UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

CB Richard Ellis Group, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1. | Title of each class of securities to which transaction applies: |

| 2. | Aggregate number of securities to which transaction applies: |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4. | Proposed maximum aggregate value of transaction: |

| 5. | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| 1. | Amount previously paid: |

| 2. | Form, Schedule or Registration Statement No.: |

| 3. | Filing Party: |

| 4. | Date Filed: |

11150 Santa Monica Blvd., Suite 1600

Los Angeles, California 90025

(310) 405-8900

April 19, 2010

Dear Fellow Stockholder:

On behalf of the Board of Directors and management of CB Richard Ellis Group, Inc., I cordially invite you to attend our annual meeting of stockholders on Wednesday, June 2, 2010, at 9882 South Santa Monica Boulevard, Beverly Hills, California at 8:00 a.m. (PDT).

The notice of meeting and proxy statement that follow describe the business we will consider at the meeting. We sincerely hope you will be able to attend the meeting. However, whether or not you are personally present, your vote is very important. We are pleased to offer multiple options for voting your shares. You may vote by telephone, via the Internet, by mail or in person as described beginning on page 2 of the proxy statement.

Thank you for your continued support of CB Richard Ellis Group, Inc.

| Sincerely yours, |

|

|

| Brett White |

| Chief Executive Officer |

CB Richard Ellis Group, Inc.

11150 Santa Monica Blvd., Suite 1600

Los Angeles, California 90025

(310) 405-8900

NOTICE OF 2010 ANNUAL MEETING OF STOCKHOLDERS

Please join us for the 2010 Annual Meeting of Stockholders of CB Richard Ellis Group, Inc. The meeting will be held at 8:00 a.m. (PDT), on Wednesday, June 2, 2010, at 9882 South Santa Monica Boulevard, Beverly Hills, California.

The purposes of the 2010 Annual Meeting of Stockholders are:

| (1) | To elect the 10 directors named in the attached Proxy Statement; |

| (2) | To ratify the appointment of KPMG LLP as our independent registered public accounting firm; and |

| (3) | To transact any other business properly introduced at the Annual Meeting. |

You must own shares of CB Richard Ellis Group, Inc. common stock at the close of business on April 9, 2010, the record date for the 2010 Annual Meeting of Stockholders, to attend and vote at the Annual Meeting and at any adjournments or postponements of the meeting. If you plan to attend, please bring a picture I.D., and if your shares are held in “street name” (i.e., through a broker, bank or other nominee), a copy of a brokerage statement reflecting your stock ownership as of April 9, 2010. Regardless of whether you will attend, please vote electronically through the Internet or by telephone or by completing and mailing your proxy card if you receive paper copies of the proxy materials, so that your shares can be voted at the Annual Meeting in accordance with your instructions. For specific instructions on voting, please refer to the instructions on either the Notice of Internet Availability of Proxy Materials you received or the proxy card if you received paper copies of the proxy materials. Voting in any of these ways will not prevent you from voting in person at the 2010 Annual Meeting of Stockholders.

We are pleased to take advantage of the Securities and Exchange Commission rules that allow issuers to furnish proxy materials to their stockholders on the Internet. As a result, we are mailing to many of our stockholders a notice instead of a paper copy of this Proxy Statement and our 2009 Annual Report. The notice contains instructions on how to access those documents over the Internet. The notice also contains instructions on how each of those stockholders can receive a paper copy of our proxy materials, including this Proxy Statement, our 2009 Annual Report and a form of proxy card or voting instruction card. We believe these rules allow us to provide you with the information you need while lowering the costs of delivery and reducing the environmental impact of the Annual Meeting.

| By Order of the Board of Directors |

|

|

| Laurence H. Midler |

| Executive Vice President, General Counsel and Secretary |

Los Angeles, California

April 19, 2010

This Proxy Statement and accompanying proxy card are available beginning April 19, 2010 in connection with the solicitation of proxies by the Board of Directors of CB Richard Ellis Group, Inc., a Delaware corporation, for use at the 2010 Annual Meeting of Stockholders, which we may refer to alternatively as the “Annual Meeting.” We may refer to ourselves in this Proxy Statement alternatively as “CBRE,” the “Company,” “we,” “us” or “our” and we may refer to our Board of Directors as the “Board.” A copy of our Annual Report to Stockholders for the 2009 fiscal year, including financial statements, is being sent simultaneously with this Proxy Statement to each stockholder who requested paper copies of these materials and will also be available at www.proxyvote.com.

| Page | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 2 | ||

| 2 | ||

| What vote is required to pass an item of business at the Annual Meeting? |

2 | |

| 2 | ||

| 2 | ||

| 3 | ||

| What happens if additional matters are presented at the Annual Meeting? |

3 | |

| 3 | ||

| 3 | ||

| 4 | ||

| 4 | ||

| 7 | ||

| 8 | ||

| 10 | ||

| 10 | ||

| 10 | ||

| 12 | ||

| 14 | ||

| 14 | ||

| 15 | ||

| 15 | ||

| 16 | ||

| 17 | ||

| 18 | ||

| 19 | ||

| 19 | ||

| 19 | ||

| 19 | ||

| 21 | ||

| Proposal No. 2: Ratification of Independent Registered Public Accounting Firm |

21 | |

| 21 | ||

| 22 | ||

| 23 | ||

| 23 | ||

| 37 | ||

| 38 | ||

| 39 | ||

| 43 | ||

| 44 | ||

| 44 | ||

| Page | ||

| 48 | ||

| 49 | ||

| 49 | ||

| 51 | ||

| RELATED-PARTY AND OTHER TRANSACTIONS INVOLVING OUR OFFICERS AND DIRECTORS |

52 | |

| 53 | ||

| 53 | ||

| 54 | ||

| A-1 | ||

PROXY STATEMENT

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

What is the purpose of the Annual Meeting of Stockholders? At the Annual Meeting, stockholders will vote upon matters described in the Notice of Annual Meeting and this Proxy Statement, including the election of directors and the ratification of the selection of KPMG LLP as our independent registered public accounting firm. In addition, once the business of the Annual Meeting is concluded, members of management will respond to questions raised by stockholders, as time permits.

Who can attend the Annual Meeting? All of our stockholders as of the April 9, 2010 record date for the Annual Meeting, or individuals holding their duly appointed proxies, may attend the Annual Meeting. You should be prepared to present photo identification for admittance. Appointing a proxy in response to this solicitation will not affect a stockholder’s right to attend the Annual Meeting and to vote in person. Please note that if you hold your common stock in “street name” (that is, through a broker, bank or other nominee), you will need to bring a copy of a brokerage statement reflecting your stock ownership as of April 9, 2010 to gain admittance to the Annual Meeting.

What am I voting on? You are voting on:

| • | The election of 10 director nominees to the Board; |

| • | The ratification of the appointment of KPMG LLP as our independent registered public accounting firm; and |

| • | Any other matters properly introduced at the Annual Meeting. |

What are the Board’s recommendations? The Board recommends a vote:

| • | for election of the nominated slate of directors (see Proposal No. 1); and |

| • | for ratification of the selection of KPMG LLP, an independent registered public accounting firm, to be the auditors of our annual financial statements for the fiscal year ending December 31, 2010 (see Proposal No. 2). |

Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board.

Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials this year instead of a full set of proxy materials? Pursuant to rules adopted by the Securities and Exchange Commission, or SEC, we are providing access to our proxy materials over the Internet. Accordingly, the Company sent a Notice of Internet Availability of Proxy Materials (the “Notice”) to the Company’s stockholders of record and beneficial owners. All stockholders will have the ability to access the proxy materials on the Web site referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. The Company encourages you to take advantage of the availability of the proxy materials on the Internet in order to help reduce the environmental impact of the Annual Meeting.

