CBRE group, inc. The Global market leader in commercial real estate services December 2017 Exhibit 99.1

This presentation contains statements that are forward looking within the meaning of the Private Securities Litigation Reform Act of 1995. These include statements regarding CBRE’s future growth momentum, operations, market share, business outlook, and financial performance expectations. These statements are estimates only and actual results may ultimately differ from them. Except to the extent required by applicable securities laws, we undertake no obligation to update or publicly revise any of the forward-looking statements that you may hear today. Please refer to our third quarter earnings release, furnished on Form 8-K, our most recent quarterly report filed on Form 10-Q and our most recent annual report filed on Form 10-K, and in particular any discussion of risk factors or forward-looking statements therein, which are available on the SEC’s website (www.sec.gov), for a full discussion of the risks and other factors that may impact any forward-looking statements that you may hear today. We may make certain statements during the course of this presentation, which include references to “non-GAAP financial measures,” as defined by SEC regulations. Where required by these regulations, we have provided reconciliations of these measures to what we believe are the most directly comparable GAAP measures, which are attached hereto within the appendix. Forward-Looking Statements 2

Market Leadership #1 Leasing #1 Property Sales #1 Outsourcing #1 Appraisal & Valuation $98 billion AUM3 Scale And Diversity 5.3 billion square feet under management1 450+ offices worldwide2 Serves clients in over 100 countries2 Serves over 90% of the Fortune 100 Over 85,000 transactions in 2016 See slide 39 for footnotes The Global Leader in an Expanding Industry Integrated services to commercial real estate investors and occupiers Leading Global Brand Lipsey’s #1 CRE brand for 16 consecutive years World’s most ethical company awarded by Ethisphere Institute for four straight years S&P 500 company since 2006 Named America’s 15th Best Employer (out of 500 companies) in 2016 by Forbes Corporate Locations affiliate locations 3

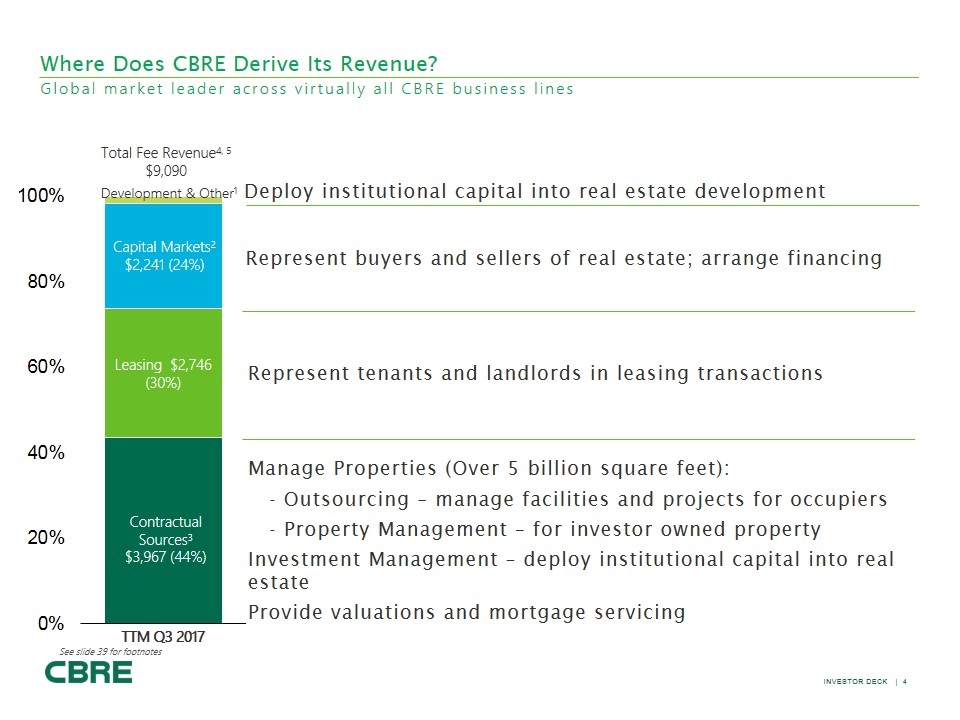

Where Does CBRE Derive Its Revenue? Global market leader across virtually all CBRE business lines Manage Properties (Over 5 billion square feet): - Outsourcing – manage facilities and projects for occupiers - Property Management – for investor owned property Investment Management – deploy institutional capital into real estate Provide valuations and mortgage servicing Total Fee Revenue4, 5 $9,090 See slide 39 for footnotes Development & Other1 Deploy institutional capital into real estate development Leasing $2,746 (30%) Contractual Sources3 $3,967 (44%) Represent buyers and sellers of real estate; arrange financing Represent tenants and landlords in leasing transactions Capital Markets2 $2,241 (24%) TTM Q3 2017 100% 80% 60% 40% 20% 0% 4

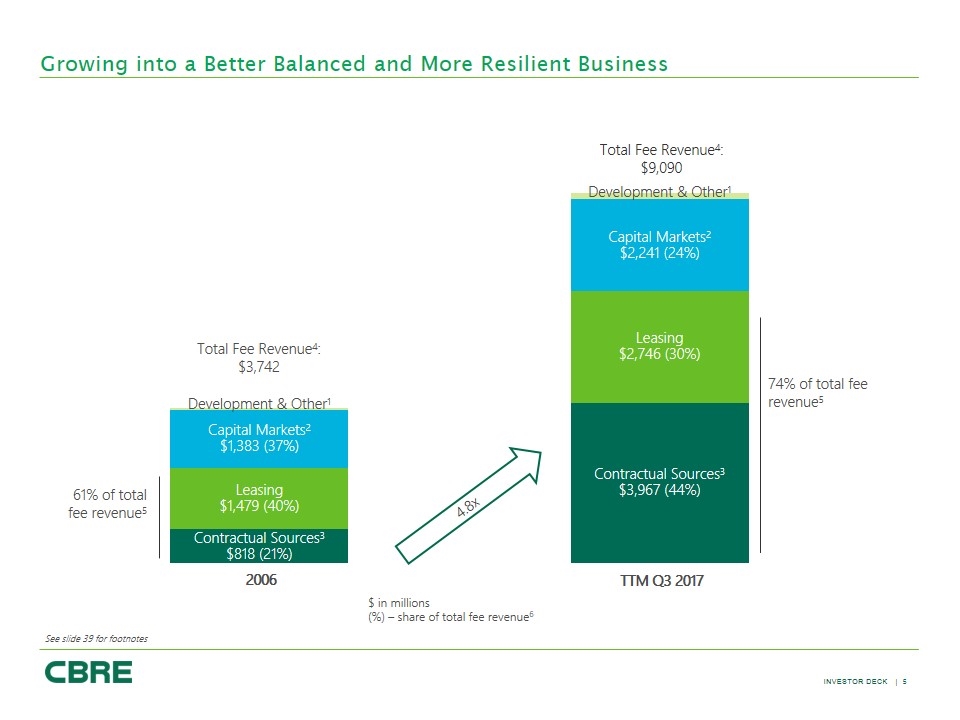

74% of total fee revenue5 See slide 39 for footnotes Growing into a Better Balanced and More Resilient Business $ in millions (%) – share of total fee revenue6 Development & other1 capital markets2 $1,383 (37%) leasing $1,479 (40%) contractual sources 3 $818 (21%) $2,241 (24%) $2,746 (30%) $3,976 (44%) 5

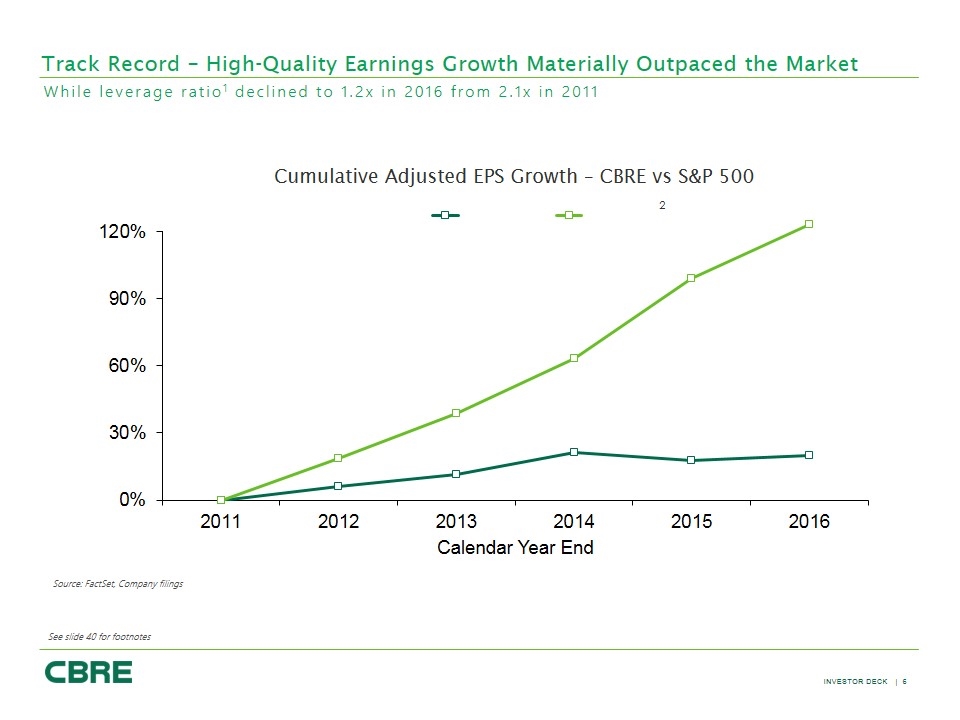

Track Record – High-Quality Earnings Growth Materially Outpaced the Market See slide 40 for footnotes Source: FactSet, Company filings Cumulative Adjusted EPS Growth – CBRE vs S&P 500 2 While leverage ratio1 declined to 1.2x in 2016 from 2.1x in 2011 (adj. eps)2 120% 90% 60% 30% 0% 2011 2012 2013 2014 2015 2016 6

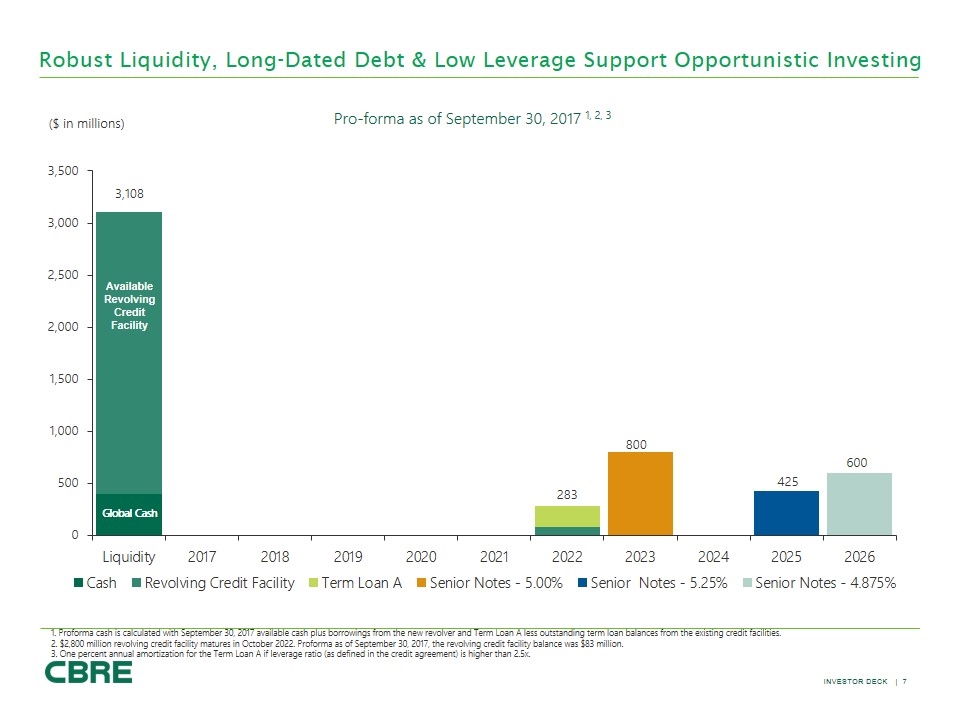

Robust Liquidity, Long-Dated Debt & Low Leverage Support Opportunistic Investing ($ in millions) Pro-forma as of September 30, 2017 1, 2, 3 Global Cash Undrawn Revolving Credit Facility Available Revolving Credit Facility Global Cash 1. Proforma cash is calculated with September 30, 2017 available cash plus borrowings from the new revolver and Term Loan A less outstanding term loan balances from the existing credit facilities. 2. $2,800 million revolving credit facility matures in October 2022. Proforma as of September 30, 2017, the revolving credit facility balance was $83 million. 3. One percent annual amortization for the Term Loan A if leverage ratio (as defined in the credit agreement) is higher than 2.5x. ($ in millions) 3,500 3,000 2,500 2,000 1,500 1,000 500 0 3,108 Liquidity 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 cash revolving credit facility term loan a senior notes – 5.00% senior notes – 5.25% senior notes – 4.875% 283 800 425 600

