| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| ☒ | No fee required. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Cover Photo: Henrietta House, CBRE’s new Advisory Services office in London, was opened in late 2021.

Design and Architecture: MoreySmith

Photography: MoreySmith, photography in house

| 2100 McKinney Avenue, Suite 1250 Dallas, Texas 75201 (214) 979-6100 |

April 4, 2023

| Dear Fellow Stockholder:

2022 was a year of divergent performance for the commercial real estate sector. The year started with bright promise as CBRE logged a record first-half performance, but transaction activity slowed significantly in the second half of the year as long-term interest rates more than doubled and credit availability contracted dramatically.

Nevertheless, several annual performance metrics touched new highs with revenue rising 11% to $30.8 billion and core earnings per share up 7% to $5.69. We benefited from solid growth in the more cyclically resilient and secularly favored parts of our business. We have done much to bolster our position in these areas and they now account for about 45% of our annual business segment operating profit. These include such business lines as facilities management, project management, loan servicing, property management and others.

Since Covid-19 first emerged on the scene three years ago, we’ve confronted a macro environment that has swung sharply between downturn and recovery. Our shareholders’ support has been critical to helping us navigate this volatile market backdrop. Through it all, we’ve focused on balancing near-term financial performance with long-term strategic investments and the return of capital to shareholders. During 2022, we invested approximately $2.1 billion in share repurchases, infill M&A and other strategic investments. Due to CBRE’s strong free cash flow, we were able to make these investments while still ending the year with virtually no net leverage.

Environmental sustainability is an area where we look forward to making further strides. As the world’s largest manager of commercial property, we believe we have an outsized opportunity to help combat climate change while assisting our clients in meeting their decarbonization and other sustainability commitments. We are also working hard to expand opportunities for businesses owned by women, minorities and other disadvantaged groups to furnish goods and services to CBRE and our clients. Our more than $1.5 billion of spending with diverse suppliers in 2022 puts us on course to reach our $3 billion goal by the end of 2025. Beyond CBRE’s walls, we are partnering with several community organizations to improve education and career development opportunities for young people of color and from underrepresented communities. This will help us build a rich pipeline of future talent and increase the ranks of next-generation diverse leaders.

We look forward to engaging with you at our annual Stockholder Meeting on Wednesday, May 17, 2023 at 11:00 a.m. (Central Time). You can attend the Annual Meeting, vote your shares electronically and submit your questions during the meeting via live webcast by visiting www.virtualshareholdermeeting.com/CBRE2023. Regardless of whether you attend, please take advantage of this opportunity to vote your shares.*

Robert E. Sulentic President and Chief Executive Officer

|

*Please see page 1 of this Proxy Statement for the many options available to vote your shares and other details on how you can participate in our Annual Meeting.

Notice of 2023 Annual

Meeting of Stockholders

| Date: Wednesday, May 17, 2023

Time: 11:00 a.m. (Central Time)

Virtual Meeting Website: www.virtualshareholdermeeting.com/CBRE2023

Record Date: March 20, 2023 |

Your Vote Matters — How to Vote:

|

Online

Visit www.proxyvote.com. You will need the 16-digit number included in your proxy card, voter instruction form or notice. | |

|

Phone

Call 1-800-690-6903 or the number on your voter instruction form. You will need the 16-digit number included in your proxy card, voter instruction form or notice. | |

|

Send your completed and signed proxy card or voter instruction form to the address on your proxy card or voter instruction form. | |

|

Via Webcast During the Annual Meeting

Visit www.virtualshareholdermeeting.com/CBRE2023. You will need the 16-digit number included in your proxy card, voter instruction form or notice. Online access begins at 10:45 a.m. (Central Time). | |

Agenda:

| 1. | Elect the 11 Board-nominated directors named in the Proxy Statement; |

| 2. | Ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023; |

| 3. | Conduct an advisory vote on named executive officer compensation for the fiscal year ended December 31, 2022; |

| 4. | Conduct an advisory vote on the frequency of future advisory votes on named executive officer compensation; |

| 5. | If properly presented, consider a stockholder proposal regarding executive stock ownership retention; and |

| 6. | Transact any other business properly introduced at the Annual Meeting. |

Your vote is important, and you are encouraged to vote promptly whether or not you plan to virtually attend the 2023 Annual Meeting of Stockholders.

We hope that you can attend the Annual Meeting. Regardless of whether you will attend via our live webcast, please complete and return your proxy so that your shares can be voted at the Annual Meeting in accordance with your instructions.

Important Notice Regarding the Availability of Proxy Materials for the 2023 Annual Meeting of Stockholders to be held on Wednesday, May 17, 2023: Our Proxy Statement and 2022 Annual Report are available free of charge on our website or www.proxyvote.com.

We believe that this allows us to provide you with the information that you need while lowering the costs of delivery and reducing the environmental impact of the Annual Meeting.

April 4, 2023

By Order of the Board of Directors

Laurence H. Midler

Executive Vice President, General Counsel, Chief Risk Officer and Secretary

This Proxy Statement and accompanying proxy card are first being made available on or about April 4, 2023. References in this Proxy Statement to “CBRE,” “the company,” “we,” “us” or “our” refer to CBRE Group, Inc. and include all of its consolidated subsidiaries, unless otherwise indicated or the context requires otherwise. References to “the Board” refer to our Board of Directors. A copy of our Annual Report for the fiscal year ended December 31, 2022, including financial statements, is being sent simultaneously with this Proxy Statement to each stockholder who requested paper copies of these materials and will also be available at www.proxyvote.com.

| CBRE 2023 PROXY STATEMENT | PROXY SUMMARY | 1 |

Proxy Summary

| To help you review the proposals to be voted upon at our 2023 Annual Meeting, we have summarized important information in this Proxy Statement and in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022. This summary does not contain all of the information that you should consider, and you should carefully read the entire Proxy Statement and Annual Report on Form 10-K before voting. |

|

Voting

Stockholders of record as of March 20, 2023 may cast their votes in any of the following ways:

| ||||||

|

|

|

| |||

| Online

Visit www.proxyvote.com. You will need the 16-digit number included in your proxy card, voter instruction form or notice. |

Phone

Call 1-800-690-6903 or the number on your voter instruction form. You will need the 16-digit number included in your proxy card, voter instruction form or notice. |

Send your completed and signed proxy card or voter instruction form to the address on your proxy card or voter instruction form. |

Via Webcast During the Annual Meeting

Visit www.virtualshareholdermeeting.com/CBRE2023. You will need the 16-digit number included in your proxy card, voter instruction form or notice. Online access begins at 10:45 a.m. (Central Time). | |||

Voting Matters and Board Recommendation

| Proposals |

Board recommendation | Page reference | ||||

|

FOR each nominee | 23 | ||||

| 2. Ratify the Appointment of Independent Registered Public Accounting Firm for 2023 |

|

FOR | 37 | |||

| 3. Advisory Vote to Approve Named Executive Officer Compensation for 2022 |

|

FOR | 40 | |||

| 4. Advisory Vote on the Frequency of Future Advisory Votes on Named Executive Officer Compensation |

|

1 YEAR | 41 | |||

|

AGAINST | 88 | ||||

| CBRE 2023 PROXY STATEMENT | PROXY SUMMARY | 2 |

Our Corporate Strategy

We aspire to be a world-class company by consistently delivering outcomes for clients and other stakeholders that they cannot get elsewhere. Fundamental to realizing this aspiration is having globally leading lines of business supported by a superior platform. We are focused on enabling our aspiration by:

| 1. |

2. | |

| Creating products that are demonstrably superior to those of our competitors and delivering them to internal and external customers |

Focusing on our strategic priorities: • Build on lines of business organically and through targeted capital investments • Execute focused strategic bets beyond our core activities that provide opportunities for rapid growth and differentiation • Establish our platform* as a growth accelerator • Improve operational efficiency by developing deeper insights and managing costs prudently | |

* CBRE platform consists of strategy, data, technology, research, people, sustainability, procurement, marketing, communications, corporate development, corporate responsibility, legal, compliance & risk, finance and other disciplines.

