. 2018 and 2019 fee revenue figures reflect ASC 606. 2

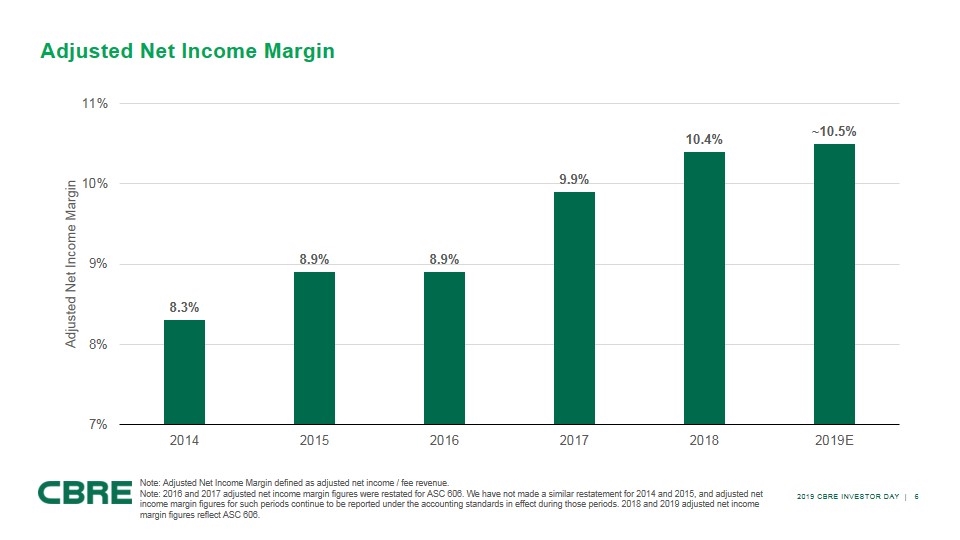

Adjusted Net Income Margin Note: Adjusted Net Income Margin defined as adjusted net income / fee revenue. Note: 2016 and 2017 adjusted net income margin figures were restated for ASC 606. We have not made a similar restatement for 2014 and 2015, and adjusted net income margin figures for such periods continue to be reported under the accounting standards in effect during those periods. 2018 and 2019 adjusted net income margin figures reflect ASC 606.

THREE NEW glOBAL SEGMENTS

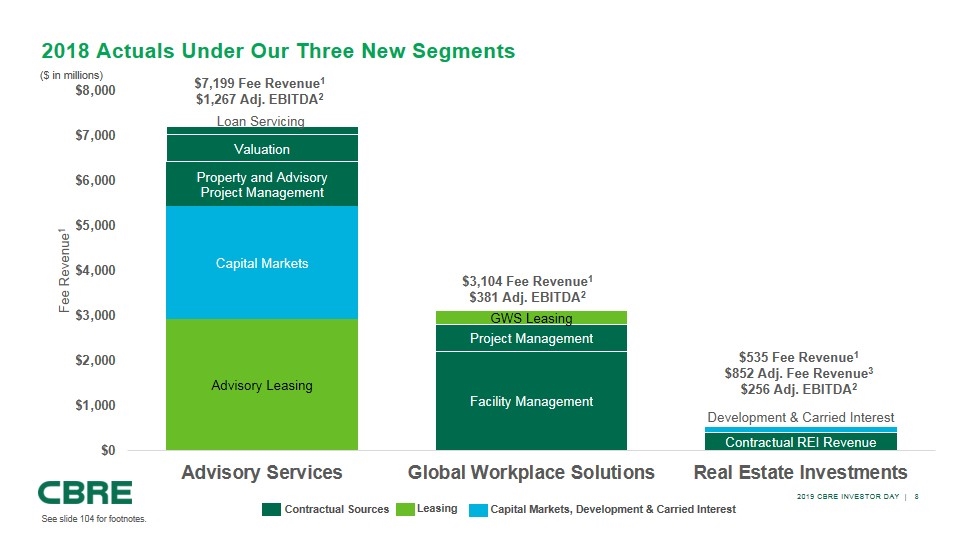

Capital Markets, Development & Carried Interest Leasing Contractual Sources 2018 Actuals Under Our Three New Segments ($ in millions) See slide 104 for footnotes. $7,199 Fee Revenue1 $1,267 Adj. EBITDA2 $535 Fee Revenue1 $852 Adj. Fee Revenue3 $256 Adj. EBITDA2 $3,104 Fee Revenue1 $381 Adj. EBITDA2

Outlook for 2019

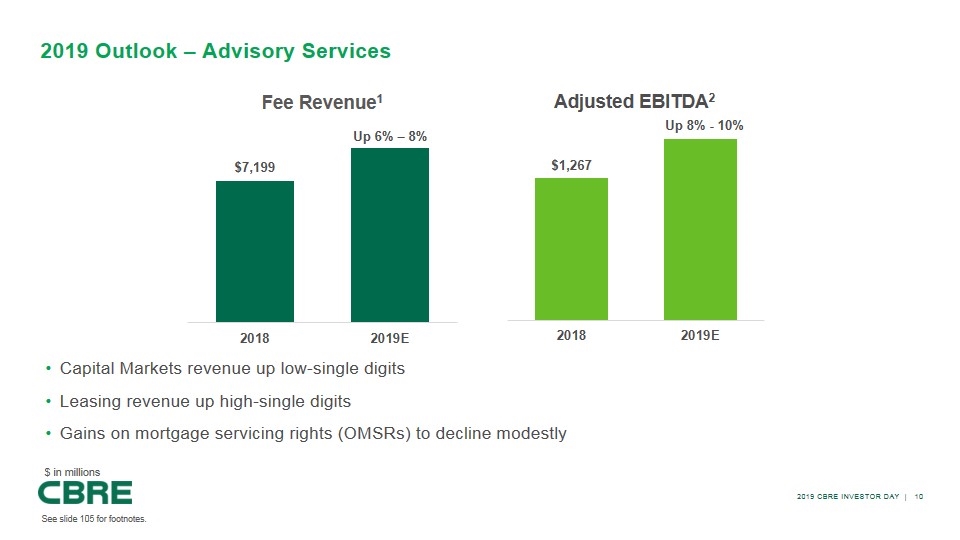

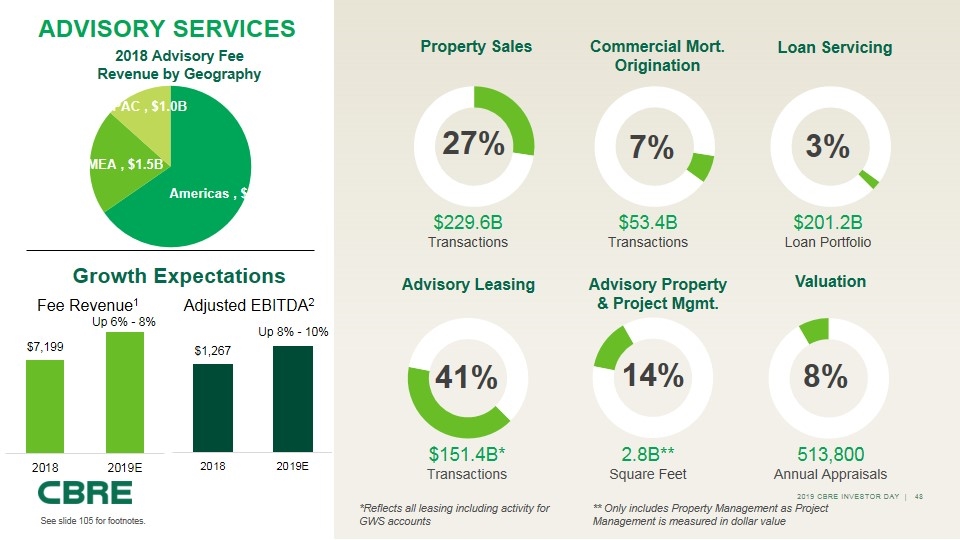

Up 8% - 10% 2019 Outlook – Advisory Services Capital Markets revenue up low-single digits Leasing revenue up high-single digits Gains on mortgage servicing rights (OMSRs) to decline modestly Up 6% – 8% $ in millions See slide 105 for footnotes.

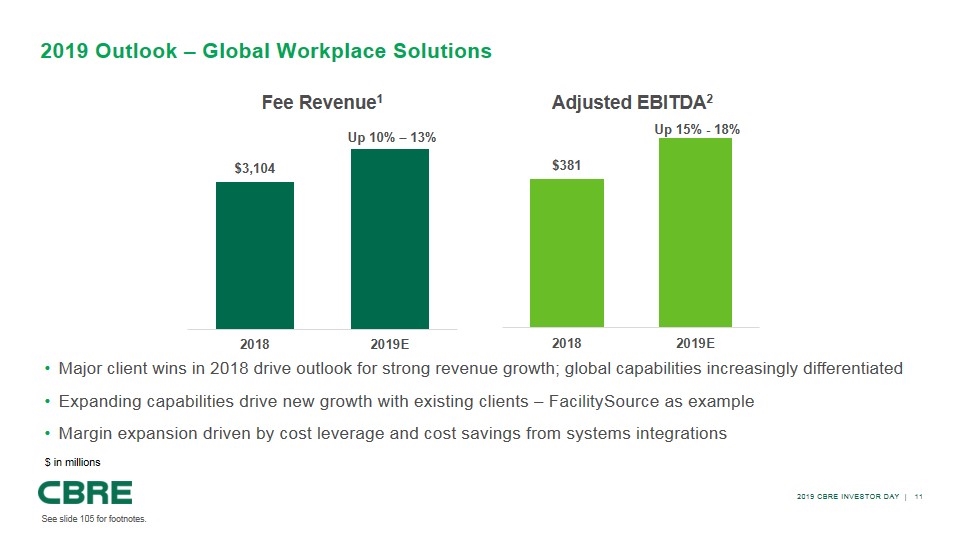

Up 15% - 18% 2019 Outlook – Global Workplace Solutions Up 10% – 13% $ in millions Major client wins in 2018 drive outlook for strong revenue growth; global capabilities increasingly differentiated Expanding capabilities drive new growth with existing clients – FacilitySource as example Margin expansion driven by cost leverage and cost savings from systems integrations See slide 105 for footnotes.

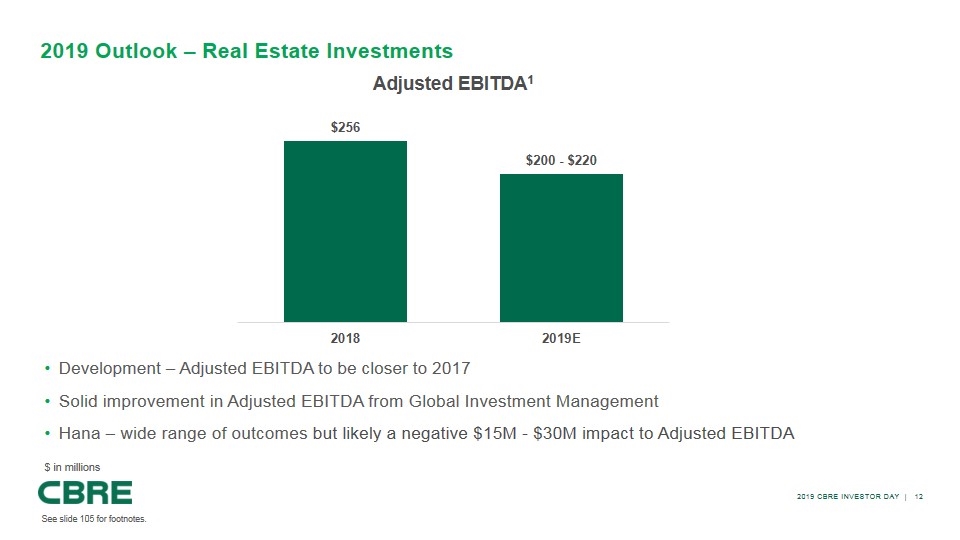

2019 Outlook – Real Estate Investments Development – Adjusted EBITDA to be closer to 2017 Solid improvement in Adjusted EBITDA from Global Investment Management Hana – wide range of outcomes but likely a negative $15M - $30M impact to Adjusted EBITDA $ in millions See slide 105 for footnotes.

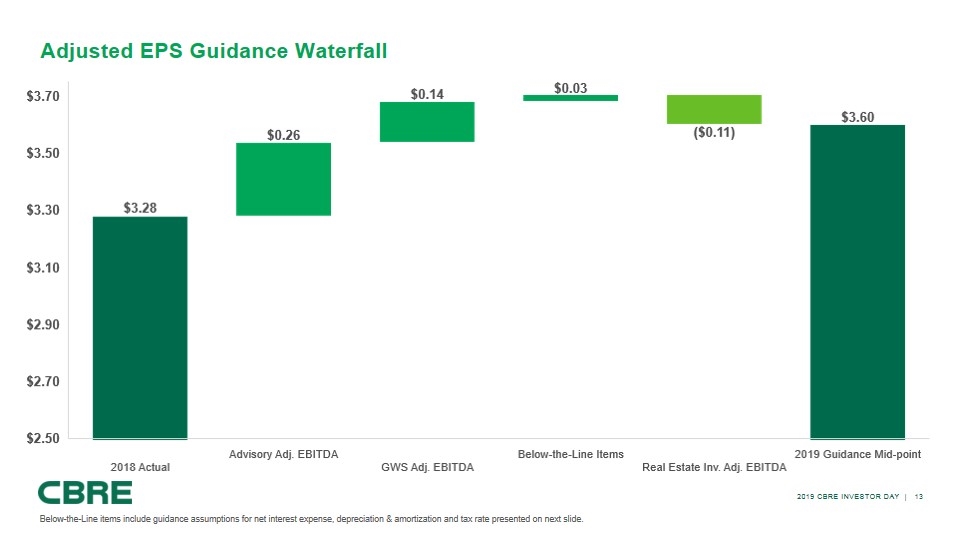

Adjusted EPS Guidance Waterfall Below-the-Line items include guidance assumptions for net interest expense, depreciation & amortization and tax rate presented on next slide.

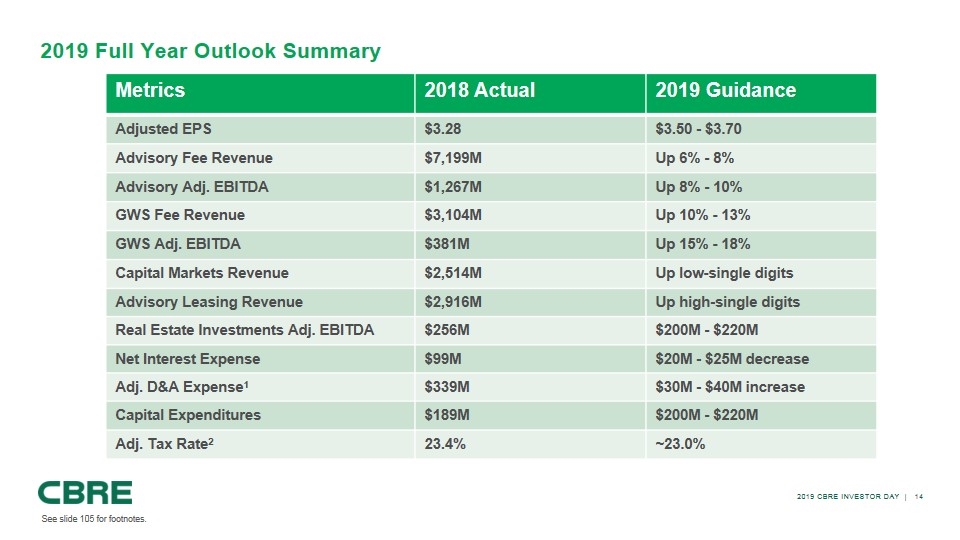

2019 Full Year Outlook Summary Metrics 2018 Actual 2019 Guidance Adjusted EPS $3.28 $3.50 - $3.70 Advisory Fee Revenue $7,199M Up 6% - 8% Advisory Adj. EBITDA $1,267M Up 8% - 10% GWS Fee Revenue $3,104M Up 10% - 13% GWS Adj. EBITDA $381M Up 15% - 18% Capital Markets Revenue $2,514M Up low-single digits Advisory Leasing Revenue $2,916M Up high-single digits Real Estate Investments Adj. EBITDA $256M $200M - $220M Net Interest Expense $99M $20M - $25M decrease Adj. D&A Expense1 $339M $30M - $40M increase Capital Expenditures $189M $200M - $220M Adj. Tax Rate2 23.4% ~23.0% See slide 105 for footnotes.

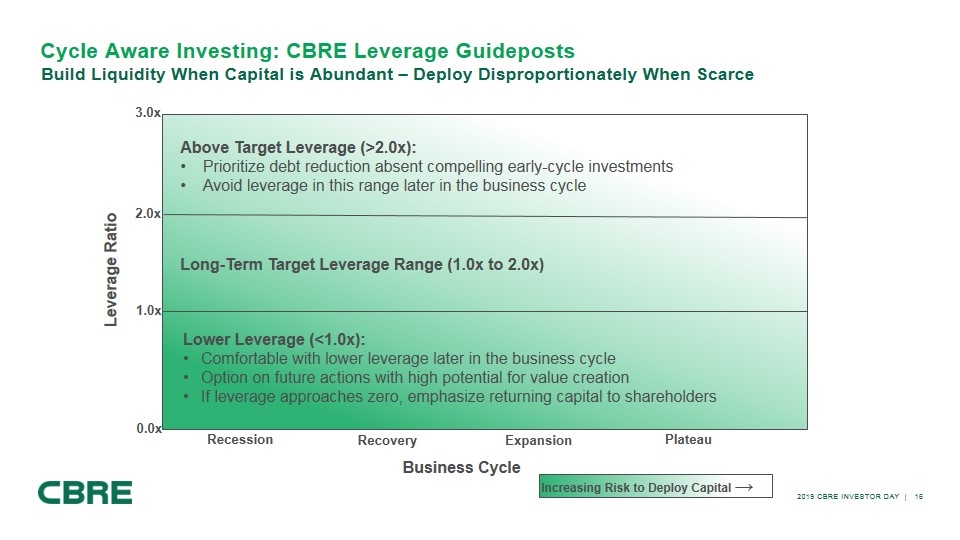

CBRE Investment

3.0x 0.0x 1.0x Leverage Ratio Recession Recovery Above Target Leverage (>2.0x): Prioritize debt reduction absent compelling early-cycle investments Avoid leverage in this range later in the business cycle Plateau Expansion Lower Leverage (<1.0x): Comfortable with lower leverage later in the business cycle Option on future actions with high potential for value creation If leverage approaches zero, emphasize returning capital to shareholders Long-Term Target Leverage Range (1.0x to 2.0x) 2.0x Business Cycle Increasing Risk to Deploy Capital → Cycle Aware Investing: CBRE Leverage Guideposts Build Liquidity When Capital is Abundant – Deploy Disproportionately When Scarce

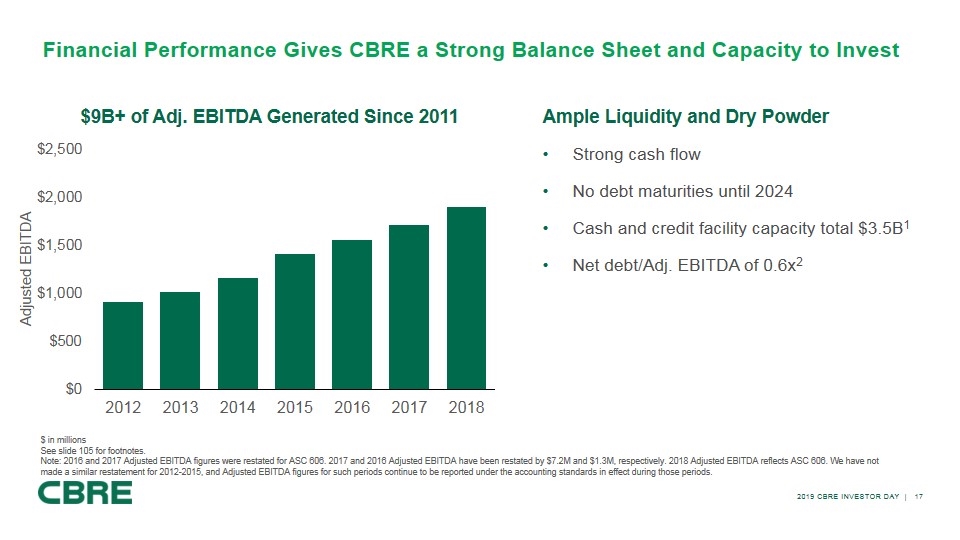

Financial Performance Gives CBRE a Strong Balance Sheet and Capacity to Invest Ample Liquidity and Dry Powder Strong cash flow No debt maturities until 2024 Cash and credit facility capacity total $3.5B1 Net debt/Adj. EBITDA of 0.6x2 $9B+ of Adj. EBITDA Generated Since 2011 $ in millions See slide 105 for footnotes. Note: 2016 and 2017 Adjusted EBITDA figures were restated for ASC 606. 2017 and 2016 Adjusted EBITDA have been restated by $7.2M and $1.3M, respectively. 2018 Adjusted EBITDA reflects ASC 606. We have not made a similar restatement for 2012-2015, and Adjusted EBITDA figures for such periods continue to be reported under the accounting standards in effect during those periods.

