CBRE group, inc. Global market leader in integrated commercial real estate services June 2017 Exhibit 99.1

This presentation contains statements that are forward looking within the meaning of the Private Securities Litigation Reform Act of 1995. These include statements regarding CBRE’s future growth momentum, operations, market share, business outlook, and financial performance expectations. These statements are estimates only and actual results may ultimately differ from them. Except to the extent required by applicable securities laws, we undertake no obligation to update or publicly revise any of the forward-looking statements that you may hear today. Please refer to our first quarter earnings release, furnished on Form 8-K, our most recent quarterly report filed on Form 10-Q and our most recent annual report filed on Form 10-K, and in particular any discussion of risk factors or forward-looking statements therein, which are available on the SEC’s website (www.sec.gov), for a full discussion of the risks and other factors that may impact any forward-looking statements that you may hear today. We may make certain statements during the course of this presentation, which include references to “non-GAAP financial measures,” as defined by SEC regulations. Where required by these regulations, we have provided reconciliations of these measures to what we believe are the most directly comparable GAAP measures, which are attached hereto within the appendix. Forward-Looking Statements

Global Leadership With Broad Capabilities #1 Leasing #1 Property Sales #1 Outsourcing #1 Appraisal & Valuation $86.5 billion AUM Investment Management1 Scale And Diversity 450+ offices worldwide2 Serves clients in over 100 countries2 Serves over 90% of the Fortune 100 $322 billion of sales and lease activity and 85,500+ transactions in 2016 5.3 billion square feet under management3 See slide 36 for footnotes The Global Market Leader CBRE is the premier global provider of integrated services to commercial real estate investors and occupiers

Fortune 500 company since 2008; ranked #214 in 2017 Ranked #1 brand for 16 consecutive years Global Real Estate Advisor of the Year five years in a row Ranked among the Most Admired Companies for five consecutive years Ranked among the top few outsourcing service providers across all industries for six consecutive years Named a World’s Most Ethical Company four years in a row S&P 500 company since 2006 S&P 500 Fortune 500 Fortune The Lipsey Company International Association of Outsourcing Professionals Euromoney Ethisphere One of only two companies to be ranked in the top 12 of the Barron’s 500 for three consecutive years (2014-2016) Barron’s 500 Forbes Named America’s 15th Best Employer (out of 500 companies) in 2016 Included in DJSI North America three years in a row Dow Jones Sustainability Indices The Leading Global Brand CBRE is recognized as the foremost commercial real estate authority

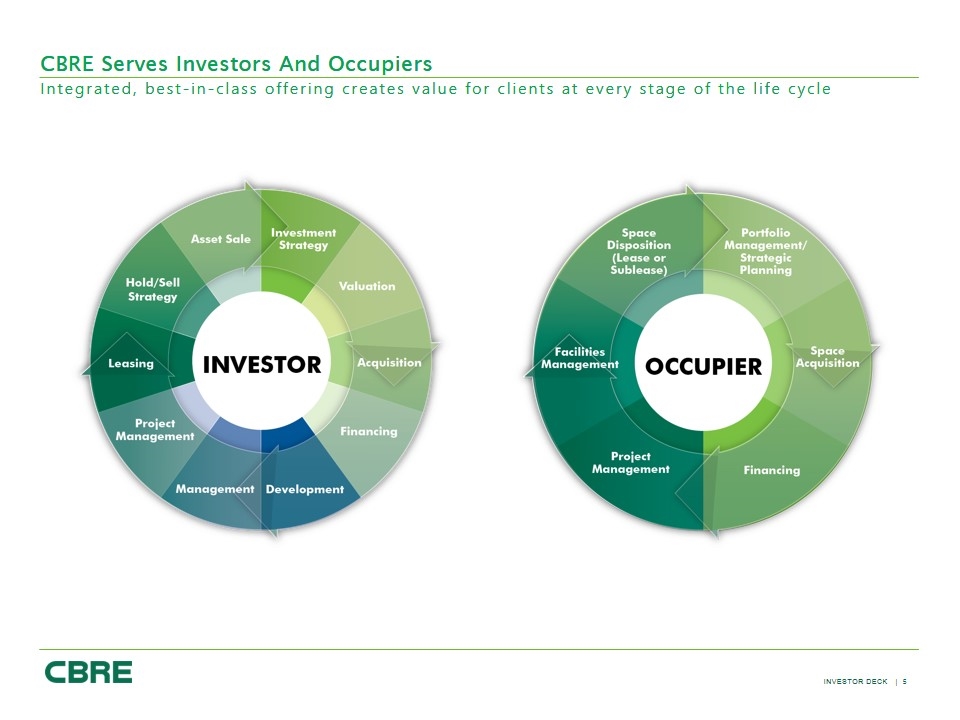

CBRE Serves Investors And Occupiers Integrated, best-in-class offering creates value for clients at every stage of the life cycle CBRE Serves Investors And Occupiers Integrated, best-in-class offering creates value for clients at every stage of the life cycle Investor Investment Strategy Valuation Acquisition Financing Development Management Project Management Leasing Hold/Sell Strategy Asset Sale Occupier Portfolio Management/Strategic Planning Space Acquisition Financing Project Management Facilities Management Space Disposition (Lease or Sublease)

Revenue +5% Adjusted EPS2 +19% Q1 2016 To Q1 2017 Track Record Of Long-Term Growth 2003 To TTM Q1 2017 Revenue CAGR +16% Adjusted EBITDA1 CAGR +18% See slide 36 for footnotes

Capitalizing on our #1 position to further extend our competitive advantage Positioned For Long-Term Growth Consolidation Leasing and capital markets service providers continue to consolidate but remain highly fragmented Occupier Outsourcing Recurring contractual revenues Still in early stage of penetration with occupiers Contributes to leasing revenues which are largely recurring over time1 Strategic Position CBRE continues to enhance its market leading global position in virtually every service line Operating platform enhancements, particularly in technology and data analytics See slide 36 for footnotes

Mergers & Acquisitions Transactions driven by top down macro strategy: Strategic in-fill acquisitions sourced principally by lines of business Highly targeted larger, transformational transactions Completed approximately 40 acquisitions since 2013 and over 110 since 2003, including five large, strategic acquisitions Proven willingness to step away when markets are frothy

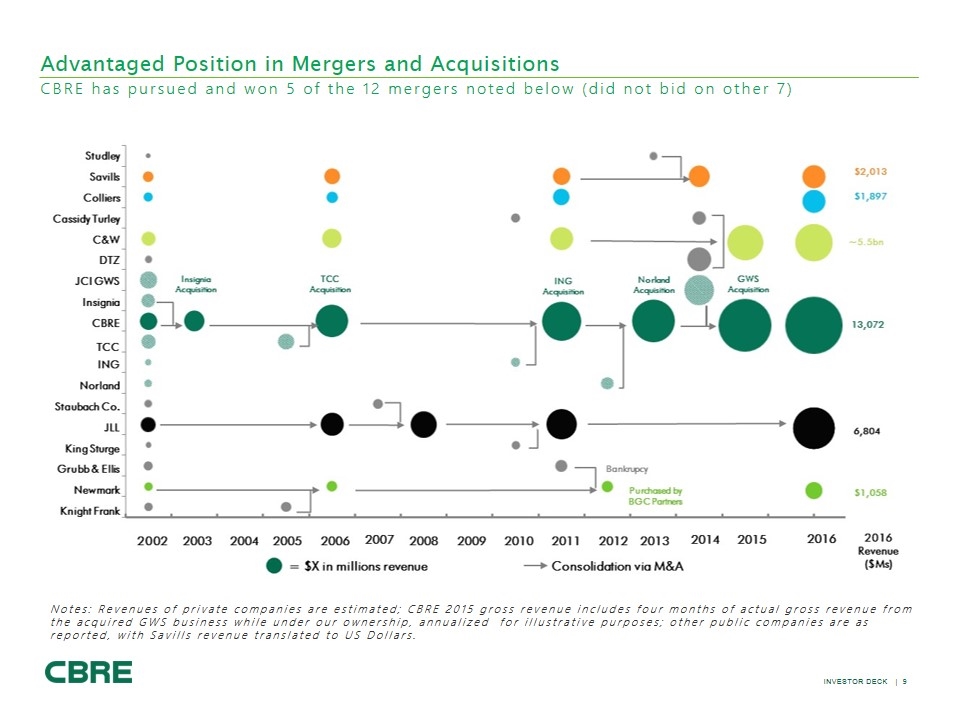

Advantaged Position in Mergers and Acquisitions Notes: Revenues of private companies are estimated; CBRE 2015 gross revenue includes four months of actual gross revenue from the acquired GWS business while under our ownership, annualized for illustrative purposes; other public companies are as reported, with Savills revenue translated to US Dollars. CBRE has pursued and won 5 of the 12 mergers noted below (did not bid on other 7) Studley Savills Colliers Cassidy Turley C&W DTZ JCIGWS Insignia CBRE TCC ING Norland Staubach Co. JLL King Sturge Grubb & Ellis Newmark Knight Frank Insignia Acquisition TCC Acquisition ING Acquisition Norland Acquisition GWS Acquisition Bankrupcy Purchased by BGC Partners $2,013 $1,897 ~5.5bn 13,072 6,804 $1,058 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2016 Revenue ($Ms) = $X in millions revenue Consolidation via M&A

