| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| ☒ | No fee required. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Photo: Courtesy of Brookfield Properties

Brookfield Place, New York City, is among the U.S. office assets that CBRE is managing under a strategic partnership with Brookfield Properties, announced in January 2024.

| 2100 McKinney Avenue, Suite 1250 Dallas, Texas 75201 (214) 979-6100 |

April 12, 2024

Dear Fellow Stockholder:

On behalf of the Board of Directors and management of CBRE Group, Inc., I cordially invite you to attend our annual meeting of stockholders on Wednesday, May 22, 2024 at 11:00 a.m. (Central Time) (the “Annual Meeting” or the “2024 Annual Meeting”). The 2024 Annual Meeting will be a virtual meeting of stockholders. You will be able to attend the 2024 Annual Meeting, vote your shares electronically and submit your questions during the meeting via live webcast by visiting www.virtualshareholdermeeting.com/CBRE2024. Stockholders will be able to listen, vote, and submit questions from their home or any location with internet connectivity. To participate in the meeting, you must have the 16-digit number that is shown on your Notice of Internet Availability of Proxy Materials or on your proxy card if you elected to receive proxy materials by mail. The notice of meeting and proxy statement that follow describe the business that we will consider at the meeting.

We hope that you will be able to attend the meeting via our live webcast. However, regardless of whether you attend the meeting, your vote is very important. We are pleased to again offer multiple options for voting your shares. Regardless of whether you attend, please take advantage of this opportunity to vote your shares.*

Thank you for your continued support of CBRE Group, Inc.

Robert E. Sulentic

Chair, President and Chief Executive Officer

*Please see page 1 of this Proxy Statement for the many options available to vote your shares and other details on how you can participate in our Annual Meeting.

Notice of 2024 Annual

Meeting of Stockholders

| Date: Wednesday, May 22, 2024

Time: 11:00 a.m. (Central Time)

Virtual Meeting Website: www.virtualshareholdermeeting.com/CBRE2024

Record Date: March 28, 2024 |

Your Vote Matters — How to Vote:

|

Online

Visit www.proxyvote.com. You will need the 16-digit number included in your proxy card, voter instruction form or notice. | |

|

Phone

Call 1-800-690-6903 or the number on your voter instruction form. You will need the 16-digit number included in your proxy card, voter instruction form or notice. | |

|

Send your completed and signed proxy card or voter instruction form to the address on your proxy card or voter instruction form. | |

|

Via Webcast During the Annual Meeting

Visit www.virtualshareholdermeeting.com/CBRE2024. You will need the 16-digit number included in your proxy card, voter instruction form or notice. Online access begins at 10:45 a.m. (Central Time). | |

Agenda:

| 1. | Elect the 11 Board-nominated directors named in the Proxy Statement; |

| 2. | Ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024; |

| 3. | Conduct an advisory vote on named executive officer compensation for the fiscal year ended December 31, 2023; and |

| 4. | Transact any other business properly introduced at the Annual Meeting. |

Your vote is important, and you are encouraged to vote promptly whether or not you plan to virtually attend the 2024 Annual Meeting of Stockholders.

We hope that you can attend the Annual Meeting. Regardless of whether you will attend via our live webcast, please complete and return your proxy so that your shares can be voted at the Annual Meeting in accordance with your instructions.

Important Notice Regarding the Availability of Proxy Materials for the 2024 Annual Meeting of Stockholders to be held on Wednesday, May 22, 2024: Our Proxy Statement and 2023 Annual Report are available free of charge on our website or www.proxyvote.com.

We believe that this allows us to provide you with the information that you need while lowering the costs of delivery and reducing the environmental impact of the Annual Meeting.

April 12, 2024

By Order of the Board of Directors

Chad Doellinger

Executive Vice President, General Counsel and Corporate Secretary

This Proxy Statement and accompanying proxy card are first being made available on or about April 12, 2024. References in this Proxy Statement to “CBRE,” “the company,” “we,” “us” or “our” refer to CBRE Group, Inc. and include all of its consolidated subsidiaries, unless otherwise indicated or the context requires otherwise. References to “the Board” refer to our Board of Directors. A copy of our Annual Report for the fiscal year ended December 31, 2023, including financial statements, is being sent simultaneously with this Proxy Statement to each stockholder who requested paper copies of these materials and will also be available at www.proxyvote.com.

| CBRE 2024 PROXY STATEMENT | PROXY SUMMARY | 1 |

Proxy Summary

| To help you review the proposals to be voted upon at our 2024 Annual Meeting, we have summarized important information in this Proxy Statement and in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023. This summary does not contain all of the information that you should consider, and you should carefully read the entire Proxy Statement and Annual Report on Form 10-K before voting. |

|

Voting

Stockholders of record as of March 28, 2024 may cast their votes in any of the following ways:

| ||||||

|

|

|

| |||

| Online

Visit www.proxyvote.com. You will need the 16-digit number included in your proxy card, voter instruction form or notice. |

Phone

Call 1-800-690-6903 or the number on your voter instruction form. You will need the 16-digit number included in your proxy card, voter instruction form or notice. |

Send your completed and signed proxy card or voter instruction form to the address on your proxy card or voter instruction form. |

Via Webcast During the Annual Meeting

Visit www.virtualshareholdermeeting.com/CBRE2024. You will need the 16-digit number included in your proxy card, voter instruction form or notice. Online access begins at 10:45 a.m. (Central Time). | |||

Voting Matters and Board Recommendation

| Proposals |

Board recommendation | Page reference | ||||

| 1. Elect Directors |

|

FOR each nominee | 23 | |||

| 2. Ratify the Appointment of Independent Registered Public Accounting Firm for 2024 |

|

FOR | 37 | |||

| 3. Advisory Vote to Approve Named Executive Officer Compensation for 2023 |

|

FOR | 40 | |||

| CBRE 2024 PROXY STATEMENT | PROXY SUMMARY | 2 |

Our Corporate Strategy

We aspire to expand our position as the leading global commercial real estate services and investment firm, defined by our scale and the superior outcomes we deliver for our constituents.

We have developed a concise strategy that we have executed over many years, fine-tuning it as market circumstances change and opportunities emerge. Our strategy consists of the following key elements:

| • | Build broad and deep presence across four key dimensions of our business: client type, service line, asset type and geography. |

| • | Deliver strong organic and inorganic growth, leveraging and building on the benefits of scale. |

| • | Integrate differentiated services to deliver superior client solutions. |

| • | Focus financial and operational resources on disproportionately growing our resilient businesses. |

| • | Leverage our functional and knowledge platform to support the growth of our business and the quality of our integrated solutions. |

| • | Identify, attract and empower top talent. |

| • | Continually focus on efficiency and cost to advance our margin advantage. |

Sustainability and Social Responsibility

In 2023, we continued to make strides on our initiatives to be a sustainable and responsible company. We believe we are well-positioned to lead our industry in providing climate change solutions that significantly reduce greenhouse gas (GHG) emissions. Our Net Zero Roadmap for Corporate Operations guides our actions to help us achieve our interim targets to reduce our GHG emissions by 2035 and reach our net zero goal by 2040. Key initiatives include goals of purchasing 100% renewable energy for our offices and electrifying our vehicle and equipment fleet.

Driving progress on diversity, equity and inclusion at CBRE and in the broader commercial real estate industry is a company-wide priority. In 2023, we spent nearly $2 billion with diverse suppliers as we work toward our pledge to spend $3 billion with diverse suppliers annually by the end of 2025. We also partner with organizations to increase outreach to and help to develop diverse talent underrepresented in our industry.

We are committed to providing transparent, meaningful sustainability information to stakeholders and publish information in accordance with the International Sustainability Standards Board’s (ISSB) disclosures, including industry-specific SASB standards and the Task Force on Climate-related Financial Disclosures (TCFD) in our Corporate Responsibility Report (CR Report). In addition, our CR Report was prepared in accordance with the Global Reporting Initiative (GRI) Standards and we have participated in the United Nations Global Compact (UNGC) and supported its Ten Principles since 2007.