Deploying Capital M&A likely to represent best risk-adjusted use of capital over long-term Large, attractive, M&A opportunities arise irregularly All major acquisitions tested against returning capital to shareholders A high volume of smaller M&A opportunities over time Returning capital to shareholders – share repurchases Share price volatility can result in exceptional opportunity Bought back $206M in stock at average price of $40.20 New $300M repurchase program approved by board If average leverage approaches zero, accelerate returning capital to shareholders absent near-term visibility to more attractive uses of capital Investment Management and Development businesses offer a unique opportunity for incremental capital investment, especially in the early years of an economic cycle

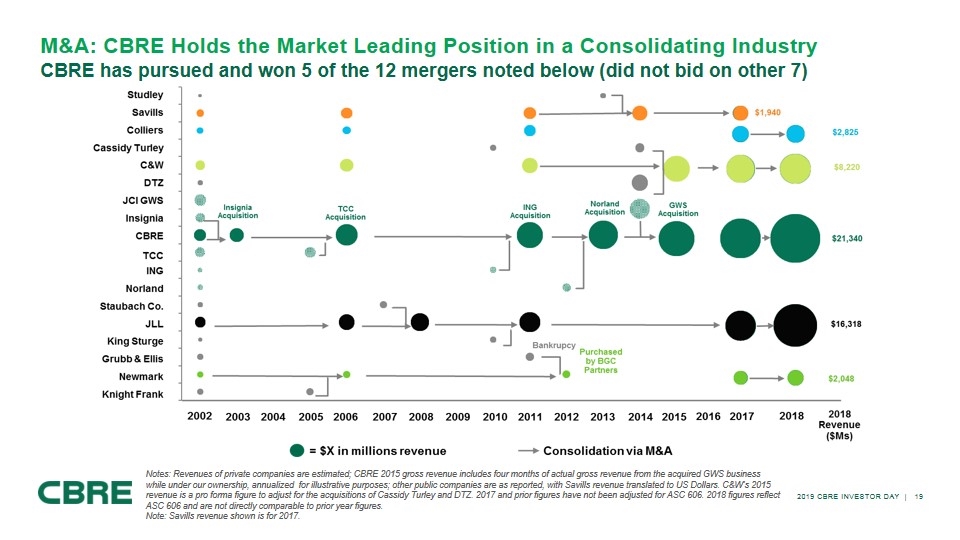

M&A: CBRE Holds the Market Leading Position in a Consolidating Industry Notes: Revenues of private companies are estimated; CBRE 2015 gross revenue includes four months of actual gross revenue from the acquired GWS business while under our ownership, annualized for illustrative purposes; other public companies are as reported, with Savills revenue translated to US Dollars. C&W’s 2015 revenue is a pro forma figure to adjust for the acquisitions of Cassidy Turley and DTZ. 2017 and prior figures have not been adjusted for ASC 606. 2018 figures reflect ASC 606 and are not directly comparable to prior year figures. Note: Savills revenue shown is for 2017. CBRE has pursued and won 5 of the 12 mergers noted below (did not bid on other 7)

Investment in Real Estate #1 commercial real estate development business in the U.S. Top 5 global commercial real estate investment management business by AUM Hess Tower, Houston, TX Park District, Dallas, TX Vermont Corridor, Los Angeles, CA

Supplemental disclosures

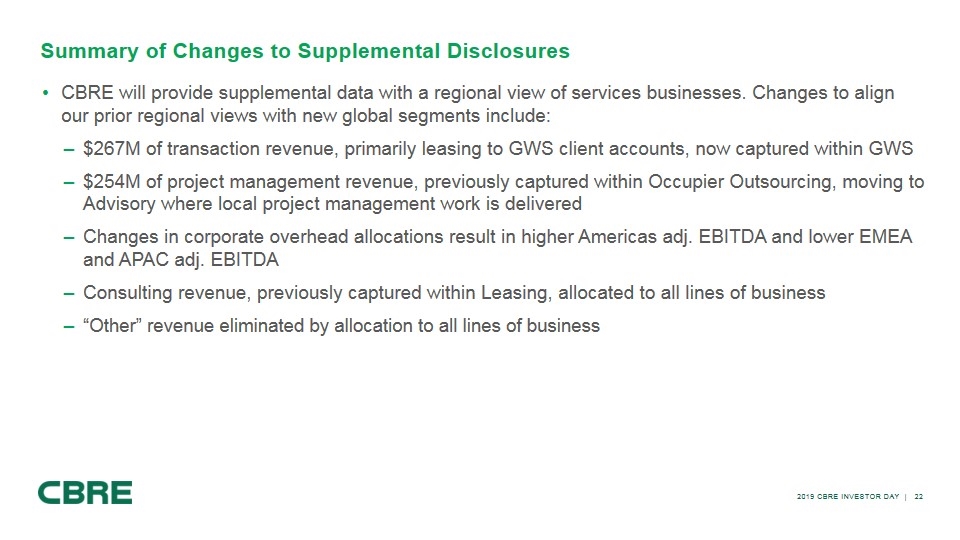

Summary of Changes to Supplemental Disclosures CBRE will provide supplemental data with a regional view of services businesses. Changes to align our prior regional views with new global segments include: $267M of transaction revenue, primarily leasing to GWS client accounts, now captured within GWS $254M of project management revenue, previously captured within Occupier Outsourcing, moving to Advisory where local project management work is delivered Changes in corporate overhead allocations result in higher Americas adj. EBITDA and lower EMEA and APAC adj. EBITDA Consulting revenue, previously captured within Leasing, allocated to all lines of business “Other” revenue eliminated by allocation to all lines of business

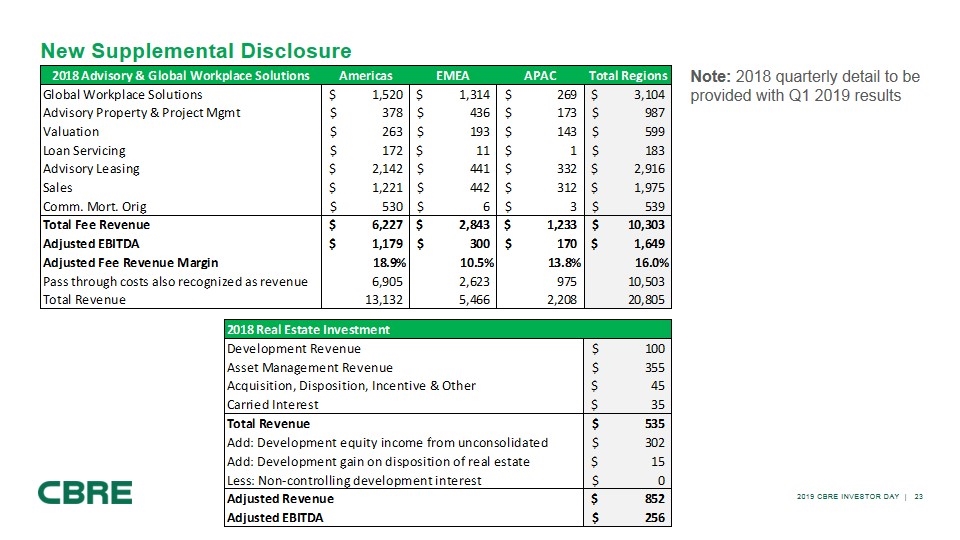

New Supplemental Disclosure Note: 2018 quarterly detail to be provided with Q1 2019 results 2018 Advisory & Global Workplace Solutions Americas EMEA APAC Total Regions Global Workplace Solutions $1,520.3871404786348 $1,314.2916767898853 $268.92004919699161 $3,103.5988664655115 Advisory Property & Project Mgmt $378.18465510077692 $435.63888280187638 $173.2127854016783 $987.03632330433152 Valuation $263.17561948586405 $192.80265318077312 $142.81197941760237 $598.79025208423957 Loan Servicing $172.11170635000002 $10.699678930812038 $0.57027338051591603 $183.38165866132798 Advisory Leasing $2,142.413423762425 $441.46237178145128 $332.31573399401628 $2,915.8194481517098 Sales $1,221.443026510557 $441.88778656928508 $311.52340689754897 $1,974.854219977391 Comm. Mort. Orig $529.75050273162719 $6.2981397135721444 $3.2985177024065542 $539.3471601476059 Total Fee Revenue $6,227.939930337026 $2,843.811897676558 $1,232.65274599076 $10,302.827928792118 Adjusted EBITDA $1,178.5617404622658 $299.92253217269177 $170.33646719117948 $1,648.820739826137 Adjusted Fee Revenue Margin 0.18926352192222115 0.10549207432138168 0.13818690441829942 0.16003574467339876 Pass through costs also recognized as revenue 6,904.8123438159901 2,622.8417311147041 974.88213673714915 10,502.536211667844 Total Revenue 13,131.906336849694 5,465.9229208823599 2,207.534882727909 20,805.364140459962 2018 Real Estate Investment Development Revenue $100.31881507000001 Asset Management Revenue $354.38722124378495 Acquisition, Disposition, Incentive & Other $44.887442638164934 Carried Interest $35.13056304445962 Total Revenue $534.7240419964096 Add: Development equity income from unconsolidated entities $302.40047951999998 Add: Development gain on disposition of real estate $14.87415399 Less: Non-controlling development interest $0.12610145 Adjusted Revenue $851.87257405640958 Adjusted EBITDA $256.35992294724747 2018 Advisory & Global Workplace Solutions Americas EMEA APAC Total Regions Global Workplace Solutions $1,520.3871404786348 $1,314.2916767898853 $268.92004919699161 $3,103.5988664655115 Advisory Property & Project Mgmt $378.18465510077692 $435.63888280187638 $173.2127854016783 $987.03632330433152 Valuation $263.17561948586405 $192.80265318077312 $142.81197941760237 $598.79025208423957 Loan Servicing $172.11170635000002 $10.699678930812038 $0.57027338051591603 $183.38165866132798 Advisory Leasing $2,142.413423762425 $441.46237178145128 $332.31573399401628 $2,915.8194481517098 Sales $1,221.443026510557 $441.88778656928508 $311.52340689754897 $1,974.854219977391 Comm. Mort. Orig $529.75050273162719 $6.2981397135721444 $3.2985177024065542 $539.3471601476059 Total Fee Revenue $6,227.939930337026 $2,843.811897676558 $1,232.65274599076 $10,302.827928792118 Adjusted EBITDA $1,178.5617404622658 $299.92253217269177 $170.33646719117948 $1,648.820739826137 Adjusted Fee Revenue Margin 0.18926352192222115 0.10549207432138168 0.13818690441829942 0.16003574467339876 Pass through costs also recognized as revenue 6,904.8123438159901 2,622.8417311147041 974.88213673714915 10,502.536211667844 Total Revenue 13,131.906336849694 5,465.9229208823599 2,207.534882727909 20,805.364140459962 2018 Real Estate Investment Development Revenue $100.31881507000001 Asset Management Revenue $355 Acquisition, Disposition, Incentive & Other $44.887442638164934 Carried Interest $35.13056304445962 Total Revenue $535.33682075262459 Add: Development equity income from unconsolidated entities $302.40047951999998 Add: Development gain on disposition of real estate $14.87415399 Less: Non-controlling development interest $0.12610145 Adjusted Revenue $852.48535281262457 Adjusted EBITDA $256.35992294724747

2019 CBRE INVESTOR DAY Chandra Dhandapani Chief Digital & Technology Officer DIGITAL & TECHNOLOGY OVERVIEW

Top Talent: Digital & Technology Leadership at CBRE Javed Roshan CDTO, Real Estate Investments Verizon, Capital One Sayee Bellamkonda CDTO, Advisory Services Ameriprise, American Express Sandeep Davé CDTO, GWS Citi, Booz Allen Umesh Patel CTO Ericsson, Bloomin’ Brands Dalia Soliman-Powers Head of Enterprise Services USAA, Capital One Sohin Chinoy Head of Digital Strategy AT Kearney Nir Rachmel CDTO, Advisory & Transactions- Americas Compstak, Yext

Our talent brand 100+ Agile, Product Development teams A new, recruiting-focused sub-brand for D&T’s agile software development teams With its youthful energy, Build gives CBRE a voice that speaks to the tech talent for which we’re competing

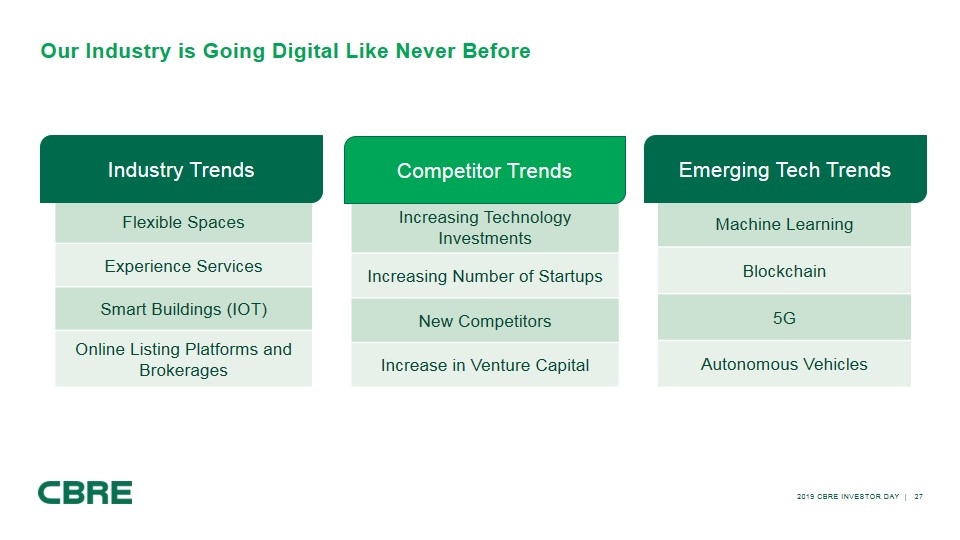

Our Industry is Going Digital Like Never Before Flexible Spaces Experience Services Smart Buildings (IOT) Online Listing Platforms and Brokerages Industry Trends Increasing Technology Investments Increasing Number of Startups New Competitors Increase in Venture Capital Competitor Trends Machine Learning Blockchain 5G Autonomous Vehicles Emerging Tech Trends

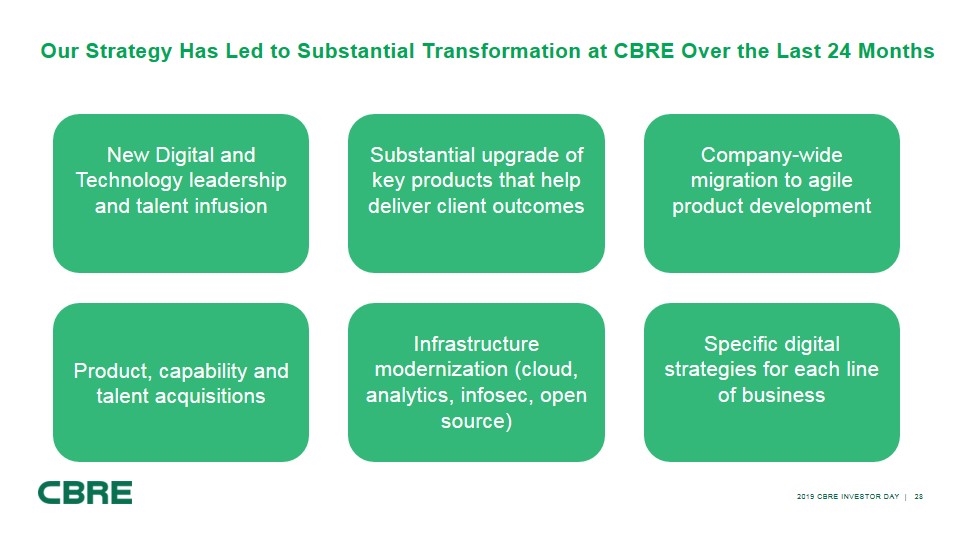

Our Strategy Has Led to Substantial Transformation at CBRE Over the Last 24 Months New Digital and Technology leadership and talent infusion Substantial upgrade of key products that help deliver client outcomes Company-wide migration to agile product development Product, capability and talent acquisitions Infrastructure modernization (cloud, analytics, infosec, open source) Specific digital strategies for each line of business

We Are Committed to Solving Emerging Needs of Our Clients Experience ‘Platform as a Service’ for Occupiers and Investors Flexible spaces Tech-enabled aggregator

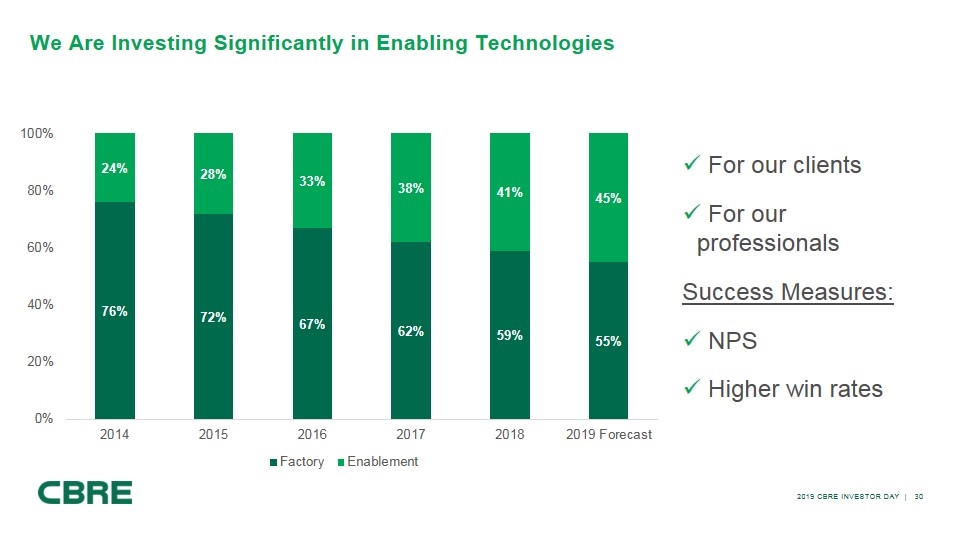

We Are Investing Significantly in Enabling Technologies For our clients For our professionals Success Measures: NPS Higher win rates

