Americas Overview Chris Ludeman President, Brokerage – Americas Exhibit 99.3 |

Americas Overview Chris Ludeman President, Brokerage – Americas Exhibit 99.3 |

Business Overview Platform and Structure |

CB

Richard Ellis | Page 3 CB Richard Ellis | Page 3

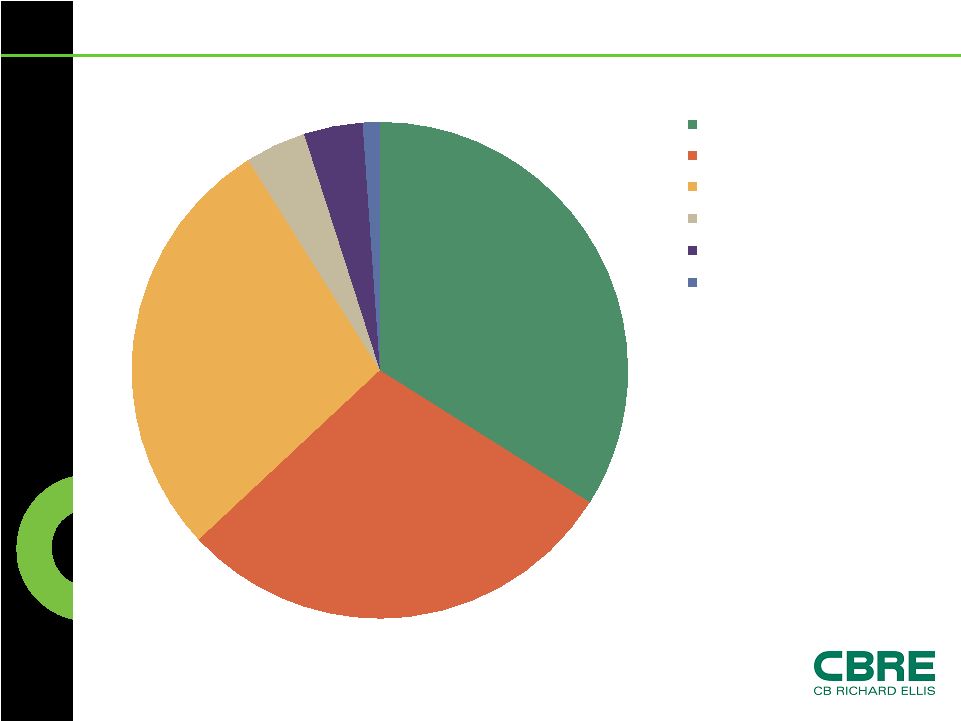

2007 Americas Revenue: $3.7 billion 34% 29% 28% 4% 4% 1% Leasing Property/Facilities Management Sales Appraisal and Valuation Commercial Mortgage Brokerage Other |

CB

Richard Ellis | Page 4 CB Richard Ellis | Page 4

2007 Americas Corporate Stats Offices 190+ (1) Employees 19,400+ (2) Brokerage Services (# of Producers) 3,500 (1) Total Transaction Value $136.1 billion Property Sales (# of Transactions) 7,025 Property Sales (Transaction Value) $87.8 billion Property Leasing (# of Transactions) 31,050 Property Leasing (Transaction Value) $48.3 billion Property & Corporate Facilities Under Management 1.1 billion sq. ft. (1) Project Management (# of Project Managers) 1,800 Loan Originations $25.0 billion Loan Servicing $110.5 billion (3) Investment Assets Under Management $18.6 billion Development in Process/Pipeline $9.2 billion Valuation and Advisory Assignments 30,725 Unique Breadth And Depth (1) Includes affiliate company totals (2) Excludes affiliate employees (3) Reflects loans serviced by GEMSA, a joint venture between CBRE Melody and GE