Who may vote? You may vote if you owned shares of our common stock at the close of business on April 9, 2010, which is the record date for the Annual Meeting. You are entitled to one vote on each matter presented at the Annual Meeting for each share of common stock you owned on that date. As of April 9, 2010, we had 321,812,614 shares of common stock outstanding.

1

Who counts the votes? Broadridge Financial Solutions, Inc. will tabulate the votes, and our Assistant Secretary will act as the inspector of the election.

Is my vote confidential? Yes, your proxy card, ballot, and voting records will not be disclosed to us unless applicable law requires disclosure, you request disclosure, or your vote is cast in a contested election (which is not applicable in 2010). If you write comments on your proxy card, your comments will be provided to us, but how you voted will remain confidential.

What vote is required to pass an item of business at the Annual Meeting? In the election for directors (Proposal No. 1), because we have 10 nominees for 10 possible director positions (i.e., an uncontested election) we require that each of the director nominees receive at least a majority of the votes present and entitled to vote. The Board has adopted a policy to institute majority voting for directors in uncontested director elections. This policy requires that directors tender their resignation upon failure to achieve a majority vote in an uncontested director election. The Corporate Governance and Nominating Committee will make a recommendation to the Board as to whether to accept or reject the tendered resignation, or whether other action should be taken. The Board will then consider the resignation taking into account the Corporate Governance and Nominating Committee’s recommendation and announce publicly within 90 days its decision of whether to accept or reject the resignation.

To ratify our Audit Committee’s appointment of KPMG LLP as our independent registered public accounting firm (Proposal No. 2), the affirmative vote of a majority of those shares of common stock present and entitled to vote is required.

If you are a shareholder of record and submit a proxy (whether by Internet, telephone or mail) without specifying a choice on any given matter to be considered at this Annual Meeting, the proxy holders will vote your shares according to the Board’s recommendation on that matter. If you hold your shares in a brokerage account, then, under New York Stock Exchange, or NYSE, rules and Delaware corporation law:

| • | With respect to Proposal No. 1 (Election of Directors), your broker is not entitled to vote your shares on this matter if no instructions are received from you. If your broker does not vote (a “broker non-vote”), this is not considered a vote cast and, therefore, will have no effect on the election of directors. Abstentions may not be specified as to the election of directors. |

| • | With respect to Proposal No. 2 (Ratification of Independent Registered Public Accounting Firm), your broker is entitled to vote your shares on this matter if no instructions are received from you. Broker non-votes and abstentions are not considered votes cast and, therefore, will be counted neither for nor against this matter. |

How will shares in the 401(k) plan be counted? If you hold common stock in our 401(k) plan as of April 9, 2010, the enclosed proxy card also serves as your voting instruction to Vanguard Fiduciary Trust Company, the trustee of our 401(k) plan, provided that you furnish your voting instructions over the Internet or by telephone, or that the enclosed proxy card is signed, returned and received, by 2:00 p.m. (PDT) on May 31, 2010. If voting instructions are not received by such time, the common stock in our 401(k) plan will be voted by the trustee in proportion to the shares for which the trustee timely receives voting instructions.

How do I vote? If you plan to attend the Annual Meeting and wish to vote in person, we will give you a ballot at the Annual Meeting. However, if your common stock is held in the name of your broker, bank or other nominee, and you want to vote in person, you will need to obtain a legal proxy from the institution that holds your common stock indicating that you were the beneficial owner of this common stock on April 9, 2010, the record date for voting at the Annual Meeting.

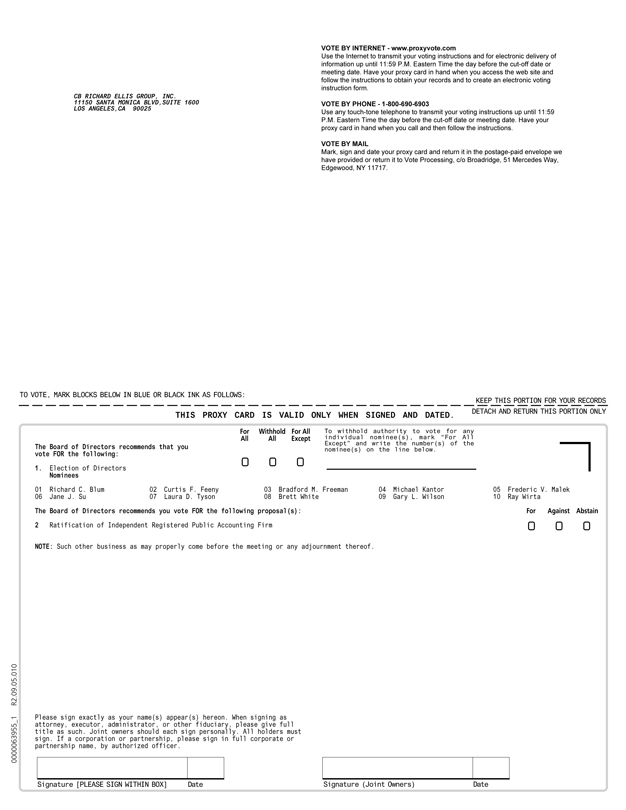

If your common stock is held in your name, there are three ways for you to vote by proxy:

| • | If you received a paper copy of the proxy materials by mail, mail the proxy card in the enclosed return envelope; |

2

| • | Call 1-800-690-6903; or |

| • | Log on to the Internet at www.proxyvote.com and follow the instructions at that site. The Web site address for Internet voting is also provided on your Notice. |

Telephone and Internet voting will close at 8:59 p.m. (PDT) on June 1, 2010, unless you are voting common stock held in our 401(k) plan, in which case the deadline for voting is 2:00 p.m. (PDT) on May 31, 2010. Unless you indicate otherwise on your proxy card, the persons named as your proxies will vote your common stock: FOR all of the nominees for director named in this Proxy Statement and FOR the ratification of KPMG LLP as our independent registered public accounting firm.

If your common stock is held in the name of your broker, bank or other nominee, you should receive separate instructions from the holder of your common stock describing how to vote your common stock.

Even if you plan to attend the Annual Meeting, we recommend that you vote your common stock in advance as described above so that your vote will be counted if you later decide not to attend the Annual Meeting.

Can I revoke my proxy? Yes, you can revoke your proxy if your common stock is held in your name by:

| • | Filing written notice of revocation before our Annual Meeting with our Secretary, Laurence H. Midler, at the address shown on the front of this Proxy Statement; |

| • | Signing a proxy bearing a later date; or |

| • | Voting in person at the Annual Meeting. |

If your common stock is held in the name of your broker, bank or other nominee, please follow the voting instructions provided by the holder of your common stock regarding how to revoke your proxy.

What happens if additional matters are presented at the Annual Meeting? Other than the two proposals described in this Proxy Statement, we are not aware of any other business to be acted upon at the Annual Meeting. If any other matters are properly introduced for a vote at the Annual Meeting and if you grant a proxy, the persons named as proxy holders will have the discretion to vote your common stock on any such additional matters.

Who pays for this proxy solicitation? We will bear the expense of preparing, printing and mailing this proxy statement and the proxies we solicit. Proxies may be solicited by mail, telephone, personal contact and electronic means and may also be solicited by directors and officers in person, by the Internet, by telephone or by facsimile transmission, without additional remuneration.

We will also request brokerage firms, banks, nominees, custodians and fiduciaries to forward proxy materials to the beneficial owners of shares of our stock as of the record date and will reimburse them for the cost of forwarding the proxy materials in accordance with customary practice. Your cooperation in promptly voting your shares and submitting your proxy by the Internet or telephone, or by completing and returning the enclosed proxy card (if you received your proxy materials in the mail), will help to avoid additional expense.