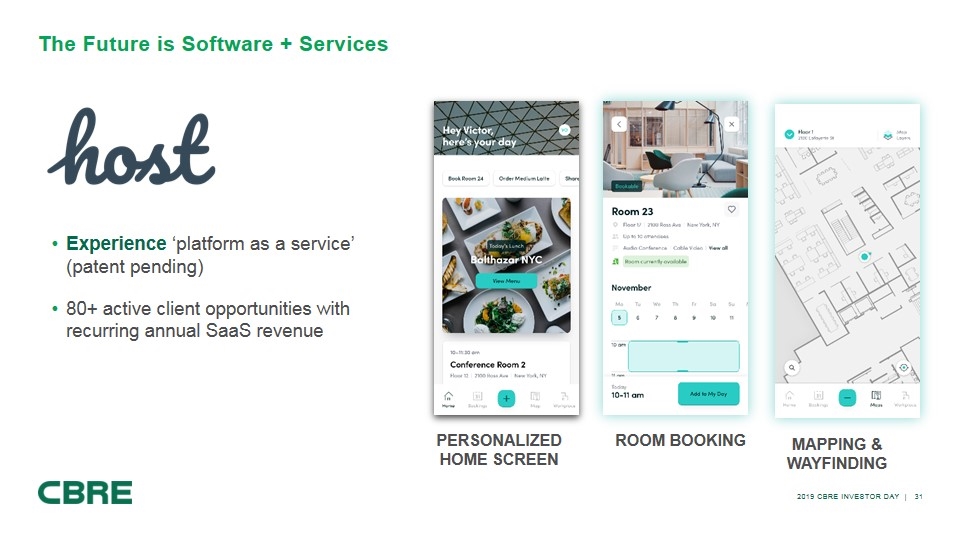

Experience ‘platform as a service’ (patent pending) 80+ active client opportunities with recurring annual SaaS revenue The Future is Software + Services PERSONALIZED HOME SCREEN ROOM BOOKING MAPPING & WAYFINDING

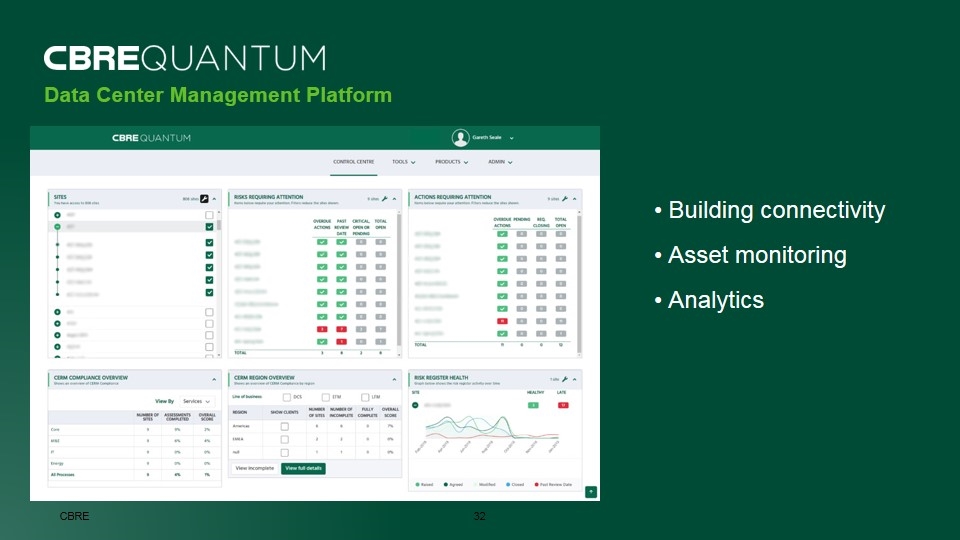

Data Center Management Platform Building connectivity Asset monitoring Analytics

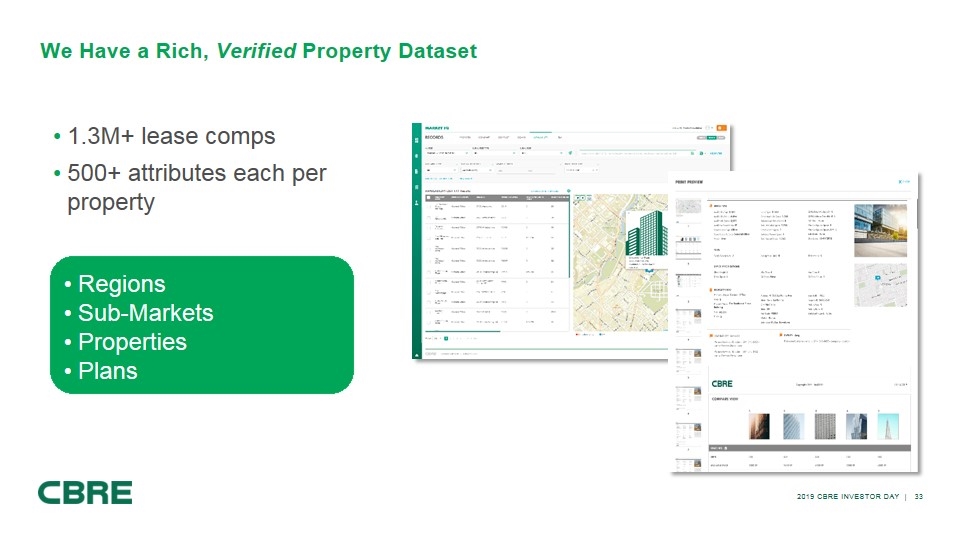

We Have a Rich, Verified Property Dataset 1.3M+ lease comps 500+ attributes each per property Regions Sub-Markets Properties Plans

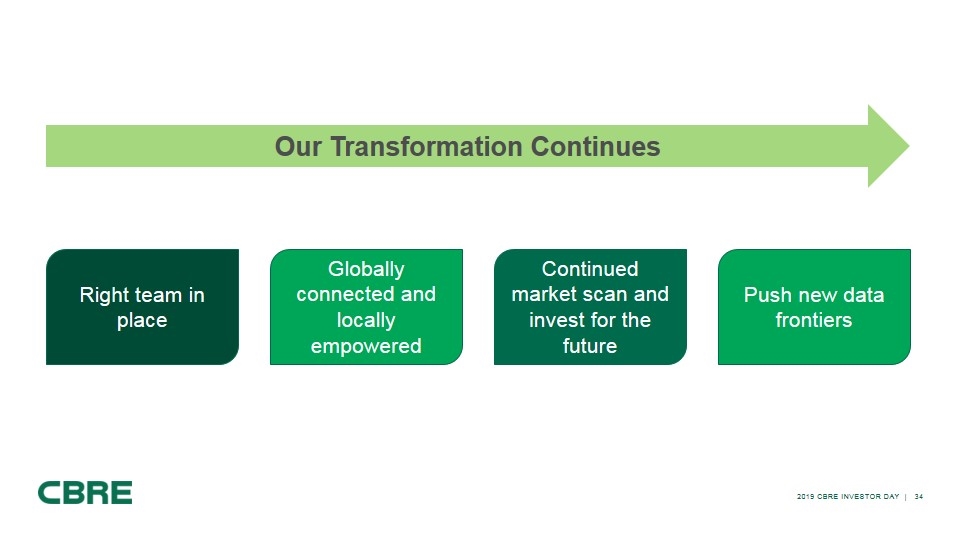

Our Transformation Continues Right team in place Globally connected and locally empowered Continued market scan and invest for the future Push new data frontiers

2019 CBRE INVESTOR DAY Danny Queenan Global Chief Executive Officer, Real Estate Investments REAL ESTATE INVESTMENTS

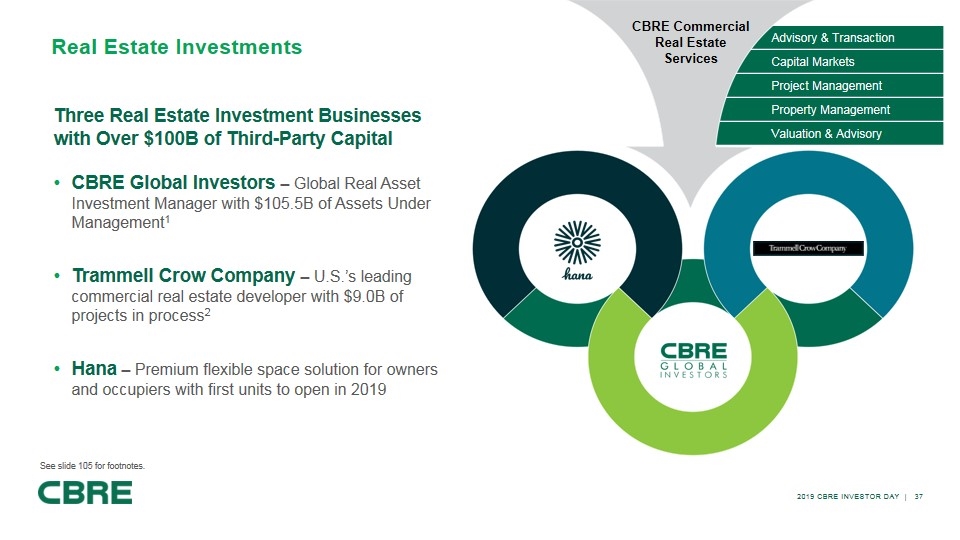

Advisory & Transaction Capital Markets Project Management Property Management Valuation & Advisory Real Estate Investments Advisory & Transaction Capital Markets Project Management Property Management Valuation & Advisory CBRE Commercial Real Estate Services Three Real Estate Investment Businesses with Over $100B of Third-Party Capital CBRE Global Investors – Global Real Asset Investment Manager with $105.5B of Assets Under Management1 Trammell Crow Company – U.S.’s leading commercial real estate developer with $9.0B of projects in process2 Hana – Premium flexible space solution for owners and occupiers with first units to open in 2019 See slide 105 for footnotes.

CBRE Reorganization – Real Estate Investments Impact Talent. Strategically placed existing talent into more impactful roles Accountability. Created clear lines of authority and accountability Collaboration. Centralized reporting structure will drive increased collaboration between Real Estate Investment businesses Efficiency. Realizing operating synergies, consistency and simplification as a result of Real Estate Investments leadership and shared services

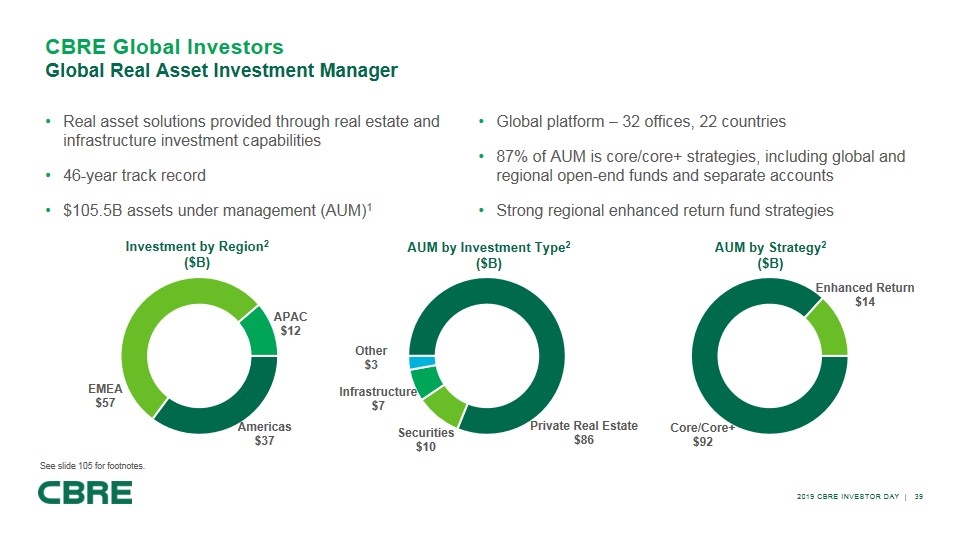

CBRE Global Investors Global Real Asset Investment Manager Real asset solutions provided through real estate and infrastructure investment capabilities 46-year track record $105.5B assets under management (AUM)1 AUM by Investment Type2 ($B) AUM by Strategy2 ($B) Investment by Region2 ($B) Global platform – 32 offices, 22 countries 87% of AUM is core/core+ strategies, including global and regional open-end funds and separate accounts Strong regional enhanced return fund strategies See slide 105 for footnotes.

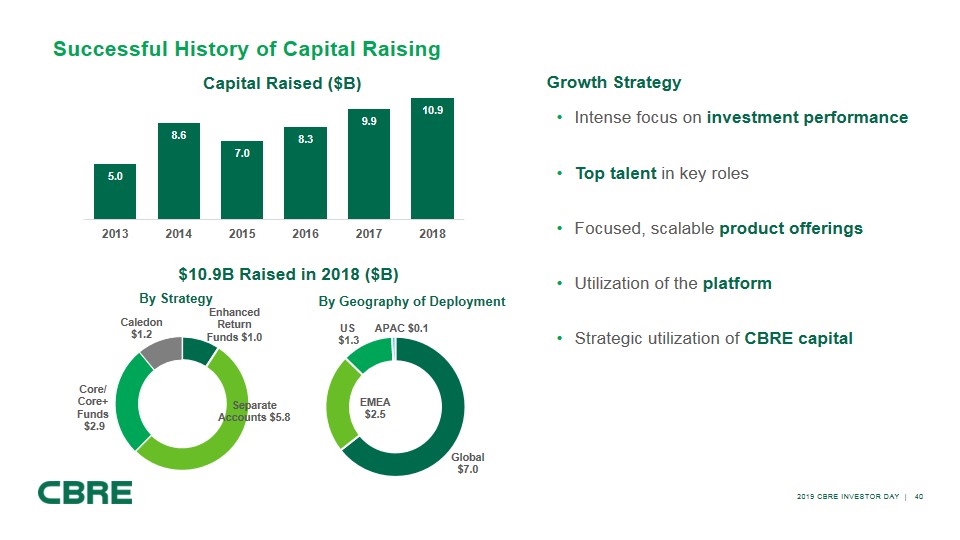

Successful History of Capital Raising Capital Raised ($B) By Strategy By Geography of Deployment $10.9B Raised in 2018 ($B) Intense focus on investment performance Top talent in key roles Focused, scalable product offerings Utilization of the platform Strategic utilization of CBRE capital Growth Strategy

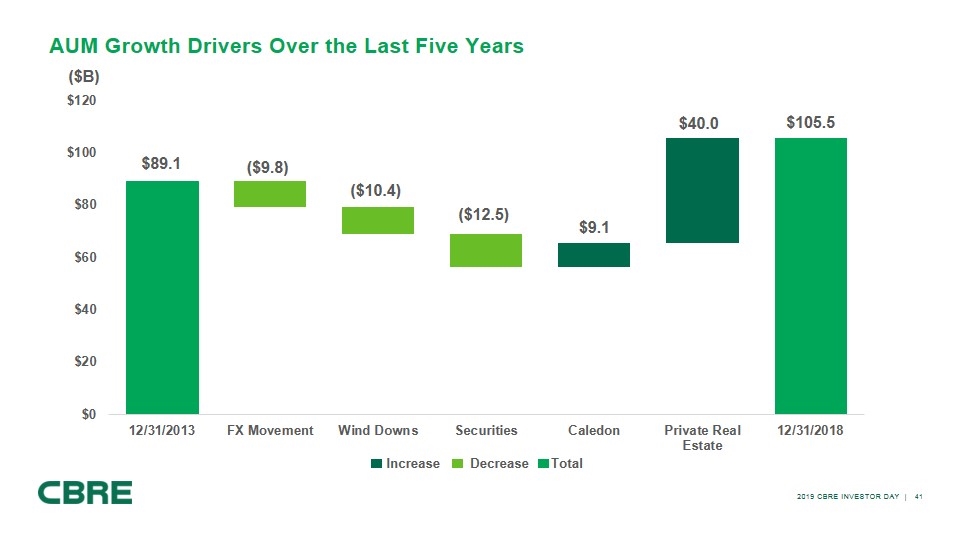

AUM Growth Drivers Over the Last Five Years $103.2 ($B) Increase Decrease Total $89.1 ($9.8) ($10.4) ($12.5) $9.1 $40.0 $105.5

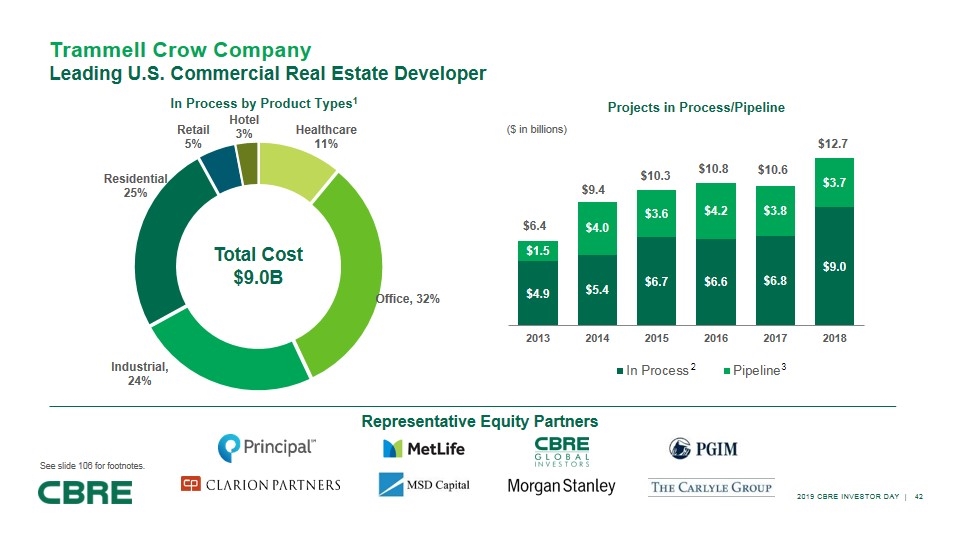

Trammell Crow Company Leading U.S. Commercial Real Estate Developer Representative Equity Partners In Process by Product Types1 Projects in Process/Pipeline ($ in billions) Total Cost $9.0B 2 3 See slide 106 for footnotes.