Environmental and Social Responsibility

In 2022, we continued to make strides on our environmental, social and governance (ESG) initiatives. As the world’s largest commercial property manager, we believe we are well-positioned to lead our industry in providing market-based climate change solutions that significantly reduce greenhouse gas (GHG) emissions. We developed our Net Zero Roadmap for Corporate Operations to help us achieve our interim science-based targets to reduce our GHG emissions by 2035 and reach our net zero by 2040 goal. Key initiatives include a goal of working toward purchasing 100% renewable energy for our offices and electrifying our vehicle and equipment fleet.

Driving progress on diversity, equity and inclusion at CBRE and in the broader commercial real estate industry is a company-wide priority. In 2022, we spent more than $1.5 billion with diverse suppliers as we work toward our pledge to spend $3 billion with diverse suppliers by the end of 2025. We also partner with organizations through time, talent and funding to expand commercial real estate career opportunities for individuals underrepresented in our industry.

We are committed to providing transparent, meaningful sustainability information to stakeholders and publish information on Sustainability Accounting Standards Board (SASB, now integrated into International Sustainability Standards Board (ISSB)) and Task Force on Climate-related Financial Disclosures (TCFD) in our Corporate Responsibility Report (CR Report). In addition, our CR Report was prepared in accordance with the Global Reporting Initiative (GRI) Standards and we have participated in the United Nations Global Compact (UNGC) and supported its Ten Principles since 2007.

To learn more about our ESG efforts, please view our Corporate Responsibility Report at www.cbre.com/responsibility. The information contained on or available through this website is not a part of, or incorporated by reference into, this Proxy Statement.

| CBRE 2023 PROXY STATEMENT | PROXY SUMMARY | 3 |

Awards & Recognition

In 2022 and early 2023, we were recognized with the following awards and accolades:

| MOST ADMIRED REAL ESTATE COMPANY

Fortune Magazine, four of past five years, including 2023 |

MOST RECOGNIZED COMMERCIAL REAL ESTATE BRAND

Lipsey Company Survey, 22nd consecutive year, including 2023 |

WORLD’S MOST ETHICAL COMPANY Ethisphere Institute, 10th consecutive year, including 2023 | ||||||

| INCLUDED IN THE DOW JONES SUSTAINABILITY WORLD INDEX

Only commercial real estate provider for four consecutive years |

LISTED IN THE BLOOMBERG GENDER EQUALITY INDEX

For four consecutive years, including 2023 |

4TH MOST SUSTAINABLE U.S. COMPANY

Barron’s, making top 100 list for six consecutive years, including 2023 | ||||||

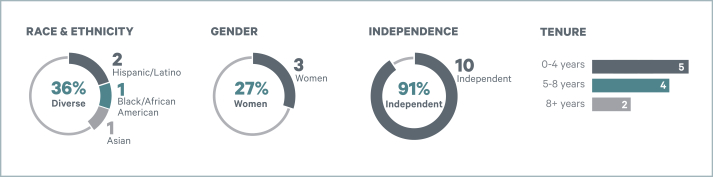

Corporate Governance Highlights

We are committed to good corporate governance, which promotes the long-term interests of stockholders, strengthens Board and management accountability, and helps build public trust in our company. Our governance practices include:

| • | Robust director selection process resulting in a diverse Board in terms of gender, race, ethnicity, experience, skills and tenure |

| • | Independent Board Chair |

| • | 10 out of 11 of our director nominees are independent |

| • | 7 out of 11 of our director nominees are diverse in terms of gender, race or ethnicity |

| • | Annual election of directors |

| • | Majority voting standard for uncontested elections |

| • | Maximum of one Board-nominated management director |

| • | 12-year director term limit |

| • | Board diversity policy to actively seek out women and underrepresented candidates |

| • | No “over-boarding” by our directors on other public-company boards |

| • | Proxy access rights for director nominations |

| • | Stockholder rights to call a special meeting |

| • | Annual Board, committee and individual director evaluations and self-assessments |

| • | Regular executive sessions, where independent directors meet without management present |

| • | Active Board oversight of strategy, risk management and environmental, social and governance matters |

| • | Stock ownership requirements for directors and executive officers |

| • | Policy restricting trading, and prohibiting hedging and short-selling, of CBRE stock |

| • | Compensation clawback policy for executive officers |

| • | Ongoing stockholder outreach and engagement |

| CBRE 2023 PROXY STATEMENT | PROXY SUMMARY | 4 |

Our Board Nominees

Our Board nominees exhibit a mix of skills, experience, diversity and perspectives:

| Name | Age | Director Since |

Principal Occupation | Independent | Committees | Other Public Company Boards | ||||||||||||

|

Brandon B. Boze Board Chair |

42 | 2012 | Partner and President of ValueAct Capital | ● | – Executive (Chair) |

0 | |||||||||||

|

Beth F. Cobert |

64 | 2017 | Acting President of the Markle Foundation | ● | – Compensation (Chair) |

0 | |||||||||||

|

Reginald H. Gilyard |

59 | 2018 | Senior Advisor to The Boston Consulting Group | ● | – Compensation – Corporate Governance and Nominating |

3 | |||||||||||

|

Shira D. Goodman |

62 | 2019 | Advisory Director of Charlesbank Capital Partners | ● | – Audit (Chair) |

1 | |||||||||||

|

E.M. Blake Hutcheson |

61 | 2022 | President and Chief Executive Officer of OMERS | ● | – Audit – Compensation |

1 | |||||||||||

|

Christopher T. Jenny |

67 | 2016 | Chair and Chief Executive Officer of Jennus Innovation | ● | – Corporate Governance and Nominating (Chair) |

0 | |||||||||||

|

Gerardo I. Lopez |

63 | 2015 | Former Executive-in-Residence at Softbank Investment Advisers | ● | – Compensation – Corporate Governance and Nominating – Executive |

2 | |||||||||||

|

Susan Meaney |

63 | 2022 | Senior Advisor to KSL Capital Partners | ● | – Audit – Corporate Governance and Nominating |

1 | |||||||||||

|

Oscar Munoz |

64 | 2020 | Special Advisor to United Airlines Holdings | ● | – Audit – Corporate Governance and Nominating |

2 | |||||||||||

|

Robert E. Sulentic |

66 | 2012 | President and Chief Executive Officer of CBRE | – Executive |

0 | ||||||||||||

|

Sanjiv Yajnik |

66 | 2017 | President of Capital One Financial Services | ● | – Audit – Compensation |

0 | |||||||||||

| Female Directors |

Racially and Ethnically Diverse Directors |

Board Committees Chaired by Women |

Independent Directors | |||

| 27% | 36% | 50% | 91% | |||

| CBRE 2023 PROXY STATEMENT | PROXY SUMMARY | 5 |

2022 Business Highlights

| Revenue | Net Revenue (1) | GAAP Net Income | ||||||

| $30.8B | $18.8B | $1.4B | ||||||

| +11% | +10% | -23% | ||||||

| Core EBITDA (1) | GAAP EPS | Core EPS (1) | ||||||

| $2.9B | $4.29 | $5.69 | ||||||

| +2% | -21% | +7% | ||||||

| 1-Year Total Stockholder Return (2) (as of 12/31/2022) | 3-Year Total Stockholder Return (2) (as of 12/31/2022) | 5-Year Total Stockholder Return (2) (as of 12/31/2022) | ||||||

| -29% | 26% | 78% | ||||||

| vs. -18% for S&P 500 (-11% underperformance) |

vs. 25% for S&P 500 (+1% outperformance) |

vs. 57% for S&P 500 (+21% outperformance) | ||||||

| (1) | These are non-GAAP financial measures. For definitions and more information, see Annex A of this Proxy Statement. Our Board and management use these non-GAAP financial measures to evaluate our performance and manage our operations. However, non-GAAP financial measures should be viewed in addition to, and not as an alternative for, financial results prepared in accordance with GAAP. The term “GAAP,” as used in this Proxy Statement, means generally accepted accounting principles in the United States. |

| (2) | Inclusive of dividends, assuming reinvestment. |

Company Performance and Financial Highlights

2022 was a challenging year for the commercial real estate sector. The year started with strong momentum and we achieved our highest-ever trailing-twelve-month revenue, earnings and free cash flow through the second quarter of 2022. Commercial real estate transaction activity, particularly capital markets activity, slowed significantly in the second half of the year as long-term interest rates more than doubled and credit availability contracted dramatically. Despite these macroeconomic pressures, we were able to achieve core earnings per share growth of 7% for full year 2022. This outcome was driven by several of the more cyclically resilient elements of our business, like outsourcing and property management, and others that are secularly favored such as project management, which continued to grow in the second half of 2022.

