UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

CBRE Group, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1. | Title of each class of securities to which transaction applies:

| |||

| 2. | Aggregate number of securities to which transaction applies:

| |||

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| 4. | Proposed maximum aggregate value of transaction:

| |||

| 5. | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials: |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1. | Amount Previously Paid:

| |||

| 2. | Form, Schedule or Registration Statement No.:

| |||

| 3. | Filing Party:

| |||

| 4. | Date Filed:

| |||

400 South Hope Street, 25th Floor

Los Angeles, California 90071

(213) 613-3333

April 4, 2017

Dear Fellow Stockholder:

On behalf of the Board of Directors and management of CBRE Group, Inc., I cordially invite you to attend our annual meeting of stockholders on Friday, May 19, 2017, at 121 South Tejon Street, Suite 900, Colorado Springs, Colorado at 8:30 a.m. (Mountain Time). The notice of meeting and proxy statement that follow describe the business that we will consider at the meeting.

We hope that you will be able to attend the meeting. However, regardless of whether you are present in person, your vote is very important. We are pleased to again offer multiple options for voting your shares. You may vote by telephone, via the internet, by mail or in person, as described beginning on page 1 of the proxy statement.

Thank you for your continued support of CBRE Group, Inc.

Sincerely yours,

Robert E. Sulentic

President and Chief Executive Officer

| Notice of 2017 Annual Meeting of Stockholders | ||

May 19, 2017

8:30 a.m. (Mountain Time)

121 South Tejon Street, Suite 900, Colorado Springs, Colorado

AGENDA:

| 1. | Elect the 11 Board-nominated directors named in the Proxy Statement; |

| 2. | Ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017; |

| 3. | Conduct an advisory vote on named executive officer compensation for the fiscal year ended December 31, 2016; |

| 4. | Conduct an advisory vote on the frequency of future advisory votes on named executive officer compensation; |

| 5. | Approve the 2017 Equity Incentive Plan; and |

| 6. | Transact any other business properly introduced at the Annual Meeting. |

Only stockholders of record as of March 20, 2017 will be entitled to attend and vote at the Annual Meeting and any adjournments or postponements thereof.

We hope that you can attend the Annual Meeting in person. Regardless of whether you will attend in person, please complete and return your proxy so that your shares can be voted at the Annual Meeting in accordance with your instructions. Any stockholder attending the Annual Meeting may vote in person even if that stockholder returned a proxy. You will need to bring a picture ID and proof of ownership of CBRE Group, Inc. stock as of the record date to enter the Annual Meeting. If your common stock is held in the name of your broker, bank or other nominee and you want to vote in person, then you will need to obtain a legal proxy from the institution that holds your common stock indicating that you were the beneficial owner of our common stock on March 20, 2017.

We are pleased to furnish proxy materials to our stockholders on the internet. We believe that this allows us to provide you with the information that you need while lowering the costs of delivery and reducing the environmental impact of the Annual Meeting.

April 4, 2017

By Order of the Board of Directors

Laurence H. Midler

Executive Vice President, General Counsel and Secretary

This Proxy Statement and accompanying proxy card are first being made available on or about April 4, 2017.

References in this Proxy Statement to “CBRE,” “the company,” “we,” “us” or “our” refer to CBRE Group, Inc. and include all of its consolidated subsidiaries, unless otherwise indicated or the context requires otherwise. References to “the Board” refer to our Board of Directors. A copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, including financial statements, is being sent simultaneously with this Proxy Statement to each stockholder who requested paper copies of these materials and will also be available at www.proxyvote.com.

Proxy Summary Information

To assist you in reviewing the proposals to be voted upon at our 2017 Annual Meeting, we have summarized important information contained in this Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2016. This summary does not contain all of the information that you should consider, and you should carefully read the entire Proxy Statement and Annual Report on Form 10-K before voting.

Voting

Stockholders of record as of March 20, 2017 may cast their votes in any of the following ways:

|

|

|

| |||

| Internet | Phone | In Person | ||||

| Visit www.proxyvote.com. You will need the 16-digit number included in your proxy card, voter instruction form or notice. | Call 1-800-690-6903 or the number on your voter instruction form. You will need the 16-digit number included in your proxy card, voter instruction form or notice. | Send your completed and signed proxy card or voter instruction form to the address on your proxy card or voter instruction form. | If you plan to attend the meeting, you will need to bring a picture ID and proof of ownership of CBRE Group, Inc. stock as of the record date. If your common stock is held in the name of your broker, bank or other nominee and you want to vote in person, then you will need to obtain a legal proxy from the institution that holds your common stock indicating that you were the beneficial owner of our common stock on March 20, 2017. | |||

Voting Matters and Board Recommendation

| Proposal | Board Vote Recommendation | |

| Elect Directors (page 6) |

ü FOR each Director Nominee | |

| Ratify the Appointment of Independent Registered Public Accounting Firm for 2017 (page 23) |

ü FOR | |

| Advisory Vote to Approve Named Executive Officer Compensation for 2016 (page 26) |

ü FOR | |

| Advisory Vote on the Frequency of Future Advisory Votes to Approve Named Executive Officer Compensation (page 27) |

ü 1 YEAR | |

| Approve the 2017 Equity Incentive Plan (page 61)

|

ü FOR

|

Fiscal Year 2016 Business Highlights(1)

| (1) | For more complete information regarding our fiscal year 2016 performance, please review our Annual Report on Form 10-K for the fiscal year ended December 31, 2016. You can obtain a free copy of our Annual Report on Form 10-K at the SEC’s website (www.sec.gov) or by submitting a written request by (i) mail to CBRE Group, Inc., Attention: Investor Relations, 200 Park Avenue, New York, New York 10166, (ii) telephone at (212) 984-6515 or (iii) e-mail at investorrelations@cbre.com. |

| CBRE - 2017 Proxy Statement | 1 |

PROXY SUMMARY INFORMATION

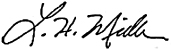

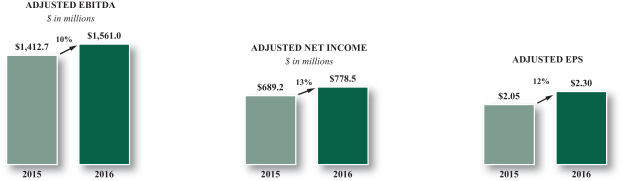

The following charts highlight our growth in adjusted EBITDA, adjusted net income and adjusted EPS for 2016 relative to 2015:

| (2) | Fee revenue is gross revenue less client reimbursed costs largely associated with our employees that are dedicated to client facilities and subcontracted vendor work performed for clients. |

| (3) | These are non-GAAP financial measures. For supplemental financial data and a corresponding reconciliation of (i) revenue computed in accordance with GAAP to fee revenue and contractual fee revenue, (ii) net income computed in accordance with GAAP to adjusted EBITDA and (iii) net income computed in accordance with GAAP to adjusted net income and to adjusted EPS, in each case for the fiscal years ended December 31, 2016 and 2015, see Annex A to this Proxy Statement. We also refer to “adjusted EBITDA,” “adjusted net income” and “adjusted EPS” from time to time in our public reporting as “EBITDA, as adjusted,” “net income attributable to CBRE Group, Inc., as adjusted” and “diluted income per share attributable to CBRE Group, Inc. shareholders, as adjusted,” respectively. As described in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, our Board and management use non-GAAP financial measures to evaluate our performance and manage our operations. However, non-GAAP financial measures should be viewed in addition to, and not as an alternative for, financial results prepared in accordance with GAAP. The term “GAAP,” as used in this Proxy Statement, means generally accepted accounting principles in the United States. |

| 2 | CBRE - 2017 Proxy Statement |

PROXY SUMMARY INFORMATION

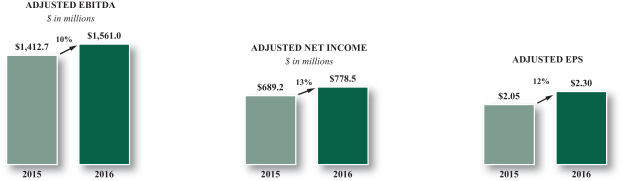

Corporate Governance Highlights

| Board Independence | ||

| Independent director nominees |

10 out of 11 | |

| Independent Chair of the Board |

Ray Wirta | |

| Director Elections | ||

| Frequency of Board elections |

Annual | |

| Voting standard for uncontested elections |

Majority Requirement | |

| Director term limits |

12 Years(4) | |

| Limit on number of Board-nominated executive officers |

Maximum 1 | |

| Proxy access for director nominations |

Yes | |

| Evaluating and Improving Board Performance |

||

| Board evaluations |

Annual | |

| Committee evaluations |

Annual | |

| Aligning Director and Executive Interests with Stockholder Interests | ||

| Director stock ownership requirements |

Yes | |

| Executive officer stock ownership requirements |

Yes | |

| Policy restricting trading, and prohibiting hedging and short-selling of, CBRE stock |