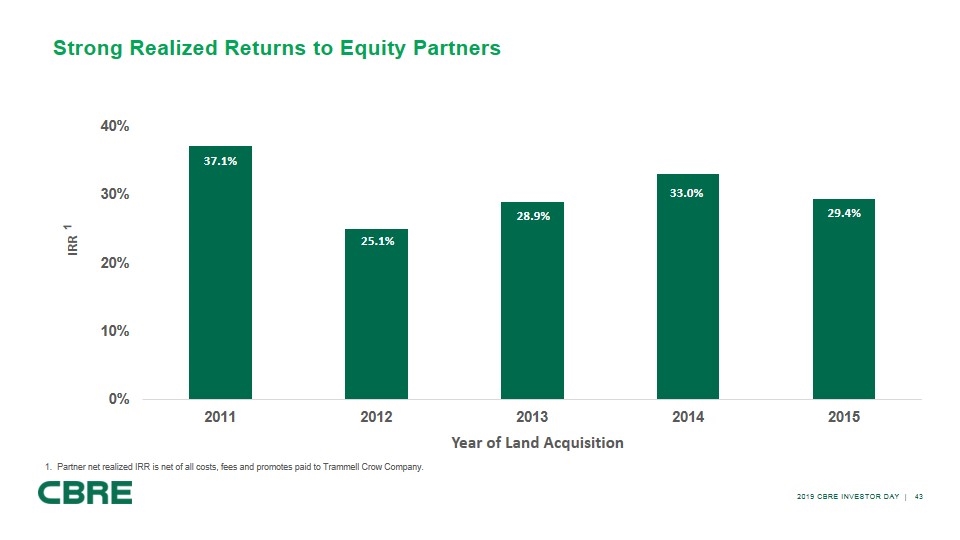

Strong Realized Returns to Equity Partners Partner net realized IRR is net of all costs, fees and promotes paid to Trammell Crow Company. 1

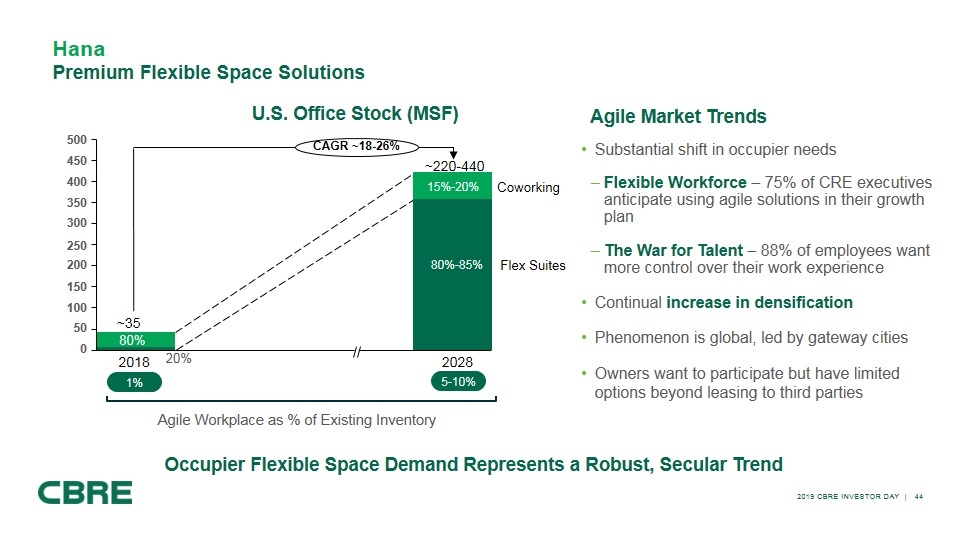

Hana Premium Flexible Space Solutions U.S. Office Stock (MSF) 15%-20% 80%-85% ~35 ~220-440 CAGR ~18-26% Agile Market Trends Substantial shift in occupier needs Flexible Workforce – 75% of CRE executives anticipate using agile solutions in their growth plan The War for Talent – 88% of employees want more control over their work experience Continual increase in densification Phenomenon is global, led by gateway cities Owners want to participate but have limited options beyond leasing to third parties 1% 5-10% Agile Workplace as % of Existing Inventory Occupier Flexible Space Demand Represents a Robust, Secular Trend 80%

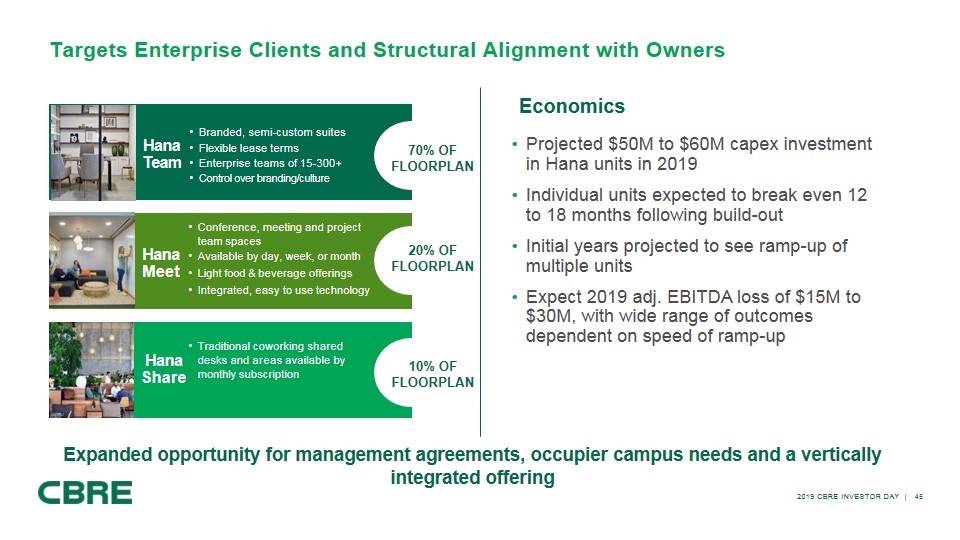

Targets Enterprise Clients and Structural Alignment with Owners Branded, semi-custom suites Flexible lease terms Enterprise teams of 15-300+ Control over branding/culture Conference, meeting and project team spaces Available by day, week, or month Light food & beverage offerings Integrated, easy to use technology Traditional coworking shared desks and areas available by monthly subscription Hana Team Hana Meet Hana Share 70% OF FLOORPLAN 20% OF FLOORPLAN 10% OF FLOORPLAN Expanded opportunity for management agreements, occupier campus needs and a vertically integrated offering Projected $50M to $60M capex investment in Hana units in 2019 Individual units expected to break even 12 to 18 months following build-out Initial years projected to see ramp-up of multiple units Expect 2019 adj. EBITDA loss of $15M to $30M, with wide range of outcomes dependent on speed of ramp-up Economics

Diversified Leadership Team: Hospitality, Tech and Consumer Product Expertise Brian Harrington Chief Experience Officer Zipcar, eBay, Starwood Scott Marshall Chief Dev. Officer / Pres. CBRE, Colliers Christopher Corpuel VP, Product Amazon, Hilton Andrew Kupiec Chief Executive Officer Zipcar, Avis Budget Robert Cartwright Chief Operating Officer WeWork, Starwood Andrew Daley VP, Marketing Zipcar, Starwood Mitch Gleason VP, Ops Excellence CBRE, WeWork Amit Seth SVP Strategy & PMO PTC, EMC Martin Ma VP, Technology NBC Universal, Disney Laura Sidney Bus. Dev., Americas Josh Beer Bus. Dev., EMEA Lindsay Wester Dir. of Brand & Comms James Friedenthal Launch Manager, UK Bob Staufenberger Sr. Dir, Construction Ben Hootnick Sr. Product Mgr Lianne Barry Sr. Associate John Stephens Manager, Product Global Workplace Solutions Digital & Technology Advisory & Transactions Services Andrew Horn VP, Underwriting CBRE, Alix Partners Angela Morris VP, Ops Finance Tishman, Crescent Hotels Alicia Spradlin VP, Physical Tech & Operations CBRE, Fujitsu Strategic Partners: Aimee Bentson Dir., Sales Ops Paul Nellist MD, Europe Anna Benaquisto Sr. Associate Jack Hendrickson Dir., Security Ops Anna Lynn Tommasone Client Services Amy Johannes Dir., PMO Trisha Sanyal Dir., HR

2019 CBRE INVESTOR DAY Mike Lafitte Global Chief Executive Officer, Advisory Services ADVISORY SERVICES

ADVISORY SERVICES Property Sales Loan Servicing Advisory Leasing 2018 Advisory Fee Revenue by Geography Advisory Property & Project Mgmt. Commercial Mort. Origination Valuation Up 6% - 8% Up 8% - 10% Growth Expectations $229.6B Transactions $53.4B Transactions $151.4B* Transactions 2.8B** Square Feet 513,800 Annual Appraisals *Reflects all leasing including activity for GWS accounts ** Only includes Property Management as Project Management is measured in dollar value $201.2B Loan Portfolio See slide 105 for footnotes.

CBRE Reorganization – Advisory Impact Focused Leadership and Accountability. Market leaders fully focused on Advisory businesses – tied to performance metrics and compensation People. Promoted up-and-coming leaders into new, more impactful, roles Collaboration. Organizing globally, not by geography, drives positive synergies and collaboration Clients. Client Care program driving connectivity across Capital Markets, Leasing and Property Management Product. Senior executive, Jack Durburg, focused on driving differentiation and integration across products

Market Backdrop: Our Industry is in Transition Client Preferences Are Changing How Does CBRE Outperform in the Evolving Environment? Top Talent Advisory Platform Scale Connectivity Culture Local Transactional Commoditized Global Advisory Differentiated

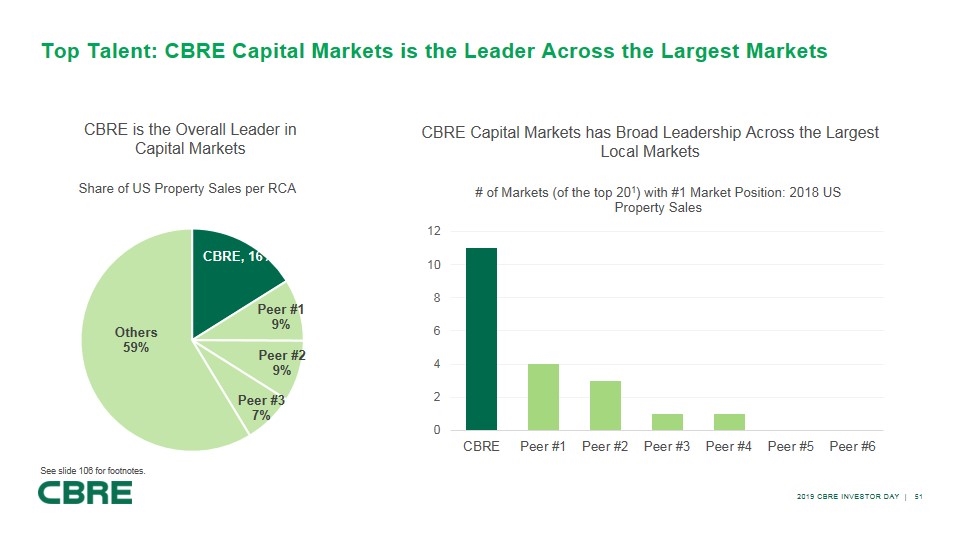

Top Talent: CBRE Capital Markets is the Leader Across the Largest Markets CBRE is the Overall Leader in Capital Markets Share of US Property Sales per RCA CBRE Capital Markets has Broad Leadership Across the Largest Local Markets See slide 106 for footnotes.

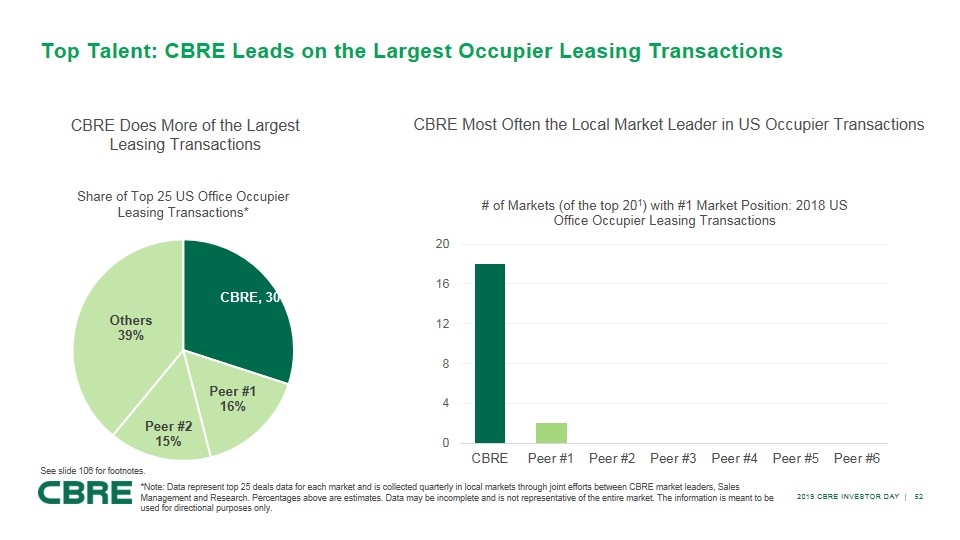

Top Talent: CBRE Leads on the Largest Occupier Leasing Transactions CBRE Does More of the Largest Leasing Transactions Share of Top 25 US Office Occupier Leasing Transactions* CBRE Most Often the Local Market Leader in US Occupier Transactions *Note: Data represent top 25 deals data for each market and is collected quarterly in local markets through joint efforts between CBRE market leaders, Sales Management and Research. Percentages above are estimates. Data may be incomplete and is not representative of the entire market. The information is meant to be used for directional purposes only. See slide 106 for footnotes.

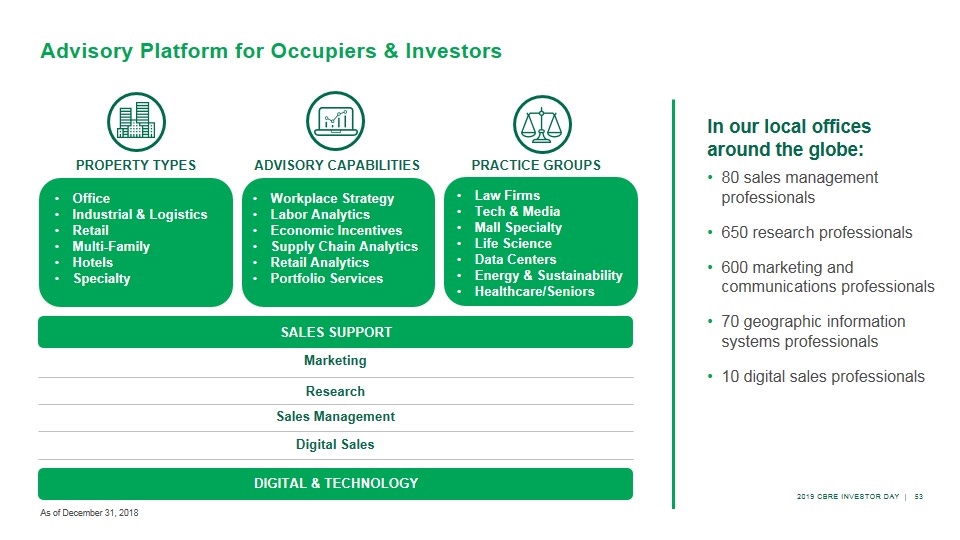

Advisory Platform for Occupiers & Investors Office Industrial & Logistics Retail Multi-Family Hotels Specialty PROPERTY TYPES Workplace Strategy Labor Analytics Economic Incentives Supply Chain Analytics Retail Analytics Portfolio Services ADVISORY CAPABILITIES Law Firms Tech & Media Mall Specialty Life Science Data Centers Energy & Sustainability Healthcare/Seniors PRACTICE GROUPS SALES SUPPORT Research Marketing Sales Management Digital Sales In our local offices around the globe: 80 sales management professionals 650 research professionals 600 marketing and communications professionals 70 geographic information systems professionals 10 digital sales professionals As of December 31, 2018 DIGITAL & TECHNOLOGY

Advisory Platform: Investing in Digital & Technology and Driving Adoption 35 products launched or rolling out in Advisory in the CBRE Vantage suite of enabling technologies Deal Flow & Connector Dimension

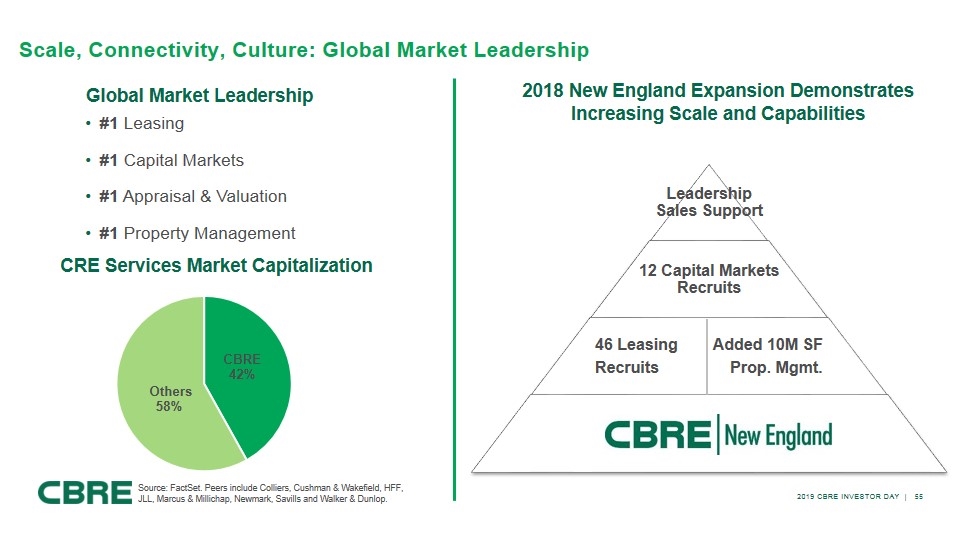

Scale, Connectivity, Culture: Global Market Leadership CRE Services Market Capitalization 2018 New England Expansion Demonstrates Increasing Scale and Capabilities Global Market Leadership #1 Leasing #1 Capital Markets #1 Appraisal & Valuation #1 Property Management Source: FactSet. Peers include Colliers, Cushman & Wakefield, HFF, JLL, Marcus & Millichap, Newmark, Savills and Walker & Dunlop. 12 Capital Markets Recruits 46 Leasing Added 10M SF Recruits Prop. Mgmt. Leadership Sales Support

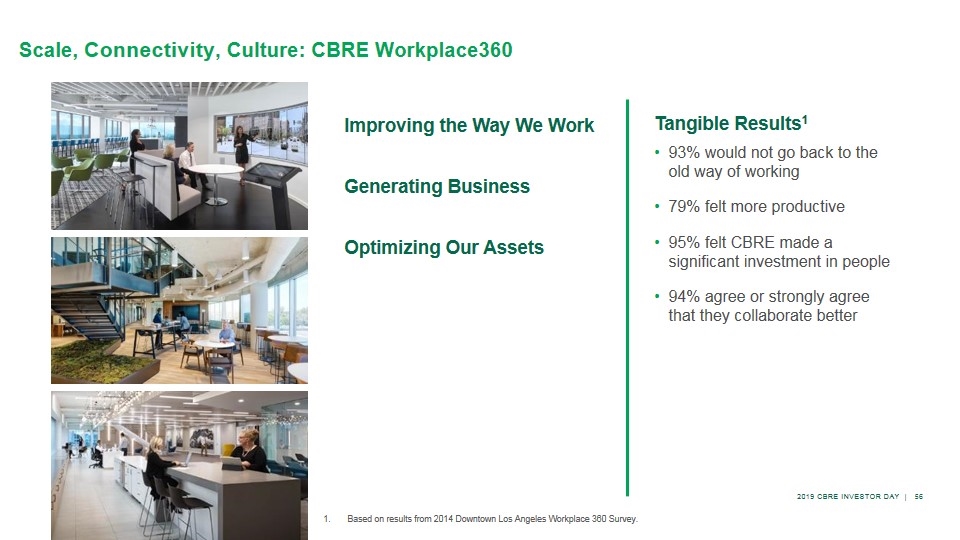

Scale, Connectivity, Culture: CBRE Workplace360 Improving the Way We Work Generating Business Optimizing Our Assets Tangible Results1 93% would not go back to the old way of working 79% felt more productive 95% felt CBRE made a significant investment in people 94% agree or strongly agree that they collaborate better Based on results from 2014 Downtown Los Angeles Workplace 360 Survey.