Capital Real Estate |

CB

Richard Ellis | Page 5 CB Richard Ellis | Page 5

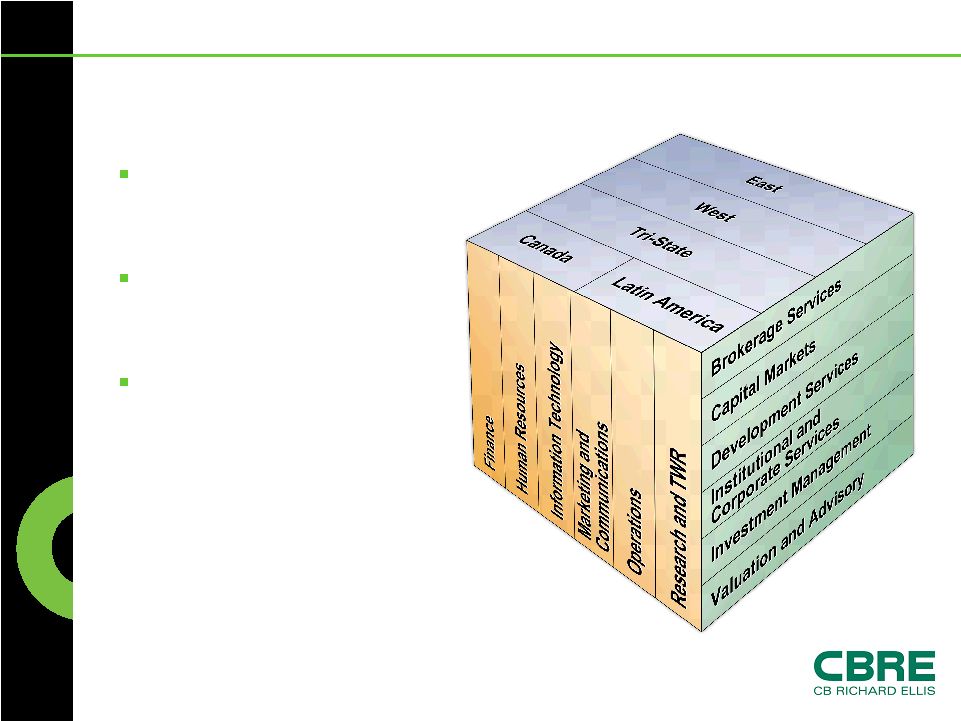

Americas Structure Large, multi-dimensional business Managed as a single entity Matrix management • Geography • Lines of business • Shared Services functions Interconnected and Interdependent |