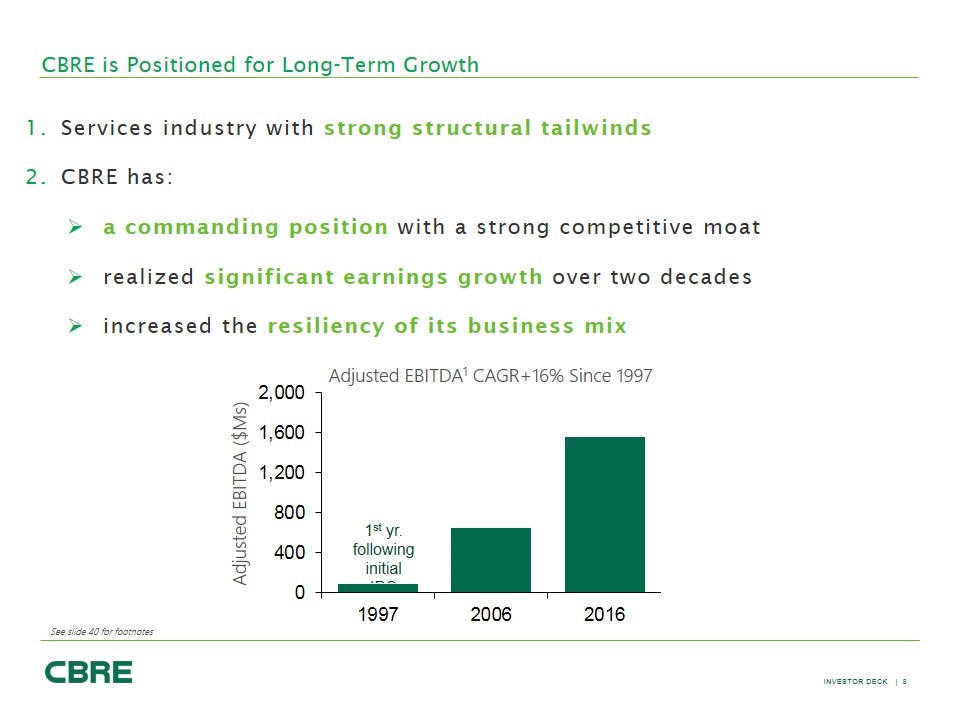

CBRE is Positioned for Long-Term Growth Services industry with strong structural tailwinds CBRE has: a commanding position with a strong competitive moat realized significant earnings growth over two decades increased the resiliency of its business mix Adjusted EBITDA1 CAGR+16% Since 1997 See slide 40 for footnotes 1st yr. following initial IPO Adjusted EBITDA ($Ms) 2,000 1,600 1,200 800 400 0 1997 2006 2016 1st yr. following initial ipo

Three Structural Tailwinds for Commercial Real Estate Services Outsourcing – Occupier Acceptance of Outsourced Commercial Real Estate Services Asset Allocation – by Institutional Investors to the Commercial Real Estate Asset Class Consolidation – Customers are Driving Consolidation to Global Industry Leaders 9

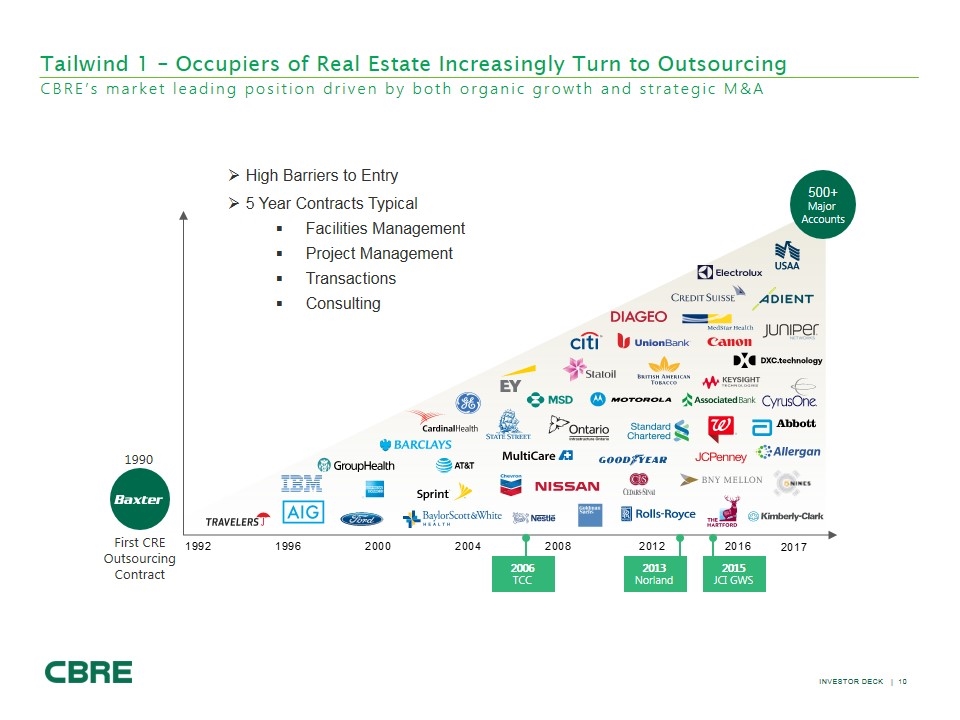

2006 TCC 2013 Norland 2015 JCI GWS 1990 First CRE Outsourcing Contract 500+ Major Accounts High Barriers to Entry 5 Year Contracts Typical Facilities Management Project Management Transactions Consulting Tailwind 1 – Occupiers of Real Estate Increasingly Turn to Outsourcing CBRE’s market leading position driven by both organic growth and strategic M&A Travelers aig ibm grouphealth American express ford Barclays at&t sprint baylor scott & white health nestle chevron multicare state street cardinal health ey citi Nissan good year goldman sachs rolls-Royce cears-Sinai standard chartered Motorola statoli msd Ontario infrastructure bny mellon the Hartford jcpenney Kimberly clark nines allergan abbot cyrusone associated bank keysight technologies dxc.technology canon juniper networks medstar credit Suisse Electrolux usaa adient 1992 1996 2000 2004 2008 2012 2016 2017 10

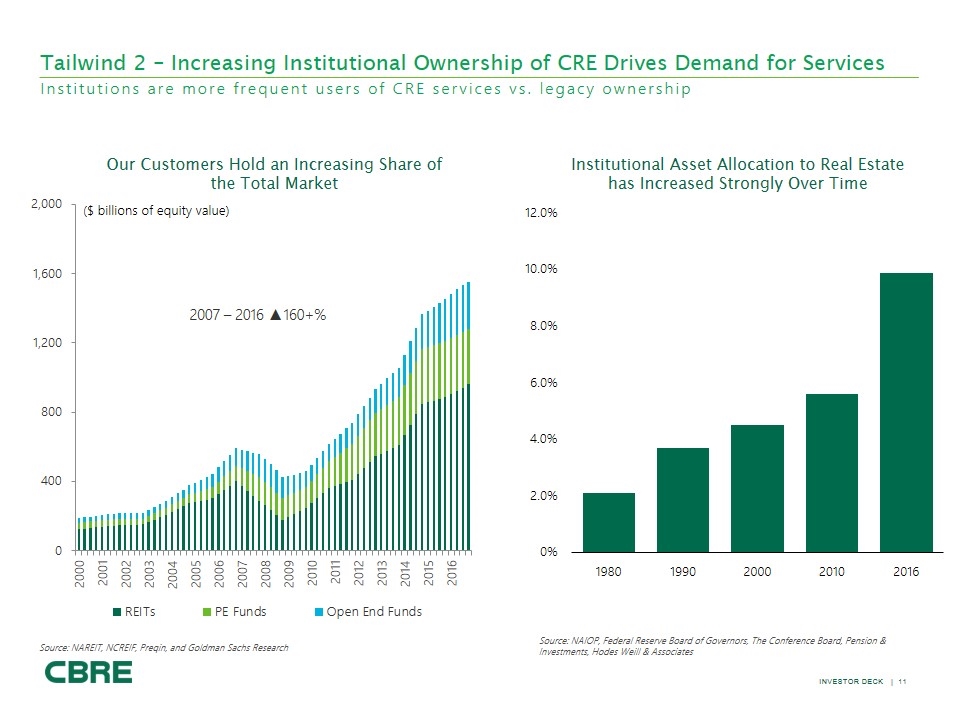

Tailwind 2 – Increasing Institutional Ownership of CRE Drives Demand for Services Institutions are more frequent users of CRE services vs. legacy ownership Source: NAREIT, NCREIF, Preqin, and Goldman Sachs Research ($ billions of equity value) 2007 – 2016 ▲160+% Institutional Asset Allocation to Real Estate has Increased Strongly Over Time Source: NAIOP, Federal Reserve Board of Governors, The Conference Board, Pension & Investments, Hodes Weill & Associates Our Customers Hold an Increasing Share of the Total Market 2,000 1,600 1,200 800 400 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2012 2013 2014 2015 2016 12.0% 10.0% 8.0% 6.0% 4.0% 2.0% 0% 1980 1990 reits pe funds open end funds

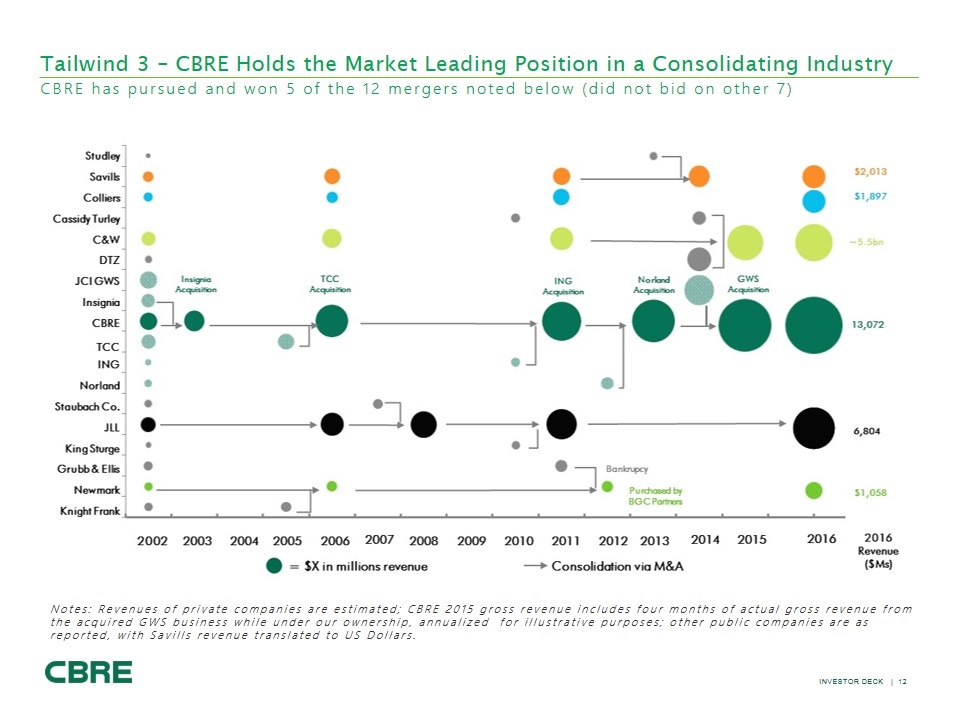

Tailwind 3 – CBRE Holds the Market Leading Position in a Consolidating Industry Notes: Revenues of private companies are estimated; CBRE 2015 gross revenue includes four months of actual gross revenue from the acquired GWS business while under our ownership, annualized for illustrative purposes; other public companies are as reported, with Savills revenue translated to US Dollars. CBRE has pursued and won 5 of the 12 mergers noted below (did not bid on other 7) Studley savills colliers Cassidy turley c&w dtz jci gws insignia cbre tcc ing norland staubach co. jll king sturge grubb & ellis Newmark knight frank 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 revenue ($ms) insignia acquisition tcc acquisition ing acquisition norland acquisition gws acquisition bankruptcy purchased by bgc partners $2,013 $1,897 ~5.5bn 13,072 6,804 $1,058 =x in millions revenue consolidation via m&a

CBRE Vantage: Industry Leading Suite of Enablement Technology Focused technology investments further differentiating CBRE and its professionals CBRE can make impactful investments at a smaller percentage of company spend vs others CBRE Floored SaaS Interactive Creation of 3D Floor Plans and Virtual Environments Sample of CBRE Technology Investments www.cbre.com/vantage CBRE Deal IQ Forum Analytics Leading Predictive Analytics Platform SaaS CRM and Deal Management Platform 13