Yes | |

| Compensation clawback policy for executive officers |

Yes | |

Summary of Board Nominees

The following table provides summary information about each of the director nominees who is being voted on by stockholders at the Annual Meeting.

| Name | Age | Director Since |

Principal Occupation | Committees | Other Public Company Boards |

|||||||||||

| Brandon B. Boze* |

36 | 2012 | Partner of Value Act Capital | CC, GC | 0 | |||||||||||

| Beth F. Cobert* |

58 | N/A | Former Senior Partner at McKinsey & Company | N/A | 0 | |||||||||||

| Curtis F. Feeny* |

59 | 2006 | Managing Director of Voyager Capital | AC, GC, EC | 1 | |||||||||||

| Bradford M. Freeman* |

75 | 2001 | Partner of Freeman Spogli & Co. Incorporated | CC, GC | 0 | |||||||||||

| Christopher T. Jenny* |

61 | 2016 | Senior Advisor to Parthenon-EY | AC, GC | 0 | |||||||||||

| Gerardo I. Lopez* |

57 | 2015 | President and Chief Executive Officer of Extended Stay America, Inc. | CC, GC | 2 | |||||||||||

| Frederic V. Malek* |

80 | 2001 | Chairman of Thayer Lodging Group | CC | 1 | |||||||||||

| Paula R. Reynolds* |

60 | 2016 | President and Chief Executive Officer of PreferWest, LLC | AC, CC | 3 | |||||||||||

| Robert E. Sulentic |

60 | 2012 | President and Chief Executive Officer of CBRE | EC | 1 | |||||||||||

| Laura D. Tyson* |

69 | 2010 | Distinguished Professor of the Graduate School, Walter A. Haas School of Business, University of California, Berkeley | AC | 2 | |||||||||||

| Ray Wirta*† |

73 | 2001 | Chief Executive Officer of The Koll Company | EC | 0 | |||||||||||

| * | Independent Director |

| † | Board Chair |

| Key: | |

| AC | Audit and Finance Committee |

| CC | Compensation Committee |

| EC | Executive Committee |

| GC | Corporate Governance and Nominating Committee |

| (4) | The application of this term-limit restriction does not go into effect until December 17, 2020 for any of the company’s directors who were serving on the Board as of December 17, 2015. See “Corporate Governance—Term Limits” on page 14. |

| CBRE - 2017 Proxy Statement | 3 |

PROXY SUMMARY INFORMATION

Executive Compensation Highlights

2016 Compensation—Set forth below is the 2016 compensation for our named executive officers and the principal capacity in which they served as of December 31, 2016. See the footnotes accompanying the Summary Compensation Table on page 48 for more information.

| Name and Principal Position | Year | Salary ($) |

Bonus ($) |

Stock Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

All Other Compensation ($) |

Total ($) |

|||||||||||||||||||||||||||||

| Robert E. Sulentic President and Chief Executive Officer |

2016 | 990,000 | 500,000 | 2,062,494 | 1,403,800 | 4,500 | 4,960,794 | |||||||||||||||||||||||||||||

| James R. Groch Chief Financial Officer and Global Director of Corporate Development |

2016 | 770,000 | 300,000 | 1,499,982 | 1,081,700 | 4,500 | 3,656,182 | |||||||||||||||||||||||||||||

| T. Ritson Ferguson Chief Executive Officer—CBRE Global Investors |

2016 | 800,000 | 756,713 | (1) | 3,799,883 | (2) | 446,500 | 4,500 | 5,807,596 | |||||||||||||||||||||||||||

| Michael J. Lafitte Global Group President, Lines of Business and Client Care |

2016 | 700,000 | 350,000 | 1,159,972 | 992,600 | 4,500 | 3,207,072 | |||||||||||||||||||||||||||||

| Calvin W. Frese, Jr. Global Group President, Geographies |

2016 | 680,000 | 300,000 | 1,124,994 | 957,700 | 4,500 | 3,067,194 | |||||||||||||||||||||||||||||

| William F. Concannon(3) Chief Executive Officer—Global Workplace Solutions |

2016 | 675,000 | 300,000 | 1,024,989 | 848,900 | 4,500 | 2,853,389 | |||||||||||||||||||||||||||||

| (1) Includes payment upon vesting of bonus amounts earned by Mr. Ferguson in prior years that were required to be deferred. For more information, please see the footnotes accompanying the Summary Compensation Table on page 48. (2) Includes a one-time equity incentive award with a target grant date value of $3,000,000 in connection with the Amended and Restated Employment Agreement we entered into with Mr. Ferguson, effective January 1, 2016. For more information regarding Mr. Ferguson’s compensation arrangements under his Amended and Restated Employment Agreement, see “Executive Compensation—Employment Agreements” on page 49. (3) We have voluntarily elected to name Mr. Concannon in this Proxy Statement as an additional named executive officer. |

| 4 | CBRE - 2017 Proxy Statement |

| CBRE - 2017 Proxy Statement | 5 |

Our Board has nominated 11 directors for election at this Annual Meeting to hold office until the next annual meeting and the election of their successors. All of the nominees, except for Ms. Cobert, currently are directors. All of the nominees were selected to serve on our Board based on:

Director Nomination Criteria: Qualifications, Skills and Experience

1 The application of this term-limit restriction does not go into effect until December 17, 2020 for any of the company’s directors who were serving on the Board as of December 17, 2015. See “Term Limits” on page 14.

| 6 | CBRE - 2017 Proxy Statement |

PROPOSAL 1

Directors’ Skills and Qualifications

2017 Director Nominees

| CBRE - 2017 Proxy Statement | 7 |

PROPOSAL 1

| 8 | CBRE - 2017 Proxy Statement |

PROPOSAL 1

| CBRE - 2017 Proxy Statement | 9 |

PROPOSAL 1

| 10 | CBRE - 2017 Proxy Statement |

PROPOSAL 1

The following summarizes the independence and tenure of our 2017 director nominees:

| ||

Required Vote

This is an uncontested Board election. As such, in order to be elected, each nominee must receive the affirmative vote of a majority of the votes cast on his or her election (i.e., votes cast “FOR” a nominee must exceed votes cast as “AGAINST”). Votes to “ABSTAIN” with respect to a nominee and broker non-votes are not considered votes cast, and so will not affect the outcome of the nominee’s election.

Recommendation

Our Board recommends that stockholders vote “FOR” all of the nominees.

| CBRE - 2017 Proxy Statement | 11 |

GOVERNANCE HIGHLIGHTS

| Corporate Governance | Compensation | Stockholder Rights | ||||||

| •11 director nominees, 10 of whom are independent |

•Pay-for-performance compensation program, which includes performance-based equity grants (our Adjusted EPS Equity Awards) |

•Annual election of all directors |

||||||

| •Director Term Limits (12 years)2 |

•Annual “say on pay” votes, with most recent favorable “say on pay” vote of over 97% |

•Majority voting requirement for directors in uncontested elections |

||||||

| •Independent Chair of the Board |

•Stock ownership requirements for directors and executive officers |

•Stockholder rights to call special meetings |

||||||

| •Regular executive sessions of independent directors |

•Policy restricting trading, and prohibiting hedging and short-selling, of CBRE stock |

•No poison pill takeover defense plans |

||||||

| •Risk oversight by the Board and its key committees |

•Compensation clawback policy for executive officers |

•Stockholders may act by written consent |

||||||

| •Maximum of one Board-nominated management director |

•Proxy access for director nominations |

|||||||

| •All incumbent directors attended at least 80% of Board and Board committee meetings |

||||||||

| •Robust Standards of Business Conduct and governance policies |

||||||||

|

•No “over-boarding” by our directors on other public-company boards

|

Process for Selecting Director Candidates

2 The application of this term-limit restriction does not go into effect until December 17, 2020 for any of the company’s directors who were serving on the Board as of December 17, 2015. See “Term Limits” on page 14.

| 12 | CBRE - 2017 Proxy Statement |

CORPORATE GOVERNANCE

Stockholder Recommendations and Nominations of Director Candidates

Director Independence

Independent Director Meetings

| CBRE - 2017 Proxy Statement | 13 |

CORPORATE GOVERNANCE

Majority Voting to Elect Directors

Director Resignation Policy Upon Change of Employment

Term Limits

Board Structure and Leadership

| 14 | CBRE - 2017 Proxy Statement |

CORPORATE GOVERNANCE

Board Risk Management

Oversight of Risk

| • | The Board oversees risk management. |

| • | Board committees, which meet regularly and report back to the full Board, play significant roles in carrying out our Board’s risk oversight function. |

| • | Company management is charged with managing risk through rigorous internal processes and strong internal controls. |

Succession Planning

Our Board reviews management succession and development plans with the CEO on at least an annual basis. These plans include CEO succession in the event of an emergency or retirement, as well as the succession plans for the CEO’s direct reports and other employees critical to our continued operations and success.