Our 2022 financial performance was further supported by disciplined asset allocation. During the year we invested approximately $2.1 billion in share repurchases (repurchasing approximately 22.9 million shares), infill M&A and other strategic investments. Due to our strong free cash flow, we were able to make these investments while still ending the year with virtually no net leverage.

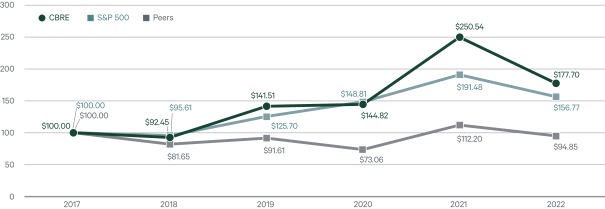

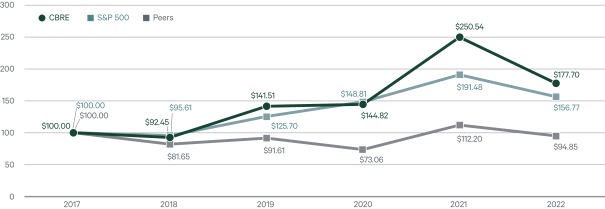

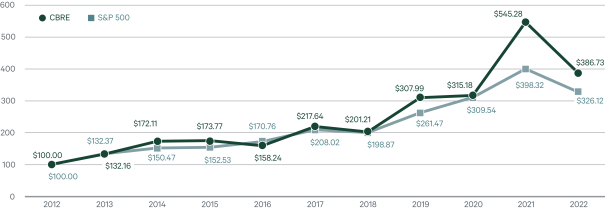

Our share price fell from an all-time high at the outset of 2022, emulating the downward trend in global equity markets amid concerns about rising interest rates and constrained liquidity. Our share price performance, however, did significantly outperform our peer group during 2022, reflecting our financial strength and competitive position within the industry. Despite the decline in 2022, our share price has outperformed the S&P 500 and our peer group over the last 5 years by 34% and 59%, respectively.

| CBRE 2023 PROXY STATEMENT | PROXY SUMMARY | 6 |

| Comparison of 5-Year Cumulative Total Return(1) among CBRE Group, Inc., the S&P 500 Index(2) and Peer Group(3)

|

| (1) | $100 invested on December 31, 2017 in stock or index-including reinvestment of dividends, fiscal year ending December 31. |

| (2) | Copyright© 2022 Standard & Poor’s, a division of S&P Global. All rights reserved. |

| (3) | Peer group contains companies with the following ticker symbols: JLL, CIGI, CWK, ISS, MMI, NMRK, SVS.L (London) and WD. |

Executive Compensation Highlights

Our Pay-for-Performance Compensation Philosophy

Our executive compensation program is designed to:

| • | Align pay and performance; |

| • | Reinforce our corporate strategy; |

| • | Attract and retain accomplished and high-performing executives; and |

| • | Motivate those executives to consistently achieve short- and long-term goals to further our corporate strategy. |

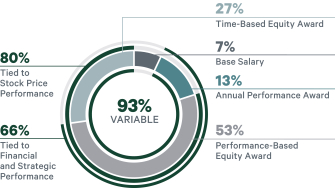

To do this, we focus a significant percentage of our executive officers’ compensation on both annual and long-term incentive awards intended to drive growth in our business and in our share price in the short- and long-term, with a relatively modest portion of compensation paid in fixed base salary.

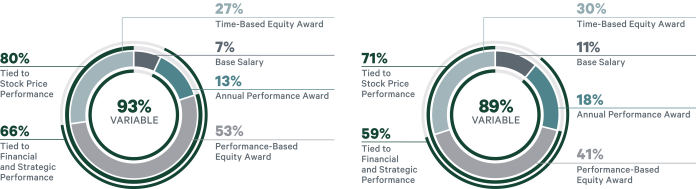

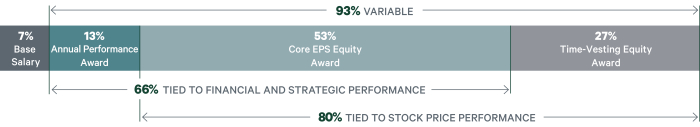

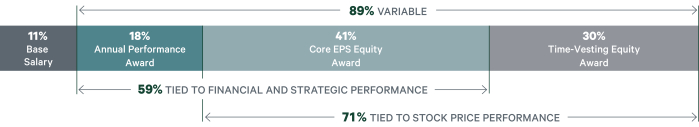

2022 Total Target Direct Compensation Mix

The total 2022 target direct compensation mix (which excludes the 2022 CEO Strategic Equity Award) for our Chief Executive Officer (“CEO”) is shown here:

| CEO Target Compensation Mix

|

| CBRE 2023 PROXY STATEMENT | PROXY SUMMARY | 7 |

2022 Performance and NEO Compensation

In 2022, we achieved solid financial performance, despite the more than doubling of long-term interest rates, sharp equity market decline and the credit crunch that constrained investment activity for most of the second half. The tougher operating environment led to reduced cash bonuses for nearly all of our named executive officers. Compared with annual cash bonus targets, 2022 cash bonuses awarded to our named executive officers averaged 98% of target, and ranged from 92.4% to 106.2%. One bonus was paid at more than 100% of target, reflecting the resilience of Global Workplace Solutions business.

2021 Core EPS Awards, which were based on our two-year cumulative Core EPS performance during 2021 and 2022, were earned at 200% of target, due to the company’s strong performance in 2021, when revenue, net revenue, earnings and free cash flow all reached all-time highs.

In February 2022, after taking into consideration the company’s performance over multiple years and Mr. Sulentic’s significant contributions during his tenure as CEO, the Compensation Committee increased Mr. Sulentic’s total target annual compensation for 2022 to $18,500,000, comprised of a $1,250,000 base salary, $2,500,000 target performance award and $14,750,000 in a target equity award. In March 2023, as part of the annual target compensation review, the Committee determined that Mr. Sulentic’s total target annual compensation for 2023 will remain the same as for 2022, with no further increases to his target compensation.

In addition, the Committee awarded Mr. Sulentic a one-time strategic equity award (“2022 CEO Strategic Equity Award”) with target grant value of $7,500,000 and a five-year cliff vesting period. Including the 2022 CEO Strategic Equity Award, 95% of Mr. Sulentic’s 2022 compensation package is tied to financial and strategic performance measures and/or total stockholder return. The Committee previously offered Mr. Sulentic a significant strategic equity award in 2017, which Mr. Sulentic declined. Notwithstanding the fact that Mr. Sulentic did not participate in the 2017 program, at that time, Mr. Sulentic entered into the same Restrictive Covenants Agreement with the company as our other named executive officers. Concurrent with the 2022 CEO Strategic Equity Award, Mr. Sulentic voluntarily extended the term of his Restrictive Covenant Agreement through December 31, 2026.

As part of the annual target compensation review, the total annual compensation targets for each of our other named executive officers (except Ms. Giamartino) were also increased to align their compensation with market levels. Ms. Giamartino’s target compensation was not increased because her compensation had been adjusted in late 2021 upon her promotion to Chief Financial Officer.

