CBRE group, inc. Investor Overview September 2018 Exhibit 99.1

This presentation contains statements that are forward looking within the meaning of the Private Securities Litigation Reform Act of 1995. These include statements regarding CBRE’s future growth momentum, operations, market share, business outlook, and financial performance expectations. These statements are estimates only and actual results may ultimately differ from them. Except to the extent required by applicable securities laws, we undertake no obligation to update or publicly revise any of the forward-looking statements that you may hear today. Please refer to our second quarter earnings release, furnished on Form 8-K, our most recent annual report filed on Form 10-K and our most recent quarterly report filed on Form 10-Q, and in particular any discussion of risk factors or forward-looking statements therein, which are available on the SEC’s website (www.sec.gov), for a full discussion of the risks and other factors that may impact any forward-looking statements that you may hear today. We may make certain statements during the course of this presentation, which include references to “non-GAAP financial measures,” as defined by SEC regulations. Where required by these regulations, we have provided reconciliations of these measures to what we believe are the most directly comparable GAAP measures, which are attached hereto within the appendix. Forward-Looking Statements

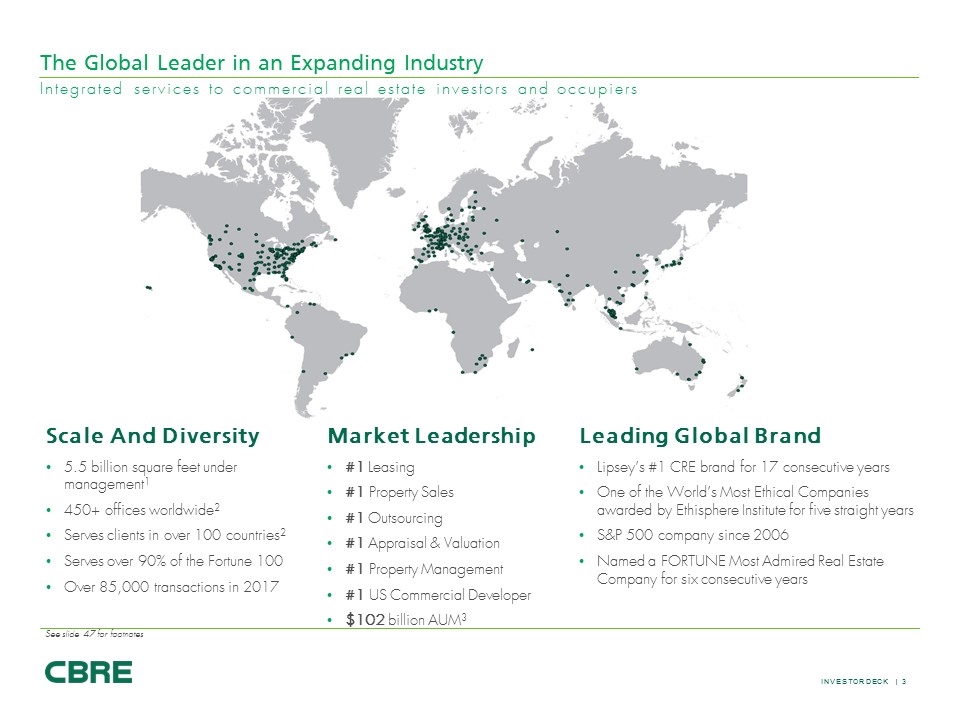

Market Leadership #1 Leasing #1 Property Sales #1 Outsourcing #1 Appraisal & Valuation #1 Property Management #1 US Commercial Developer $102 billion AUM3 Scale And Diversity 5.5 billion square feet under management1 450+ offices worldwide2 Serves clients in over 100 countries2 Serves over 90% of the Fortune 100 Over 85,000 transactions in 2017 The Global Leader in an Expanding Industry Integrated services to commercial real estate investors and occupiers Leading Global Brand Lipsey’s #1 CRE brand for 17 consecutive years One of the World’s Most Ethical Companies awarded by Ethisphere Institute for five straight years S&P 500 company since 2006 Named a FORTUNE Most Admired Real Estate Company for six consecutive years See slide 47 for footnotes

CBRE Strategic priorities Intense Focus on Client Outcomes Top Talent: Leadership and Production Premier Platform, Notably Digital & Technology Scale, Connectivity and Culture Strategic Investment, Notably M&A and Digital & Tech Thoughtful, Intensive Cost Management

Why Reorganize? Advances CBRE’s Client-Focused Strategy Streamline lines of responsibility; flatter organization with potential operating efficiencies Elevate most talented executives into most impactful roles Increase financial transparency and accountability REAL ESTATE INVESTMENTS ADVISORY SERVICES GLOBAL WORKPLACE SOLUTIONS CBRE’s Three Global Businesses – 2019 and Beyond

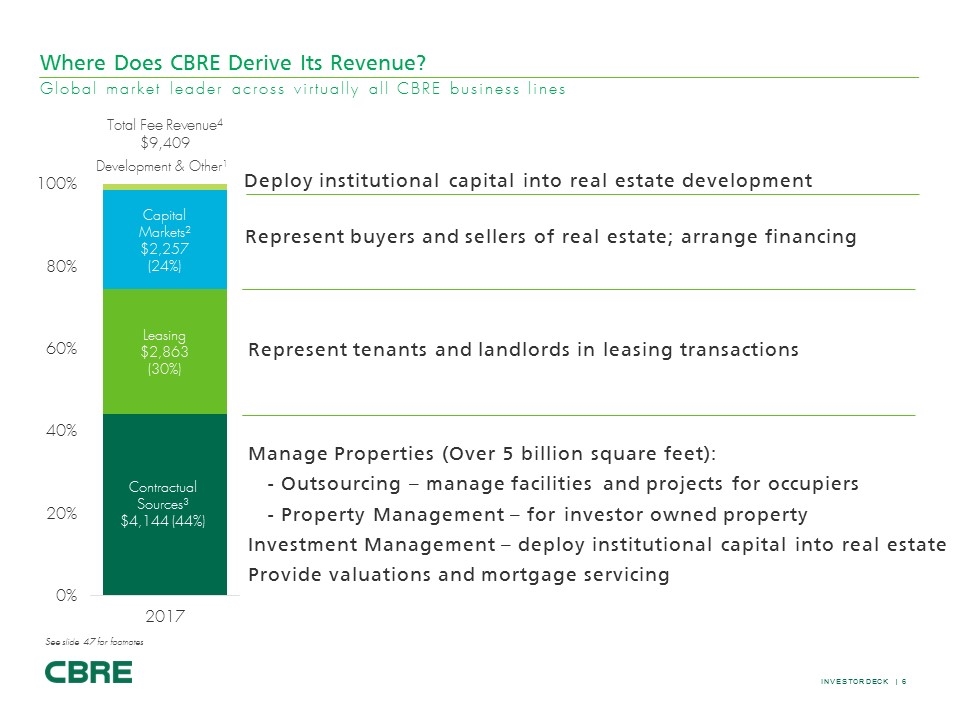

Where Does CBRE Derive Its Revenue? Global market leader across virtually all CBRE business lines Manage Properties (Over 5 billion square feet): - Outsourcing – manage facilities and projects for occupiers - Property Management – for investor owned property Investment Management – deploy institutional capital into real estate Provide valuations and mortgage servicing Deploy institutional capital into real estate development Represent buyers and sellers of real estate; arrange financing Represent tenants and landlords in leasing transactions Total Fee Revenue4 $9,409 Development & Other1 See slide 47 for footnotes Capital Markets 2 $2,257 (24%) Leasing $2,863 (30%) Contractual Sources 3 $4,144 (44%) 100 80 60 40 20 0 %

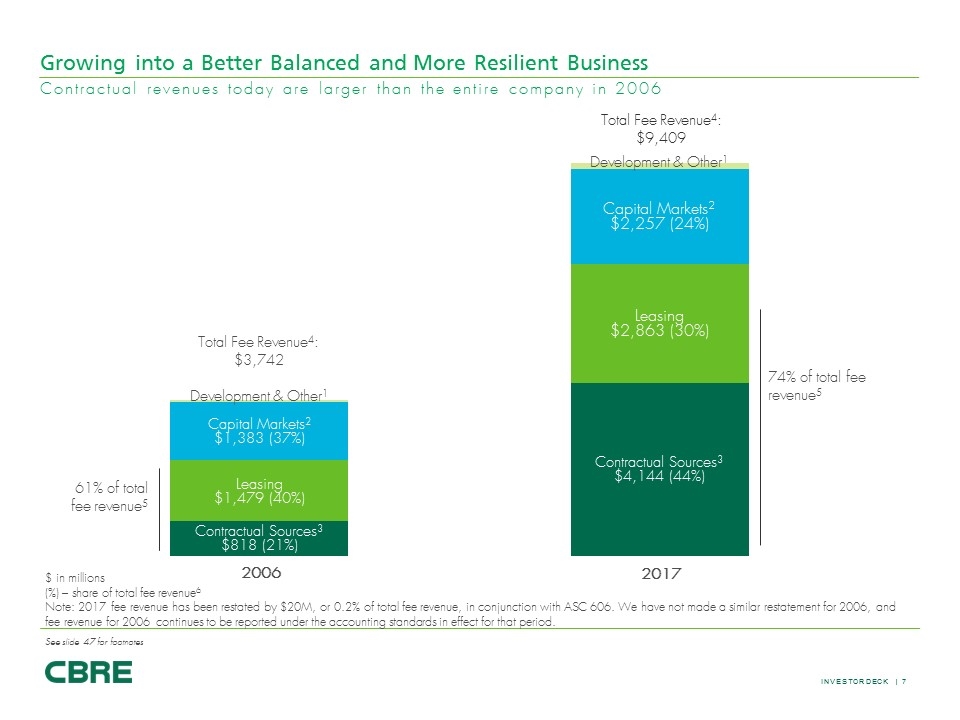

74% of total fee revenue5 See slide 47 for footnotes Growing into a Better Balanced and More Resilient Business $ in millions (%) – share of total fee revenue6 Note: 2017 fee revenue has been restated by $20M, or 0.2% of total fee revenue, in conjunction with ASC 606. We have not made a similar restatement for 2006, and fee revenue for 2006 continues to be reported under the accounting standards in effect for that period. Contractual revenues today are larger than the entire company in 2006 Contractual Sources 3 $818 (21%) Contractual Sources 3 $4,144 (44%) Leasing $1,479 (40%) Leasing $2,863 (30%) Capital Markets 2 $1,383 (37%) Capital Markets 2 $2,257 (24%) Development & Other 1 Development & Other1 Total Fee Revenue4: $3,742 Total Fee Revenue4: $9,409

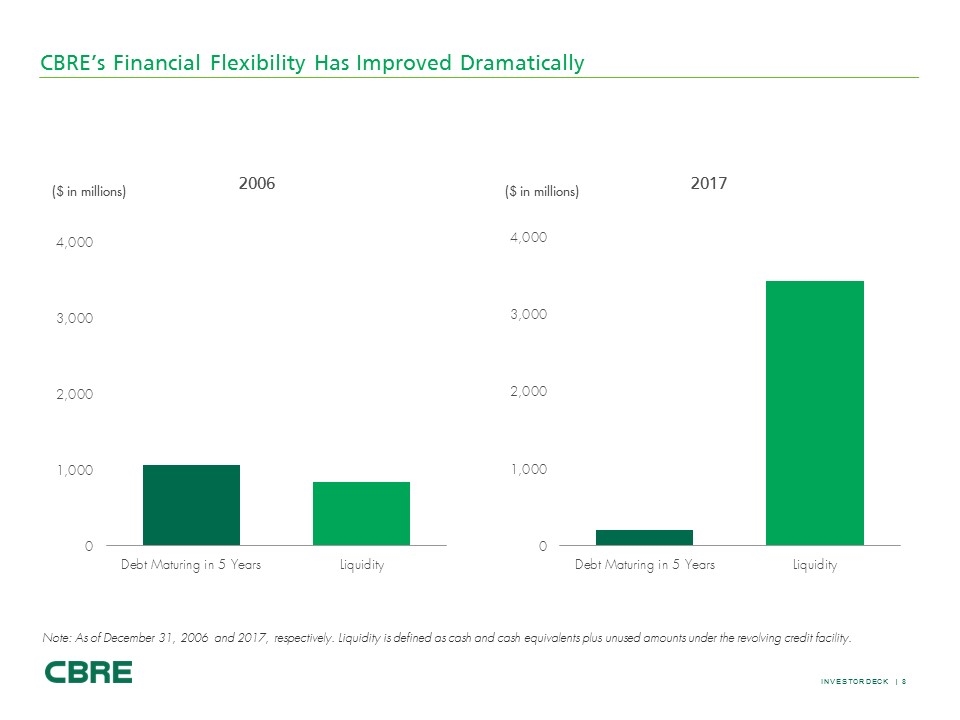

CBRE’s Financial Flexibility Has Improved Dramatically ($ in millions) ($ in millions) Note: As of December 31, 2006 and 2017, respectively. Liquidity is defined as cash and cash equivalents plus unused amounts under the revolving credit facility. Debt maturing in 5 years Liquidity 4,00 3,000 2,000 1,000 0

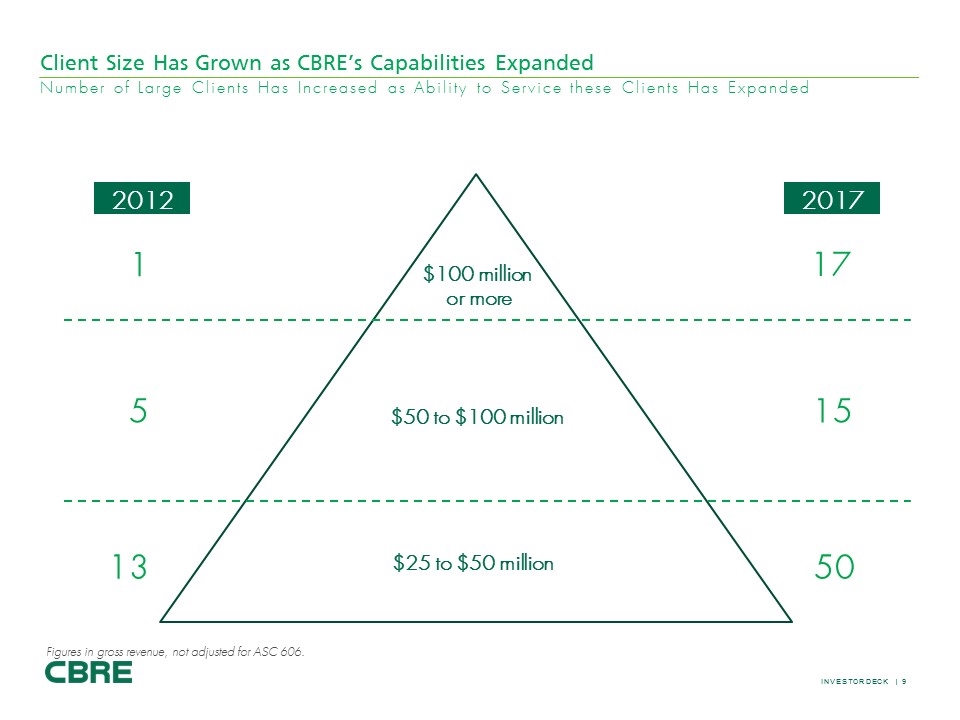

Client Size Has Grown as CBRE’s Capabilities Expanded Number of Large Clients Has Increased as Ability to Service these Clients Has Expanded $100 million or more $50 to $100 million $25 to $50 million 2012 2017 13 50 5 1 15 17 Figures in gross revenue, not adjusted for ASC 606.