Sales and Leasing Trends |

CB

Richard Ellis | Page 7 CB Richard Ellis | Page 7

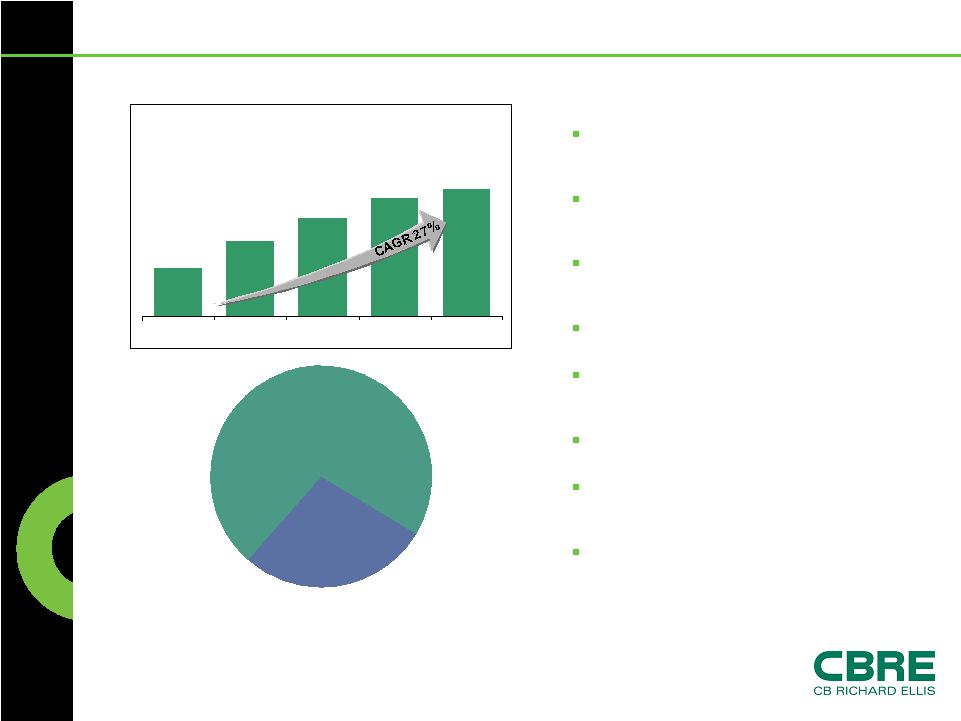

CBRE Americas Sales Revenue ($ in millions) 389 606 796 959 1,025 2003 2004 2005 2006 2007 Sales Trends 1Q 2008 Update Investment volumes well off 2007 pace due to credit market dislocation $100 million+ assets especially difficult to finance Buyer and seller expectations remain out of alignment Pricing of risk is still fluid Spreads have narrowed modestly post Bear Stearns but remain unusually wide CMBS market still largely frozen Thin volume of trades creates lack of predictability Equity capital is plentiful but apprehensive. No investor wants to be first and wrong 28% Sales % of FY 2007 Total Revenue Includes Trammell Crow Company’s operations prior to the acquisition on December

20, 2006. The financial information including Trammell Crow Company

is presented for informational purposes and does not purport to represent what CBRE Americas’ results of operations or financial position would have been had the Trammell Crow Company acquisition, in fact, occurred prior to

December 20, 2006. 1 |

CB

Richard Ellis | Page 8 CB Richard Ellis | Page 8

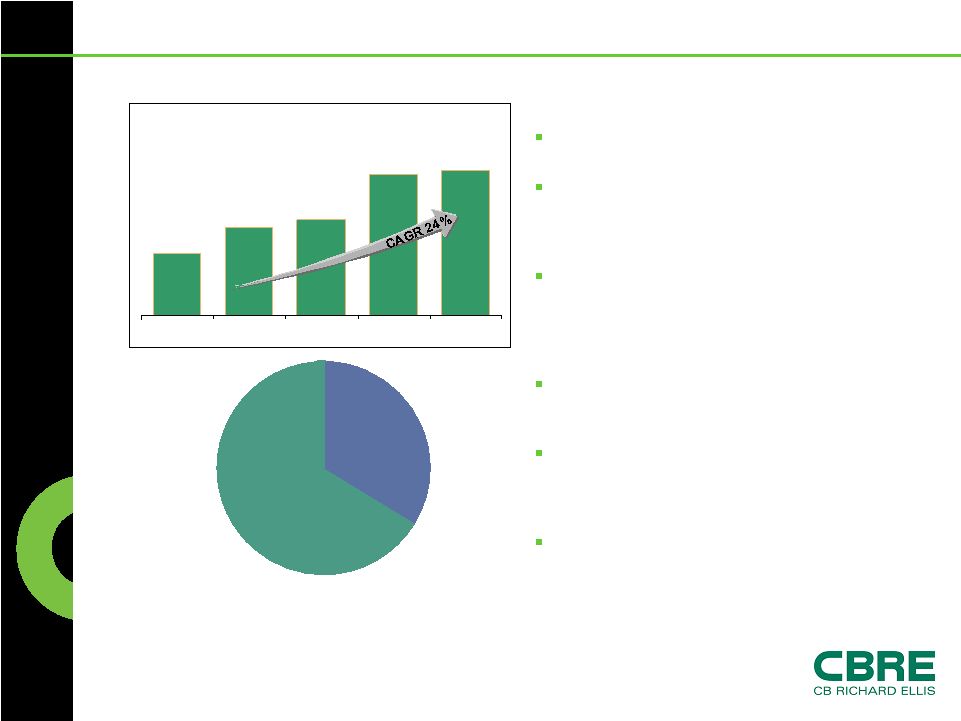

34% Leasing Trends Q1 2008 Leasing Update Office vacancy up to 12.9% nationally Impetus for office vacancy increase is suburbs; Downtowns continue to hold steady Construction remains below norms of past cycles, helping to sustain rent levels in most markets and increases in some markets Markets with heavy residential subprime exposure are faring worse Absorption of industrial space has slowed due to decline in imports, especially in port markets Industrial supply pipeline remains in check and rent growth should continue; albeit at slower pace CBRE Americas Leasing Revenue ($ in millions) 528 755 815 1,208 1,241 2003 2004 2005 2006 2007 Leasing % of FY 2007 Total Revenue 1 Includes Trammell Crow Company’s operations prior to the acquisition on December