To learn more, please read our Corporate Responsibility Report at www.cbre.com/responsibility. The information contained on or available through this website is not a part of, or incorporated by reference into, this Proxy Statement.

| CBRE 2024 PROXY STATEMENT | PROXY SUMMARY | 3 |

Awards & Recognition

In 2023 and early 2024, we were recognized with the following awards and accolades:

| MOST ADMIRED REAL ESTATE COMPANIES

Fortune Magazine, fourteen years in a row, including 2024 |

MOST RECOGNIZED COMMERCIAL REAL ESTATE BRAND

Lipsey Company Survey, 23rd consecutive year, including 2024 |

WORLD’S MOST ETHICAL COMPANY Ethisphere Institute, 11th consecutive year, including 2024 | ||||||

| A TOP COMPANY FOR CAREER GROWTH

The Wall Street Journal ranks us within the top 10% of Fortune 500 companies for creating opportunities for people to advance their careers, outperforming all other real estate companies |

LISTED IN THE BLOOMBERG GENDER EQUALITY INDEX

For four consecutive years, including 2023 |

3rd MOST SUSTAINABLE U.S. COMPANY

Barron’s, making top 100 list for seven consecutive years, including 2024 | ||||||

Corporate Governance Highlights

We are committed to good corporate governance, which promotes the long-term interests of stockholders, strengthens Board and management accountability, and helps build public trust in our company. Our governance practices include:

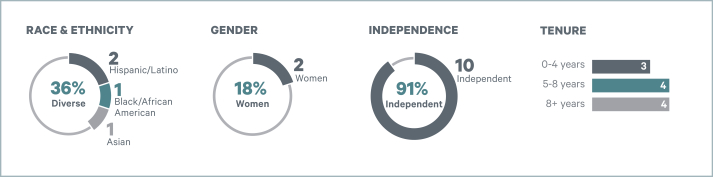

| • | Robust director selection process resulting in a diverse Board in terms of experience, skills, tenure, gender, race and ethnicity |

| • | Strong lead independent director, elected by independent directors |

| • | 10 out of 11 of our director nominees are independent |

| • | 6 out of 11 of our director nominees are diverse in terms of gender, race or ethnicity |

| • | 100% independent Board committees |

| • | Annual election of directors |

| • | Majority voting standard for uncontested elections |

| • | 12-year director term limit |

| • | Board diversity policy to actively seek out women and underrepresented candidates |

| • | No “over-boarding” by our directors on other public-company boards |

| • | Proxy access rights for director nominations |

| • | Maximum of one Board-nominated management director |

| • | Annual Board, committee and individual director evaluations and self-assessments |

| • | Regular executive sessions, where independent directors meet without management present |

| • | Active Board oversight of strategy, risk management, sustainability, social responsibility and governance matters |

| • | Stock ownership requirements for directors and executive officers |

| • | Policy restricting trading, and prohibiting hedging and short-selling, of CBRE stock |

| • | Ongoing stockholder outreach and engagement |

| • | Stockholder rights to call a special meeting |

| • | No poison pill takeover defense plans |

| CBRE 2024 PROXY STATEMENT | PROXY SUMMARY | 4 |

Our Board Nominees

Our Board nominees exhibit a mix of skills, experience, diversity and perspectives:

| Name | Age | Director Since |

Principal Occupation | Independent | Committees | Other Public Company Boards | ||||||||

|

Brandon B. Boze |

43 | 2012 | Former Partner and President of ValueAct Capital | ● | – Compensation – Corporate Governance and Nominating – Executive |

0 | |||||||

|

Beth F. Cobert |

65 | 2017 | Former President of the Markle Foundation | ● | – Compensation (Chair) |

0 | |||||||

|

Reginald H. Gilyard |

60 | 2018 | Senior Advisor to The Boston Consulting Group | ● | – Compensation – Corporate Governance and Nominating |

3 | |||||||

|

Shira D. Goodman Lead Independent Director |

63 | 2019 | Advisory Director to Charlesbank Capital Partners | ● | – Executive (Chair) |

1 | |||||||

|

E.M. Blake Hutcheson |

63 | 2022 | President and Chief Executive Officer of OMERS | ● | – Audit – Compensation |

1 | |||||||

|

Christopher T. Jenny |

68 | 2016 | Chair and Chief Executive Officer of Jennus Innovation | ● | – Corporate Governance and Nominating (Chair) |

0 | |||||||

|

Gerardo I. Lopez |

64 | 2015 | Former Executive-in-Residence at Softbank Investment Advisers | ● | – Audit (Chair) – Executive |

2 | |||||||

|

Guy A. Metcalfe |

56 | 2024 | Former Managing Director and Global Chair of Real Estate of Morgan Stanley | ● | – Compensation – Corporate Governance and Nominating |

1 | |||||||

|

Oscar Munoz |

65 | 2020 | Former Chair and Chief Executive Officer of United Airlines Holdings | ● | – Audit – Corporate Governance and Nominating |

2 | |||||||

|

Robert E. Sulentic Board Chair |

67 | 2012 | Chair, President and Chief Executive Officer of CBRE | – Executive |

0 | ||||||||

|

Sanjiv Yajnik |

67 | 2017 | President of Capital One Financial Services | ● | – Audit – Compensation |

0 | |||||||

| Female Directors |

Racially and Ethnically Diverse Directors |

Board Committees Chaired by Women |

Independent Directors | |||

| 18% | 36% | 50% | 91% | |||

| CBRE 2024 PROXY STATEMENT | PROXY SUMMARY | 5 |

2023 Business Highlights

| Revenue | Net Revenue (1) | GAAP Net Income | ||||||

| $31.9B | $18.3B | $986M | ||||||

| +3.6% | -2.7% | -30.0% | ||||||

| Core EBITDA (1) | GAAP EPS | Core EPS (1) | ||||||

| $2.2B | $3.15 | $3.84 | ||||||

| -24.5% | -26.6% | -32.5% | ||||||

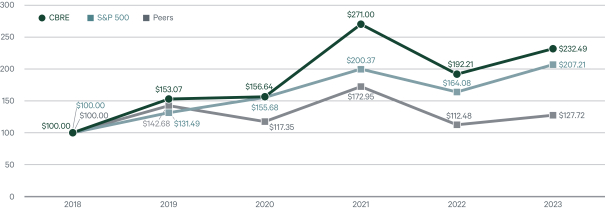

| 1-Year Total Stockholder Return (2) (as of 12/31/2023) | 3-Year Total Stockholder Return (2) (as of 12/31/2023) | 5-Year Total Stockholder Return (2) (as of 12/31/2023) | ||||||

| 21% | 48% | 132% | ||||||

| vs. 26% for S&P 500 (-5% underperformance) |

vs. 33% for S&P 500 (+15% outperformance) |

vs. 107% for S&P 500 (+25% outperformance) | ||||||

| (1) | These are non-GAAP financial measures. For definitions and more information, see Annex A of this Proxy Statement. Our Board and management use these non-GAAP financial measures to evaluate our performance and manage our operations. However, non-GAAP financial measures should be viewed in addition to, and not as an alternative for, financial results prepared in accordance with GAAP. The term “GAAP,” as used in this Proxy Statement, means generally accepted accounting principles in the United States. |

| (2) | Inclusive of dividends, assuming reinvestment. |

Company Performance and Financial Highlights

Our pay-for-performance approach aligns management and stockholder interests. The real estate capital markets environment weighed on our business performance in 2023, particularly the transactional business lines within the Advisory Services and Real Estate Investments segments, which are sensitive to market cycles. While overall net revenue fell 3%, our Resilient Businesses (including the entire GWS business, property management, loan servicing, asset management fees in Investment Management and valuations), together, grew net revenue at a 10% clip. These businesses are well-positioned for growth across market cycles. On the other hand, revenue from our Transactional Businesses (sales, leasing, mortgage origination, carried interest and incentive and development fees) slumped 21% last year, but are poised to resume growth when the market cycle turns. Despite the year’s challenges, we invested approximately $961.3 million in share buybacks (repurchasing approximately 7,867,348 shares), infill M&A and other strategic investments, while ending the year below the midpoint of our target leverage range, giving us substantial liquidity to finance future growth.