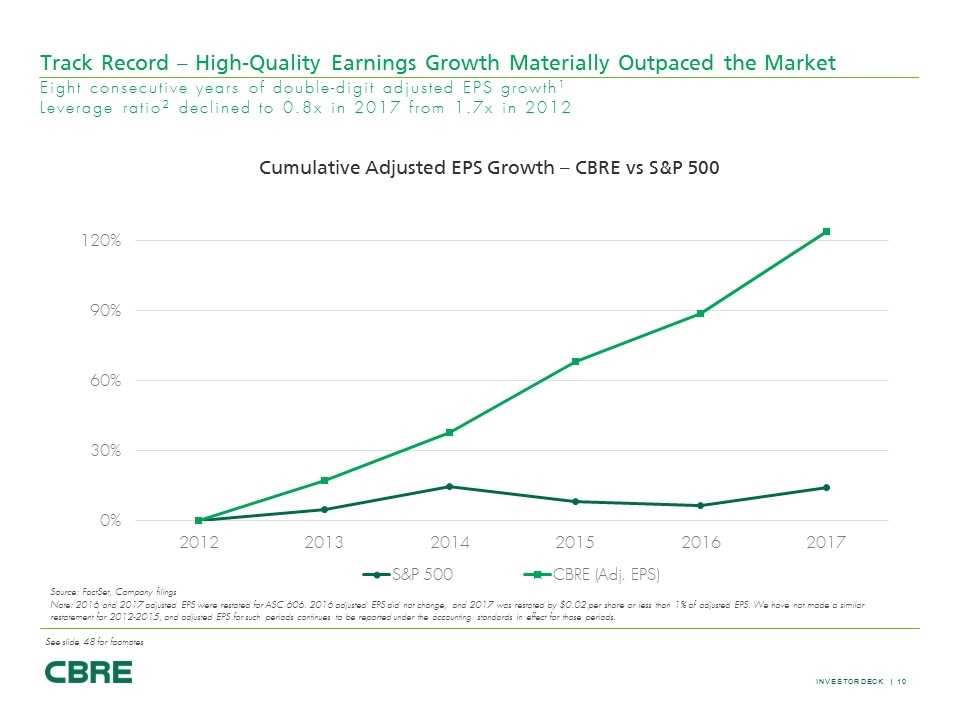

Track Record – High-Quality Earnings Growth Materially Outpaced the Market Eight consecutive years of double-digit adjusted EPS growth1 Leverage ratio2 declined to 0.8x in 2017 from 1.7x in 2012 Source: FactSet, Company filings Note: 2016 and 2017 adjusted EPS were restated for ASC 606. 2016 adjusted EPS did not change, and 2017 was restated by $0.02 per share or less than 1% of adjusted EPS. We have not made a similar restatement for 2012-2015, and adjusted EPS for such periods continues to be reported under the accounting standards in effect for those periods. Cumulative Adjusted EPS Growth – CBRE vs S&P 500 See slide 48 for footnotes

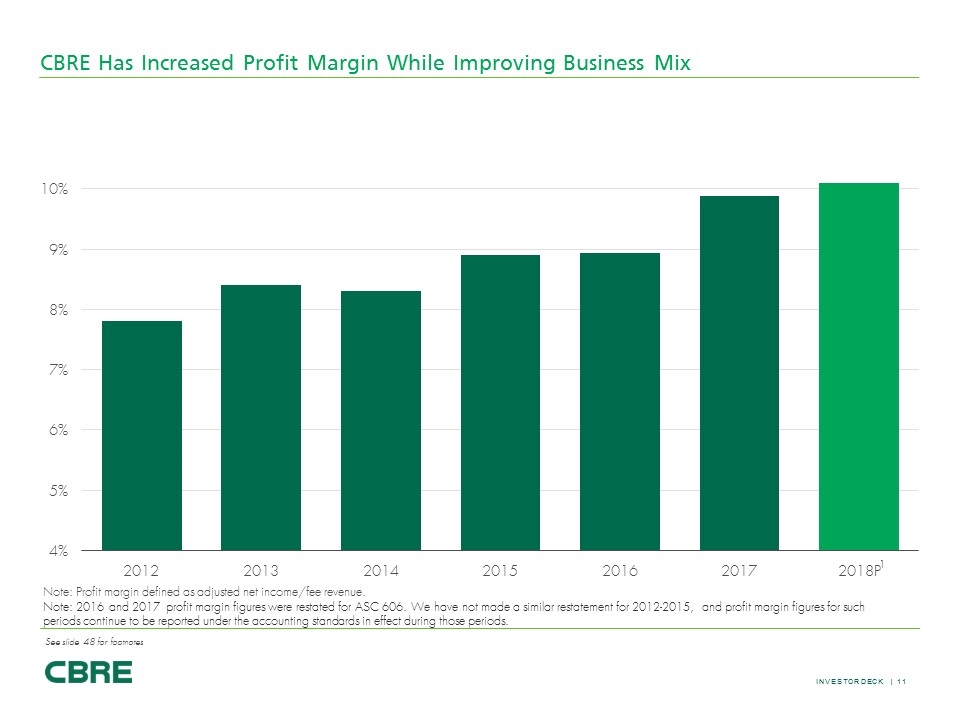

CBRE Has Increased Profit Margin While Improving Business Mix Note: Profit margin defined as adjusted net income/fee revenue. Note: 2016 and 2017 profit margin figures were restated for ASC 606. We have not made a similar restatement for 2012-2015, and profit margin figures for such periods continue to be reported under the accounting standards in effect during those periods. 1 See slide 48 for footnotes

Three Structural Tailwinds for Commercial Real Estate Services Outsourcing – Occupier Acceptance of Outsourced Commercial Real Estate Services Asset Allocation – By Institutional Investors to the Commercial Real Estate Asset Class Consolidation – Customers are Driving Consolidation to Global Industry Leaders

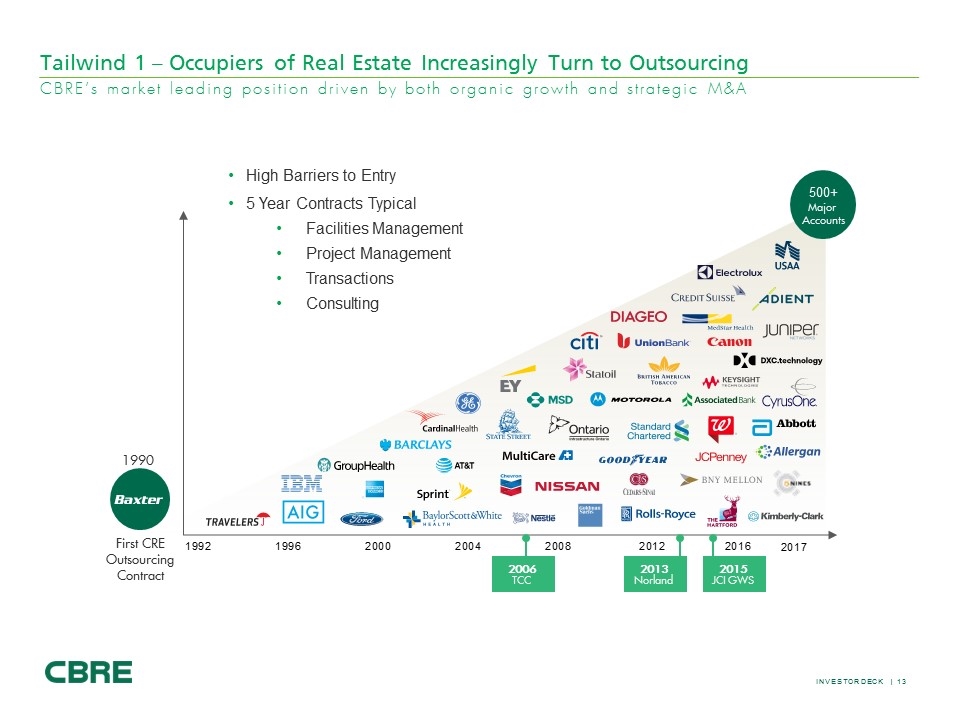

2006 TCC 2013 Norland 2015 JCI GWS 1990 First CRE Outsourcing Contract 500+ Major Accounts High Barriers to Entry 5 Year Contracts Typical Facilities Management Project Management Transactions Consulting Tailwind 1 – Occupiers of Real Estate Increasingly Turn to Outsourcing CBRE’s market leading position driven by both organic growth and strategic M&A

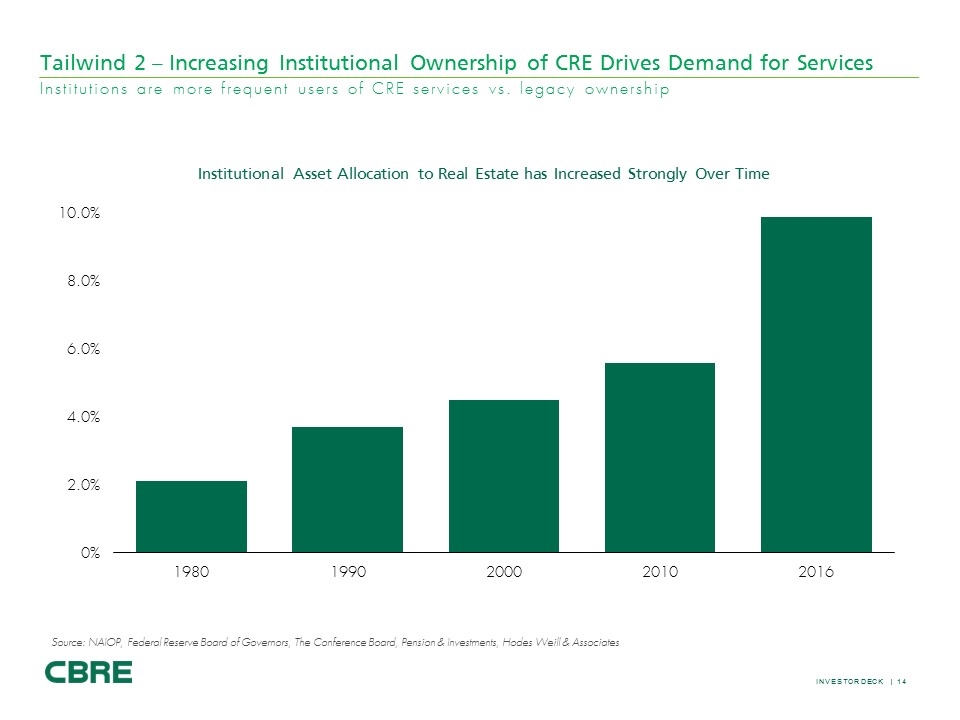

Tailwind 2 – Increasing Institutional Ownership of CRE Drives Demand for Services Institutions are more frequent users of CRE services vs. legacy ownership Institutional Asset Allocation to Real Estate has Increased Strongly Over Time Source: NAIOP, Federal Reserve Board of Governors, The Conference Board, Pension & Investments, Hodes Weill & Associates

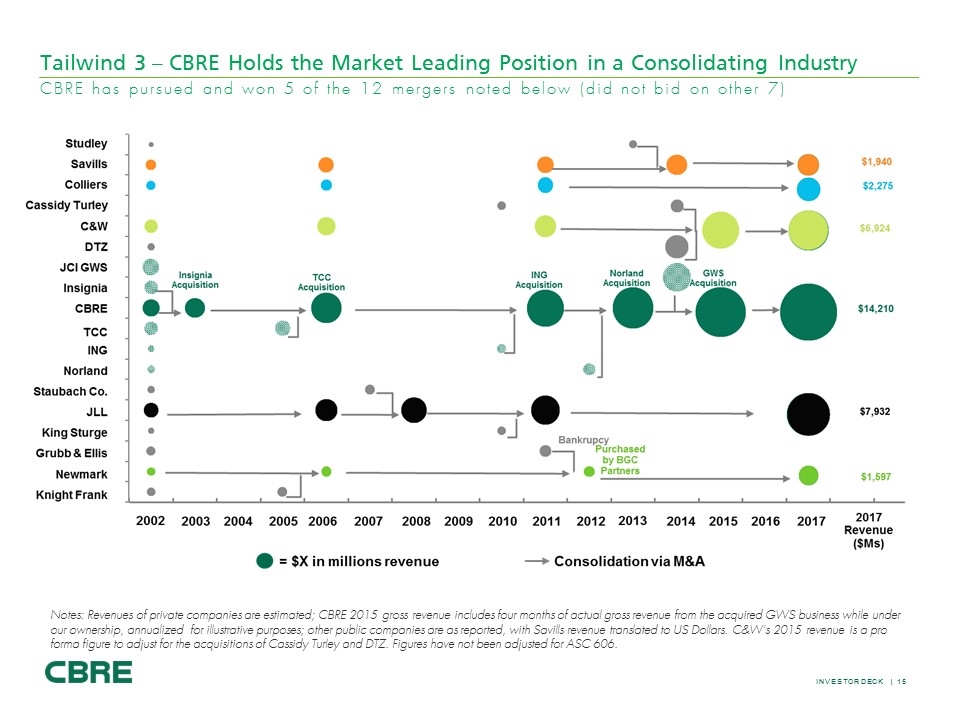

Tailwind 3 – CBRE Holds the Market Leading Position in a Consolidating Industry Notes: Revenues of private companies are estimated; CBRE 2015 gross revenue includes four months of actual gross revenue from the acquired GWS business while under our ownership, annualized for illustrative purposes; other public companies are as reported, with Savills revenue translated to US Dollars. C&W’s 2015 revenue is a pro forma figure to adjust for the acquisitions of Cassidy Turley and DTZ. Figures have not been adjusted for ASC 606. CBRE has pursued and won 5 of the 12 mergers noted below (did not bid on other 7)

Focused technology investments further differentiating CBRE and its professionals CBRE can make impactful investments at a smaller percentage of company spend vs others CBRE Floored SaaS Interactive Creation of 3D Floor Plans and Virtual Environments Sample of CBRE Technology Investments www.cbre.com/vantage CBRE Deal IQ Forum Analytics Leading Predictive Analytics Platform SaaS CRM and Deal Management Platform We Believe Digital Opportunities Significantly Exceed Disruption Risk

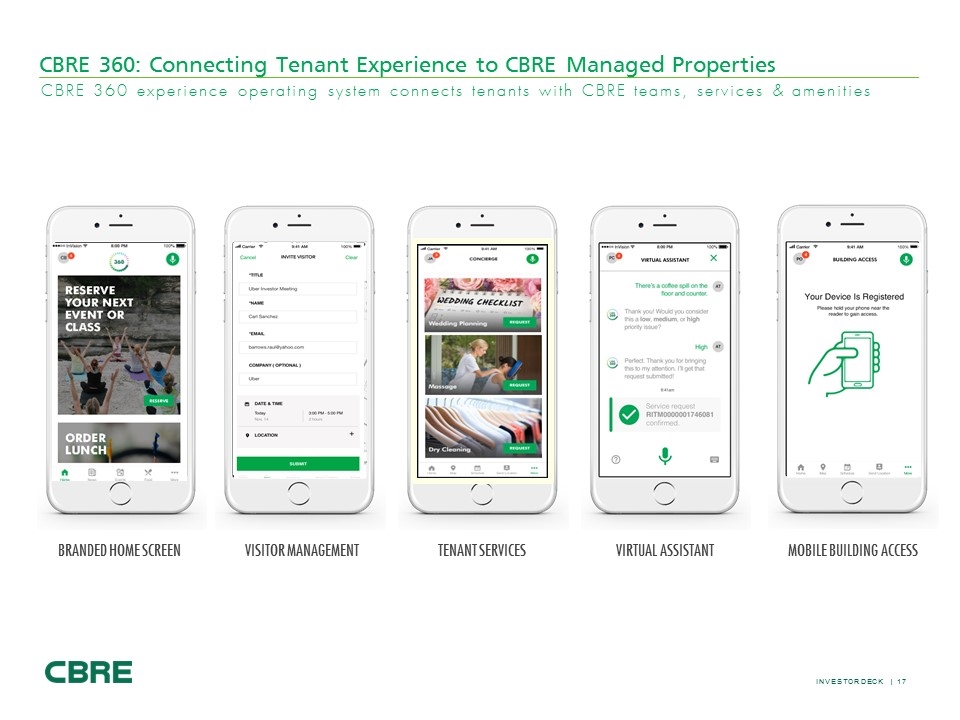

CBRE 360 experience operating system connects tenants with CBRE teams, services & amenities CBRE 360: Connecting Tenant Experience to CBRE Managed Properties BRANDED HOME SCREEN VISITOR MANAGEMENT VIRTUAL ASSISTANT TENANT SERVICES MOBILE BUILDING ACCESS

