$300

million Senior Secured Term Loan A-1 Public Presentation to Lenders

March 2008 Exhibit 99.1 |

$300

million Senior Secured Term Loan A-1 Public Presentation to Lenders

March 2008 Exhibit 99.1 |

Page 2 This presentation contains statements that are forward looking within the meaning of the Private Securities Litigation Reform Act of 1995. These statements should be considered as estimates only and actual results may ultimately differ from these estimates. Except to the extent required by applicable securities laws, CB Richard Ellis Group, Inc. undertakes no obligation to update or publicly revise any of the forward- looking statements that you may hear today. Please refer to our current annual report on Form 10-

K (in particular, “Item 1-A, Risk Factors”) which is filed with the

SEC and available at the SEC’s website (http://www.sec.gov ), for a full discussion of the risks and other factors that may impact any estimates that you may hear today. We may make certain statements during the course of this presentation which include references to “non- GAAP financial measures,” as defined by SEC regulations. As required by these regulations, we have provided reconciliations of these measures to what we believe are the most directly comparable GAAP measures. Forward Looking Statements Forward Looking Statements |

Page

3 Transaction Overview Transaction Overview |

Page 4 Transaction Summary Transaction Summary CBRE is exercising the accordion provision in its existing credit agreement to syndicate a $300 million Term Loan Proceeds from the new loan will be used to fund working capital needs, pay expenses associated with the syndication and for general corporate purposes Both Moody’s and S&P have reaffirmed CBRE’s corporate and facility ratings of Ba1/BB+ Pro forma for the transaction, TTM 12/31/07 Net Debt / Normalized EBITDA is 1.8x CBRE is exercising the accordion provision in its existing credit agreement to syndicate a $300 million Term Loan Proceeds from the new loan will be used to fund working capital needs, pay expenses associated with the syndication and for general corporate purposes Both Moody’s and S&P have reaffirmed CBRE’s corporate and facility ratings of Ba1/BB+ Pro forma for the transaction, TTM 12/31/07 Net Debt / Normalized EBITDA is 1.8x ($ in millions) Sources Uses New Term Loan A-1 $300.0 Finance Working Capital / General $293.5 Corporate Purposes Transaction Fees and Expenses 6.5 Total Sources $300.0 Total Uses $300.0 |

Page 5 Capitalization Capitalization 1. Revolving credit facility of $600.0 million, funded in the amount of $227.1 million at

12/31/07. 2. Excludes $255.8 million of non-recourse warehouse facility, $42.6 million of

non-recourse revolving credit facility in Development Services as well

as $459.4 million of non-recourse notes payable on real estate as of December 31, 2007. 3. Based on CBRE share price of $18.99 on 3/5/08. 4. Normalized EBITDA excludes merger-related costs, integration costs related to

acquisitions, and loss on trading securities acquired in the TCC

acquisition. 5. Covenant EBITDA includes adjustments as per the credit agreement which includes $61.6 million of development services gains that cannot be recognized under purchase accounting rules. 6. Excludes $17.4 million of interest expense related to non-recourse notes payable on

real estate for FY 2007. 1. Revolving credit facility of $600.0 million, funded in the amount of $227.1 million at

12/31/07. 2. Excludes $255.8 million of non-recourse warehouse facility, $42.6 million of

non-recourse revolving credit facility in Development Services as well

as $459.4 million of non-recourse notes payable on real estate as of December 31, 2007. 3. Based on CBRE share price of $18.99 on 3/5/08. 4. Normalized EBITDA excludes merger-related costs, integration costs related to

acquisitions, and loss on trading securities acquired in the TCC

acquisition. 5. Covenant EBITDA includes adjustments as per the credit agreement which includes $61.6 million of development services gains that cannot be recognized under purchase accounting rules. 6. Excludes $17.4 million of interest expense related to non-recourse notes payable on

real estate for FY 2007. Actual Pro Forma Cum. Mult. Cum. Net Multi. % of Ratio ($ in millions) 12/31/2007 12/31/2007 EBITDA EBITDA Cap. Requirement Cash $342.9 $409.3 Revolving Credit Facility 1 $227.1 $0.0 0.0x – – Existing Term Loan A 827.0 827.0 0.9x 0.4x 13.7% New Term Loan A-1 - 300.0 2.2x 1.7x 18.6% Existing Term Loan B 960.0 960.0 2.2x 1.7x 34.5% Other Debt 2 21.6 21.6 2.2x 1.8x 34.9% Total Debt $2,035.7 $2,108.6 2.2x 1.8x 34.9% Market Value of Equity 3 3,935.5 3,935.5 65.1% Total Capitalization $5,971.2 $6,044.1 100.0% FYE 12/31/07 Normalized EBITDA 4 $970.1 $970.1 Total Debt/Normalized EBITDA 2.1x 2.2x Net Debt/Normalized EBITDA 1.7x 1.8x FYE 12/31/07 Covenant EBITDA 5 $1,057.5 $1,057.5 Total Debt/Covenant EBITDA 1.9x 2.0x Net Debt/Covenant EBITDA 1.6x 1.6x 3.75x Consolidated Cash Interest Expense 6 $142.0 $164.1 Normalized EBITDA/Cash Interest Expense 6.8x 5.9x Covenant EBITDA/Cash Interest Expense 7.4x 6.4x 2.25x |