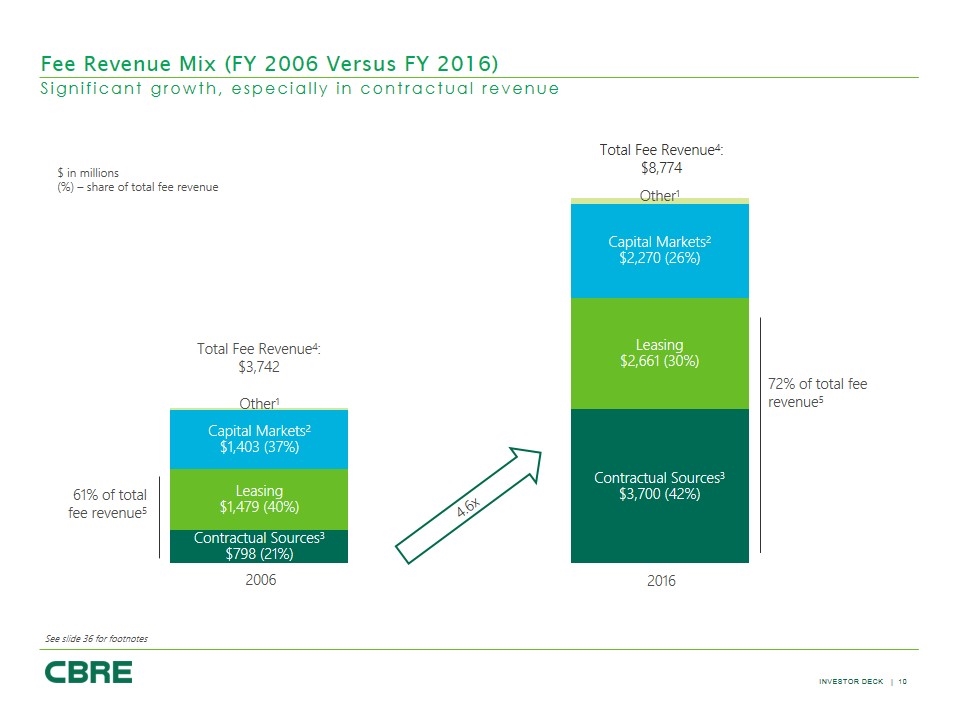

72% of total fee revenue5 See slide 36 for footnotes Fee Revenue Mix (FY 2006 Versus FY 2016) Significant growth, especially in contractual revenue Total Fee Revenue4: $4,742 Other1 Capital Markets2 $1,403 (37%) Leasing $1,479 (40%) Contractual Sources3 $798 (21%) 2006 61% of total fee revenue5 4.6x Total Fee Revenue4: $8,774 Other1 Capital Markets2 $2,270 (26%) Leasing $2,661 (30%) Contractual Sources3 $3,700 (42%) 2016 72% of total fee revenue5

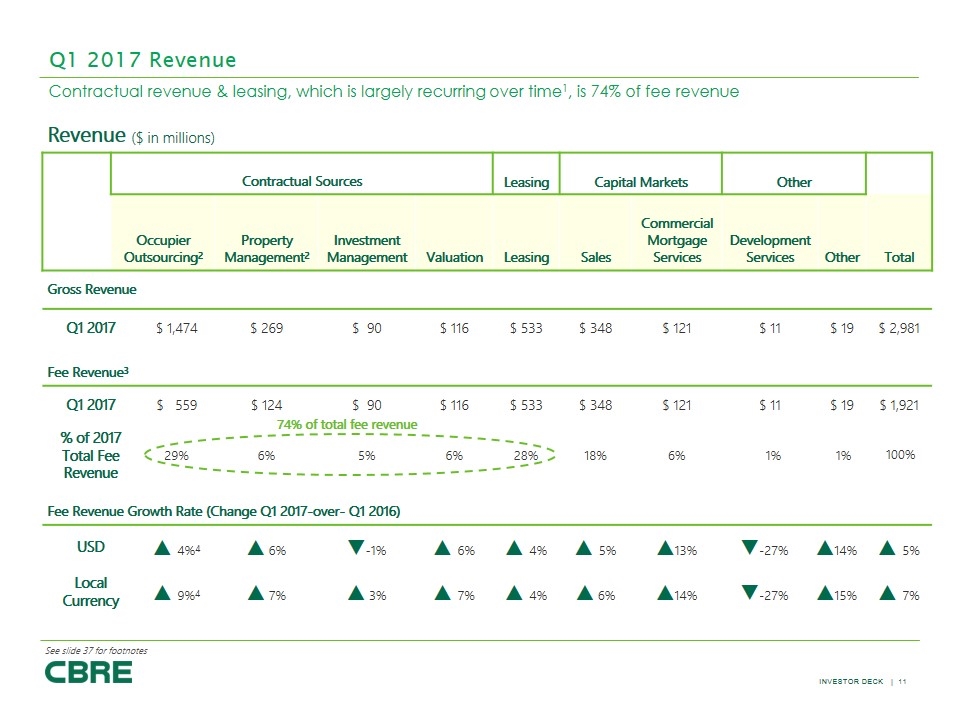

Revenue ($ in millions) Contractual Sources Leasing Capital Markets Other Occupier Outsourcing2 Property Management2 Investment Management Valuation Leasing Sales Commercial Mortgage Services Development Services Other Total Gross Revenue Q1 2017 $ 1,474 $ 269 $ 90 $ 116 $ 533 $ 348 $ 121 $ 11 $ 19 $ 2,981 Fee Revenue3 Q1 2017 $ 559 $ 124 $ 90 $ 116 $ 533 $ 348 $ 121 $ 11 $ 19 $ 1,921 % of 2017 Total Fee Revenue 29% 6% 5% 6% 28% 18% 6% 1% 1% 100% Fee Revenue Growth Rate (Change Q1 2017-over- Q1 2016) USD ▲ 4%4 ▲ 6% ▼-1% ▲ 6% ▲ 4% ▲ 5% ▲13% ▼-27% ▲14% ▲ 5% Local Currency ▲ 9%4 ▲ 7% ▲ 3% ▲ 7% ▲ 4% ▲ 6% ▲14% ▼-27% ▲15% ▲ 7% Q1 2017 Revenue Contractual revenue & leasing, which is largely recurring over time1, is 74% of fee revenue 74% of total fee revenue See slide 37 for footnotes

CBRE Key Takeaways Operates in an industry with strong underlying growth dynamics The global leader across virtually all business lines Industry-leading profitability Leveraging digital and data with expertise and scale Has a balanced business with a more stable growth profile Is an investment grade company 18% average annual return on invested capital over 4 years Is continuing to extend its competitive advantage in the marketplace

Business line slides

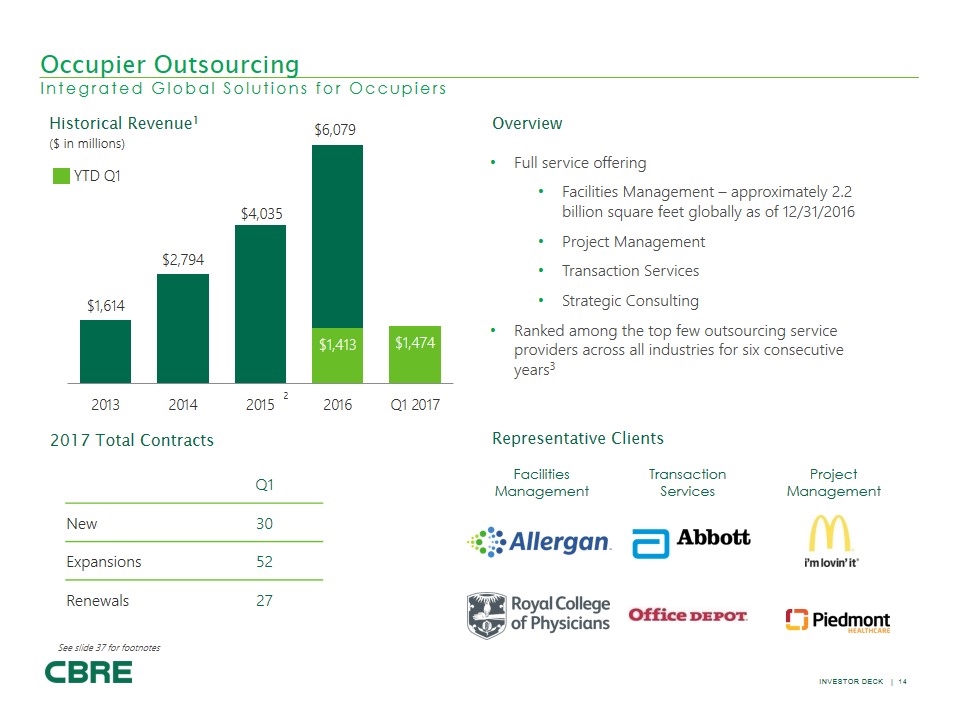

Q1 New 30 Expansions 52 Renewals 27 Historical Revenue1 Overview 2017 Total Contracts Full service offering Facilities Management – approximately 2.2 billion square feet globally as of 12/31/2016 Project Management Transaction Services Strategic Consulting Ranked among the top few outsourcing service providers across all industries for six consecutive years3 Facilities Management Transaction Services Project Management Representative Clients 2 ($ in millions) Occupier Outsourcing Integrated Global Solutions for Occupiers YTD Q1 See slide 37 for footnotes ($ in millions) YTD Q1 $1,614 2013 $2,794 2014 $4,035 2015 2 $6,079 $1,413 2016 $1,474 Q1 2017 Allergan Royal College of Physicians Abbott Office Depot I’m lovin’ it Piedmont Healthcare