Investing in Local Market Leadership to Bring it All Together United Kingdom 23 Offices $39.2B Transaction Value Continental Europe 118 Offices $54.3B Transaction Value North Asia 33 Offices $23.5B Transaction Value Pacific 23 Offices $11.1B Transaction Value Southeast Asia, India, Middle East, Africa 46 Offices $10.9B Transaction Value Canada 24 Offices $14.2B Transaction Value Mountain-Northwest 39 Offices $48.6B Transaction Value Midwest 30 Offices $22.1B Transaction Value Pacific Southwest 23 Offices $35.5B Transaction Value Northeast 35 Offices $50.2B Transaction Value Southeast 42 Offices $41.4B Transaction Value South-Central & Latin Americas 40 Offices $30.0B Transaction Value Note: Affiliate offices not included in totals

CBRE Advisory Differentiation For our Clients: Top producer talent Advisory platform, notably Digital & Technology Scale, connectivity and culture Global account management BETTER CLIENT OUTCOMES For our Professionals: Differentiated Advisory platform, notably Digital & Technology Culture and connectivity Enviable client roster and relationships Industry’s deepest professional leadership team MORE SUCCESSFUL CAREERS

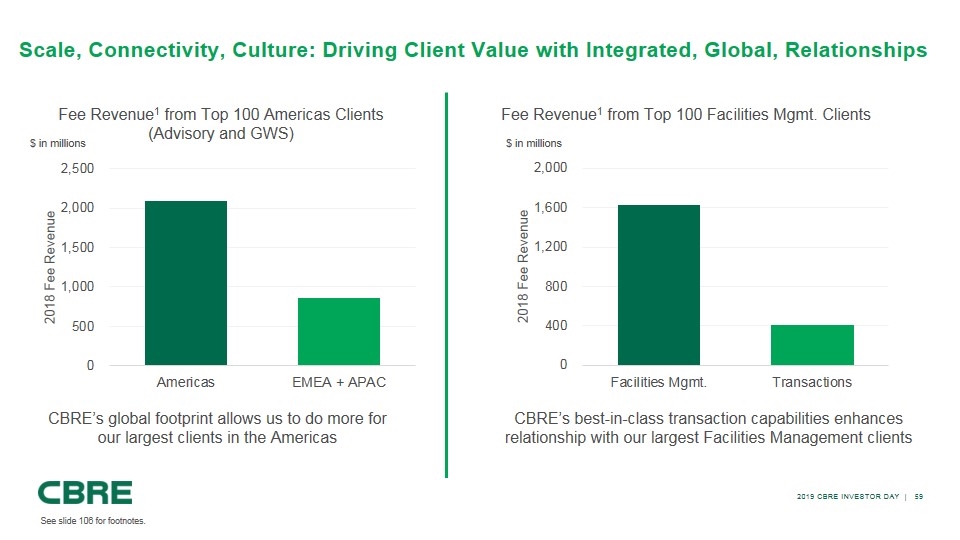

Scale, Connectivity, Culture: Driving Client Value with Integrated, Global, Relationships Fee Revenue1 from Top 100 Americas Clients (Advisory and GWS) Fee Revenue1 from Top 100 Facilities Mgmt. Clients CBRE’s global footprint allows us to do more for our largest clients in the Americas CBRE’s best-in-class transaction capabilities enhances relationship with our largest Facilities Management clients $ in millions $ in millions See slide 106 for footnotes.

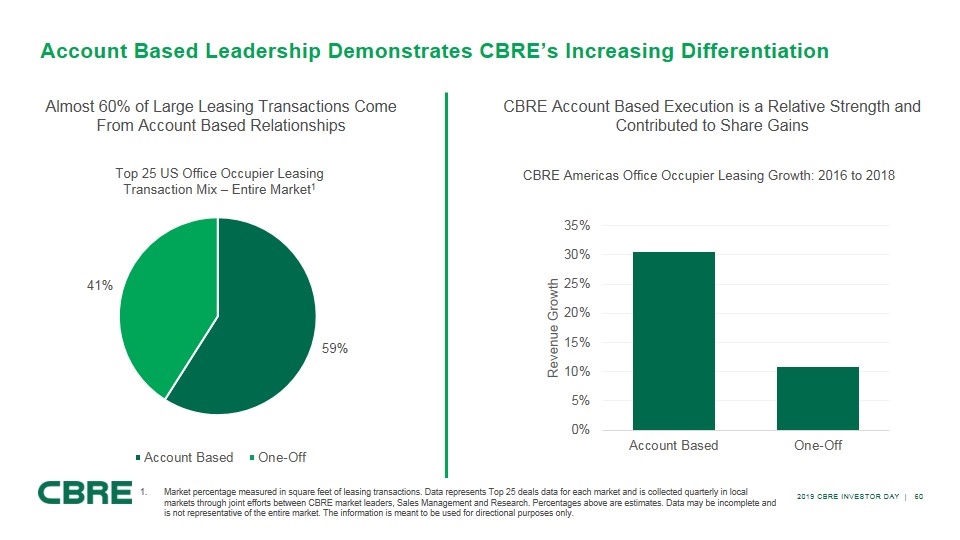

Account Based Leadership Demonstrates CBRE’s Increasing Differentiation Almost 60% of Large Leasing Transactions Come From Account Based Relationships CBRE Account Based Execution is a Relative Strength and Contributed to Share Gains Market percentage measured in square feet of leasing transactions. Data represents Top 25 deals data for each market and is collected quarterly in local markets through joint efforts between CBRE market leaders, Sales Management and Research. Percentages above are estimates. Data may be incomplete and is not representative of the entire market. The information is meant to be used for directional purposes only. Top 25 US Office Occupier Leasing Transaction Mix – Entire Market1 CBRE Americas Office Occupier Leasing Growth: 2016 to 2018

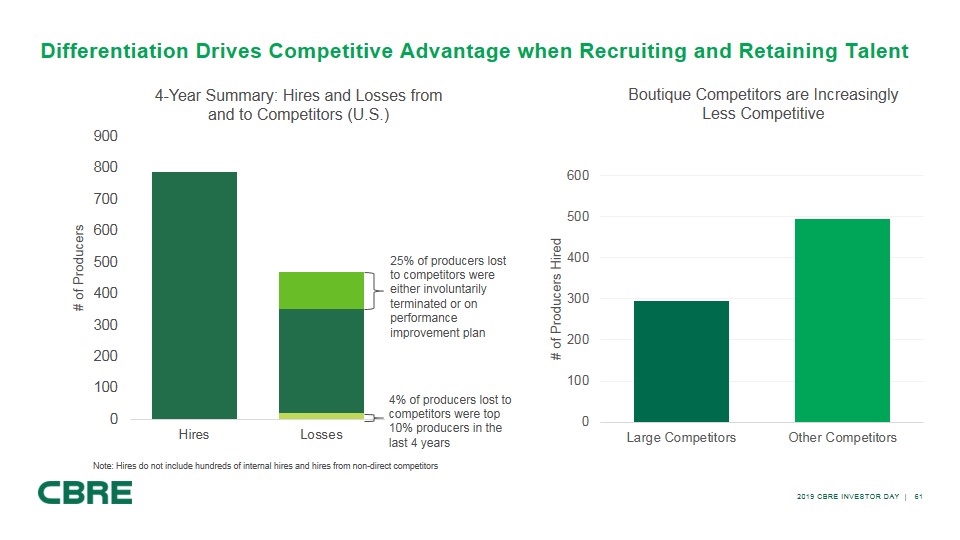

Differentiation Drives Competitive Advantage when Recruiting and Retaining Talent 4-Year Summary: Hires and Losses from and to Competitors (U.S.) Boutique Competitors are Increasingly Less Competitive 25% of producers lost to competitors were either involuntarily terminated or on performance improvement plan 4% of producers lost to competitors were top 10% producers in the last 4 years Note: Hires do not include hundreds of internal hires and hires from non-direct competitors

2019 CBRE INVESTOR DAY Lynn Williams Vice Chairman, Advisory & Transaction Services ADVISORY SERVICES CASE STUDY

My Path to CBRE Career Crossroads Joined CBRE in 2015 after starting career at a competitor. Joined CBRE in 2015 after starting career at a competitor Occupier Client Expectations Talent Local Global Thought leadership and innovation Advisory capabilities Tools/Technology/Data Leadership committed to: Extraordinary client service Results

Investment in Advisory capabilities drive better client outcomes Investments are differentiated within the industry and provide a competitive advantage Driving management consensus Defining the new paradigm Navigating the platform Ensuring client confidence Key differentiator Establishing parameters for initiatives Navigating P&L ramifications Aligning financial reporting requirements Andy Ratner Executive Vice President, Los Angeles Leveraging CBRE’s Investments in Advisory Capabilities Top Local Leadership Workplace Strategy Labor Analytics Financial Consulting Group

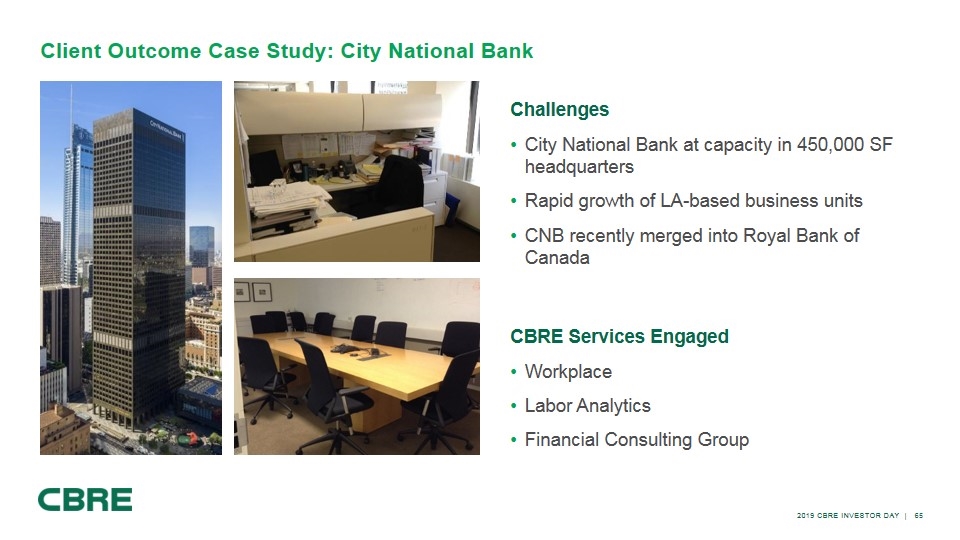

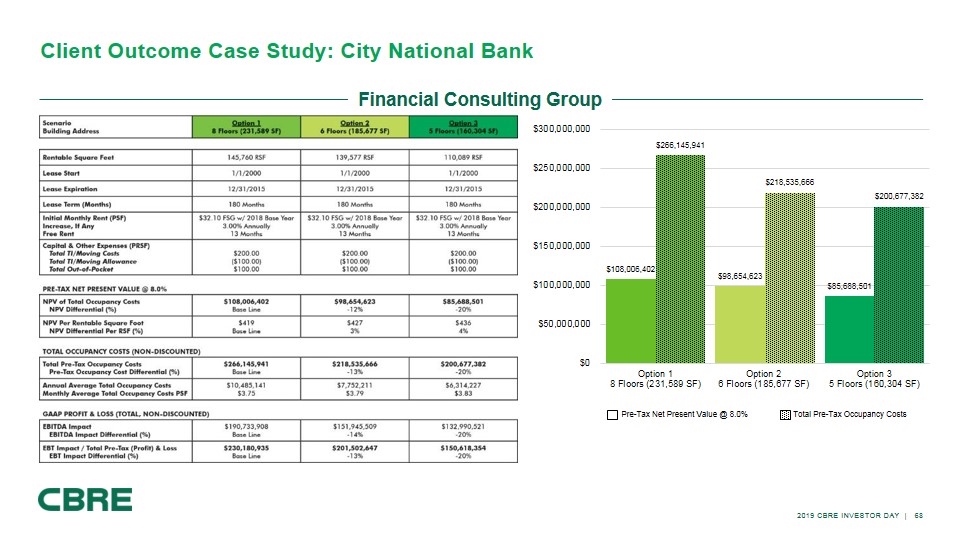

Client Outcome Case Study: City National Bank CBRE Services Engaged Workplace Labor Analytics Financial Consulting Group Challenges City National Bank at capacity in 450,000 SF headquarters Rapid growth of LA-based business units CNB recently merged into Royal Bank of Canada

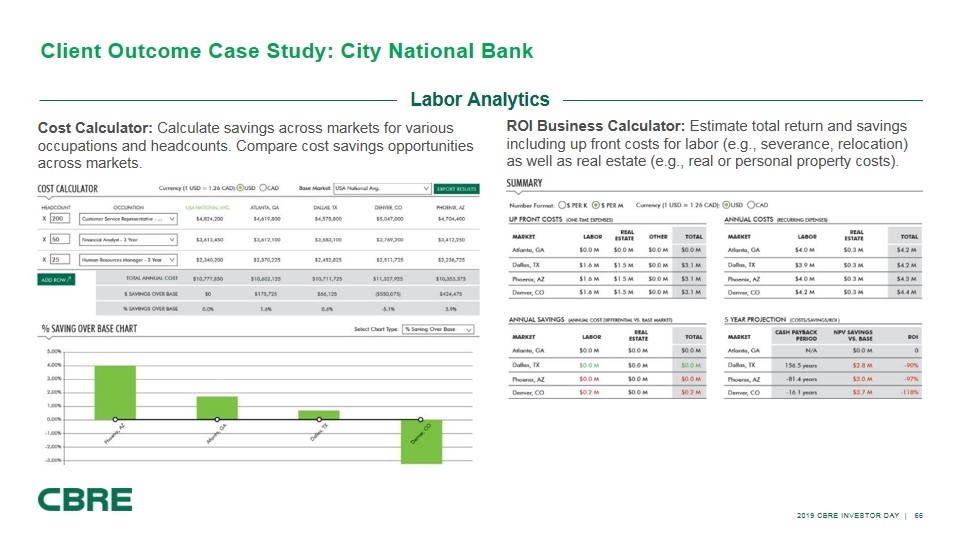

Client Outcome Case Study: City National Bank Cost Calculator: Calculate savings across markets for various occupations and headcounts. Compare cost savings opportunities across markets. ROI Business Calculator: Estimate total return and savings including up front costs for labor (e.g., severance, relocation) as well as real estate (e.g., real or personal property costs). Labor Analytics

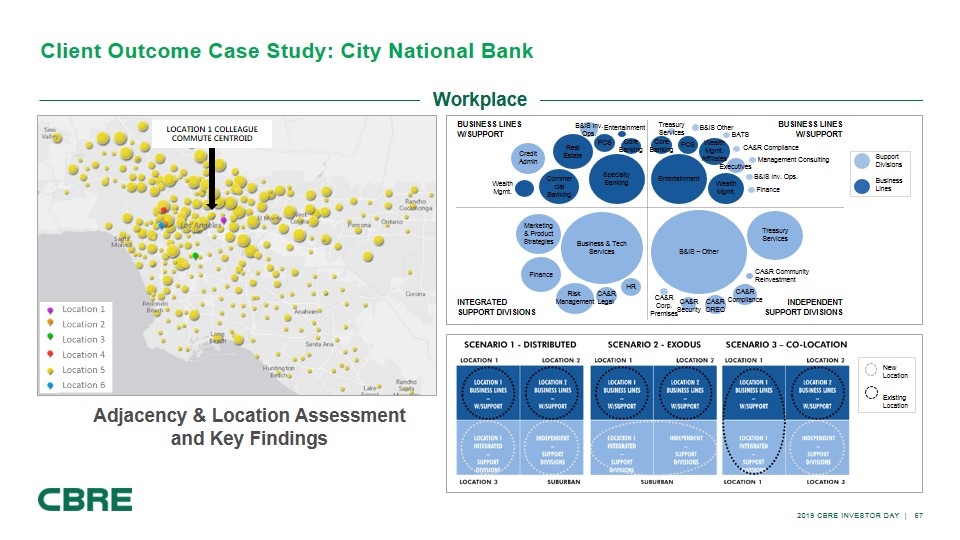

Client Outcome Case Study: City National Bank Adjacency & Location Assessment and Key Findings LOCATION 1 COLLEAGUE COMMUTE CENTROID Support Divisions Business Lines INTEGRATED SUPPORT DIVISIONS INDEPENDENT SUPPORT DIVISIONS BUSINESS LINES W/SUPPORT BUSINESS LINES W/SUPPORT Commercial Banking Specialty Banking PCS Real Estate Entertainment Credit Admin Business & Tech Services Marketing & Product Strategies CA&R Community Reinvestment HR B&IS – Other Finance Treasury Services CA&R Corp. Premises Wealth Mgmt. BATS B&IS Inv. Ops. CA&R Compliance Entertainment Management Consulting PCS Treasury Services B&IS Other CA&R Security Core Banking Core Banking B&IS Inv. Ops. Executives Wealth Mgmt. CA&R Compliance Finance Risk Management CA&R Legal CA&R OREO Wealth Mgmt. Affiliates New Location Existing Location Workplace

Client Outcome Case Study: City National Bank Financial Consulting Group Pre-Tax Net Present Value @ 8.0% Total Pre-Tax Occupancy Costs

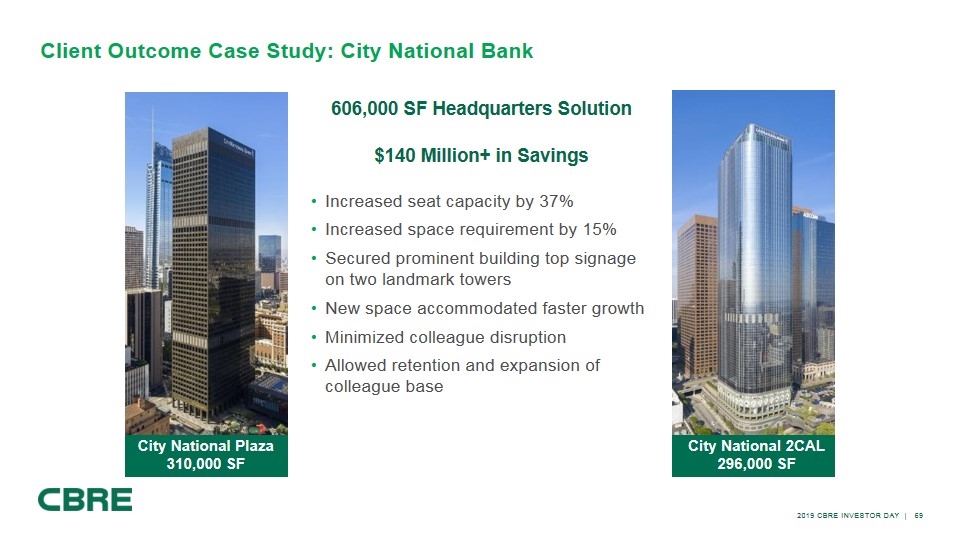

606,000 SF Headquarters Solution $140 Million+ in Savings Increased seat capacity by 37% Increased space requirement by 15% Secured prominent building top signage on two landmark towers New space accommodated faster growth Minimized colleague disruption Allowed retention and expansion of colleague base City National Plaza 310,000 SF City National 2CAL 296,000 SF Client Outcome Case Study: City National Bank

City National 2CAL 296,000 SF Client Outcome Case Study: City National Bank New Efficient Flexible Workspace

CBRE-Driven Professional Success Dramatically Increased Productivity 95 transactions in 3M square feet in 10 countries Energized Professional Engagement Top 300 each year Colbert Coldwell Circle (top 3%) (2017, 2016) Edward S. Gordon Award winner Prolonged Career Horizon

2019 CBRE INVESTOR DAY Bill Concannon Global Chief Executive Officer, Global Workplace Solutions GLOBAL WORKPLACE SOLUTIONS

Global Workplace Solutions Account-Based Contractual Business 4 Major Service Offerings 49,000 Employees 100+ Countries 500+ Contractual Client Portfolios 95% Client Satisfaction Mission Create measurably superior client outcomes by improving occupant experiences through safe, engaging and high performing workplaces. 3.3B square feet 17.4M occupants Facilities Management 130 client portfolios managed 160,000 leases managed Advisory & Transactions $25.4B managed capital projects 1,901 project managers Project Management Consulting & Analytics Integrated Account Solutions Comprising Four Major Service Lines As of December 31, 2018

CBRE Reorganization – Global Workplace Solutions Impact Business model. Creates a clear structure of our global operating model, lines of business and client outcomes Accountability. Creates strong lines of accountability and authority within our accounts-based business Transparency. Provides visibility into the growth, performance and margins of our Global Workplace Solutions business Clients. Aligns customer and market buying behavior with how we present segment performance to external audiences