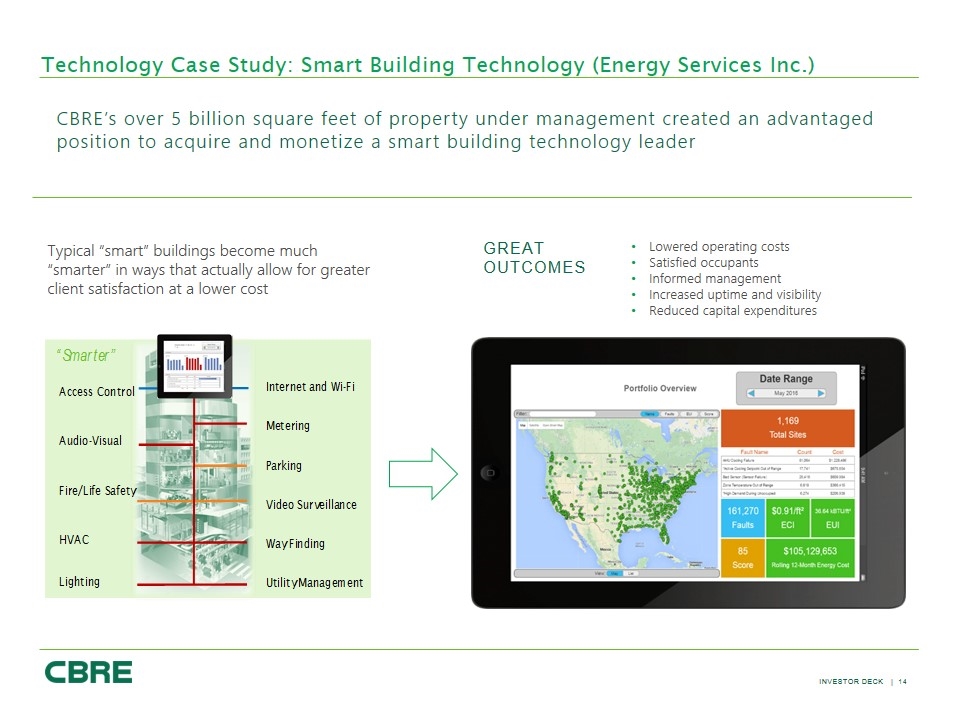

Technology Case Study: Smart Building Technology (Energy Services Inc.) CBRE’s over 5 billion square feet of property under management created an advantaged position to acquire and monetize a smart building technology leader Great Outcomes Lowered operating costs Satisfied occupants Informed management Increased uptime and visibility Reduced capital expenditures Typical “smart” buildings become much “smarter” in ways that actually allow for greater client satisfaction at a lower cost “smarter” access control audio-visual fire/life safety hvac lighting internet and wi-fi metering parking video surveillance way finding utility management 14

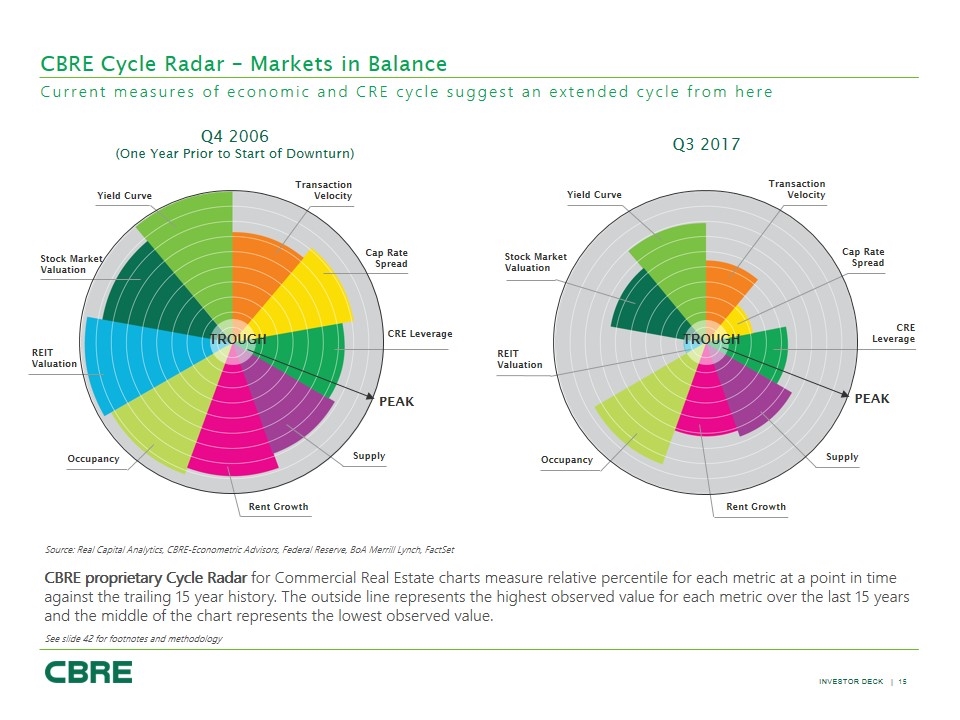

CBRE Cycle Radar – Markets in Balance Current measures of economic and CRE cycle suggest an extended cycle from here Q3 2017 Q4 2006 (One Year Prior to Start of Downturn) CBRE proprietary Cycle Radar for Commercial Real Estate charts measure relative percentile for each metric at a point in time against the trailing 15 year history. The outside line represents the highest observed value for each metric over the last 15 years and the middle of the chart represents the lowest observed value. Source: Real Capital Analytics, CBRE-Econometric Advisors, Federal Reserve, BoA Merrill Lynch, FactSet See slide 42 for footnotes and methodology Yield Curve Transaction Velocity Cap Rate Spread CRE Leverage Supply Rent Growth Occupancy REIT Valuation Stock Market Valuation TROUGH Yield Curve Transaction Velocity Cap Rate Spread CRE Leverage Supply Rent Growth Occupancy REIT Valuation Stock Market Valuation PEAK TROUGH PEAK 15

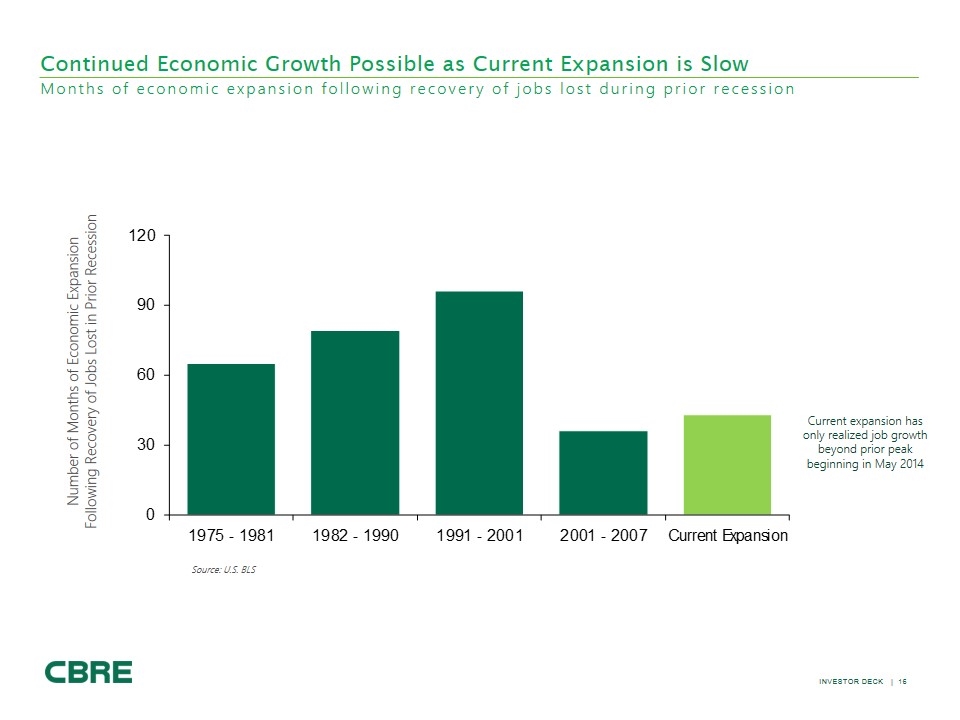

Continued Economic Growth Possible as Current Expansion is Slow Months of economic expansion following recovery of jobs lost during prior recession Number of Months of Economic Expansion Following Recovery of Jobs Lost in Prior Recession Source: U.S. BLS Current expansion has only realized job growth beyond prior peak beginning in May 2014 120 90 60 30 0 1975 – 1981 1982 – 1990 1991 – 2001 2001 – 2007 current expansion source: u.s. bls 16

CBRE is Positioned for Long-Term Growth CBRE: Leads a services industry with strong structural tailwinds, has a durable business model with significant free cash flow, and has achieved long-term growth through business cycles, while continuing to significantly diversify its business mix Business Cycle: CBRE Cycle Radar suggests an extended business cycle; CBRE has a strong balance sheet and considerable liquidity to deploy in a downturn if a recession occurs earlier than expected 17

Business line slides

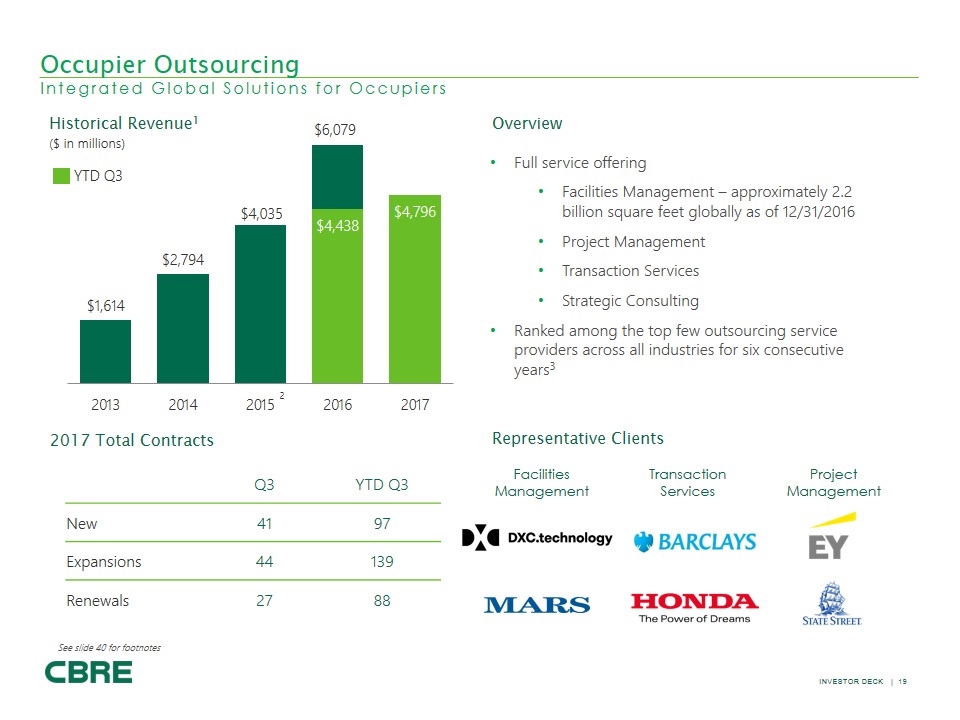

Q3 YTD Q3 New 41 97 Expansions 44 139 Renewals 27 88 Historical Revenue1 Overview 2017 Total Contracts Full service offering Facilities Management – approximately 2.2 billion square feet globally as of 12/31/2016 Project Management Transaction Services Strategic Consulting Ranked among the top few outsourcing service providers across all industries for six consecutive years3 Facilities Management Transaction Services Project Management Representative Clients 2 ($ in millions) Occupier Outsourcing Integrated Global Solutions for Occupiers YTD Q3 See slide 40 for footnotes dxc.tecchnology Barclays ey mars honda the power of dreams state street $1,614 $2,794 $4,035 $6,079 $4,438 $4,796 2013 2014 2015 2016 2017 19

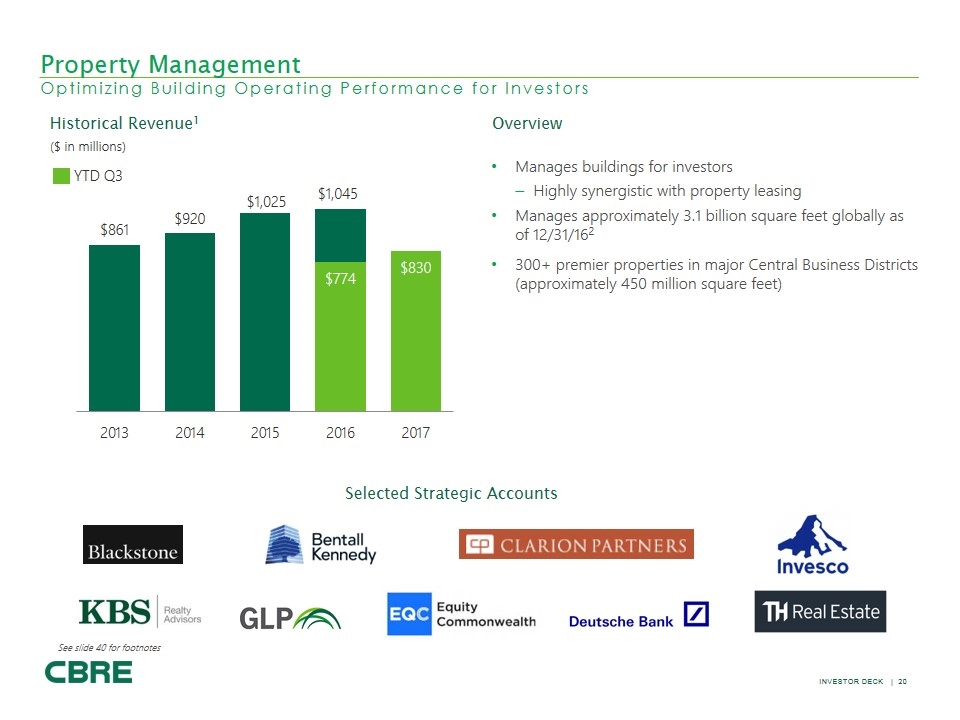

Historical Revenue1 Overview Selected Strategic Accounts ($ in millions) Manages buildings for investors Highly synergistic with property leasing Manages approximately 3.1 billion square feet globally as of 12/31/162 300+ premier properties in major Central Business Districts (approximately 450 million square feet) See slide 40 for footnotes Property Management Optimizing Building Operating Performance for Investors YTD Q3 $861 $920 $1,025 $1,045 $774 $830 2013 2014 2015 2016 2017 blackstone Bentall kennedy clarion partners invesco kbs realty advisors glp eqc equity commonwealth deutsche bank th real estate