Where can I find corporate governance materials? Our Corporate Governance Guidelines, Standards of Business Conduct, Code of Ethics for Senior Financial Officers, Policy Regarding Transactions with Related Parties, Equity Award Policy and the charters for the Acquisition Committee, Audit Committee, Compensation Committee, Corporate Governance and Nominating Committee, and Executive Committee are published in the Corporate Governance section of the Investor Relations page on our Web site at www.cbre.com. (We are not including the other information contained on, or available through, our Web site as a part of, or incorporating such information by reference into, this Proxy Statement.)

3

NOMINEES FOR ELECTION TO THE BOARD

At the Annual Meeting, our stockholders will elect 10 directors to serve until our annual meeting of stockholders in 2011 or until their respective successors are elected and qualified. The Board seeks independent directors who represent a mix of backgrounds and experiences that will enhance the quality of the Board’s deliberations and decisions. In nominating candidates, the Board considers a diversified membership in the broadest sense, including persons diverse in experience, gender and ethnicity. The Board does not discriminate on the basis of race, color, national origin, gender, religion, disability, or sexual preference. Our director nominees were nominated by the Board based on the recommendation of the Corporate Governance and Nominating Committee, or Governance Committee. They were selected on the basis of outstanding achievement in their professional careers, broad experience, personal and professional integrity, their ability to make independent, analytical inquiries, financial literacy, mature judgment, high performance standards, familiarity with our business and industry, and an ability to work collegially. We also believe that all of our director nominees have a reputation for integrity, honesty and adherence to high ethical standards. All nominees are presently directors of CBRE and each of the nominees has consented, if elected as a director to our Board, to serve until his or her term expires.

Your proxy holder will vote your common stock for the Board’s nominees, unless you instruct otherwise. If a nominee is unable to serve as a director, your proxy holder may vote for any substitute nominee proposed by the Board.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE 10 NOMINEES LISTED BELOW.

| Name |

Age | Position | ||

| Richard C. Blum |

74 | Chairperson; Executive Committee Chairperson; Governance Committee and Acquisition Committee member | ||

| Curtis F. Feeny |

52 | Director; Audit Committee Chairperson; Governance Committee member | ||

| Bradford M. Freeman |

68 | Director; Governance Committee Chairperson; Compensation Committee and Acquisition Committee member | ||

| Michael Kantor |

70 | Director; Acquisition Committee and Governance Committee member | ||

| Frederic V. Malek |

73 | Director; Compensation Committee Chairperson; Audit Committee member | ||

| Jane J. Su |

46 | Director; Compensation Committee member | ||

| Laura D. Tyson |

62 | Director; Acquisition Committee member | ||

| Brett White |

50 | Director, Chief Executive Officer; Acquisition Committee Chairperson; Executive Committee member | ||

| Gary L. Wilson |

70 | Director; Audit Committee member | ||

| Ray Wirta |

66 | Director; Executive Committee and Acquisition Committee member |

Richard C. Blum

Mr. Blum has been Chairperson of our Board since September 2001 and a member of our Board since July 2001. He is the Chairman and President of Richard C. Blum & Associates, Inc., the general partner of Blum Capital Partners, L.P., a long-term strategic equity investment management firm that acts as general partner for

4

various investment partnerships and provides investment advisory services, which he founded in 1975. Mr. Blum holds a B.A. and an M.B.A. from the University of California, Berkeley. He previously served on the boards of directors of Glenborough Realty Trust Incorporated and URS Corporation. Mr. Blum has experience in the capital markets and securities business, and broad knowledge of our business through his many years of experience on our Board.

Curtis F. Feeny

Mr. Feeny has been a member of our Board since December 2006. He has been a Managing Director of Voyager Capital, a venture capital firm, since January 2000. Mr. Feeny was a director of Trammell Crow Company from May 2001 through December 2006. From 1992 through 1999, Mr. Feeny served as Executive Vice President of Stanford Management Co., which manages the $12.6 billion endowment of Stanford University. Mr. Feeny holds a B.S. from Texas A&M University and an M.B.A. from Harvard Business School. Mr. Feeny brings broad knowledge of the commercial real estate industry from his service as an employee and later director of the Trammell Crow Company, which we acquired in 2006. He also has broad experience counseling companies through growth, and experience in corporate finance matters.

Bradford M. Freeman

Mr. Freeman has been a member of our Board since July 2001. Mr. Freeman is a founding partner of Freeman Spogli & Co. Incorporated, a private investment company founded in 1983. He is also a member of the board of directors of Edison International. Mr. Freeman holds a B.A. from Stanford University and an M.B.A. from Harvard Business School. Mr. Freeman brings experience in the capital markets and securities business to the Board, in addition to his broad knowledge of our business through his many years of experience on our Board.

Michael Kantor

Mr. Kantor has been a member of our Board since February 2004. Mr. Kantor has been a partner with the law firm of Mayer Brown LLP since March 1997. From 1993 to 1996, he served as the U.S. Trade Representative and from 1996 to 1997 as U.S. Secretary of Commerce. Mr. Kantor is also a member of the advisory board of directors of ING USA and a member of the international advisory board of Fleishman-Hillard. Mr. Kantor holds a B.A. from Vanderbilt University and a J.D. from Georgetown University. Mr. Kantor brings to the Board many years of experience as a lawyer counseling companies and their boards of directors. He also has extensive knowledge and experience in government and foreign markets.

Frederic V. Malek

Mr. Malek has been a member of our Board since September 2001. He has served as Chairman of Thayer Capital Partners, a merchant banking firm he founded, since 1993 and Co-Chairman of Thayer Lodging Group, a sponsor of private hotel REITs, which he also founded in 1993. Mr. Malek is on the board of directors of Dupont Fabros Technology, Inc. He previously served on the boards of directors of Automatic Data Processing Corp., the Federal National Mortgage Association, Northwest Airlines Corporation, and FPL Group, Inc. Mr. Malek holds a B.S. from the U.S. Military Academy at West Point and an M.B.A. from Harvard Business School. Mr. Malek has experience in real estate investment and a broad knowledge of our business from his many years of experience on our Board. He also brings to the Board operational experience as a former president of a major public company, and is knowledgeable in corporate finance and experienced as an audit committee member.

Jane J. Su

Ms. Su has been a member of our Board since October 2006. Ms. Su is a partner at Blum Capital Partners, L.P. Prior to joining Blum Capital Partners, L.P. in 2002, she was a principal of Banc of America Equity Partners—Asia from 1996 to 2000. Ms. Su holds a B.A. from Dartmouth College and an M.B.A. from the

5

Stanford Graduate School of Business. Ms. Su has experience in the capital markets and principal investment business, and brings to the Board a deep understanding of business in the Asia Pacific region, particularly China, which is a large growth market for the Company.

Laura D. Tyson

Dr. Tyson has been a member of our Board since March 2010. Dr. Tyson has been the S.K. and Angela Chan Professor of Global Management at the Walter A. Haas School of Business, University of California at Berkeley since July 2008, and Professor of Business Administration there since January 2007. Dr. Tyson was previously Dean of the London Business School from January 2002 to December 2006 and Dean of the Walter A. Haas School of Business, University of California at Berkeley from July 1998 to December 2001, and was Professor of Business Administration and Economics there from January 1997 to June 1998. She previously served as National Economic Adviser to the President of the United States from February 1995 to December 1996, and was the first woman to Chair the White House Council of Economic Advisers, in which capacity she served from January 1993 to February 1995. Dr. Tyson serves on the boards of directors of AT&T Inc., Eastman Kodak Company, Morgan Stanley and Silver Spring Network. She also serves on the boards of directors of MIT Corporation, the Peter G. Peterson Institute of International Economics and the New America Foundation. Dr. Tyson holds a B.A. from Smith College and a Ph.D. in Economics from the Massachusetts Institute of Technology. Dr. Tyson brings experience from serving on the boards of directors of complex global organizations, and is a noted economist who brings experience in government and broad macro-economic knowledge to our Board. Dr. Tyson was recommended to the Board by one of our non-management directors.