Board Meetings and Committees

| CBRE - 2017 Proxy Statement | 15 |

CORPORATE GOVERNANCE

The following table describes the current members of each of the committees of our Board, and the number of meetings held during fiscal year 2016:

| Director | Board | Audit and Finance |

Compensation | Governance | Executive | |||||

| Brandon B. Boze |

ü | ü | ü | |||||||

| Curtis F. Feeny |

ü | CHAIR | ü | ü | ||||||

| Bradford M. Freeman |

ü | ü | ü | |||||||

| Christopher T. Jenny |

ü | ü | CHAIR | |||||||

| Gerardo I. Lopez |

ü | ü | ü | |||||||

| Frederic V. Malek |

ü | CHAIR | ||||||||

| Paula R. Reynolds |

ü | ü | ü | |||||||

| Robert E. Sulentic |

ü | ü | ||||||||

| Laura D. Tyson |

ü | ü | ||||||||

| Ray Wirta |

CHAIR | CHAIR | ||||||||

| Number of Meetings |

6 | 8 | 3 | 3 | 0(1) |

| (1) | Our Executive Committee did not hold any formal meetings in 2016, but acted six times by unanimous written consent. |

| 16 | CBRE - 2017 Proxy Statement |

CORPORATE GOVERNANCE

Board Attendance at Annual Meeting of Stockholders

Although the Board understands that there may be situations that prevent a director from attending an annual meeting of stockholders, it is the Board’s policy that all directors should attend these meetings. All of our incumbent directors attended our 2016 annual meeting of stockholders on May 13, 2016.

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee are set forth in the table on page 16. None of Messrs. Boze, Freeman, Lopez, Malek, or Ms. Reynolds has ever been an officer or employee of the company or any of its subsidiaries. In addition, during 2016, none of our directors was employed as an executive officer of another entity where any of our executive officers served on that entity’s board of directors or compensation committee (or its equivalent).

Director Compensation

| CBRE - 2017 Proxy Statement | 17 |

CORPORATE GOVERNANCE

The following table provides information regarding compensation earned during the fiscal year ended December 31, 2016 by each non-employee director for his or her Board and committee service. Robert E. Sulentic, who is our President and CEO, is not compensated for his role as a director. Compensation information for Mr. Sulentic is described under “Compensation Discussion and Analysis” beginning on page 28 and under “Executive Compensation” beginning on page 48. For stock awards in the table below, the dollar amounts indicated reflect the aggregate grant date fair value for awards granted during the fiscal year ended December 31, 2016.

| Name |

Fees Earned or Paid in Cash(1) ($) |

Stock Awards(2)(3) ($) |

Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) |

Total ($) |

||||||||||||

| Richard C. Blum(4) |

— | — | — | — | ||||||||||||

| Brandon B. Boze |

81,000 | 149,996 | — | 230,996 | ||||||||||||

| Curtis F. Feeny |

101,000 | 149,996 | — | 250,996 | ||||||||||||

| Bradford M. Freeman(5) |

80,000 | 149,996 | 3,660 | 233,656 | ||||||||||||

| Christopher T. Jenny(6) |

118,205 | 200,404 | — | 318,609 | ||||||||||||

| Michael Kantor(4)(5) |

1,000 | — | 542 | 1,542 | ||||||||||||

| Gerardo I. Lopez(5) |

79,000 | 149,996 | 89 | 229,085 | ||||||||||||

| Frederic V. Malek(5) |

88,000 | 149,996 | 2,891 | 240,887 | ||||||||||||

| Paula R. Reynolds(7) |

95,320 | 176,616 | — | 271,936 | ||||||||||||

| Laura D. Tyson |

81,000 | 149,996 | — | 230,996 | ||||||||||||

| Gary L. Wilson(4)(5) |

4,000 | — | 1,326 | 5,326 | ||||||||||||

| Ray Wirta |

75,000 | 149,996 | — | 224,996 | ||||||||||||

| (1) | Includes fees associated with the annual Board service retainer, attendance at committee meetings and chairing a Board committee. Our non-employee directors may elect to receive shares of our common stock in lieu of cash payments (in like amounts). We reflect these “stock in lieu of cash” payments under the column titled “Fees Earned or Paid in Cash,” and not under the “Stock Awards” column. |

| (2) | This represents the grant date fair value under Financial Accounting Standards Board, Accounting Standards Codification (“ASC”), Topic 718, Stock Compensation, of all restricted stock units granted to the directors during 2016. See also Note 2 “Significant Accounting Policies” and Note 12 “Employee Benefit Plans” to our consolidated financial statements as reported in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016 for a discussion of the valuation of our stock awards. |

| (3) | Each of Ms. Reynolds, Dr. Tyson and Messrs. Boze, Feeny, Freeman, Jenny, Lopez, Malek and Wirta was awarded 5,230 restricted stock units pursuant to our director compensation policy, valued at the fair market value of our common stock of $28.68 per share on the award date of May 13, 2016. |

| (4) | Messrs. Blum, Kantor and Wilson retired from our Board in May 2016. |

| (5) | Pursuant to our Deferred Compensation Plan, our non-employee directors are eligible to defer their director fees as described under “Summary of Plans, Programs and Agreements—Deferred Compensation Plan” on page 55. |

| • | Mr. Freeman deferred a total of $80,000 of his 2016 cash compensation. During 2016, Mr. Freeman’s total deferred account balance (which included amounts deferred during 2016 as well as amounts deferred from prior years) accrued interest at an annualized rate of 4.0% for the period from January 1, 2016 through March 31, 2016, 3.9% for the period from April 1, 2016 through June 30, 2016, 3.6% for the period from July 1, 2016 through September 30, 2016 and 3.3% for the period from October 1, 2016 through December 31, 2016. Mr. Freeman’s total accrued interest for 2016 was $14,619. |

| • | Mr. Kantor did not make any deferrals of his 2016 cash compensation. During 2016, Mr. Kantor’s total deferred account balance (which included amounts deferred from prior years) accrued interest at an annualized rate of 4.0% for the period from January 1, 2016 through March 31, 2016, 3.9% for the period from April 1, 2016 through June 30, 2016 and 3.6% for the period from July 1, 2016 through September 30, 2016. No interest accrued during the fourth quarter of 2016. We distributed the deferred account balance under our Deferred Compensation Plan in accordance with Mr. Kantor’s prior election following his retirement from our Board in May 2016. Mr. Kantor’s total accrued interest for 2016 was $2,288. |

| • | Mr. Lopez deferred a total of $37,500 of his 2016 cash compensation. During 2016, Mr. Lopez’s total deferred account balance accrued interest at an annualized rate of 3.6% for the period from July 1, 2016 through September 30, 2016 and 3.3% for the period from October 1, 2016 through December 31, 2016. Mr. Lopez’s total accrued interest for 2016 was $309. |

| • | Mr. Malek deferred a total of $88,000 of his 2016 cash compensation. During 2016, Mr. Malek’s total deferred account balance (which included amounts deferred during 2016 as well as amounts deferred from prior years) accrued interest at an annualized rate of 4.0% for the period from January 1, 2016 through March 31, 2016, 3.9% for the period from April 1, 2016 through June 30, 2016, 3.6% for the period from July 1, 2016 through September 30, 2016 and 3.3% for the period from October 1, 2016 through December 31, 2016. Mr. Malek’s total accrued interest for 2016 was $11,513. |

| • | Mr. Wilson deferred a total of $4,000 of his 2016 cash compensation. During 2016, Mr. Wilson’s total deferred account balance (which included amounts deferred during 2016 as well as amounts deferred from prior years) accrued interest at an annualized rate of 4.0% for the period from January 1, 2016 through March 31, 2016, 3.9% for the period from April 1, 2016 through June 30, 2016 and 3.6% for the period from July 1, 2016 through September 30, 2016. No accrued interest accrued during the fourth quarter of 2016. We distributed the deferred account balance under our Deferred Compensation Plan in accordance with Mr. Wilson’s prior election following his retirement from our Board in May 2016. Mr. Wilson’s total accrued interest for 2016 was $5,595. |

| In accordance with SEC rules regarding above-market interest on non-qualified deferred compensation, accrued interest for 2016 of $3,660, $542, $89, $2,891 and $1,326 for Messrs. Freeman, Kantor, Lopez, Malek and Wilson, respectively, is considered to be compensation and is shown in the “Change in Pension Value and Nonqualified Deferred Compensation Earnings” column based on a comparison to 120% of the long-term quarterly applicable federal rate for the months when the interest rate was set. |

| 18 | CBRE - 2017 Proxy Statement |

CORPORATE GOVERNANCE

| (6) | Mr. Jenny was appointed to our Board on January 12, 2016 and as such received pro-rated director compensation for 2016. The pro-rated portion of his annual cash retainer under our director compensation policy was $25,205 and the pro-rated portion of his equity grant was 1,662 restricted stock units, valued at the fair market value of our common stock of $30.33 per share on the award date of January 12, 2016. |

| (7) | Ms. Reynolds was appointed to our Board on March 10, 2016 and as such received pro-rated director compensation for 2016. The pro-rated portion of her annual cash retainer under our director compensation policy was $13,320 and the pro-rated portion of her equity grant was 1,003 restricted stock units, valued at the fair market value of our common stock of $26.54 per share on the award date of March 10, 2016. |