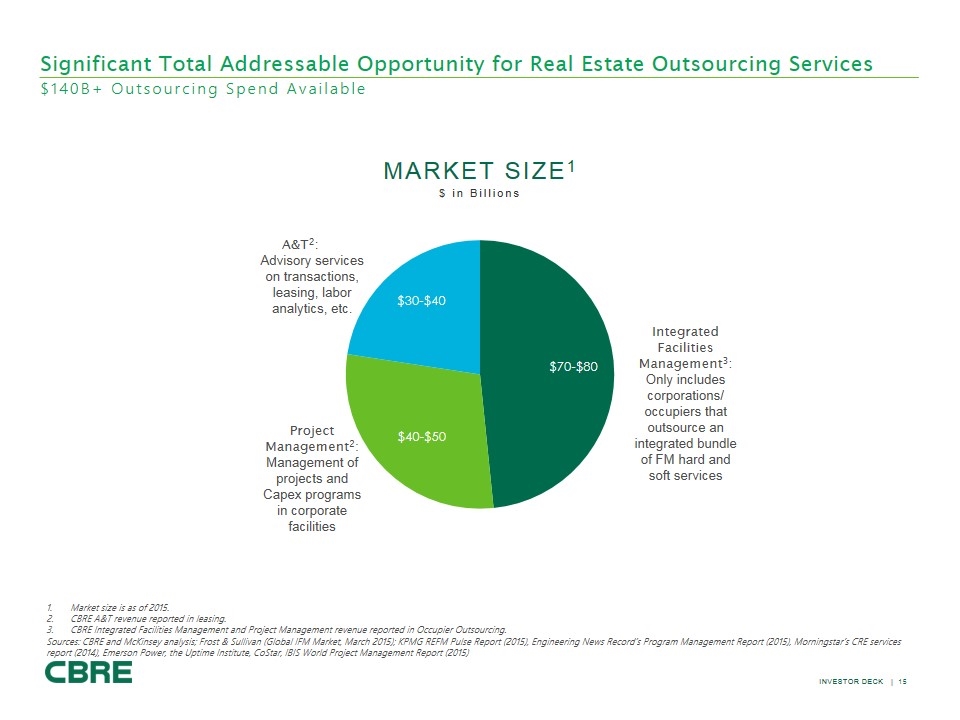

A&T2: Advisory services on transactions, leasing, labor analytics, etc. Significant Total Addressable Opportunity for Real Estate Outsourcing Services $140B+ Outsourcing Spend Available $ in Billions Market Size1 Market size is as of 2015. CBRE A&T revenue reported in leasing. CBRE Integrated Facilities Management and Project Management revenue reported in Occupier Outsourcing. Sources: CBRE and McKinsey analysis; Frost & Sullivan (Global IFM Market, March 2015); KPMG REFM Pulse Report (2015), Engineering News Record’s Program Management Report (2015), Morningstar’s CRE services report (2014), Emerson Power, the Uptime Institute, CoStar, IBIS World Project Management Report (2015) Integrated Facilities Management3: Only includes corporations/ occupiers that outsource an integrated bundle of FM hard and soft services Project Management2: Management of projects and Capex programs in corporate facilities $30-$40 $70-$80 $40-$50 Market Size1 $ in Billions A&T2 Advisory services on transactions, leasing, labor analytics, etc. $30-$40 Project Management2 Management of the projects and Capex programs in corporate facilities $40-$50 Integrated Facilities Management3 Only includes corporations/occupiers that outsource an integrated bundle of FM hard and soft services

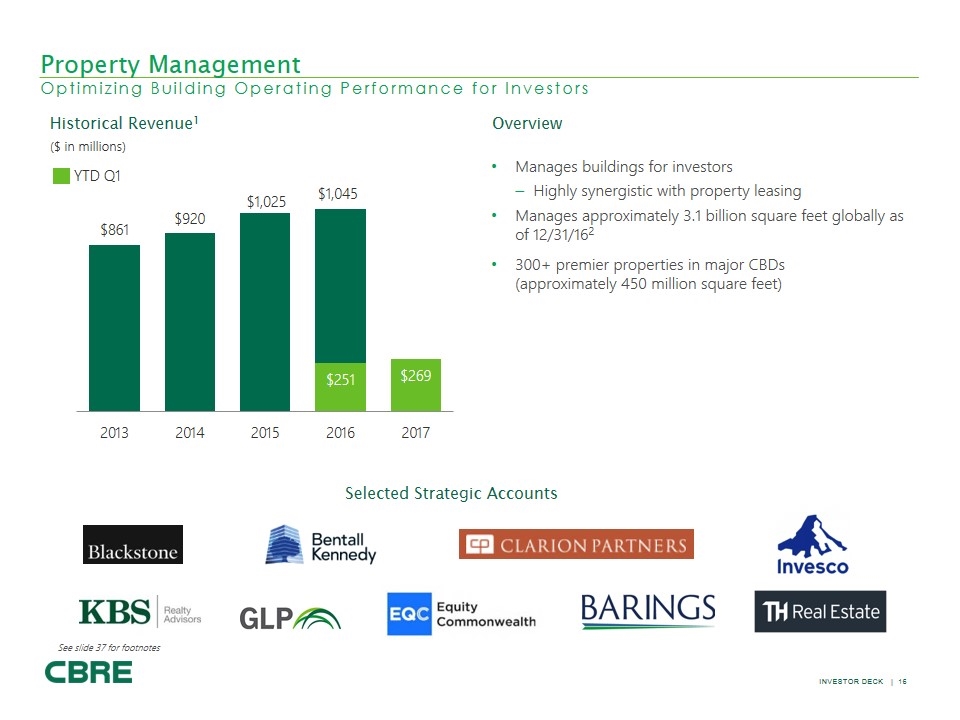

Historical Revenue1 Overview Selected Strategic Accounts ($ in millions) Manages buildings for investors Highly synergistic with property leasing Manages approximately 3.1 billion square feet globally as of 12/31/162 300+ premier properties in major CBDs (approximately 450 million square feet) See slide 37 for footnotes Property Management Optimizing Building Operating Performance for Investors YTD Q1 ($ in millions) YTD Q1 $861 $920 $1,025 $1,045 $251 $269 2013 2014 2015 2016 2017 Blackstone Bentall Kennedy Clarion Partners Invesco KBS Realty Advisors GLP Equity Commonwealth Barings TH Real Estate

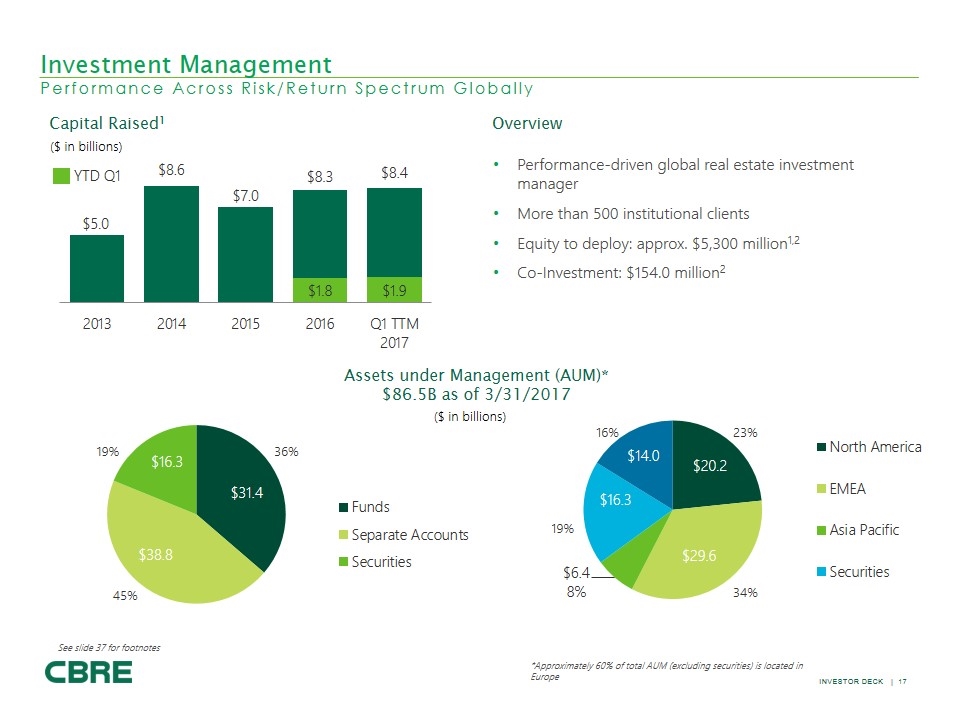

Capital Raised1 Assets under Management (AUM)* $86.5B as of 3/31/2017 Overview ($ in billions) Performance-driven global real estate investment manager More than 500 institutional clients Equity to deploy: approx. $5,300 million1,2 Co-Investment: $154.0 million2 ($ in billions) *Approximately 60% of total AUM (excluding securities) is located in Europe Investment Management Performance Across Risk/Return Spectrum Globally YTD Q1 See slide 37 for footnotes ($ in billions) YTD Q1 $5.0 $8.6 $7.0 $8.3 $8.4 $1.8 $ 1.9 2013 2014 2015 2016 Q1 TTM 2017 19% 45% 36% $16.3 $31.4 $38.8 Funds Separate Accounts Securities 16% 23% 34% 8% 19% $14.0 $20.2 $16.3 $29.6 $6.4 North America EMEA Asia Pacific Securities

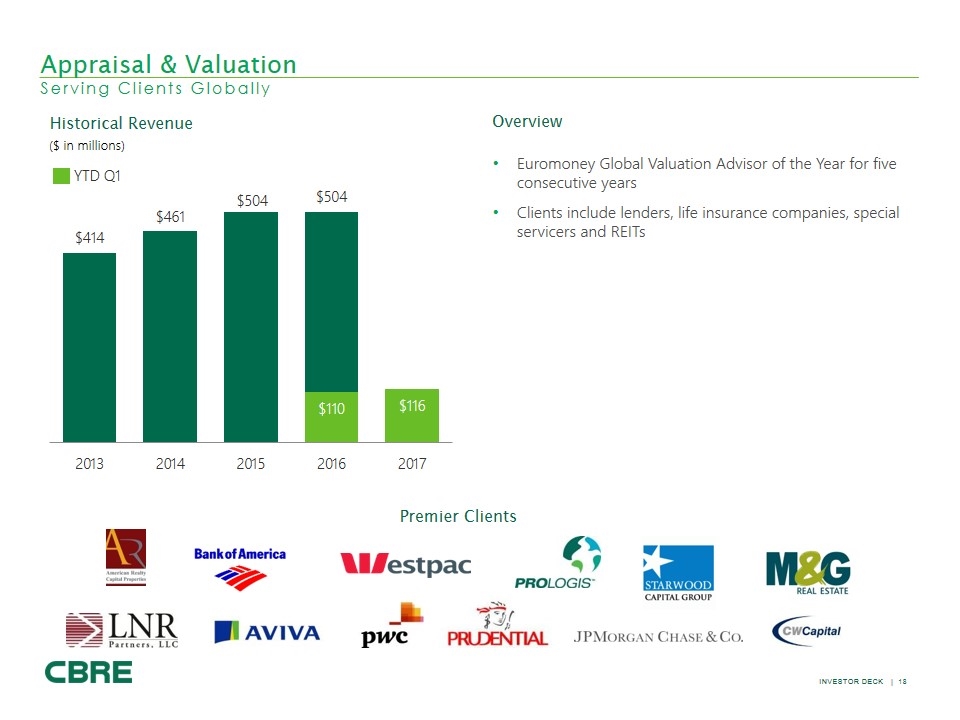

Premier Clients ($ in millions) Euromoney Global Valuation Advisor of the Year for five consecutive years Clients include lenders, life insurance companies, special servicers and REITs Overview Historical Revenue Appraisal & Valuation Serving Clients Globally YTD Q1 ($ in millions) YTD Q1 $414 $461 $504 $504 $ 110 $116 2013 2014 2015 2016 2017 American Realty Capital Properties Bank of America Westpac Prologis Starwood Capital Group M&G Real Estate LNR Partners, LLC Aviva pwc Prudential JPMorgan Chase&Co. CWCapital