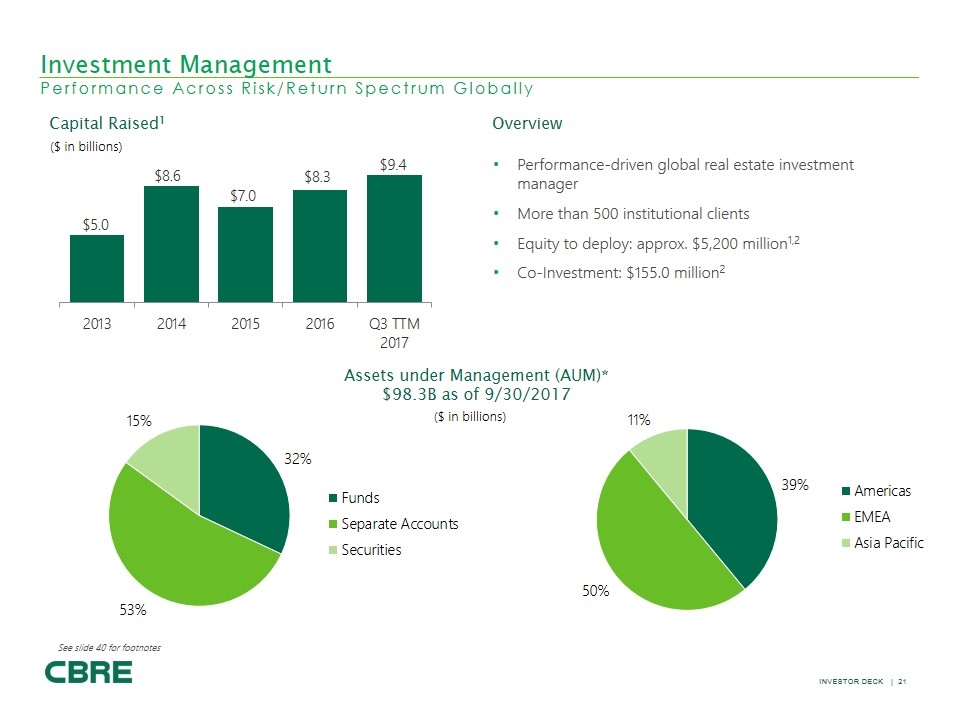

Capital Raised1 Assets under Management (AUM)* $98.3B as of 9/30/2017 Overview ($ in billions) Performance-driven global real estate investment manager More than 500 institutional clients Equity to deploy: approx. $5,200 million1,2 Co-Investment: $155.0 million2 ($ in billions) Investment Management Performance Across Risk/Return Spectrum Globally See slide 40 for footnotes $5.0 $8.6 $7.0 $8.3 $9.4 2013 2014 2015 2016 q3 ttm 2017 assets under management (aum)* $98.3b as of 9/30/2017 ($ in billions 15% 32% 53% funds separate accounts securities Americas emea asia pacific 11% 39% 50% 21

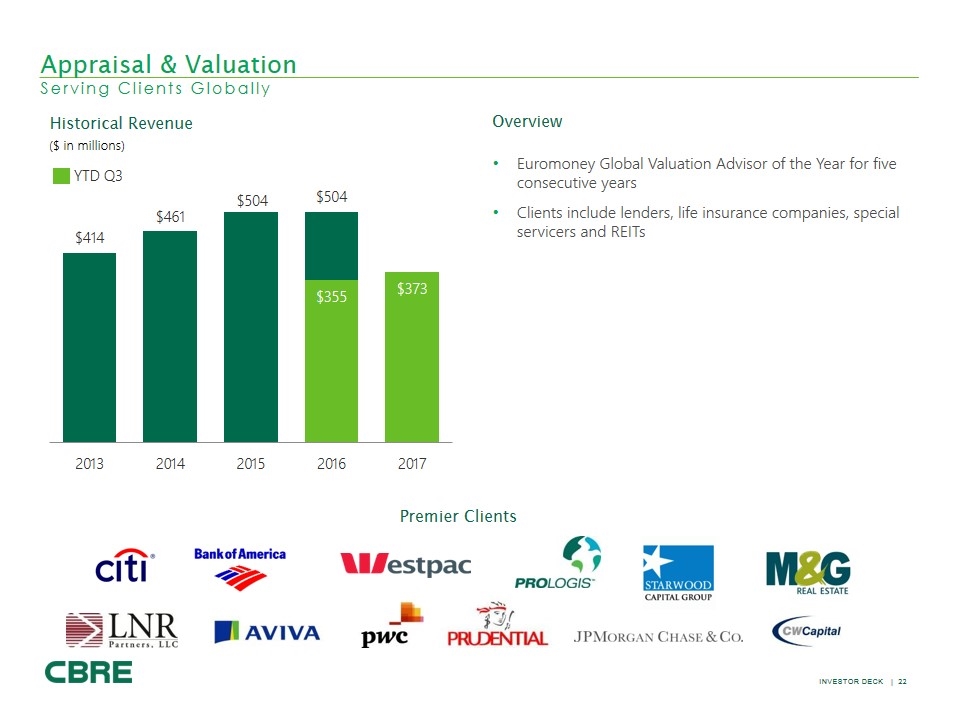

Premier Clients ($ in millions) Euromoney Global Valuation Advisor of the Year for five consecutive years Clients include lenders, life insurance companies, special servicers and REITs Overview Historical Revenue Appraisal & Valuation Serving Clients Globally YTD Q3 $414 $461 $504 $355 $373 2013 2014 2015 2016 2017 citi LNR partners, llc bank of America aviva Westpac pwc prudential prologis jpmorgan chase & co. starwood capital group m&g real estate cw capital 22

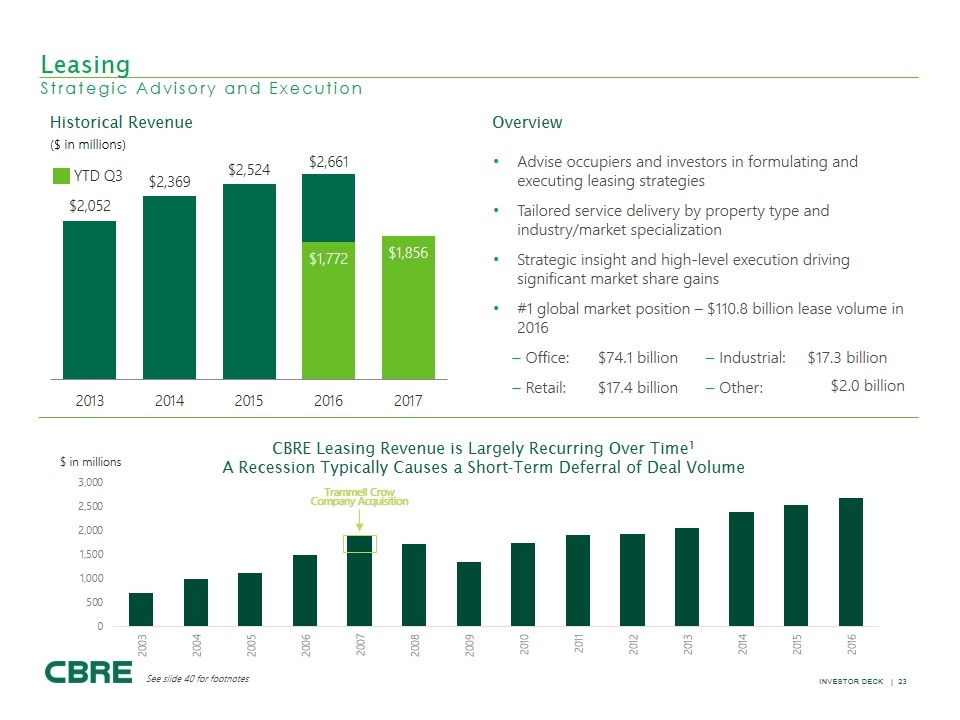

Overview Advise occupiers and investors in formulating and executing leasing strategies Tailored service delivery by property type and industry/market specialization Strategic insight and high-level execution driving significant market share gains #1 global market position – $110.8 billion lease volume in 2016 − Office: $74.1 billion − Industrial: $17.3 billion − Retail: $17.4 billion − Other: ($ in millions) Historical Revenue Leasing Strategic Advisory and Execution Trammell Crow Company Acquisition $2.0 billion YTD Q3 See slide 40 for footnotes $ in millions $2,052 $2,369 $2,524 $2,661 $1,772 $1,856 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 3,000 2,500 2,000 1,500 1,000 500 0 23

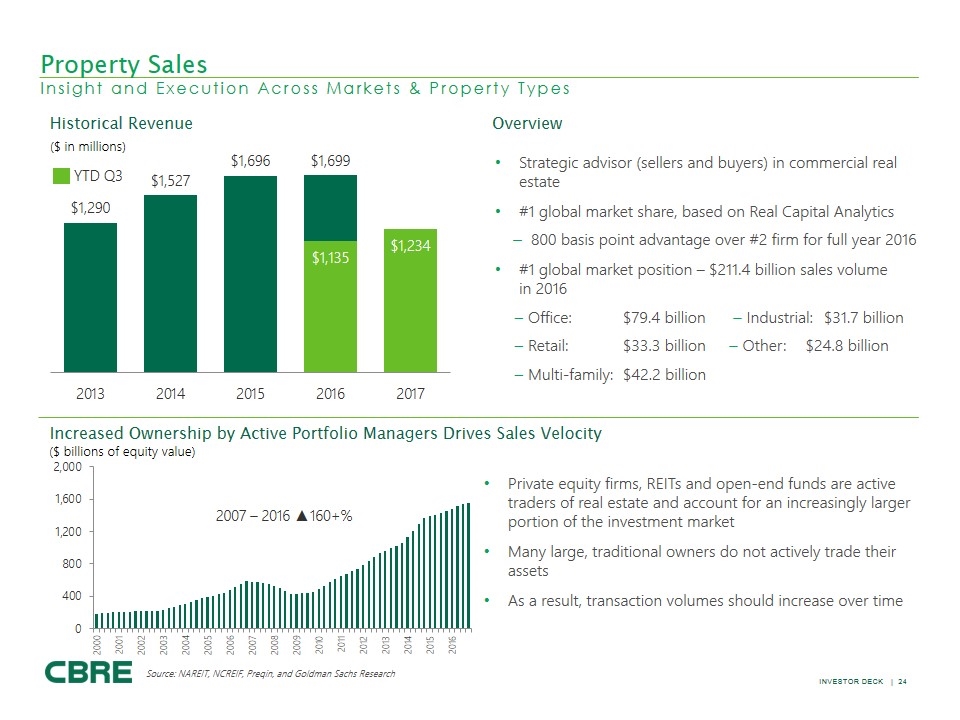

Increased Ownership by Active Portfolio Managers Drives Sales Velocity Strategic advisor (sellers and buyers) in commercial real estate #1 global market share, based on Real Capital Analytics 800 basis point advantage over #2 firm for full year 2016 #1 global market position – $211.4 billion sales volume in 2016 − Office:$79.4 billion − Industrial:$31.7 billion − Retail:$33.3 billion − Other:$24.8 billion − Multi-family:$42.2 billion Overview Historical Revenue ($ in millions) Source: NAREIT, NCREIF, Preqin, and Goldman Sachs Research ($ billions of equity value) 2007 – 2016 ▲160+% Property Sales Insight and Execution Across Markets & Property Types Private equity firms, REITs and open-end funds are active traders of real estate and account for an increasingly larger portion of the investment market Many large, traditional owners do not actively trade their assets As a result, transaction volumes should increase over time YTD Q3 $1,290 $1,527 $1,696 $1,699 $1,135 $1,234 2,000 1,600 1,200 800 400 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2017 2015 2016 2017