Page

6 Industry Overview and Company Highlights Industry Overview and Company Highlights |

Page 7 The World’s Premier Commercial Real Estate Service Provider The World’s Premier Commercial Real Estate Service Provider Transactional Business Outsourcing Business Investment Management Business #1 in property sales with $180.1 billion #1 in leasing with $84.1 billion #1 in transaction value with $264.2 billion #1 in property sales with $180.1 billion #1 in leasing with $84.1 billion #1 in transaction value with $264.2 billion Corporate services relationships with 270 clients #1 in property and facilities management with 1.6 billion square feet managed 1 #1 in project management with 2,500+ professionals Corporate services relationships with 270 clients #1 in property and facilities management with 1.6 billion square feet managed 1 #1 in project management with 2,500+ professionals $38 billion of investment assets under management (as of 12/31/07) $38 billion of investment assets under management (as of 12/31/07) Development Business $9.2 billion in process and pipeline projects (as of 12/31/07) $9.2 billion in process and pipeline projects (as of 12/31/07) 1. Excludes joint ventures and affiliates. |

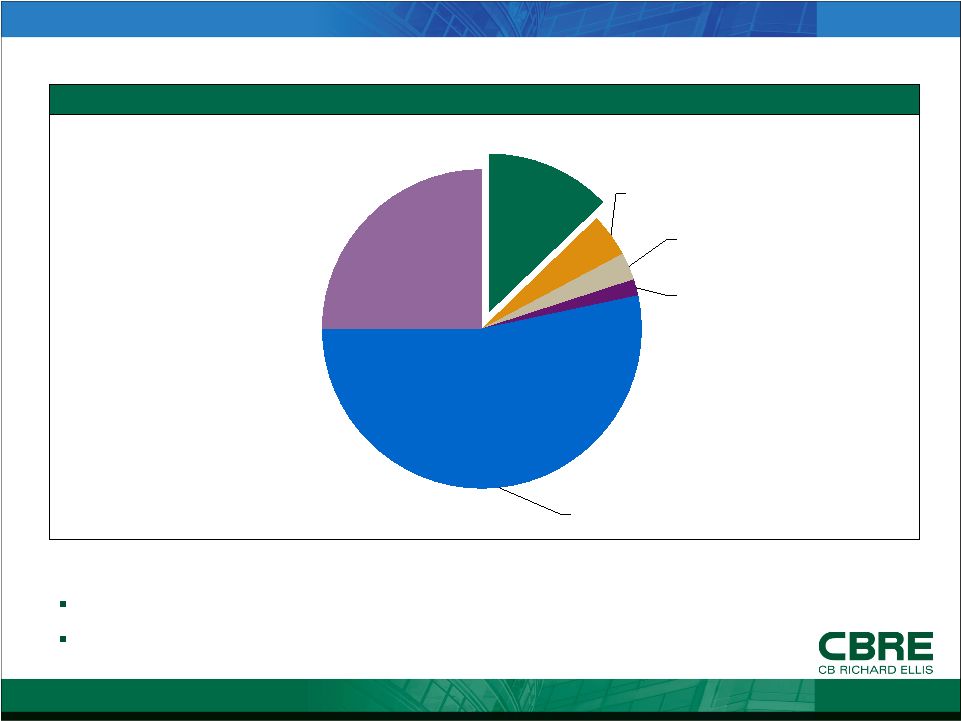

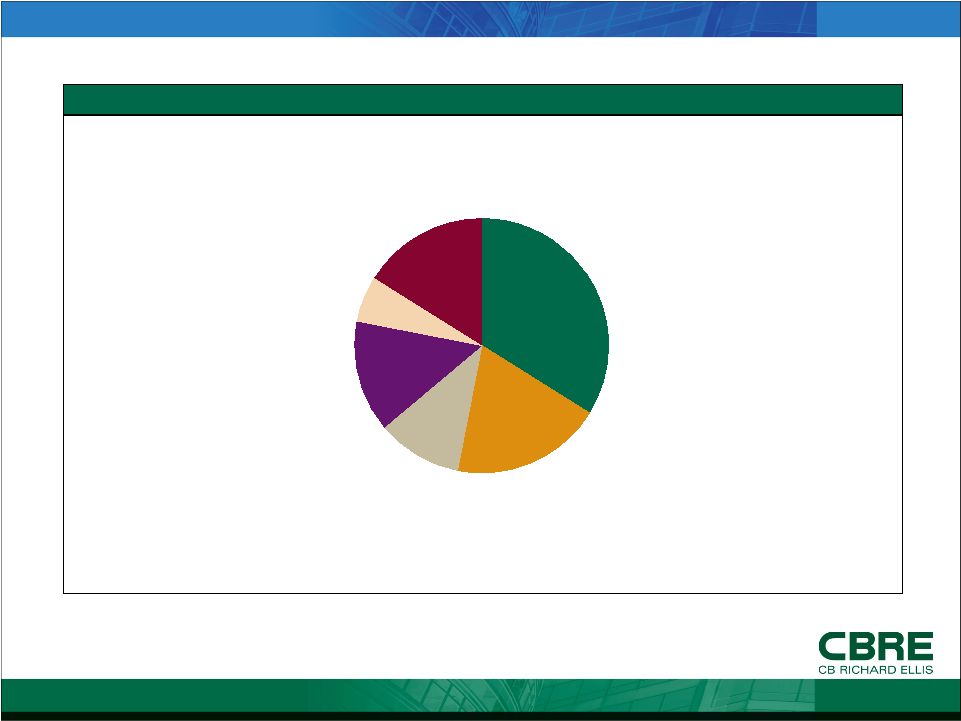