2022 NEO Total Annual Compensation

Set forth below is the 2022 annual compensation for our named executive officers. The table below differs from the total compensation reported in the Summary Compensation Table in that it excludes the strategic equity awards granted to Mr. Sulentic.

| Name and Principal Position |

Year | Salary ($) |

Bonus ($) |

Annual Stock ($) |

Non-Equity Incentive Plan Compensation ($) |

All Other Compensation ($) |

Total ($) |

|||||||||||||||||||||

| Robert E. Sulentic President and Chief Executive Officer |

2022 | 1,167,500 | — | 14,749,919 | 2,477,350 | 6,000 | 18,400,769 | |||||||||||||||||||||

| Emma E. Giamartino Chief Financial Officer |

2022 | 680,000 | — | 1,819,920 | 965,940 | 6,000 | 3,471,860 | |||||||||||||||||||||

| Chandra Dhandapani Chief Executive Officer, |

2022 | 737,500 | — | 3,116,344 | 1,168,623 | 4,308 | 5,026,775 | |||||||||||||||||||||

| John E. Durburg Chief Executive Officer, |

2022 | 756,250 | — | 4,064,936 | 1,072,389 | 6,000 | 5,899,575 | |||||||||||||||||||||

| Daniel G. Queenan Chief Executive Officer, |

2022 | 756,250 | — | 4,064,936 | 1,077,155 | 6,000 | 5,904,341 | |||||||||||||||||||||

| Michael J. Lafitte Former Global Group President, CBRE Client Care and CEO, Trammell Crow Company |

2022 | 765,000 | — | 4,064,936 | 1,160,000 | 6,000 | 5,995,936 | |||||||||||||||||||||

| (1) | Annual Stock Awards Column Does not include a Strategic Equity Award granted to Mr. Sulentic in the amount of $7,500,000. |

| CBRE 2023 PROXY STATEMENT | PROXY SUMMARY | 8 |

Forward-Looking Statements

This Proxy Statement contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including statements regarding the company’s sustainability and social responsibility targets, strategies and goals. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the company’s actual results and performance in future periods to be materially different from any future results or performance suggested in forward-looking statements in this Proxy Statement. Any forward-looking statements speak only as of the date of this Proxy Statement and, except to the extent required by applicable securities laws, the company expressly disclaims any obligation to update or revise any of them to reflect actual results, any changes in expectations or any change in events. If the company does update one or more forward-looking statements, no inference should be drawn that it will make additional updates with respect to those or other forward-looking statements. Readers are urged to carefully review and consider the various disclosures made in the company’s Annual Report for the year ended December 31, 2022, particularly those under the captions “Cautionary Note on Forward-Looking Statements,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as in the company’s press releases and other periodic filings with the SEC.

This Proxy Statement contains certain voluntary disclosures regarding our sustainability and social responsibility goals and related matters because we believe these matters are of interest to our investors; however, we do not believe these disclosures are “material” as that concept is defined by or construed in accordance with the securities laws or any other laws of the U.S. or any other jurisdiction, or as that concept is used in the context of financial statements and financial reporting. These disclosures speak only as of the date on which they are made, and we undertake no obligation and expressly disclaim any duty to correct or update such disclosures, whether as a result of new information, future events or otherwise, except as required by applicable law.

| CBRE 2023 PROXY STATEMENT | TABLE OF CONTENTS | 9 |

Table of Contents

| 10 | ||||

| 10 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 18 | ||||

| 19 | ||||

| 21 | ||||

| 22 | ||||

| 23 | ||||

| 23 | ||||

| 23 | ||||

| 23 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

| 25 | ||||

| 26 | ||||

| 27 | ||||

| 28 | ||||

| 35 | ||||

| Proposal 2: Ratify Appointment of Independent Registered Public Accounting Firm | 37 | |||

| 38 | ||||

| 38 | ||||

| 38 | ||||

| Proposal 3: Advisory Vote on Executive Compensation | 40 | |||

| CBRE 2023 PROXY STATEMENT | CORPORATE GOVERNANCE — GOVERNANCE HIGHLIGHTS | 10 |

Corporate Governance

Our Corporate Governance framework is designed to strengthen the Board of Directors’ oversight of management and to serve the long-term interests of our stockholders, employees and other stakeholders. Governance is a continuous focus for us, starting with our Board and committees of the Board that meet several times throughout the year, and extending to management and our employees. We are committed to maintaining the highest standards of business conduct and corporate governance.

Governance Highlights

Corporate Governance

| • | Robust director selection process resulting in a diverse Board in terms of gender, race, ethnicity, experience, skills and tenure |

| • | 11 director nominees, 10 of whom are independent |

| • | Director Term Limits (12 years) |

| • | Independent Board Chair |

| • | Board diversity policy to actively seek out women and underrepresented candidates |

| • | Active Board oversight of strategy, risk management and environmental, social and governance matters |

| • | Annual Board, committee and individual director evaluations and self-assessments |

| • | Maximum of one Board-nominated management director |

| • | Robust Standards of Business Conduct and governance policies |

| • | No “over-boarding” by our directors on other public-company boards |

Compensation

| • | Pay-for-performance compensation program, which includes performance-based equity grants |

| • | Annual “say on pay” votes, with most recent favorable “say on pay” vote of approximately 94% |

| • | Stock ownership requirements for directors and executive officers |

| • | Policy restricting trading, and prohibiting hedging and short-selling, of CBRE stock |

| • | Compensation clawback policy for executive officers |

Stockholder Rights

| • | Annual election of all directors |

| • | Majority voting requirement for directors in uncontested elections |

| • | Stockholder rights to call special meetings |

| • | No poison pill takeover defense plans |

| • | Stockholders may act by written consent |

| • | Proxy access for director nominations |

| • | Ongoing stockholder outreach and engagement |

| Corporate Governance Materials

The following materials, along with other Governance documents, are available on our website, https://ir.cbre.com/governance/governance-documents/default.aspx.

| ||

| • Standards of Business Conduct

• Corporate Governance Guidelines

• Policy Regarding Transactions with Interested Parties

• Whistleblower Policy

• Equity Award Policy

• Anti-Corruption Policy

• Charter, By-laws and Board Committee Charters

|

These materials are also available in print to any person, without charge, by emailing us at investorrelations@cbre.com or by written request to:

Investor Relations Department CBRE Group, Inc. 2100 McKinney Avenue, Suite 1250 Dallas, Texas 75201 | |

| CBRE 2023 PROXY STATEMENT | CORPORATE GOVERNANCE — GOVERNANCE HIGHLIGHTS | 11 |

Governance Policies & Practices

Standards of Business Conduct. Our Board has adopted a Standards of Business Conduct applicable to all directors, officers and employees that states our corporate values and ethical standards, including our commitment to respect, integrity, service and excellence. We are firmly committed to conducting business with the highest integrity and in compliance with the letter and spirit of the law. If the Board grants any waivers from the Standards of Business Conduct to any of our directors or executive officers, or if we amend such policies, we will, if required, disclose these matters through the Investor Relations section of our website on a timely basis.

Corporate Governance Guidelines. Our Board has adopted Corporate Governance Guidelines, which provide a framework within which our Board, assisted by its committees, directs our affairs.

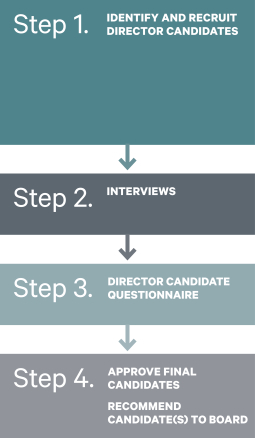

Board Diversity Policy. As part of the search process for a new director, the Corporate Governance and Nominating Committee of our Board, or Governance Committee, will actively seek out women and underrepresented candidates to include in the pool from which Board nominees are chosen and will instruct any search firm engaged for the search to provide a set of candidates that includes both underrepresented people of color and different genders.

Director Overboarding Policy. Our directors who are public company executive officers may serve on no more than two public company boards (including the company’s Board). Directors that are not public company executive officers may serve on no more than five public company boards (including the company’s Board), or to the extent such director is the chair or lead independent director of a public company board, then no more than four public company boards (including the company’s Board). Consideration is also given to the nature of and time involved in a director’s service on other boards (including public company leadership roles) and other outside commitments.

Policy Regarding Transactions with Interested Parties and Corporate Opportunities. Our Board has adopted a related-party transactions and corporate opportunities policy that directs our Audit Committee to review and approve, among other things, potential conflicts of interest between us and our directors and executive officers.

Whistleblower Policy. We have a Whistleblower Policy that directs our Audit Committee to investigate complaints (received directly or through management) regarding:

| • | deficiencies in or noncompliance with our internal accounting controls or accounting policies; |

| • | circumvention of our internal accounting controls; |

| • | fraud in the preparation or review of our financial statements or records; |

| • | misrepresentations regarding our financial statements or reports; |

| • | violations of legal or regulatory requirements; and |

| • | retaliation against whistleblowers. |

Equity Award Policy. We have an Equity Award Policy that is designed to maintain the integrity of the equity award process and to ensure compliance with all applicable laws. The Equity Award Policy sets forth the procedures that must be followed in connection with employee awards. Our Equity Award Policy is described in greater detail under the heading “Compensation Discussion and Analysis—Section 6. Compensation Policies and Practices.”