The table below shows the aggregate number of stock awards (i.e., restricted stock units) and option awards outstanding for each non-employee director as of December 31, 2016:

| Name | Aggregate Number of Stock Awards Outstanding |

Aggregate Number of Shares Underlying Options Outstanding |

||||||

| Richard C. Blum |

— | — | ||||||

| Brandon B. Boze |

5,230 | — | ||||||

| Curtis F. Feeny |

5,230 | 5,056 | ||||||

| Bradford M. Freeman |

5,230 | 5,056 | ||||||

| Christopher T. Jenny |

5,230 | — | ||||||

| Michael Kantor |

— | — | ||||||

| Gerardo I. Lopez |

5,230 | — | ||||||

| Frederic V. Malek |

5,230 | 5,056 | ||||||

| Paula R. Reynolds |

5,230 | — | ||||||

| Laura D. Tyson |

5,230 | 5,852 | ||||||

| Gary L. Wilson |

— | — | ||||||

| Ray Wirta |

5,230 | 5,056 | ||||||

Corporate Governance Guidelines and Code of Ethics

| CBRE - 2017 Proxy Statement | 19 |

CORPORATE GOVERNANCE

Current copies of our Board’s Standards of Business Conduct, Code of Ethics for Senior Financial Officers, Corporate Governance Guidelines, Policy Regarding Transactions with Interested Parties and Corporate Opportunities, Whistleblower Policy and Equity Award Policy are available on our website and in print upon written request to our Investor Relations Department at CBRE Group, Inc., 200 Park Avenue, New York, New York 10166, or by email at investorrelations@cbre.com. If the Board grants any waivers from the Board’s Standards of Business Conduct or the Code of Ethics for Senior Financial Officers to any of our directors or executive officers, or if we amend such policies, we will, if required, disclose these matters through the Investor Relations section of our website on a timely basis.

Stock Ownership Requirements

Corporate Responsibility and Sustainability

| 20 | CBRE - 2017 Proxy Statement |

CORPORATE GOVERNANCE

Communications with our Board

Submission of Stockholder Proposals and Board Nominees

| CBRE - 2017 Proxy Statement | 21 |

CORPORATE GOVERNANCE

| 22 | CBRE - 2017 Proxy Statement |

PROPOSAL 2 RATIFY APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Required Vote

Approval of this Proposal 2 requires the affirmative vote (i.e., “FOR” votes) of a majority of the shares present or represented and entitled to vote thereon at our 2017 Annual Meeting. A vote to “ABSTAIN” will count as “present” for purposes of this proposal and so will have the same effect as a vote “AGAINST” this proposal. In the absence of instructions, your broker may vote your shares on this proposal. For more information, see “General Information about the Annual Meeting—Voting Instructions and Information—If you do not vote/effect of broker non-votes” on page 73.

Recommendation

Our Board recommends that stockholders vote “FOR” ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017.

| CBRE - 2017 Proxy Statement | 23 |

The following table shows the fees for audit and other services provided by KPMG LLP for the fiscal years ended December 31, 2016 and 2015 (in millions):

| Fees |

Fiscal 2016 | Fiscal 2015 | ||||||

| Audit Fees |

$ | 9.6 | 7.5 | |||||

| Audit-Related Fees |

2.5 | 1.9 | ||||||

| Tax Fees |

4.7 | 4.4 | ||||||

| All Other Fees |

— | — | ||||||

|

|

|

|

|

|||||

| Total Fees |

$ | 16.8 | 13.8 | |||||

|

|

|

|

|

|||||

A description of the types of services provided in each category is as follows:

Audit and Finance Committee Pre-Approval Process

Audit and Finance Committee Report

| 24 | CBRE - 2017 Proxy Statement |

AUDIT AND OTHER FEES

| CBRE - 2017 Proxy Statement | 25 |

PROPOSAL 3 ADVISORY VOTE ON EXECUTIVE COMPENSATION

Required Vote

Approval of this Proposal 3 requires the affirmative vote (i.e., “FOR” votes) of a majority of the shares present or represented and entitled to vote thereon at our 2017 Annual Meeting. A vote to “ABSTAIN” will count as “present” for purposes of this proposal and so will have the same effect as a vote “AGAINST” this proposal. A broker non-vote will not count as “present,” and so will have no effect in determining the outcome with respect to this proposal.

Recommendation

Our Board recommends that stockholders vote “FOR” the advisory approval of the compensation of our named executive officers for the fiscal year ended December 31, 2016.

| 26 | CBRE - 2017 Proxy Statement |

PROPOSAL 4 ADVISORY VOTE ON THE FREQUENCY OF THE VOTE ON EXECUTIVE COMPENSATION

Required Vote

The number of votes for “1 YEAR,” “2 YEARS,” “3 YEARS” or “ABSTAIN” will be counted, and the frequency with the highest number of votes will be the frequency that our stockholders approve. A vote to “ABSTAIN” will have no effect on the voting results of this proposal. A broker non-vote will also have no effect in determining the outcome with respect to this proposal.

Recommendation

Our Board recommends that stockholders vote for a frequency of “1 YEAR” with respect to future advisory votes on executive compensation.

| CBRE - 2017 Proxy Statement | 27 |

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis, or CD&A, provides you with detailed information regarding the material elements of compensation paid to our executive officers, including the considerations and objectives underlying our compensation policies and practices. Although our executive compensation program is generally applicable to all of our executive officers, this CD&A focuses primarily on the program as applied to the following executives (whom we refer to as “named executive officers”), which executives served in the following principal capacities as of December 31, 2016:

| Robert E. Sulentic |

President and CEO |

|||||

| James R. Groch |

Chief Financial Officer and Global Director of Corporate Development |

|||||

| T. Ritson Ferguson |

Chief Executive Officer—CBRE Global Investors(1) |

|||||

| Michael J. Lafitte |

Global Group President, Lines of Business and Client Care(2) |

|||||

| Calvin W. Frese, Jr. |

Global Group President, Geographies(3) |

|||||

| William F. Concannon |

Chief Executive Officer—Global Workplace Solutions(4) |

| (1) | Prior to his promotion to CEO of CBRE Global Investors in March 2016, Mr. Ferguson served as the Chief Investment Officer of CBRE Global Investors, and as the co-Chief Investment Officer of CBRE Clarion Securities LLC. |

| (2) | Prior to his promotion to Global Group President, Lines of Business and Client Care in June 2016, Mr. Lafitte served as our Chief Operating Officer. |

| (3) | Prior to his promotion to Global Group President, Geographies in June 2016, Mr. Frese served as our CEO—Americas. |

| (4) | We have voluntarily elected to name Mr. Concannon in this Proxy Statement as an additional named executive officer. |

2016 Executive Summary

Business Highlights

In fiscal year 2016, we delivered strong results. Some highlights are as follows:

| • | Our revenue totaled $13.1 billion, up 20% from 2015. |

| • | Our fee revenue3 totaled $8.7 billion, up 13% from 2015.4 |

| • | On a GAAP basis, net income for 2016 increased 5% to $572.0 million and earnings per diluted share rose 4% to $1.69 per share. |

| • | Our adjusted net income was $778.5 million, up 13% from 2015.4 |

| • | Our adjusted EPS was $2.30, up 12% from 2015.4 |

| • | Our adjusted EBITDA was $1.6 billion, up 10% from 2015.4 |

| • | Our business mix continued to shift toward more recurring revenue with contractual fee revenue (which includes revenues from our Occupier-Outsourcing, Property Management, Investment Management and Valuation business lines) comprising approximately 42% of total fee revenue, up from 37% in 2015.4 |

| • | We generated revenue from a well-balanced, highly-diversified base of clients. In 2016, our client roster included over 90 of the Fortune 100 companies. |

| • | In 2016, we were ranked by Forbes as the 15th best employer in America, and in early 2017 for the fifth consecutive year, we were named a Fortune Most Admired Company in the real estate sector. This recognition reflects the strength of our brand and the high value we place on our people. |

3 Fee revenue is gross revenue less client reimbursed costs largely associated with our employees that are dedicated to client facilities and subcontracted vendor work performed for clients.