Page 8 CBRE 12.7% Self Providers 25.0% JLL 2.8% GBE 1.9% C&W 4.4% Other / Third Party 53.2% #1 Position in a Fragmented Market #1 Position in a Fragmented Market $27 Billion Commercial Real Estate Market in the U.S.¹ Source: 2007 external public filings and CBRE management estimate as of December 31,

2007. 1. Excludes global investment management and development services. Source: 2007 external public filings and CBRE management estimate as of December 31,

2007. 1. Excludes global investment management and development services. Large and growing market – 4.2% CAGR from 1997 – 2007 Highly fragmented – top four firms have 21.8% of market share |

Page 9 Corporate 34% Individuals / Partnerships 11% Pension funds 14% Other 16% Insurance companies / Banks 19% REITS 6% Diversified Client Base Diversified Client Base CBRE 2007 Revenue by Client Type |

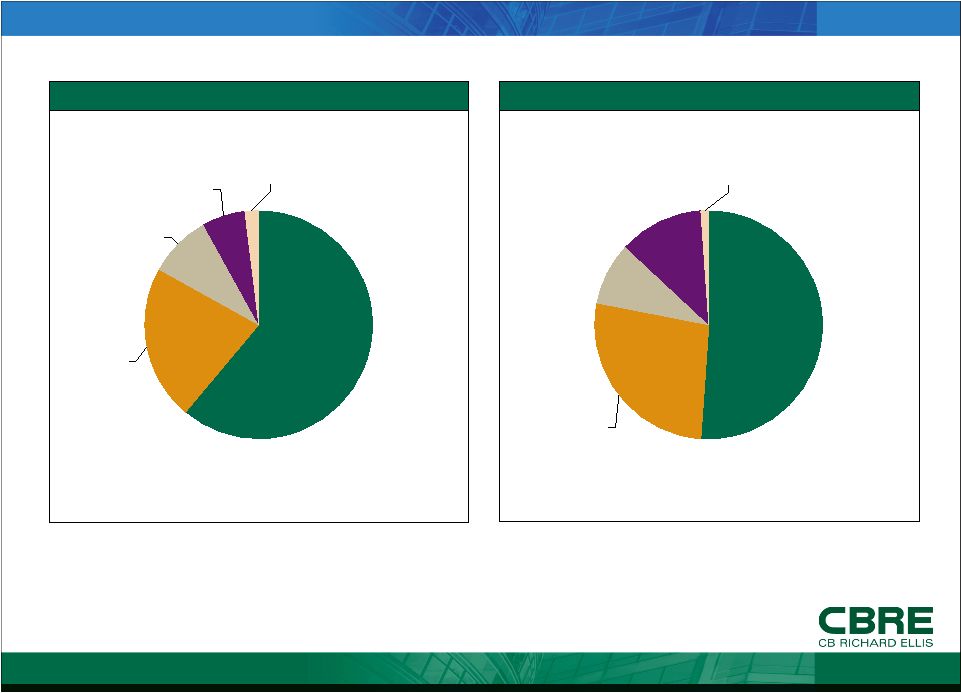

Page 10 Global Reach Global Reach FY 2007 Revenue¹ FY 2007 Normalized² EBITDA Americas 61% Asia Pacific 9% Global Investment Management 6% EMEA 22% Development Services 2% Americas 51% Asia Pacific 9% Global Investment Management 12% EMEA 27% Development Services 1% 1. Includes revenue from discontinued operations, which totaled $2.1 million for the year

ended December 31, 2007. 2. Normalized EBITDA excludes merger-related charges, integration costs related to