| CBRE 2024 PROXY STATEMENT | PROXY SUMMARY | 6 |

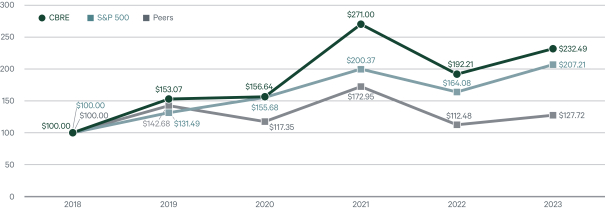

| Comparison of 5-Year Cumulative Total Return(1) among CBRE Group, Inc., the S&P 500 Index(2) and Peer Group(3)

|

| (1) | $100 invested on December 31, 2018 in stock or index-including reinvestment of dividends, fiscal year ending December 31. |

| (2) | Copyright© 2024 Standard & Poor’s, a division of S&P Global. All rights reserved. |

| (3) | Peer group contains companies with the following ticker symbols: JLL, CIGI, CWK, ISS, MMI, NMRK, SVS.L (London) and WD. |

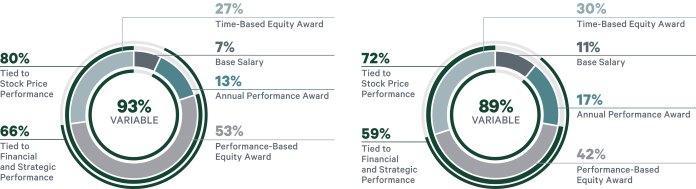

Executive Compensation Highlights

Our Pay-for-Performance Compensation Philosophy

Our executive compensation program is designed to:

| • | Align pay and performance; |

| • | Reinforce our corporate strategy; |

| • | Attract and retain accomplished and high-performing executives; and |

| • | Motivate those executives to consistently achieve short- and long-term goals to further our corporate strategy. |

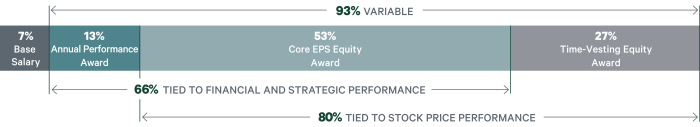

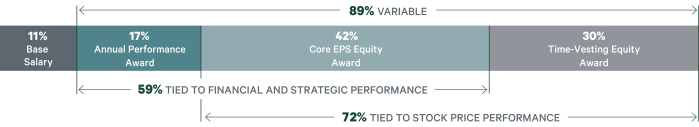

To do this, we focus a significant percentage of our executive officers’ compensation on both annual and long-term incentive awards intended to drive growth in our business and in our share price in the short- and long-term, with a relatively modest portion of compensation paid in fixed base salary.

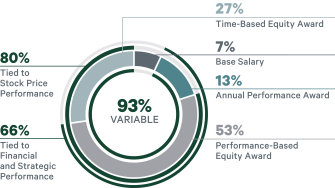

2023 Total Target Direct Compensation Mix

The total 2023 target direct compensation mix is shown here:

| CEO Target Compensation Mix

|

| CBRE 2024 PROXY STATEMENT | PROXY SUMMARY | 7 |

2023 Performance and NEO Compensation

2023 was a difficult year for commercial real estate. The tougher operating environment led to reduced cash bonuses for all of our named executive officers. Compared with annual cash bonus targets, 2023 cash bonuses awarded to our named executive officers averaged 86.2% of target, and ranged from 76.5% to 94.1%.

2022 Core EPS Awards, the vesting of which was based on our two-year cumulative Core EPS performance during 2022 and 2023, were paid out at 0% (i.e., all 2022 Core EPS Equity Awards were forfeited). This reflected financial results that were below target due to the challenging market environment that prevailed for most of the two-year performance period.

In 2023, as part of the review of target annual compensation opportunities, the Compensation Committee approved increases to the annual long term-term equity targets for Mses. Giamartino and Dhandapani. The Compensation Committee also approved an increase to Ms. Giamartino’s salary and EBP target. These increases (from 2022) were intended to align their compensation with market levels.

2023 NEO Total Annual Compensation

Set forth below is the 2023 annual compensation for our named executive officers.

| Name and Principal Position |

Year | Salary ($) |

Bonus ($) |

Annual Stock ($) |

Non-Equity Incentive Plan Compensation ($) |

All Other Compensation ($) |

Total ($) |

|||||||||||||||||||||

| Robert E. Sulentic Chair, President and Chief Executive Officer |

2023 | 1,250,000 | — | 14,749,941 | 2,352,893 | 6,000 | 18,358,834 | |||||||||||||||||||||

| Emma E. Giamartino Chief Financial Officer |

2023 | 695,000 | — | 3,199,880 | 980,273 | 6,000 | 4,881,153 | |||||||||||||||||||||

| Chandra Dhandapani Former Chief Executive Officer, |

2023 | 750,000 | — | 3,649,996 | 1,020,417 | 6,000 | 5,426,413 | |||||||||||||||||||||

| John E. Durburg Chief Executive Officer of U.S. and Canada, |

2023 | 775,000 | — | 4,064,992 | 887,973 | 6,000 | 5,733,965 | |||||||||||||||||||||

| Daniel G. Queenan Chief Executive Officer, |

2023 | 775,000 | — | 4,064,992 | 908,371 | 6,000 | 5,754,363 | |||||||||||||||||||||

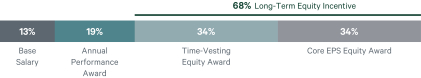

2024 Updates to Long-Term Incentive Award Design

As part of the Committee’s annual review of our compensation program, and in response to feedback from our investors, the Compensation Committee approved a change to the design of our annual performance-based awards. Beginning in 2024, our annual performance-based awards will incorporate two metrics—core EPS and relative total shareholder return. For additional information, see our Form 8-K filed on March 11, 2024.

| CBRE 2024 PROXY STATEMENT | PROXY SUMMARY | 8 |

Forward-Looking Statements

This Proxy Statement contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including statements regarding the company’s sustainability and social responsibility targets, strategies and goals. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the company’s actual results and performance in future periods to be materially different from any future results or performance suggested in forward-looking statements in this Proxy Statement. Any forward-looking statements speak only as of the date of this Proxy Statement and, except to the extent required by applicable securities laws, the company expressly disclaims any obligation to update or revise any of them to reflect actual results, any changes in expectations or any change in events. If the company does update one or more forward-looking statements, no inference should be drawn that it will make additional updates with respect to those or other forward-looking statements. Readers are urged to carefully review and consider the various disclosures made in the company’s Annual Report for the year ended December 31, 2023, particularly those under the captions “Cautionary Note on Forward-Looking Statements,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as in the company’s press releases and other periodic filings with the SEC.

This Proxy Statement contains certain voluntary disclosures regarding our sustainability and social responsibility goals and related matters because we believe these matters are of interest to our investors; however, we do not believe these disclosures are “material” as that concept is defined by or construed in accordance with the securities laws or any other laws of the U.S. or any other jurisdiction, or as that concept is used in the context of financial statements and financial reporting. These disclosures speak only as of the date on which they are made, and we undertake no obligation and expressly disclaim any duty to correct or update such disclosures, whether as a result of new information, future events or otherwise, except as required by applicable law.

| CBRE 2024 PROXY STATEMENT | TABLE OF CONTENTS | 9 |

Table of Contents

| 10 | ||||

| 10 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 19 | ||||

| 21 | ||||

| 22 | ||||

| 23 | ||||

| 23 | ||||

| 23 | ||||

| 23 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

| 25 | ||||

| 26 | ||||

| 27 | ||||

| 28 | ||||

| 35 | ||||

| Proposal 2: Ratify Appointment of Independent Registered Public Accounting Firm | 37 | |||

| 38 | ||||

| 38 | ||||

| 38 | ||||

| CBRE 2024 PROXY STATEMENT | CORPORATE GOVERNANCE — GOVERNANCE HIGHLIGHTS | 10 |

Corporate Governance

Our Corporate Governance framework is designed to strengthen the Board of Directors’ oversight of management and to serve the long-term interests of our stockholders, employees and other stakeholders. Governance is a continuous focus for us, starting with our Board and committees of the Board that meet several times throughout the year, and extending to management and our employees. We are committed to maintaining the highest standards of business conduct and corporate governance.