20, 2006. The financial information including Trammell Crow Company

is presented for informational purposes and does not purport to represent what CBRE Americas’ results of operations or financial position would have been had the Trammell Crow Company acquisition, in fact, occurred prior to

December 20, 2006. |

Key

Americas Initiatives |

CB

Richard Ellis | Page 10 CB Richard Ellis | Page 10

Key Americas Initiatives Fill all gaps through acquisitions & recruiting Explore new business segments Develop key niche practices/specialty services Drive enterprise selling throughout organization Leverage marketing to improve client outreach Enhance research brand and output Invest in technology for competitive advantage Embrace commitment to corporate responsibility |

CB

Richard Ellis | Page 11 CB Richard Ellis | Page 11

Niche Practices: Sustainable Practice Group |

CB

Richard Ellis | Page 12 CB Richard Ellis | Page 12

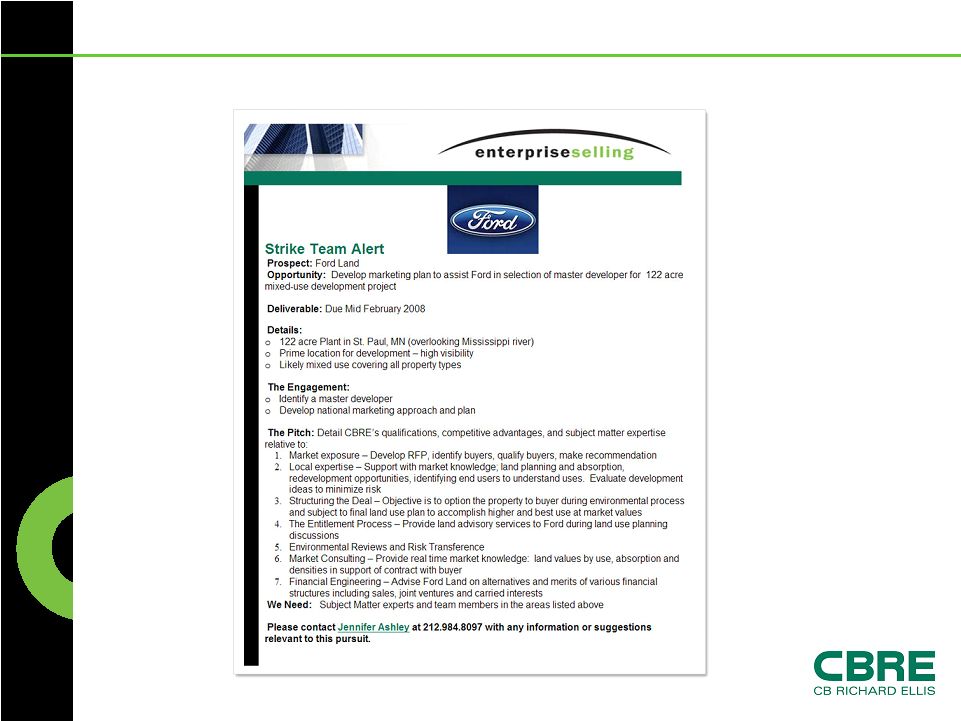

Enterprise Selling Strike Team Alert |

CB

Richard Ellis | Page 13 CB Richard Ellis | Page 13

Enterprise Selling Track Record in Q1 2008 10 WINS (80% Success Rate) 18 PURSUITS IN PROGRESS HQ Tenant Representation Industrial Leasing Agency Portfolio Disposition Land/Master Developer Valuation Plant Disposition Sale Disposition Development Services Land Sale Property Management Retail Agency Consulting Chicago Toronto St. Louis Charlotte Pittsburgh Atlanta Tacoma Kansas City Columbia Hawaii New Jersey Minneapolis Executive-led business pursuit process Patterned after Trammell Crow GCS model Evaluating opportunities across geographic & functional matrix Harvesting best talent from the enterprise on tailored basis Dedicated marketing support for quality and consistency Increasing level of engagement across enterprise |

