Global Corporate Services Overview Mike Lafitte President, Institutional & Corporate Services Exhibit 99.7 |

Global Corporate Services Overview Mike Lafitte President, Institutional & Corporate Services Exhibit 99.7 |

#1

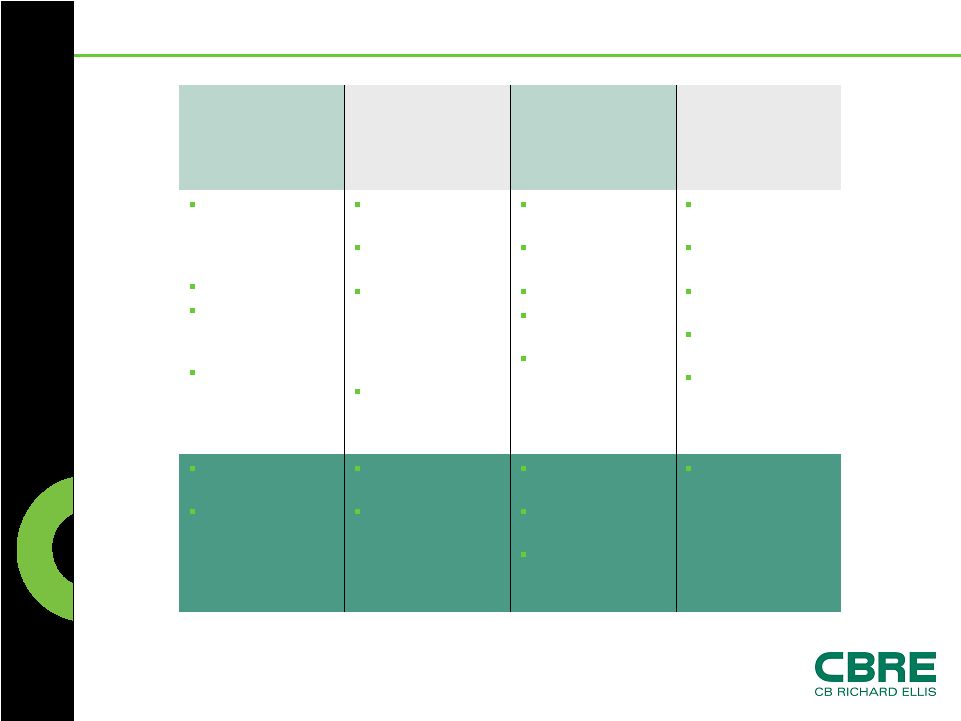

Provider Of Every Outsourced Real Estate Service * Including

affiliates 200+ global consultants 6,000 professionals 1.9 BSF under management* $20 billion opex under management 2,500 project managers $3 billion capex managed 5,300 brokers worldwide $264 billion in transactions Organizational design Portfolio optimization Workplace strategy Land use analysis and strategy Fiscal and economic impact analysis Sourcing and procurement Operations and maintenance Energy services Health, safety and security Environmental sustainability Full service outsourcing Program management One-off integrated transaction management/ project management Moves, adds, changes Global execution of transactions with a portfolio- wide focus Optimize portfolio Lease administration services Multiple- transaction focus Consulting Property and Facilities Project Management Transaction Management |

How

GCS Business Works Large occupiers – Corporate, Healthcare and Government “Portfolio-wide” services – not limited to individual deals or transactions Multiple services; cross-selling opportunities Contractual relationships Relationships over years; recurring revenue |