Governance Highlights

Corporate Governance

| • | Robust director selection process resulting in a diverse Board in terms of experience, skills, tenure, gender, race and ethnicity |

| • | 11 director nominees, 10 of whom are independent |

| • | Director term limits (12 years) |

| • | Strong lead independent director, elected by independent directors |

| • | 100% independent committees |

| • | Board diversity policy to actively seek out women and underrepresented candidates |

| • | Active Board oversight of strategy, risk management, sustainability, social responsibility and governance matters |

| • | Annual Board, committee and individual director evaluations and self-assessments |

| • | Maximum of one Board-nominated management director |

| • | Robust Standards of Business Conduct and governance policies |

| • | No “over-boarding” by our directors on other public-company boards |

Compensation

| • | Pay-for-performance compensation program, which includes performance-based equity grants |

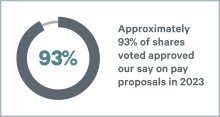

| • | Annual “say on pay” votes, with most recent favorable “say on pay” vote of approximately 93% |

| • | Stock ownership requirements for directors and executive officers |

| • | Policy restricting trading, and prohibiting hedging and short-selling, of CBRE stock |

Stockholder Rights

| • | Annual election of all directors |

| • | Majority voting requirement for directors in uncontested elections |

| • | Stockholder rights to call special meetings |

| • | No poison pill takeover defense plans |

| • | Stockholders may act by written consent |

| • | Proxy access for director nominations |

| • | Ongoing stockholder outreach and engagement |

| Corporate Governance Materials

The following materials, along with other Governance documents, are available on our website, https://ir.cbre.com/leadership/governance-documents.

| ||

| • Standards of Business Conduct

• Corporate Governance Guidelines

• Policy Regarding Transactions with Interested Parties

• Whistleblower Policy

• Equity Award Policy

• Anti-Corruption Policy

• Charter, By-laws and Board Committee Charters

|

These materials are also available in print to any person, without charge, by emailing us at investorrelations@cbre.com or by written request to:

Investor Relations Department CBRE Group, Inc. 2100 McKinney Avenue, Suite 1250 Dallas, Texas 75201 | |

| CBRE 2024 PROXY STATEMENT | CORPORATE GOVERNANCE — GOVERNANCE HIGHLIGHTS | 11 |

Governance Policies & Practices

Standards of Business Conduct. Our Board has adopted a Standards of Business Conduct applicable to all directors, officers and employees that states our corporate values and ethical standards, including our commitment to respect, integrity, service and excellence. We are firmly committed to conducting business with the highest integrity and in compliance with the letter and spirit of the law. If the Board grants any waivers from the Standards of Business Conduct to any of our directors or executive officers, or if we amend such policies, we will, if required, disclose these matters through the Investor Relations section of our website on a timely basis.

Corporate Governance Guidelines. Our Board has adopted Corporate Governance Guidelines, which provide a framework within which our Board, assisted by its committees, directs our affairs.

Board Diversity Policy. As part of the search process for a new director, the Corporate Governance and Nominating Committee of our Board, or Governance Committee, will actively seek out women and underrepresented candidates to include in the pool from which Board nominees are chosen and will instruct any search firm engaged for the search to provide a set of candidates that includes both underrepresented people of color and different genders.

Director Overboarding Policy. Our directors who are public company executive officers may serve on no more than two public company boards (including the company’s Board). Directors that are not public company executive officers may serve on no more than five public company boards (including the company’s Board), or to the extent such director is the chair or lead independent director of a public company board, then no more than four public company boards (including the company’s Board). Consideration is also given to the nature of and time involved in a director’s service on other boards (including public company leadership roles) and other outside commitments.

Policy Regarding Transactions with Interested Parties and Corporate Opportunities. Our Board has adopted a related-party transactions and corporate opportunities policy that directs our Audit Committee to review and approve, among other things, potential conflicts of interest between us and our directors and executive officers.

Whistleblower Policy. We have a Whistleblower Policy that directs our Audit Committee to investigate complaints (received directly or through management) regarding:

| • | deficiencies in or noncompliance with our internal accounting controls or accounting policies; |

| • | circumvention of our internal accounting controls; |

| • | fraud in the preparation or review of our financial statements or records; |

| • | misrepresentations regarding our financial statements or reports; |

| • | violations of legal or regulatory requirements; and |

| • | retaliation against whistleblowers. |

Equity Award Policy. We have an Equity Award Policy that is designed to maintain the integrity of the equity award process and to ensure compliance with all applicable laws. The Equity Award Policy sets forth the procedures that must be followed in connection with employee awards. Our Equity Award Policy is described in greater detail under the heading “Compensation Discussion and Analysis—Section 6. Compensation Policies and Practices.”

Anti-Corruption Policy. Our global Anti-Corruption Policy contains strict prohibitions on any employee or agent of the company offering or providing anything that could be perceived as a bribe to gain or maintain any business advantage.

Compensation Clawback Policy. We have a policy that requires us to recover cash-based and performance-based-equity incentive compensation paid to any current or former “Section 16 officer” if there is a restatement of our financial results. The policy mandates clawback from any applicable officer who received an award overpayment, without regard to whether any misconduct occurred or whether an officer bears responsibility for the required restatement. Our Compensation Clawback Policy is described in greater detail under the heading “Compensation Discussion and Analysis—Section 6. Compensation Policies and Practices.”

| CBRE 2024 PROXY STATEMENT | CORPORATE GOVERNANCE — STOCK OWNERSHIP REQUIREMENTS | 12 |

Stock Ownership Requirements

In order to align the interests of our executives and Board members with the interests of our stockholders, the Compensation Committee has adopted executive officer stock ownership requirements that are applicable to all of our Section 16 officers. In addition, our Board has adopted stock ownership requirements for non-employee directors.

Executive Officers

Our executive officers have a minimum common stock ownership requirement of two to six times their annual base salary. Our CEO’s minimum ownership requirement is six times his annual base salary and each other NEO’s minimum ownership requirement is three times their annual base salary. If at any time an executive officer’s equity holdings do not satisfy these minimum ownership requirements, depending on his or her position, the executive must retain 100% (for our CEO) or 75% (for our other named executive officers) of the shares remaining after payment of taxes and exercise price upon the exercise of stock options or upon the vesting of restricted stock or the settlement of vested restricted stock units, as applicable.

Shares that count toward compliance with the requirements include:

| • | shares owned outright (either directly or indirectly); |

| • | shares issued upon the settlement of vested restricted stock units; and |

| • | allocated shares in other company benefit plans. |

Shares that do not count toward achievement of the requirements include:

| • | unexercised outstanding stock options (whether or not vested); and |

| • | unvested/unearned restricted stock and restricted stock units. |

Non-Employee Directors

Each non-employee director has a minimum common stock ownership requirement of five times the value of the annual stock grants made by us to the non-employee director pursuant to our director compensation plan. If at any time the common stock ownership requirement is not satisfied, the director must retain 100% of the shares remaining after payment of taxes and exercise price upon exercise of stock options, the vesting of restricted stock or the settlement of vested restricted stock units, as applicable.

Shares that count toward compliance with the requirements include:

| • | shares owned outright by the director (either directly or beneficially, e.g., through a family trust); and |

| • | shares issued upon the settlement of vested restricted stock units. |

Shares that do not count toward achievement of the requirements include:

| • | shares held by mutual or hedge funds in which the non-employee director is a general partner, limited partner or investor; |

| • | unexercised outstanding stock options (whether or not vested); |

| • | unvested/unearned restricted stock units or restricted stock; and |

| • | shares transferred to a non-employee director’s employer pursuant to such employer’s policies. |

Board Structure and Leadership

All of our directors are elected at each annual meeting of stockholders and hold office until the next election. Our Board has authority under our by-laws to fill vacancies and to increase or, upon the occurrence of a vacancy, decrease its size between annual meetings of stockholders.

We believe strong independent leadership is essential for the Board to effectively perform its functions and to help ensure independent oversight of management. Our Corporate Governance Guidelines provide the Board with the flexibility to choose the appropriate Board leadership structure for the company based on what it believes is best for the company and its shareholders at a given point in time. Our Corporate Governance Guidelines also provide that if the same person holds the chair and chief executive officer roles, or if the chair is not independent, then the independent directors will elect from among themselves, on an annual basis, a lead independent director.