Brett White

Mr. White has served as our Chief Executive Officer since June 2005, and been a member of our Board since September 2001. He previously served as our President from September 2001 to March 2010 and prior to that was Chairman of the Americas of CB Richard Ellis Services, Inc. from May 1999 to September 2001 and was its President of Brokerage Services from August 1997 to May 1999. Prior to that, he was one of its Executive Vice Presidents from March 1994 to July 1997 and Managing Officer of its Newport Beach, California office from May 1993 to March 1994. Mr. White is also a member of the board of directors of Edison International and a Trustee of the University of San Francisco. He previously served on the board of directors of Mossimo, Inc. Mr. White holds a B.A. from the University of California, Santa Barbara. Mr. White brings intimate knowledge of our operations to the Board based on day-to-day leadership as our current Chief Executive Officer and his cumulative experience in leadership positions within the Company.

Gary L. Wilson

Mr. Wilson has been a member of our Board since September 2001. Mr. Wilson is a private investor and General Partner of Manhattan Pacific Partners. He previously served as Chairman of Northwest Airlines Corporation from April 1997 to May 2007 and prior to that as its Co-Chairman from January 1991 to April 1997. Mr. Wilson also serves on the board of directors of Yahoo! Inc. He is also a Trustee Emeritus of Duke University, a member of the Board of Overseers of the Keck School of Medicine of the University of Southern California, a member of the NCAA Leadership Advisory Board, and a member of the board of directors of Millennium Promise. He previously served on the boards of directors of Northwest Airlines, Inc. and The Walt Disney Company. Mr. Wilson holds a B.A. from Duke University and an M.B.A. from the Wharton Graduate School of Business and Commerce at the University of Pennsylvania. Mr. Wilson brings experience from serving on the boards of directors of complex global organizations, and has a broad knowledge of our business through his many years of experience on our Board. He also brings to the Board operational experience as a former chief financial officer of major public companies, and is knowledgeable in corporate finance and experienced as an audit committee member.

6

Ray Wirta

Mr. Wirta has been a member of our Board since September 2001. He has served as the Chief Executive Officer of The Koll Company since November 2009. Mr. Wirta served as our Chief Executive Officer from September 2001 to June 2005. From May 1999 to September 2001, he served as Chief Executive Officer of CB Richard Ellis Services, Inc. and served as its Chief Operating Officer from May 1998 to May 1999. Mr. Wirta served as a director and as the Non-Executive Chairman of Realty Finance Corporation and previously the Chairman from May 2005 through August 2009. He also served as Interim Chief Executive Officer and President of that company from April 2007 to September 2007. Mr. Wirta holds a B.A. from California State University, Long Beach and an M.B.A. in International Management from Golden Gate University. Mr. Wirta brings to the Board many years of experience in the commercial real estate industry, including operational experience as our former chief executive officer.

Our director compensation policy provides for the following annual compensation for each of our non-employee directors:

| • | a $30,000 annual cash retainer, which the directors opted to forego in 2009; |

| • | a grant of a number of unrestricted shares of our common stock with a fair market value equal to $10,000 on the date of grant; |

| • | a stock option grant for a number of shares equal to $50,000 divided by the fair market value of our common stock on the date of grant, which vest in quarterly installments over a three-year period from the date of grant and which expire, to the extent unexercised, seven years from the date of grant; and |

| • | a restricted stock grant for a number of shares equal to $35,000 divided by the fair market value of our common stock on the date of grant, which vest in full on the third (3rd) anniversary of the date of the grant, provided that under certain circumstances where a director does not continue to serve, the shares vest immediately prior to such departure in the amount of one-third ( 1/3) of the total number of shares subject to the grant for each full year the director served on the Board after the date of grant. |

Pursuant to this policy, our directors also receive an additional payment of $2,000 per Board meeting attended and $1,000 per committee meeting attended (regardless of whether the meeting attended is scheduled in conjunction with a Board meeting). The chairperson of the Audit Committee receives an additional annual cash retainer of $15,000, and the chairpersons of the Governance Committee and Compensation Committee receive additional annual cash retainers of $10,000 each.

We also reimburse our non-employee directors for all reasonable out-of-pocket expenses incurred in the performance of their duties as directors. Our employee directors do not receive any fees for attendance at meetings or for their service on our Board.

7

The following table provides compensation information for the fiscal year ended December 31, 2009 for each member of our Board earned during the year, other than Robert E. Sulentic and Brett White, who are our executive officers. Compensation information for Mr. Sulentic, who was a director until March 2009, and Mr. White is described beginning on page 23 under “Executive Compensation—Compensation Discussion and Analysis.” For stock and option awards, the dollar amounts set forth in the table below reflect the aggregate grant date fair value for the fiscal year ended December 31, 2009.

| Name |

Fees Earned or Paid in Cash (1) ($) |

Stock Awards (2) (3)(6) ($) |

Option Awards (4) (5)(6) ($) |

Change in Pension Value and Nonqualified Deferred Compensation Earnings |

All Other Compensation ($) |

Total ($) | ||||||||||

| Richard C. Blum |

$ | 19,000 | $ | 44,985 | $ | 24,288 | — | — | $ | 88,273 | ||||||

| Patrice M. Daniels |

7,250 | 44,985 | 24,288 | — | — | 76,523 | ||||||||||

| Curtis F. Feeny |

36,583 | 44,985 | 24,288 | — | — | 105,856 | ||||||||||

| Bradford M. Freeman |

31,167 | 44,985 | 24,288 | — | — | 100,440 | ||||||||||

| Michael Kantor |

12,000 | 44,985 | 24,288 | — | — | 81,273 | ||||||||||

| Frederic V. Malek |

29,000 | 44,985 | 24,288 | — | — | 98,273 | ||||||||||

| Jane J. Su |

15,000 | 44,985 | 24,288 | — | — | 84,273 | ||||||||||

| Gary L. Wilson |

23,000 | 44,985 | 24,288 | — | — | 92,273 | ||||||||||

| Ray Wirta |

12,000 | 44,985 | 24,288 | — | — | 81,273 | ||||||||||

| (1) | Includes fees associated with attendance at meetings and chairing a Board Committee. |

| (2) | At December 31, 2009, (i) each of Ms. Su and Messrs. Blum, Feeny, Freeman, Kantor, Malek and Wilson held an aggregate of 6,687 shares of unvested stock awards, and (ii) Mr. Wirta held an aggregate of 6,632 shares of unvested stock awards. |

| (3) | Each of Ms. Su and Messrs. Blum, Feeny, Freeman, Kantor, Malek, Wilson and Wirta was awarded 1,184 unrestricted shares of our common stock and 4,146 restricted shares of our common stock pursuant to our director compensation policy, valued at the fair market value of our common stock of $8.44 on the award date of June 2, 2009, for a total value of $44,985. |

| (4) | Each of Ms. Su and Messrs. Blum, Feeny, Freeman, Kantor, Malek, Wilson and Wirta was awarded a grant of an option to purchase 5,924 shares of our common stock pursuant to our director compensation policy, with a per share fair value of $4.10 on the award date of June 2, 2009. |

| (5) | At December 31, 2009, (i) each of Messrs. Freeman and Malek held an aggregate of 24,268 unexercised stock options, (ii) Mr. Blum held an aggregate of 15,421 unexercised stock options, (iii) Mr. Kantor held an aggregate of 65,839 unexercised stock options, (iv) Mr. Feeny held an aggregate of 10,123 unexercised stock options, (v) Ms. Su held an aggregate of 10,471 unexercised stock options, (vi) Mr. Wirta held an aggregate of 9,476 unexercised stock options that he received as a non-employee director of our Board and The Wirta Family Trust, of which Mr. Wirta serves as a co-trustee, held an aggregate of 1,894,879 unexercised stock options (which were awarded in connection with his employment as our Chief Executive Officer from 1998 to 2005), and (vii) Mr. Wilson held an aggregate of 107,410 unexercised stock options. |

| (6) | In recognition of the valuable service provided by Ms. Daniels, who passed on June 13, 2009, the Board accelerated the vesting on all remaining shares of Ms. Daniels unvested stock and stock options as of June 30, 2009. |

BOARD STRUCTURE, LEADERSHIP AND RISK MANAGEMENT

Our Board currently consists of 10 directors. The Board has determined that each of Ms. Su and Dr. Tyson and Messrs. Blum, Freeman, Feeny, Kantor, Malek and Wilson is “independent,” as described in greater detail under the heading titled “Corporate Governance—Director Independence” below. All of our directors are elected

8

at each annual meeting of stockholders and hold office until the next election. The Board has authority under our By-laws to fill vacancies and to increase or, upon the occurrence of a vacancy, decrease its size between annual meetings of stockholders.