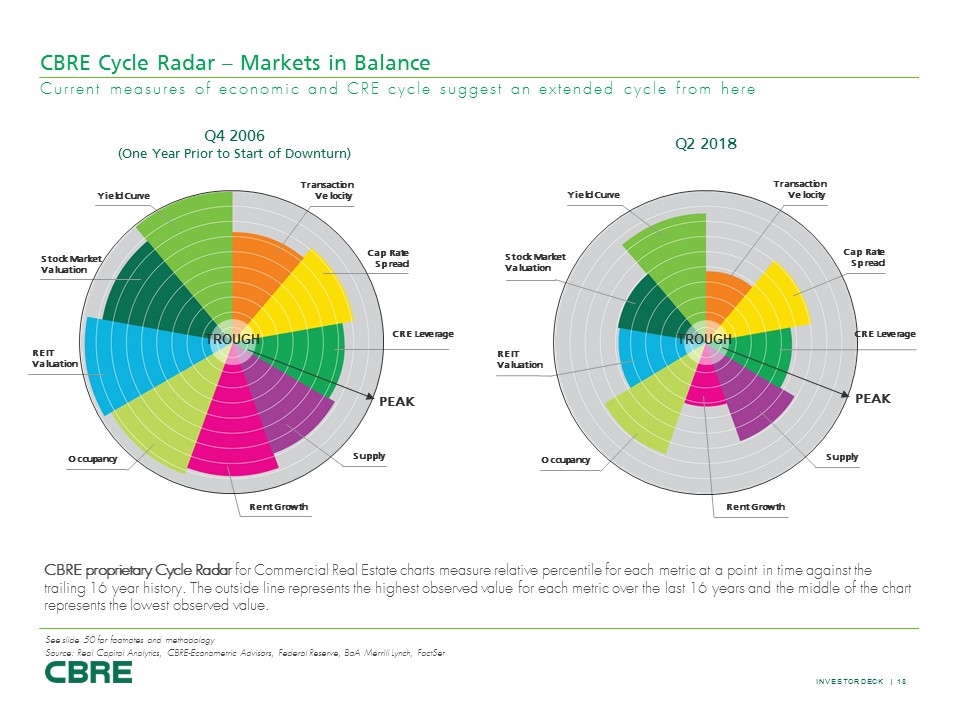

CBRE Cycle Radar – Markets in Balance Current measures of economic and CRE cycle suggest an extended cycle from here Q4 2006 (One Year Prior to Start of Downturn) CBRE proprietary Cycle Radar for Commercial Real Estate charts measure relative percentile for each metric at a point in time against the trailing 16 year history. The outside line represents the highest observed value for each metric over the last 16 years and the middle of the chart represents the lowest observed value. Source: Real Capital Analytics, CBRE-Econometric Advisors, Federal Reserve, BoA Merrill Lynch, FactSet See slide 50 for footnotes and methodology Yield Curve Transaction Velocity Cap Rate Spread CRE Leverage Supply Rent Growth Occupancy REIT Valuation Stock Market Valuation TROUGH PEAK Q2 2018 TROUGH Yield Curve Transaction Velocity Cap Rate Spread CRE Leverage Supply Rent Growth Occupancy REIT Valuation Stock Market Valuation PEAK

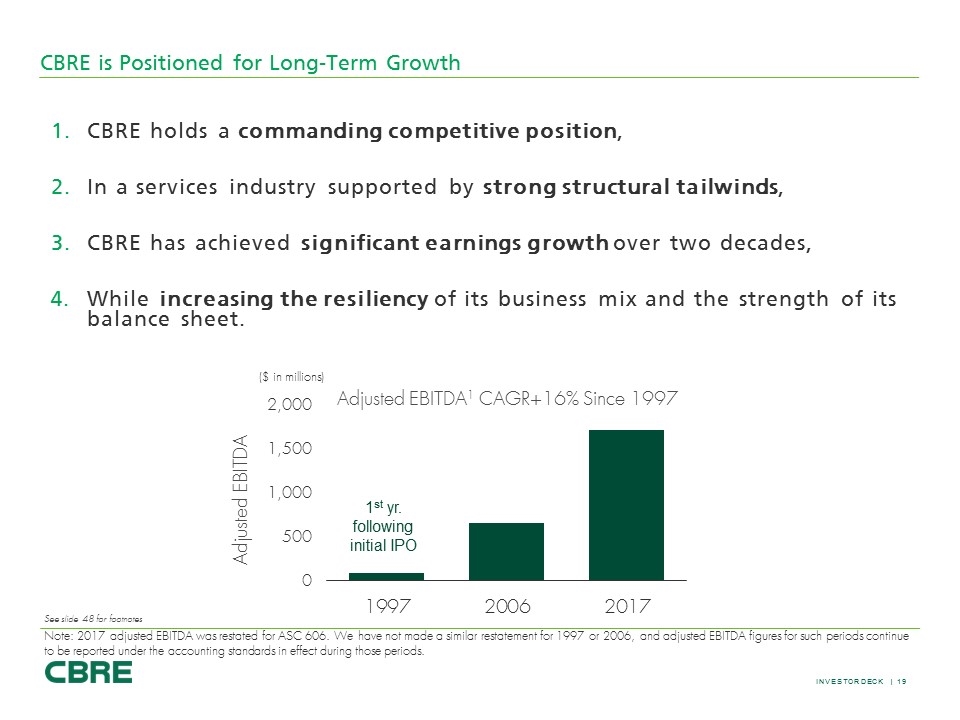

CBRE is Positioned for Long-Term Growth CBRE holds a commanding competitive position, In a services industry supported by strong structural tailwinds, CBRE has achieved significant earnings growth over two decades, While increasing the resiliency of its business mix and the strength of its balance sheet. Adjusted EBITDA1 CAGR+16% Since 1997 1st yr. following initial IPO Adjusted EBITDA ($ in millions) Note: 2017 adjusted EBITDA was restated for ASC 606. We have not made a similar restatement for 1997 or 2006, and adjusted EBITDA figures for such periods continue to be reported under the accounting standards in effect during those periods. See slide 48 for footnotes

Business line slides

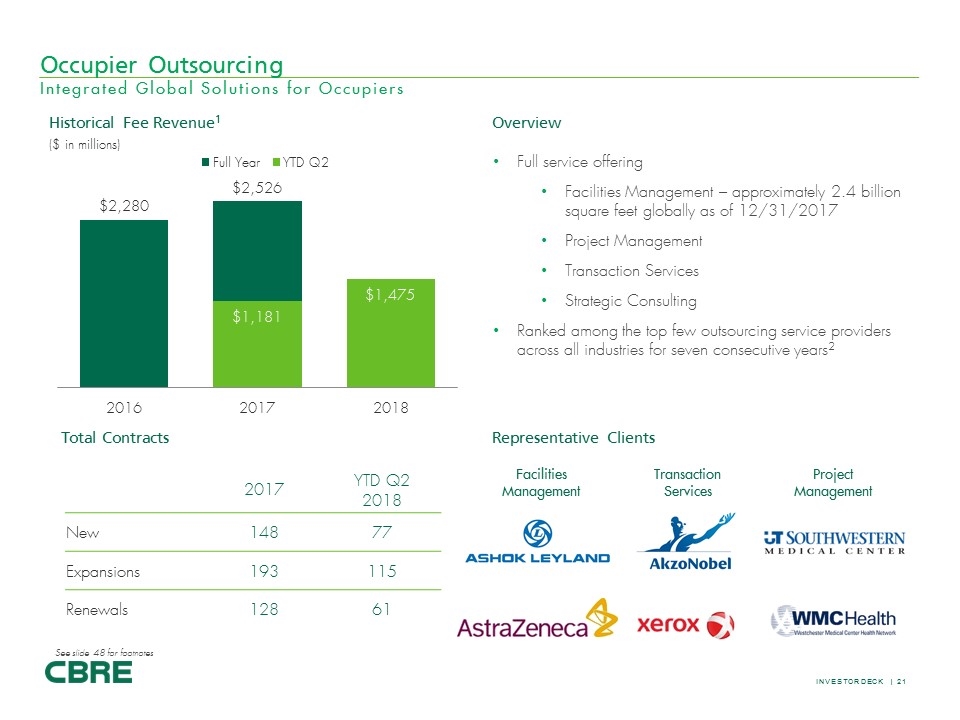

2017 YTD Q2 2018 New 148 77 Expansions 193 115 Renewals 128 61 Historical Fee Revenue1 Overview Total Contracts Full service offering Facilities Management – approximately 2.4 billion square feet globally as of 12/31/2017 Project Management Transaction Services Strategic Consulting Ranked among the top few outsourcing service providers across all industries for seven consecutive years2 Facilities Management Transaction Services Project Management Representative Clients ($ in millions) Occupier Outsourcing Integrated Global Solutions for Occupiers See slide 48 for footnotes $2,280 $2,526 $1,475

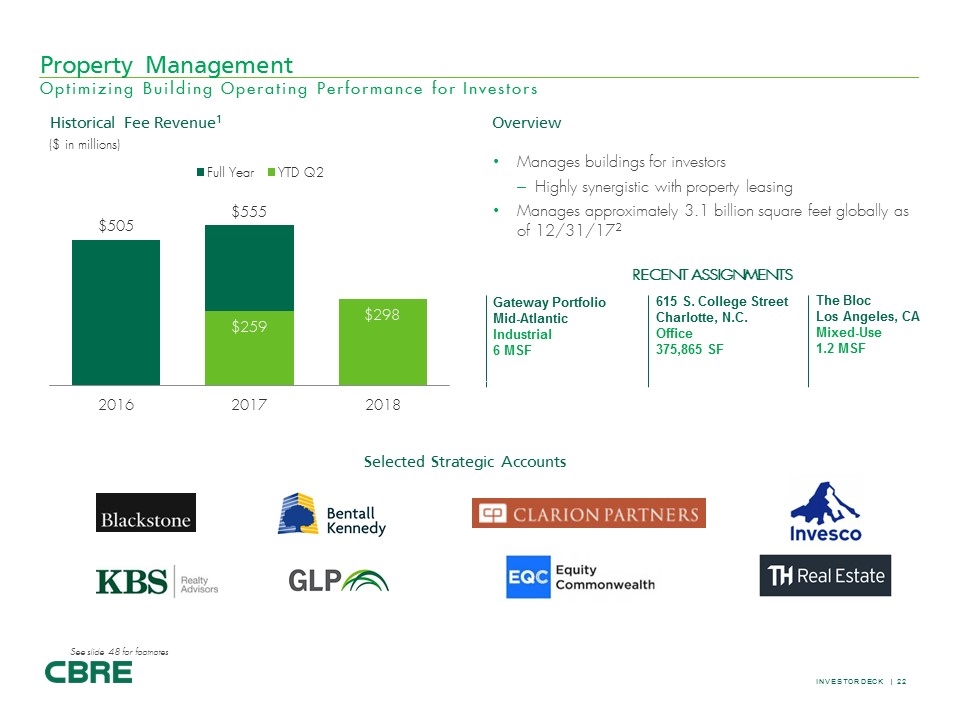

Historical Fee Revenue1 Overview Selected Strategic Accounts Manages buildings for investors Highly synergistic with property leasing Manages approximately 3.1 billion square feet globally as of 12/31/172 See slide 48 for footnotes Property Management Optimizing Building Operating Performance for Investors ($ in millions) RECENT assignmentS Gateway Portfolio Mid-Atlantic Industrial 6 MSF 615 S. College Street Charlotte, N.C. Office 375,865 SF The Bloc Los Angeles, CA Mixed-Use 1.2 MSF $505 $555 $259 $298

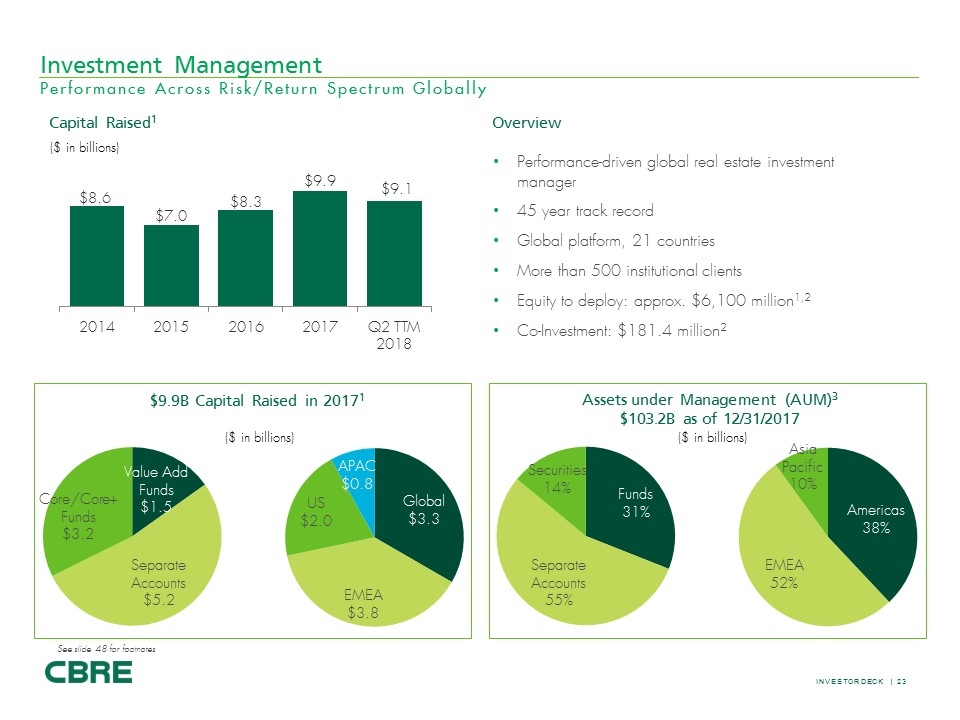

Capital Raised1 Assets under Management (AUM)3 $103.2B as of 12/31/2017 Overview ($ in billions) Performance-driven global real estate investment manager 45 year track record Global platform, 21 countries More than 500 institutional clients Equity to deploy: approx. $6,100 million1,2 Co-Investment: $181.4 million2 ($ in billions) Investment Management Performance Across Risk/Return Spectrum Globally See slide 48 for footnotes $9.9B Capital Raised in 20171 ($ in billions) APAC $0.8 US $2.0 EMEA $3.8 Global $3.3 Securities 14% Funds 31% Separate Accounts 55% Asia Pacific 10% EMEA 52% Americas 38%

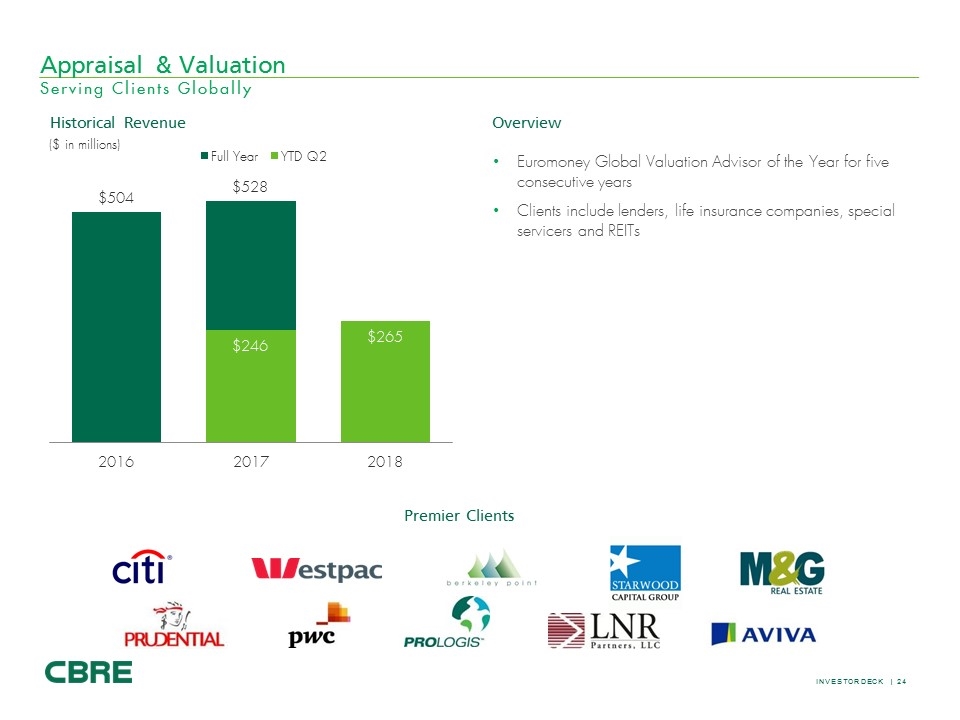

Premier Clients Euromoney Global Valuation Advisor of the Year for five consecutive years Clients include lenders, life insurance companies, special servicers and REITs Overview Historical Revenue Appraisal & Valuation Serving Clients Globally ($ in millions) $504 $528 $246 $265

