EMEA

Overview Robert E. Sulentic Group President EMEA, Asia Pacific & Development Services Exhibit 99.4 |

EMEA

Overview Robert E. Sulentic Group President EMEA, Asia Pacific & Development Services Exhibit 99.4 |

Our

Business in EMEA |

CB

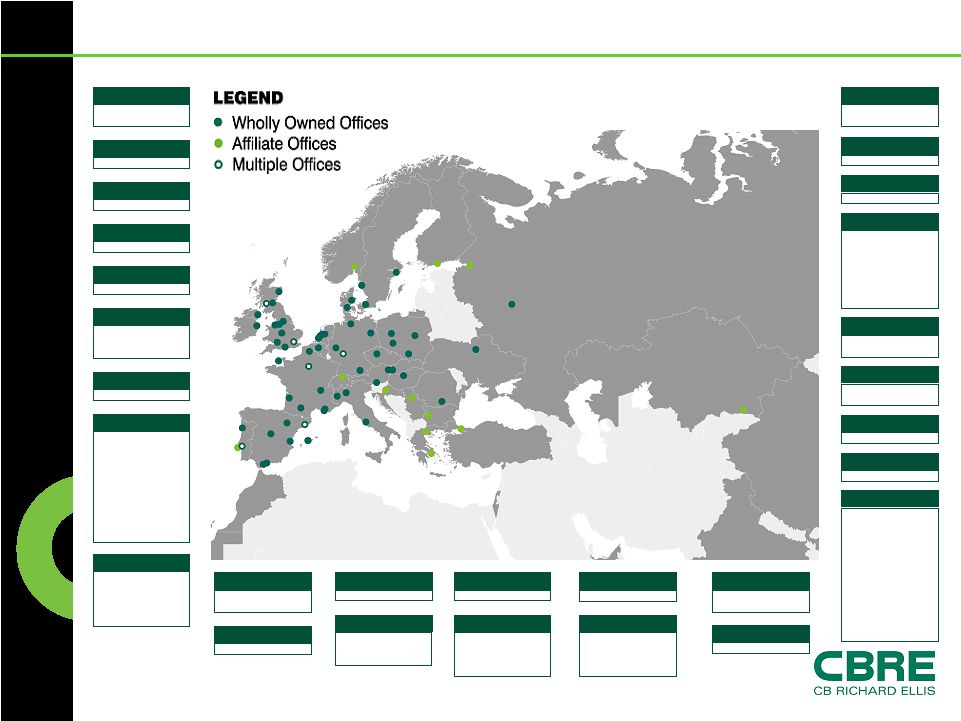

Richard Ellis | Page 3 Where Are We: Europe Austria Klagenfurt Vienna Belgium Brussels Bulgaria Sofia Croatia Zagreb Czech Rep Prague Denmark Aarhus Copenhagen Kolding Finland Helsinki France Paris – 6 offices Paris region – 4 offices Aix-en-Provence Bordeaux Lille Lyon Marseille Toulouse 27 regional offices (not shown on map) Germany Berlin Düsseldorf Frankfurt am Main Hamburg Munich Hungary Budapest Italy Milan Rome Turin The Netherlands Amsterdam Almere The Hague Hoofddorp Poland Kraków Poznañ Warsaw Wroclaw Serbia Belgrade Slovakia Bratislava Spain Barcelona – 2 offices Madrid Málaga Marbella Palma de Mallorca Valencia Zaragoza Sweden Gothenburg Stockholm Switzerland Geneva Zurich Turkey Istanbul UK Aberdeen Belfast Birmingham Bristol Edinburgh Glasgow (2 offices) Jersey Leeds Liverpool London (3 offices) Manchester Southampton Ukraine Kiev Greece Athens Thessaloniki Ireland Dublin Kazakhstan Almaty Portugal Lisbon – 2 offices Porto Russia Moscow St Petersburg Romania Bucharest Norway Oslo |