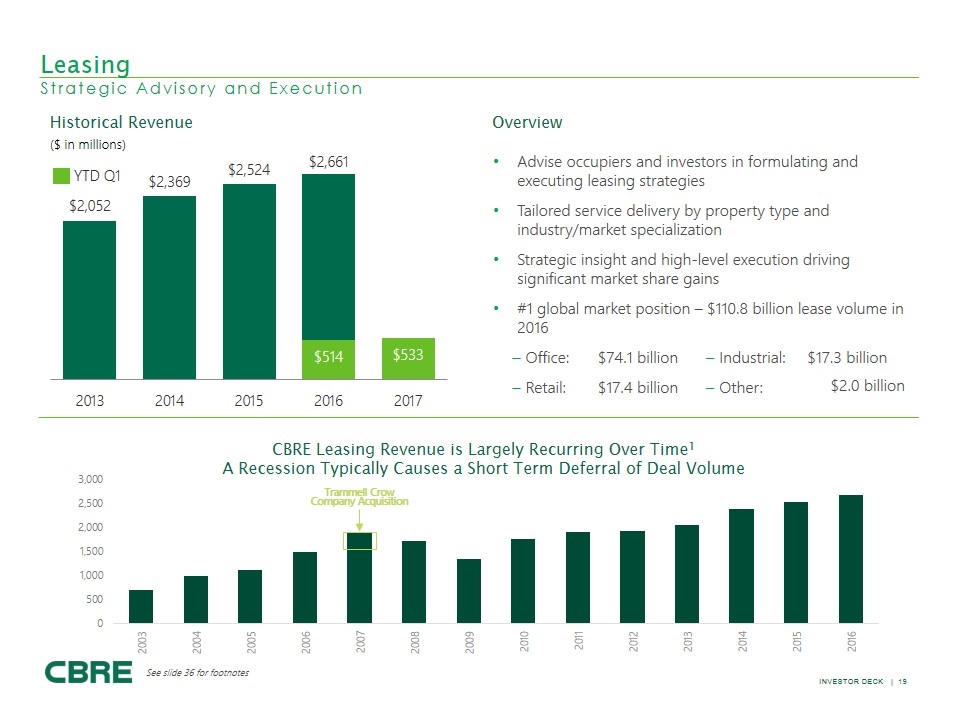

Overview Advise occupiers and investors in formulating and executing leasing strategies Tailored service delivery by property type and industry/market specialization Strategic insight and high-level execution driving significant market share gains #1 global market position – $110.8 billion lease volume in 2016 − Office: $74.1 billion − Industrial: $17.3 billion − Retail: $17.4 billion − Other: ($ in millions) Historical Revenue Leasing Strategic Advisory and Execution Trammell Crow Company Acquisition $2.0 billion YTD Q1 See slide 36 for footnotes ($ in millions) YTD Q1 $2,052 $2,369 $2,524 $2,661 $514 $ 533 2013 2014 2015 2016 2017 3,000 2,500 2,000 1,500 1,000 500 0 2003 2005 2006 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Trammell Crow Company Acquisition

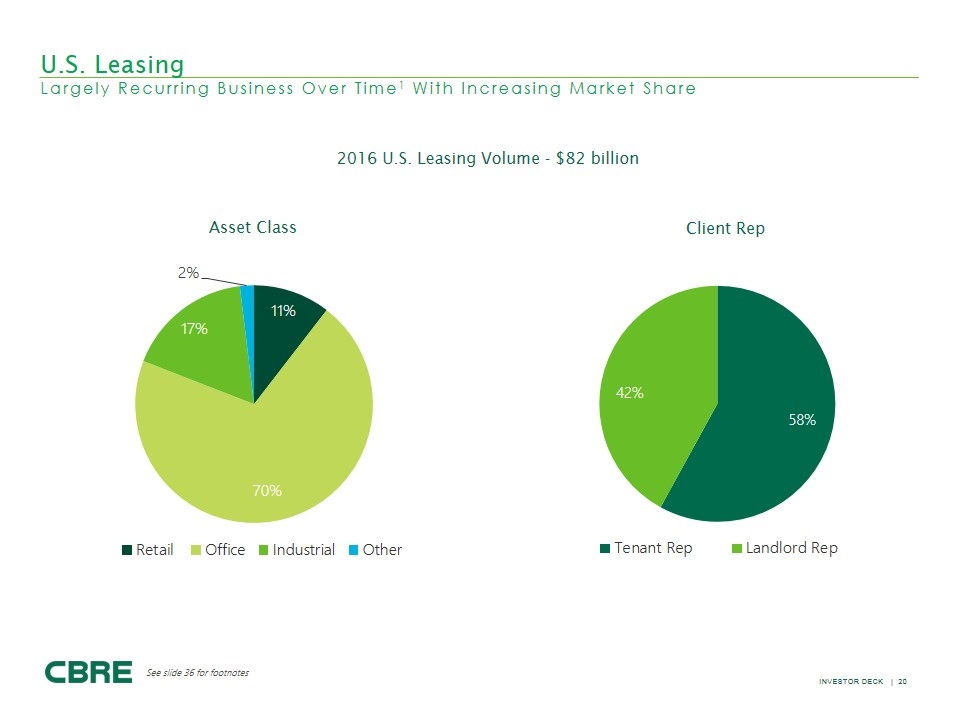

U.S. Leasing Largely Recurring Business Over Time1 With Increasing Market Share 2016 U.S. Leasing Volume - $82 billion See slide 36 for footnotes Asset Class 2% 17% 11% 70% Retail Office Industrial Other Client Rep 42% 58% Tenant Rep Landlord Rep

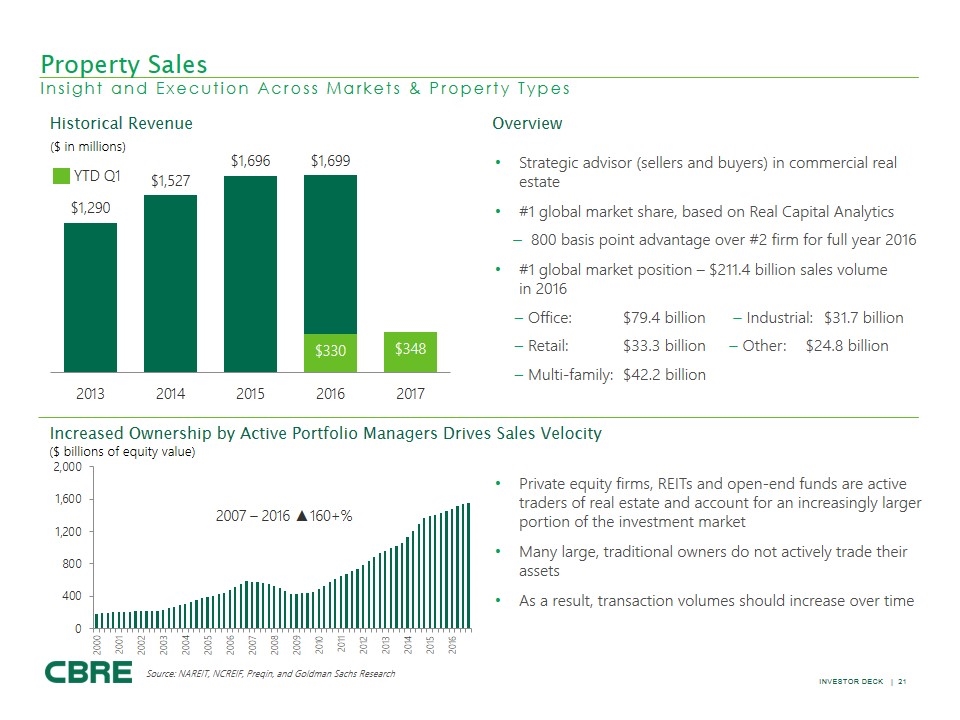

Increased Ownership by Active Portfolio Managers Drives Sales Velocity Strategic advisor (sellers and buyers) in commercial real estate #1 global market share, based on Real Capital Analytics 800 basis point advantage over #2 firm for full year 2016 #1 global market position – $211.4 billion sales volume in 2016 − Office:$79.4 billion − Industrial:$31.7 billion − Retail:$33.3 billion − Other:$24.8 billion − Multi-family:$42.2 billion Overview Historical Revenue ($ in millions) Source: NAREIT, NCREIF, Preqin, and Goldman Sachs Research ($ billions of equity value) 2007 – 2016 ▲160+% Property Sales Insight and Execution Across Markets & Property Types Private equity firms, REITs and open-end funds are active traders of real estate and account for an increasingly larger portion of the investment market Many large, traditional owners do not actively trade their assets As a result, transaction volumes should increase over time YTD Q1 YTD Q1 $1,290 $1,627 $1,696 $1,699 $330 $348 2013 2014 2015 2016 2017 2,000 1,600 1,200 800 400 0 2007 – 2016 160+% 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