4 For supplemental financial data and a corresponding reconciliation of (i) revenue computed in accordance with GAAP to fee revenue and contractual fee revenue, (ii) net income computed in accordance with GAAP to adjusted EBITDA and (iii) net income computed in accordance with GAAP to adjusted net income and to adjusted EPS, in each case for the fiscal years ended December 31, 2016 and 2015, please see Annex A to this Proxy Statement.

| 28 | CBRE - 2017 Proxy Statement |

COMPENSATION DISCUSSION AND ANALYSIS

The following charts highlight our growth in adjusted EBITDA, adjusted net income and adjusted EPS for 2016 relative to 2015:

Executive Compensation Highlights

| CBRE - 2017 Proxy Statement | 29 |

COMPENSATION DISCUSSION AND ANALYSIS

COMPONENTS OF OUR EXECUTIVE COMPENSATION PROGRAM

Titles indicated in the table below reflect the principal capacity in which the named executive officer served as of December 31, 2016.

| Compensation Component |

Description and Purpose | Committee Actions for 2016 | ||||||

| Base Salary |

•Provides a minimum level of fixed compensation necessary to attract and retain senior executives. •Set at a level that recognizes the skills, experience, leadership and individual contribution of each executive as well as the scope and complexity of the executive’s role, including due consideration given to appropriate comparator group benchmarking. |

•In 2016, the Committee did not adjust base salaries for Messrs. Sulentic, Groch, Lafitte, Frese or Concannon. • The base salary of T. Ritson Ferguson, the CEO of CBRE Global Investors, was $800,000 in 2016. This base salary was established by the Amended and Restated Employment Agreement we entered into with Mr. Ferguson, effective January 1, 2016, in connection with his promotion to Chief Investment Officer of CBRE Global Investors. Mr. Ferguson’s promotion to CEO of CBRE Global Investors in March 2016 did not result in an additional adjustment to this base salary. |

||||||

| Annual Performance Awards | • Variable cash incentive opportunity tied to achievement of financial and individual strategic objectives. • The financial performance measure used to determine a significant portion of each executive’s earned award is adjusted EBITDA as measured at the global level and, for each of our business lines, as measured at the segment or business level. • Each executive (except for Mr. Ferguson) had a target cash performance award opportunity, consisting of a “financial portion” (80% of the total award for 2016) and a “strategic measures portion” (20% of the total award for 2016). • Mr. Ferguson had a target cash performance award opportunity, consisting of a “financial portion” (60% of the total award for 2016) and a “strategic measures portion” (40% of the total award for 2016). • Actual cash incentive awards earned can range from zero to 200% of target. • An executive may also earn a supplemental and discretionary bonus award in cases of exceptional and exceedingly deserving circumstances. |

• In 2016, the Committee did not increase the target annual performance award for Messrs. Sulentic, Groch, Lafitte, Frese or Concannon relative to 2015. • Global Adjusted EBITDA for 2016 was slightly below the target level. 2016 adjusted EBITDA for our Americas segment, which impacted Mr. Frese’s earned bonus for 2016, was also slightly below the target level. 2016 Adjusted EBITDA for our Global Investment Management segment, which impacted Mr. Ferguson’s earned bonus for 2016, was below the threshold level. 2016 Adjusted EBITDA for our Development Services segment, which also impacted Mr. Ferguson’s earned bonus for 2016, was above the threshold level. Lastly, 2016 Adjusted EBITDA for our Global Workplace Solutions business was below the target level, which impacted Mr. Concannon’s earned bonus for 2016. As a result, the financial adjustment factors for our named executive officers ranged from 0.0% to 200.0% • Each named executive officer exceeded their strategic performance objectives resulting in strategic adjustment factors ranging from 125% to 140%. • In addition, the Committee approved supplemental awards for Messrs. Sulentic, Groch, Lafitte, Frese and Concannon under our Executive Bonus Plan in recognition of their contributions to among other things, our record financial performance in 2016. • For more detail on each named executive officer’s target bonus opportunity and the performance factors considered in determining actual earned bonuses for 2016, please refer to the discussion beginning on page 37 in this CD&A. |

||||||

| Long-Term Incentives | • Annual grants of restricted stock units intended to align the interests of our executives with those of stockholders over a multi-year period, and to support executive retention objectives. • Generally, our executives will receive two-thirds of their target annual long-term incentive award value in the form of a Time Vesting Equity Award, and one-third of the target award value in the form of an Adjusted EPS Equity Award. (We describe these two types of awards in greater detail under the heading “Components of Our Program—Elements of our compensation program” beginning on page 35.) |

• In 2016, the Committee did not increase the annual long-term equity target for Messrs. Sulentic, Groch, Lafitte, Frese or Concannon relative to 2015. • Historically, annual equity grants have been made in August. In 2016, the Committee decided to change our annual equity grant date from August to March, effective March 2017. The Committee determined that awarding equity grants in the first quarter of a fiscal year would allow the Committee to set performance-based goals for our Adjusted EPS Equity Awards using prior year actuals rather than forecast. As our Adjusted EPS Equity Awards are tied to fiscal year performance, this allows us to set future growth targets with greater confidence. Moving the grant date to March also allows the Committee to evaluate all components of total direct compensation (i.e. base salary, annual performance awards and long-term equity) at the same time. To effectuate this change in annual grant timing, in August 2016, the Committee awarded our executives a “stub” grant, as a bridge between August 2016 and the date of the next annual grant in March 2017. The “stub” grant value was equal to 50% of each named executive officer’s target annual long-term incentive award value and |

| 30 | CBRE - 2017 Proxy Statement |

COMPENSATION DISCUSSION AND ANALYSIS

| Compensation Component |

Description and Purpose | Committee Actions for 2016 | ||||||

| consisted solely of a Time Vesting Equity Award. As a result, in 2016, our named executive officers only received 50% of their normal “target” grant value. The March 2017 grant was awarded at the normal “target” grant value, 50% in the form of a Time Vesting Equity Award and 50% in the form of an Adjusted EPS Equity Award to maintain the two-thirds time-based, one-third performance-based mix for the combined August 2016 and March 2017 awards. • In 2016, Mr. Ferguson also received an additional equity incentive award with a target grant date value of $3,000,000 in connection with the Amended and Restated Employment Agreement we entered into with him, effective January 1, 2016. One-fourth of the target award value was granted in the form of a Time Vesting Equity Award, and three-fourths of the target award value was granted in the form of a Performance Based Equity Award. For more information regarding Mr. Ferguson’s compensation arrangements under his Amended and Restated Employment Agreement, see “Executive Compensation—Employment Agreements” on page 49. |

Corporate Governance Highlights

| Compensation and Corporate Governance Policies and Practices | ||||||

| •Independence |

We have a Compensation Committee that is 100% independent. The Committee engages its own compensation consultant and confirms each year that the consultant has no conflicts of interest and is independent. |

|||||

| •No Hedging |

We have a policy prohibiting all directors and employees from engaging in any hedging transactions with CBRE securities held by them, which includes the purchase of any financial instrument (including prepaid variable forward contracts, equity swaps and collars) designed to hedge or offset any decrease in the market value of our securities. |

|||||

| •Compensation Clawback Policy |

We have a “compensation clawback policy” that permits the company, subject to the discretion and approval of our Board, to recover cash-based and performance-based-equity incentive compensation paid to any current or former “Section 16 officer” if there is a restatement of our financial results in certain circumstances. These circumstances are described in greater detail in this CD&A under the heading “Other Relevant Policies and Practices—Compensation Clawback Policy” on page 44. |

|||||

| •Stock Ownership Requirements |

We have stock ownership requirements for directors and our executive officers that require retention of threshold amounts of the net shares acquired upon the exercise of stock options, the vesting of restricted stock or the settlement of vested restricted stock units until required ownership levels are met. |

|||||

|

•Equity Award Policy |

We have an Equity Award Policy that is designed to maintain the integrity of the equity award process. The Equity Award Policy sets forth the procedures that must be followed in connection with employee awards and imposes stringent controls around any award made outside of the normal cycle. |

|||||

|

•No “Single Trigger” Change of Control Payments |

We do not have employment contracts, plans or other agreements that provide for “single trigger” change of control payments or benefits (including automatic accelerated vesting of equity awards upon a change of control only) to any of our named executive officers. |

|||||

|

•No Special Perquisites |

Our named executive officers receive no special perquisites or other personal benefits, unless such benefits serve a reasonable business purpose, such as ensuring the continued health and wellness of our executive officers. |

|||||

|

•No Tax Gross-Ups |

As a policy matter, we do not provide tax gross-ups to our named executive officers. |