We have separated the roles of Chief Executive Officer and Chairman of the Board since 2001 in recognition of the differences between the two roles. The Chief Executive Officer is responsible for setting the strategic direction and the day-to-day leadership and performance of the Company, while the Chairman provides guidance to the Chief Executive Officer, sets the agenda for Board meetings and presides over meetings of the full Board.

The Board has an active role, as a whole and also at the committee level, in overseeing management of the Company’s risks. The Board regularly reviews information regarding the Company’s credit, liquidity and operations, as well as the risks associated with each. The Company’s Compensation Committee is responsible for overseeing the management of risks relating to our compensation plans and arrangements. The Audit Committee oversees management of risks related to our financial reports and record-keeping and potential conflicts of interest. The Governance Committee manages risks associated with the independence of the Board of Directors and the composition of our Board and its committees. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board is regularly informed through committee reports about such risks.

Our Compensation Committee has discussed the concept of risk as it relates to our compensation program and the Committee does not believe our compensation program encourages excessive or inappropriate risk taking. We generally structure our pay to consist of both fixed and variable compensation. The fixed (or salary) portion of compensation is designed to provide a steady income regardless of our stock price performance so that executives and managers do not feel pressured to focus exclusively on stock price performance to the detriment of other important business metrics. The variable (performance award and equity) portions of compensation are designed to reward both short- and long-term corporate performance in a balanced manner. For short-term performance, our performance awards are awarded based on annual EBITDA targets. For long-term performance, our stock option and restricted stock awards generally vest over four years and provide enhanced value if our stock price increases over time. In this way, our executives and managers are not encouraged to take risks for short-term gain at the expense of the long-term health of our business. We feel that these variable elements of compensation are a sufficient percentage of overall compensation to motivate executives and managers to produce superior short- and long-term corporate results, while the fixed element is also sufficiently high so that they are not encouraged to take unnecessary or excessive risks. Because EBITDA is the performance measure for determining incentive payments, we believe our executives and managers are encouraged to take a balanced approach that focuses on corporate profitability, rather than other measures such as revenue targets, which may incentivize management to drive sales levels without regard to cost structure. If we are not profitable at a reasonable level, generally there are no payouts under the bonus program. We have stock ownership guidelines, which we believe provide a considerable incentive for our executives and managers to consider our long-term interests because a portion of their personal investment portfolio consists of CBRE stock. In addition, we prohibit all hedging transactions involving our stock so none of our executives or managers can insulate themselves from the effects of poor CBRE stock price performance. Finally, our bonus program for executives and managers has been structured around corporate and regional EBITDA for many years and we have seen no evidence that it encourages unnecessary or excessive risk taking.

As described in greater detail under the heading titled “Related-Party and Other Transactions Involving Our Officers and Directors—Securityholders’ Agreement,” pursuant to a securityholders’ agreement, our stockholders affiliated with Blum Capital Partners, L.P. are entitled to nominate a percentage of our total number of directors that is equivalent to the percentage of the outstanding common stock beneficially owned by these affiliates, with this percentage of our directors being rounded up to the nearest whole number of directors. These affiliates of Blum Capital Partners have nominated Mr. Blum and Ms. Su to our Board.

9

EXECUTIVE SESSIONS OF NON-MANAGEMENT DIRECTORS

Our non-management directors meet without management present each time the full Board convenes for a regularly scheduled meeting. If the Board convenes for a special meeting, the non-management directors will meet in executive session if circumstances warrant. The Chairperson of the Board, who is a non-management director, presides over executive sessions of the Board.

The Board welcomes communications from stockholders. For information on how to communicate with our independent directors, please refer to the information set forth under the heading “Corporate Governance—Communications with the Board”.

The Board held six regularly scheduled and special meetings during the past fiscal year to review significant developments, engage in strategic planning, and act on matters requiring Board approval. Each incumbent director attended an aggregate of at least 75 percent of the Board meetings, and the meetings of committees on which he or she served, during the period that he or she served in 2009.

| Committee |

Members |

Functions and Additional Information |

Number of Meetings in Fiscal 2009 | |||

| Acquisition |

Brett White(1) Richard C. Blum Bradford M. Freeman Michael Kantor Ray Wirta |

• Review and recommend acquisition strategies to the full Board • May investigate acquisition candidates • Review and approve merger and acquisition transactions above the Chief Executive Officer’s authority and up to the dollar thresholds set by the Board • May review and make recommendations to the full Board on merger, acquisition and investment transactions that exceed the Acquisition Committee’s approval authority |

0(2) | |||

| Audit |

Patrice M. Daniels(1)(3) Curtis F. Feeny(1)(3) Frederic V. Malek Gary L. Wilson |

• Retain, compensate, oversee and terminate any independent registered public accounting firm in connection with the financial audit, and approve all audit and any permissible non-audit services provided by our independent auditors • Receive direct reports from our independent auditors • Review and discuss annual audited and quarterly unaudited financial statements with management and our independent auditors • Review with our independent auditor any audit matters and management’s response • Discuss earnings releases, financial information and earnings guidance provided to analysts and rating agencies |

8 | |||

10

| Committee |

Members |

Functions and Additional Information |

Number of Meetings in Fiscal 2009 | |||

| • Establish procedures to handle complaints regarding accounting, internal accounting controls or auditing matters • Obtain and review, at least annually, an independent auditors’ report describing the independent auditors’ internal quality-control procedures and any material issues raised by the most recent internal quality-control review of the independent auditors or any inquiry by governmental authorities • Set hiring policies for employees or former employees of the independent auditors • Retain independent legal counsel and other outside advisors as it deems necessary to carry out its duties • Our Board has determined that each member of our Audit Committee is “independent,” as defined under and required by federal securities laws and the rules of the NYSE |

||||||

| Compensation |

Frederic V. Malek(1) Bradford M. Freeman Jane J. Su |

• Review executive compensation policies, plans and programs • Review and approve compensation for our Chief Executive Officer and our other executive officers • Review and approve any employment contracts or similar arrangement between us and any of our executive officers • Review and consult with our Chief Executive Officer concerning performance of individual executives and related matters • Administer our stock plans, incentive compensation plans and any such plans that the Board may from time to time adopt, and exercise all the powers, duties and responsibilities of the Board with respect to such plans • Our Board has determined that each member of our Compensation Committee is “independent,” as defined under and required by the rules of the NYSE |

3 | |||

| Corporate Governance and Nominating |

Bradford M. Freeman(1)(4) Richard C. Blum Curtis F. Feeny(4) Michael Kantor(5) |

• Recommend to the Board proposed nominees for election to the Board by our stockholders, including an annual review as to the renominations of incumbents and proposed nominees for election by the Board to fill vacancies that occur between stockholder meetings • Make recommendations to the Board regarding corporate governance matters and practices, including as to director compensation and directors and officers liability insurance |