Currently, our Board leadership structure consists of a lead independent director, a Board chair (who is also our chief executive officer) and strong independent committee chairs. The Board believes our structure provides independent Board leadership with the benefit of our chief executive officer serving as the chair at our regular board meetings. The Board regularly reviews its leadership structure and has determined that this structure is in the best interests of the company and its shareholders at this time. Among other factors, the Board considered and evaluated: Mr. Sulentic’s deep knowledge of CBRE and extensive commercial real estate experience, the importance of consistent, unified leadership to execute and oversee the company’s strategy, the strong and highly independent composition of the Board and the meaningful responsibilities of the lead independent director.

Shira D. Goodman has served as our lead independent director since November 2023 and has been a director since 2019. The independent directors believe that Ms. Goodman is well suited to serve as lead independent director given her significant managerial, operational and global experience. As a result of her broad-based and relevant background, Ms. Goodman is well-positioned as lead independent director to provide constructive, independent and informed guidance and oversight to management. The Board believes that the presence of our lead independent director who has meaningful oversight responsibilities, together with a combined chair and chief executive officer, provides the company with the optimal leadership to drive the company forward at this time.

| CBRE 2024 PROXY STATEMENT | CORPORATE GOVERNANCE — DIRECTOR INDEPENDENCE | 13 |

Director Independence

Under our Board’s Corporate Governance Guidelines and the listing standards of the NYSE, our Board must consist of a majority of independent directors. In addition, all members of the Audit Committee, Compensation Committee and Governance Committee must be independent directors as defined by our Corporate Governance Guidelines and NYSE listing standards. Members of the Compensation Committee must also meet applicable NYSE independence requirements for compensation committee members, and members of the Audit Committee must further satisfy a separate SEC independence requirement, which generally provides that they may not (i) accept directly or indirectly any consulting, advisory or other compensatory fee from us or any of our subsidiaries, other than their compensation as directors or members of the Audit Committee or any other committees of our Board or (ii) be an affiliated person of ours.

Our Board regularly conducts a review of possible conflicts of interest and related-party transactions through the use of questionnaires, director self-reporting and diligence conducted by management. This review includes consideration of any investments and agreements between directors and their related persons and the company, including those described under “Related-Party Transactions” in this Proxy Statement, and such person’s beneficial ownership of our securities. The Board has determined that 91% of our director nominees (all except for Mr. Sulentic) are independent in accordance with NYSE listing standards and our Board’s Categorical Independence Standards that it has adopted relating to our director independence. These Categorical Independence Standards are posted on the Corporate Governance section of the Investor Relations page on our website at www.cbre.com. The information contained on or available through this website is not a part of, or incorporated by reference into, this Proxy Statement.

| CBRE 2024 PROXY STATEMENT | CORPORATE GOVERNANCE — BOARD MEETINGS AND COMMITTEES | 14 |

Board Meetings and Committees

Our Board held seven meetings during fiscal year 2023 to review significant developments, engage in strategic planning and act on matters requiring Board approval. In 2023, each incumbent director attended at least 75% of our Board meetings and meetings of committees on which he or she served (taken in the aggregate) during the period that he or she served thereon.

Our Board currently has four standing committees that met or acted by written consent during fiscal year 2023: the Audit Committee, the Compensation Committee, the Governance Committee and the Executive Committee. Each committee (other than the Executive Committee) is composed entirely of directors whom our Board has determined to be independent under current NYSE standards. Each committee operates under a charter approved by our Board that sets out the purposes and responsibilities of the committee and that are published in the Corporate Governance section of the Investor Relations page on our website at www.cbre.com. In accordance with our Board’s Corporate Governance Guidelines, our Board and each of the Audit Committee, Compensation Committee and Governance Committee conducts an annual performance self-assessment with the purpose of increasing the effectiveness of our Board and its committees.

The following table describes the current members of each of the committees of our Board, and the number of meetings held during fiscal year 2023:

| Director |

Board | Audit | Compensation | Governance | Executive | |||||||

| Brandon B. Boze |

● |

|

● | ● | ● |

| ||||||

| Beth F. Cobert |

● |

|

CHAIR |

|

|

| ||||||

| Reginald H. Gilyard |

● |

|

● | ● |

|

| ||||||

| Shira D. Goodman |

LEAD INDEPENDENT DIRECTOR |

|

|

|

CHAIR |

| ||||||

| E.M. Blake Hutcheson |

● | ● | ● |

|

|

| ||||||

| Christopher T. Jenny |

● |

|

|

CHAIR |

|

| ||||||

| Gerardo I. Lopez |

● | CHAIR |

|

|

● |

| ||||||

| Susan Meaney |

● | ● |

|

● |

|

| ||||||

| Guy A. Metcalfe |

● |

|

● | ● |

|

| ||||||

| Oscar Munoz |

● | ● |

|

● |

|

| ||||||

| Robert E. Sulentic |

CHAIR | ● | ||||||||||

| Sanjiv Yajnik |

● | ● | ● | |||||||||

| Number of Meetings |

7 | 9 | 5 | 4 | 0(1) | |||||||

| (1) | Our Executive Committee did not hold any formal meetings in 2023, but acted four times by unanimous written consent. |

Board Attendance at Annual Meeting of Stockholders

Although the Board understands that there may be situations that prevent a director from attending an annual meeting of stockholders, it is the Board’s policy that all directors should attend these meetings. All of our then-serving directors attended our 2023 annual meeting of stockholders on May 17, 2023.

Independent Director Meetings

Our non-management directors meet in executive session without management present each time the full Board convenes for a regularly scheduled meeting. If our Board convenes for a special meeting, the non-management directors will meet in executive session if circumstances warrant. The lead independent director of our Board presides over executive sessions of non-management directors.

| CBRE 2024 PROXY STATEMENT | CORPORATE GOVERNANCE — BOARD MEETINGS AND COMMITTEES | 15 |

Board Committees

| Audit Committee | Chair: Gerardo I. Lopez* |

Members: E.M. Blake Hutcheson Susan Meaney Oscar Munoz* Sanjiv Yajnik* | ||

The Audit Committee provides oversight of our accounting and financial reporting and disclosure processes, the adequacy of the systems of disclosure and internal control established by management, our compliance with legal and regulatory requirements and the audit of our financial statements.

THE AUDIT COMMITTEE ALSO:

| • | Retains, compensates, oversees and terminates the independent auditor and evaluates its qualifications, independence and performance; |

| • | Pre-approves all audit and any non-audit services performed by the independent auditor; |

| • | Reviews the results of the independent audit and internal audits as well as reports from our Chief Financial Officer, our Chief Accounting Officer, our Chief Ethics & Compliance Officer, our Head of Risk Management, our Head of Internal Audit, our Head of Financial Risk Management Compliance, our Chief Information Security Officer and our General Counsel; |

| • | Reviews the independent auditor’s report describing our internal quality-control procedures and any material issues raised by the most recent internal quality-control review or any inquiry by governmental authorities; |

| • | In consultation with the independent auditor, management and internal auditors, reviews the integrity of our internal and external financial reporting processes; |

| • | Reviews financial statements and earnings releases and guidance provided to analysts and rating agencies; |

| • | Reviews the Chief Ethics & Compliance Officer’s report on the effectiveness of our compliance with applicable ethical, legal, and regulatory requirements; |

| • | Reviews our cybersecurity readiness and other policies and procedures related to data governance; |

| • | Establishes procedures to handle complaints regarding accounting, internal controls or auditing matters; and |

| • | Oversees the company’s major financial, cybersecurity and information technology risk exposures. |

All members of the Audit Committee are “financially literate” under NYSE listing standards.

* These three directors meet the SEC’s qualifications for an “audit committee financial expert.”

All members of the Audit Committee are independent within the meaning of SEC regulations, the listing standards of the NYSE and our Board’s Corporate Governance Guidelines, in each case, as such regulations, standards and guidelines apply to audit committee members.

| Compensation Committee | Chair: Beth F. Cobert |

Members: Brandon B. Boze Reginald H. Gilyard E.M. Blake Hutcheson Guy A. Metcalfe Sanjiv Yajnik | ||

The Compensation Committee oversees the development and administration of our executive compensation policies, plans and programs, including reviewing and approving compensation of our executive officers and any compensation contracts or arrangements with our executive officers.