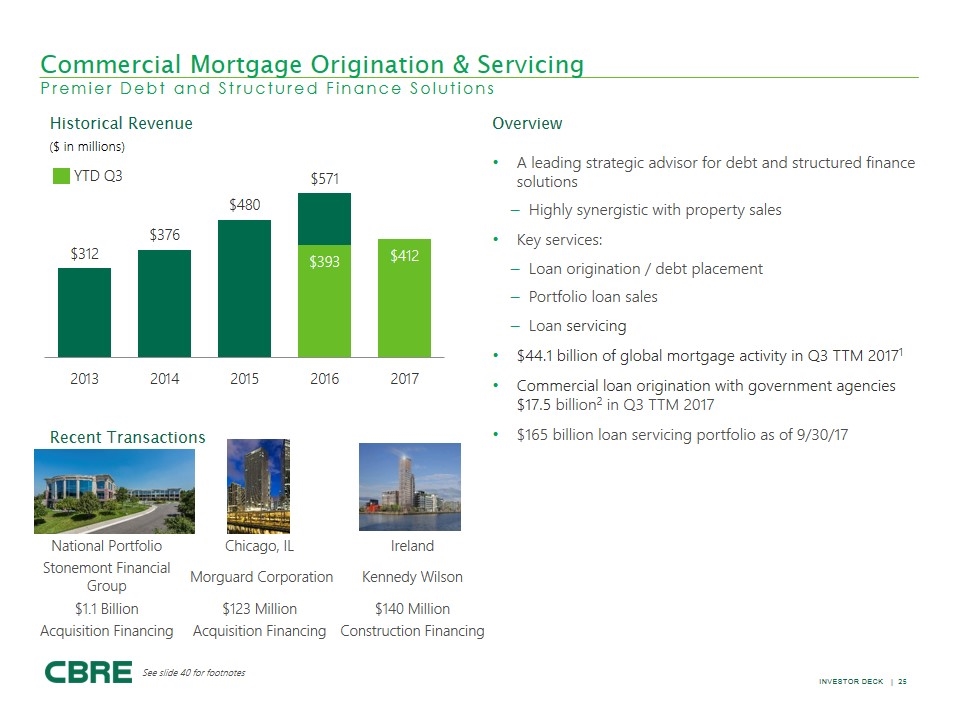

Recent Transactions A leading strategic advisor for debt and structured finance solutions Highly synergistic with property sales Key services: Loan origination / debt placement Portfolio loan sales Loan servicing $44.1 billion of global mortgage activity in Q3 TTM 20171 Commercial loan origination with government agencies $17.5 billion2 in Q3 TTM 2017 $165 billion loan servicing portfolio as of 9/30/17 Overview Historical Revenue ($ in millions) See slide 40 for footnotes Commercial Mortgage Origination & Servicing Premier Debt and Structured Finance Solutions YTD Q3 National Portfolio Chicago, IL Ireland Stonemont Financial Group Morguard Corporation Kennedy Wilson $1.1 Billion $123 Million $140 Million Acquisition Financing Acquisition Financing Construction Financing $312 $376 $480 $571 $393 $412 2013 2014 2015 2016 2017 25

2 Projects In Process/Pipeline1 Overview Recent Projects A premier brand in U.S. development 65+ year record of excellence Partner with leading institutional capital sources Modest capital required from CBRE $116.7 million of co-investment at the end of Q3 2017 $15.9 million in repayment guarantees on outstanding debt balances at the end of Q3 2017 ($ in billions) 3 See slide 41 for footnotes Development Services Trammell Crow Company – A Premier Brand in U.S. development Park District The Boardwalk LA Plaza Principio Commerce Park Dallas, TX Mixed-Use Irvine, CA Office Los Angeles, CA Mixed-use North End, MD Industrial In process2 pipeline3 1.5 4.0 3.6 4.2 5.4 4.9 9.7 6.6 5.9 2013 2014 2015 2016 q3 2017 26

appendix

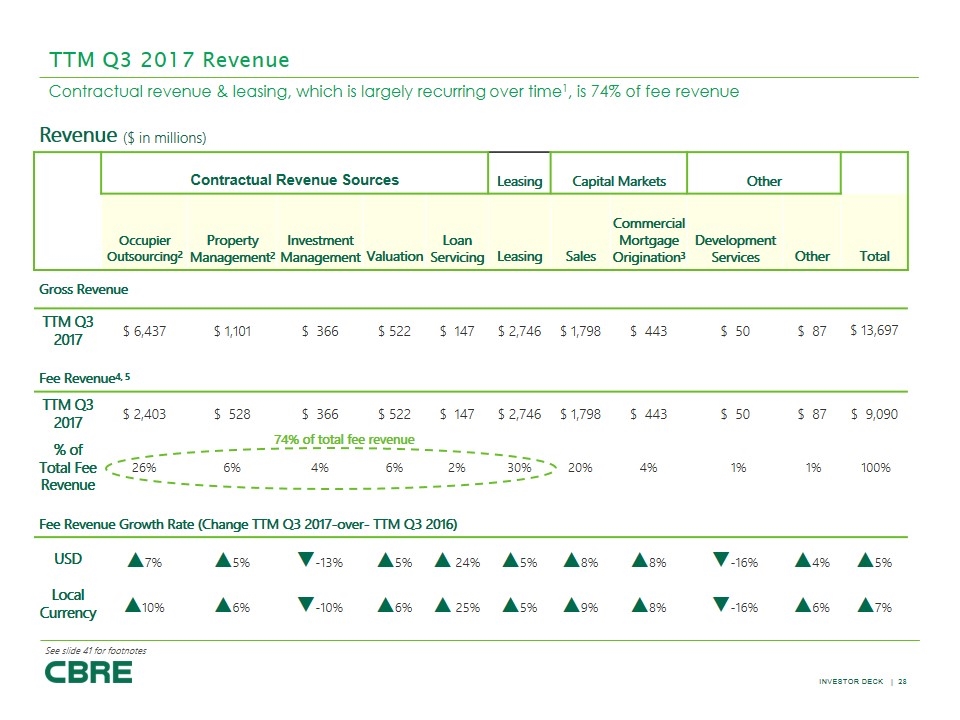

Revenue ($ in millions) Contractual Revenue Sources Leasing Capital Markets Other Occupier Outsourcing2 Property Management2 Investment Management Valuation Loan Servicing Leasing Sales Commercial Mortgage Origination3 Development Services Other Total Gross Revenue TTM Q3 2017 $ 6,437 $ 1,101 $ 366 $ 522 $ 147 $ 2,746 $ 1,798 $ 443 $ 50 $ 87 $ 13,697 Fee Revenue4, 5 TTM Q3 2017 $ 2,403 $ 528 $ 366 $ 522 $ 147 $ 2,746 $ 1,798 $ 443 $ 50 $ 87 $ 9,090 % of Total Fee Revenue 26% 6% 4% 6% 2% 30% 20% 4% 1% 1% 100% Fee Revenue Growth Rate (Change TTM Q3 2017-over- TTM Q3 2016) USD ▲7% ▲5% ▼-13% ▲5% ▲ 24% ▲5% ▲8% ▲8% ▼-16% ▲4% ▲5% Local Currency ▲10% ▲6% ▼-10% ▲6% ▲ 25% ▲5% ▲9% ▲8% ▼-16% ▲6% ▲7% TTM Q3 2017 Revenue Contractual revenue & leasing, which is largely recurring over time1, is 74% of fee revenue 74% of total fee revenue See slide 41 for footnotes 28

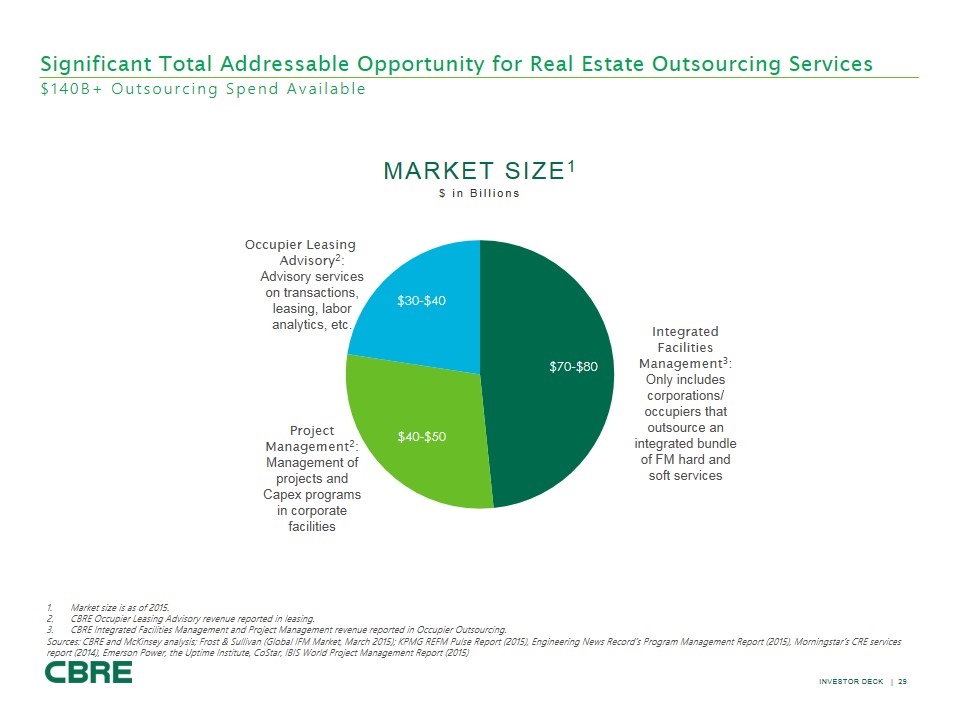

Occupier Leasing Advisory2: Advisory services on transactions, leasing, labor analytics, etc. Significant Total Addressable Opportunity for Real Estate Outsourcing Services $140B+ Outsourcing Spend Available $ in Billions Market Size1 Market size is as of 2015. CBRE Occupier Leasing Advisory revenue reported in leasing. CBRE Integrated Facilities Management and Project Management revenue reported in Occupier Outsourcing. Sources: CBRE and McKinsey analysis; Frost & Sullivan (Global IFM Market, March 2015); KPMG REFM Pulse Report (2015), Engineering News Record’s Program Management Report (2015), Morningstar’s CRE services report (2014), Emerson Power, the Uptime Institute, CoStar, IBIS World Project Management Report (2015) Integrated Facilities Management3: Only includes corporations/ occupiers that outsource an integrated bundle of FM hard and soft services Project Management2: Management of projects and Capex programs in corporate facilities $30-$40 $70-$80 $40-$50 29

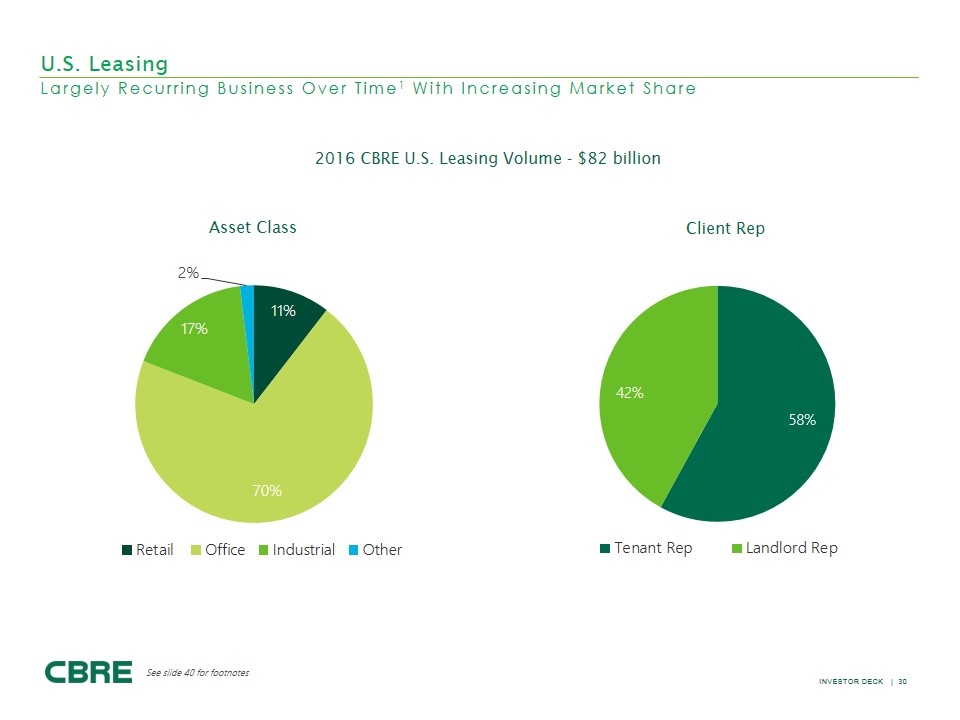

U.S. Leasing Largely Recurring Business Over Time1 With Increasing Market Share 2016 CBRE U.S. Leasing Volume - $82 billion See slide 40 for footnotes Asset class client rep 17% 2% 11% 70% 42% 58% retail office industrial other tenant rep landlord rep 30

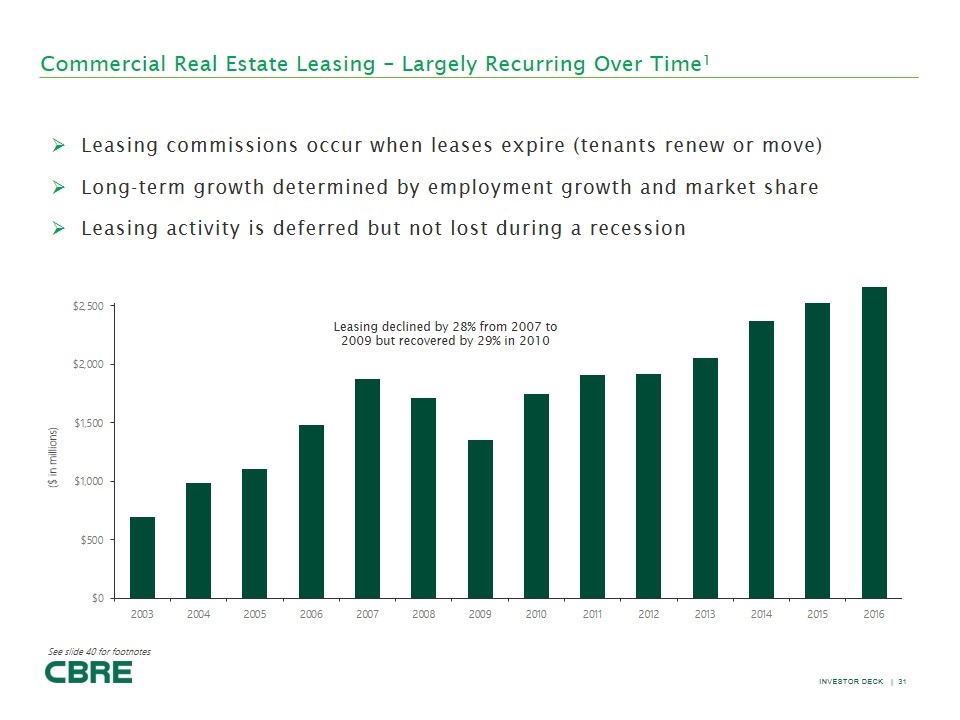

Commercial Real Estate Leasing – Largely Recurring Over Time1 See slide 40 for footnotes Leasing commissions occur when leases expire (tenants renew or move) Long-term growth determined by employment growth and market share Leasing activity is deferred but not lost during a recession ($ in millions) $2,500 $2,000 $1,500 $1,000 $500 $0 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Leasing declined by 28% from 2007 to 2009 but recovered by 29% in 2010 31