|||||

| CBRE - 2017 Proxy Statement | 31 |

COMPENSATION DISCUSSION AND ANALYSIS

Philosophy and Objectives of Our Executive Compensation Program

How We Make Compensation Decisions

Our Compensation Committee

| 32 | CBRE - 2017 Proxy Statement |

COMPENSATION DISCUSSION AND ANALYSIS

Our Chief Executive Officer

The Committee’s Independent Compensation Consultant

| CBRE - 2017 Proxy Statement | 33 |

COMPENSATION DISCUSSION AND ANALYSIS

Comparative Market Data

| AECOM |

Jones Lang LaSalle Incorporated |

|||||

| Aon plc |

ManpowerGroup Inc. |

|||||

| Brookfield Asset Management Inc. |

Marsh & McLennan Companies, Inc. |

|||||

| Cognizant Technology Solutions Corporation |

Realogy Holdings Corp |

|||||

| Computer Sciences Corporation |

Xerox Corporation |

|||||

| Fidelity National Financial, Inc. |

Waste Management, Inc. |

|||||

| Fluor Corporation |

Willis Group Holdings Public Limited Company |

|||||

| Jacobs Engineering Group Inc. |

Say on Pay Results

| 34 | CBRE - 2017 Proxy Statement |

COMPENSATION DISCUSSION AND ANALYSIS

Compensation Risk Assessment

Components of Our Program

Elements of our compensation program

| Name | 2016 Base Salary |

Change from 2015 | ||||

| Robert E. Sulentic President and Chief Executive Officer |

$ | 990,000 | No change. | |||

| James R. Groch Chief Financial Officer and Global Director of Corporate Development |

$ | 770,000 | No change. | |||

| T. Ritson Ferguson Chief Executive Officer—CBRE Global Investors |

$ | 800,000 | Mr. Ferguson was not a named executive officer for 2015, and so we do not present compensation information for him for that year. | |||

| Michael J. Lafitte Global Group President, Lines of Business and Client Care |

$ | 700,000 | No change. | |||

| Calvin W. Frese, Jr. Global Group President, Geographies |

$ | 680,000 | No change. | |||

| William F. Concannon Chief Executive Officer—Global Workplace Solutions |

$ | 675,000 | No change. | |||

| CBRE - 2017 Proxy Statement | 35 |

COMPENSATION DISCUSSION AND ANALYSIS

| Name | 2016 EBP Target Awards |

Change from 2015 | ||||

| Robert E. Sulentic President and Chief Executive Officer |

$ | 1,485,000 | No change. | |||

| James R. Groch Chief Financial Officer and Global Director of Corporate Development |

$ | 1,155,000 | No change. | |||

| T. Ritson Ferguson Chief Executive Officer—CBRE Global Investors |

$ | 969,231 | (1) | Mr. Ferguson was not a named executive officer for 2015, and so we do not present compensation information for him for that year. | ||

| Michael J. Lafitte Global Group President, Lines of Business and Client Care |

$ | 1,050,000 | No change. | |||

| Calvin W. Frese, Jr. Global Group President, Geographies |

$ | 1,020,000 | No change. | |||

| William F. Concannon Chief Executive Officer—Global Workplace Solutions |

$ | 975,000 | No change. | |||

| (1) | Mr. Ferguson became eligible to participate in our EBP on March 14, 2016, when he became an executive officer and a Section16 officer. This amount reflects Mr. Ferguson’s target award of $1,200,000 under our EBP, pro-rated for the portion of 2016 in which he participated in such plan. Pursuant to Mr. Ferguson’s Amended and Restated Employment Agreement, he was also eligible for a target bonus of $230,769 for the period from January 1, 2016 through March 13, 2016. While this stub period bonus was not payable pursuant to the EBP, it was calculated using the same award payout determinations as his EBP award. |

5 For additional information on adjusted EBITDA, please see footnote (3) under “Proxy Summary Information” on page 2.

| 36 | CBRE - 2017 Proxy Statement |

COMPENSATION DISCUSSION AND ANALYSIS

The 2016 adjusted EBITDA targets for our named executive officers, as compared to actual adjusted EBITDA in 2016, were as follows:

| Target for 2016 adjusted EBITDA |

Actual 2016 adjusted EBITDA |

Relevant Business Measure Weighting |

||||||||||

| Robert E. Sulentic President and Chief Executive Officer James R. Groch Chief Financial Officer and Global Director of Corporate Development Michael J. Lafitte Global Group President, Lines of Business and Client Care |

$ |

1,621.7 million |

|

$ |

1,561.0 million |

|

|

Global (100%) |

| |||

| Calvin W. Frese, Jr. Global Group President, Geographies |

$ | 1,043.5 million | $ | 1,005.8 million | 6 | Americas (50%) | ||||||

| $

|

1,621.7 million

|

|

$

|

1,561.0 million

|

|

|

Global (50%)

|

| ||||

| T. Ritson Ferguson Chief Executive Officer—CBRE Global Investors |

$ | 85.5 million | $ | 113.9 million | 7 | Development Services (10%) | ||||||

| $ | 134.8 million | $ | 83.2 million | 8 | Global Investors (65%) | |||||||

| $ | 1,621.7 million | $ | 1,561.0 million | Global (25%) | ||||||||

|

William F. Concannon Chief Executive Officer—Global Workplace Solutions |

$ | 496.7 million | $ | 457.5 million | 9 | Global Workplace Solutions (50%) | ||||||

| $

|

1,621.7 million

|

|

$

|

1,561.0 million

|

|

|

Global (50%)

|

| ||||

6 2016 Adjusted EBITDA for our Americas segment was $949.6 million. For a reconciliation of net income computed in accordance with GAAP to EBITDA and adjusted EBITDA for our Americas segment for the fiscal year ended December 31, 2016, see Annex A to this Proxy Statement. We then modified the 2016 adjusted EBITDA figure for our Americas segment to add back certain overhead costs and equity compensation expense that are not fully attributable to that region in order to arrive at a “bonusable” adjusted EBITDA figure for our Americas segment for 2016. We consider the $1,005.8 million figure in the table above to be the “bonusable” adjusted EBITDA figure.

7 For a reconciliation of net income computed in accordance with GAAP to EBITDA and adjusted EBITDA for our Development Services segment for the fiscal year ended December 31, 2016, see Annex A to this Proxy Statement.

8 For a reconciliation of net income computed in accordance with GAAP to EBITDA and adjusted EBITDA for our Global Investment Management segment for the fiscal year ended December 31, 2016, see Annex A to this Proxy Statement.

9 For a reconciliation of net income computed in accordance with GAAP to EBITDA and adjusted EBITDA for our Global Workplace Solutions business for the fiscal year ended December 31, 2016, see Annex A to this Proxy Statement.

| CBRE - 2017 Proxy Statement | 37 |

COMPENSATION DISCUSSION AND ANALYSIS

The table below (which reflects the principal capacity in which our named executive officers served as of December 31, 2016) describes the financial and strategic measures applied to each of our named executive officers and their resulting payouts against targets under the EBP for 2016.

| Name | Financial Measures | Strategic Measures | 2016 Target | 2016 Payout | ||||||||||||||||

| Robert E. Sulentic President and Chief Executive Officer |

•Global adjusted EBITDA—100% |

Mr. Sulentic was expected to achieve specific objectives set for him in the following areas: •Refreshment of the company’s business strategy •Advancement of leadership structure •Cost control •Data strategy advancements |

$ 1,485,000 | $ 1,403,800 | (1) | |||||||||||||||

| Actual Achievement Against Target 96.3% Adjustment Factor: 87.5% |

Strategic Performance Rating: 140% | |||||||||||||||||||

| (1) | This amount does not include a supplemental and discretionary bonus award granted to Mr. Sulentic of $500,000 under our EBP in recognition of his exemplary leadership and outstanding performance during 2016. Including this award, the total EBP award for Mr. Sulentic for 2016 was $1,903,800. A further explanation of this supplemental and discretionary one-time award is provided immediately below this table. |

| 38 | CBRE - 2017 Proxy Statement |

COMPENSATION DISCUSSION AND ANALYSIS

| Name | Financial Measures | Strategic Measures | 2016 Target | 2016 Payout | ||||||||

| James R. Groch Chief Financial Officer and Global Director of Corporate Development |

•Global adjusted EBITDA—100% |

Mr. Groch was expected to achieve specific objectives set for him in the following areas: •Refreshment of the company’s business strategy •Finance team development and recruitment •Cost control •Data strategy advancements |

$ 1,155,000 | $ 1,081,700(2) | ||||||||

|

Actual Achievement Against Target: 96.3% Adjustment Factor: 87.5% |

Strategic Performance Rating: 135% | |||||||||||

| T. Ritson Ferguson Chief Executive Officer—CBRE Global Investors |

•Global adjusted EBITDA—25% •Development Services adjusted EBITDA—10% •Global Investment Management adjusted EBITDA—65% |