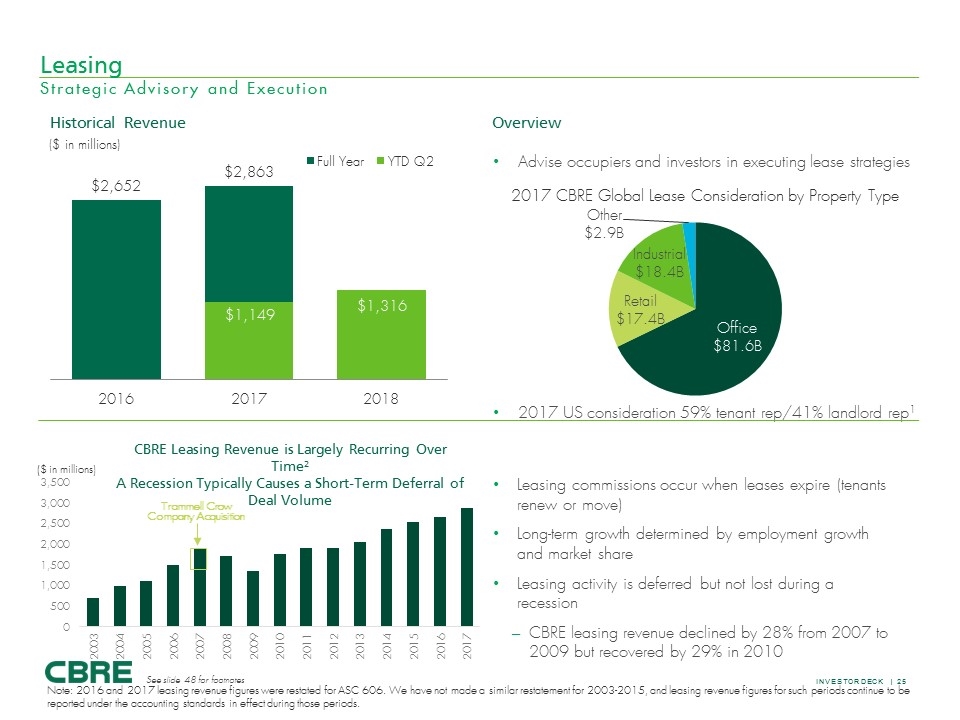

Advise occupiers and investors in executing lease strategies 2017 US consideration 59% tenant rep/41% landlord rep1 Overview Historical Revenue Leasing Strategic Advisory and Execution Trammell Crow Company Acquisition See slide 48 for footnotes ($ in millions) Leasing commissions occur when leases expire (tenants renew or move) Long-term growth determined by employment growth and market share Leasing activity is deferred but not lost during a recession CBRE leasing revenue declined by 28% from 2007 to 2009 but recovered by 29% in 2010 2017 CBRE Global Lease Consideration by Property Type ($ in millions) Note: 2016 and 2017 leasing revenue figures were restated for ASC 606. We have not made a similar restatement for 2003-2015, and leasing revenue figures for such periods continue to be reported under the accounting standards in effect during those periods.

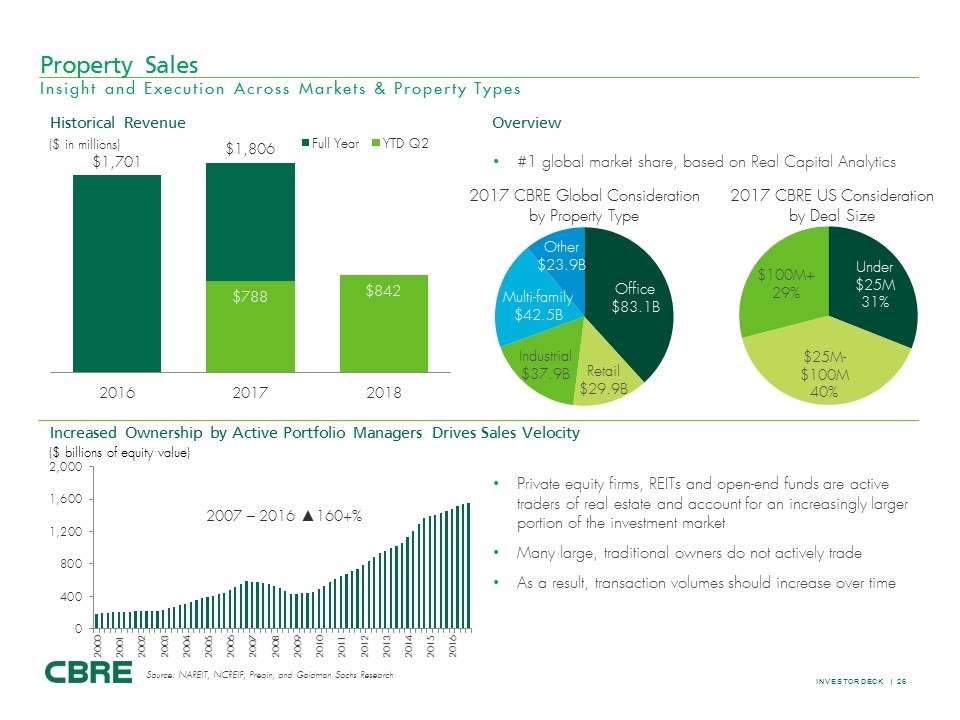

Historical Revenue #1 global market share, based on Real Capital Analytics Increased Ownership by Active Portfolio Managers Drives Sales Velocity Overview Source: NAREIT, NCREIF, Preqin, and Goldman Sachs Research ($ billions of equity value) 2007 – 2016 ▲160+% Property Sales Insight and Execution Across Markets & Property Types Private equity firms, REITs and open-end funds are active traders of real estate and account for an increasingly larger portion of the investment market Many large, traditional owners do not actively trade As a result, transaction volumes should increase over time 2017 CBRE Global Consideration by Property Type 2017 CBRE US Consideration by Deal Size ($ in millions) $1,701 $1,806 $788 $842 Other $23.9B Multi-family $42.5B Industrial $37.9B Retail 29.9B Office 83.1B 100M+ 29% Under $25M 31% $25M-100M 40%

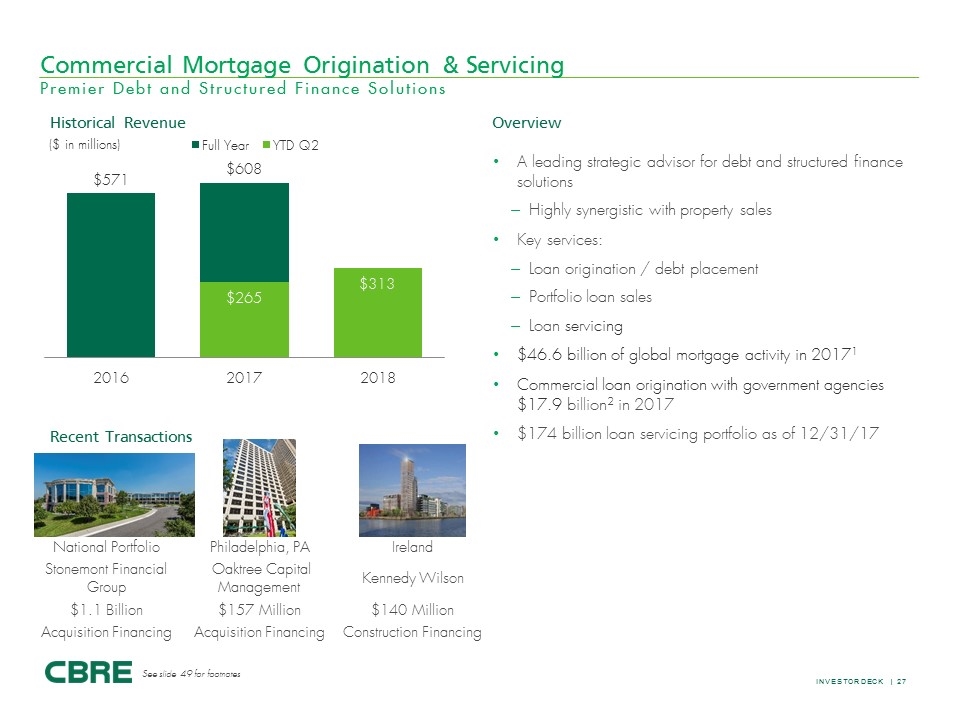

Historical Revenue Recent Transactions A leading strategic advisor for debt and structured finance solutions Highly synergistic with property sales Key services: Loan origination / debt placement Portfolio loan sales Loan servicing $46.6 billion of global mortgage activity in 20171 Commercial loan origination with government agencies $17.9 billion2 in 2017 $174 billion loan servicing portfolio as of 12/31/17 Overview See slide 49 for footnotes Commercial Mortgage Origination & Servicing Premier Debt and Structured Finance Solutions National Portfolio Philadelphia, PA Ireland Stonemont Financial Group Oaktree Capital Management Kennedy Wilson $1.1 Billion $157 Million $140 Million Acquisition Financing Acquisition Financing Construction Financing ($ in millions)

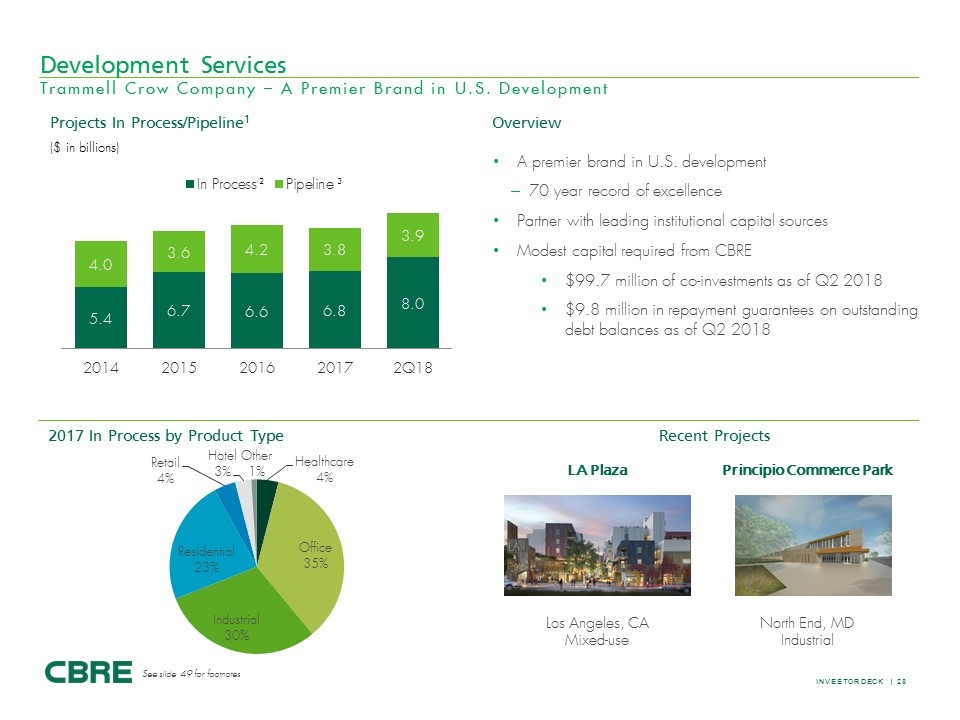

2 Projects In Process/Pipeline1 Overview Recent Projects A premier brand in U.S. development 70 year record of excellence Partner with leading institutional capital sources Modest capital required from CBRE $99.7 million of co-investments as of Q2 2018 $9.8 million in repayment guarantees on outstanding debt balances as of Q2 2018 ($ in billions) 3 Development Services Trammell Crow Company – A Premier Brand in U.S. Development LA Plaza Principio Commerce Park Los Angeles, CA Mixed-use North End, MD Industrial 2017 In Process by Product Type See slide 49 for footnotes

appendix

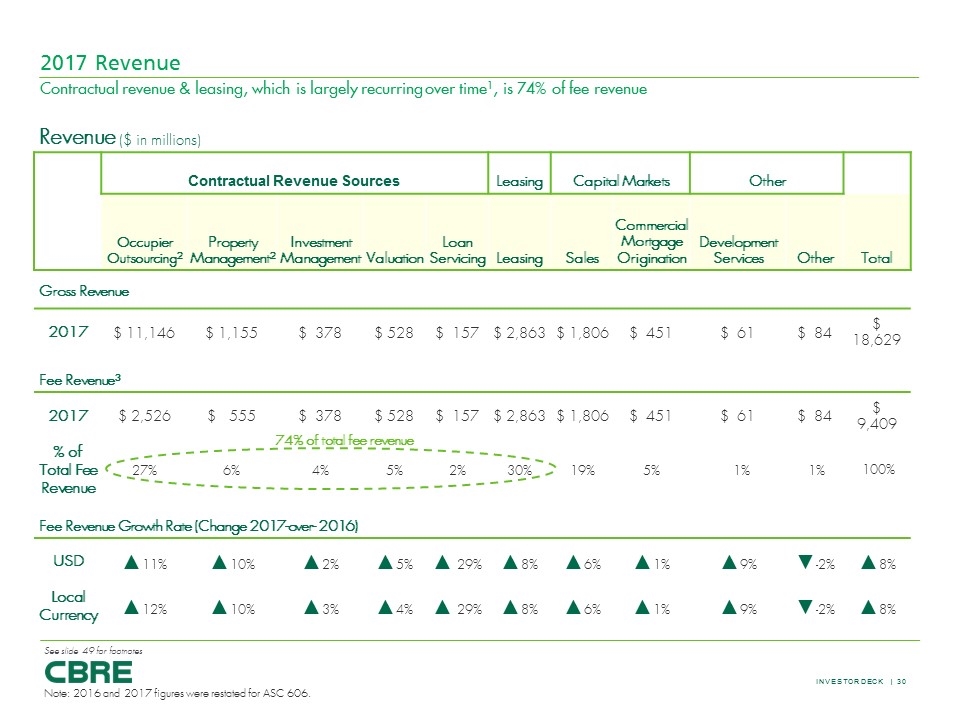

Revenue ($ in millions) Contractual Revenue Sources Leasing Capital Markets Other Occupier Outsourcing2 Property Management2 Investment Management Valuation Loan Servicing Leasing Sales Commercial Mortgage Origination Development Services Other Total Gross Revenue 2017 $ 11,146 $ 1,155 $ 378 $ 528 $ 157 $ 2,863 $ 1,806 $ 451 $ 61 $ 84 $ 18,629 Fee Revenue3 2017 $ 2,526 $ 555 $ 378 $ 528 $ 157 $ 2,863 $ 1,806 $ 451 $ 61 $ 84 $ 9,409 % of Total Fee Revenue 27% 6% 4% 5% 2% 30% 19% 5% 1% 1% 100% Fee Revenue Growth Rate (Change 2017-over- 2016) USD ▲11% ▲10% ▲2% ▲5% ▲ 29% ▲8% ▲6% ▲1% ▲9% ▼-2% ▲8% Local Currency ▲12% ▲10% ▲3% ▲4% ▲ 29% ▲8% ▲6% ▲1% ▲9% ▼-2% ▲8% Contractual revenue & leasing, which is largely recurring over time1, is 74% of fee revenue 74% of total fee revenue See slide 49 for footnotes 2017 Revenue Note: 2016 and 2017 figures were restated for ASC 606.