CB

Richard Ellis | Page 4 Where Are We: Middle East & Africa

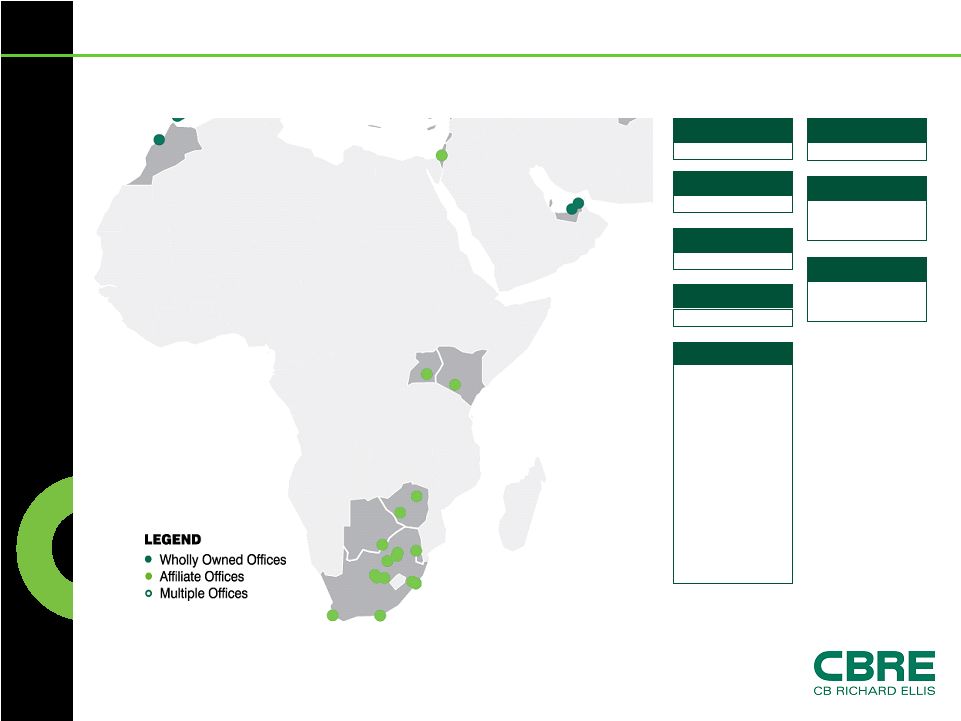

Zimbabwe Bulawayo Harare Uganda Kampala UAE Dubai Abu Dhabi Botswana Gaborone South Africa Bloemfontein Cape Town Durban(2) Jo’burg(2) Kimberley Klerksdorp Nelspruit Pietermaritzburg Polokwane Port Elizabeth Pretoria Kenya Nairobi Morocco Casablanca Israel Tel Aviv |

CB

Richard Ellis | Page 5 EMEA Sectors and Service Lines Sectors Airports & Aviation Automotive Banking & Finance Government Health Care Hotels Industrial & Logistics Life Sciences Media Petroleum Retail & Leisure Residential & Mixed Use Telecoms Service Lines Asset Management Brokerage Building Consultancy Capital Markets Debt Advisory Development Energy & Environmental Facilities Management Global Corporate Services Professional Consultancy Property Management Real Estate Finance Research & Consultancy Tenant Representation Valuation & Advisory |

CB

Richard Ellis | Page 6 2007 EMEA Corporate Stats Revenue $1.3 billion Total Transaction Value $107.8 billion Property Sales (Number of Transactions) 2,350 Property Sales (Transaction Value) $74.6 billion Property Leasing (Number of Transactions) 5,175 Property Leasing (Transaction Value) $33.2 billion Property & Corporate Facilities Under Management 281 million sq. ft.* Loan Servicing $2.0 billion Investment Assets Under Management $16.9 billion Valuation & Advisory Assignments 60,725 * Includes affiliate offices |