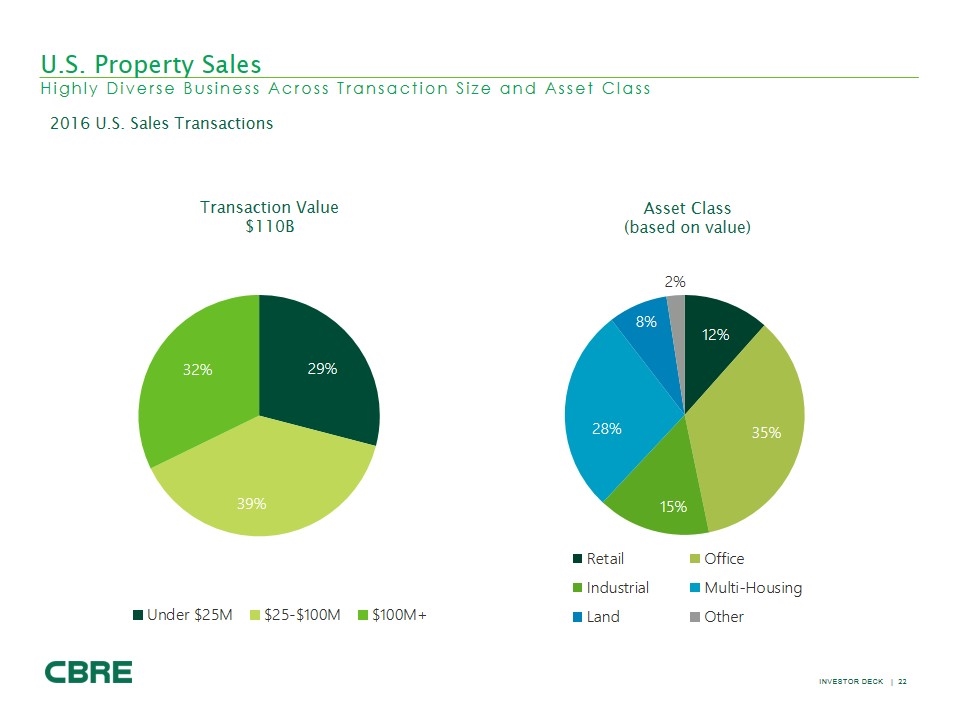

2016 U.S. Sales Transactions U.S. Property Sales Highly Diverse Business Across Transaction Size and Asset Class Transaction Value $110B 32% 29% 39% Under $25M $25-$100M $100M+ Asset Class (based on value) 8% 2% 12% 35% 15% 28% Retail Industrial Land Office Multi-Housing Other

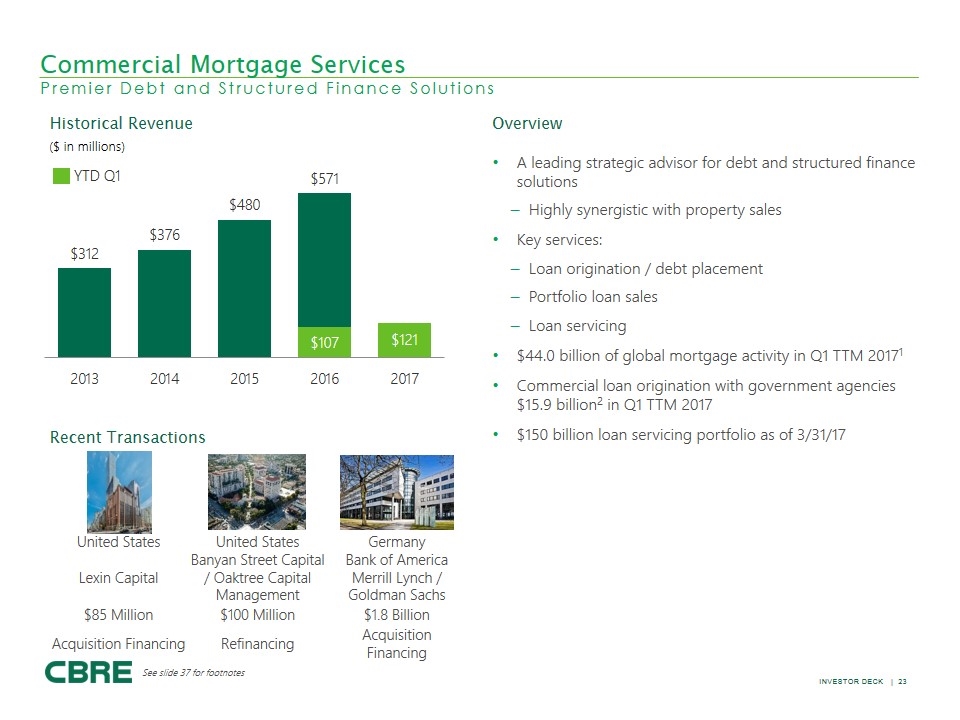

United States United States Germany Lexin Capital Banyan Street Capital / Oaktree Capital Management Bank of America Merrill Lynch / Goldman Sachs $85 Million $100 Million $1.8 Billion Acquisition Financing Refinancing Acquisition Financing Recent Transactions A leading strategic advisor for debt and structured finance solutions Highly synergistic with property sales Key services: Loan origination / debt placement Portfolio loan sales Loan servicing $44.0 billion of global mortgage activity in Q1 TTM 20171 Commercial loan origination with government agencies $15.9 billion2 in Q1 TTM 2017 $150 billion loan servicing portfolio as of 3/31/17 Overview Historical Revenue ($ in millions) See slide 37 for footnotes Commercial Mortgage Services Premier Debt and Structured Finance Solutions YTD Q1 YTD Q1 $312 $376 $480 $571 $107 $121 2013 2014 2015 2016 2017

Park District The Boardwalk LA Plaza Principio Commerce Park Dallas, TX Mixed-Use Newport Beach, CA Office Los Angeles, CA Mixed-use North End, MD Industrial 2 Projects In Process/Pipeline1 Overview Recent Projects A premier brand in U.S. development 65+ year record of excellence Partner with leading institutional capital sources $125.9 million of co-investment at the end of Q1 2017 $15.6 million in repayment guarantees on outstanding debt balances at the end of Q1 2017 ($ in billions) 3 See slide 37 for footnotes Development Services Trammell Crow Company – A Premier Brand in U.S. In Process2 Pipeline3 1.5 4.9 4.0 5.4 3.6 6.7 4.2 6.6 5.1 5.9 2013 2014 2015 2016 Q1 2017

appendix

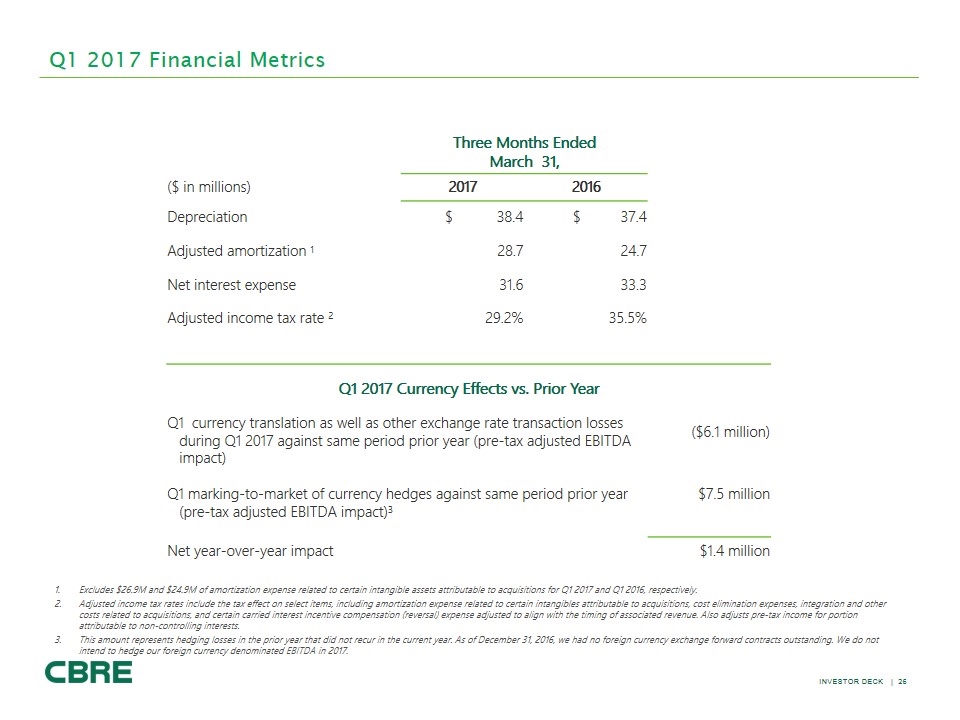

Q1 2017 Financial Metrics Three Months Ended March 31, ($ in millions) 2017 2016 Depreciation $ 38.4 $ 37.4 Adjusted amortization 1 28.7 24.7 Net interest expense 31.6 33.3 Adjusted income tax rate 2 29.2% 35.5% Q1 2017 Currency Effects vs. Prior Year Q1 currency translation as well as other exchange rate transaction losses during Q1 2017 against same period prior year (pre-tax adjusted EBITDA impact) ($6.1 million) Q1 marking-to-market of currency hedges against same period prior year (pre-tax adjusted EBITDA impact)3 $7.5 million Net year-over-year impact $1.4 million Excludes $26.9M and $24.9M of amortization expense related to certain intangible assets attributable to acquisitions for Q1 2017 and Q1 2016, respectively. Adjusted income tax rates include the tax effect on select items, including amortization expense related to certain intangibles attributable to acquisitions, cost elimination expenses, integration and other costs related to acquisitions, and certain carried interest incentive compensation (reversal) expense adjusted to align with the timing of associated revenue. Also adjusts pre-tax income for portion attributable to non-controlling interests. This amount represents hedging losses in the prior year that did not recur in the current year. As of December 31, 2016, we had no foreign currency exchange forward contracts outstanding. We do not intend to hedge our foreign currency denominated EBITDA in 2017.