IN ADDITION, THE COMPENSATION COMMITTEE:

| • | Reviews the performance of our executive officers, including our CEO; |

| • | Retains its independent compensation consultant, Frederic W. Cook & Co., Inc., or FW Cook. FW Cook reports directly to the Committee, attends meetings and provides advice to the Committee; and |

| • | Considers the results of annual stockholder advisory votes on the compensation of our named executive officers in connection with the discharge of its responsibilities. |

| CBRE 2024 PROXY STATEMENT | CORPORATE GOVERNANCE — BOARD MEETINGS AND COMMITTEES | 16 |

Each Compensation Committee member qualifies as a “non-employee director” for purposes of the Securities Exchange Act of 1934, as amended, or the Exchange Act. All members are “independent” under NYSE listing standards applicable to compensation committee members. All members of the Compensation Committee are independent within the meaning of SEC regulations, the listing standards of the NYSE and our Board’s Corporate Governance Guidelines, in each case, as such regulations, standards and guidelines apply to compensation committee members.

| Corporate Governance and Nominating Committee | Chair: Christopher T. Jenny |

Members: Brandon B. Boze Reginald H. Gilyard Susan Meaney Guy A. Metcalfe Oscar Munoz | ||

The Corporate Governance and Nominating Committee oversees our Board’s corporate governance procedures and practices, including:

| • | Developing and recommending to our Board a set of corporate governance principles, including nomination criteria and independence standards; |

| • | Recommendations of individuals for service on our Board; |

| • | Recommendations to our Board regarding the size, composition, structure, operations, performance and effectiveness of the Board; |

| • | Conducting an annual review of director compensation; |

| • | Considering feedback obtained from shareholder outreach; and |

| • | Overseeing annual Board, committee and individual director evaluations and self-assessments. |

All members are “independent” under NYSE listing standards and rules.

| Executive Committee | Chair: Shira D. Goodman |

Members: Brandon B. Boze Gerardo I. Lopez Robert E. Sulentic

| ||

The Executive Committee implements policy decisions of our Board and is authorized to act on our Board’s behalf between meetings of our Board, including by approving certain transactions within dollar thresholds established by our Board.

The Executive Committee also engages in the periodic review of our balance sheet management, borrowings and capital markets activities.

Compensation Committee Interlocks and Insider Participation

None of Ms. Cobert, Messrs. Boze, Gilyard, Hutcheson, Metcalfe and Yajnik (all current members of the Compensation Committee) or Mr. Lopez (who served on the Compensation Committee for a portion of 2023) has ever been an officer or employee of the company or any of its subsidiaries. In addition, during 2023, none of our directors were employed as an executive officer of another entity where any of our executive officers served on that entity’s board of directors or compensation committee (or its equivalent).

| CBRE 2024 PROXY STATEMENT | CORPORATE GOVERNANCE — SELECTED AREAS OF BOARD OVERSIGHT | 17 |

Selected Areas of Board Oversight

Oversight of Risk Management

| The Board oversees risk management. | Full Board

Our Board regularly reviews information regarding our most significant strategic, operational, financial and compliance risks and is responsible for ensuring that the company has crisis management and business continuity plans in place to deal with potential crises. Our Board maintains direct oversight over our enterprise risk management process rather than delegating this function to a Board or management committee.

Although each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board is regularly informed through committee chair reports about such risks. These committee chair reports are presented at every regularly scheduled Board meeting. | |||||||

| ||||||||

| Company management is charged with managing risk through rigorous risk mitigation activities and strong internal controls. | Management

Our Executive Risk Committee is chaired by our Head of Risk Management and consists of senior executives representing a cross-section of our lines of business, operational areas and geographic regions. Our Executive Risk Committee is responsible for identifying and assessing our most significant risks. After this identification and assessment process, we assign each of our top risks to an executive-level (typically C-suite) risk owner, who is then charged with developing mitigation action plans which are then presented to the Executive Risk Committee.

Multiple times during the year, our Head of Risk Management provides a detailed presentation on identified significant risks to the Board or a committee of the Board. Certain risks that are determined to be best managed directly by the Board versus management or that are in areas specific to a particular Board committee expertise are monitored and overseen at the Board or committee level as appropriate. | |||||||

| ||||||||

| Board committees, which meet regularly and report back to the full Board, play significant roles in carrying out our Board’s risk oversight function. | The Audit Committee

oversees management of risks related to our financial reports and record-keeping and potential conflicts of interest. They also oversee our risk assessment and risk management processes more generally including major business, financial, information technology risks (including cybersecurity and data security risks), legal and reputational risk exposures, as well as risks related to crisis management and business continuity.

The Audit Committee receives regular reports from our Chief Financial Officer, our Chief Accounting Officer, our Chief Ethics & Compliance Officer, our Head of Risk Management, our Head of Internal Audit, our Head of Financial Risk Management Compliance, our Chief Information Security Officer as well as updates from our General Counsel on any developments affecting our overall risk profile and on issues of non-compliance and incident management. | |||||||

| The Compensation Committee

is responsible for overseeing the management of risks relating to our compensation plans and arrangements. For additional information regarding the Compensation Committee’s assessment of our compensation-related risks, please see “Compensation Discussion and Analysis—Section 3. How We Make Compensation Decisions—Compensation Risk Assessment.” |

The Governance Committee

manages risks associated with corporate governance practices, investor engagement, Board independence and the composition of our Board and its committees. | |||||||

| CBRE 2024 PROXY STATEMENT | CORPORATE GOVERNANCE — SELECTED AREAS OF BOARD OVERSIGHT | 18 |

Oversight of Strategy

Our Board is responsible for providing governance and oversight over the strategy, operations and management of our company. Each quarter, our Board and management devote a substantial amount of time in strategy-focused meetings discussing strategic issues that are most important to the company. At each regular Board meeting, our Board receives business and strategy updates from leaders across the company and reviews our operating plans and overall financial performance, and provides significant guidance and feedback. Annually, our Board reviews and approves our capital allocation and spending budgets, which are designed to strategically deploy capital intended to facilitate investments required to achieve operational excellence.

Oversight of Sustainability and Social Responsibility

As part of our Board’s strategic and risk oversight, our Board oversees our strategic planning and risk management policies and procedures related to sustainability and social responsibility. Our Board has made a deliberate decision to retain governance of these matters at the Board level. Our Board chose not to delegate these matters to a specific committee because it believes that these matters are integral to the company’s future success. Throughout the year, our Board receives reports and engages in discussions with management on key sustainability and social responsibility matters, including progress on sustainability services we provide to clients to meet their commercial real estate sustainability goals, the company’s diversity, equity and inclusion initiatives, and other efforts to be a responsible company in our communities. The Board also receives annual updates on how these risks are being addressed, mitigated and managed across the company, including sustainable development considerations that influence market, reputational, operational and political risks.

Oversight of Succession Planning

Our Board reviews management succession and development plans with the CEO on at least an annual basis, and as needed throughout the year. These plans include CEO succession in the event of an emergency or retirement, as well as the succession plans for the CEO’s direct reports and other employees critical to our continued operations and success.

| CBRE 2024 PROXY STATEMENT | CORPORATE GOVERNANCE — SUSTAINABILITY AND SOCIAL RESPONSIBILITY | 19 |

Sustainability and Social Responsibility

We are determined to set the pace for our sector on sustainability and social responsibility. We recognize the impact we have on our communities, clients, employees and other stakeholders—and focus on initiatives that support our aspiration to grow our business responsibly and sustainably.

Our Chief Sustainability Officer oversees our corporate and client solutions sustainability initiatives, including accountability for progress toward our goal to achieve net zero carbon emissions by 2040. Our Chief Culture Officer, reporting directly to our Chief Executive Officer, oversees and drives progress on social impact and other initiatives, including our ethics and compliance; diversity, equity and inclusion; and community engagement.

We are pleased to receive various recognition for our performance, including rising to #3 on Barron’s 100 Most Sustainable Companies in the U.S. list in February 2024 (a list we have made for seven consecutive years), improving to an A- score on CDP’s climate change disclosure, and being named to 3BL’s 100 Best Corporate Citizens five years in a row.