CB

Richard Ellis | Page 7 EuroMoney Awards for Excellence in Real Estate Pan Western European Award Advisory in: Consultancy, Agency/Letting, Research, Transaction Execution &

Valuation European Property Awards European Retail Agency Team of the Year European Industrial Agency Team of the Year Irish Property Awards Investment Agency Team of the Year EG Property Awards Property Advisor of the Year – Ireland Office EGi Deals Competition Top National Agent in Retail in: London, South East, East Midlands, North West 3rd consecutive year Estates Gazette Property Marketing Awards Best Marketing Campaign by a Corporate Property Adviser Great Place to Work® Institute One of the 50 Best Companies to Work for in Ireland – 4th consecutive year One of the Top 10 Companies in Ireland – 2nd consecutive year Great Place to Work® Institute “Best Workplaces France 2008” – 10th place Property Week Awards Office Agency Team of the Year Retail & Leisure Agency Team of the Year Property Deal of the Year won by HSBC for the sale at Canary Wharf Property Week/ OAS Office Development Awards Green Development Award in: Village, Butterfield, LutonEuropean Retail CBRE EMEA Milestones 2007-08 |

CB

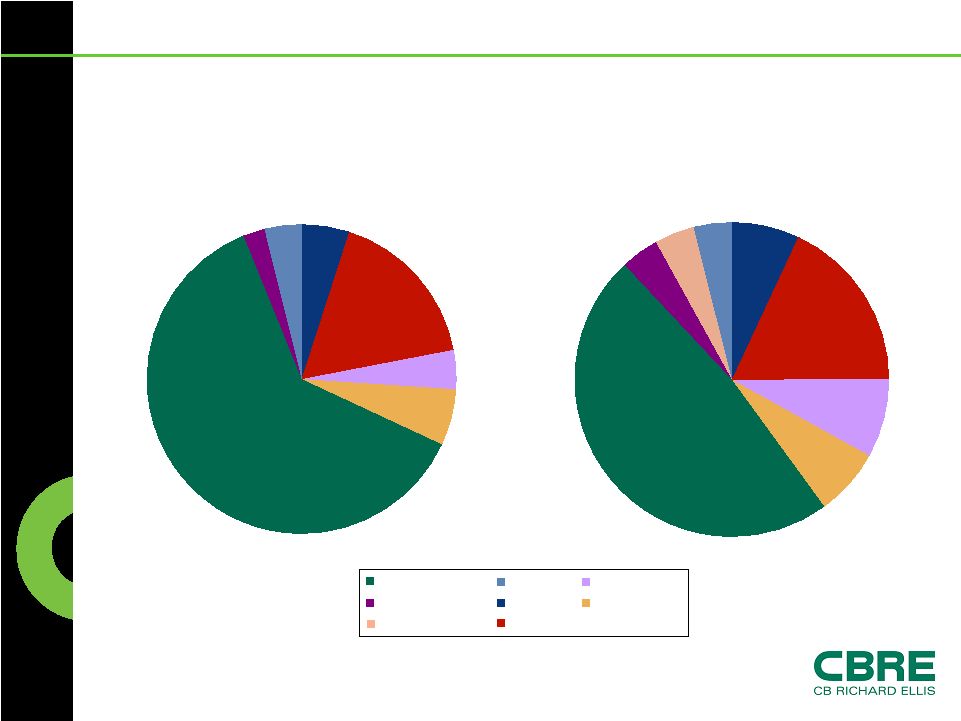

Richard Ellis | Page 8 EMEA Geographic Spread 7% 18% 8% 7% 48% 4% 4% 4% 5% 17% 4% 6% 62% 2% 4% 2004 2007 * Other: Includes UAE, Italy, Sweden, among others Revenue Benelux France Germany Other * Spain/Portugal UK CEE Ireland |