acquisitions and loss on trading securities acquired in the TCC acquisition. |

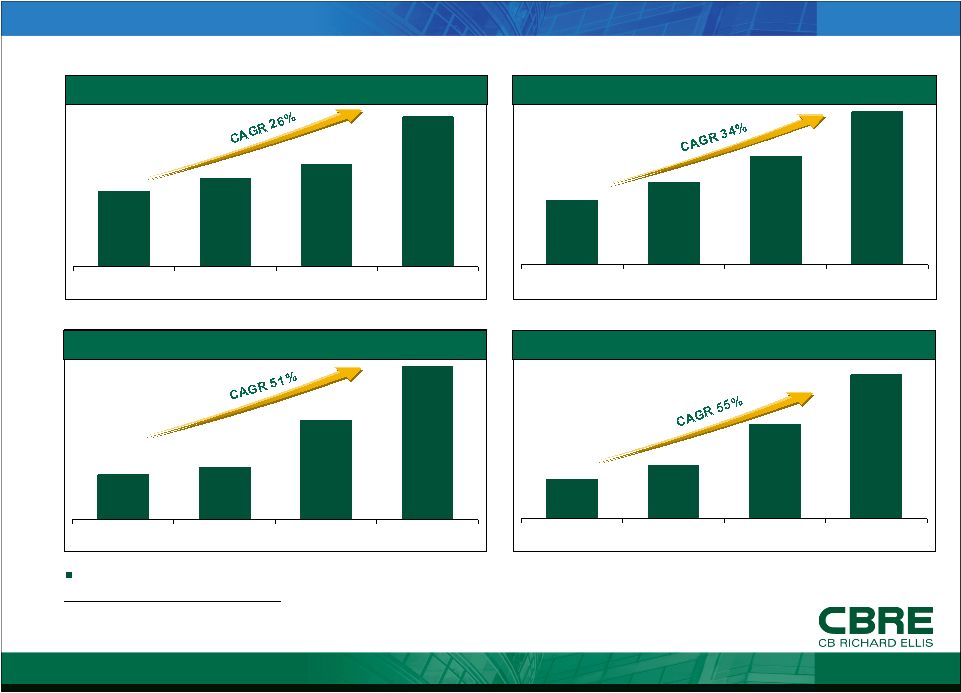

Page 11 Americas 1,842 2,173 2,507 3,690 2004 2005 2006 2007 EMEA 551 707 934 1,314 2004 2005 2006 2007 Asia Pacific 160 187 355 549 2004 2005 2006 2007 Global Investment Management 94 127 228 348 2004 2005 2006 2007 Segment Revenue Performance¹ Segment Revenue Performance¹ Strong growth across all segments 1. Excludes development services segment. Americas EMEA Global Investment Management Asia Pacific ($ in millions) ($ in millions) ($ in millions) ($ in millions) |

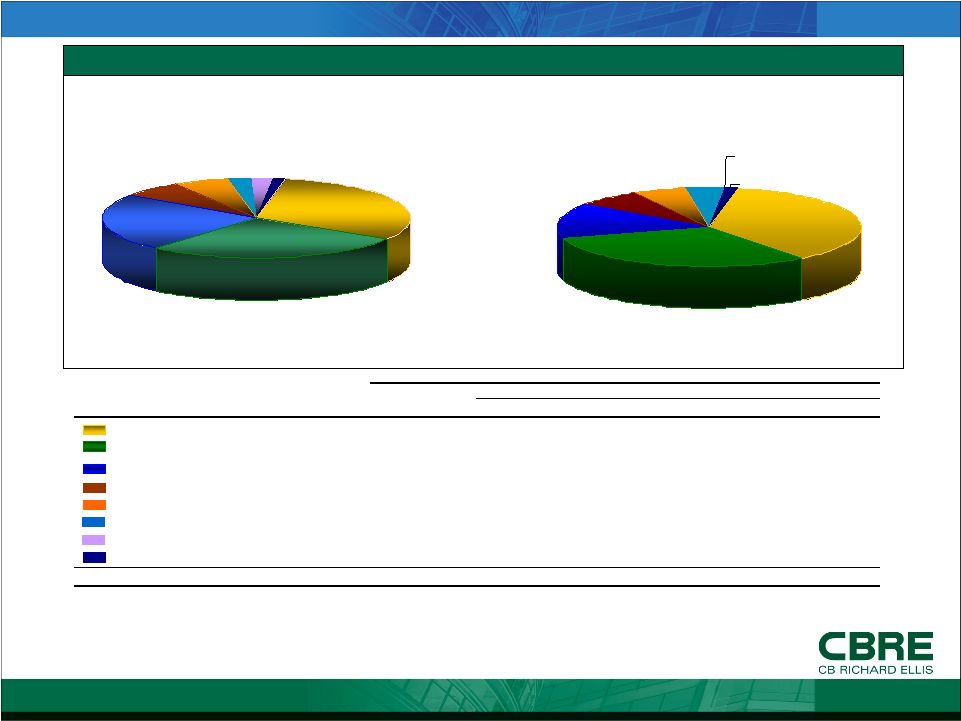

Page 12 31% 28% 23% 6% 6% 3% 1% 2% 37% 31% 14% 7% 6% 4% 0% 1% 1. Includes revenue from discontinued operations, which totaled $2.1 million for the year

ended December 31, 2007. 2. Includes Trammell Crow Company’s operations for the period from the 12/20/2006

acquisition through 12/31/2006. 3. Includes Trammell Crow Company’s operations prior to the acquisition on December