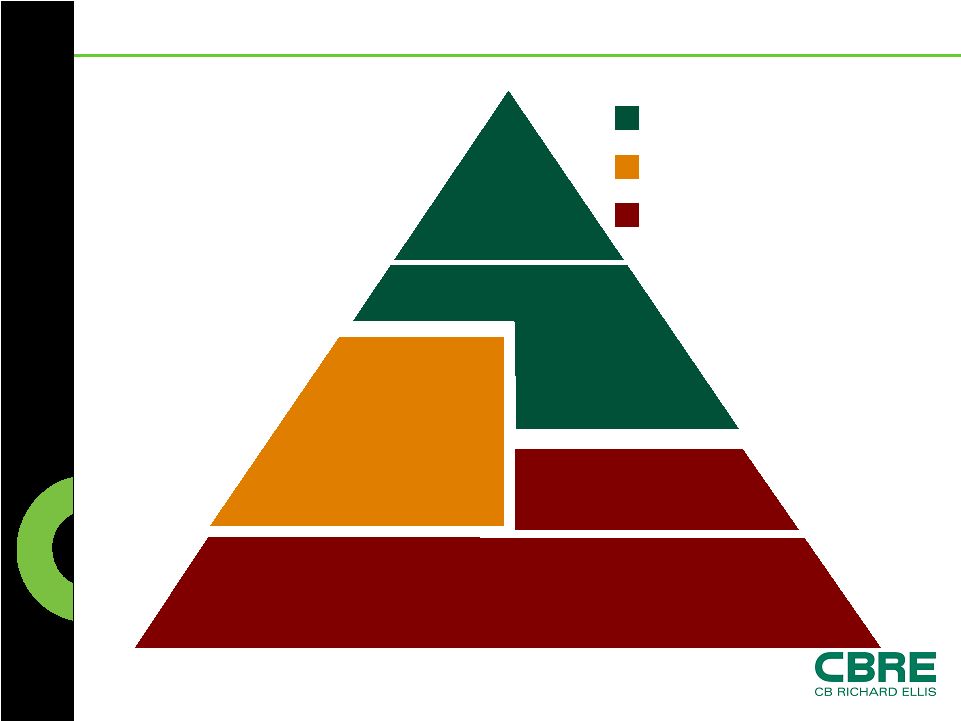

How

Our Clients Buy Contract w/ Renewable Term Contract w/ Finite Term No Contract – Deal by Deal Brokerage One-off/Local Programs (e.g., Compliance, Operational Refit, Growth, Rebranding) (Single or Multiple Services) Full Service - Domestic Portfolio Full Service – Global Preferred Brokerage & PJM– No Contract Single Transaction + PJM One-off/Local Projects |

Real

Estate Outsourcing Market Opportunity: 30% increase in corporate real

estate centralization expected over the next 3 years – a prelude to outsourcing (1) 90% expect outsourced corporate real estate spend to increase – with 45% expecting it to “increase greatly” (2) 30% increase in real estate outsourcing RFPs received in 2007 (1) Deloitte, 2008 (2) CoreNet, 2007 Continued Real Estate Outsourcing Growth by Corporates |

Corporate real estate major determinant of company’s environmental impact (1) LEED-registered projects are set to account for 25% of all new construction in the U.S. (2) 75% cite energy utilization as an important or very important issue in their organization (3) 50% workplace utilization increasingly common (4) (1) Deloitte, 2007 (2) Frost & Sullivan, 2008 (3) CoreNet, 2008 (4) CBRE Consulting Clients Seeking New Facility Services (e.g. Environmental Sustainability, Energy, Space Utilization) Real Estate Outsourcing Market Opportunity: |

Shared services (including real estate) are increasingly being globalized (1) EMEA outpaces Americas in outsourcing growth for first time in 2007 (2) Non-U.S. companies (especially Europe) leading in demand for sustainable facility services (3) (1) Deloitte, 2007 (2) TPI, 2008 (3) CORENET, 2007 Non-U.S. Companies Adopting Real Estate Outsourcing Real Estate Outsourcing Market Opportunity: |

Top 100 hospital systems = ~1 billion s.f. Over 10% YOY growth in healthcare outsourcing service contracts (1) U.S. Federal portfolio = ~3.9 billion s.f. (2) Annual U.S. Federal contract spend (2) • $21 billion for operations of government-owned facilities • $19 billion for construction of structures and facilities (1) Modern Healthcare, 2007 (2) Federal Real Property report, 2006 Healthcare and Government/Public Sectors Just Beginning Real Estate Outsourcing Real Estate Outsourcing Market Opportunity: |

Outsourcing Services: CBRE Differentiators Global coverage and local market intelligence Industry’s largest base of global consultants and subject matter experts in each service line Account management approach – integration of services Leading platform infrastructure • Accounting • HR • IT • Procurement Sophisticated performance management and customer satisfaction |

Turning Information into Insight EXECUTIVES STRATEGISTS SERVICE LINE PRACTITIONERS Single application, fully integrated dashboard. Proprietary diagnostic toolset for organization, portfolio & operational assessments, current and future market & econometric analysis and industry benchmarks. Comprehensive suite of application solutions to drive labor efficiencies and ensure consistent processes across the portfolio Portfolio Optimization Rent & Opex Savings Opportunities Labor Efficiencies and Process Consistency Sourcing Insight Utility Insight Financial Insight Service Insight Project Insight Portfolio Insight |

Recent GCS Successes Significant new contracts won in 2007 • 30% are for two or more services • 70% utilized existing local CBRE brokerage relationships Nearly 50% of new 2007 wins included non-U.S. geography in service scope 70% of 2007 new business revenue came from client expansions Renewed >95% of 2007 expiring contracts |

Recent GCS Successes Top ranked Consultancy Firm Top Global Corporate Real Estate Services CoreNet H. Bruce Russell Global Innovator’s award Named Top Outsourcing Provider by IAOP Recognition Clients |

2008

Initiatives Continue cross-selling to current GCS clients Accelerate Healthcare and Government/public sector verticals Deepen global services/platform Lead industry in environmental/energy services, consulting and technology Drive outsourcing services to CBRE’s “middle market” brokerage relationships Targeted acquisitions |

GCS

2007/2008 Case Studies 3,000 locations Full service contract Multiple geographic regions Centralizing real estate function and beginning to outsource Decided to explore Facilities Management and came to market for 5 million s.f. in EMEA Client >13 years Full service contract; multiple geographic regions Facilities Management services for new headquarters facility in Shanghai, China Awarded Transaction Management services in United States After signing contract, expanded scope into EMEA Client >8 years Renewed full service outsourcing 200-person account team |