Facilities management

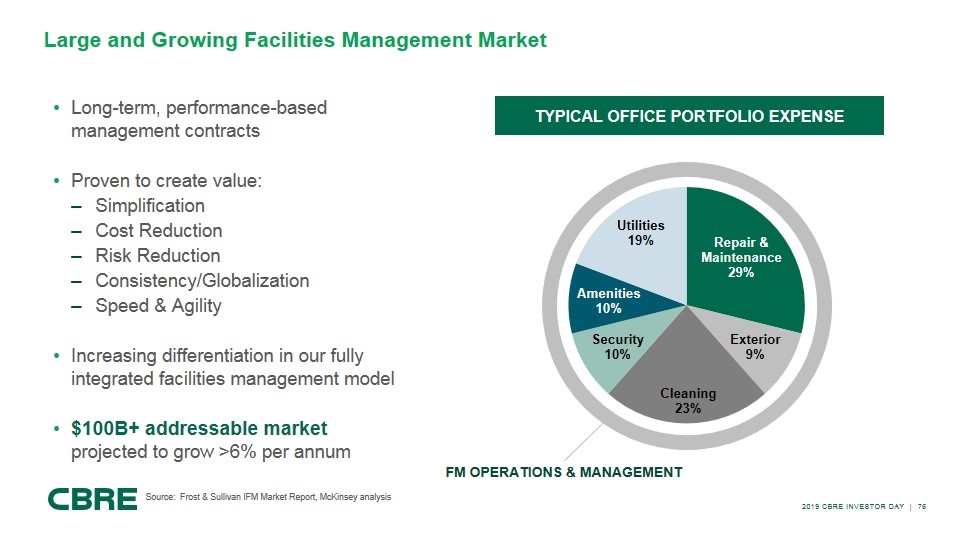

Large and Growing Facilities Management Market Long-term, performance-based management contracts Proven to create value: Simplification Cost Reduction Risk Reduction Consistency/Globalization Speed & Agility Increasing differentiation in our fully integrated facilities management model $100B+ addressable market projected to grow >6% per annum Typical office portfolio EXPENSE FM OPERATIONS & Management Source: Frost & Sullivan IFM Market Report, McKinsey analysis

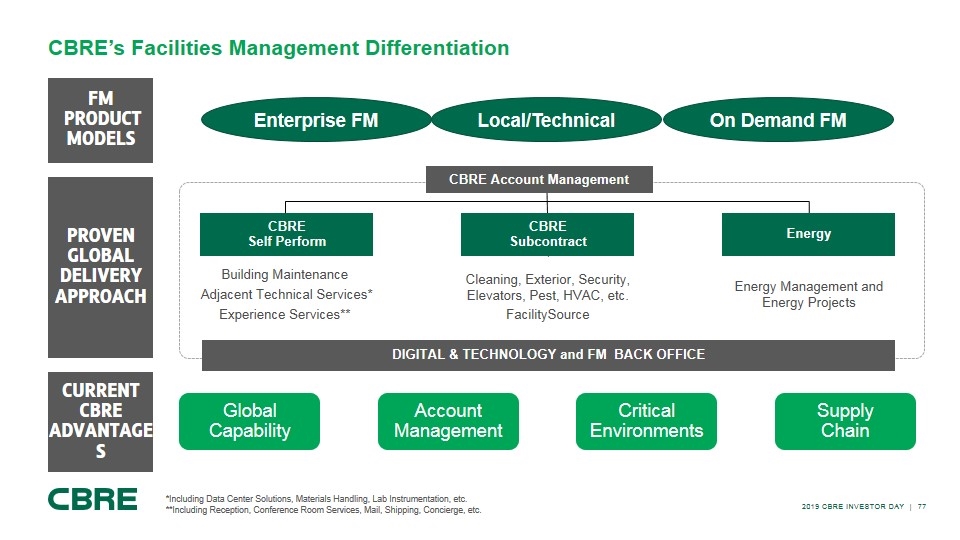

CBRE Self Perform CBRE Subcontract Energy CBRE Account Management Building Maintenance Adjacent Technical Services* Experience Services** Energy Management and Energy Projects Cleaning, Exterior, Security, Elevators, Pest, HVAC, etc. FacilitySource DIGITAL & TECHNOLOGY and FM BACK OFFICE Enterprise FM Local/Technical FM PRODUCT MODELS On Demand FM PROVEN GLOBAL DELIVERY APPROACH CURRENT CBRE ADVANTAGES Global Capability Account Management Critical Environments Supply Chain *Including Data Center Solutions, Materials Handling, Lab Instrumentation, etc. **Including Reception, Conference Room Services, Mail, Shipping, Concierge, etc. CBRE’s Facilities Management Differentiation

project management

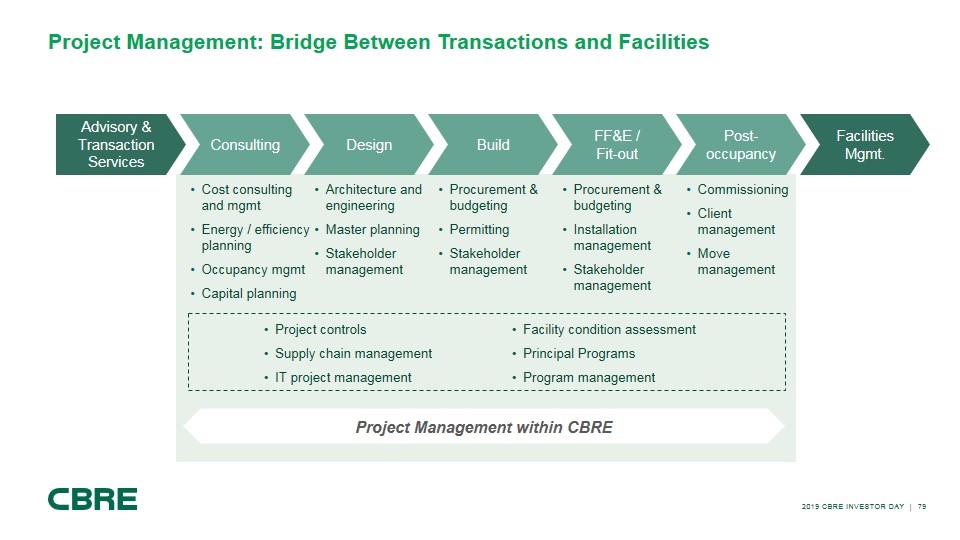

Project Management: Bridge Between Transactions and Facilities Advisory & Transaction Services Design Cost consulting and mgmt Energy / efficiency planning Occupancy mgmt Capital planning Architecture and engineering Master planning Stakeholder management Consulting Project Management within CBRE Post-occupancy Facilities Mgmt. Build FF&E / Fit-out Procurement & budgeting Permitting Stakeholder management Commissioning Client management Move management Procurement & budgeting Installation management Stakeholder management Facility condition assessment Principal Programs Program management Project controls Supply chain management IT project management

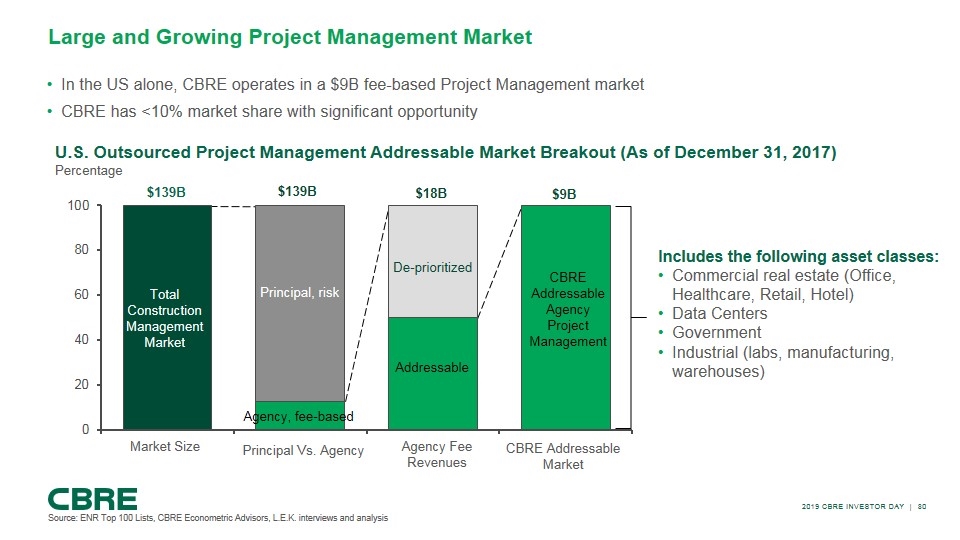

Large and Growing Project Management Market Source: ENR Top 100 Lists, CBRE Econometric Advisors, L.E.K. interviews and analysis Addressable U.S. Outsourced Project Management Addressable Market Breakout (As of December 31, 2017) Percentage De-prioritized Total Construction Management Market Market Size Principal Vs. Agency Principal, risk Agency Fee Revenues CBRE Addressable Agency Project Management CBRE Addressable Market Includes the following asset classes: Commercial real estate (Office, Healthcare, Retail, Hotel) Data Centers Government Industrial (labs, manufacturing, warehouses) In the US alone, CBRE operates in a $9B fee-based Project Management market CBRE has <10% market share with significant opportunity expansion

Global workplace solutions Positioned for growth

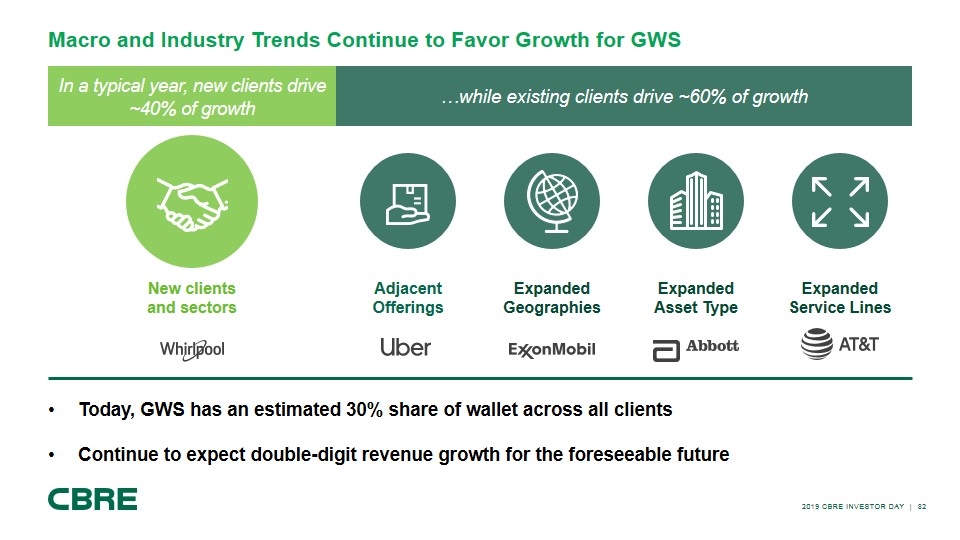

Macro and Industry Trends Continue to Favor Growth for GWS In a typical year, new clients drive ~40% of growth …while existing clients drive ~60% of growth New clients and sectors Adjacent Offerings Expanded Geographies Expanded Asset Type Expanded Service Lines Today, GWS has an estimated 30% share of wallet across all clients Continue to expect double-digit revenue growth for the foreseeable future

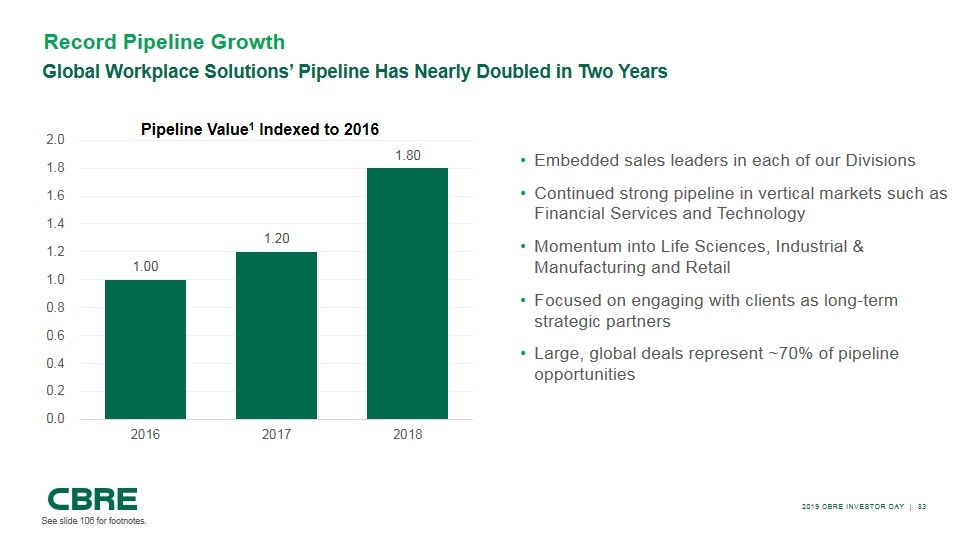

Record Pipeline Growth Global Workplace Solutions’ Pipeline Has Nearly Doubled in Two Years Pipeline Value1 Indexed to 2016 Embedded sales leaders in each of our Divisions Continued strong pipeline in vertical markets such as Financial Services and Technology Momentum into Life Sciences, Industrial & Manufacturing and Retail Focused on engaging with clients as long-term strategic partners Large, global deals represent ~70% of pipeline opportunities See slide 106 for footnotes.

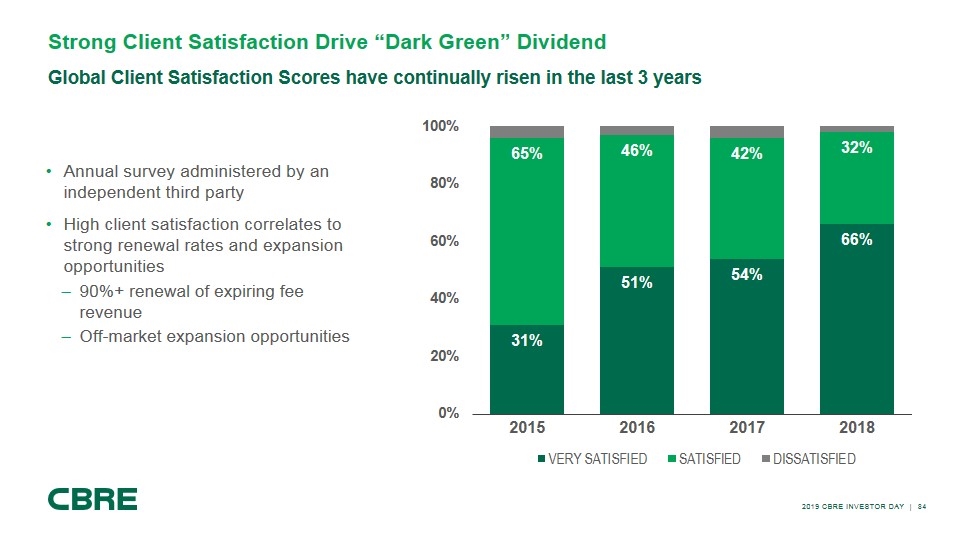

Strong Client Satisfaction Drive “Dark Green” Dividend Global Client Satisfaction Scores have continually risen in the last 3 years Annual survey administered by an independent third party High client satisfaction correlates to strong renewal rates and expansion opportunities 90%+ renewal of expiring fee revenue Off-market expansion opportunities

Large and growing outsourcing markets provide significant headway for growth Momentum demonstrated through pipeline growth and improved client outcomes Integrated account model and new adjacent services drive continued differentiation In Summary…

2019 CBRE INVESTOR DAY Darcy Mackay Chief Human Resources Officer Understanding Global Workplace Solutions: A Case Study of the CBRE/Uber Relationship

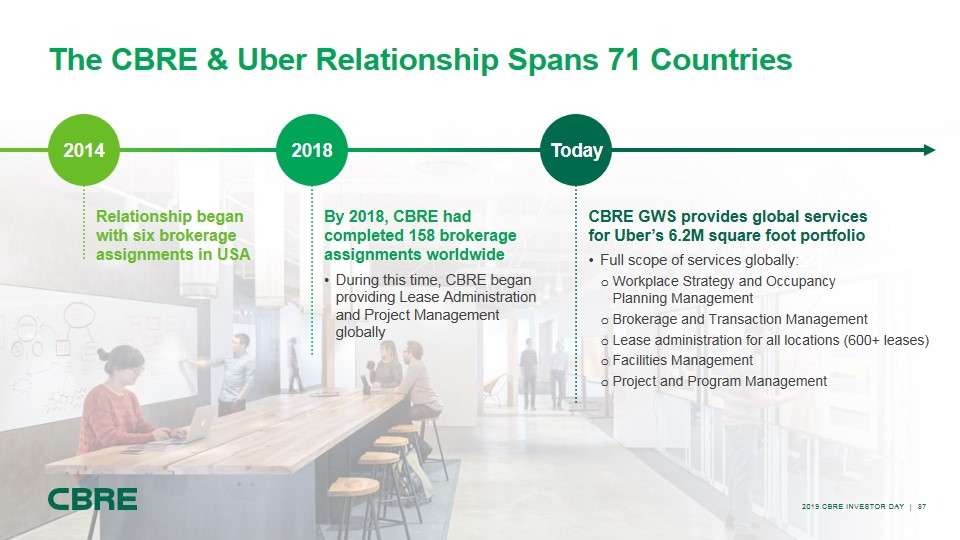

The CBRE & Uber Relationship Spans 71 Countries 2014 2018 Relationship began with six brokerage assignments in USA Today 2019 CBRE Investor Day | By 2018, CBRE had completed 158 brokerage assignments worldwide During this time, CBRE began providing Lease Administration and Project Management globally CBRE GWS provides global services for Uber’s 6.2M square foot portfolio Full scope of services globally: Workplace Strategy and Occupancy Planning Management Brokerage and Transaction Management Lease administration for all locations (600+ leases) Facilities Management Project and Program Management

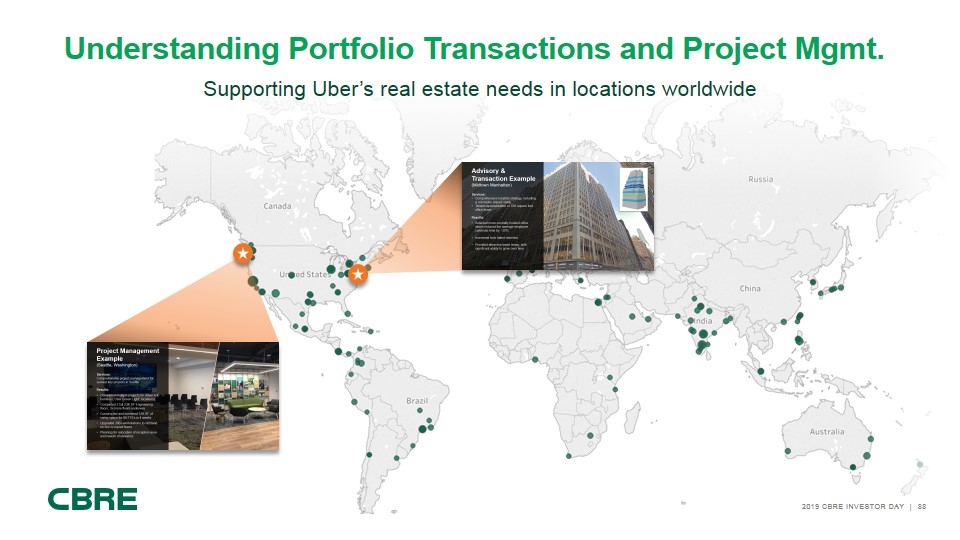

Supporting Uber’s real estate needs in locations worldwide Understanding Portfolio Transactions and Project Mgmt. 2019 CBRE Investor Day |