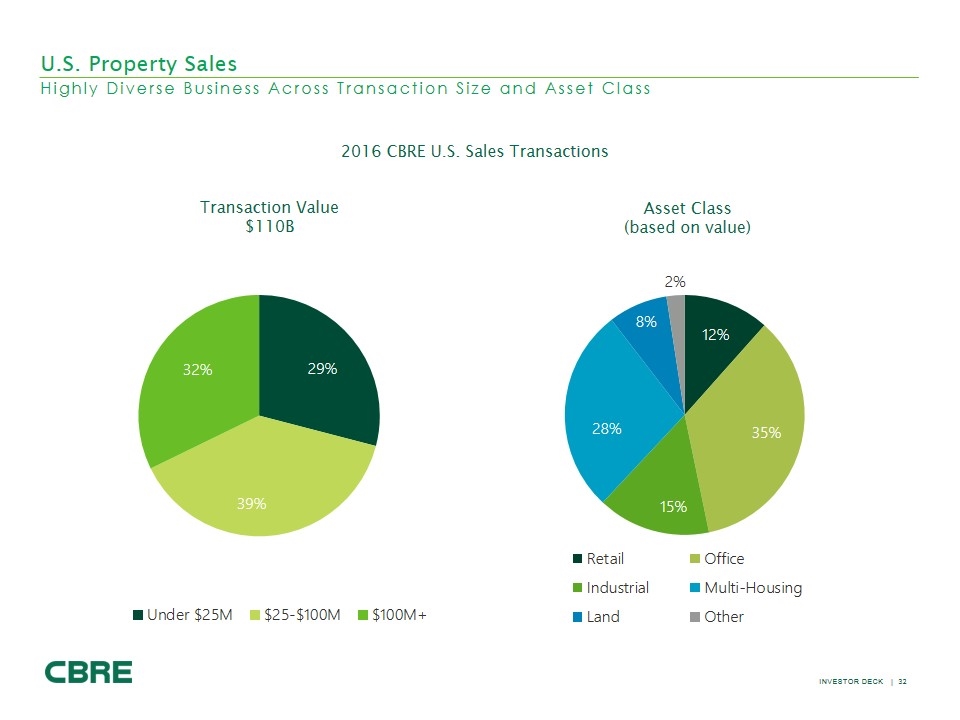

2016 CBRE U.S. Sales Transactions U.S. Property Sales Highly Diverse Business Across Transaction Size and Asset Class Transaction value $110b asset class (based on value) 32% 29% 39% 8% 2% 12% 28% 15% 35% under $25m $25-$100m $100m+ retail office industrial multi-housing land other

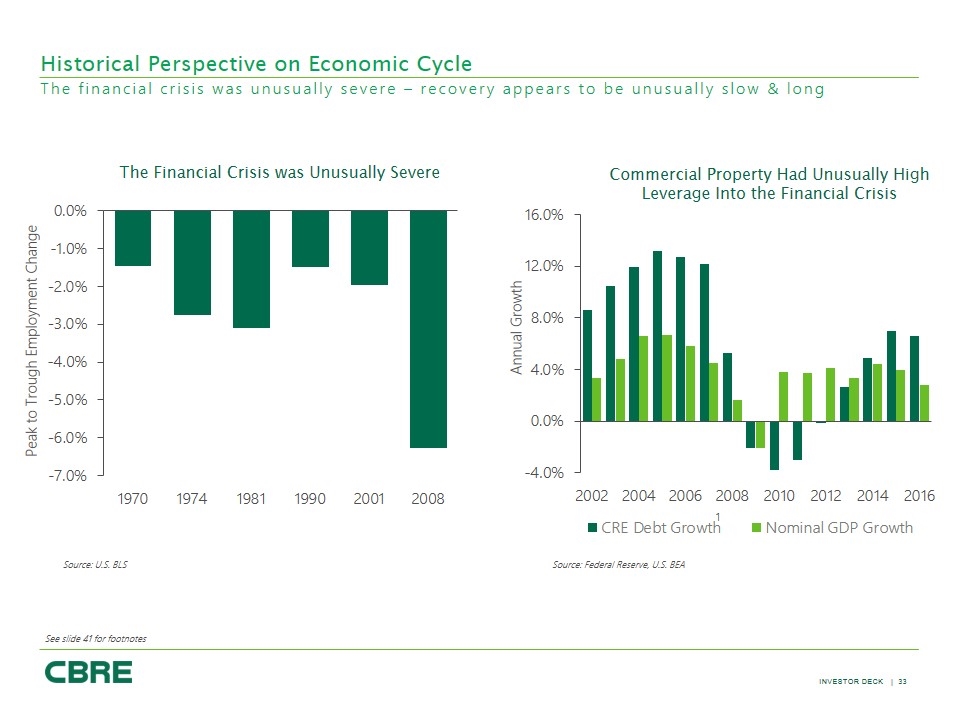

Historical Perspective on Economic Cycle The financial crisis was unusually severe – recovery appears to be unusually slow & long See slide 41 for footnotes The Financial Crisis was Unusually Severe Commercial Property Had Unusually High Leverage Into the Financial Crisis Source: U.S. BLS Source: Federal Reserve, U.S. BEA Peak to Trough Employment Change Annual Growth 1 0.0% -1.0% -2.0% -3.0% -4.0% -5.0% -6.0% -7.0% 1970 1974 1981 1990 2001 2008 16.0% 12.0% 8.0% 4.0% 0.0% 2002 2004 2006 2010 2012 2014 2016 cre debt growth nominal gdp growth 33

Non-GAAP financial measures The following measures are considered “non-GAAP financial measures” under SEC guidelines: fee revenue contractual fee revenue net income attributable to CBRE Group, Inc., as adjusted (which we also refer to as “adjusted net income”) diluted income per share attributable to CBRE Group, Inc. shareholders, as adjusted (which we also refer to as “adjusted earnings per share” or “adjusted EPS”) EBITDA and adjusted EBITDA These measures are not recognized measurements under United States generally accepted accounting principles, or “GAAP.” When analyzing our operating performance, readers should use them in addition to, and not as an alternative for, their most directly comparable financial measure calculated and presented in accordance with GAAP. Because not all companies use identical calculations, our presentation of these measures may not be comparable to similarly titled measures of other companies. Our management generally uses these non-GAAP financial measures to evaluate operating performance and for other discretionary purposes. The company believes that these measures provide a more complete understanding of ongoing operations, enhance comparability of current results to prior periods and may be useful for investors to analyze our financial performance because they eliminate the impact of selected charges that may obscure trends in the underlying performance of our business. The company further uses certain of these measures, and believes that they are useful to investors, for purposes described below. With respect to fee revenue: the company believes that investors may find this measure useful to analyze the financial performance of our Occupier Outsourcing and Property Management business lines and our business generally. Fee revenue excludes costs reimbursable by clients, and as such provides greater visibility into the underlying performance of our business. With respect to contractual fee revenue: the company believes that investors may find this measure useful to analyze our overall financial performance because it identifies revenue streams that are typically more stable over time. With respect to adjusted net income, adjusted EPS, EBITDA and adjusted EBITDA: the company believes that investors may find these measures useful in evaluating our operating performance compared to that of other companies in our industry because these calculations generally eliminate the accounting effects of acquisitions, which would include impairment charges of goodwill and intangibles created from acquisitions—and in the case of EBITDA and adjusted EBITDA—the effects of financings and income tax and the accounting effects of capital spending. All of these measures may vary for different companies for reasons unrelated to overall operating performance. In the case of EBITDA and adjusted EBITDA, these measures are not intended to be measures of free cash flow for our management’s discretionary use because they do not consider cash requirements such as tax and debt service payments. The EBITDA and adjusted EBITDA measures calculated herein may also differ from the amounts calculated under similarly titled definitions in our credit facilities and debt instruments, which amounts are further adjusted to reflect certain other cash and non-cash charges and are used by us to determine compliance with financial covenants therein and our ability to engage in certain activities, such as incurring additional debt and making certain restricted payments. The company also uses adjusted EBITDA and adjusted EPS as significant components when measuring our operating performance under our employee incentive compensation programs. 34

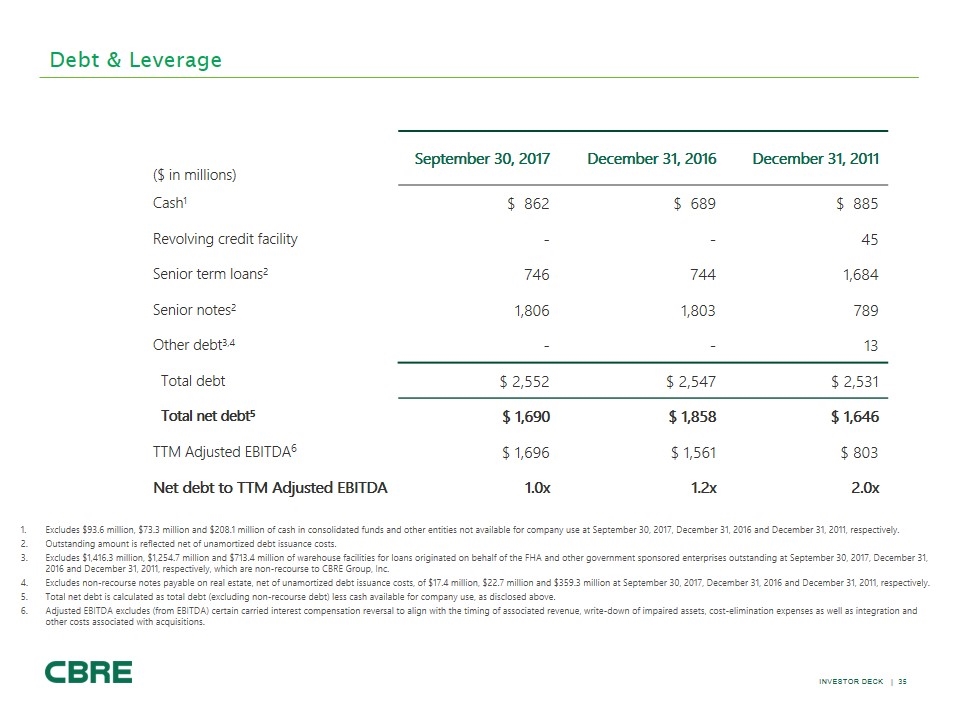

Debt & Leverage Excludes $93.6 million, $73.3 million and $208.1 million of cash in consolidated funds and other entities not available for company use at September 30, 2017, December 31, 2016 and December 31, 2011, respectively. Outstanding amount is reflected net of unamortized debt issuance costs. Excludes $1,416.3 million, $1,254.7 million and $713.4 million of warehouse facilities for loans originated on behalf of the FHA and other government sponsored enterprises outstanding at September 30, 2017, December 31, 2016 and December 31, 2011, respectively, which are non-recourse to CBRE Group, Inc. Excludes non-recourse notes payable on real estate, net of unamortized debt issuance costs, of $17.4 million, $22.7 million and $359.3 million at September 30, 2017, December 31, 2016 and December 31, 2011, respectively. Total net debt is calculated as total debt (excluding non-recourse debt) less cash available for company use, as disclosed above. Adjusted EBITDA excludes (from EBITDA) certain carried interest compensation reversal to align with the timing of associated revenue, write-down of impaired assets, cost-elimination expenses as well as integration and other costs associated with acquisitions. ($ in millions) September 30, 2017 December 31, 2016 December 31, 2011 Cash1 $ 862 $ 689 $ 885 Revolving credit facility - - 45 Senior term loans2 746 744 1,684 Senior notes2 1,806 1,803 789 Other debt3,4 - - 13 Total debt $ 2,552 $ 2,547 $ 2,531 Total net debt5 $ 1,690 $ 1,858 $ 1,646 TTM Adjusted EBITDA6 $ 1,696 $ 1,561 $ 803 Net debt to TTM Adjusted EBITDA 1.0x 1.2x 2.0x 35