Anti-Corruption Policy. Our global Anti-Corruption Policy contains strict prohibitions on any employee or agent of the company offering or providing anything that could be perceived as a bribe to gain or maintain any business advantage.

Compensation Clawback Policy. We have a policy that permits us, subject to the discretion and approval of our Board, to recover cash-based and performance-based-equity incentive compensation paid to any current or former “Section 16 officer” if there is a restatement of our financial results in certain circumstances. These circumstances are described in greater detail under “Compensation Discussion and Analysis—Section 6. Compensation Policies and Practices.” We intend to amend our policy as necessary to comply with the Securities and Exchange Commission’s (SEC) recently finalized rules on clawbacks once the New York Stock Exchange (NYSE) has adopted its related listing standards.

| CBRE 2023 PROXY STATEMENT | CORPORATE GOVERNANCE — STOCK OWNERSHIP REQUIREMENTS | 12 |

Stock Ownership Requirements

In order to align the interests of our executives and Board members with the interests of our stockholders, the Compensation Committee has adopted executive officer stock ownership requirements that are applicable to all of our Section 16 officers and our Board has adopted stock ownership requirements for non-employee directors.

Executive Officers

Our executive officers have a minimum common stock ownership requirement of two to five times their annual base salary. Our CEO’s minimum ownership requirement is five times his annual base salary and each other NEO’s minimum ownership requirement is three times their annual base salary. If at any time an executive officer’s equity holdings do not satisfy these minimum ownership requirements, depending on his or her position, the executive must retain 100% (for our CEO) or 75% (for our other named executive officers) of the shares remaining after payment of taxes and exercise price upon the exercise of stock options or upon the vesting of restricted stock or the settlement of vested restricted stock units, as applicable.

Shares that count toward compliance with the requirements include:

| • | shares owned outright (either directly or indirectly); |

| • | shares issued upon the settlement of vested restricted stock units; and |

| • | allocated shares in other company benefit plans. |

Shares that do not count toward achievement of the requirements include:

| • | unexercised outstanding stock options (whether or not vested); and |

| • | unvested/unearned restricted stock and restricted stock units. |

Non-Employee Directors

Each non-employee director has a minimum common stock ownership requirement of five times the value of the annual stock grants made by us to the non-employee director pursuant to our director compensation plan. If at any time the common stock ownership requirement is not satisfied, the director must retain 100% of the shares remaining after payment of taxes and exercise price upon exercise of stock options, the vesting of restricted stock or the settlement of vested restricted stock units, as applicable.

Shares that count toward compliance with the requirements include:

| • | shares owned outright by the director (either directly or beneficially, e.g., through a family trust); and |

| • | shares issued upon the settlement of vested restricted stock units. |

Shares that do not count toward achievement of the requirements include:

| • | shares held by mutual or hedge funds in which the non-employee director is a general partner, limited partner or investor; |

| • | unexercised outstanding stock options (whether or not vested); |

| • | unvested/unearned restricted stock units or restricted stock; and |

| • | shares transferred to a non-employee director’s employer pursuant to such employer’s policies. |

Board Structure and Leadership

Our Board currently consists of 11 directors, all of whom have been nominated for re-election.

All of our directors are elected at each annual meeting of stockholders and hold office until the next election. Our Board has authority under our by-laws to fill vacancies and to increase or, upon the occurrence of a vacancy, decrease its size between annual meetings of stockholders.

Since 2001, we have separated the roles of CEO and Chair of the Board in recognition of the differences between the two positions. Our CEO is responsible for setting the strategic direction and overseeing the day-to-day leadership and performance of the company. The Chair of our Board, who is independent of management, provides oversight and guidance to our CEO.

Director Independence

Under our Board’s Corporate Governance Guidelines and the listing standards of the NYSE, our Board must consist of a majority of independent directors. In addition, all members of the Audit Committee, Compensation Committee and Governance Committee must be independent directors as defined by our Corporate Governance Guidelines and NYSE listing standards. Members of the Compensation Committee must also meet applicable NYSE independence requirements for compensation committee members, and members of the Audit Committee must further satisfy a separate SEC independence requirement, which generally provides that they may not (i) accept directly or indirectly any consulting, advisory or other compensatory fee from us or any of our subsidiaries, other than their compensation as directors or members of the Audit Committee or any other committees of our Board or (ii) be an affiliated person of ours.

Our Board regularly conducts a review of possible conflicts of interest and related-party transactions through the use of questionnaires, director self-reporting and diligence conducted by management. This review includes consideration of any investments and agreements between directors and their related persons and the company, including those described under “Related-Party Transactions” in this Proxy Statement, and such person’s beneficial ownership of our securities. The Board has determined that 91% of our director nominees (all except for Mr. Sulentic) are independent in accordance with NYSE listing standards and our Board’s Categorical Independence Standards that it has adopted relating to our director independence. These Categorical Independence Standards are posted on the Corporate Governance section of the Investor Relations page on our website at www.cbre.com. The information contained on or available through this website is not a part of, or incorporated by reference into, this Proxy Statement.

| CBRE 2023 PROXY STATEMENT | CORPORATE GOVERNANCE — BOARD MEETINGS AND COMMITTEES | 13 |

Board Meetings and Committees

Our Board held six meetings during fiscal year 2022 to review significant developments, engage in strategic planning and act on matters requiring Board approval. In 2022, each incumbent director attended at least 75% of our Board meetings and meetings of committees on which he or she served (taken in the aggregate) during the period that he or she served thereon.

Our Board currently has four standing committees that met or acted by written consent during fiscal year 2022: the Audit Committee, the Compensation Committee, the Governance Committee and the Executive Committee.

The following table describes the current members of each of the committees of our Board, and the number of meetings held during fiscal year 2022:

| Director |

Board | Audit | Compensation | Governance | Executive | |||||

| Brandon B. Boze |

CHAIR |

|

|

|

CHAIR | |||||

| Beth F. Cobert |

● |

|

CHAIR |

|

| |||||

| Reginald H. Gilyard |

● |

|

● | ● |

| |||||

| Shira D. Goodman |

● | CHAIR |

|

|

| |||||

| E.M. Blake Hutcheson |

● | ● | ● |

|

| |||||

| Christopher T. Jenny |

● |

|

|

CHAIR |

| |||||

| Gerardo I. Lopez |

● |

|

● | ● | ● | |||||

| Susan Meaney |

● | ● |

|

● |

| |||||

| Oscar Munoz |

● | ● |

|

● |

| |||||

| Robert E. Sulentic |

● |

|

|

|

● | |||||

| Sanjiv Yajnik |

● | ● | ● | |||||||

| Number of Meetings |

6 | 9 | 3 | 4 | 0(1) | |||||

| (1) | Our Executive Committee did not hold any formal meetings in 2022, but acted four times by unanimous written consent. |

Each committee (other than the Executive Committee) is composed entirely of directors whom our Board has determined to be independent under current NYSE standards. Each committee operates under a charter approved by our Board that sets out the purposes and responsibilities of the committee and that are published in the Corporate Governance section of the Investor Relations page on our website at www.cbre.com. In accordance with our Board’s Corporate Governance Guidelines, our Board and each of the Audit Committee, Compensation Committee and Governance Committee conducts an annual performance self-assessment with the purpose of increasing the effectiveness of our Board and its committees. The responsibilities of our Board committees are described below.

Board Attendance at Annual Meeting of Stockholders

Although the Board understands that there may be situations that prevent a director from attending an annual meeting of stockholders, it is the Board’s policy that all directors should attend these meetings. All of our then-serving directors attended our 2022 annual meeting of stockholders on May 18, 2022.

Independent Director Meetings

Our non-management directors meet in executive session without management present each time the full Board convenes for a regularly scheduled meeting. If our Board convenes for a special meeting, the non-management directors will meet in executive session if circumstances warrant. The Chair of our Board is a non-management director that presides over executive sessions of our Board.

| CBRE 2023 PROXY STATEMENT | CORPORATE GOVERNANCE — BOARD MEETINGS AND COMMITTEES | 14 |

Board Committees

In 2022, as part of an evaluation of directors’ time commitments, the Board implemented a new policy limiting committee chairs to service on one committee. Given the elevated responsibilities of its committee chairs, the Board believes that this new policy will increase director effectiveness and provide opportunities for new directors to take on more responsibility, while maintaining an appropriate committee size.

| Audit Committee | Chair: Shira D. Goodman |

Members: E.M. Blake Hutcheson Susan Meaney Oscar Munoz* Sanjiv Yajnik* | ||

The Audit Committee provides oversight of our accounting and financial reporting and disclosure processes, the adequacy of the systems of disclosure and internal control established by management, our compliance with legal and regulatory requirements and the audit of our financial statements.