20, 2006. The financial information including Trammell Crow Company is presented for informational purposes and does not purport to

represent what CB Richard Ellis’ results of operations of financial position would have been had the Trammell Crow Company

acquisition, in fact, occurred prior to December 20, 2006. 1. Includes revenue from discontinued operations, which totaled $2.1 million for the year

ended December 31, 2007. 2. Includes Trammell Crow Company’s operations for the period from the 12/20/2006

acquisition through 12/31/2006. 3. Includes Trammell Crow Company’s operations prior to the acquisition on December

20, 2006. The financial information including Trammell Crow Company is presented for informational purposes and does not purport to

represent what CB Richard Ellis’ results of operations of financial position would have been had the Trammell Crow Company

acquisition, in fact, occurred prior to December 20, 2006. Revenue Breakdown Broad Services Platform Broad Services Platform FY 2007 FY 2006 ($ in millions) Year Ended December 31, 2006 2007 1 Reported 2 % Change Including TCC 3 % Change Leasing $1,869.7 $1,478.9 26 $1,709.0 9 Sales 1,659.9 1,245.9 33 1,359.0 22 Property and Facilities Management 1,395.6 567.5 146 1,145.0 22 Appraisal and Valuation 386.3 288.2 34 288.2 34 Investment Management 352.1 232.7 51 232.7 51 Commercial Mortgage Brokerage 162.9 157.5 3 157.5 3 Development Services 125.6 7.2 N/A 40.2 212 Other 84.2 54.1 56 80.8 4 Total $6,036.3 $4,032.0 50 $5,012.4 20 |

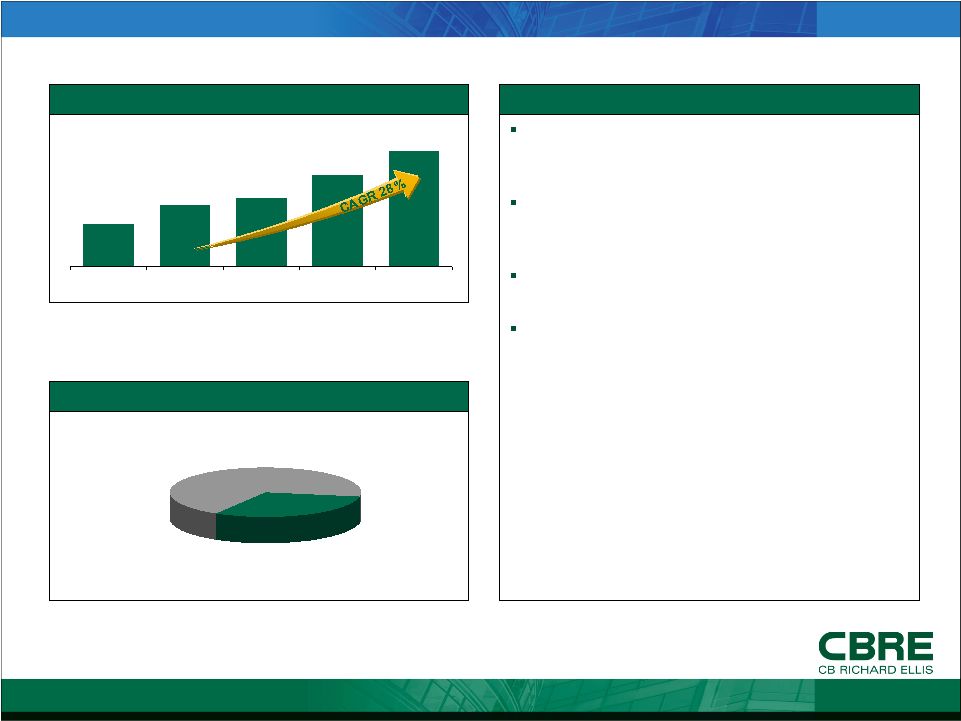

Page 13 Leasing Update Leasing Update CBRE Global Leasing Revenue Leasing as % of FY 2007 Total Revenue Business Update Fundamentals of leasing business remain strong, despite slowing in US and EMEA in the fourth quarter of 2007 In U.S. rational levels of new construction in 2008 should support continued increase in rents, albeit at a slower pace than 2007 Signs of modestly weakening office leasing and easing of rental growth rates in EMEA In Asia, strong demand for office space and tight supply continue to drive up rents in markets such as China, Singapore, Tokyo and India Fundamentals of leasing business remain strong, despite slowing in US and EMEA in the fourth quarter of 2007 In U.S. rational levels of new construction in 2008 should support continued increase in rents, albeit at a slower pace than 2007 Signs of modestly weakening office leasing and easing of rental growth rates in EMEA In Asia, strong demand for office space and tight supply continue to drive up rents in markets such as China, Singapore, Tokyo and India $692 $986 $1,106 $1,479 $1,870 2003 2004 2005 2006 2007 1. Includes Trammell Crow Company’s revenue for the period from the 12/20/2006 acquisition date through 12/31/2006. 1 ($ in millions) 31% |