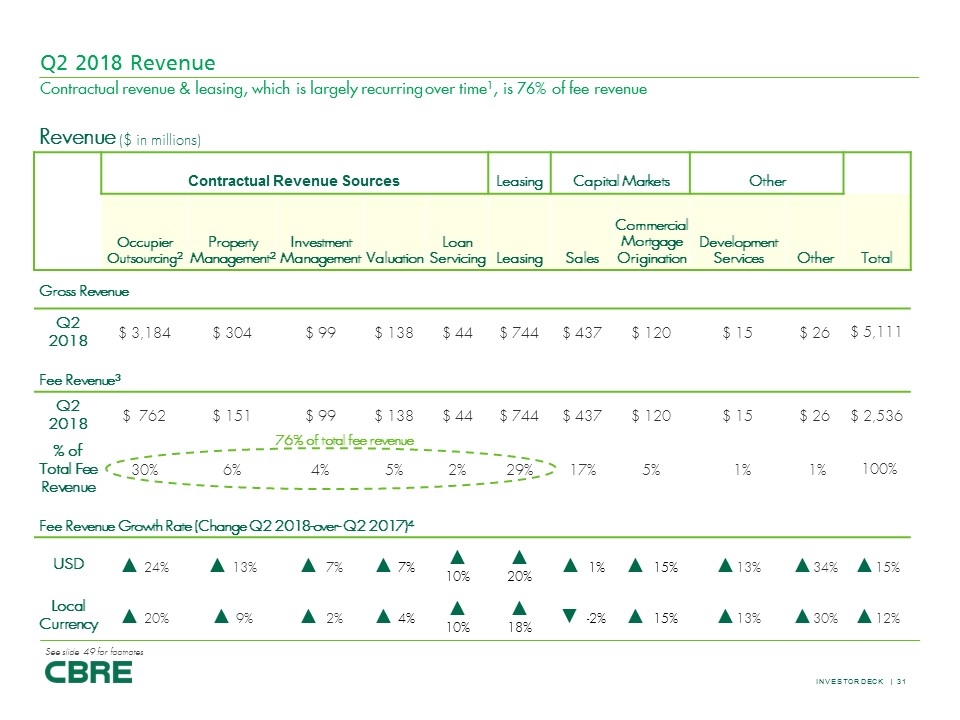

Revenue ($ in millions) Contractual Revenue Sources Leasing Capital Markets Other Occupier Outsourcing2 Property Management2 Investment Management Valuation Loan Servicing Leasing Sales Commercial Mortgage Origination Development Services Other Total Gross Revenue Q2 2018 $ 3,184 $ 304 $ 99 $ 138 $ 44 $ 744 $ 437 $ 120 $ 15 $ 26 $ 5,111 Fee Revenue3 Q2 2018 $ 762 $ 151 $ 99 $ 138 $ 44 $ 744 $ 437 $ 120 $ 15 $ 26 $ 2,536 % of Total Fee Revenue 30% 6% 4% 5% 2% 29% 17% 5% 1% 1% 100% Fee Revenue Growth Rate (Change Q2 2018-over- Q2 2017)4 USD ▲ 24% ▲ 13% ▲ 7% ▲ 7% ▲ 10% ▲ 20% ▲ 1% ▲ 15% ▲13% ▲34% ▲15% Local Currency ▲ 20% ▲ 9% ▲ 2% ▲ 4% ▲ 10% ▲ 18% ▼ -2% ▲ 15% ▲13% ▲30% ▲12% Contractual revenue & leasing, which is largely recurring over time1, is 76% of fee revenue 76% of total fee revenue See slide 49 for footnotes Q2 2018 Revenue

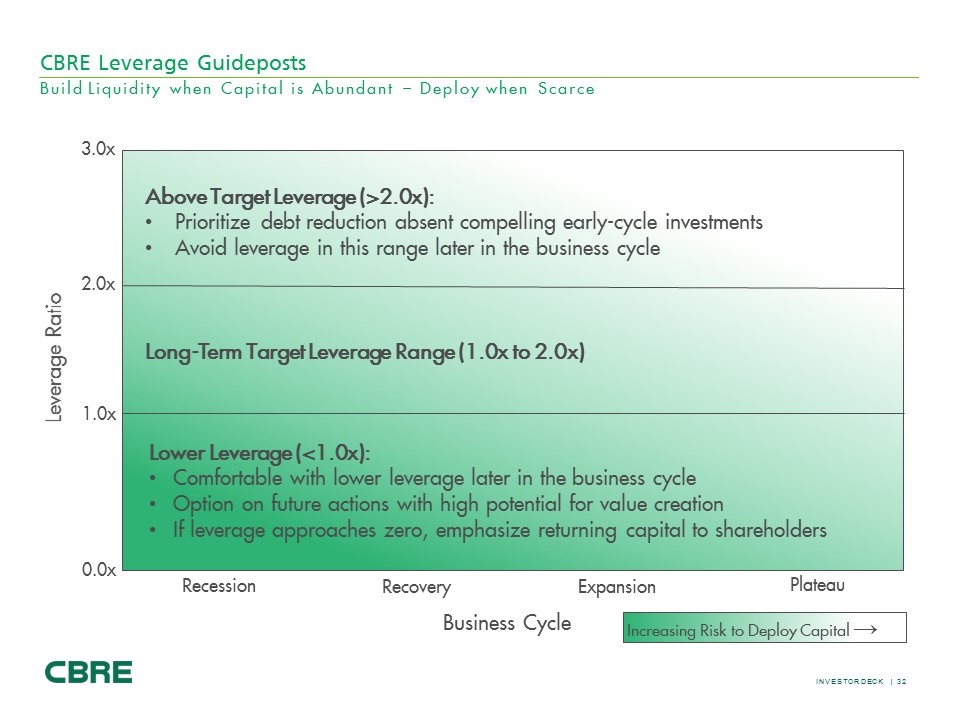

3.0x 0.0x 1.0x Leverage Ratio Recession Recovery Above Target Leverage (>2.0x): Prioritize debt reduction absent compelling early-cycle investments Avoid leverage in this range later in the business cycle Plateau Expansion Lower Leverage (<1.0x): Comfortable with lower leverage later in the business cycle Option on future actions with high potential for value creation If leverage approaches zero, emphasize returning capital to shareholders Long-Term Target Leverage Range (1.0x to 2.0x) 2.0x Business Cycle Increasing Risk to Deploy Capital → CBRE Leverage Guideposts Build Liquidity when Capital is Abundant – Deploy when Scarce

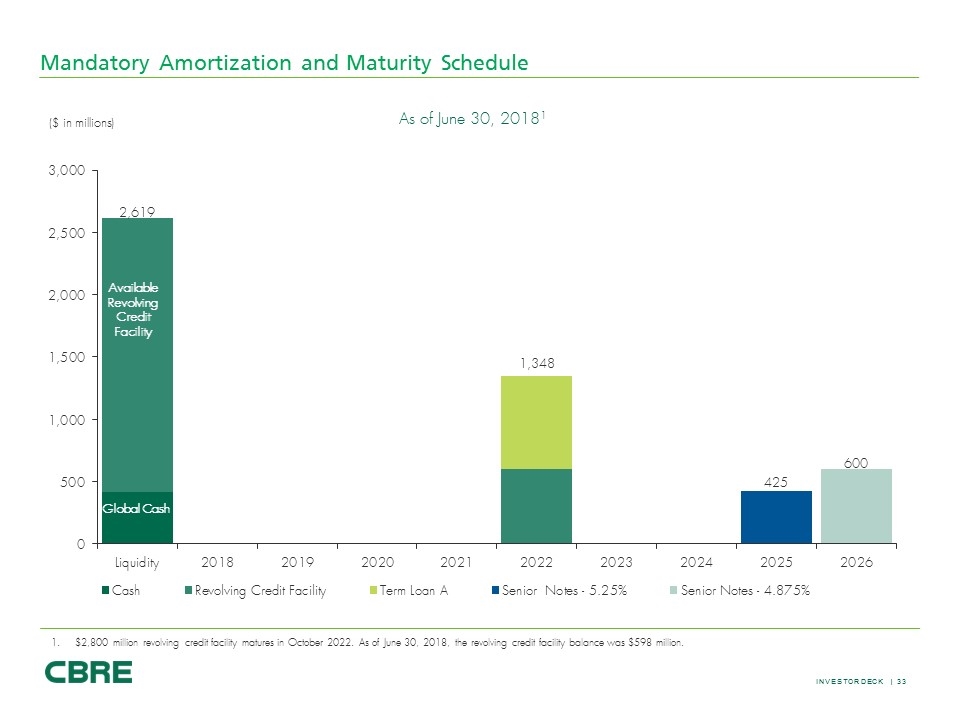

Mandatory Amortization and Maturity Schedule $2,800 million revolving credit facility matures in October 2022. As of June 30, 2018, the revolving credit facility balance was $598 million. Global Cash Available Revolving Credit Facility ($ in millions) As of June 30, 20181

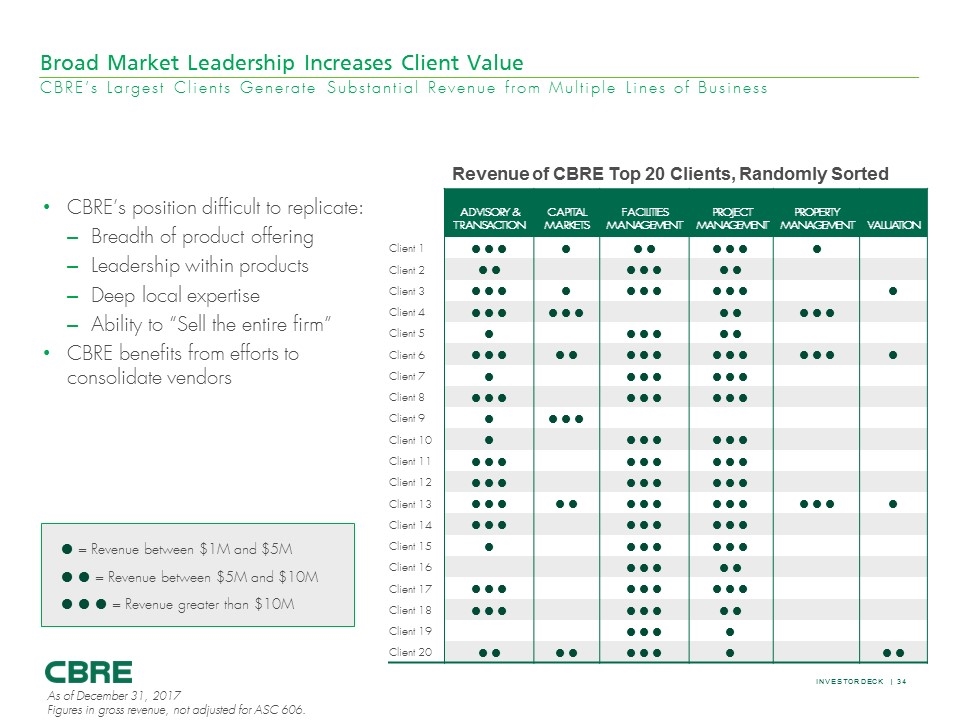

Advisory & Transaction Capital Markets Facilities Management Project Management Property Management Valuation Client 1 ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ Client 2 ˜ ˜ ˜ ˜ ˜ ˜ ˜ Client 3 ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ Client 4 ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ Client 5 ˜ ˜ ˜ ˜ ˜ ˜ Client 6 ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ Client 7 ˜ ˜ ˜ ˜ ˜ ˜ ˜ Client 8 ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ Client 9 ˜ ˜ ˜ ˜ Client 10 ˜ ˜ ˜ ˜ ˜ ˜ ˜ Client 11 ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ Client 12 ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ Client 13 ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ Client 14 ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ Client 15 ˜ ˜ ˜ ˜ ˜ ˜ ˜ Client 16 ˜ ˜ ˜ ˜ ˜ Client 17 ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ Client 18 ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ Client 19 ˜ ˜ ˜ ˜ Client 20 ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ ˜ Broad Market Leadership Increases Client Value CBRE’s position difficult to replicate: Breadth of product offering Leadership within products Deep local expertise Ability to “Sell the entire firm” CBRE benefits from efforts to consolidate vendors ˜ = Revenue between $1M and $5M ˜ ˜ = Revenue between $5M and $10M ˜ ˜ ˜ = Revenue greater than $10M Revenue of CBRE Top 20 Clients, Randomly Sorted As of December 31, 2017 Figures in gross revenue, not adjusted for ASC 606. CBRE’s Largest Clients Generate Substantial Revenue from Multiple Lines of Business

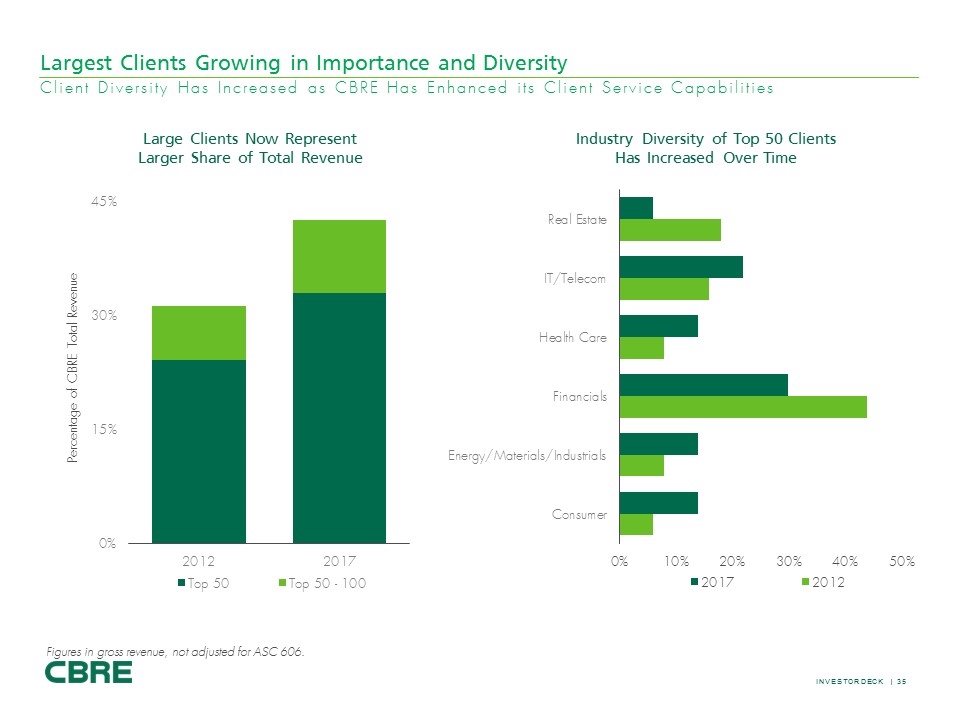

Largest Clients Growing in Importance and Diversity Large Clients Now Represent Larger Share of Total Revenue Industry Diversity of Top 50 Clients Has Increased Over Time Percentage of CBRE Total Revenue Figures in gross revenue, not adjusted for ASC 606. Client Diversity Has Increased as CBRE Has Enhanced its Client Service Capabilities

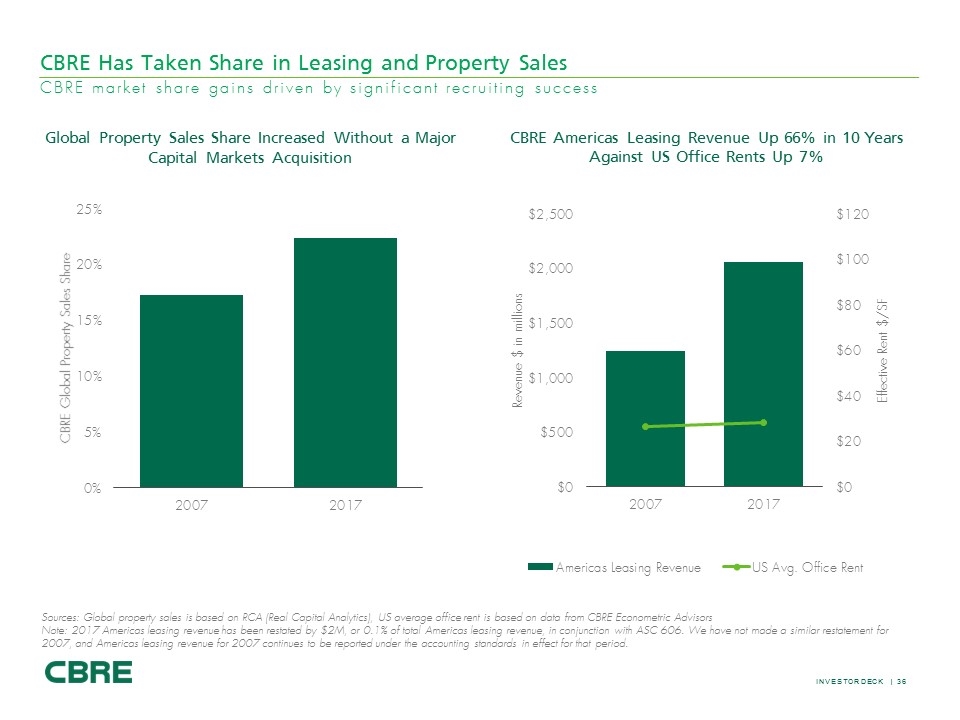

CBRE Has Taken Share in Leasing and Property Sales Sources: Global property sales is based on RCA (Real Capital Analytics), US average office rent is based on data from CBRE Econometric Advisors Note: 2017 Americas leasing revenue has been restated by $2M, or 0.1% of total Americas leasing revenue, in conjunction with ASC 606. We have not made a similar restatement for 2007, and Americas leasing revenue for 2007 continues to be reported under the accounting standards in effect for that period. CBRE Americas Leasing Revenue Up 66% in 10 Years Against US Office Rents Up 7% Global Property Sales Share Increased Without a Major Capital Markets Acquisition CBRE market share gains driven by significant recruiting success