THE AUDIT COMMITTEE ALSO:

| • | Retains, compensates, oversees and terminates the independent auditor and evaluates its qualifications, independence and performance; |

| • | Pre-approves all audit and any non-audit services performed by the independent auditor; |

| • | Reviews the results of the independent audit and internal audits as well as reports from our Chief Financial Officer, our Chief Accounting Officer, our Chief Ethics & Compliance Officer, our Head of Internal Audit, our Head of SOX compliance, our Chief Digital & Technology Officer and our General Counsel and Chief Risk Officer; |

| • | Reviews the independent auditor’s report describing our internal quality-control procedures and any material issues raised by the most recent internal quality-control review or any inquiry by governmental authorities; |

| • | In consultation with the independent auditor, management and internal auditors, reviews the integrity of our internal and external financial reporting processes; |

| • | Reviews financial statements and earnings releases and guidance provided to analysts and rating agencies; |

| • | Reviews the Chief Ethics & Compliance Officer’s report on the effectiveness of our compliance with applicable ethical, legal, and regulatory requirements; |

| • | Reviews our cybersecurity readiness and other policies and procedures related to data governance; |

| • | Establishes procedures to handle complaints regarding accounting, internal controls or auditing matters; and |

| • | Oversees the company’s major financial, cybersecurity and information technology risk exposures. |

All members of the Audit Committee are “financially literate” under NYSE listing standards.

* These two directors meet the SEC’s qualifications for an “audit committee financial expert.”

All members of the Audit Committee are independent within the meaning of SEC regulations, the listing standards of the NYSE and our Board’s Corporate Governance Guidelines, in each case, as such regulations, standards and guidelines apply to audit committee members.

| Compensation Committee | Chair: Beth F. Cobert |

Members: Reginald H. Gilyard E.M. Blake Hutcheson Gerardo I. Lopez Sanjiv Yajnik | ||

The Compensation Committee oversees the development and administration of our executive compensation policies, plans and programs, including reviewing and approving compensation of our executive officers and any compensation contracts or arrangements with our executive officers.

IN ADDITION, THE COMPENSATION COMMITTEE:

| • | Reviews the performance of our executive officers, including our CEO; |

| • | Retains Frederic W. Cook & Co., Inc., or FW Cook, as its independent compensation consultant. FW Cook reports directly to the Committee, attends meetings and provides advice to the Committee; and |

| • | Considers the results of annual stockholder advisory votes on the compensation of our named executive officers in connection with the discharge of its responsibilities. |

| CBRE 2023 PROXY STATEMENT | CORPORATE GOVERNANCE — BOARD MEETINGS AND COMMITTEES | 15 |

Each Compensation Committee member qualifies as a “non-employee director” for purposes of the Securities Exchange Act of 1934, as amended, or the Exchange Act . All members are “independent” under NYSE listing standards applicable to compensation committee members. All members of the Compensation Committee are independent within the meaning of SEC regulations, the listing standards of the NYSE and our Board’s Corporate Governance Guidelines, in each case, as such regulations, standards and guidelines apply to compensation committee members.

| Corporate Governance and Nominating Committee | Chair: Christopher T. Jenny |

Members: Reginald H. Gilyard Gerardo I. Lopez Susan Meaney Oscar Munoz | ||

The Corporate Governance and Nominating Committee oversees our Board’s corporate governance procedures and practices, including:

| • | Developing and recommending to our Board a set of corporate governance principles, including nomination criteria and independence standards; |

| • | Recommendations of individuals for service on our Board; |

| • | Recommendations to our Board regarding the size, composition, structure, operations, performance and effectiveness of the Board; |

| • | Conducting an annual review of director compensation; |

| • | Considering feedback obtained from shareholder outreach; and |

| • | Overseeing annual Board, committee and individual director evaluations and self-assessments. |

All members are “independent” under NYSE listing standards and rules.

| Executive Committee | Chair: Brandon B. Boze |

Members: Gerardo I. Lopez Robert E. Sulentic

| ||

The Executive Committee implements policy decisions of our Board and is authorized to act on our Board’s behalf between meetings of our Board, including by approving certain transactions within dollar thresholds established by our Board.

The Executive Committee also engages in the periodic review of our balance sheet management, borrowings and capital markets activities.

Compensation Committee Interlocks and Insider Participation

None of Ms. Cobert, Messrs. Gilyard, Hutcheson, Lopez and Yajnik (all current members of the Compensation Committee) or Ms. Goodman (who served on the Compensation Committee for a portion of 2022) has ever been an officer or employee of the company or any of its subsidiaries. In addition, during 2022, none of our directors were employed as an executive officer of another entity where any of our executive officers served on that entity’s board of directors or compensation committee (or its equivalent).

| CBRE 2023 PROXY STATEMENT | CORPORATE GOVERNANCE — SELECTED AREAS OF BOARD OVERSIGHT | 16 |

Selected Areas of Board Oversight

Oversight of Risk Management

| The Board oversees risk management. | Full Board

Our Board regularly reviews information regarding our most significant strategic, operational, financial and compliance risks and is responsible for ensuring that the company has crisis management and business continuity plans in place to deal with potential crises. Our Board maintains direct oversight over our enterprise risk management process rather than delegating this function to a Board or management committee.

Although each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board is regularly informed through committee chair reports about such risks. These committee chair reports are presented at every regularly scheduled Board meeting. | |||||||

| ||||||||

| Company management is charged with managing risk through rigorous risk mitigation activities and strong internal controls. | Management

Our Executive Risk Committee is chaired by our Chief Risk Officer and consists of senior executives representing a cross-section of our lines of business, operational areas and geographic regions. Our Executive Risk Committee is responsible for identifying and assessing our most significant risks. After this identification and assessment process, we assign each of our top risks to an executive-level (typically C-suite) risk owner, who is then charged with developing mitigation action plans which are then presented to the Executive Risk Committee.

Multiple times during the year, our Chief Risk Officer provides a detailed presentation on identified significant risks to the Board or a committee of the Board. Certain risks that are determined to be best managed directly by the Board versus management or that are in areas specific to a particular Board committee expertise are monitored and overseen at the Board or committee level as appropriate. | |||||||

| ||||||||

| Board committees, which meet regularly and report back to the full Board, play significant roles in carrying out our Board’s risk oversight function. | The Audit Committee

oversees management of risks related to our financial reports and record-keeping and potential conflicts of interest. They also oversee our risk assessment and risk management processes more generally including major business, financial, information technology risks (including cybersecurity and data security risks), legal and reputational risk exposures, as well as risks related to crisis management and business continuity.

The Audit Committee receives regular reports from our Chief Financial Officer, our Chief Ethics & Compliance Officer, our Head of Internal Audit, our Head of SOX Compliance, our Chief Digital & Technology Officer as well as updates from our General Counsel and Chief Risk Officer on any developments affecting our overall risk profile and on issues of non-compliance and incident management. | |||||||

| The Compensation Committee

is responsible for overseeing the management of risks relating to our compensation plans and arrangements. For additional information regarding the Compensation Committee’s assessment of our compensation-related risks, please see “Compensation Discussion and Analysis—Section 3. How We Make Compensation Decisions—Compensation Risk Assessment.” |

The Governance Committee

manages risks associated with corporate governance practices, investor engagement, Board independence and the composition of our Board and its committees. | |||||||

| CBRE 2023 PROXY STATEMENT | CORPORATE GOVERNANCE — SELECTED AREAS OF BOARD OVERSIGHT | 17 |

Oversight of Strategy

Our Board is responsible for providing governance and oversight over the strategy, operations and management of our company. Each quarter, our Board and management devote a substantial amount of time in strategy-focused meetings discussing strategic issues that are most important to the company. At each regular Board meeting, our Board receives business and strategy updates from leaders across the company and reviews our operating plans and overall financial performance, and provides significant guidance and feedback. Annually, our Board reviews and approves our capital allocation and spending budgets, which are designed to strategically deploy capital intended to facilitate investments required to achieve operational excellence.