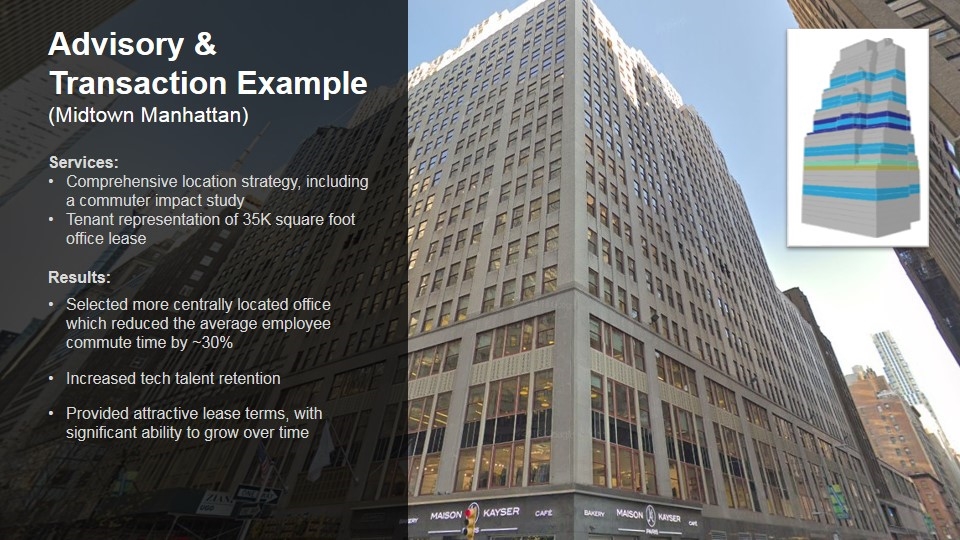

Advisory & Transaction Example (Midtown Manhattan) Services: Comprehensive location strategy, including a commuter impact study Tenant representation of 35K square foot office lease Results: Selected more centrally located office which reduced the average employee commute time by ~30% Increased tech talent retention Provided attractive lease terms, with significant ability to grow over time

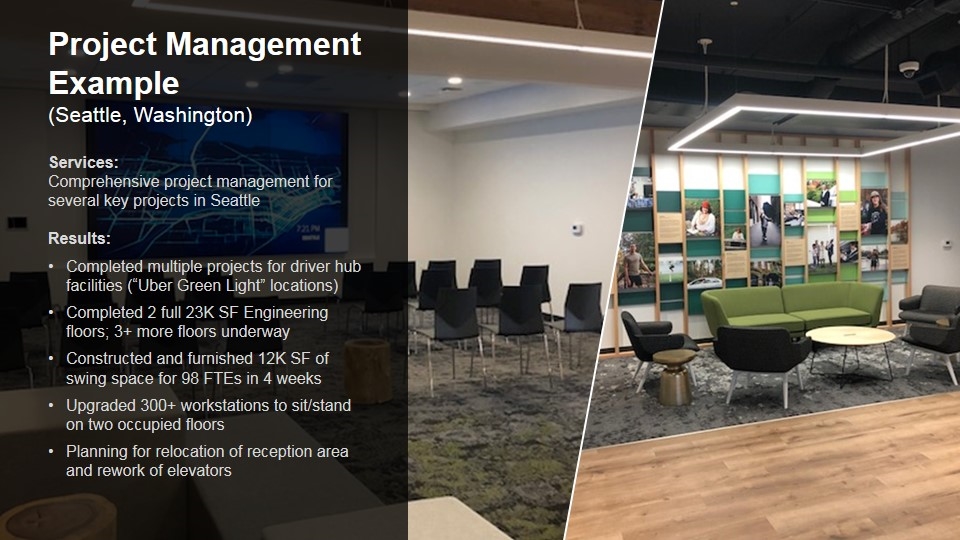

Project Management Example (Seattle, Washington) Services: Comprehensive project management for several key projects in Seattle Results: Completed multiple projects for driver hub facilities (“Uber Green Light” locations) Completed 2 full 23K SF Engineering floors; 3+ more floors underway Constructed and furnished 12K SF of swing space for 98 FTEs in 4 weeks Upgraded 300+ workstations to sit/stand on two occupied floors Planning for relocation of reception area and rework of elevators

Facilities Management Example Maintain building equipment (e.g., HVAC, lighting, plumbing, building controls) Leverage economies of scale for service contracts (e.g., janitorial, landscaping) Support services (e.g., Host, supply chain, safety, accounting) Third-Party Vendors CBRE Support Team CBRE Engineers

The Expanding Definition of Facilities Management: Experience Services When you enter the facility, you are greeted by an “experience” concierge On your way to your meeting, you take notice of the clean surroundings Your walk includes taking a modern elevator to one of the higher floors in the building “It just works.” The temperature and air quality are both pleasant

All AV, refreshments, etc., are ready During a break, you are offered snacks from Uber’s coffee bar At the end of the meeting, the experience concierge returns your coat The Expanding Definition of Facilities Management: Experience Services You notice your meeting space’s unique set up

Introducing CBRE host

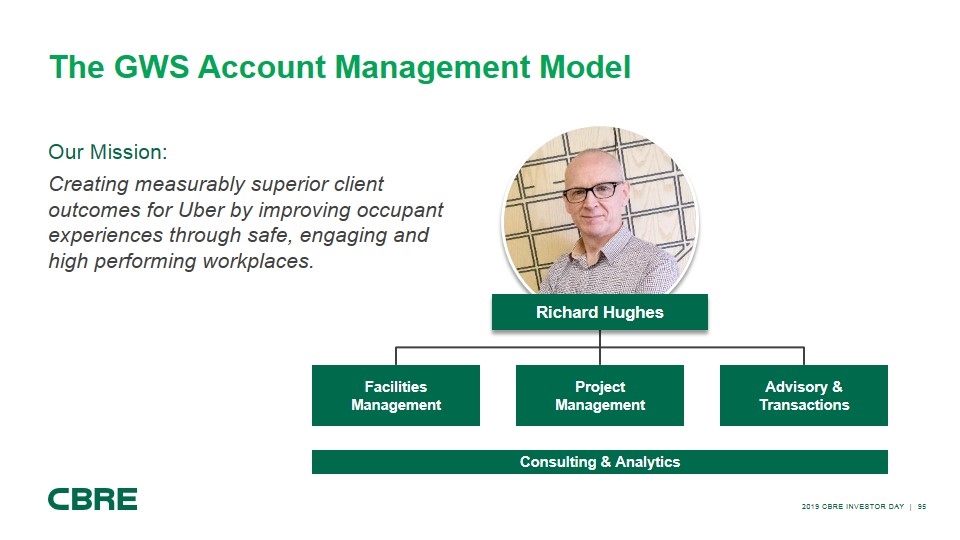

The GWS Account Management Model Our Mission: Creating measurably superior client outcomes for Uber by improving occupant experiences through safe, engaging and high performing workplaces. Facilities Management Advisory & Transactions Project Management Consulting & Analytics Richard Hughes

Footnotes and gaap reconciliation tables

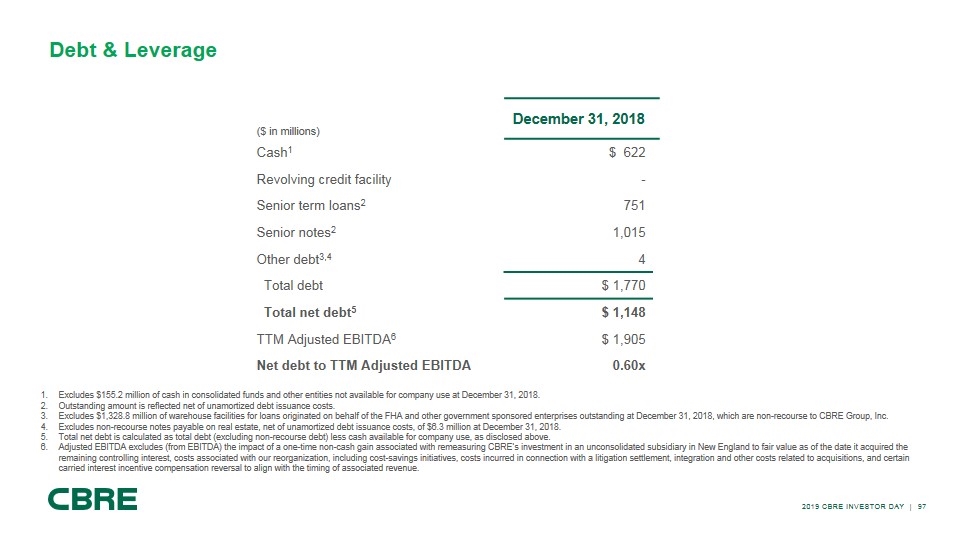

($ in millions) December 31, 2018 Cash1 $ 622 Revolving credit facility - Senior term loans2 751 Senior notes2 1,015 Other debt3,4 4 Total debt $ 1,770 Total net debt5 $ 1,148 TTM Adjusted EBITDA6 $ 1,905 Net debt to TTM Adjusted EBITDA 0.60x Debt & Leverage Excludes $155.2 million of cash in consolidated funds and other entities not available for company use at December 31, 2018. Outstanding amount is reflected net of unamortized debt issuance costs. Excludes $1,328.8 million of warehouse facilities for loans originated on behalf of the FHA and other government sponsored enterprises outstanding at December 31, 2018, which are non-recourse to CBRE Group, Inc. Excludes non-recourse notes payable on real estate, net of unamortized debt issuance costs, of $6.3 million at December 31, 2018. Total net debt is calculated as total debt (excluding non-recourse debt) less cash available for company use, as disclosed above. Adjusted EBITDA excludes (from EBITDA) the impact of a one-time non-cash gain associated with remeasuring CBRE’s investment in an unconsolidated subsidiary in New England to fair value as of the date it acquired the remaining controlling interest, costs associated with our reorganization, including cost-savings initiatives, costs incurred in connection with a litigation settlement, integration and other costs related to acquisitions, and certain carried interest incentive compensation reversal to align with the timing of associated revenue.

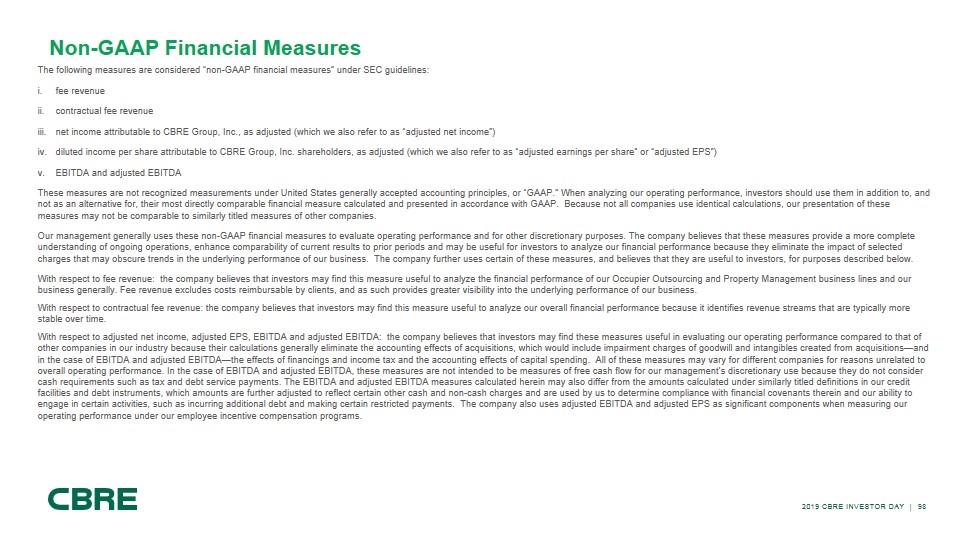

Non-GAAP Financial Measures The following measures are considered “non-GAAP financial measures” under SEC guidelines: fee revenue contractual fee revenue net income attributable to CBRE Group, Inc., as adjusted (which we also refer to as “adjusted net income”) diluted income per share attributable to CBRE Group, Inc. shareholders, as adjusted (which we also refer to as “adjusted earnings per share” or “adjusted EPS”) EBITDA and adjusted EBITDA These measures are not recognized measurements under United States generally accepted accounting principles, or “GAAP.” When analyzing our operating performance, investors should use them in addition to, and not as an alternative for, their most directly comparable financial measure calculated and presented in accordance with GAAP. Because not all companies use identical calculations, our presentation of these measures may not be comparable to similarly titled measures of other companies. Our management generally uses these non-GAAP financial measures to evaluate operating performance and for other discretionary purposes. The company believes that these measures provide a more complete understanding of ongoing operations, enhance comparability of current results to prior periods and may be useful for investors to analyze our financial performance because they eliminate the impact of selected charges that may obscure trends in the underlying performance of our business. The company further uses certain of these measures, and believes that they are useful to investors, for purposes described below. With respect to fee revenue: the company believes that investors may find this measure useful to analyze the financial performance of our Occupier Outsourcing and Property Management business lines and our business generally. Fee revenue excludes costs reimbursable by clients, and as such provides greater visibility into the underlying performance of our business. With respect to contractual fee revenue: the company believes that investors may find this measure useful to analyze our overall financial performance because it identifies revenue streams that are typically more stable over time. With respect to adjusted net income, adjusted EPS, EBITDA and adjusted EBITDA: the company believes that investors may find these measures useful in evaluating our operating performance compared to that of other companies in our industry because their calculations generally eliminate the accounting effects of acquisitions, which would include impairment charges of goodwill and intangibles created from acquisitions—and in the case of EBITDA and adjusted EBITDA—the effects of financings and income tax and the accounting effects of capital spending. All of these measures may vary for different companies for reasons unrelated to overall operating performance. In the case of EBITDA and adjusted EBITDA, these measures are not intended to be measures of free cash flow for our management’s discretionary use because they do not consider cash requirements such as tax and debt service payments. The EBITDA and adjusted EBITDA measures calculated herein may also differ from the amounts calculated under similarly titled definitions in our credit facilities and debt instruments, which amounts are further adjusted to reflect certain other cash and non-cash charges and are used by us to determine compliance with financial covenants therein and our ability to engage in certain activities, such as incurring additional debt and making certain restricted payments. The company also uses adjusted EBITDA and adjusted EPS as significant components when measuring our operating performance under our employee incentive compensation programs.

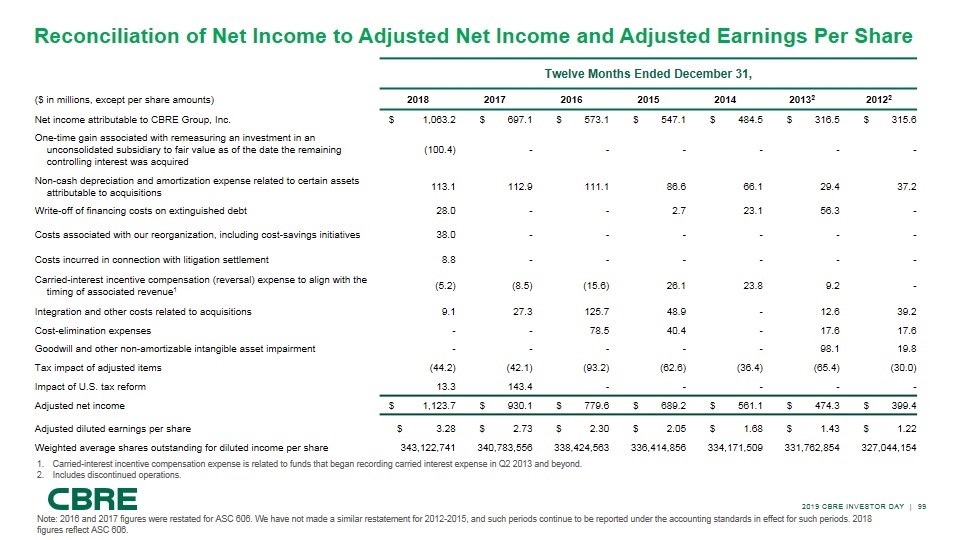

Reconciliation of Net Income to Adjusted Net Income and Adjusted Earnings Per Share Twelve Months Ended December 31, ($ in millions, except per share amounts) 2018 2017 2016 2015 2014 20132 20122 Net income attributable to CBRE Group, Inc. $ 1,063.2 $ 697.1 $ 573.1 $ 547.1 $ 484.5 $ 316.5 $ 315.6 One-time gain associated with remeasuring an investment in an unconsolidated subsidiary to fair value as of the date the remaining controlling interest was acquired (100.4) - - - - - - Non-cash depreciation and amortization expense related to certain assets attributable to acquisitions 113.1 112.9 111.1 86.6 66.1 29.4 37.2 Write-off of financing costs on extinguished debt 28.0 - - 2.7 23.1 56.3 - Costs associated with our reorganization, including cost-savings initiatives 38.0 - - - - - - Costs incurred in connection with litigation settlement 8.8 - - - - - - Carried-interest incentive compensation (reversal) expense to align with the timing of associated revenue1 (5.2) (8.5) (15.6) 26.1 23.8 9.2 - Integration and other costs related to acquisitions 9.1 27.3 125.7 48.9 - 12.6 39.2 Cost-elimination expenses - - 78.5 40.4 - 17.6 17.6 Goodwill and other non-amortizable intangible asset impairment - - - - - 98.1 19.8 Tax impact of adjusted items (44.2) (42.1) (93.2) (62.6) (36.4) (65.4) (30.0) Impact of U.S. tax reform 13.3 143.4 - - - - - Adjusted net income $ 1,123.7 $ 930.1 $ 779.6 $ 689.2 $ 561.1 $ 474.3 $ 399.4 Adjusted diluted earnings per share $ 3.28 $ 2.73 $ 2.30 $ 2.05 $ 1.68 $ 1.43 $ 1.22 Weighted average shares outstanding for diluted income per share 343,122,741 340,783,556 338,424,563 336,414,856 334,171,509 331,762,854 327,044,154 Carried-interest incentive compensation expense is related to funds that began recording carried interest expense in Q2 2013 and beyond. Includes discontinued operations. Note: 2016 and 2017 figures were restated for ASC 606. We have not made a similar restatement for 2012-2015, and such periods continue to be reported under the accounting standards in effect for such periods. 2018 figures reflect ASC 606.