3 | |||

11

| Committee |

Members |

Functions and Additional Information |

Number of Meetings in Fiscal 2009 | |||

| • Review and consult with our chief executive officer concerning selection of officers and management succession planning • Our Board has determined that each member of the Governance Committee is “independent,” as defined under and required by the rules of the NYSE |

||||||

| Executive |

Richard C. Blum(1) Brett White Ray Wirta |

• Implements policy decisions of the Board • Acts on the Board’s behalf between Board meetings, including the approval of transactions that do not exceed dollar thresholds established by the full Board |

0(2) | |||

| (1) | Committee Chairperson. |

| (2) | Our Acquisition Committee did not hold any formal meetings in 2009. Our Executive Committee did not hold any formal meetings in 2009, but acted two times by unanimous written consent. |

| (3) | Mr. Feeny was elected to the Audit Committee in June 2009, and replaced Ms. Daniels as Chairperson on the committee after her passing in June 2009. |

| (4) | Mr. Feeny served as Chairperson on the Governance Committee through June 2009, at which time he was replaced by Mr. Freeman. |

| (5) | Mr. Kantor was appointed to the Governance Committee in December 2009. |

The Audit Committee is comprised of three directors, each of whom is independent under NYSE rules and applicable securities laws. The Board of Directors has determined that each member of the Audit Committee is financially literate as required under NYSE rules, and is an audit committee financial expert as described under “Corporate Governance—Audit Committee Financial Experts” on page 18. The Audit Committee operates under a written charter adopted by the Board of Directors, a copy of which is published in the Corporate Governance section of the Investor Relations page of our Web site at www.cbre.com. The charter is also attached to this Proxy Statement as Appendix A.

The Audit Committee assists the Board in fulfilling its responsibilities to the stockholders with respect to our independent auditors, our corporate accounting and reporting practices, and the quality and integrity of our financial statements and reports. Since the effective date of the Sarbanes-Oxley Act of 2002, the Audit Committee has become responsible for the appointment, compensation and oversight of the work of our independent auditors. In addition, the Audit Committee reviews all potential related-party transactions involving our directors and executive officers.

The Audit Committee discussed with our independent auditors the scope, extent and procedures for the fiscal 2009 audit. Following completion of the audit, the Audit Committee met with our independent auditors, with and without management present, to discuss the results of their examinations, the cooperation received by the auditors during the audit examination, their evaluation of our internal controls over financial reporting and the overall quality of our financial reporting.

Management is primarily responsible for our financial statements, reporting process and systems of internal controls. In ensuring that management fulfilled that responsibility, the Audit Committee reviewed and discussed with management the audited financial statements in the Annual Report on Form 10-K for the fiscal year ended

12

December 31, 2009. Discussion topics included the quality and acceptability of the accounting principles, the reasonableness of significant judgments, the clarity of disclosures in the financial statements, and an assessment of the work of the independent auditors.

The independent auditors are responsible for expressing an opinion on the conformity of the audited financial statements with generally accepted accounting principles. The Audit Committee reviewed and discussed with the independent auditors their judgments as to the quality and acceptability of our accounting principles and such other matters as are required to be discussed under generally accepted auditing standards pursuant to Statement of Auditing Standards No. 61 and Rule 2-07 of Regulation S-X. In addition, the Audit Committee received from the independent auditors written disclosures and a letter regarding their independence as required by applicable rules of the Public Company Accounting Oversight Board regarding the independent auditors’ communications with the Audit Committee, discussed with the independent auditors their independence from us and our management, and considered the compatibility of non-audit services with the auditors’ independence.

Based on the reviews and discussions described above, the Audit Committee recommended to the Board (and the Board subsequently approved) the inclusion of the audited financial statements in the Annual Report on Form 10-K for the fiscal year ended December 31, 2009 for filing with the SEC.

In addition, the Audit Committee selected KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2010. The Board concurred with the selection of KPMG LLP. The Board has recommended to the stockholders that they ratify and approve the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2010.

In accordance with law, the Audit Committee is responsible for establishing procedures for the receipt, retention and treatment of complaints we receive regarding accounting, internal accounting controls or auditing matters, including the confidential, anonymous submission by our employees, received through established procedures, of concerns regarding questionable accounting or auditing matters. The Audit Committee approved establishment of an ethics and compliance program in 2004 and receives periodic reports from the Chief Compliance Officer regarding that program.

Audit Committee

Curtis F. Feeny, Chair

Frederic V. Malek

Gary L. Wilson

Notwithstanding any statement in any of our filings with the SEC that might incorporate part or all of any filings with the SEC by reference, including this Proxy Statement, the foregoing Report of the Audit Committee is not incorporated into any such filings.

13

BOARD AND COMMITTEE GOVERNING DOCUMENTS

The Board has adopted a Standards of Business Conduct applicable to our directors, officers and employees, a Code of Ethics for Senior Financial Officers applicable to our Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer, Corporate Governance Guidelines, a Policy Regarding Transactions with Related Parties, and an Equity Award Policy. In addition, the Acquisition Committee, Audit Committee, Compensation Committee, Governance Committee and Executive Committee have adopted charters, which, along with the aforementioned policies, are published in the Corporate Governance section of the Investor Relations page on our Web site at www.cbre.com. In addition, these documents also are available in print to any stockholder who requests a copy from our Investor Relations Department at CB Richard Ellis Group, Inc., 200 Park Ave., 17th Floor, New York, New York 10166, or by email at investorrelations@cbre.com. In accordance with the Corporate Governance Guidelines, the Board and each of the Compensation Committee, Audit Committee and Governance Committee conducts an annual performance self-assessment with the purpose of increasing effectiveness of the Board and its committees. (The Company’s Web site address provided above and elsewhere in this Proxy Statement is not intended to function as a hyperlink, and the information on the Company’s Web site is not and should not be considered part of this Proxy Statement and is not incorporated by reference herein.)

Majority Voting Standard to Elect Directors. Our Board has adopted a policy to require majority voting for directors in uncontested director elections. Our Corporate Governance Guidelines require that directors tender their resignation upon failure to achieve a majority vote in an uncontested director election. The Governance Committee will make a recommendation to the Board as to whether to accept or reject the tendered resignation, or whether other action should be taken. The Board will then consider such resignation, taking into account the Governance Committee’s recommendation and announce publicly within 90 days its decision of whether to accept or reject the resignation.

Stock Ownership Guidelines. Our Board is committed to director and senior management stock ownership. The Compensation Committee has adopted Executive Officer Stock Ownership Guidelines that are applicable to all Section 16 officers, including the executive officers named in this Proxy Statement. Mr. White, our Chief Executive Officer and Mr. Sulentic, our President, have a target minimum common stock ownership level of five times their annual base salaries. Our other executive officers named in this Proxy Statement (Messrs. Borok, Frese, Blain, and Strong) have target minimum common stock ownership levels of three times their annual base salaries. At any time the executive officer’s equity holdings do not satisfy these guidelines, Messrs. White and Sulentic must retain 100%, and Messrs. Borok, Frese, Blain and Strong must retain 75%, of the shares remaining after payment of taxes and exercise price upon exercise of stock options or upon the vesting of restricted stock. Shares counting toward achievement of the guideline include: shares owned outright (either directly or indirectly), vested restricted stock units, and allocated shares in other Company benefit plans. Unexercised outstanding stock options (whether or not vested) and unvested/unearned restricted and performance shares do not count toward the guideline.