CB

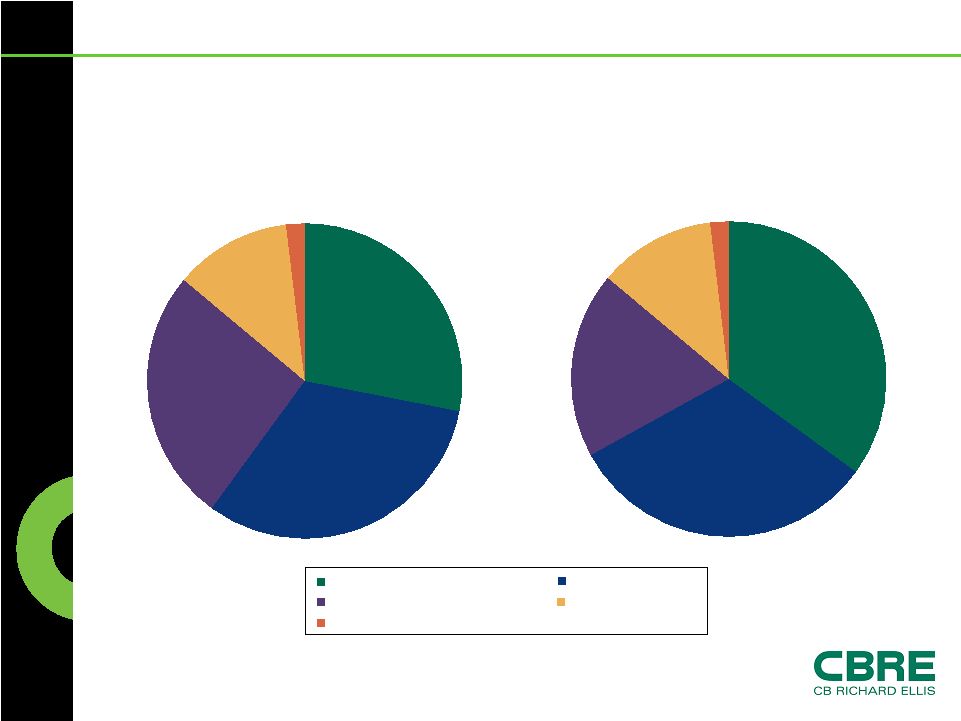

Richard Ellis | Page 9 28% 32% 26% 12% 2% 2004 2007 35% 32% 19% 12% 2% 33.8% Property & Facilities Management Sales Leasing Appraisal & Valuation Other EMEA Revenue by Service Line |

CB

Richard Ellis | Page 10 Source: CB Richard Ellis, Property Data,

KTI Source of Funds into European Real Estate In 2007, $381 billion of capital was invested in Europe; 22% of this came from

outside the region. North America $64 billion 17.0% Asia $5 billion 1.4% Australia $5 billion 1.3% Middle East $10 billion 2.7% European x-border $123 billion 32.3% European Domestic $173 billion 45.3% EUROPE Total: $381 billion |