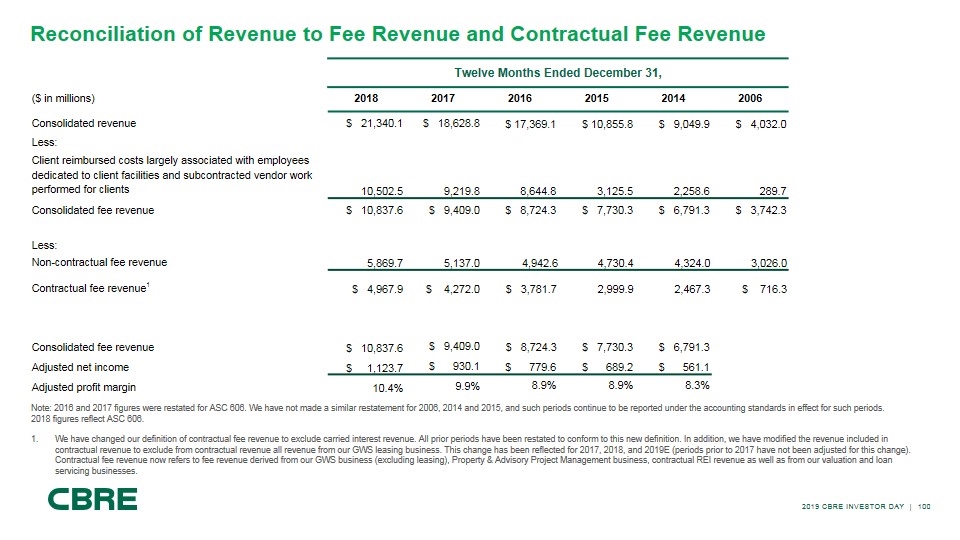

Twelve Months Ended December 31, ($ in millions) 2018 2017 2016 2015 2014 2006 Consolidated revenue $ 21,340.1 $ 18,628.8 $ 17,369.1 $ 10,855.8 $ 9,049.9 $ 4,032.0 Less: Client reimbursed costs largely associated with employees dedicated to client facilities and subcontracted vendor work performed for clients 10,502.5 9,219.8 8,644.8 3,125.5 2,258.6 289.7 Consolidated fee revenue $ 10,837.6 $ 9,409.0 $ 8,724.3 $ 7,730.3 $ 6,791.3 $ 3,742.3 Less: Non-contractual fee revenue 5,869.7 5,137.0 4,942.6 4,730.4 4,324.0 3,026.0 Contractual fee revenue1 $ 4,967.9 $ 4,272.0 $ 3,781.7 2,999.9 2,467.3 $ 716.3 Consolidated fee revenue $ 10,837.6 $ 9,409.0 $ 8,724.3 $ 7,730.3 $ 6,791.3 Adjusted net income $ 1,123.7 $ 930.1 $ 779.6 $ 689.2 $ 561.1 Adjusted profit margin 10.4% 9.9% 8.9% 8.9% 8.3% Reconciliation of Revenue to Fee Revenue and Contractual Fee Revenue Note: 2016 and 2017 figures were restated for ASC 606. We have not made a similar restatement for 2006, 2014 and 2015, and such periods continue to be reported under the accounting standards in effect for such periods. 2018 figures reflect ASC 606. We have changed our definition of contractual fee revenue to exclude carried interest revenue. All prior periods have been restated to conform to this new definition. In addition, we have modified the revenue included in contractual revenue to exclude from contractual revenue all revenue from our GWS leasing business. This change has been reflected for 2017, 2018, and 2019E (periods prior to 2017 have not been adjusted for this change). Contractual fee revenue now refers to fee revenue derived from our GWS business (excluding leasing), Property & Advisory Project Management business, contractual REI revenue as well as from our valuation and loan servicing businesses.

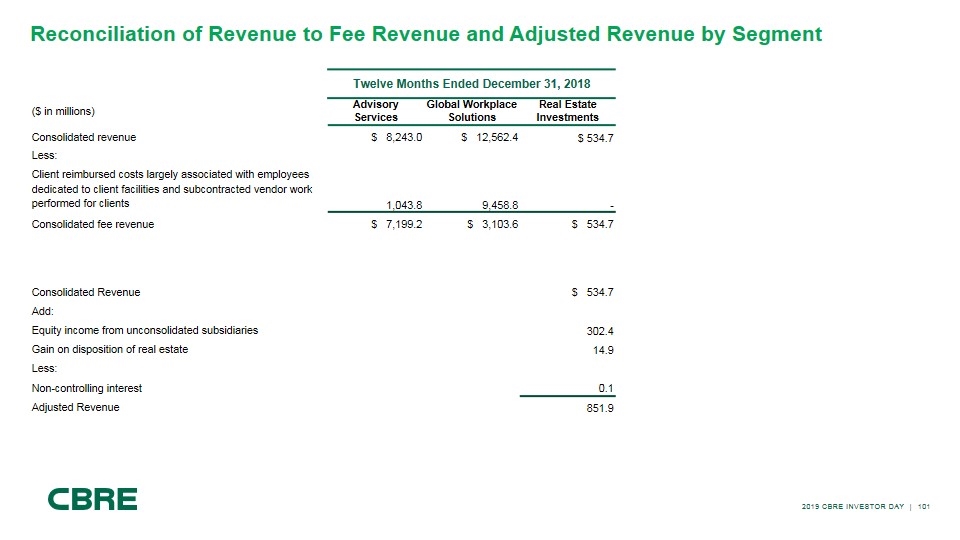

Twelve Months Ended December 31, 2018 ($ in millions) Advisory Services Global Workplace Solutions Real Estate Investments Consolidated revenue $ 8,243.0 $ 12,562.4 $ 534.7 Less: Client reimbursed costs largely associated with employees dedicated to client facilities and subcontracted vendor work performed for clients 1,043.8 9,458.8 - Consolidated fee revenue $ 7,199.2 $ 3,103.6 $ 534.7 Consolidated Revenue $ 534.7 Add: Equity income from unconsolidated subsidiaries 302.4 Gain on disposition of real estate 14.9 Less: Non-controlling interest 0.1 Adjusted Revenue 851.9 Reconciliation of Revenue to Fee Revenue and Adjusted Revenue by Segment

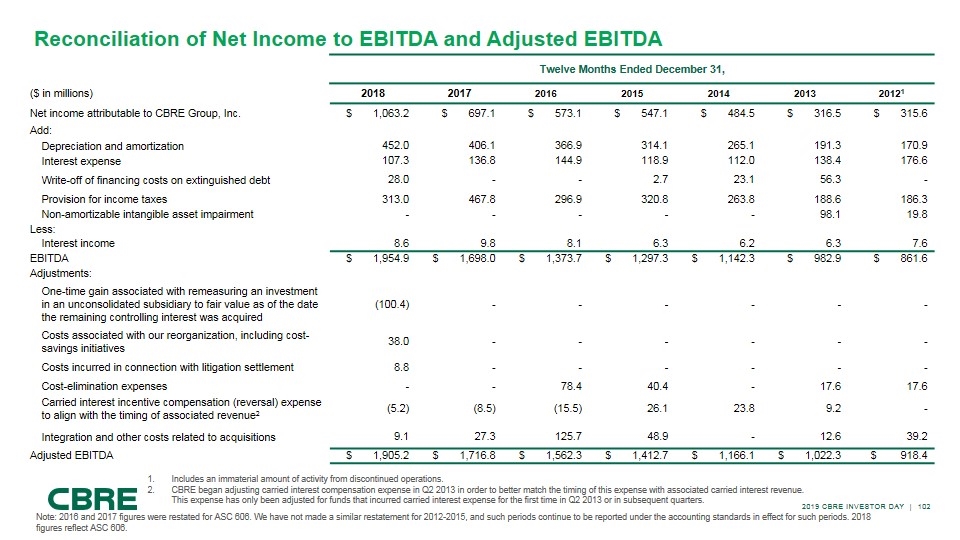

Twelve Months Ended December 31, ($ in millions) 2018 2017 2016 2015 2014 2013 20121 Net income attributable to CBRE Group, Inc. $ 1,063.2 $ 697.1 $ 573.1 $ 547.1 $ 484.5 $ 316.5 $ 315.6 Add: Depreciation and amortization 452.0 406.1 366.9 314.1 265.1 191.3 170.9 Interest expense 107.3 136.8 144.9 118.9 112.0 138.4 176.6 Write-off of financing costs on extinguished debt 28.0 - - 2.7 23.1 56.3 - Provision for income taxes 313.0 467.8 296.9 320.8 263.8 188.6 186.3 Non-amortizable intangible asset impairment - - - - - 98.1 19.8 Less: Interest income 8.6 9.8 8.1 6.3 6.2 6.3 7.6 EBITDA $ 1,954.9 $ 1,698.0 $ 1,373.7 $ 1,297.3 $ 1,142.3 $ 982.9 $ 861.6 Adjustments: One-time gain associated with remeasuring an investment in an unconsolidated subsidiary to fair value as of the date the remaining controlling interest was acquired (100.4) - - - - - - Costs associated with our reorganization, including cost-savings initiatives 38.0 - - - - - - Costs incurred in connection with litigation settlement 8.8 - - - - - - Cost-elimination expenses - - 78.4 40.4 - 17.6 17.6 Carried interest incentive compensation (reversal) expense to align with the timing of associated revenue2 (5.2) (8.5) (15.5) 26.1 23.8 9.2 - Integration and other costs related to acquisitions 9.1 27.3 125.7 48.9 - 12.6 39.2 Adjusted EBITDA $ 1,905.2 $ 1,716.8 $ 1,562.3 $ 1,412.7 $ 1,166.1 $ 1,022.3 $ 918.4 Reconciliation of Net Income to EBITDA and Adjusted EBITDA Includes an immaterial amount of activity from discontinued operations. CBRE began adjusting carried interest compensation expense in Q2 2013 in order to better match the timing of this expense with associated carried interest revenue. This expense has only been adjusted for funds that incurred carried interest expense for the first time in Q2 2013 or in subsequent quarters. Note: 2016 and 2017 figures were restated for ASC 606. We have not made a similar restatement for 2012-2015, and such periods continue to be reported under the accounting standards in effect for such periods. 2018 figures reflect ASC 606.

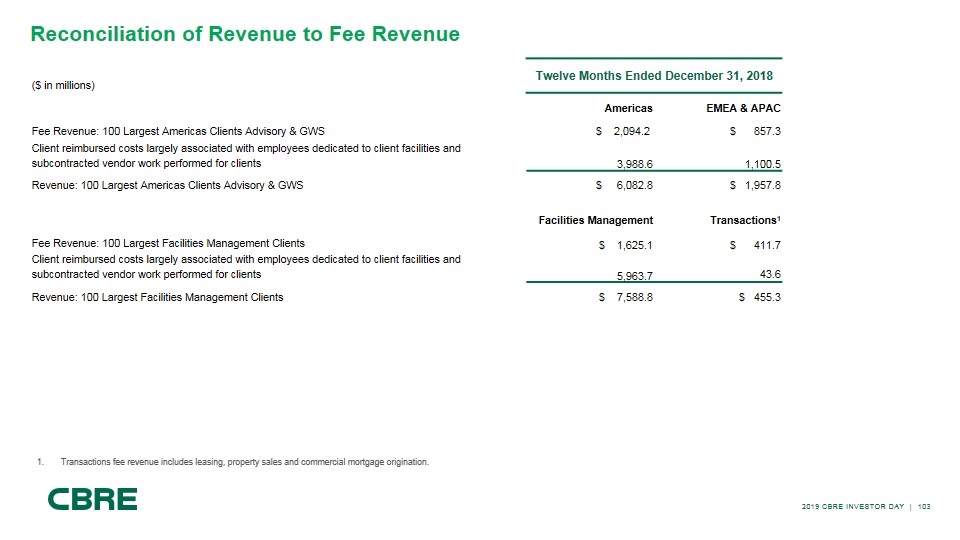

($ in millions) Twelve Months Ended December 31, 2018 Americas EMEA & APAC Fee Revenue: 100 Largest Americas Clients Advisory & GWS $ 2,094.2 $ 857.3 Client reimbursed costs largely associated with employees dedicated to client facilities and subcontracted vendor work performed for clients 3,988.6 1,100.5 Revenue: 100 Largest Americas Clients Advisory & GWS $ 6,082.8 $ 1,957.8 Facilities Management Transactions1 Fee Revenue: 100 Largest Facilities Management Clients $ 1,625.1 $ 411.7 Client reimbursed costs largely associated with employees dedicated to client facilities and subcontracted vendor work performed for clients 5,963.7 43.6 Revenue: 100 Largest Facilities Management Clients $ 7,588.8 $ 455.3 Reconciliation of Revenue to Fee Revenue Transactions fee revenue includes leasing, property sales and commercial mortgage origination.

Footnotes Slide 4 Adjusted EPS excludes a one-time non-cash gain associated with remeasuring CBRE’s investment in an unconsolidated subsidiary in New England to fair value as of the date it acquired the remaining controlling interest, depreciation and amortization expense related to certain assets attributable to acquisitions, integration and other costs related to acquisitions, costs associated with our reorganization, including cost-savings initiatives, costs incurred in connection with a litigation settlement, write-off of financing costs on extinguished debt, cost-elimination expenses, goodwill and other non-amortizable intangible asset impairment and certain carried interest incentive compensation (reversal) expense to align with the timing of associated revenue as well as adjusts the provision for income taxes for such charges. Adjusted EPS also excludes the tax impact of U.S. tax reform initially recorded in the fourth quarter of 2017 and finalized during 2018. All EPS information is based on diluted shares. Slide 5 Fee Revenue is gross revenue less both client reimbursed costs largely associated with our employees that are dedicated to client facilities and subcontracted vendor work performed for clients. We have changed our definition of contractual fee revenue to exclude carried interest revenue. All prior periods have been restated to conform to this new definition. In addition, we have modified the revenue included in contractual revenue to exclude from contractual revenue all revenue from our GWS leasing business. This change has been reflected for 2017, 2018, and 2019E (periods prior to 2017 have not been adjusted for this change). Contractual fee revenue now refers to fee revenue derived from our GWS business (excluding leasing), Property & Advisory Project Management business, contractual REI revenue as well as from our valuation and loan servicing businesses. Slide 8 Fee revenue is gross revenue less both client reimbursed costs largely associated with employees that are dedicated to client facilities and subcontracted vendor work performed for clients. EBITDA represents earnings before net interest expense, write-off of financing costs on extinguished debt, income taxes, depreciation and amortization. Amounts shown for adjusted EBITDA further remove (from EBITDA) the impact of certain cash and non-cash items related to acquisitions, costs associated with our reorganization, including cost-savings initiatives, certain carried interest incentive compensation reversal to align with the timing of associated revenue and other non-recurring costs. Revenue and fee revenue are the same amount for REI as this segment does not have client reimbursed costs. Adjusted fee revenue is Real Estate Investments fee revenue plus equity income from unconsolidated subsidiaries and gain on disposition of real estate, net of non-controlling interest. We believe that investors may find this measure useful to analyze the financial performance of our Real Estate Investments segment because it is more reflective of its total operations. See reconciliation on slide 101. Note – We have not reconciled the consolidated adjusted net income margin and adjusted EBITDA guidance included in this presentation to the most directly comparable GAAP measure because this cannot be done without unreasonable effort due to the variability and low visibility with respect to costs related to acquisitions, carried interest incentive compensation and financing costs, which are potential adjustments to future earnings. We expect the variability of these items to have a potentially unpredictable, and a potentially significant, impact on our future GAAP financial results. Consolidated gross revenue for 2019 is expected to be up 8% to 10% as compared to 2018, while consolidated fee revenue for 2019 is expected to be up 7% to 9% as compared to 2018. In the first quarter of 2018, the company adopted new revenue recognition guidance. Restatements have been made to 2017 and 2016 financial data included in this presentation on slides 4, 5, 6, 7, 99, 100 and 102 to conform with the 2018 presentation. Financial data for periods prior to 2016 have not been restated and continue to be reported under the accounting standards in effect for the relevant period. Accordingly, such prior period amounts should not be compared with the restated financial data for 2016 and 2017 and the reported financial data for 2018. Although we believe that any prior period amounts would not be significantly different if we had restated such periods to conform with the 2018 presentation, there can be no assurance that there would not be a difference, and any such difference may be material.

Footnotes Slides 10, 11, 48 Fee revenue is gross revenue less both client reimbursed costs largely associated with employees that are dedicated to client facilities and subcontracted vendor work performed for clients. EBITDA represents earnings before net interest expense, write-off of financing costs on extinguished debt, income taxes, depreciation and amortization. Amounts shown for adjusted EBITDA further remove (from EBITDA) the impact of certain cash and non-cash items related to acquisitions, costs associated with our reorganization (including cost-savings initiatives) and other non-recurring costs. Slide 12 EBITDA represents earnings before net interest expense, write-off of financing costs on extinguished debt, income taxes, depreciation and amortization. Amounts shown for adjusted EBITDA further remove (from EBITDA) the impact of costs associated with our reorganization (including cost-savings initiatives) and certain carried interest incentive compensation reversal to align with the timing of associated revenue. Slide 14 Adjusted D&A expense removes certain depreciation and amortization expense related to certain acquisitions. Adjusted Tax Rate is the effective tax rate on adjusted pre-tax income after removing net income attributable to non-controlling interests. Slide 17 As of 12/31/18. Net debt is calculated as total debt (excluding non-recourse debt) less available cash for company use. Calculation represents net debt at December 31, 2018 divided by adjusted EBITDA for FY2018. See slide 97. Slide 37 As of December 31, 2018. Assets under management (AUM) refers to the fair market value of real asset-related investments with respect to which CBRE Global Investors provides, on a global basis, oversight, investment management services and other advice and which generally consist of investments in real assets; equity in funds and joint ventures; securities portfolios; operating companies and real asset-related loans. This AUM is intended principally to reflect the extent of CBRE Global Investors’ presence in the global real asset market, and its calculation of AUM may differ from the calculations of other investment or asset managers. In process figures include Long-Term Operating Assets (LTOA) of $30M for Q4 2018, $151M for Q4 2017, $152M for Q4 2016, $152M for Q4 2015, $273M for Q4 2014 and $851M for Q4 2013. LTOA are projects that have achieved a stabilized level of occupancy or have been held 18-24 months following shell completion or acquisition. Slide 39 As of December 31, 2018. Assets under management (AUM) refers to the fair market value of real asset-related investments with respect to which CBRE Global Investors provides, on a global basis, oversight, investment management services and other advice and which generally consist of investments in real assets; equity in funds and joint ventures; securities portfolios; operating companies and real asset-related loans. This AUM is intended principally to reflect the extent of CBRE Global Investors’ presence in the global real asset market, and its calculation of AUM may differ from the calculations of other investment or asset managers. As of December 31, 2018. Investment by Region refers to the regional mandate and/or the location of the underlying investment. AUM by investment type refers to the allocation of assets across the four primary segments: Private Real Estate, Securities, Private Infrastructure and Other. AUM by Strategy refers to the allocation of assets among strategies. Core / Core Plus generally refers to investment strategies that include stabilized investments, with a moderate return and leverage profile. Enhanced Return generally refers to value-add and opportunistic investment strategies with a higher return and leverage profile. Allocation figures are subject to change and may not sum due to rounding.

Footnotes Slide 42 In process as of December 31, 2018. In process figures include Long-Term Operating Assets (LTOA) of $30M for Q4 2018, $151M for Q4 2017, $152M for Q4 2016, $152M for Q4 2015, $273M for Q4 2014 and $851M for Q4 2013. LTOA are projects that have achieved a stabilized level of occupancy or have been held 18-24 months following shell completion or acquisition. Pipeline deals are projects we are pursuing which we believe have a greater than 50% chance of closing or where land has been acquired and the projected construction start is more than 12 months out. Slide 51 Top 20 U.S. markets as defined by RCA. Markets include New York City Metro, Los Angeles Metro, San Francisco Metro, Washington D.C. Metro, Dallas, Chicago, Atlanta, Boston Metro, Miami/South Florida, Houston, Seattle, Phoenix, Denver, San Diego, Philadelphia Metro, Orlando, Las Vegas, Austin, Charlotte and Tampa. Slide 52 Top 20 U.S. markets as defined by RCA. Markets include New York City Metro, Los Angeles Metro, San Francisco Metro, Washington D.C. Metro, Dallas, Chicago, Atlanta, Boston Metro, Miami/South Florida, Houston, Seattle, Phoenix, Denver, San Diego, Philadelphia Metro, Orlando, Las Vegas, Austin, Charlotte and Tampa. Leasing data represents the same top 20 markets as defined by RCA but with market boundaries defined by CBRE research. Slide 59 Fee revenue is gross revenue less both client reimbursed costs largely associated with employees that are dedicated to client facilities and subcontracted vendor work performed for clients. Slide 83 GWS pipeline is defined as the GWS pursuits where a prospect has requested a formal pricing proposal from CBRE, either via a formal RFP process or via an off-market proposal. Pipeline includes both new prospect pursuits, as well as expansion opportunities with existing clients. Pipeline excludes early stage client cultivation activities and client contracts up for renewal.