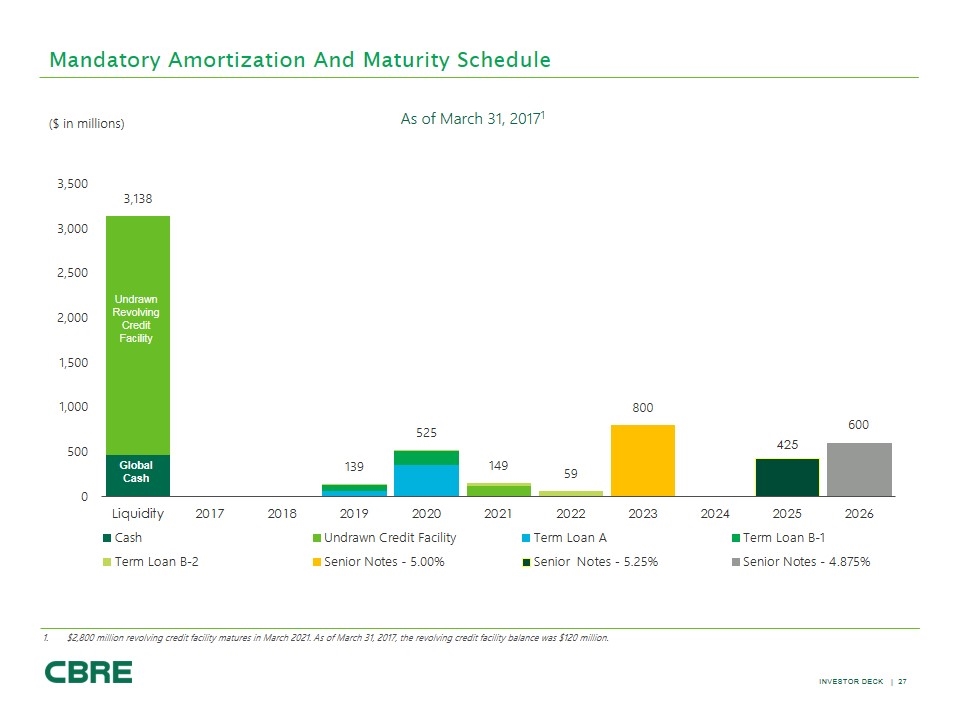

Mandatory Amortization And Maturity Schedule ($ in millions) $2,800 million revolving credit facility matures in March 2021. As of March 31, 2017, the revolving credit facility balance was $120 million. As of March 31, 20171 Global Cash Undrawn Revolving Credit Facility 3,500 3,000 2,500 2,000 1,500 1,000 500 0 3,138 139 525 149 59 800 425 600 Undrawn Revolving Credit Facility Global Cash Liquidity 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 Cash Term Loan B-2 Undrawn Credit Facility Senior Notes – 5.00% Term Loan A Senior Notes – 5.25% Term Loan B-1 Senior Notes – 4.875%

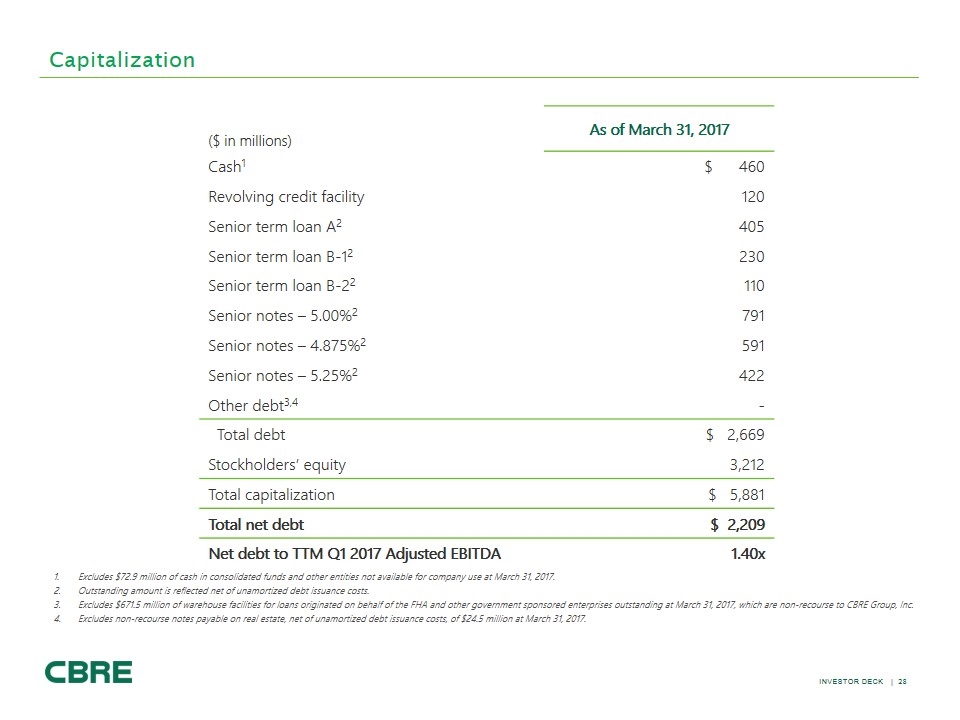

Capitalization ($ in millions) As of March 31, 2017 Cash1 $ 460 Revolving credit facility 120 Senior term loan A2 405 Senior term loan B-12 230 Senior term loan B-22 110 Senior notes – 5.00%2 791 Senior notes – 4.875%2 591 Senior notes – 5.25%2 422 Other debt3,4 - Total debt $ 2,669 Stockholders’ equity 3,212 Total capitalization $ 5,881 Total net debt $ 2,209 Net debt to TTM Q1 2017 Adjusted EBITDA 1.40x Excludes $72.9 million of cash in consolidated funds and other entities not available for company use at March 31, 2017. Outstanding amount is reflected net of unamortized debt issuance costs. Excludes $671.5 million of warehouse facilities for loans originated on behalf of the FHA and other government sponsored enterprises outstanding at March 31, 2017, which are non-recourse to CBRE Group, Inc. Excludes non-recourse notes payable on real estate, net of unamortized debt issuance costs, of $24.5 million at March 31, 2017.

Non-GAAP Financial Measures The following measures are considered “non-GAAP financial measures” under SEC guidelines: fee revenue contractual fee revenue net income attributable to CBRE Group, Inc., as adjusted (which we also refer to as “adjusted net income”) diluted income per share attributable to CBRE Group, Inc. shareholders, as adjusted (which we also refer to as “adjusted earnings per share” or “adjusted EPS”) EBITDA and adjusted EBITDA Return on Invested Capital (ROIC) None of these measures is a recognized measurement under United States generally accepted accounting principles, or “GAAP,” and when analyzing our operating performance, readers should use them in addition to, and not as an alternative for, their most directly comparable financial measure calculated and presented in accordance with GAAP. Because not all companies use identical calculations, our presentation of these measures may not be comparable to similarly titled measures of other companies. Our management generally uses these non-GAAP financial measures to evaluate operating performance and for other discretionary purposes, and the company believes that these measures provide a more complete understanding of ongoing operations, enhance comparability of current results to prior periods and may be useful for investors to analyze our financial performance because they eliminate the impact of selected charges that may obscure trends in the underlying performance of our business. The company further uses certain of these measures, and believes that they are useful to investors, for purposes described below. With respect to fee revenue: the company believes that investors may find this measure useful to analyze the financial performance of our Occupier Outsourcing and Property Management business lines and our business generally because it excludes costs reimbursable by clients, and as such provides greater visibility into the underlying performance of our business. With respect to contractual fee revenue: the company believes that investors may find this measure useful to analyze our overall financial performance because it identifies revenue streams that are typically more stable over time. With respect to adjusted net income, adjusted EPS, EBITDA, adjusted EBITDA: the company believes that investors may find these measures useful in evaluating our operating performance compared to that of other companies in our industry because these calculations generally eliminate the accounting effects of acquisitions, which would include impairment charges of goodwill and intangibles created from acquisitions—and in the case of EBITDA and adjusted EBITDA—the effects of financings and income tax and the accounting effects of capital spending. All of these measures may vary for different companies for reasons unrelated to overall operating performance. In the case of EBITDA and adjusted EBITDA, these measures are not intended to be measures of free cash flow for our management’s discretionary use because they do not consider cash requirements such as tax and debt service payments. The EBITDA and adjusted EBITDA measures calculated herein may also differ from the amounts calculated under similarly titled definitions in our credit facilities and debt instruments, which amounts are further adjusted to reflect certain other cash and non-cash charges and are used by us to determine compliance with financial covenants therein and our ability to engage in certain activities, such as incurring additional debt and making certain restricted payments. The company also uses adjusted EBITDA and adjusted EPS as significant components when measuring our operating performance under our employee incentive compensation programs. With respect to ROIC, the company believes that investors may find this measure useful in evaluating the return on their investment in CBRE compared to that of other companies in our industry and alternative investments.

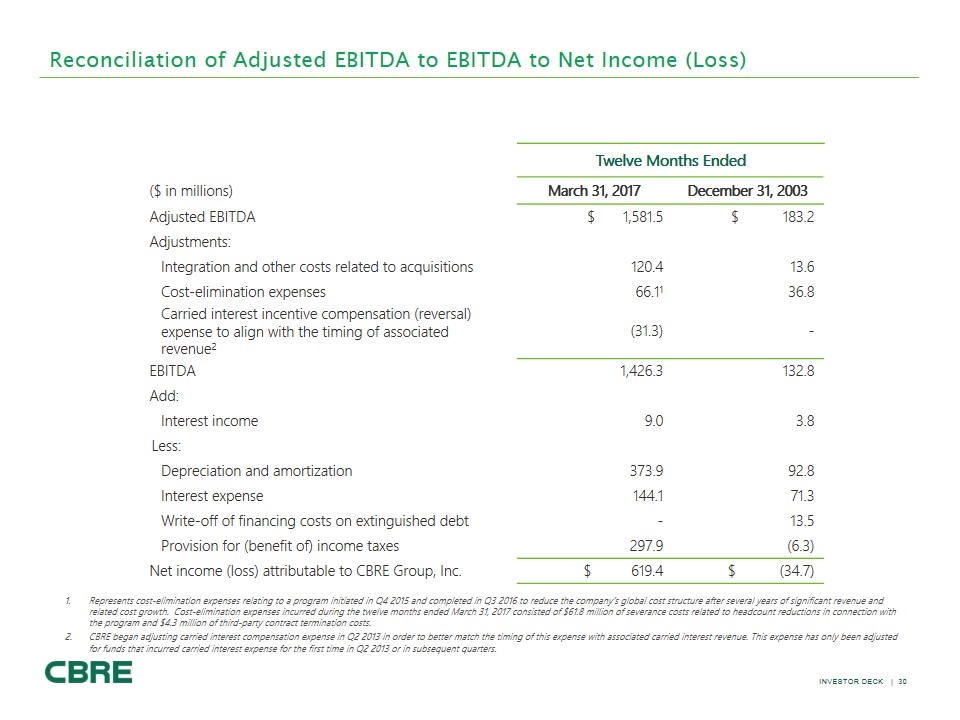

Twelve Months Ended ($ in millions) March 31, 2017 December 31, 2003 Adjusted EBITDA $ 1,581.5 $ 183.2 Adjustments: Integration and other costs related to acquisitions 120.4 13.6 Cost-elimination expenses 66.11 36.8 Carried interest incentive compensation (reversal) expense to align with the timing of associated revenue2 (31.3) - EBITDA 1,426.3 132.8 Add: Interest income 9.0 3.8 Less: Depreciation and amortization 373.9 92.8 Interest expense 144.1 71.3 Write-off of financing costs on extinguished debt - 13.5 Provision for (benefit of) income taxes 297.9 (6.3) Net income (loss) attributable to CBRE Group, Inc. $ 619.4 $ (34.7) Reconciliation of Adjusted EBITDA to EBITDA to Net Income (Loss) Represents cost-elimination expenses relating to a program initiated in Q4 2015 and completed in Q3 2016 to reduce the company’s global cost structure after several years of significant revenue and related cost growth. Cost-elimination expenses incurred during the twelve months ended March 31, 2017 consisted of $61.8 million of severance costs related to headcount reductions in connection with the program and $4.3 million of third-party contract termination costs. CBRE began adjusting carried interest compensation expense in Q2 2013 in order to better match the timing of this expense with associated carried interest revenue. This expense has only been adjusted for funds that incurred carried interest expense for the first time in Q2 2013 or in subsequent quarters.