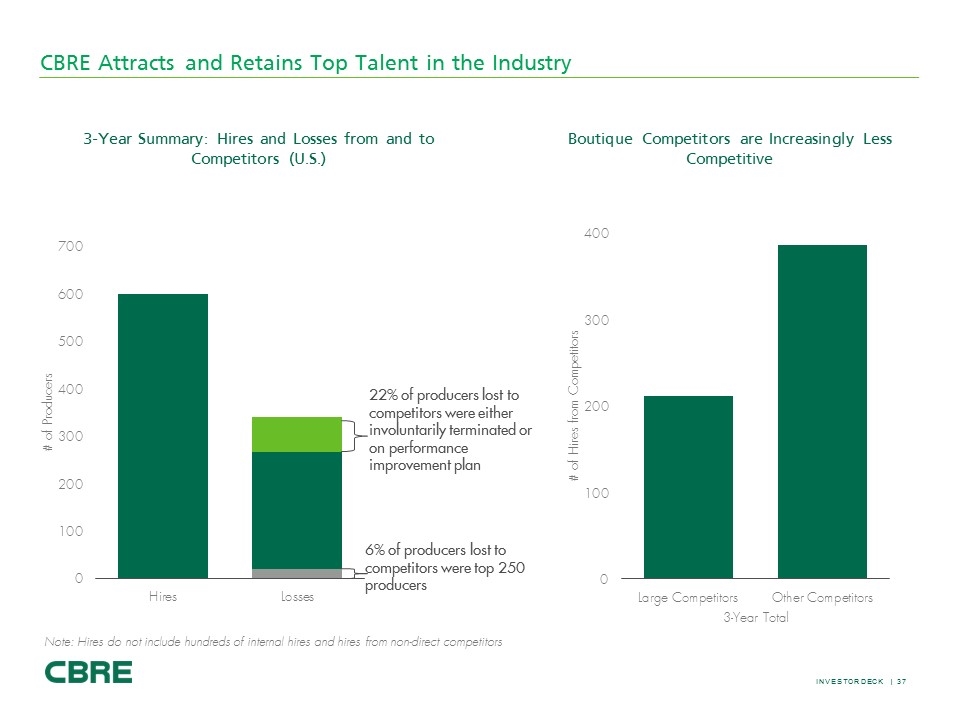

CBRE Attracts and Retains Top Talent in the Industry 3-Year Summary: Hires and Losses from and to Competitors (U.S.) Boutique Competitors are Increasingly Less Competitive Note: Hires do not include hundreds of internal hires and hires from non-direct competitors 22% of producers lost to competitors were either involuntarily terminated or on performance improvement plan 6% of producers lost to competitors were top 250 producers

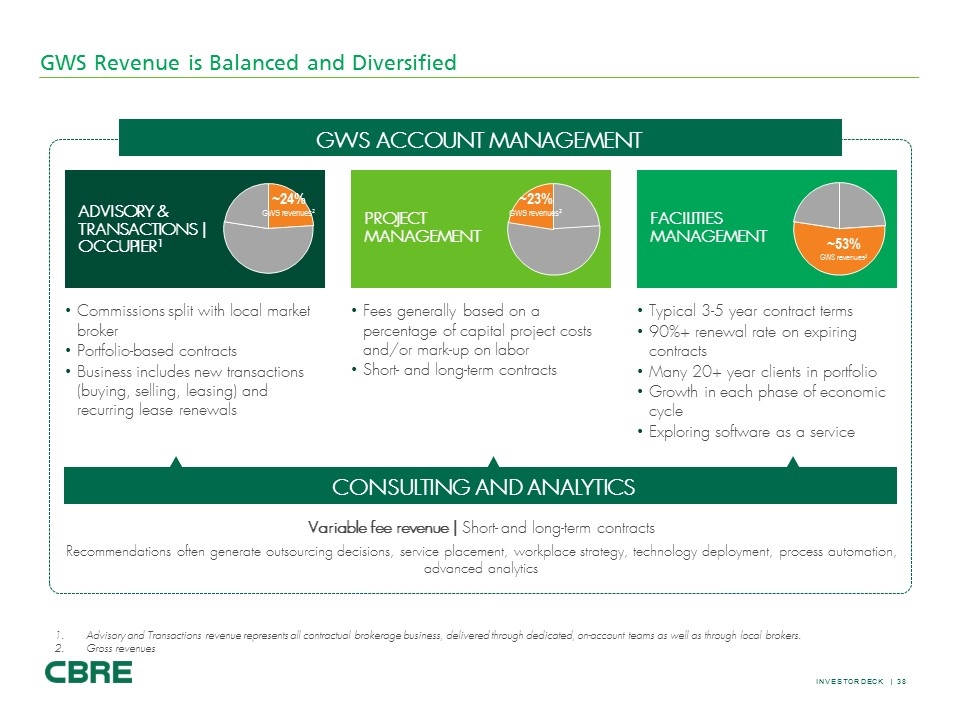

CONSULTING AND ANALYTICS GWS Revenue is Balanced and Diversified Typical 3-5 year contract terms 90%+ renewal rate on expiring contracts Many 20+ year clients in portfolio Growth in each phase of economic cycle Exploring software as a service Fees generally based on a percentage of capital project costs and/or mark-up on labor Short- and long-term contracts Commissions split with local market broker Portfolio-based contracts Business includes new transactions (buying, selling, leasing) and recurring lease renewals Variable fee revenue | Short- and long-term contracts Recommendations often generate outsourcing decisions, service placement, workplace strategy, technology deployment, process automation, advanced analytics ~53% GWS revenues2 ~23% GWS revenues2 ~24% GWS revenues2 Advisory and Transactions revenue represents all contractual brokerage business, delivered through dedicated, on-account teams as well as through local brokers. Gross revenues ADVISORY & TRANSACTIONS | OCCUPIER1 PROJECT MANAGEMENT FACILITIES MANAGEMENT GWS ACCOUNT MANAGEMENT

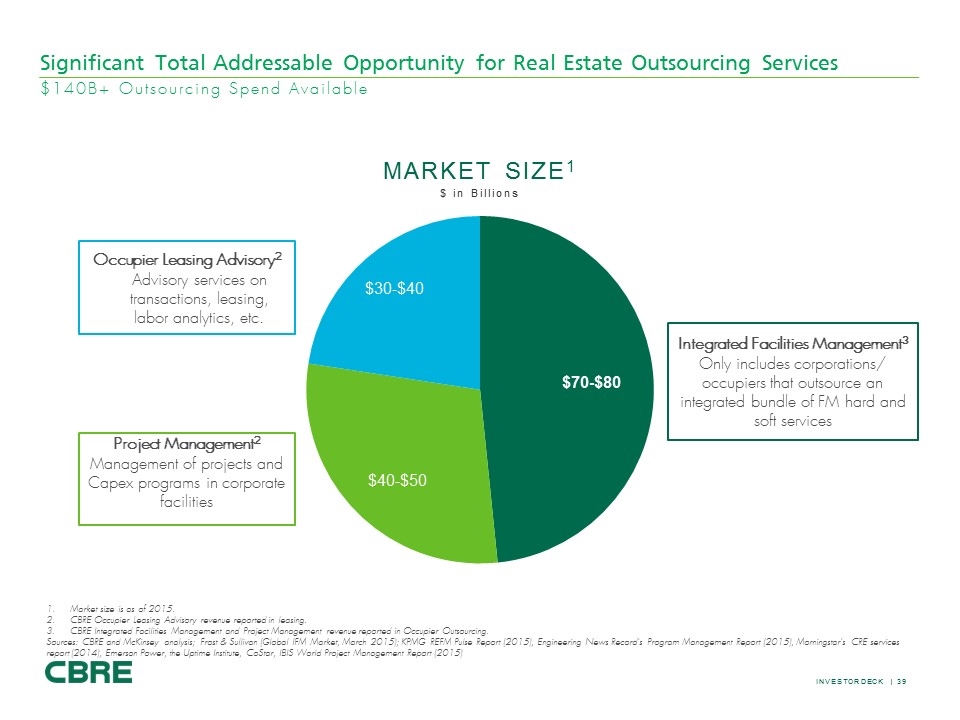

Occupier Leasing Advisory2 Advisory services on transactions, leasing, labor analytics, etc. Significant Total Addressable Opportunity for Real Estate Outsourcing Services $ in Billions Market Size1 Market size is as of 2015. CBRE Occupier Leasing Advisory revenue reported in leasing. CBRE Integrated Facilities Management and Project Management revenue reported in Occupier Outsourcing. Sources: CBRE and McKinsey analysis; Frost & Sullivan (Global IFM Market, March 2015); KPMG REFM Pulse Report (2015), Engineering News Record’s Program Management Report (2015), Morningstar’s CRE services report (2014), Emerson Power, the Uptime Institute, CoStar, IBIS World Project Management Report (2015) Integrated Facilities Management3 Only includes corporations/ occupiers that outsource an integrated bundle of FM hard and soft services Project Management2 Management of projects and Capex programs in corporate facilities $30-$40 $70-$80 $40-$50 $140B+ Outsourcing Spend Available

Non-GAAP financial measures The following measures are considered “non-GAAP financial measures” under SEC guidelines: fee revenue contractual fee revenue net income attributable to CBRE Group, Inc., as adjusted (which we also refer to as “adjusted net income”) diluted income per share attributable to CBRE Group, Inc. shareholders, as adjusted (which we also refer to as “adjusted earnings per share” or “adjusted EPS”) EBITDA and adjusted EBITDA These measures are not recognized measurements under United States generally accepted accounting principles, or “GAAP.” When analyzing our operating performance, readers should use them in addition to, and not as an alternative for, their most directly comparable financial measure calculated and presented in accordance with GAAP. Because not all companies use identical calculations, our presentation of these measures may not be comparable to similarly titled measures of other companies. Our management generally uses these non-GAAP financial measures to evaluate operating performance and for other discretionary purposes. The company believes that these measures provide a more complete understanding of ongoing operations, enhance comparability of current results to prior periods and may be useful for investors to analyze our financial performance because they eliminate the impact of selected charges that may obscure trends in the underlying performance of our business. The company further uses certain of these measures, and believes that they are useful to investors, for purposes described below. With respect to fee revenue: the company believes that investors may find this measure useful to analyze the financial performance of our Occupier Outsourcing and Property Management business lines and our business generally. Fee revenue excludes costs reimbursable by clients, and as such provides greater visibility into the underlying performance of our business. With respect to contractual fee revenue: the company believes that investors may find this measure useful to analyze our overall financial performance because it identifies revenue streams that are typically more stable over time. With respect to adjusted net income, adjusted EPS, EBITDA and adjusted EBITDA: the company believes that investors may find these measures useful in evaluating our operating performance compared to that of other companies in our industry because these calculations generally eliminate the accounting effects of acquisitions, which would include impairment charges of goodwill and intangibles created from acquisitions—and in the case of EBITDA and adjusted EBITDA—the effects of financings and income tax and the accounting effects of capital spending. All of these measures may vary for different companies for reasons unrelated to overall operating performance. In the case of EBITDA and adjusted EBITDA, these measures are not intended to be measures of free cash flow for our management’s discretionary use because they do not consider cash requirements such as tax and debt service payments. The EBITDA and adjusted EBITDA measures calculated herein may also differ from the amounts calculated under similarly titled definitions in our credit facilities and debt instruments, which amounts are further adjusted to reflect certain other cash and non-cash charges and are used by us to determine compliance with financial covenants therein and our ability to engage in certain activities, such as incurring additional debt and making certain restricted payments. The company also uses adjusted EBITDA and adjusted EPS as significant components when measuring our operating performance under our employee incentive compensation programs.

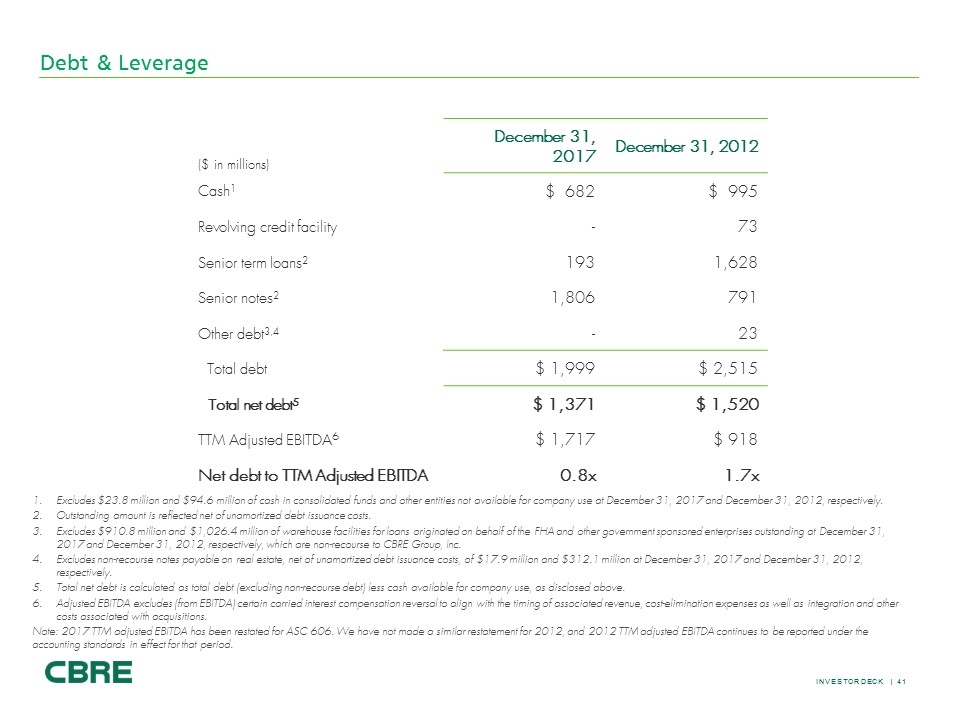

Debt & Leverage Excludes $23.8 million and $94.6 million of cash in consolidated funds and other entities not available for company use at December 31, 2017 and December 31, 2012, respectively. Outstanding amount is reflected net of unamortized debt issuance costs. Excludes $910.8 million and $1,026.4 million of warehouse facilities for loans originated on behalf of the FHA and other government sponsored enterprises outstanding at December 31, 2017 and December 31, 2012, respectively, which are non-recourse to CBRE Group, Inc. Excludes non-recourse notes payable on real estate, net of unamortized debt issuance costs, of $17.9 million and $312.1 million at December 31, 2017 and December 31, 2012, respectively. Total net debt is calculated as total debt (excluding non-recourse debt) less cash available for company use, as disclosed above. Adjusted EBITDA excludes (from EBITDA) certain carried interest compensation reversal to align with the timing of associated revenue, cost-elimination expenses as well as integration and other costs associated with acquisitions. Note: 2017 TTM adjusted EBITDA has been restated for ASC 606. We have not made a similar restatement for 2012, and 2012 TTM adjusted EBITDA continues to be reported under the accounting standards in effect for that period. ($ in millions) December 31, 2017 December 31, 2012 Cash1 $ 682 $ 995 Revolving credit facility - 73 Senior term loans2 193 1,628 Senior notes2 1,806 791 Other debt3,4 - 23 Total debt $ 1,999 $ 2,515 Total net debt5 $ 1,371 $ 1,520 TTM Adjusted EBITDA6 $ 1,717 $ 918 Net debt to TTM Adjusted EBITDA 0.8x 1.7x