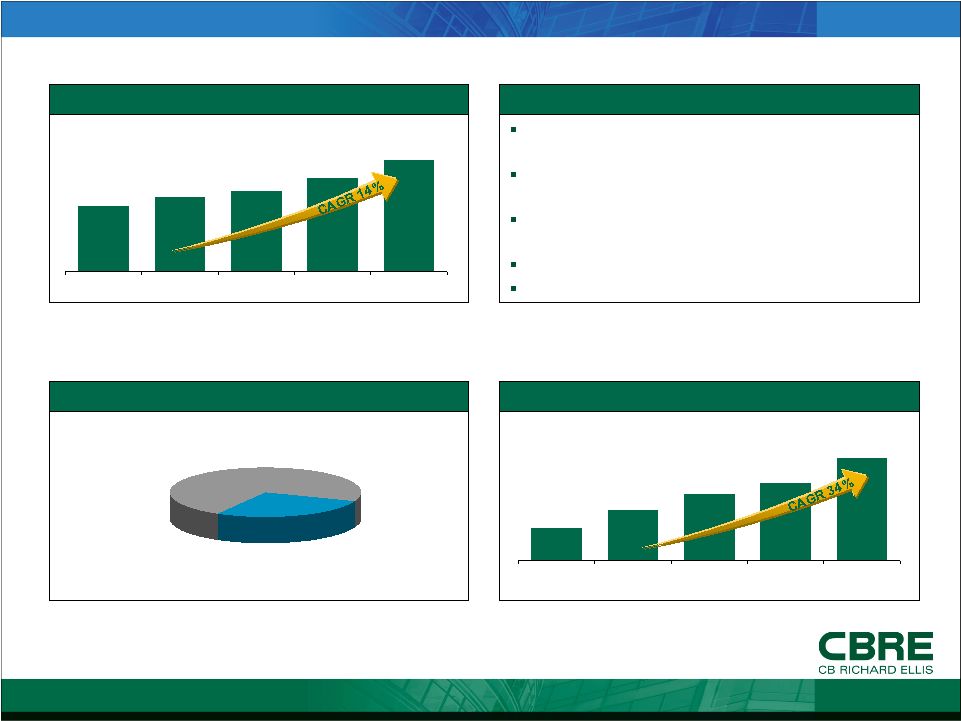

Page 14 Sales Update Sales Update Institutional Investment in Real Estate Sales as % of FY 2007 Total Revenue Business Update Challenging credit markets impacted investment sales activities Continued high level of capital allocation to real estate Rising rents support investment sales underwriting Exchange rates favor foreign investment in U.S. Lower interest rates support cap rates Challenging credit markets impacted investment sales activities Continued high level of capital allocation to real estate Rising rents support investment sales underwriting Exchange rates favor foreign investment in U.S. Lower interest rates support cap rates ($ in billions) Source: IREI $423 $479 $520 $606 $719 2003 2004 2005 2006 2007 Global Sales Revenue ($ in millions) $513 $807 $1,078 $1,246 $1,660 2003 2004 2005 2006 2007 1. Includes Trammell Crow Company’s revenue for the period from the 12/20/2006 acquisition date through 12/31/2006. 1 28% |