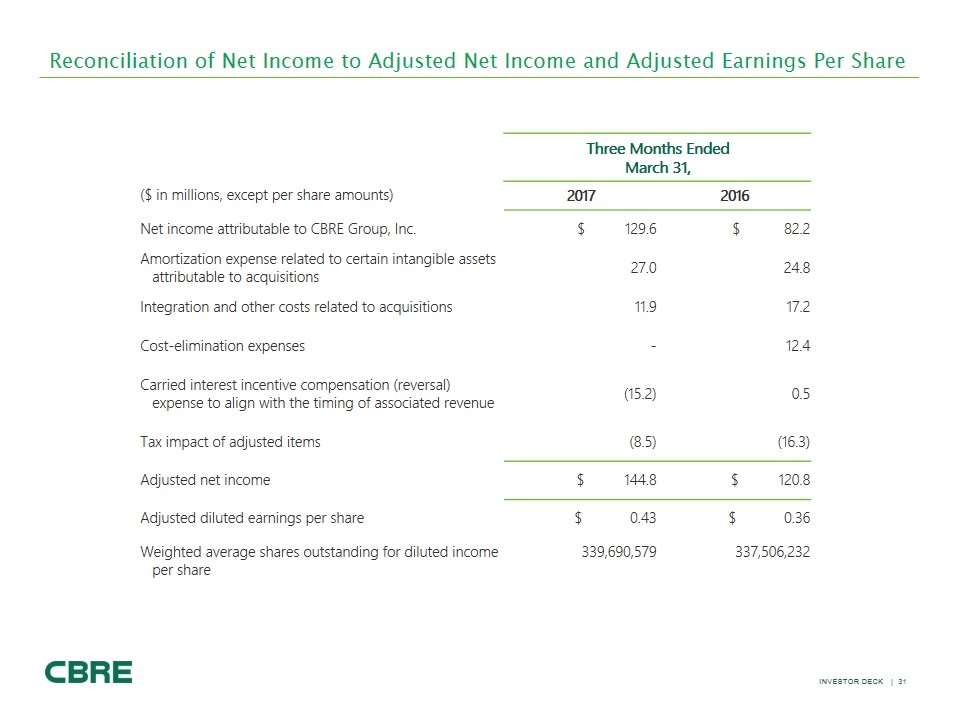

Three Months Ended March 31, ($ in millions, except per share amounts) 2017 2016 Net income attributable to CBRE Group, Inc. $ 129.6 $ 82.2 Amortization expense related to certain intangible assets attributable to acquisitions 27.0 24.8 Integration and other costs related to acquisitions 11.9 17.2 Cost-elimination expenses - 12.4 Carried interest incentive compensation (reversal) expense to align with the timing of associated revenue (15.2) 0.5 Tax impact of adjusted items (8.5) (16.3) Adjusted net income $ 144.8 $ 120.8 Adjusted diluted earnings per share $ 0.43 $ 0.36 Weighted average shares outstanding for diluted income per share 339,690,579 337,506,232 Reconciliation of Net Income to Adjusted Net Income and Adjusted Earnings Per Share

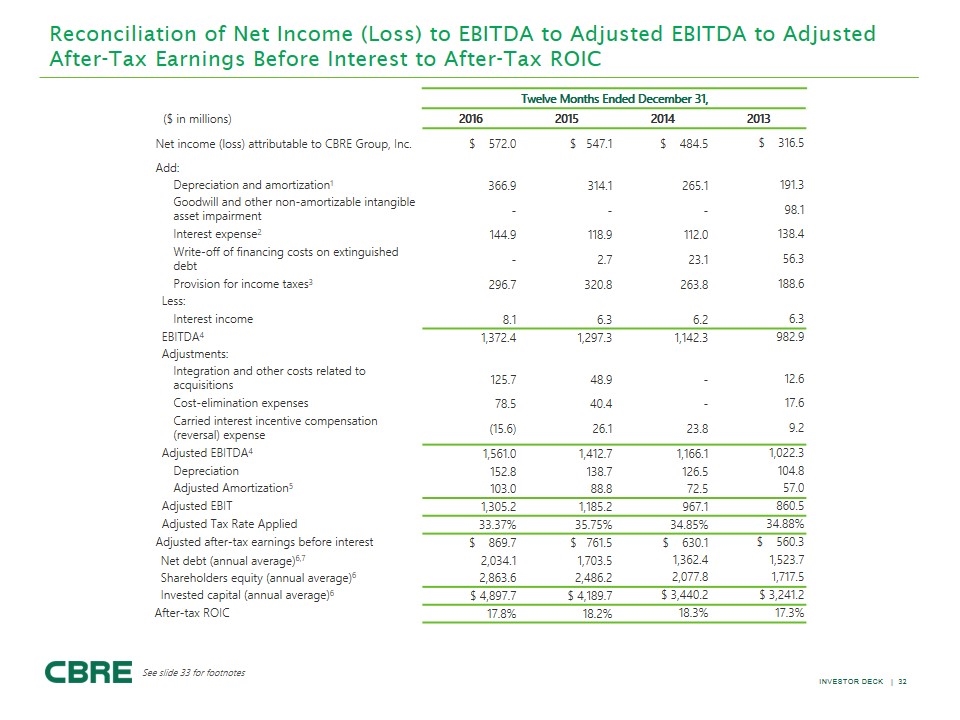

Reconciliation of Net Income (Loss) to EBITDA to Adjusted EBITDA to Adjusted After-Tax Earnings Before Interest to After-Tax ROIC Twelve Months Ended December 31, ($ in millions) 2016 2015 2014 2013 Net income (loss) attributable to CBRE Group, Inc. $ 572.0 $ 547.1 $ 484.5 $ 316.5 Add: Depreciation and amortization1 366.9 314.1 265.1 191.3 Goodwill and other non-amortizable intangible asset impairment - - - 98.1 Interest expense2 144.9 118.9 112.0 138.4 Write-off of financing costs on extinguished debt - 2.7 23.1 56.3 Provision for income taxes3 296.7 320.8 263.8 188.6 Less: Interest income 8.1 6.3 6.2 6.3 EBITDA4 1,372.4 1,297.3 1,142.3 982.9 Adjustments: Integration and other costs related to acquisitions 125.7 48.9 - 12.6 Cost-elimination expenses 78.5 40.4 - 17.6 Carried interest incentive compensation (reversal) expense (15.6) 26.1 23.8 9.2 Adjusted EBITDA4 1,561.0 1,412.7 1,166.1 1,022.3 Depreciation 152.8 138.7 126.5 104.8 Adjusted Amortization5 103.0 88.8 72.5 57.0 Adjusted EBIT 1,305.2 1,185.2 967.1 860.5 Adjusted Tax Rate Applied 33.37% 35.75% 34.85% 34.88% Adjusted after-tax earnings before interest $ 869.7 $ 761.5 $ 630.1 $ 560.3 Net debt (annual average)6,7 2,034.1 1,703.5 1,362.4 1,523.7 Shareholders equity (annual average)6 2,863.6 2,486.2 2,077.8 1,717.5 Invested capital (annual average)6 $ 4,897.7 $ 4,189.7 $ 3,440.2 $ 3,241.2 After-tax ROIC 17.8% 18.2% 18.3% 17.3% See slide 33 for footnotes

Reconciliation of Net Income (Loss) to EBITDA to Adjusted EBITDA to Adjusted After-Tax Earnings Before Interest to After-Tax ROIC Includes depreciation and amortization related to discontinued operations of $0.9 million for the year ended December 31, 2013. Includes interest expense related to discontinued operations of $3.3 million for the year ended December 31, 2013. Includes provision for income taxes related to discontinued operations of $1.3 million for the year ended December 31, 2013. Includes EBITDA related to discontinued operations of $7.9 million for the year ended December 31, 2013. Adjusted amortization excludes amortization expense related to certain intangible assets attributable to acquisitions of $111.1 million, $86.6 million, $66.1 million and $29.5 million for the years ended December 31, 2016, 2015, 2014 and 2013, respectively. Annual average is the average of the beginning and year end balances. Net debt includes total debt, excluding amounts that are non-recourse to the company, less cash available for general corporate use. In the third quarter of 2015, the company elected to early adopt the provisions of ASU2015-03, “Interest-Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs.” This ASU requires that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the carrying amount of that debt liability instead of separately being recorded in other assets. Such debt issuance costs are reflected as a component of net debt in 2015 and 2016. For 2014 and prior, amounts have not been restated to conform with this presentation.