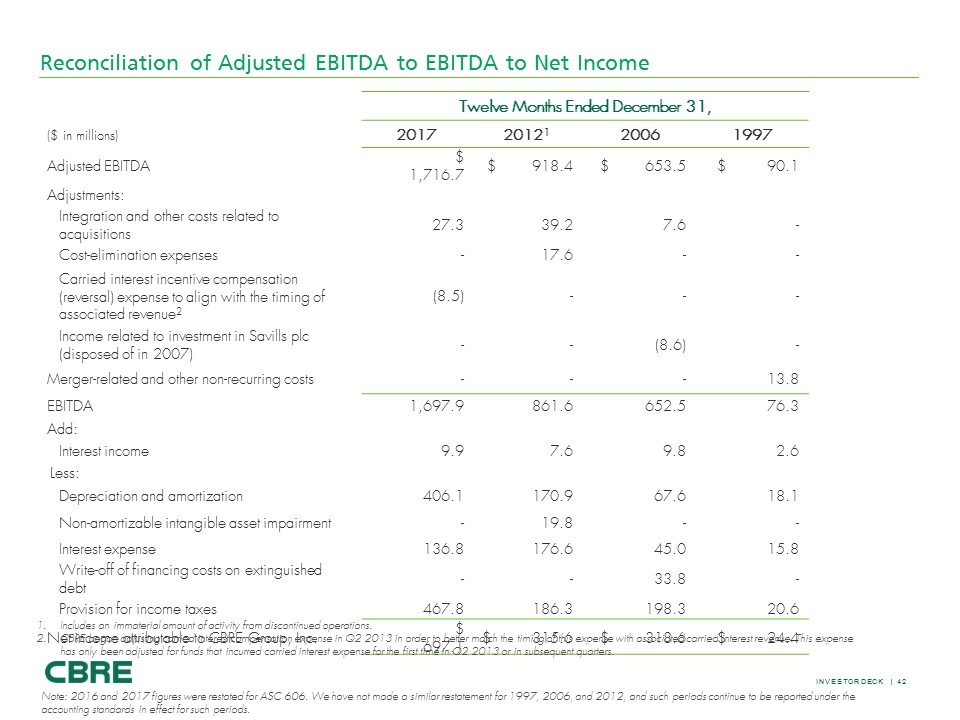

Twelve Months Ended December 31, ($ in millions) 2017 20121 2006 1997 Adjusted EBITDA $ 1,716.7 $ 918.4 $ 653.5 $ 90.1 Adjustments: Integration and other costs related to acquisitions 27.3 39.2 7.6 - Cost-elimination expenses - 17.6 - - Carried interest incentive compensation (reversal) expense to align with the timing of associated revenue2 (8.5) - - - Income related to investment in Savills plc (disposed of in 2007) - - (8.6) - Merger-related and other non-recurring costs - - - 13.8 EBITDA 1,697.9 861.6 652.5 76.3 Add: Interest income 9.9 7.6 9.8 2.6 Less: Depreciation and amortization 406.1 170.9 67.6 18.1 Non-amortizable intangible asset impairment - 19.8 - - Interest expense 136.8 176.6 45.0 15.8 Write-off of financing costs on extinguished debt - - 33.8 - Provision for income taxes 467.8 186.3 198.3 20.6 Net income attributable to CBRE Group, Inc. $ 697.1 $ 315.6 $ 318.6 $ 24.4 Reconciliation of Adjusted EBITDA to EBITDA to Net Income Includes an immaterial amount of activity from discontinued operations. CBRE began adjusting carried interest compensation expense in Q2 2013 in order to better match the timing of this expense with associated carried interest revenue. This expense has only been adjusted for funds that incurred carried interest expense for the first time in Q2 2013 or in subsequent quarters. Note: 2016 and 2017 figures were restated for ASC 606. We have not made a similar restatement for 1997, 2006, and 2012, and such periods continue to be reported under the accounting standards in effect for such periods.

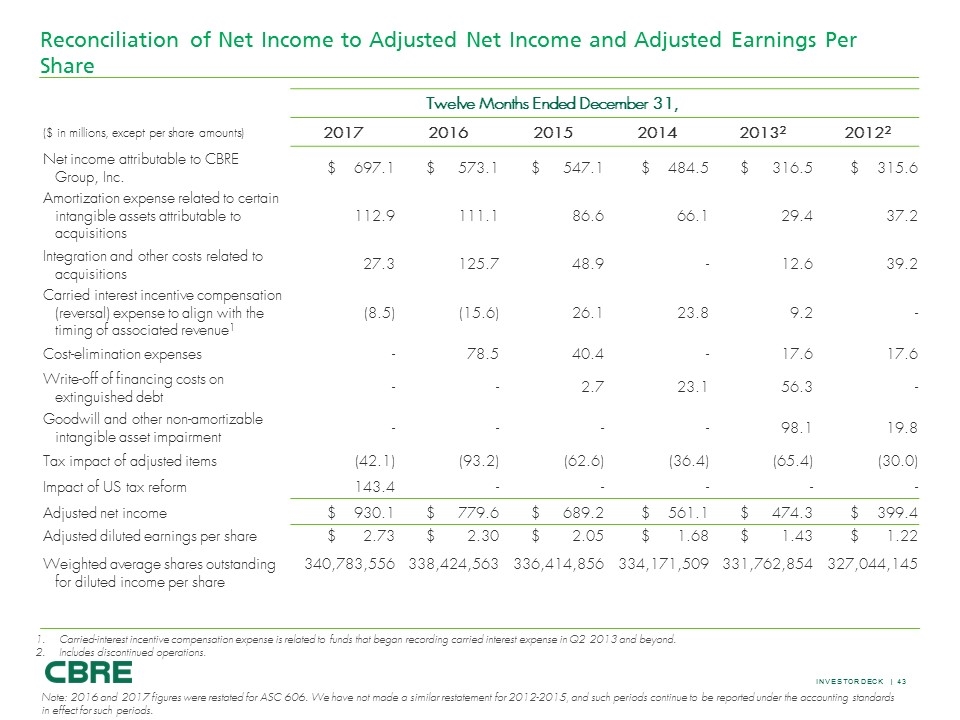

Twelve Months Ended December 31, ($ in millions, except per share amounts) 2017 2016 2015 2014 20132 20122 Net income attributable to CBRE Group, Inc. $ 697.1 $ 573.1 $ 547.1 $ 484.5 $ 316.5 $ 315.6 Amortization expense related to certain intangible assets attributable to acquisitions 112.9 111.1 86.6 66.1 29.4 37.2 Integration and other costs related to acquisitions 27.3 125.7 48.9 - 12.6 39.2 Carried interest incentive compensation (reversal) expense to align with the timing of associated revenue1 (8.5) (15.6) 26.1 23.8 9.2 - Cost-elimination expenses - 78.5 40.4 - 17.6 17.6 Write-off of financing costs on extinguished debt - - 2.7 23.1 56.3 - Goodwill and other non-amortizable intangible asset impairment - - - - 98.1 19.8 Tax impact of adjusted items (42.1) (93.2) (62.6) (36.4) (65.4) (30.0) Impact of US tax reform 143.4 - - - - - Adjusted net income $ 930.1 $ 779.6 $ 689.2 $ 561.1 $ 474.3 $ 399.4 Adjusted diluted earnings per share $ 2.73 $ 2.30 $ 2.05 $ 1.68 $ 1.43 $ 1.22 Weighted average shares outstanding for diluted income per share 340,783,556 338,424,563 336,414,856 334,171,509 331,762,854 327,044,145 Reconciliation of Net Income to Adjusted Net Income and Adjusted Earnings Per Share Carried-interest incentive compensation expense is related to funds that began recording carried interest expense in Q2 2013 and beyond. Includes discontinued operations. Note: 2016 and 2017 figures were restated for ASC 606. We have not made a similar restatement for 2012-2015, and such periods continue to be reported under the accounting standards in effect for such periods.

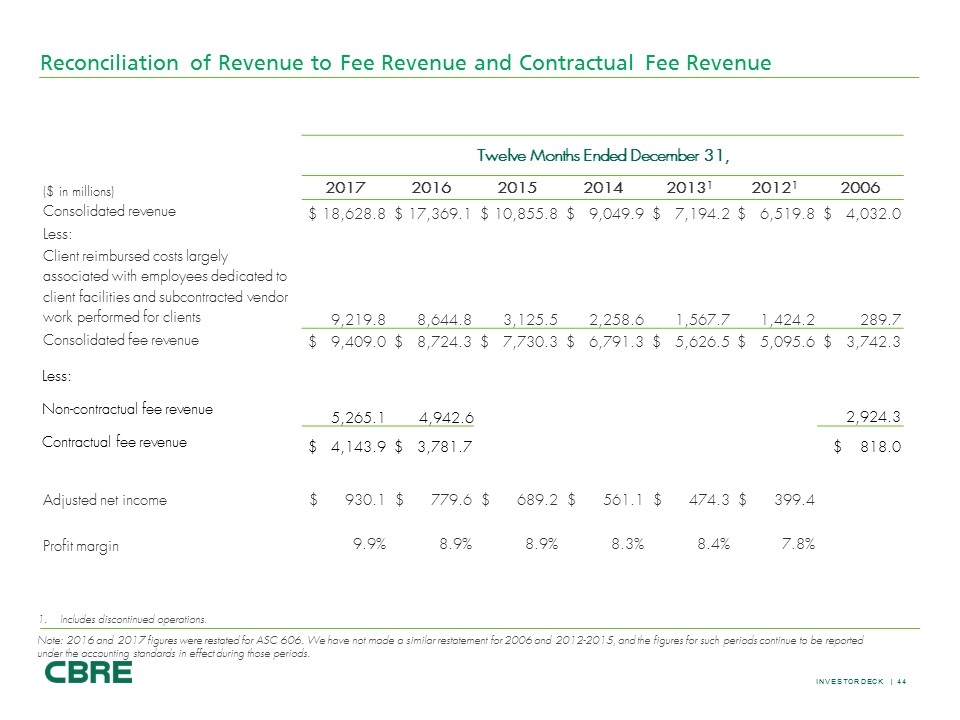

Twelve Months Ended December 31, ($ in millions) 2017 2016 2015 2014 20131 20121 2006 Consolidated revenue $ 18,628.8 $ 17,369.1 $ 10,855.8 $ 9,049.9 $ 7,194.2 $ 6,519.8 $ 4,032.0 Less: Client reimbursed costs largely associated with employees dedicated to client facilities and subcontracted vendor work performed for clients 9,219.8 8,644.8 3,125.5 2,258.6 1,567.7 1,424.2 289.7 Consolidated fee revenue $ 9,409.0 $ 8,724.3 $ 7,730.3 $ 6,791.3 $ 5,626.5 $ 5,095.6 $ 3,742.3 Less: Non-contractual fee revenue 5,265.1 4,942.6 2,924.3 Contractual fee revenue $ 4,143.9 $ 3,781.7 $ 818.0 Adjusted net income $ 930.1 $ 779.6 $ 689.2 $ 561.1 $ 474.3 $ 399.4 Profit margin 9.9% 8.9% 8.9% 8.3% 8.4% 7.8% Reconciliation of Revenue to Fee Revenue and Contractual Fee Revenue Includes discontinued operations. Note: 2016 and 2017 figures were restated for ASC 606. We have not made a similar restatement for 2006 and 2012-2015, and the figures for such periods continue to be reported under the accounting standards in effect during those periods.

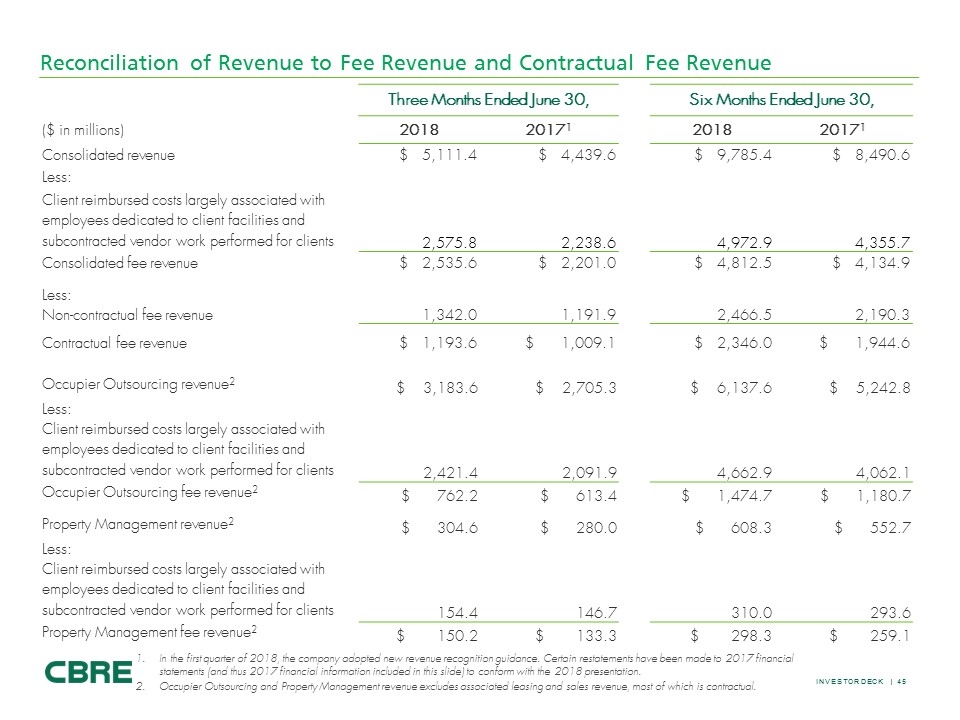

Three Months Ended June 30, Six Months Ended June 30, ($ in millions) 2018 20171 2018 20171 Consolidated revenue $ 5,111.4 $ 4,439.6 $ 9,785.4 $ 8,490.6 Less: Client reimbursed costs largely associated with employees dedicated to client facilities and subcontracted vendor work performed for clients 2,575.8 2,238.6 4,972.9 4,355.7 Consolidated fee revenue $ 2,535.6 $ 2,201.0 $ 4,812.5 $ 4,134.9 Less: Non-contractual fee revenue 1,342.0 1,191.9 2,466.5 2,190.3 Contractual fee revenue $ 1,193.6 $ 1,009.1 $ 2,346.0 $ 1,944.6 Occupier Outsourcing revenue2 $ 3,183.6 $ 2,705.3 $ 6,137.6 $ 5,242.8 Less: Client reimbursed costs largely associated with employees dedicated to client facilities and subcontracted vendor work performed for clients 2,421.4 2,091.9 4,662.9 4,062.1 Occupier Outsourcing fee revenue2 $ 762.2 $ 613.4 $ 1,474.7 $ 1,180.7 Property Management revenue2 $ 304.6 $ 280.0 $ 608.3 $ 552.7 Less: Client reimbursed costs largely associated with employees dedicated to client facilities and subcontracted vendor work performed for clients 154.4 146.7 310.0 293.6 Property Management fee revenue2 $ 150.2 $ 133.3 $ 298.3 $ 259.1 Reconciliation of Revenue to Fee Revenue and Contractual Fee Revenue In the first quarter of 2018, the company adopted new revenue recognition guidance. Certain restatements have been made to 2017 financial statements (and thus 2017 financial information included in this slide) to conform with the 2018 presentation. Occupier Outsourcing and Property Management revenue excludes associated leasing and sales revenue, most of which is contractual.

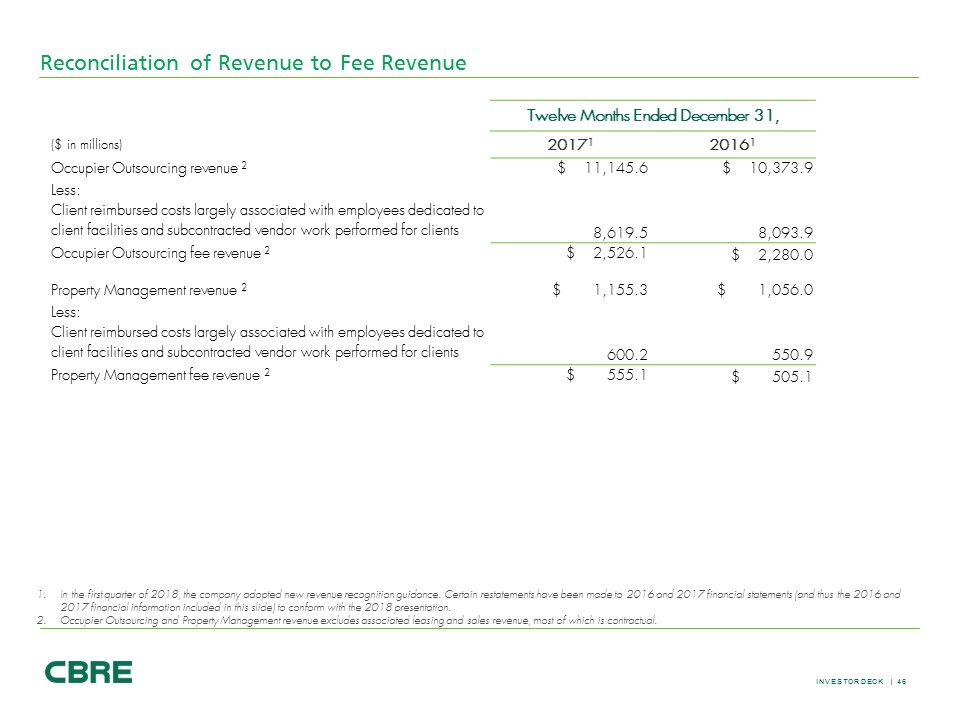

Twelve Months Ended December 31, ($ in millions) 20171 20161 Occupier Outsourcing revenue 2 $ 11,145.6 $ 10,373.9 Less: Client reimbursed costs largely associated with employees dedicated to client facilities and subcontracted vendor work performed for clients 8,619.5 8,093.9 Occupier Outsourcing fee revenue 2 $ 2,526.1 $ 2,280.0 Property Management revenue 2 $ 1,155.3 $ 1,056.0 Less: Client reimbursed costs largely associated with employees dedicated to client facilities and subcontracted vendor work performed for clients 600.2 550.9 Property Management fee revenue 2 $ 555.1 $ 505.1 Reconciliation of Revenue to Fee Revenue In the first quarter of 2018, the company adopted new revenue recognition guidance. Certain restatements have been made to 2016 and 2017 financial statements (and thus the 2016 and 2017 financial information included in this slide) to conform with the 2018 presentation. Occupier Outsourcing and Property Management revenue excludes associated leasing and sales revenue, most of which is contractual.