Oversight of ESG, Sustainability and Human Capital Management

As part of our Board’s strategic and risk oversight, our Board oversees our ESG strategic planning and risk management policies and procedures. Our Board has made a deliberate decision to retain governance of ESG, sustainability and human capital management matters at the Board level. Our Board chose not to delegate these matters to a specific committee because it believes that these matters are integral to the company’s future success. Throughout the year, our Board receives reports and engages in discussions with management on key ESG and sustainability matters, including progress on sustainability services we provide to clients to meet their commercial real estate sustainability goals, the company’s diversity, equity and inclusion initiatives, and other efforts to be a responsible company in our communities. The Board also receives annual updates on how ESG risk is being addressed, mitigated and managed across the company, including sustainable development considerations that influence market, reputational, operational and political risks.

Oversight of Succession Planning

Our Board reviews management succession and development plans with the CEO on at least an annual basis, and as needed throughout the year. These plans include CEO succession in the event of an emergency or retirement, as well as the succession plans for the CEO’s direct reports and other employees critical to our continued operations and success.

| CBRE 2023 PROXY STATEMENT | CORPORATE GOVERNANCE — INFORMATION TECHNOLOGY/CYBER SECURITY | 18 |

Information Technology/Cyber Security

Information technology and cyber security are critical components of our risk management program. The Audit Committee receives regular, quarterly reports on these matters from our Chief Digital & Technology Officer and our Chief Information Security Officer. These reports include the status of projects to strengthen the company’s security systems and improve cyber readiness, as well as on existing and emerging threat landscapes.

Risk Oversight of IT/Cyber Security

Our information technology and cyber security program is focused on the following areas:

| GOVERNANCE

We operate under an Information Security Management System (“ISMS”) which is clearly defined through specific policies and standards. |

• Policies are owned by senior management to ensure that they are well embedded in the business and all subsequent standards align to the wider business strategy.

• At least annually, these policies are reviewed to ensure they remain relevant.

• Third-party subject matter experts are leveraged across several fields to ensure we maintain an approach that is in line with leading industry recommendations.

• Through our ISMS, we meet or exceed ISO and local legislative frameworks.

| |||

| SECURITY AWARENESS / TRAINING

All employees are required to adhere to our Standards of Business Conduct, which identifies an employee’s responsibility for information security.

|

• We provide annual cyber security training for all employees, as well as additional role-specific information security training.

• Security awareness articles are disseminated periodically throughout the year.

• We sponsor a “Cyber Security Month” in October each year and conduct regular phishing exercises.

| |||

| TECHNICAL SAFEGUARDS

We deploy measures to protect our cloud environments, network perimeter and internal Information Technology platforms. |

Protection measures include:

• internal and external firewalls;

• network intrusion detection and prevention;

• penetration testing;

• vulnerability assessments;

|

• robust SLA-driven patch management processes;

• threat intelligence;

• anti-malware and access controls; plus

• data loss prevention and monitoring.

| ||

| SUPPLIER RELATIONSHIPS

We conduct vendor security reviews for prospective and current third-party suppliers and service providers. |

Vender security reviews evaluate numerous key security controls and the outputs of these reviews are used:

• as part of business decisions regarding procurement;

• to assess their overall security posture relative to a defined set of security criteria; and

• vendor risk assessments are used to assess and influence the security posture of our vendors.

| |||

| INCIDENT RESPONSE PLANS

We maintain and update incident response plans that address the life cycle of a cyber incident and routinely evaluate the effectiveness of such plans.

|

Incident response plans focus on:

• technical issues, including detection, response and recovery;

• cyber threats, with a focus on external communication and legal compliance; and

• breach simulations and penetration testing through internal and external exercises.

| |||

| CERTIFICATIONS

Our security program is audited on an annual basis by an accredited certification body, leading accounting firms and institutional clients.

|

• We have obtained ISO 27001 and ISO 27701 certifications for our Americas, EMEA and APAC and India IT offices.

• We have also certified our platform to SOC1 Type II and SOC2 Type II standards.

• We conduct annual SOX testing and compliance of financial systems.

| |||

| INSURANCE | • We maintain an information security insurance policy to protect our company against computer-related crimes and losses.

| |||

| CBRE 2023 PROXY STATEMENT | CORPORATE GOVERNANCE — ENVIRONMENTAL AND SOCIAL RESPONSIBILITY | 19 |

Environmental and Social Responsibility

We are determined to set the pace for our sector on priority environmental and social topics. We recognize the impact we have on our communities, clients, employees and stakeholders—and our focus areas of corporate responsibility are foundational elements that support our aspiration to grow our business responsibly and sustainably.

Our Chief Responsibility Officer, reporting directly to our Chief Executive Officer, oversees and drives progress on key ESG initiatives and reporting, including diversity, equity and inclusion. In February 2023, we hired a Chief Sustainability Officer who oversees our internal and client-facing environmental sustainability initiatives.

In recognition of our progress in ESG, we are the only commercial real estate services provider included in the Dow Jones Sustainability World Index—a feat that we have accomplished for the past four years. In addition, we rose to #4 on Barron’s 100 Most Sustainable Companies in the U.S. list in March 2023, a list we have made for six consecutive years.

Environmental Sustainability

As the world’s largest manager of commercial properties, we believe that we can play an outsized role reimagining the relationship between the built environment and natural world, including through sustainability services in high demand from our clients. We have developed our Net Zero Roadmap for Corporate Operations, outlining four pathways that will help us realize our goal to achieve net zero carbon emissions by 2040: Buildings, Energy, Transport and Procurement. Each pathway includes strategic objectives that will be delivered through near-term actions and program-level strategies. This is supported by our interim science-based targets to reduce our GHG emissions by 68% for our operations, 67% for our investor client portfolio, and 79% for our occupier client portfolio—all by 2035. Key initiatives include purchasing 100% renewable energy for our offices by the end of 2025 and electrifying our vehicle and equipment fleet by the end of 2035.

Our Commitment to Transparency

We are committed to providing transparent, meaningful sustainability information to stakeholders and have published SASB (now integrated into ISSB) and TCFD-aligned disclosures in our CR Report since 2017 and 2019, respectively. In addition, our report was prepared in accordance with GRI Standards and we have participated in the UNGC and supported its Ten Principles since 2007.

Social Responsibility

People are at the center of our strategy to deliver measurably superior outcomes for clients, and therefore we place a high priority on attracting, retaining and developing the best talent. We champion four key values—Respect, Integrity, Service, Excellence—which serve as the foundation upon which our company is built and as a touchstone for how our employees conduct themselves.

Learning and Development

We prioritize and invest in a range of learning and talent development programs designed to enable employees to thrive at CBRE and build their careers. To this end, we leverage a range of different learning approaches including: webinars, live virtual and in-person training, self-paced digital learning, coaching, mentoring and on-the-job projects. To increase diversity, equity and inclusion awareness and adoption, we have curated a learning path focused on essential topics such as bias in all of its forms, cultural competence, communication, allyship, and accountability, as well as how to engage with colleagues and peers. In 2022, we also developed a new training to foster more inclusive behaviors which will be rolled out in 2023.

Workplace Safety and Wellbeing

We drive a culture where safety and wellbeing are integrated into every business decision. We insist on high global standards and leadership accountability, striving to continually improve safety and wellbeing outcomes. Our wellbeing programs focus on five dimensions: occupational, social, environmental, physical and intellectual. In 2022, we hosted our annual Global Safety and Wellbeing Week, themed “Safe and Well Across Every Dimension.” Our “Be Well” campaign supports employee wellbeing through benefits enhancements, information and resources, an internal podcast series and other engagement programs that received external recognition.