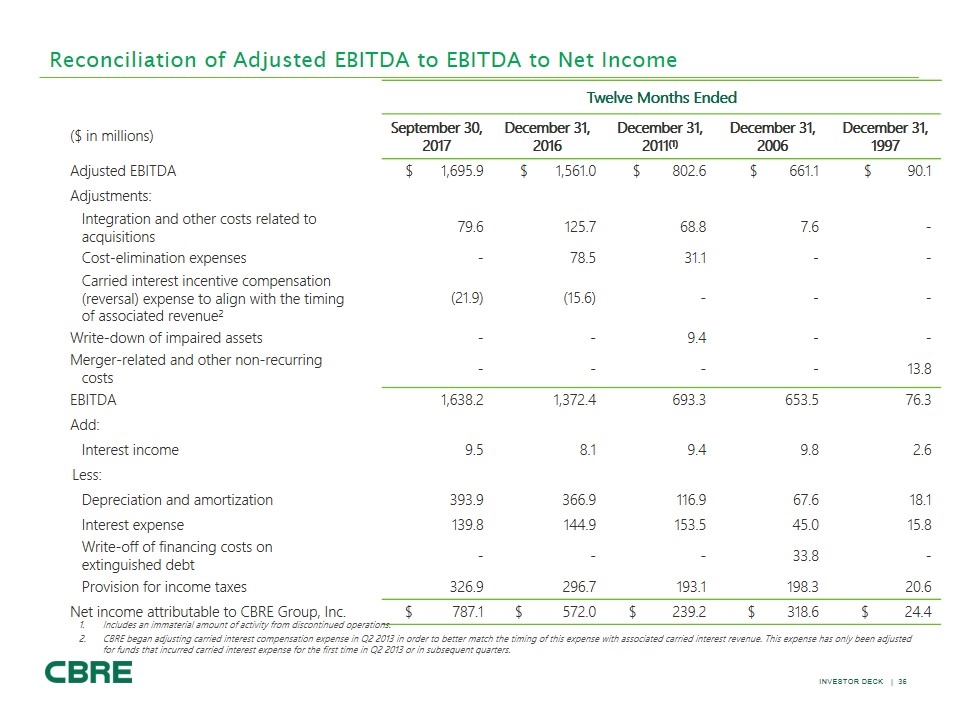

Twelve Months Ended ($ in millions) September 30, 2017 December 31, 2016 December 31, 2011(1) December 31, 2006 December 31, 1997 Adjusted EBITDA $ 1,695.9 $ 1,561.0 $ 802.6 $ 661.1 $ 90.1 Adjustments: Integration and other costs related to acquisitions 79.6 125.7 68.8 7.6 - Cost-elimination expenses - 78.5 31.1 - - Carried interest incentive compensation (reversal) expense to align with the timing of associated revenue2 (21.9) (15.6) - - - Write-down of impaired assets - - 9.4 - - Merger-related and other non-recurring costs - - - - 13.8 EBITDA 1,638.2 1,372.4 693.3 653.5 76.3 Add: Interest income 9.5 8.1 9.4 9.8 2.6 Less: Depreciation and amortization 393.9 366.9 116.9 67.6 18.1 Interest expense 139.8 144.9 153.5 45.0 15.8 Write-off of financing costs on extinguished debt - - - 33.8 - Provision for income taxes 326.9 296.7 193.1 198.3 20.6 Net income attributable to CBRE Group, Inc. $ 787.1 $ 572.0 $ 239.2 $ 318.6 $ 24.4 Reconciliation of Adjusted EBITDA to EBITDA to Net Income Includes an immaterial amount of activity from discontinued operations. CBRE began adjusting carried interest compensation expense in Q2 2013 in order to better match the timing of this expense with associated carried interest revenue. This expense has only been adjusted for funds that incurred carried interest expense for the first time in Q2 2013 or in subsequent quarters. 36

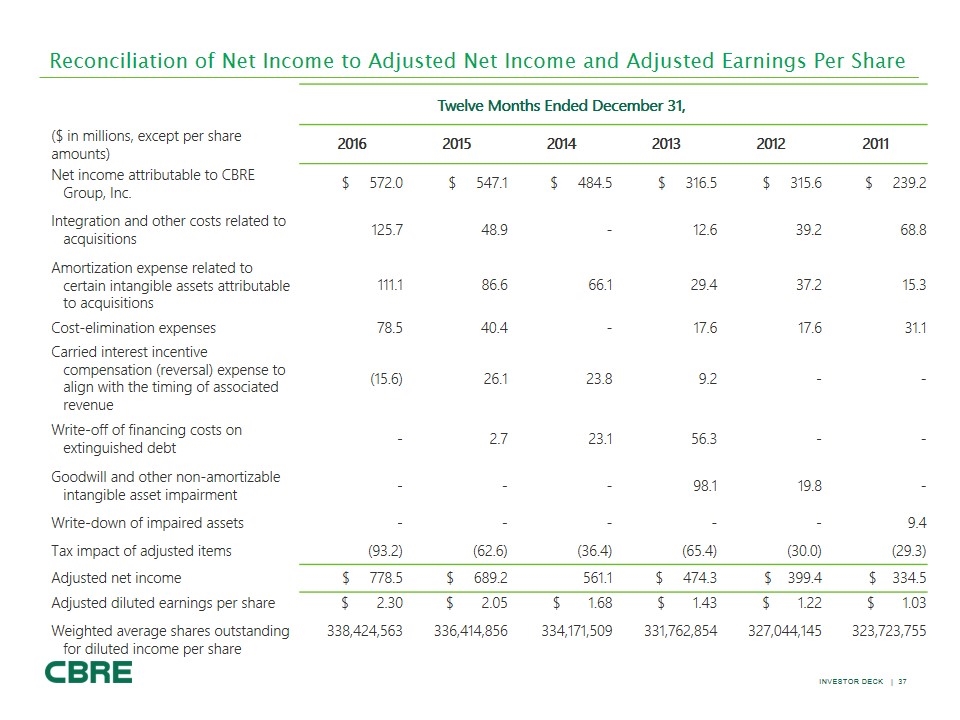

Twelve Months Ended December 31, ($ in millions, except per share amounts) 2016 2015 2014 2013 2012 2011 Net income attributable to CBRE Group, Inc. $ 572.0 $ 547.1 $ 484.5 $ 316.5 $ 315.6 $ 239.2 Integration and other costs related to acquisitions 125.7 48.9 - 12.6 39.2 68.8 Amortization expense related to certain intangible assets attributable to acquisitions 111.1 86.6 66.1 29.4 37.2 15.3 Cost-elimination expenses 78.5 40.4 - 17.6 17.6 31.1 Carried interest incentive compensation (reversal) expense to align with the timing of associated revenue (15.6) 26.1 23.8 9.2 - - Write-off of financing costs on extinguished debt - 2.7 23.1 56.3 - - Goodwill and other non-amortizable intangible asset impairment - - - 98.1 19.8 - Write-down of impaired assets - - - - - 9.4 Tax impact of adjusted items (93.2) (62.6) (36.4) (65.4) (30.0) (29.3) Adjusted net income $ 778.5 $ 689.2 561.1 $ 474.3 $ 399.4 $ 334.5 Adjusted diluted earnings per share $ 2.30 $ 2.05 $ 1.68 $ 1.43 $ 1.22 $ 1.03 Weighted average shares outstanding for diluted income per share 338,424,563 336,414,856 334,171,509 331,762,854 327,044,145 323,723,755 Reconciliation of Net Income to Adjusted Net Income and Adjusted Earnings Per Share 37

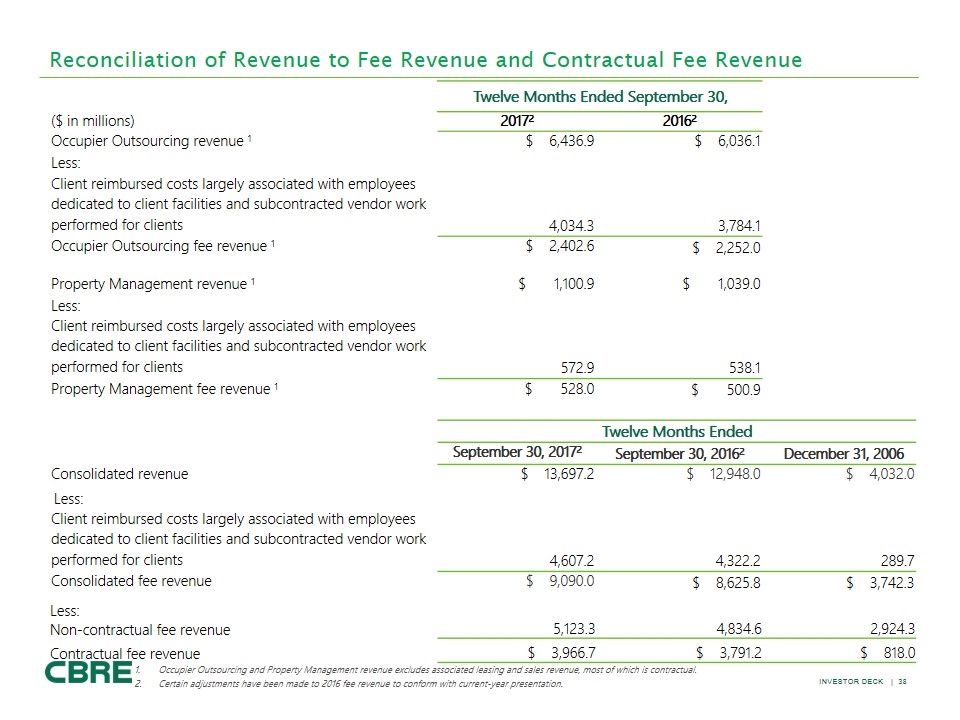

Twelve Months Ended September 30, ($ in millions) 20172 20162 Occupier Outsourcing revenue 1 $ 6,436.9 $ 6,036.1 Less: Client reimbursed costs largely associated with employees dedicated to client facilities and subcontracted vendor work performed for clients 4,034.3 3,784.1 Occupier Outsourcing fee revenue 1 $ 2,402.6 $ 2,252.0 Property Management revenue 1 $ 1,100.9 $ 1,039.0 Less: Client reimbursed costs largely associated with employees dedicated to client facilities and subcontracted vendor work performed for clients 572.9 538.1 Property Management fee revenue 1 $ 528.0 $ 500.9 Twelve Months Ended September 30, 20172 September 30, 20162 December 31, 2006 Consolidated revenue $ 13,697.2 $ 12,948.0 $ 4,032.0 Less: Client reimbursed costs largely associated with employees dedicated to client facilities and subcontracted vendor work performed for clients 4,607.2 4,322.2 289.7 Consolidated fee revenue $ 9,090.0 $ 8,625.8 $ 3,742.3 Less: Non-contractual fee revenue 5,123.3 4,834.6 2,924.3 Contractual fee revenue $ 3,966.7 $ 3,791.2 $ 818.0 Reconciliation of Revenue to Fee Revenue and Contractual Fee Revenue Occupier Outsourcing and Property Management revenue excludes associated leasing and sales revenue, most of which is contractual. Certain adjustments have been made to 2016 fee revenue to conform with current-year presentation. 38

Footnotes Slide 4 Other includes Development Services revenue (1%) and Other revenue (1%). Capital Markets includes Sales revenue (20%) and Commercial Mortgage Brokerage (excluding Loan Servicing) revenue (4%). Contractual Sources include Occupier Outsourcing and Property Management revenue (32%; excludes associated sales and lease revenues, most of which are contractual), Global Investment Management revenue (4%) Valuation revenue (6%) and Loan Servicing (2%). Fee Revenue is gross revenue less client reimbursed costs largely associated with our employees that are dedicated to client facilities and subcontracted vendor work performed for clients. Certain adjustments have been made to 2016 fee revenue to conform with current-year presentation. Fee revenue includes Loan Servicing within Contractual Sources, consistent with the fee revenue disclosure seen on slide 28. NOTE: Local currency percent changes versus prior year are non-GAAP financial measures noted on slide 28. These percent changes are calculated by comparing current year results versus prior year results, in each case at prior year exchange rates. Slide 3 Property and corporate facilities under management as of December 31, 2016; 7% of this square footage is managed by affiliates. As of December 31, 2016, includes affiliates. Assets Under Management (AUM) as of September 30, 2017. Slide 5 Other includes Development Services revenue (1% in both 2006 and TTM Q3 2017) and Other revenue (1% in both 2006 and TTM Q3 2017). Capital Markets includes Sales revenue (33% in 2006 and 20% in TTM Q3 2017) and Commercial Mortgage Brokerage (excluding Loan Servicing) revenue (4% in both 2006 and TTM Q3 2017). Contractual Sources include Occupier Outsourcing and Property Management revenue (7% in 2006 and 32% in TTM Q3 2017; excludes associated sales and lease revenues, most of which are contractual), Global Investment Management revenue (6% in 2006 and 4% in TTM Q3 2017) Valuation revenue (8% in 2006 and 6% in TTM Q3 2017) and Loan Servicing (0.5% in 2006 and 2% in TTM Q3 2017). Fee Revenue is gross revenue less client reimbursed costs largely associated with our employees that are dedicated to client facilities and subcontracted vendor work performed for clients. Certain adjustments have been made to 2016 fee revenue to conform with current-year presentation. On a GAAP revenue basis (as opposed to a fee revenue basis) contractual plus leasing revenues are 64% and 83% of GAAP revenues in 2006 and TTM Q3 2017, respectively. Fee revenue includes Loan Servicing within Contractual Sources, consistent with the fee revenue disclosure seen on slide 28. 39