Sustainability

As the world’s largest manager of commercial properties, we have an outsized opportunity and obligation to accelerate the decarbonization of the commercial real estate market at scale—through our own operations, for our clients and for the industry overall. Our Net Zero Roadmap for Corporate Operations outlines four pathways that will help us realize our goal of achieving net zero carbon emissions by 2040: Buildings, Energy, Transport and Procurement. Each pathway includes strategic objectives that are delivered through near-term actions and program-level strategies.

Our Commitment to Transparency

We are committed to providing transparent, meaningful sustainability information to stakeholders in accordance with the International Sustainability Standards Board’s (ISSB) reporting frameworks, including publishing SASB and TCFD disclosure in our CR Report since 2017 and 2019, respectively. In addition, our report was prepared in accordance with GRI Standards and we have participated in the UNGC and supported its Ten Principles since 2007.

Social Responsibility

People are at the center of our strategy to deliver measurably superior outcomes for clients, and we place a high priority on attracting, retaining and developing the best talent. We champion four key values—Respect, Integrity, Service, Excellence—which serve as the foundation upon which our company is built and as a touchstone for how our employees conduct themselves. Our programs are designed to help prepare our professionals to thrive in their current and future roles, develop our leaders of tomorrow, reward our people with competitive pay and benefits, foster an engaging and inclusive workplace, and improve productivity through investments in technology, tools and resources.

Commitment to Diversity, Equity and Inclusion (“DE&I”)

We believe our company is at its best when people of different backgrounds and life experiences come together to produce great results for our clients, communities and each other. Our strategic priorities include: strengthening an inclusive culture where everyone is valued and supported in achieving their full potential, increasing the diversity of our workforce and suppliers with whom we partner, and driving impact in the communities where we live and work.

We are committed to driving economic impact in the marketplace through our supplier diversity initiatives and spent nearly $2 billion to increase diversity among our suppliers in 2023, putting us on track to reach our goal of spending to $3.0 billion by the end of 2025. As part of our Community Impact Initiative, we made significant financial contributions to nonprofit organizations that are helping to improve education and career development opportunities for women, racial and ethnic minorities, people with disabilities, individuals who identify as LGBTQ+, and people with military service.

We publicly report demographics, including diversity data contained in our EEO-1 Submission, for our U.S. workforce in our CR Report.

Employee Engagement

Employee engagement is imperative because people are at the center of our strategy. As a services organization, our ability to engage our employees is critical in achieving our goals. Employee engagement is tied to several key organizational outcomes: employee retention; absenteeism and wellness; productivity; safety; client satisfaction and retention; revenue growth and stockholder returns.

In 2023, we partnered with an external vendor for the sixth time to conduct a worldwide employee engagement survey. CBRE’s “Your Voice” Employee Engagement Survey gave all employees an opportunity to provide confidential feedback about their work experiences. The 2023 survey had a response rate of 84% and again showed an increase in overall employee engagement, up from the previous year. We had top scores in areas of ethics & compliance; client focus; diversity, equity and inclusion; safety & wellness; supervision & management; and operating as a socially and environmentally responsible organization. Company leaders are committed to making further gains in these and other key areas through action plans based on employee feedback, and we plan to continue measuring our progress in future surveys.

| CBRE 2024 PROXY STATEMENT | CORPORATE GOVERNANCE — SUSTAINABILITY AND SOCIAL RESPONSIBILITY | 20 |

Total Rewards and Wellbeing

We are committed to providing eligible employees with meaningful and affordable benefits while also ensuring our people experience a caring workplace culture that contributes to their wellbeing. We provide competitive total rewards programs in all the markets in which we operate, including fixed and variable pay, and comprehensive, company-specific benefits. Additionally, managers may implement flexible work arrangements, such as compressed work weeks and flextime, after considering several factors such as the nature of the employee’s work. We provide a variety of programs to support holistic physical and behavioral health, short and long-term financial stability, family planning and emotional resiliency for employees at any stage in their career. Our workplace wellbeing program provides employees with tools and resources to actively manage their wellbeing, including monthly workshops and online courses.

Learning and Development

We prioritize and invest in a range of learning and talent development programs that enable employees to thrive at CBRE and build their careers. To this end, we leverage a range of different learning approaches, including: webinars, live virtual and in-person training, self-paced digital learning, coaching, mentoring and on-the-job learning. To support inclusivity, we offer training programs in 32 languages.

Workplace Safety

We drive a culture where safety and wellbeing are integrated into business decisions. We insist on high global standards and leadership accountability, strong worker participation and competency, and best in class technology, supplier management and risk assessment programs. In 2023, we hosted our annual Global Safety and Wellbeing Week, themed “Be Safe. Be Well. Be Your Best Self,” to provide our employees with strategies that enable them to be safe and well at the end of every workday. Our employee engagement scores for safety are among the company’s top three scores. Finally, we continue to grow third-party certification of our management systems based on various International Organization for Standardization (ISO) requirements for occupational health and safety and risk management, as well as alignment with elements of ISO’s environmental and quality management standards.

Communities and Giving

At CBRE, we take a holistic approach to meeting the evolving needs of our communities and the people in them. Through our CBRE Cares programs, we encourage and support employees around the world to volunteer and donate to causes that are important to them. This includes activating fundraisers for large-scale disasters and humanitarian events with a corporate match, as well as providing support to our employees impacted by disasters. We also strategically invest in nonprofit programs focused on three main areas: driving climate action solutions, expanding the diverse workforce talent pool of tomorrow and improving communities in our global headquarters city of Dallas, Texas.

Public Policy & Political Participation

We prohibit the use of company funds for contributions to political candidates, political parties, or candidate campaigns and we do not have a political action committee. We recognize, however, that some laws might have a significant impact on the quality of services we offer to our clients, our employees in the workplace and the local communities we serve. Our legislative outreach and targeted lobbying activities focus on educating policymakers through data-driven research about the commercial real estate industry with the goal of helping legislators create fact-based, informed policy. We have retained professional lobbyists for local- and state-focused issues such as land use entitlement, business development, community relations, and state-level legislative and administrative rulemaking.

In 2023, we continued to improve our lobbyist tracking and compliance program in the U.S. to maintain a record of company-wide lobbying expenditures to enhance transparency and adhere to the highest ethical standards. Because of these efforts, we were recognized for being in the 90th percentile on the Center for Political Accountability Zicklin Index of Corporate Political Disclosure and Accountability.

| CBRE 2024 PROXY STATEMENT | CORPORATE GOVERNANCE — STOCKHOLDER ENGAGEMENT | 21 |

| Awards and Recognition

In 2023 and in early 2024, our ESG efforts were recognized with the following awards and accolades: | ||

| • In 2023, we were listed on Forbes 2023 Net Zero Leaders list as the highest-ranked commercial real estate services company.

• In 2024, we secured an A- score from CDP on its climate change disclosure. CDP is considered the global standard for corporate transparency on climate impacts, risks and opportunities.

• In 2024, for the 11th consecutive year, we were named as one of the World’s Most Ethical Companies by Ethisphere, a global leader in defining and advancing the standards of ethical business practices.

• In 2024, we were listed #3 on Barron’s list of the 100 Most Sustainable Companies in the U.S. We have made the top 100 list for seven consecutive years. The 1,000 largest U.S. publicly held companies were considered for this recognition based on various environmental, social and governance performance indicators.

• In 2023, we were recognized by the Disability Equality Index as a Best Place to Work for Disability Inclusion and earned a top score.

|

• We were included in the 3BL Media 100 Best Corporate Citizens list in 2023 for the fifth year in a row, which recognizes outstanding environmental, social and governance transparency and performance.

• We earned a place in the 2023 Bloomberg Gender-Equality Index (“GEI”) for the fourth straight year. The public companies in the Bloomberg GEI support gender equality through policy development, representation and transparency.

• We were named a Best Place to Work for LGBTQ+ Equality according to the Human Rights Campaign. CBRE received a perfect score on the 2023 Corporate Equality Index, a national benchmarking survey and report on corporate policies and practices related to LGBTQ+ workplace equality, for the tenth consecutive year.