Our Continued Covid-19 Response

We continued to develop and implement many initiatives during the Covid-19 pandemic to promote and ensure the safety and wellbeing of our employees, including:

| • | Adoption of benefit programs to support our people during the Covid-19 pandemic, including regional-specific benefits such as special Covid-19 paid time off (PTO) in the U.S. and Canada to volunteer for Covid-19 relief efforts, receive and recover from vaccination doses, and in some circumstances, for employees required to miss work due to their own Covid-19 illness or to take care of family members without impacting their accrued PTO; |

| • | A Covid-19 Risk Assessment Center, responsible for managing and monitoring positive Covid-19 cases among CBRE employees and advising on Covid-19 topics, such as benefits available, isolation periods, travel bans and return to work; and |

| • | A pandemic crisis management plan leaders used to respond to the pandemic and help build awareness for employees on how to stay safe while working. |

| CBRE 2023 PROXY STATEMENT | CORPORATE GOVERNANCE — ENVIRONMENTAL AND SOCIAL RESPONSIBILITY | 20 |

Commitment to Diversity, Equity and Inclusion (“DE&I”)

We believe our company is at its best when people of different backgrounds and life experiences come together to produce great results for our clients, communities and each other. Our strategic priorities include: increasing the diversity of our workforce, strengthening an inclusive culture where everyone is valued and supported in achieving their full potential, and investing in the communities where we live and work. We have many programs and initiatives focused on driving these outcomes. These include building a diverse talent pool and interview process, collaborating with partners to expand career opportunities for talent underrepresented in our industry, and enhancing data analysis and improving technological capabilities to better inform decisions.

We are committed to driving economic impact in the marketplace through our supplier diversity initiatives and spent more than $1.5 billion with diverse suppliers in 2022, with a goal to lift that annual spend to $3.0 billion by the end of 2025. Also, as part of our Community Impact Initiative, we made significant financial contributions to nonprofit organizations that are helping to improve education and career development opportunities for women, racial and ethnic minorities, people with disabilities, individuals who identify as LGBTQ+, and people with military service. These efforts will help to build the pipeline of talent well into the future and enable our workforce to reflect the diversity of our communities. Our employee business resource groups have more than 19,000 members globally and are an essential element of our DE&I activities. They facilitate career and professional development sessions, create networking opportunities, and organize conversations and events on DE&I issues.

We publicly report demographics, including diversity data contained in our EEO-1 Submission, for our U.S. workforce in our CR Report.

Our policies and practices have earned the company a place in the Bloomberg Gender-Equality Index for four consecutive years, the Human Rights Campaign’s Corporate Equality Index for nine consecutive years, the Disability Equality Index, and recognition from the National Minority Supplier Development Council and the Women’s Business Enterprise National Council.

Employee Engagement

Employee engagement is imperative because people are at the center of our strategy. As a services organization, our ability to engage our employees is critical in achieving our goals. Employee engagement is tied to several key organizational outcomes: employee retention; absenteeism and wellness; productivity; safety; client satisfaction and retention; revenue growth and stockholder returns.

In March 2022, we partnered with an external vendor for the fifth time to conduct a worldwide employee engagement survey. CBRE’s “Your Voice” Employee Engagement Survey provided all employees an opportunity to provide confidential feedback about their work experiences. The 2022 survey had a response rate of 83% globally and our results showed an increase in overall employee engagement, up from the previous year. We had top and improved scores in areas of safety and wellbeing; ethics and compliance; diversity, equity and inclusion; supervisor management; client focus; and operating as a socially and environmentally responsible organization. Company leaders are committed to making further gains in these and other key areas through action plans based on employee feedback, and we plan to continue measuring our progress in future surveys.

Communities and Giving

We are committed to supporting and adding value to the communities where our employees live and work around the world, as well as in communities where the need is greatest. In 2022, we launched fundraising programs to support refugees from Ukraine, including affected employees of our Ukraine affiliate, and victims of hurricanes, fires and floods. Our total charitable giving, including employee donations, totaled more than $19 million in 2022, including our Community Impact Initiative, first launched in 2021. We align our philanthropy with the company’s overarching ESG priorities and focus on three main areas: driving climate action solutions, building the workforce of tomorrow by expanding opportunities for underrepresented individuals in our industry and improving our global headquarters city of Dallas. We also encourage our employees to give back by volunteering in our communities.

Public Policy & Political Participation

We prohibit the use of company funds for contributions to political candidates, political parties, or candidate campaigns and we do not have a political action committee. We recognize, however, that some laws might have a significant impact on the quality of services we offer to our clients, our employees in the workplace and the local communities we serve. Our legislative outreach and targeted lobbying activities focus on educating policymakers through data-driven research about the commercial real estate industry with the goal of helping legislators create fact-based, informed policy. We have retained professional lobbyists for local- and state-focused issues such as land use entitlement, business development, community relations, and state-level legislative and administrative rulemaking.

In 2022, we continued to improve our lobbyist tracking and compliance program in the U.S. to maintain a record of company-wide lobbying expenditures to enhance transparency and adhere to the highest ethical standards. Because of these efforts, we were recognized for being in the 90th percentile on the Center for Political Accountability Zicklin Index of Corporate Political Disclosure and Accountability.

| CBRE 2023 PROXY STATEMENT | CORPORATE GOVERNANCE — STOCKHOLDER ENGAGEMENT | 21 |

| Awards and Recognition

In 2022 and in early 2023, our ESG efforts were recognized with the following awards and accolades: | ||

| • We were named to the Dow Jones Sustainability World Index in December 2022 for the fourth year in a row and included in the Dow Jones Sustainability Index – North America for the ninth year in a row. Inclusion in these indexes are based on an assessment of a company’s financially material ESG factors.

• In 2023, for the 10th consecutive year, we were named as one of the World’s Most Ethical Companies by Ethisphere, a global leader in defining and advancing the standards of ethical business practices.

• In 2023, we were listed #4 on Barron’s list of the 100 Most Sustainable Companies in the U.S., we have made the top 100 list for six consecutive years. The 1,000 largest U.S. publicly held companies were considered for this recognition based on various environmental, social and governance performance indicators.

|

• We were included in the 3BL Media 100 Best Corporate Citizens list in 2022 for the fourth year in a row, which recognizes outstanding environmental, social and governance transparency and performance.

• We earned a place in the 2023 Bloomberg Gender-Equality Index (“GEI”) for the fourth straight year. The public companies in the Bloomberg GEI support gender equality through policy development, representation and transparency.

• We were named a Best Place to Work for LGBTQ+ Equality according to the Human Rights Campaign. CBRE received a perfect score on the 2022 Corporate Equality Index, a national benchmarking survey and report on corporate policies and practices related to LGBTQ+ workplace equality, for the ninth consecutive year.

• We received a 2023 EPA ENERGY STAR® Partner of the Year – Sustained Excellence Award, marking the 16th consecutive year of ENERGY STAR recognition.

| |

To learn more about our ESG efforts, please view our Corporate Responsibility Report at www.cbre.com/responsibility. The information contained on or available through this website is not a part of, or incorporated by reference into, this Proxy Statement.

Stockholder Engagement

We believe that engagement with our stockholders provide us with a valuable understanding of our stockholders’ perspectives and meaningful opportunities to share our views with them.

Throughout the year, management and members of our Board engage with a significant portion of our stockholders through a variety of forums. Our interactions cover a broad range of governance, financial and business topics. Stockholder feedback is regularly provided to the Board and the company’s management.

A brief description of our stockholder engagement efforts are outlined below.

| How We Engage

• Quarterly earning calls

• Investor conferences

• Annual Shareholder Meeting

• Stockholder Outreach Program |

2022 Engagements

• As part of stockholder outreach program, we extended invitations to engage to institutional shareholders holding in the aggregate over 60% of our shares to discuss governance matters

• We met with shareholders representing more than 45% of shares outstanding

| |||

| How We Communicate

• Annual Report

• Proxy Statement

• SEC filings

• Press releases

• Company website

• Corporate Responsibility Report |

2022 Engagement Topics

• Strategy and execution

• Board refreshment

• Compensation practices

• Risk oversight, stockholder rights

• Sustainability, human capital

• Material weakness remediation | |||

| CBRE 2023 PROXY STATEMENT | CORPORATE GOVERNANCE — STOCKHOLDER ENGAGEMENT | 22 |

Communications with our Board

Stockholders and other interested parties may write to the Board Chair (who acts as the lead independent director), the entire Board or any of its members by:

|

Mail:

CBRE Group, Inc. c/o Laurence H. Midler, Executive Vice President, General Counsel, Chief Risk Officer and Secretary 2100 McKinney Avenue, Suite 1250 Dallas, Texas 75201 |

|

Email:

to larry.midler@cbre.com. | |||

The Board considers stockholder questions and comments to be important and endeavors to respond promptly and appropriately, even though the Board may not be able to respond to all stockholder inquiries directly.