Mr. Ferguson was expected to achieve specific objectives set for him in the following areas: •Global Investors leadership transition •Clarion Securities leadership transition •Growth of Global Investment Management business •Development of the Global Investment Management leadership team |

$ 969,231(3) | $ 446,500(4) | ||||||||

| Actual Achievement Against Target: 96.3% (Global); 133.3% (Development Services) and 61.7% (Global Investment Management)

Global Adjustment Factor: 87.5% Development Services Adjustment Factor: 200.0% Global Investment Management Adjustment Factor: 0.0% |

Strategic Performance Rating: 125% | |||||||||||

| Michael J. Lafitte Global Group President, Lines of Business and Client Care |

•Global adjusted EBITDA—100% |

Mr. Lafitte was expected to achieve specific objectives set for him in the following areas: •Development of the project management leadership team •Advancement of Global Workplace Solutions business in key strategic areas •Capital Markets business growth •Growth and execution in EMEA •Cost control |

$ 1,050,000 | $ 992,600(2) | ||||||||

|

Actual Achievement Against Target: 96.3% Adjustment Factor: 87.5% |

Strategic Performance Rating: 140% | |||||||||||

| (2) | This amount does not include a supplemental and discretionary “CEO award” granted to each of Messrs. Groch, Lafitte, Frese and Concannon of $300,000, $350,000, $300,000 and $300,000, respectively, under our EBP in recognition of their exemplary leadership and outstanding performance during 2016. Including this CEO award, the total EBP award for Messrs. Groch, Lafitte, Frese and Concannon for 2016 was $1,381,700, $1,342,600, $1,257,700 and $1,148,900, respectively. A further explanation of this CEO award is provided immediately below this table. |

| (3) | Mr. Ferguson became eligible to participate in our EBP on March 14, 2016, when he became an executive officer and a Section 16 officer. This amount reflects Mr. Ferguson’s target award of $1,200,000 under our EBP, as pro-rated for the portion of 2016 in which he participated in such plan. |

| (4) | This amount does not include the following: |

| (i) | the payment upon vesting of bonus amounts earned by Mr. Ferguson in 2011, 2012 and 2013, in the amounts of $199,882, $183,683, and $198,098 respectively, that were required to be deferred under the CBRE Clarion Securities Holdings LLC Deferred Bonus Co-Investment Plan, as amended, which Mr. Ferguson was a participant in prior to 2016; |

| (ii) | the payment upon vesting of bonus amounts earned by Mr. Ferguson in 2013 and 2014, in the amounts of $50,000 and $18,750, respectively, that were required to be deferred under the CBRE Global Investors Global Leadership Team (GLT) Pool, which Mr. Ferguson was a participant in prior to 2016; and |

| (iii) | a bonus, in the amount of $106,300, for the period from January 1, 2016 to March 13, 2016. This bonus was granted pursuant to Mr. Ferguson’s Amended and Restated Employment Agreement for the portion of 2016 where he was not eligible to participate in the EBP. Although Mr. Ferguson was not eligible to participate in the EBP until he became a Section 16 officer on March 14, 2016, the pro-rated bonus was calculated using the same award payout determinations as his EBP award. Including this stub period bonus, the total incentive bonus award paid to Mr. Ferguson for 2016 was $552,800. |

| CBRE - 2017 Proxy Statement | 39 |

COMPENSATION DISCUSSION AND ANALYSIS

| Name | Financial Measures | Strategic Measures | 2016 Target | 2016 Payout | ||||||||

| Calvin W. Frese, Jr. Global Group President, Geographies (formerly CEO— Americas) |

•Global adjusted EBITDA—50% •Americas adjusted EBITDA—50% |

Mr. Frese was expected to achieve specific objectives set for him in the following areas: •Establish goals for growth in revenue, EBITDA and measurable client satisfaction with respect to the Advisory & Transaction Services business •Define operating key performance indicators for the Americas •Development of the project management leadership team •Capital Markets business growth •Cost control |

$ 1,020,000 | $ 957,700(2) | ||||||||

| Actual Achievement Against Target: 96.3% (Global); 96.4% (Americas)

Global Adjustment Factor: 87.5% Americas Adjustment Factor: 87.8% |

Strategic Performance Rating: 135% | |||||||||||

| William F. Concannon Chief Executive Officer—Global Workplace Solutions |

•Global adjusted EBITDA—50% •Global Workplace Solutions adjusted EBITDA—50% |

Mr. Concannon was expected to achieve specific objectives set for him in the following areas: •Client development •Business process and risk management •Restructure and grow enterprise facilities management business •Development of the project management leadership team |

$ 975,000 | $ 848,900(2) | ||||||||

| Actual Achievement Against Target: 96.3% (Global); 92.1% (Global Workplace Solutions)

Global Adjustment Factor: 87.5% Global Workplace Solutions Adjustment Factor: 73.7% |

Strategic Performance Rating: 140% | |||||||||||

| 40 | CBRE - 2017 Proxy Statement |

COMPENSATION DISCUSSION AND ANALYSIS

The table below (which reflects the principal capacity in which our named executive officers served as of December 31, 2016) represents the dollar values (measured at grant date fair value) underlying the annual equity awards that were made to our named executive officers for 2016. As noted above, due to the change described to our annual grant date, our named executive officers only received 50% of their normal “target” grant value, which was awarded solely in the form of a Time Vesting Equity Award. For additional information regarding the long-term incentives of our named executive officers for 2016, see the heading entitled “2016 Executive Summary—Executive Compensation Highlights” on page 29.

| Name |

2016 Annual Equity Awards(1) |

|||

| Robert E. Sulentic President and Chief Executive Officer |

$ | 2,062,500 | ||

| James R. Groch Chief Financial Officer and Global Director of Corporate Development |

$ | 1,500,000 | ||

| T. Ritson Ferguson Chief Executive Officer—CBRE Global Investors |

$ | 800,000 | (2) | |

| Michael J. Lafitte Global Group President, Lines of Business and Client Care |

$ | 1,160,000 | ||

| Calvin W. Frese, Jr. Global Group President, Geographies |

$ | 1,125,000 | ||

| William F. Concannon Chief Executive Officer—Global Workplace Solutions

|

$

|

1,025,000

|

| |

| (1) | These amounts reflect the Committee-approved award values, with the actual number of restricted stock units granted rounded down to the nearest whole share as set forth on the “Grants of Plan-Based Awards” table on page 50. |

| (2) | This amount does not reflect an equity incentive award with a target value of $3,000,000 as of the grant date that was granted to Mr. Ferguson pursuant to his Amended and Restated Employment Agreement. For more information, see “Executive Compensation—Employment Agreements” on page 49. |

| CBRE - 2017 Proxy Statement | 41 |

COMPENSATION DISCUSSION AND ANALYSIS

Additional Elements of Our Compensation Program

| 42 | CBRE - 2017 Proxy Statement |

COMPENSATION DISCUSSION AND ANALYSIS

Other Relevant Policies and Practices

Equity Ownership Policy

STOCK OWNERSHIP REQUIREMENT

Titles indicated in table reflect principal capacity in which the named executive officer served as of December 31, 2016.

| Name | Minimum Requirement | |||

| Robert E. Sulentic President and Chief Executive Officer |

5x Base Salary | |||

| James R. Groch Chief Financial Officer and Global Director of Corporate Development |

3x Base Salary | |||

| T. Ritson Ferguson Chief Executive Officer—CBRE Global Investors |

3x Base Salary | |||

| Michael J. Lafitte Global Group President, Lines of Business and Client Care |

3x Base Salary | |||

| Calvin W. Frese, Jr. Global Group President, Geographies |

3x Base Salary | |||

| William F. Concanon Chief Executive Officer—Global Workplace Solutions

|

3x Base Salary | |||

A further description of this policy and the applicable thresholds can be found under “Corporate Governance—Stock Ownership Requirements” on page 20.