• We received a 2024 EPA ENERGY STAR® Partner of the Year – Sustained Excellence Award, marking the 17th consecutive year of ENERGY STAR recognition.

| |

To learn more, please read our Corporate Responsibility Report at www.cbre.com/responsibility. The information contained on or available through this website is not a part of, or incorporated by reference into, this Proxy Statement.

Stockholder Engagement

We believe that engagement with our stockholders provide us with a valuable understanding of our stockholders’ perspectives and meaningful opportunities to share our views with them.

Throughout the year, management and members of our Board engage with a significant portion of our stockholders through a variety of forums. Our interactions cover a broad range of governance, financial and business topics. Stockholder feedback is regularly provided to the Board and the company’s management.

A brief description of our stockholder engagement efforts are outlined below.

| How We Engage

• Quarterly earning calls

• Investor conferences

• Annual Shareholder Meeting

• Stockholder Outreach Program |

2023 Engagements

• As part of our stockholder outreach program, we extended invitations to institutional shareholders holding in the aggregate approximately 70% of our shares outstanding to discuss governance matters

• We met with shareholders representing approximately 30% of our shares outstanding

| |||

| How We Communicate

• Annual Report

• Proxy Statement

• SEC filings

• Press releases

• Company website

• Corporate Responsibility Report |

2023 Engagement Topics

• Strategy and execution

• Board refreshment

• Board leadership structure

• Sustainability, human capital

• Compensation practices

• Stock retention policies

| |||

| CBRE 2024 PROXY STATEMENT | CORPORATE GOVERNANCE — STOCKHOLDER ENGAGEMENT | 22 |

Communications with our Board

Stockholders and other interested parties may write to the Board Chair, Lead Independent Director, the entire Board or any of its members by:

|

Mail:

CBRE Group, Inc. c/o Chad Doellinger, Executive Vice President, General Counsel and Corporate Secretary 2100 McKinney Avenue, Suite 1250 Dallas, Texas 75201 |

|

Email:

to chad.doellinger@cbre.com. | |||

The Board considers stockholder questions and comments to be important and endeavors to respond promptly and appropriately, even though the Board may not be able to respond to all stockholder inquiries directly.

The Board has developed a process to assist with managing inquiries and communications. The General Counsel will review any stockholder communications and will forward to the Board Chair, Lead Independent Director, our Board or any of its members a summary and/or copies of any such correspondence that deals with the functions of our Board or committees thereof or that the General Counsel otherwise determines requires their attention. Certain circumstances may require that our Board depart from the procedures described above, such as the receipt of threatening letters or emails or voluminous inquiries with respect to the same subject matter.

| CBRE 2024 PROXY STATEMENT | PROPOSAL 1: ELECT DIRECTORS — DIRECTOR NOMINATION CRITERIA | 23 |

Proposal 1:

Elect Directors

Our Board has nominated 11 directors for election at this Annual Meeting to hold office until the next annual meeting and the election of their successors. All of the nominees were selected to serve on our Board based the following criteria:

| • | outstanding achievement in their professional careers; |

| • | broad experience; |

| • | personal and professional integrity; |

| • | their ability to make independent, analytical inquiries; |

| • | financial literacy; |

| • | mature judgment; |

| • | high-performance standards; |

| • | familiarity with our business and industry; and |

| • | an ability to work collegially. |

We believe that all of our director nominees have a reputation for honesty and adherence to high ethical standards. Each agreed to be named in this Proxy Statement and to serve if elected.

Director Nomination Criteria

Our Board seeks directors who represent a mix of backgrounds and experiences that will enhance the quality of our Board’s deliberations and decisions. In nominating candidates, our Board considers a diversified membership in the broadest sense, including multiple directors who are women and directors who identify in one or more of the following categories: racial, ethnic or national origin minorities, people with disabilities, LGBTQ+, and military/veterans. Our Board does not discriminate on the basis of race, color, national origin, gender, religion, disability or sexual orientation or any other category protected by law. When evaluating candidates, our Board considers whether potential nominees possess integrity, accountability, informed judgment, financial literacy, mature confidence and high-performance standards.

Our Board is especially interested in adding candidates over time who are operating executives (particularly current chief executives or other operating executives of other large public companies) or who have a strong technology background and in both cases a passion for building a transformative business on a global basis. Other factors include having directors with international experience, including knowledge of emerging markets or management of business operations and resources that are dispersed across a global platform.

Director Independence

A majority of our Board must be independent under our Corporate Governance Guidelines and New York Stock Exchange (NYSE) listing standards. Also, at least one member of our Audit Committee should have the qualifications and skills necessary to be considered an “Audit Committee Financial Expert” under Section 407 of the Sarbanes-Oxley Act, as defined by the rules of the Securities and Exchange Commission, or SEC.

Director Term Limits

Under our by-laws, our Board may not nominate any non-management director for re-election to the Board if that director has completed 12 years of service as an independent member of the Board on or prior to the date of election to which such nomination relates. No exemptions are permitted. Our Board believes that these restrictions contribute to Board stability, vitality and diversity and help ensure that our Board continuously benefits from a balanced mix of perspectives and experiences.

| CBRE 2024 PROXY STATEMENT | PROPOSAL 1: ELECT DIRECTORS — DIRECTOR NOMINATION CRITERIA | 24 |

Director Service on Other Public Company Boards

Our Board recognizes that service on other public company boards provides directors valuable experience that benefits the company. Our Board also believes, however, that it is critical that directors dedicate sufficient time to their service on the company’s Board. Directors are expected to advise the chair of the Corporate Governance and Nominating Committee of our Board, or the Governance Committee, in advance of accepting an invitation to serve on another board of directors. This allows the Governance Committee to evaluate the impact of the director joining another board based on various factors relevant to the specific situation, including the nature and extent of a director’s other professional obligations, potential conflicts of interest and the time commitment required by the new position.

Our Corporate Governance Guidelines provide that:

| • | Directors who are public company executive officers may sit on no more than two public company boards (including the company’s Board); and |

| • | Directors that are not public company executive officers may sit on no more than five public company boards (including the company’s Board), or to the extent such director is the chair or lead independent director of a public company board, then no more than four public company boards (including the company’s Board). |

The Governance Committee also takes into consideration the nature of and time involved in a director’s service on other boards (including public company leadership roles) and other outside commitments when evaluating the suitability of individual directors. The Governance Committee conducts an annual review of director commitment levels, and affirms that all of our director nominees are compliant with company’s overboarding policy.

Director Resignation Policy Upon Change of Employment

Our Board’s Corporate Governance Guidelines require that directors tender their resignation upon a change of their employment. The Governance Committee will then consider whether the change in employment has any bearing on the director’s ability to serve on our Board, our Board’s goals regarding Board composition or any other factors considered appropriate and relevant. Our Board will then determine whether to accept or reject the tendered resignation.

Majority Voting to Elect Directors

In uncontested elections, directors are elected by a “majority vote” requirement. Under this requirement, in order for a nominee to be elected in an uncontested election, the nominee must receive the affirmative vote of a majority of the votes cast in his or her election (i.e., votes cast “FOR” a nominee must exceed votes cast as “AGAINST”). Votes to “ABSTAIN” with respect to a nominee and broker non-votes are not considered votes cast, and so will not affect the outcome of the nominee’s election. The company maintains a plurality vote standard in contested director elections, where the number of nominees exceeds the number of directors to be elected.

If an incumbent director in an uncontested election does not receive a majority of votes cast for such incumbent’s election, the director is required to submit a letter of resignation to the Board for consideration by the Governance Committee. The Governance Committee is required to promptly assess the appropriateness of such nominee continuing to serve as a director and recommend to the Board the action to be taken with respect to the tendered resignation. The Board will act on the Governance Committee’s recommendation within 90 days of the date of the certification of election results.

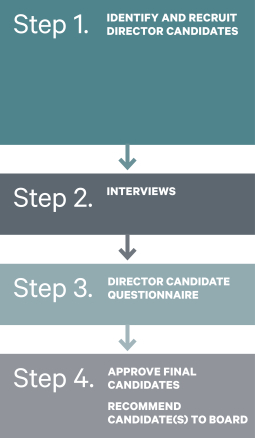

Required Vote