Business Performance |

CB

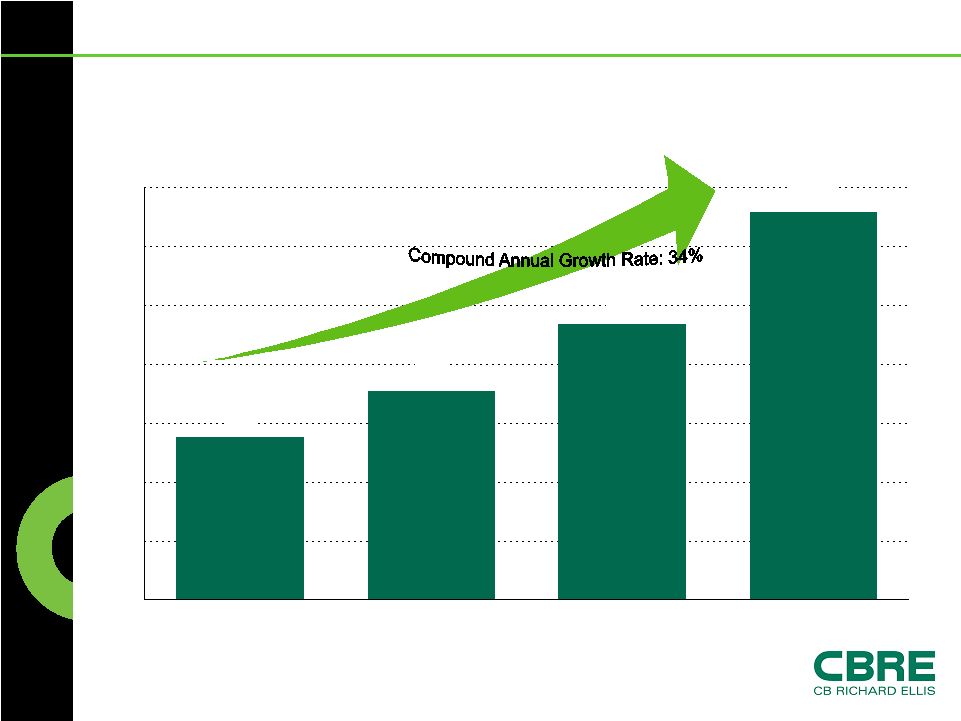

Richard Ellis | Page 12 EMEA Revenue Progression ($ in millions) 551 707 934 1,314 0 200 400 600 800 1,000 1,200 1,400 2004 2005 2006 2007 +28% +32% +41% |

CB

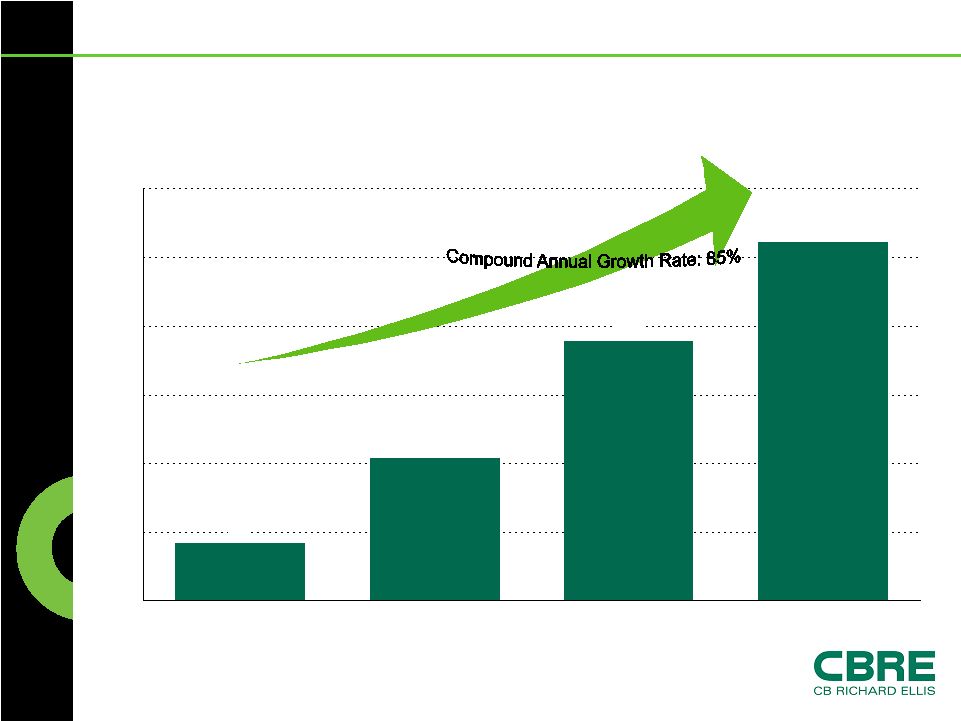

Richard Ellis | Page 13 EMEA EBITDA Progression ($ in millions) 42 104 189 261 0 50 100 150 200 250 300 2004 2005 2006 2007 +216% +79% +38% |