The Board also has adopted Stock Ownership Guidelines for Outside Directors. Each non-employee director has a target minimum common stock ownership level of five times the value of the annual restricted and unrestricted stock grants made by the Company to these outside directors pursuant to its then current director compensation plan. At any time these guidelines are not satisfied, the director must retain the shares remaining after payment of taxes and exercise price upon exercise of stock options or upon the vesting of restricted stock. Shares counting toward achievement of the guideline include: shares owned outright by the director (either directly or beneficially, e.g., through a family trust) and vested restricted stock or restricted stock units. Shares that do not count toward achievement of the guideline include: (a) shares held by mutual or hedge funds in which the outside director is a general partner, limited partner or investor; (b) unexercised outstanding stock options (whether or not vested); (c) unvested/unearned restricted stock or restricted stock units; and (d) shares transferred to an outside director’s employer pursuant to such firm’s policies.

14

Director Resignation Policy. Our Corporate Governance Guidelines require that directors tender their resignation upon a change of employment. The Governance Committee would then consider whether such change in employment has any bearing on the director’s ability to serve, the Board’s goals regarding Board composition, and any other factors considered appropriate and relevant. The Board would then determine whether to accept or reject such resignation.

Management Succession. The Board periodically reviews with the CEO management succession and development plans, which include CEO succession in the event of an emergency or retirement, as well as the succession of other employees critical to our continued operations and success.

Amended Policy Regarding Transactions with Related Parties. Our Board has adopted a written related party transactions policy. See “Review and Approval of Transactions with Related Persons” on page 53.

For information related to the independence of Board members see “Director Independence” on page 17.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

During the fiscal year ended December 31, 2009, the members of our Compensation Committee were Frederic V. Malek, Bradford M. Freeman and Jane J. Su. None of Messrs. Malek and Freeman or Ms. Su has ever been an officer or employee of our Company or any of our subsidiaries. During 2009, none of our executive officers served on the compensation committee (or equivalent), or the board of directors, of another entity whose executive officer(s) served on our Compensation Committee or Board.

Stockholders and other interested parties may write to the Chairperson of the Board (who acts as the lead independent director), the entire Board or any of its members at CB Richard Ellis Group, Inc., c/o Laurence H. Midler, General Counsel and Secretary, 11150 Santa Monica Blvd., Suite 1600, Los Angeles, California 90025. Stockholders and other interested parties also may e-mail the Chairperson, the entire Board or any of its members c/o larry.midler@cbre.com. The Board may not be able to respond to all stockholder inquiries directly. Therefore, the Board has developed a process to assist it with managing inquiries.

The General Counsel will perform a legal review in the normal discharge of his duties to ensure that communications forwarded to the Chairperson, the Board or any of its members preserve the integrity of the process. While the Board oversees management, it does not participate in day-to-day management functions or business operations, and is not normally in the best position to respond to inquiries with respect to those matters. For example, items that are unrelated to the duties and responsibilities of the Board such as spam, junk mail and mass mailings, ordinary course disputes over fees or services, personal employee complaints, business inquiries, new product or service suggestions, resumes and other forms of job inquiries, surveys, business solicitations or advertisements will not be forwarded to the Chairperson or any other director. In addition, material that is unduly hostile, threatening, illegal or similarly unsuitable will not be forwarded to the Chairperson or any other director and will not be retained.

Any communication that is relevant to the conduct of our business and is not forwarded will be retained for one year and made available to the Chairperson and any other independent director on request. The independent directors grant the General Counsel discretion to decide what correspondence shall be shared with our management and specifically instruct that any personal employee complaints be forwarded to our Human Resources Department. If a response on behalf of the Board is appropriate, we gather any information and documentation necessary for answering the inquiry and provide the information and documentation as well as a proposed response to the appropriate directors. We also may attempt to communicate with the stockholder for any necessary clarification. Our General Counsel (or his designee) reviews and approves responses on behalf of the Board in consultation with the applicable director, as appropriate.

15

Certain circumstances may require that the Board depart from the procedures described above, such as the receipt of threatening letters or e-mails or voluminous inquiries with respect to the same subject matter. Nevertheless, the Board considers stockholder questions and comments important, and endeavors to respond promptly and appropriately.

NOMINATION PROCESS FOR DIRECTOR CANDIDATES

The Governance Committee is, among other things, responsible for identifying and evaluating potential candidates and recommending candidates to the Board for nomination. The Governance Committee is governed by a written charter, a copy of which is published in the Corporate Governance section of the Investor Relations page of our Web site at www.cbre.com.

The Governance Committee regularly reviews the composition of the Board and whether the addition of directors with particular experiences, skills, or characteristics would make the Board more effective. When a need arises to fill a vacancy, or it is determined that a director possessing particular experiences, skills, or characteristics would make the Board more effective, the Governance Committee initiates a search. As a part of the search process, the Governance Committee may consult with other directors and members of senior management, and may hire a search firm to assist in identifying and evaluating potential candidates.

When considering a candidate, the Governance Committee reviews the candidate’s experiences, skills, and characteristics. The Governance Committee also considers whether a potential candidate would otherwise qualify for membership on the Board, and whether the potential candidate would likely satisfy the independence requirements of the NYSE as described below.

Candidates are selected on the basis of outstanding achievement in their professional careers, broad experience, personal and professional integrity, their ability to make independent, analytical inquiries, financial literacy, mature judgment, high performance standards, familiarity with our business and industry, and an ability to work collegially. Other factors include having members with various and relevant career experience and technical skills, and having a Board that is, as a whole, diverse. Where appropriate, we will conduct a criminal and background check on the candidate. In addition, at least a majority of the Board must be independent as determined by the Board under the guidelines of the NYSE listing standards, and at least one member of the Board should have the qualifications and skills necessary to be considered an “Audit Committee Financial Expert” under Section 407 of the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley Act”), as defined by the rules of the SEC.

All potential candidates are interviewed by our Chief Executive Officer, our Board Chairperson and Governance Committee Chairperson, and, to the extent practicable, the other members of the Governance Committee, and may be interviewed by other directors and members of senior management as desired and as schedules permit. In addition, the General Counsel conducts a review of the director questionnaire submitted by the candidate and, as appropriate, a background and reference check is conducted. The Governance Committee then meets to consider and approve the final candidates, and either makes its recommendation to the Board to fill a vacancy, or add an additional member, or recommends a slate of candidates to the Board for nomination for election to the Board. The selection process for candidates is intended to be flexible, and the Governance Committee, in the exercise of its discretion, may deviate from the selection process when particular circumstances warrant a different approach.

Stockholders may recommend candidates to our Board. See “Corporate Governance—Submission of Stockholder Proposals and Board Nominees” on page 19 for more information.

Stockholders affiliated with Blum Capital Partners are entitled to nominate directors as set forth under “Related-Party and Other Transactions Involving Our Officers and Directors” on page 52.

16

Pursuant to our Corporate Governance Guidelines and the listing rules of the NYSE, the Board must consist of at least a majority of independent directors. As of March 31, 2010, 80% of our Board is independent. In addition, all members of the Audit Committee, Compensation Committee and Governance Committee must be independent directors as defined by the Corporate Governance Guidelines and the listing rules of the NYSE. Members of the Audit Committee must also satisfy a separate SEC independence requirement, which generally provides that they may not (1) accept directly or indirectly any consulting, advisory or other compensatory fee from us or any of our subsidiaries, other than their compensation as directors or members of the Audit or any other committees of the Board, or (2) be an affiliated person of ours.