Footnotes Slide 6 Other includes Development Services revenue (1%) and Other revenue (1%). Capital Markets includes Sales revenue (19%) and Commercial Mortgage Origination (excludes Loan Servicing) revenue (5%). Contractual Sources include Occupier Outsourcing and Property Management revenue (33%; excludes associated sales and lease revenues, most of which are contractual), Valuation revenue (5%), Global Investment Management revenue (4%) and Loan Servicing (2%). Fee Revenue is gross revenue less both client reimbursed costs largely associated with our employees that are dedicated to client facilities and subcontracted vendor work performed for clients. NOTES: Local currency percent changes versus prior year are non-GAAP financial measures noted on slides 30 and 31. These percent changes are calculated by comparing current year results versus prior year results, in each case at prior year exchange rates. In the first quarter of 2018, the company adopted new revenue recognition guidance. Restatements have been made to 2017 and 2016 financial data included in this presentation on slides 6, 7, 10, 11, 19, 21, 22, 25, 26, 30, 31, 36, 41, 42, 43, 44, 45, and 46 to conform with the 2018 presentation. Financial data for periods prior to 2016 have not been restated and continue to be reported under the accounting standards in effect for the relevant period. Accordingly, such prior period amounts should not be compared with the restated financial data for 2016, 2017 and 2018. Although we believe that any prior period amounts would not be significantly different if we had restated such periods to conform with the 2018 presentation, there can be no assurance that there would not be a difference, and any such difference may be material. Slide 3 Property and corporate facilities under management as of December 31, 2017, includes square footage managed by affiliates. As of December 31, 2017, includes affiliates. Assets Under Management (AUM) as of June 30, 2018. Assets under management (AUM) refers to the fair market value of real asset-related investments with respect to which CBRE Global Investors provides, on a global basis, oversight, investment management services and other advice and which generally consist of investments in real assets; equity in funds and joint ventures; securities portfolios; operating companies and real asset-related loans. This AUM is intended principally to reflect the extent of CBRE Global Investors’ presence in the global real asset market, and its calculation of AUM may differ from the calculations of other investment or asset managers. Slide 7 Other includes Development Services revenue (1% in both 2006 and 2017) and Other revenue (1% in both 2006 and 2017). Capital Markets includes Sales revenue (33% in 2006 and 19% in 2017) and Commercial Mortgage Origination (excludes Loan Servicing) revenue (4% in 2006 and 5% in 2017). Contractual Sources include Occupier Outsourcing and Property Management revenue (7% in 2006 and 33% in 2017; excludes associated sales and lease revenues, most of which are contractual), Global Investment Management revenue (6% in 2006 and 4% in 2017) Valuation revenue (8% in 2006 and 5% in 2017) and Loan Servicing (0.5% in 2006 and 2% in 2017). Fee Revenue is gross revenue less both client reimbursed costs largely associated with our employees that are dedicated to client facilities and subcontracted vendor work performed for clients. On a GAAP revenue basis (as opposed to a fee revenue basis) contractual plus leasing revenues are 64% and 83% of GAAP revenues in 2006 and 2017, respectively. Fee revenue includes Loan Servicing within Contractual Sources, consistent with the fee revenue disclosure seen on slides 30 and 31.

Footnotes Slide 21 Historical revenue for Occupier Outsourcing line of business excludes associated sales and leasing revenue, most of which is contractual. Per International Association of Outsourcing Professionals (IAOP). Slide 22 Property Management (also known as Asset Services) revenue excludes associated sales and leasing revenue, most of which is contractual. Approximately 6% of this square footage is managed by affiliates. Slide 23 Excludes global securities business. As of June 30, 2018. Assets under management (AUM) refers to the fair market value of real asset-related investments with respect to which CBRE Global Investors provides, on a global basis, oversight, investment management services and other advice and which generally consist of investments in real assets; equity in funds and joint ventures; securities portfolios; operating companies and real asset-related loans. This AUM is intended principally to reflect the extent of CBRE Global Investors’ presence in the global real asset market, and its calculation of AUM may differ from the calculations of other investment or asset managers. Slide 10 Adjusted EPS excludes the effect of select charges from GAAP EPS as well as adjusts the provision for income taxes for such charges. Adjustments during the periods presented included amortization expense related to certain intangible assets attributable to acquisitions, cost-elimination expenses, integration and other costs related to acquisitions, certain carried interest incentive compensation (reversal) expense to align with the timing of associated revenue, write-off of financing costs on extinguished debt and goodwill and other non-amortizable intangible asset impairment. Adjustments for the twelve months ended December 31, 2017 also include the tax impact of U.S. tax reform. Leverage ratio is defined as year-end Net Debt divided by full-year adjusted EBITDA. Net Debt is defined as total debt, net of unamortized debt premiums, discounts and issuance costs, excluding warehouse facilities for loans originated on behalf of FHA and other government sponsored entities which are non-recourse to CBRE Group, Inc., non-recourse notes payable on real estate, and net of cash, excluding cash in consolidated funds and other entities not available for company use at year-end. Slide 25 Tenant rep and landlord rep split based on 2017 CBRE US lease consideration value. We regard leasing revenue as largely recurring over time because unlike most other transaction businesses, leasing activity normally takes place when leases expire. The average lease expires in five to six years. This means that, on average, in a typical year approximately 17% to 20% of leases roll over and a new leasing decision must be made. When a lease expires in the ordinary course, we expect it to be renewed, extended or the tenant to vacate the space to lease another space in the market. In each instance, a transaction is completed. If there is a downturn in economic activity, some tenants may seek a short term lease extension, often a year, before making a longer term commitment. In this scenario, that delayed leasing activity tends to be stacked on top of the normal activity in the following year. Thus, we characterize leasing as largely recurring over time because we expect an expiration of a lease, in the ordinary course, to lead to an opportunity for a leasing commission from such completed transaction. Slide 19 Adjusted EBITDA excludes (from EBITDA) certain carried interest incentive compensation reversal to align with the timing of associated revenue, integration and other costs related to acquisitions, merger-related and other non-recurring charges and income related to investment in Savills plc (disposed of in January 2007). Slide 11 CBRE has not reconciled adjusted net income for 2018P to the most directly comparable GAAP measure because this cannot be done without unreasonable effort due to the variability and low visibility with respect to costs related to acquisitions, carried interest incentive compensation and financing costs, which are potential adjustments to future earnings. We expect the variability of these items to have a potentially unpredictable and potentially significant impact on our future GAAP financial results.

Footnotes Slide 28 As of December 31 for each year presented. In Process figures include Long-Term Operating Assets (LTOA) of $0.2 billion for Q4 2017, $0.2 billion for Q4 2016, $0.1 billion for Q4 2015, $0.3 billion for Q4 2014 and $0.9 billion for Q4 2013. LTOA are projects that have achieved a stabilized level of occupancy or have been held 18-24 months following shell completion or acquisition. Pipeline deals are those projects we are pursuing which we believe have a greater than 50% chance of closing or where land has been acquired and the projected construction start is more than twelve months out. Slide 30 Contractual revenue refers to revenue derived from our Occupier Outsourcing, Property Management, Investment Management, Valuation and Loan Servicing businesses. We regard leasing revenue as largely recurring over time because unlike most other transaction businesses, leasing activity normally takes place when leases expire. The average lease expires in five to six years. This means that, on average, in a typical year approximately 17% to 20% of leases roll over and a new leasing decision must be made. When a lease expires in the ordinary course, we expect it to be renewed, extended or the tenant to vacate the space to lease another space in the market. In each instance, a transaction is completed. If there is a downturn in economic activity, some tenants may seek a short term lease extension, often a year, before making a longer term commitment. In this scenario, that delayed leasing activity tends to be stacked on top of the normal activity in the following year. Thus, we characterize leasing as largely recurring over time because we expect an expiration of a lease, in the ordinary course, to lead to an opportunity for a leasing commission from such completed transaction even if delayed by a year or two during an economic downturn. Occupier Outsourcing and Property Management revenue excludes associated leasing and sales revenue, most of which is contractual. Fee revenue is gross revenue less both client reimbursed costs largely associated with employees that are dedicated to client facilities and subcontracted vendor work performed for clients. Slide 27 Activity includes loan originations, loan sales, and affiliate loan originations. As measured in dollar value loaned. Slide 31 Contractual revenue refers to revenue derived from our Occupier Outsourcing, Property Management, Investment Management, Valuation and Loan Servicing businesses. We regard leasing revenue as largely recurring over time because unlike most other transaction businesses, leasing activity normally takes place when leases expire. The average lease expires in five to six years. This means that, on average, in a typical year approximately 17% to 20% of leases roll over and a new leasing decision must be made. When a lease expires in the ordinary course, we expect it to be renewed, extended or the tenant to vacate the space to lease another space in the market. In each instance, a transaction is completed. If there is a downturn in economic activity, some tenants may seek a short term lease extension, often a year, before making a longer term commitment. In this scenario, that delayed leasing activity tends to be stacked on top of the normal activity in the following year. Thus, we characterize leasing as largely recurring over time because we expect an expiration of a lease, in the ordinary course, to lead to an opportunity for a leasing commission from such completed transaction even if delayed by a year or two during an economic downturn. Occupier Outsourcing and Property Management revenue excludes associated leasing and sales revenue, most of which is contractual. Fee revenue is gross revenue less both client reimbursed costs largely associated with employees that are dedicated to client facilities and subcontracted vendor work performed for clients.

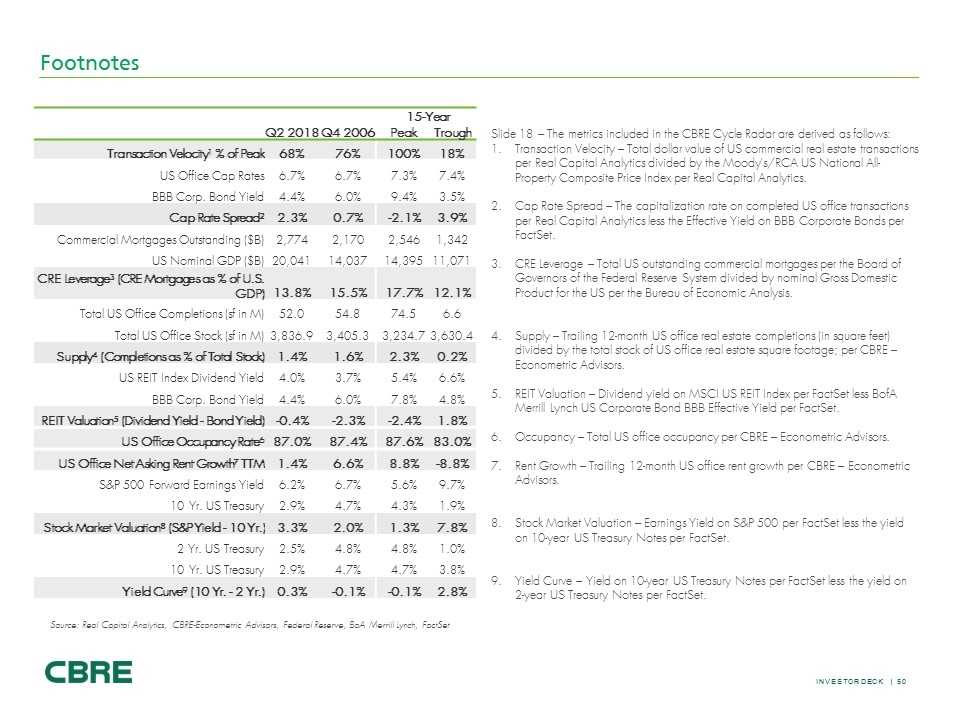

Footnotes Slide 18 – The metrics included in the CBRE Cycle Radar are derived as follows: Transaction Velocity – Total dollar value of US commercial real estate transactions per Real Capital Analytics divided by the Moody’s/RCA US National All-Property Composite Price Index per Real Capital Analytics. Cap Rate Spread – The capitalization rate on completed US office transactions per Real Capital Analytics less the Effective Yield on BBB Corporate Bonds per FactSet. CRE Leverage – Total US outstanding commercial mortgages per the Board of Governors of the Federal Reserve System divided by nominal Gross Domestic Product for the US per the Bureau of Economic Analysis. Supply – Trailing 12-month US office real estate completions (in square feet) divided by the total stock of US office real estate square footage; per CBRE – Econometric Advisors. REIT Valuation – Dividend yield on MSCI US REIT Index per FactSet less BofA Merrill Lynch US Corporate Bond BBB Effective Yield per FactSet. Occupancy – Total US office occupancy per CBRE – Econometric Advisors. Rent Growth – Trailing 12-month US office rent growth per CBRE – Econometric Advisors. Stock Market Valuation – Earnings Yield on S&P 500 per FactSet less the yield on 10-year US Treasury Notes per FactSet. Yield Curve – Yield on 10-year US Treasury Notes per FactSet less the yield on 2-year US Treasury Notes per FactSet. Source: Real Capital Analytics, CBRE-Econometric Advisors, Federal Reserve, BoA Merrill Lynch, FactSet 15-Year Q2 2018 Q4 2006 Peak Trough Transaction Velocity1 % of Peak 68% 76% 100% 18% US Office Cap Rates 6.7% 6.7% 7.3% 7.4% BBB Corp. Bond Yield 4.4% 6.0% 9.4% 3.5% Cap Rate Spread2 2.3% 0.7% -2.1% 3.9% Commercial Mortgages Outstanding ($B) 2,774 2,170 2,546 1,342 US Nominal GDP ($B) 20,041 14,037 14,395 11,071 CRE Leverage3 (CRE Mortgages as % of U.S. GDP) 13.8% 15.5% 17.7% 12.1% Total US Office Completions (sf in M) 52.0 54.8 74.5 6.6 Total US Office Stock (sf in M) 3,836.9 3,405.3 3,234.7 3,630.4 Supply4 (Completions as % of Total Stock) 1.4% 1.6% 2.3% 0.2% US REIT Index Dividend Yield 4.0% 3.7% 5.4% 6.6% BBB Corp. Bond Yield 4.4% 6.0% 7.8% 4.8% REIT Valuation5 (Dividend Yield - Bond Yield) -0.4% -2.3% -2.4% 1.8% US Office Occupancy Rate6 87.0% 87.4% 87.6% 83.0% US Office Net Asking Rent Growth7 TTM 1.4% 6.6% 8.8% -8.8% S&P 500 Forward Earnings Yield 6.2% 6.7% 5.6% 9.7% 10 Yr. US Treasury 2.9% 4.7% 4.3% 1.9% Stock Market Valuation8 (S&P Yield - 10 Yr.) 3.3% 2.0% 1.3% 7.8% 2 Yr. US Treasury 2.5% 4.8% 4.8% 1.0% 10 Yr. US Treasury 2.9% 4.7% 4.7% 3.8% Yield Curve9 (10 Yr. - 2 Yr.) 0.3% -0.1% -0.1% 2.8%