Policies restricting stock trading and prohibiting hedging and short-selling

| CBRE - 2017 Proxy Statement | 43 |

COMPENSATION DISCUSSION AND ANALYSIS

Compensation Clawback Policy

Equity Award Policy and procedures for equity grants

Section 162(m) tax considerations

| 44 | CBRE - 2017 Proxy Statement |

COMPENSATION DISCUSSION AND ANALYSIS

Compensation Committee Report

| CBRE - 2017 Proxy Statement | 45 |

We have provided below summary biographies of our named executive officers who are described above in the CD&A, as well as our other executive officers as of March 20, 2017 (other than Mr. Sulentic). Information on Mr. Sulentic can be found on page 10 under “Elect Directors—2017 Director Nominees.”

| 46 | CBRE - 2017 Proxy Statement |

EXECUTIVE MANAGEMENT

| CBRE - 2017 Proxy Statement | 47 |

Summary Compensation Table

The following table sets forth compensation information in respect of the fiscal years ended December 31, 2016, 2015 and 2014 for our CEO, Chief Financial Officer and the four other most highly compensated executive officers for 2016.

| Name and Principal Position |

Year |

Salary ($) |

Bonus(1)(5) ($) |

Stock Awards(2) ($) |

Non-Equity Incentive Plan Compensation(3) ($) |

All Other Compensation(4) ($) |

Total ($) |

|||||||||||||||||||||

| Robert E. Sulentic |

2016 | 990,000 | 500,000 | 2,062,494 | 1,403,800 | 4,500 | 4,960,794 | |||||||||||||||||||||

| President and Chief Executive Officer |

2015 | 967,500 | 607,130 | 4,124,980 | 1,992,870 | 3,750 | 7,696,230 | |||||||||||||||||||||

| 2014 | 875,000 | — | 3,749,953 | 1,740,000 | 3,000 | 6,367,953 | ||||||||||||||||||||||

| James R. Groch |

2016 | 770,000 | 300,000 | 1,499,982 | 1,081,700 | 4,500 | 3,656,182 | |||||||||||||||||||||

| Chief Financial Officer and Global Director of Corporate Development |

|

2015 2014 |

|

|

752,500 675,000 |

|

|

500,000 — |

|

|

2,999,930 2,699,941 |

|

|

1,550,000 1,300,700 |

|

|

3,750 3,000 |

|

|

5,806,180 4,678,641 |

| |||||||

| T. Ritson Ferguson |

2016 | 800,000 | 756,713 | 3,799,883 | (6) | 446,500 | 4,500 | 5,807,596 | ||||||||||||||||||||

| Chief Executive Officer— CBRE Global Investors(7) |

||||||||||||||||||||||||||||

| Michael J. Lafitte |

2016 | 700,000 | 350,000 | 1,159,972 | 992,600 | 4,500 | 3,207,072 | |||||||||||||||||||||

| Global Group |

2015 | 675,000 | 400,000 | 2,319,980 | 1,409,100 | 3,750 | 4,807,830 | |||||||||||||||||||||

| President, Lines Business and Client Care |

2014 | 600,000 | — | 2,219,939 | 1,213,000 | 3,000 | 4,035,939 | |||||||||||||||||||||

| Calvin W. Frese, Jr. |

2016 | 680,000 | 300,000 | 1,124,994 | 957,700 | 4,500 | 3,067,194 | |||||||||||||||||||||

| Global Group President, Geographies |

|

2015 2014 |

|

|

660,000 600,000 |

|

|

400,000 100,000 |

|

|

2,249,948 2,159,966 |

|

|

1,282,800 1,205,300 |

|

|

3,750 3,000 |

|

|

4,596,498 4,068,266 |

| |||||||

| William F. Concannon |

2016 | 675,000 | 300,000 | 1,024,989 | 848,900 | 4,500 | 2,853,389 | |||||||||||||||||||||

| Chief Executive Officer— Global Workplace Solutions(8) |

2015 | 650,000 | 300,000 | |

2,049,924 |

|

|

1,180,900 |

|

|

3,750 |

|

|

4,184,574 |

| |||||||||||||

| (1) | For 2016, Mr. Sulentic received a supplemental and discretionary bonus award granted under the EBP of $500,000, and Messrs. Groch, Lafitte, Frese and Concannon each received a supplemental and discretionary CEO award of $300,000, $350,000, $300,000 and $300,000, respectively, granted under our EBP, in recognition of their exemplary leadership and outstanding performance during 2016. |

| (2) | All grants for 2016 were made under and governed by the 2012 Equity Incentive Plan, as described under “Summary of Plans, Programs and Agreements” on page 52, and include Time Vesting Equity Awards that were granted to each of Messrs. Sulentic, Groch, Ferguson, Lafitte, Frese and Concannon in the amount of 69,049, 50,217, 26,782, 38,834, 37,663 and 34,315 restricted stock units, respectively, which are scheduled to vest 25% per year over four years (on each of August 11, 2017, 2018, 2019 and 2020). In August 2016, we changed our annual equity grant date from August to March, effective March 2017. As a result, in August 2016, our executives received a “stub” grant, consisting solely of a Time Vesting Equity Award equal to 50% of their target annual long-term incentive award value (as set forth in the table above). In March 2017, we continued our normal practice of granting a combination of Time Vesting Equity Awards and Adjusted EPS Equity Awards. The March 2017 grant was awarded at the normal “target” grant value, 50% in the form of a Time Vesting Equity Award and 50% in the form of an Adjusted EPS Equity Award to maintain the two-thirds time-based, one-third performance-based mix for the combined August 2016 and March 2017 awards. See Note 2 (“Significant Accounting Policies”) and Note 12 (“Employee Benefit Plans”) to our consolidated financial statements as reported in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016 for a discussion of the valuation of our stock awards. |

| (3) | Amounts in this column relate to compensation pursuant to our annual performance award plans referred to in this Proxy Statement as the EIP and EBP, which are described below under “Summary of Plans, Programs and Agreements” on page 52. Amounts reflected in this table generally are based on the achievement of financial and strategic performance objectives that are established at the beginning of each fiscal year and that are further described under the heading “Compensation Discussion and Analysis—Components of Our Program—Elements of our compensation program” beginning on page 35 and “Grants of Plan-Based Awards” on page 50. For Mr. Ferguson, the amount further reflects that his EBP award was pro-rated for the portion of 2016 in which he participated in the EBP. |

| (4) | The amounts in this column for each of Messrs. Sulentic, Groch, Ferguson, Lafitte, Frese and Concannon reflect our matching contributions to their 401(k) accounts pursuant to our employee 401(k) match policy based on their respective contributions to such accounts. |

| (5) | The amount in this column for Mr. Ferguson reflects the following: |

| (i) | the payment upon vesting of bonus amounts earned by Mr. Ferguson in 2011, 2012 and 2013, in the amounts of $199,882, $183,683 and $198,098, respectively, that were required to be deferred under the CBRE Clarion Securities Holdings LLC Deferred Bonus Co-Investment Plan, as amended, which Mr. Ferguson was a participant in prior to 2016; |

| (ii) | the payment upon vesting of bonus amounts earned by Mr. Ferguson in 2013 and 2014, in the amounts of $50,000 and $18,750, respectively, that were required to be deferred under the CBRE Global Investors Global Leadership Team (GLT) Pool, which Mr. Ferguson was a participant in prior to 2016; and |

| (iii) | a bonus, in the amount of $106,300, for the period from January 1, 2016 to March 13, 2016. This bonus was granted pursuant to Mr. Ferguson’s Amended and Restated Employment Agreement for the portion of 2016 where he was not eligible to participate in the EBP. Although Mr. Ferguson was not eligible to participate in the EBP until he became a Section 16 officer on March 14, 2016, the pro-rated bonus was calculated using the same award payout determinations as his EBP award. |

| 48 | CBRE - 2017 Proxy Statement |

EXECUTIVE COMPENSATION

| (6) | On February 10, 2016, Mr. Ferguson received an initial equity incentive award with a target value as of the grant date of $3,000,000 (the “Initial Equity Award”). One-quarter of the Initial Equity Award representing 31,236 restricted stock units is scheduled to vest in three equal annual installments on each of December 31, 2016, 2017 and 2018 (the “Time Vesting Initial Equity Award”), subject to Mr. Ferguson’s continued employment through each such dates. Three-quarters of the Initial Equity Award (the “Performance-Based Equity Grant”) representing 93,708 performance restricted stock units is scheduled to vest in three equal annual installments, on each of December 31, 2016, 2017 and 2018, subject to Mr. Ferguson’s continued employment through each such dates. The number of shares that are delivered upon each vesting date of the Performance-Based Equity Grant is determined by the Compensation Committee in its discretion, following receipt of a written appraisal of Mr. Ferguson’s overall performance by the CEO of the company. With respect to the Performance-Based Equity Grant which vested on December 31, 2016, Mr. Ferguson vested in 20,824 restricted stock units (of the 31,236 restricted stock units previously awarded). For more information, see the “Grants of Plan-Based Awards” table on page 50, “Option Exercises and Stock Vested” table on page 52, and “Executive Compensation—Employment Agreements” set forth below. |

| (7) | We have not shown compensation information for Mr. Ferguson for the fiscal years ended December 31, 2015 and 2014 because Mr. Ferguson was not a named executive officer for those years. |

| (8) | We have not shown compensation information for Mr. Concannon for the fiscal year ended December 31, 2014 because Mr. Concannon was not a named executive officer for that year. |

Employment Agreements

None of our named executive officers for 2016 are parties to an employment agreement (other than Mr. Ferguson).