CB

Richard Ellis | Page 14 CB Richard Ellis | Page 14

Enterprise Selling Track Record in Q1 2008 |

CB

Richard Ellis | Page 15 CB Richard Ellis | Page 15

Enhance Research Brand Becoming the Industry Voice |

CB

Richard Ellis | Page 16 CB Richard Ellis | Page 16

Invest in Technology Web-based platform that will empower sales brokers and investors to perform online real estate transactions Transaction ‘efficiency tool’ Tenant-friendly building portal – private label for building owners Provides: • Building services and contact information • Leasing information: brochures, vacancies, floor plans, etc. • Building communication • Documents ools and esources to dvise and ollaborate Interactive knowledge center providing real-time best practices, content and tools for our sales and leasing professionals Black box that crunches CBRE Research market data and TWR projections Helps investors proactively manage large portfolios and capitalize on market opportunities Enable Productivity & Extend Competitive Advantage T R A C |

Americas Market Position |

CB

Richard Ellis | Page 18 CB Richard Ellis | Page 18

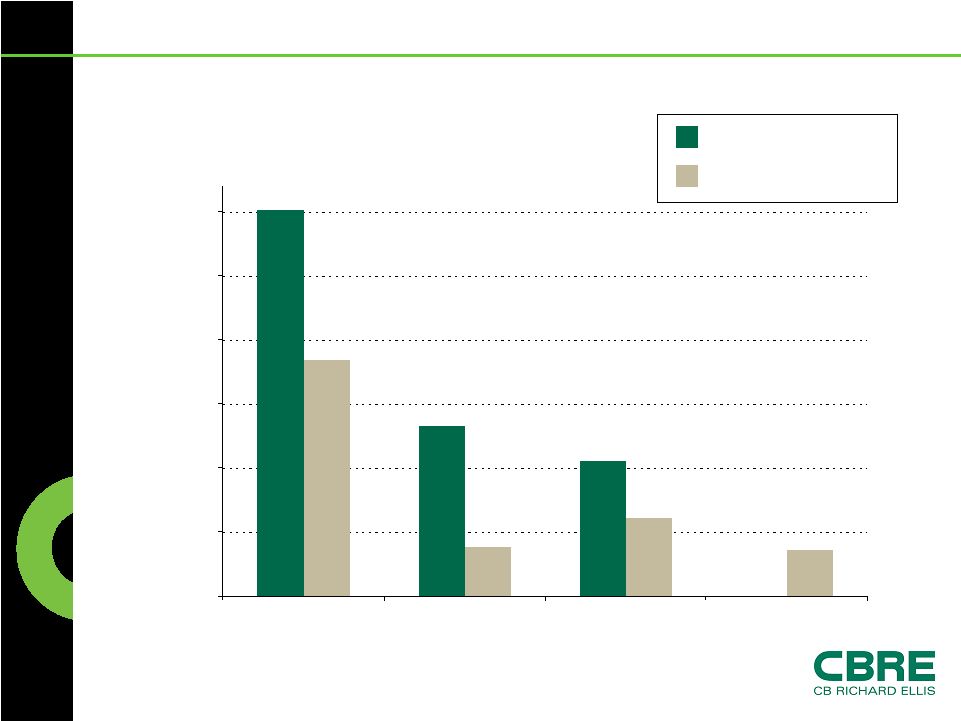

CBRE vs. the Competition – Americas $2,652 $6,036 (1) $2,100 (2) $3,690 $764 $1,218 (3) $718 (4) $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 CBRE JLL C&W Grubb & Ellis (1) Includes revenue from discontinued operations of $2 million (2) As per Cushman & Wakefield 2007 Annual Review (3) U.S. Revenue (4) Proforma comprises $513 million for legacy Grubb & Ellis combined with $205

million for Triple Net Properties 2007 Global Revenue 2007 Americas Revenue $ in millions |