CB

Richard Ellis | Page 14 Recent EMEA Acquisitions/New

Affiliates Cederholm Denmark 2008 DGI Davis George United Kingdom 2007 Grenvillle Smith & Duncan United Kingdom 2008 ED Consulting CBRE Italy Valuation Italy 2007 CB Richard Ellis The Ukraine 2008 FM Arquitectos Spain 2007 Guy Neplaz Conseil France 2007 Eurisko Romania 2008 Paul Gee & Co Ltd United Kingdom 2008 Neoturis Portugal 2007 |

CB

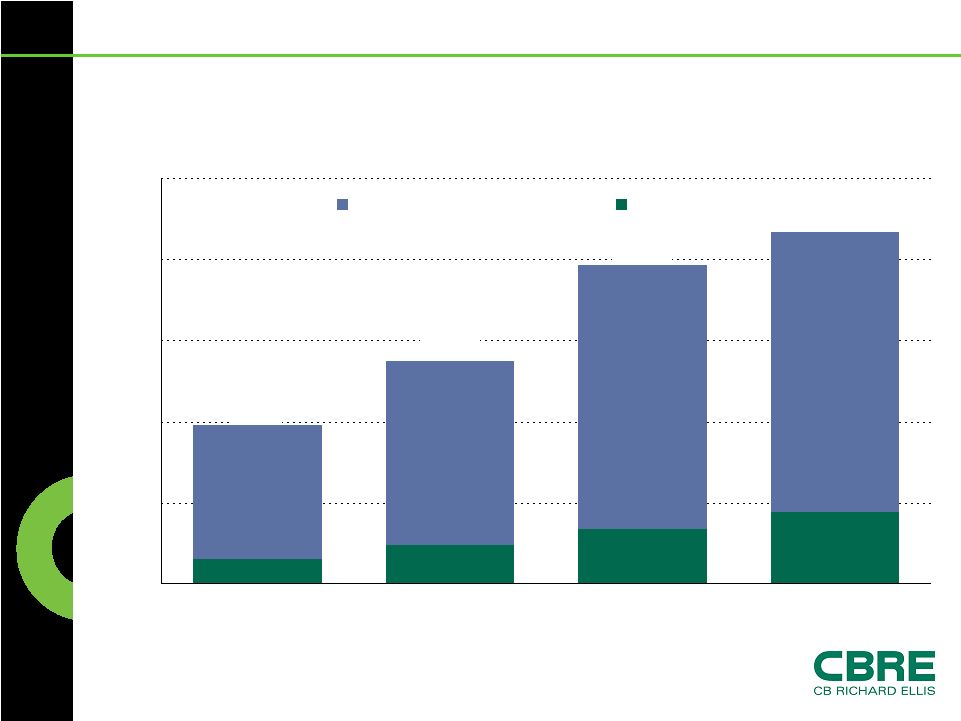

Richard Ellis | Page 15 EMEA Market Share 98.0 137.6 196.6 217.0 21% 17% 17% 16% 0 50 100 150 200 250 2004 2005 2006 2007 Market Size (€ in billions) CBRE Share Capital Markets |

Objectives & Key Strategies |

CB

Richard Ellis | Page 17 Market Opportunity Long-term fundamentals remain sound Outsourcing of commercial real estate services continues to gain acceptance Delivering common standards • Increased quality and frequency of valuations • Greater intermediation: decline in “direct” transactions Low industry concentration Opportunity to grow market share |

CB

Richard Ellis | Page 18 Key Strategies Attract, reward and retain the best people • Highest industry productivity Full-service, owned offices in all major territories • Organic • Acquisition Service line innovation and development Achieve clear market leadership by geography, by service line and by brand reputation |

CB

Richard Ellis | Page 19 Strategic Advantage Most complete network in EMEA—and globally The best people • Low attrition rates Client Management • Locally • Cross-Border Highest operating margin Industry-leading acquisition and integration capabilities with broad opportunities for cross-selling Brand & Marketing |