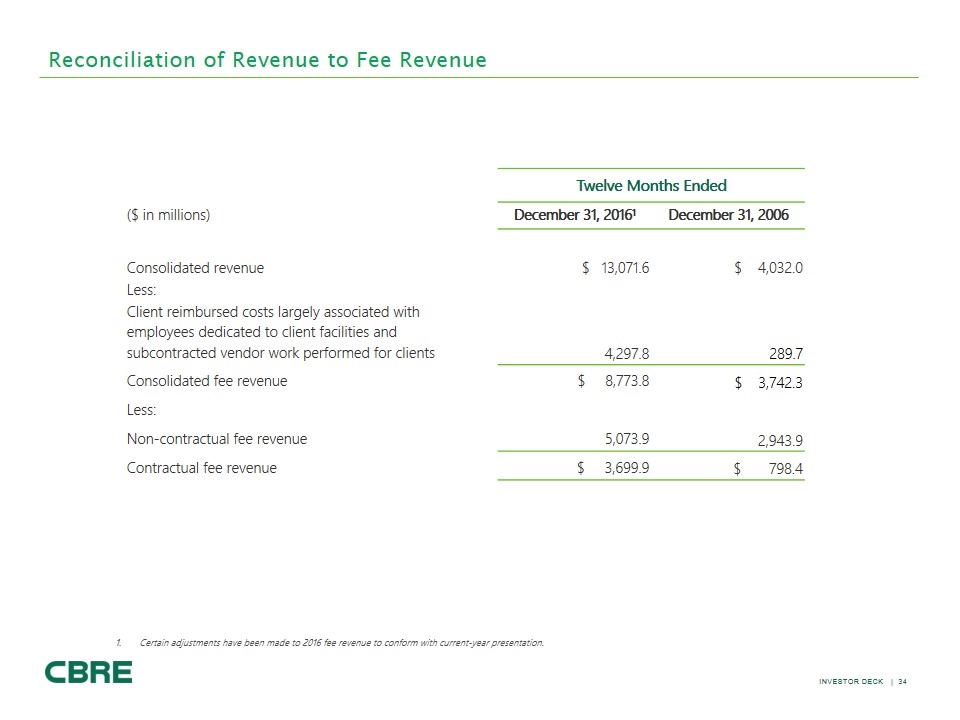

Reconciliation of Revenue to Fee Revenue Twelve Months Ended ($ in millions) December 31, 20161 December 31, 2006 Consolidated revenue $ 13,071.6 $ 4,032.0 Less: Client reimbursed costs largely associated with employees dedicated to client facilities and subcontracted vendor work performed for clients 4,297.8 289.7 Consolidated fee revenue $ 8,773.8 $ 3,742.3 Less: Non-contractual fee revenue 5,073.9 2,943.9 Contractual fee revenue $ 3,699.9 $ 798.4 Certain adjustments have been made to 2016 fee revenue to conform with current-year presentation.

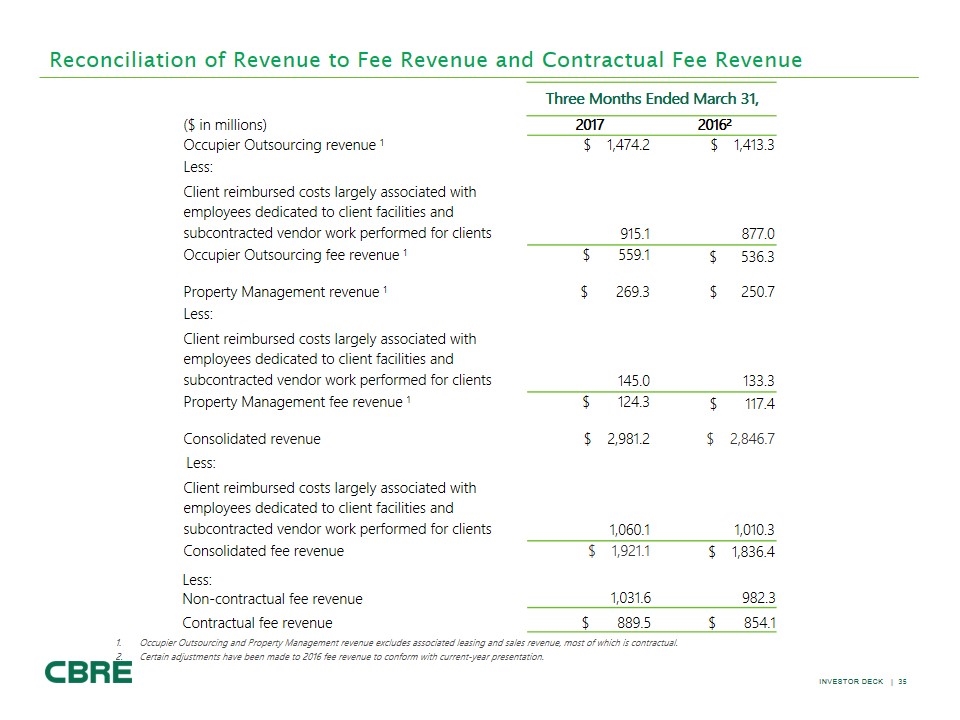

Three Months Ended March 31, ($ in millions) 2017 20162 Occupier Outsourcing revenue 1 $ 1,474.2 $ 1,413.3 Less: Client reimbursed costs largely associated with employees dedicated to client facilities and subcontracted vendor work performed for clients 915.1 877.0 Occupier Outsourcing fee revenue 1 $ 559.1 $ 536.3 Property Management revenue 1 $ 269.3 $ 250.7 Less: Client reimbursed costs largely associated with employees dedicated to client facilities and subcontracted vendor work performed for clients 145.0 133.3 Property Management fee revenue 1 $ 124.3 $ 117.4 Consolidated revenue $ 2,981.2 $ 2,846.7 Less: Client reimbursed costs largely associated with employees dedicated to client facilities and subcontracted vendor work performed for clients 1,060.1 1,010.3 Consolidated fee revenue $ 1,921.1 $ 1,836.4 Less: Non-contractual fee revenue 1,031.6 982.3 Contractual fee revenue $ 889.5 $ 854.1 Reconciliation of Revenue to Fee Revenue and Contractual Fee Revenue Occupier Outsourcing and Property Management revenue excludes associated leasing and sales revenue, most of which is contractual. Certain adjustments have been made to 2016 fee revenue to conform with current-year presentation.

Footnotes Slide 6 Adjusted EBITDA excludes (from EBITDA) certain carried interest incentive compensation (reversal) expense to align with the timing of associated revenue, cost-elimination expenses and integration and other costs related to acquisitions. Adjusted EPS excludes the effect of select charges from GAAP EPS as well as adjusts the provision for income taxes for such charges. Adjustments during the periods presented included amortization expense related to certain intangible assets attributable to acquisitions, cost elimination expenses, integration and other costs related to acquisitions, and certain carried interest incentive compensation expense (reversal) to align with the timing of associated revenue. NOTE: Local currency percent changes versus prior year are non-GAAP financial measures noted on slide 11. These percent changes are calculated by comparing current year results versus prior year results, in each case at prior year exchange rates. Slide 3 Assets Under Management (AUM) as of March 31, 2017. As of December 31, 2016, includes affiliates. Property and corporate facilities under management as of December 31, 2016; 7% of this square footage is managed by affiliates. Slide 7, 18 & 19 We regard leasing revenue as largely recurring over time because unlike most other transaction businesses, leasing activity normally takes place when leases expire. The average lease expires in five to six years. This means that, on average, in a typical year approximately 17% to 20% of leases roll over and a new leasing decision must be made. When a lease expires in the ordinary course, we expect it to be renewed, extended or the tenant to vacate the space to lease another space in the market. In each instance, a transaction is completed. If there is a downturn in economic activity, some tenants may seek a short term lease extension, often a year, before making a longer term commitment. In this scenario, that delayed leasing activity tends to be stacked on top of the normal activity in the following year. Thus, we characterize leasing as largely recurring over time because we expect an expiration of a lease, in the ordinary course, to lead to an opportunity for a leasing commission from such completed transaction. Slide 10 Other includes Development Services revenue (1% in both 2006 and 2016) and Other revenue (1% in both 2006 and 2016). Capital Markets includes Sales revenue (33% in 2006 and 19% in 2016) and Commercial Mortgage Services revenue (4% in 2006 and 7% in 2016). Contractual Sources include Occupier Outsourcing and Property Management revenue (7% in 2006 and 32% in 2016; excludes associated sales and lease revenues, most of which are contractual), Global Investment Management revenue (6% in 2006 and 4% in 2016), and Valuation revenue (8% in 2006 and 6% in 2016). Fee Revenue is gross revenue less client reimbursed costs largely associated with our employees that are dedicated to client facilities and subcontracted vendor work performed for clients. Certain adjustments have been made to 2016 fee revenue to conform with current-year presentation. On a GAAP revenue basis (as opposed to a fee revenue basis) contractual plus leasing revenues are 64% and 82% of GAAP revenues in 2006 and 2016, respectively.

Slide 17 Excludes global securities business. As of March 31, 2017. Slide 24 As of December 31 for each year presented except Q1 2017. In Process figures include Long-Term Operating Assets (LTOA) of $0.2 billion for Q1 2017, $0.2 billion for Q4 2016, $0.1 billion for Q4 2015, $0.3 billion for Q4 2014 and $0.9 billion for Q4 2013. LTOA are projects that have achieved a stabilized level of occupancy or have been held 18-24 months following shell completion or acquisition. Pipeline deals are those projects we are pursuing which we believe have a greater than 50% chance of closing or where land has been acquired and the projected construction start is more than twelve months out. Slide 14 Historical revenue for Occupier Outsourcing line of business (formerly Global Corporate Services or GCS, now called Global Workplace Solutions) excludes associated sales and leasing revenue, most of which is contractual. 2015 revenue includes four months of contribution from the Global Workplace Solutions business acquired on September 1, 2015. Per International Association of Outsourcing Professionals (IAOP). Slide 16 Property Management (also known as Asset Services) revenue excludes associated leasing revenue. 11% of this square footage is managed by affiliates. Slide 23 Activity includes loan originations and loan sales, and affiliate loan originations. As measured in dollar value loaned. Slide 11 Contractual revenue refers to revenue derived from our Occupier Outsourcing, Property Management, Investment Management and Valuation businesses. We regard leasing revenue as largely recurring over time because unlike most other transaction businesses, leasing activity normally takes place when leases expire. The average lease expires in five to six years. This means that, on average, in a typical year approximately 17% to 20% of leases roll over and a new leasing decision must be made. When a lease expires in the ordinary course, we expect it to be renewed, extended or the tenant to vacate the space to lease another space in the market. In each instance, a transaction is completed. If there is a downturn in economic activity, some tenants may seek a short term lease extension, often a year, before making a longer term commitment. In this scenario, that delayed leasing activity tends to be stacked on top of the normal activity in the following year. Thus, we characterize leasing as largely recurring over time because we expect an expiration of a lease, in the ordinary course, to lead to an opportunity for a leasing commission from such completed transaction. Occupier Outsourcing and Property Management revenue excludes associated leasing and sales revenue, most of which is contractual. Fee revenue is gross revenue less both client reimbursed costs largely associated with employees that are dedicated to client facilities and subcontracted vendor work performed for clients. Certain adjustments have been made to 2016 fee revenue to conform with current-year presentation. Footnotes