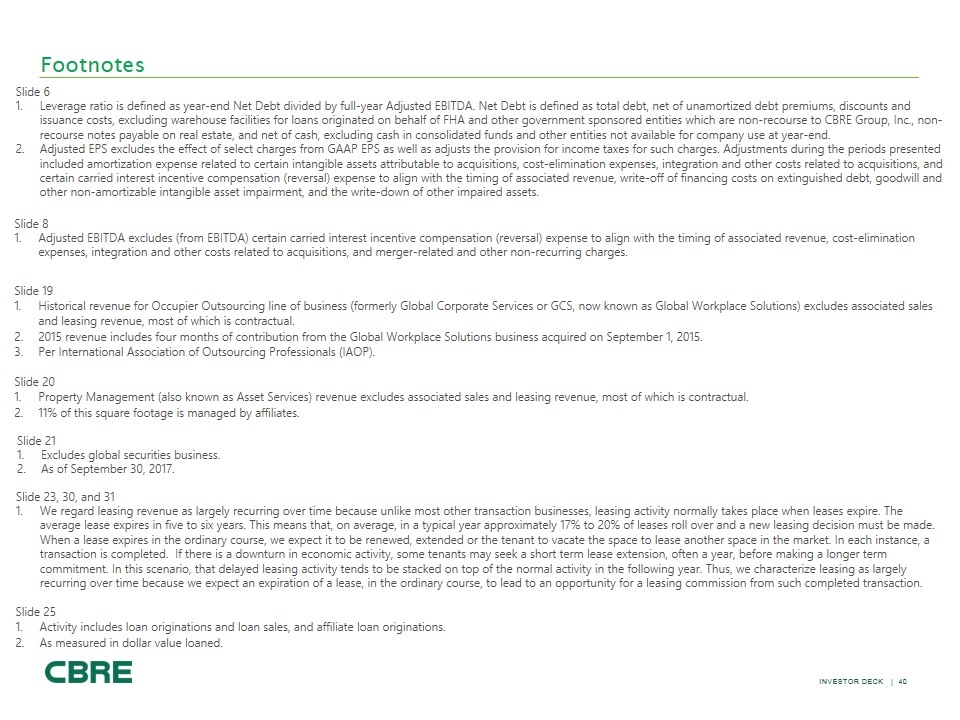

Slide 8 Adjusted EBITDA excludes (from EBITDA) certain carried interest incentive compensation (reversal) expense to align with the timing of associated revenue, cost-elimination expenses, integration and other costs related to acquisitions, and merger-related and other non-recurring charges. Footnotes Slide 19 Historical revenue for Occupier Outsourcing line of business (formerly Global Corporate Services or GCS, now known as Global Workplace Solutions) excludes associated sales and leasing revenue, most of which is contractual. 2015 revenue includes four months of contribution from the Global Workplace Solutions business acquired on September 1, 2015. Per International Association of Outsourcing Professionals (IAOP). Slide 20 Property Management (also known as Asset Services) revenue excludes associated sales and leasing revenue, most of which is contractual. 11% of this square footage is managed by affiliates. Slide 21 Excludes global securities business. As of September 30, 2017. Slide 6 Leverage ratio is defined as year-end Net Debt divided by full-year Adjusted EBITDA. Net Debt is defined as total debt, net of unamortized debt premiums, discounts and issuance costs, excluding warehouse facilities for loans originated on behalf of FHA and other government sponsored entities which are non-recourse to CBRE Group, Inc., non-recourse notes payable on real estate, and net of cash, excluding cash in consolidated funds and other entities not available for company use at year-end. Adjusted EPS excludes the effect of select charges from GAAP EPS as well as adjusts the provision for income taxes for such charges. Adjustments during the periods presented included amortization expense related to certain intangible assets attributable to acquisitions, cost-elimination expenses, integration and other costs related to acquisitions, and certain carried interest incentive compensation (reversal) expense to align with the timing of associated revenue, write-off of financing costs on extinguished debt, goodwill and other non-amortizable intangible asset impairment, and the write-down of other impaired assets. Slide 25 Activity includes loan originations and loan sales, and affiliate loan originations. As measured in dollar value loaned. Slide 23, 30, and 31 We regard leasing revenue as largely recurring over time because unlike most other transaction businesses, leasing activity normally takes place when leases expire. The average lease expires in five to six years. This means that, on average, in a typical year approximately 17% to 20% of leases roll over and a new leasing decision must be made. When a lease expires in the ordinary course, we expect it to be renewed, extended or the tenant to vacate the space to lease another space in the market. In each instance, a transaction is completed. If there is a downturn in economic activity, some tenants may seek a short term lease extension, often a year, before making a longer term commitment. In this scenario, that delayed leasing activity tends to be stacked on top of the normal activity in the following year. Thus, we characterize leasing as largely recurring over time because we expect an expiration of a lease, in the ordinary course, to lead to an opportunity for a leasing commission from such completed transaction. 40

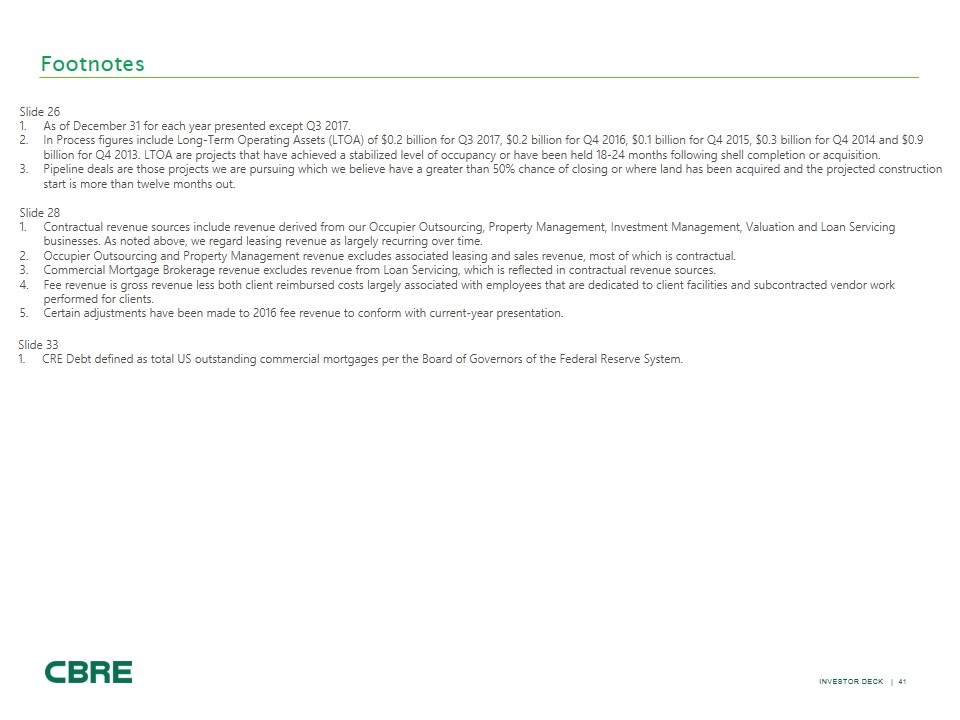

Footnotes Slide 33 CRE Debt defined as total US outstanding commercial mortgages per the Board of Governors of the Federal Reserve System. Slide 26 As of December 31 for each year presented except Q3 2017. In Process figures include Long-Term Operating Assets (LTOA) of $0.2 billion for Q3 2017, $0.2 billion for Q4 2016, $0.1 billion for Q4 2015, $0.3 billion for Q4 2014 and $0.9 billion for Q4 2013. LTOA are projects that have achieved a stabilized level of occupancy or have been held 18-24 months following shell completion or acquisition. Pipeline deals are those projects we are pursuing which we believe have a greater than 50% chance of closing or where land has been acquired and the projected construction start is more than twelve months out. Slide 28 Contractual revenue sources include revenue derived from our Occupier Outsourcing, Property Management, Investment Management, Valuation and Loan Servicing businesses. As noted above, we regard leasing revenue as largely recurring over time. Occupier Outsourcing and Property Management revenue excludes associated leasing and sales revenue, most of which is contractual. Commercial Mortgage Brokerage revenue excludes revenue from Loan Servicing, which is reflected in contractual revenue sources. Fee revenue is gross revenue less both client reimbursed costs largely associated with employees that are dedicated to client facilities and subcontracted vendor work performed for clients. Certain adjustments have been made to 2016 fee revenue to conform with current-year presentation. 41

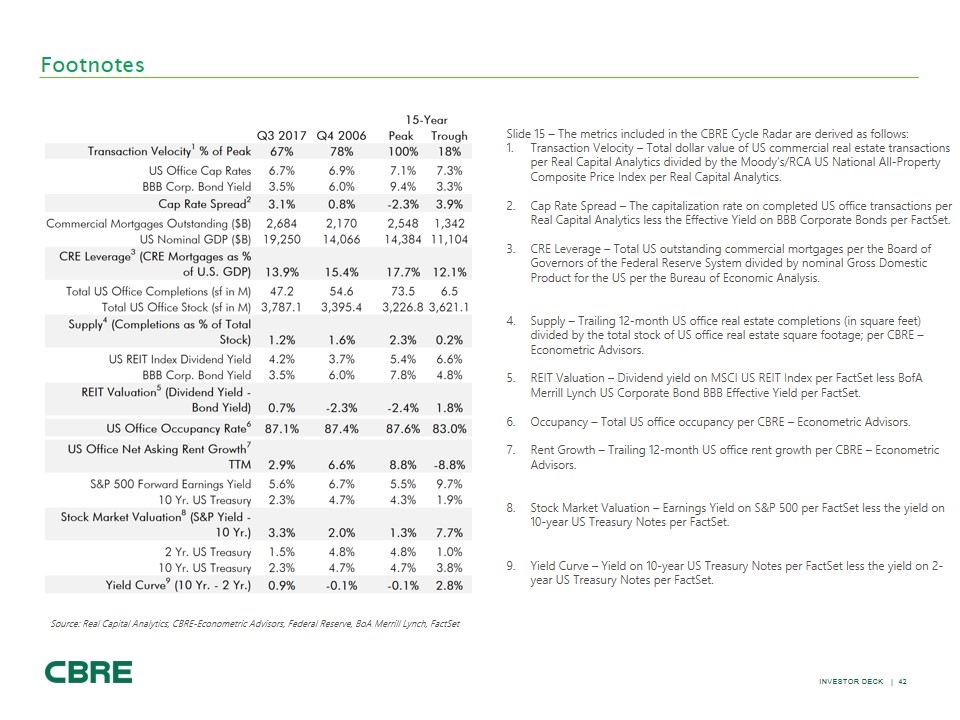

Footnotes Slide 15 – The metrics included in the CBRE Cycle Radar are derived as follows: Transaction Velocity – Total dollar value of US commercial real estate transactions per Real Capital Analytics divided by the Moody’s/RCA US National All-Property Composite Price Index per Real Capital Analytics. Cap Rate Spread – The capitalization rate on completed US office transactions per Real Capital Analytics less the Effective Yield on BBB Corporate Bonds per FactSet. CRE Leverage – Total US outstanding commercial mortgages per the Board of Governors of the Federal Reserve System divided by nominal Gross Domestic Product for the US per the Bureau of Economic Analysis. Supply – Trailing 12-month US office real estate completions (in square feet) divided by the total stock of US office real estate square footage; per CBRE – Econometric Advisors. REIT Valuation – Dividend yield on MSCI US REIT Index per FactSet less BofA Merrill Lynch US Corporate Bond BBB Effective Yield per FactSet. Occupancy – Total US office occupancy per CBRE – Econometric Advisors. Rent Growth – Trailing 12-month US office rent growth per CBRE – Econometric Advisors. Stock Market Valuation – Earnings Yield on S&P 500 per FactSet less the yield on 10-year US Treasury Notes per FactSet. Yield Curve – Yield on 10-year US Treasury Notes per FactSet less the yield on 2-year US Treasury Notes per FactSet. Source: Real Capital Analytics, CBRE-Econometric Advisors, Federal Reserve, BoA Merrill Lynch, FactSet Transaction velocity1% of peak us office cap rates bb corp. bond yield cap rate spread2 commercial mortagages outstanding ($b) us nominal gpd cre leverage3 (cre mortgages a % of u.s. gdp) total us office completions (sf in m) total us office stock (sf in m) supply4 (completions as % of total stock) us reit index dividend yield bbb corp. bond yield reit valuation5 (dividend yield – bond yield) us office occupancy rate6 us office net asking rent growth 7 ttm s&p 500 forward earning yield 10 yr. us treasury stock market valuation8 (s&p yield – 10 yr.) 2 yr. us treasury 10r. Us treasury yield curve9 (1- yr. – 2 yr.) q3 2017 2006 peak 15-year peak trough 67% 78% 100% 18% 6.7% 6.9% 7.1% 7.3% 3.5% 6.0% 9.4% 3.3% 3.1% 0.8% -2.3% 3.9% 2,684 2,170 2,548 1,342 19,250 14,066 14,384 11,104 13.9% 15.4% 17.7% 12.1% 47.2 54.6 73.5 6.5 3,787.1 3,395.4 3,226.8 3,624.1 1.2% 1.6% 2.3% 0.2% 4.2% 3.7% 5.4% 6.6% 3.5% 6.0% 7.8% 4.8% 0.7% -2.3% -2.4% 1.8% 87.1% 87.4% 87.6% 83.0% 2.9% 6.6% 8.8% -8.8% 5.6% 6.7% 5.5% 9.7% 2.3% 4.7% 4.3% 1.9% 3.3% 2.0% 1.3% 7.7% 1.5% 4.8% 1.0% 3.8% 0.9% -0.1% 2.8% 42