We adopted the following categorical standards for director independence in compliance with the NYSE corporate governance listing standards: No director qualifies as “independent” unless the Board affirmatively determines each year that the director has no material relationship with us or any of our subsidiaries (either directly or as a partner, stockholder or officer of an organization that has a relationship with us). We and our subsidiaries must identify which directors are independent and disclose the basis for that determination.

| 1. | The following relationships shall be deemed immaterial in determining director independence: |

| • | The director, or a company of which the director serves as an officer, director, employee or consultant, receives products or services (e.g., brokerage or property management services) from us or our affiliates or subsidiaries in the ordinary course of business and on substantially the same terms as those prevailing at the time for comparable products or services provided to unaffiliated third parties, subject to the dollar limitations described elsewhere in these categorical standards for director independence. |

| • | A relationship arising solely from a director’s status as an officer, employee or owner of two percent or more of the equity of a company to which we are indebted at the end of our preceding fiscal year, so long as the aggregate amount of the indebtedness of us to such company is not in excess of two percent of our total consolidated assets at the end of our preceding fiscal year. |

| 2. | However, a director is not independent if: |

| • | The director is, or has been within the last three years, our employee or an employee of any of our subsidiaries, or an immediate family member is, or has been within the last three years, an executive officer of ours or any of our subsidiaries. |

| • | The director has received, or has an immediate family member who has received, during any 12-month period within the last three years, more than $120,000 in direct compensation from us, or any of our subsidiaries, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service). |

| • | The director or an immediate family member is a current partner of a firm that is our internal or external auditor; the director is a current employee of such a firm; the director has an immediate family member who is a current employee of such a firm and who personally works on our, or any of our subsidiaries, audit within that time; or the director or an immediate family member was within the past three years (but is no longer) a partner or employee of such a firm and personally worked on our, or any of our subsidiaries, audit within that time. |

| • | The director or an immediate family member is, or has been within the last three years, employed as an executive officer of another company where any of our present executive officers, or any present executive officers of any of our subsidiaries, at the same time serves or served on that company’s compensation committee. |

| • | The director or an immediate family member is, or during the last three years was, an officer or senior employee of a company on whose board of directors any of our present executive officers, or any present executive officers of any of our subsidiaries, at the same time serves or served. |

17

| • | The director is a current employee, or an immediate family member is a current executive officer, of a company or firm that has made payments to, or received payments from, us or any of our subsidiaries for property or services in an amount that, in any of the last three fiscal years, exceeds the greater of $1 million, or 2% of such other company’s consolidated gross revenues. |

| • | The director or an immediate family member is affiliated with or employed by a tax-exempt entity that received significant contributions (i.e., more than 2% of the annual contributions received by the entity or more than $1 million in a single fiscal year, whichever amount is lower) from us, any of our affiliates, any executive officer or any affiliate of an executive officer within the preceding twelve-month period, unless the contribution was approved in advance by the Board. |

As a result of the Board’s independence review, which included consideration of the investments and agreements described under “Related-Party and Other Transactions Involving Our Officers and Directors”, the Board affirmatively determined that all of our non-employee directors nominated for election at the Annual Meeting are independent of us and our management under the standards set forth in the Corporate Governance Guidelines, with the exception of Mr. Wirta. Mr. Wirta is not considered independent because of the compensation he received from a consulting relationship with us, which ended June 1, 2007.

AUDIT COMMITTEE FINANCIAL EXPERTS

Our Board has determined that Messrs. Feeny, Malek and Wilson qualify as “audit committee financial experts,” as this term has been defined by the SEC in Item 407(d)(5)(ii) of Regulation S-K. Messrs. Feeny, Malek and Wilson were each determined by our Board to meet the qualifications of an “audit committee financial expert” in accordance with SEC rules, including based on their prior experience: Mr Malek actively supervised chief financial officers as a former president of Northwest Airlines, Inc. and Marriott International, Inc., and Mr. Wilson previously served as chief financial officer at Northwest Airlines, Inc. and The Walt Disney Company.

Our Board determined that Mr. Feeny acquired the required attributes for such designation as a result of the following relevant experience, which forms of experience are not listed in any order of importance and were not assigned any relative weights or values by our Board in making such determination:

| • | Mr. Feeny received a B.S. degree in mechanical engineering from Texas A&M University and an M.B.A. from Harvard Business School. |

| • | Mr. Feeny has been a managing director at Voyager Capital, a venture capital firm, since 2000 and has served on numerous company boards of directors. |

| • | Mr. Feeny served on the Trammell Crow Company Audit Committee prior to our acquisition of that company in 2006, and chaired the Finance and Audit Committee of the Presidio Trust (a 6-million square foot asset based public/private partnership with the U.S. government). |

| • | Mr. Feeny served on the board of directors of Stanford Federal Credit Union where he reviewed financial reports and accounting statements for this financial institution. He also served on the Investment Committee of the Children’s Health Council, where he helped oversee the endowment and returns. |

| • | Mr. Feeny was the Executive Vice President of the Stanford Management Company, which oversaw Stanford University’s endowment, from 1992 to 2000, during which time assets under management grew from $1.5 billion to $9.0 billion. |

| • | Mr. Feeny was previously a managing partner for Trammell Crow Company in Seattle, with $700 million of assets under management. |

18

AUDIT COMMITTEE PRE-APPROVAL POLICY

The Audit Committee’s policy is to pre-approve all significant audit and permissible non-audit services provided by our independent auditors. These services may include audit services, audit-related services, tax services and other services. Pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. Our independent auditors and management are required to periodically report to the Audit Committee regarding the extent of services provided by the independent auditors in accordance with this pre-approval, and the fees for the services performed to date. The Audit Committee may also pre-approve particular services on a case-by-case basis.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

KPMG LLP’s fees for the fiscal years ended December 31, 2009 and 2008 were as follows (in millions):

| Fiscal 2009 |

Fiscal 2008 | |||||

| Audit Fees |

$ | 6.0 | $ | 5.1 | ||

| Audit-Related Fees |

0.8 | 0.3 | ||||

| Tax Fees |

0.6 | 0.4 | ||||

| All Other Fees |

— | — | ||||

| Total Fees |

$ | 7.4 | $ | 5.8 | ||

A description of the types of services provided in each category is as follows:

Audit Fees—Includes audit of our annual financial statements, review of our quarterly reports on Form 10-Q, statutory audits required internationally, and consents and assistance with and review of registration statements filed with the SEC. In addition, audit fees include those fees related to KPMG LLP’s audit of the effectiveness of our internal controls over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act.

Audit-Related Fees—Includes audits of our employee benefit plans, financial due diligence in connection with acquisitions, and accounting consultations related to generally accepted accounting principles, or GAAP, and the application of GAAP to proposed transactions.

Tax Fees—Includes tax compliance at international locations, domestic and international tax advice and planning and assistance with tax audits and appeals.

None of the services described above were approved by the Audit Committee pursuant to the de minimis exception provided in Rule 2-01(c)(7)(i)(C) of Regulation S-X promulgated by the SEC.

BOARD ATTENDANCE AT ANNUAL MEETING OF STOCKHOLDERS

While the Board understands that there may be situations that prevent a director from attending an annual meeting of stockholders, the Board strongly encourages all directors to make attendance at all annual meetings of stockholders a priority. At the 2009 Annual Meeting on June 2, 2009, eight of our directors attended in person.

SUBMISSION OF STOCKHOLDER PROPOSALS AND BOARD NOMINEES

If you would like to recommend a candidate for possible inclusion in our 2011 proxy statement or bring business before our annual meeting of stockholders in 2011, you must send notice to Laurence H. Midler, Secretary, CB Richard Ellis Group, Inc., 11150 Santa Monica Blvd., Suite 1600, Los Angeles, California 90025, by registered, certified, or express mail and provide the required information as described below.

19

Stockholders who wish to present a proposal in accordance with SEC Rule 14a-8 for inclusion in the Company’s proxy materials to be distributed in connection with next year’s annual meeting must submit their proposals in accordance with that rule so that they are received by the Secretary at the Company’s executive offices no later than the close of business on December 20, 2010. As the rules of the SEC make clear, simply submitting a proposal does not guarantee that it will be included.