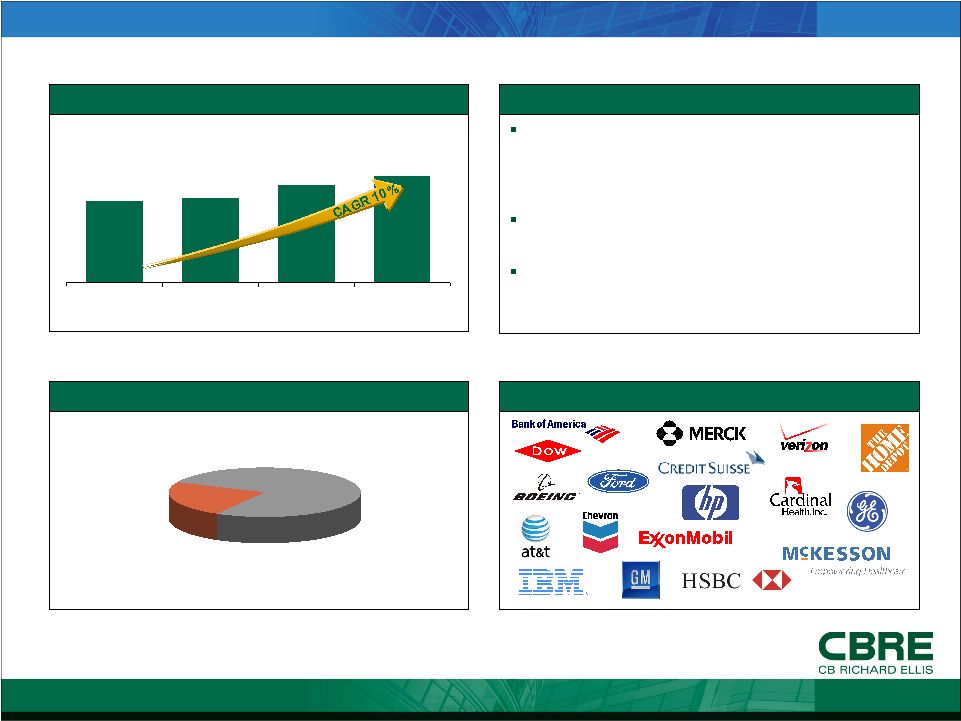

Page 15 23% Outsourcing Services Update Outsourcing Services Update CBRE Global Square Footage Managed¹ Outsourcing as % of FY 2007 Total Revenue² Business Update Continue to significantly expand our contractual work for major corporate clients by leveraging the strength of the legacy TCC outsourcing capabilities and cross selling Won or expanded eight Corporate Outsourcing relationships during the fourth quarter Added 26 new corporate outsourcing clients, expanded our services for 18 existing clients, and renewed our contracts with 17 clients in 2007 Continue to significantly expand our contractual work for major corporate clients by leveraging the strength of the legacy TCC outsourcing capabilities and cross selling Won or expanded eight Corporate Outsourcing relationships during the fourth quarter Added 26 new corporate outsourcing clients, expanded our services for 18 existing clients, and renewed our contracts with 17 clients in 2007 (SF in millions) 1. Represents combined data for CBRE and TCC; does not include joint ventures and affiliates. 1,203 1,248 1,444 1,579 2004 2005 2006 2007 88 of the Fortune 100 2. Management fees include property management, facilities management and project management fees. Does not include transaction revenues associated with outsourcing services. |

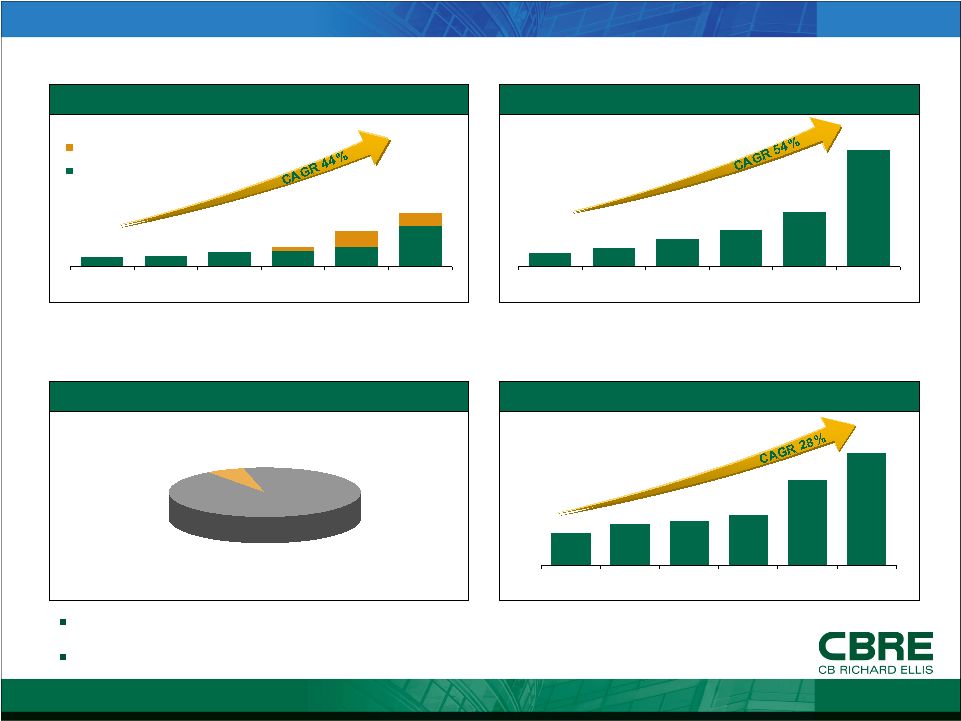

Page 16 Global Investment Management Update Global Investment Management Update Annual Revenue Investment Management as % of FY 2007 Revenue Annual EBITDA ($ in millions) $57.1 $68.4 $94.0 $99.3 $126.3 $259.2 $28.0 $101.7 $88.7 $127.3 $228.0 $347.9 2002 2003 2004 2005 2006 2007 Carried Interest Investment Management Assets Under Management ($ in millions) $13.0 $18.0 $26.8 $35.5 $52.7 $113.1 2002 2003 2004 2005 2006 2007 ($ in billions) $11 $14 $15 $17 $29 $38 2002 2003 2004 2005 2006 2007 120 institutional investor partner and clients $9.6 billion in equity capital raised in 2007 6% |

Page 17 Development Services Update Development Services Update Projects in Process / Pipeline Development Services as % of FY 2007 Revenue Business Update Develops properties for user/investor clients on a fee and/or co-investment basis $136 million FY 2007 revenue $134 million co-invested at YE 2007 $7 million of recourse debt to CBRE Develops properties for user/investor clients on a fee and/or co-investment basis $136 million FY 2007 revenue $134 million co-invested at YE 2007 $7 million of recourse debt to CBRE ($ in billions) $2.2 $3.8 $5.0 $4.9 $3.6 $2.8 $2.6 $3.6 $5.4 $6.5 $2.3 $1.4 $2.0 $2.3 $1.4 $1.5 $2.5 $2.7 $3.0 $2.7 $4.5 $5.2 $7.0 $7.2 $5.0 $4.3 $5.1 $6.3 $8.4 $9.2 4Q98 4Q99 4Q00 4Q01 4Q02 4Q03 4Q04 4Q05 4Q06 4Q07 Annual Normalized EBITDA ($ in millions) $15.9 $31.3 $34.8 $37.3 $73.9 2003 2004 2005 2006 2007 1. Includes Trammell Crow Company’s operations prior to the acquisition on

12/20/06. 2. 2007 reflects full year pro-forma results for Development Services, including

the impact of gains ($61.6 million), which cannot be recognized under purchase accounting rules. 97% 11% 7% 98% 2% Pipeline Pipeline Projects in Process Projects in Process |

Page 18 Financial Overview Financial Overview |

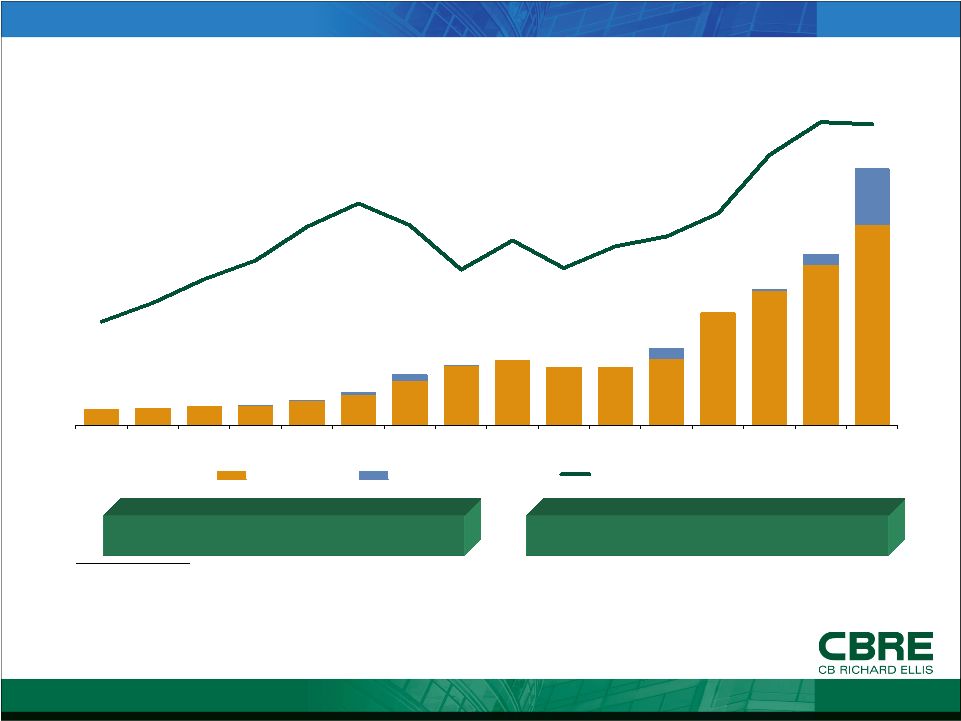

Page 19 5.6% 6.6% 7.9% 8.9% 10.6% 11.9% 10.7% 8.4% 9.9% 8.4% 9.6% 10.1% 11.3% 14.4% 16.2% 16.1% $360 $392 $429 $469 $583 $759 $1,187 $1,403 $1,518 $1,362 $1,362 $1,810 $2,647 $3,194 $4,032 $6,036 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 Organic Revenue Revenue From Acquisitions Normalized EBITDA Margin Consistent Long Term Growth¹ ($ in millions) 1. No reimbursements are included for the period 1992 through 1996, as amounts were immaterial. Reimbursement from 1997 through 2001 have been estimated. For 2002 through 2007, reimbursements are included.

2. Includes TCC activity for the period December 20, 2006 through December 31, 2006.

3. Includes revenue from discontinued operations, which totaled $2.1 million for the year

ended December 31, 2007. 4. Normalized EBITDA margin excludes merger-related costs, integration costs related

to acquisitions, one-time IPO-related compensation expense and

gains/losses on trading securities acquired in the TCC acquisition. 5.

Pro-forma EBITDA margin adjusted for $61.6 million of gains from Development

Services, which cannot be recognized under purchase accounting rules.

Target EBITDA Margin = 20% 2007 Pro-Forma EBITDA Margin = 17.1% Average Annual Organic Growth : 12% 2 2 4 4 5 3 3 |

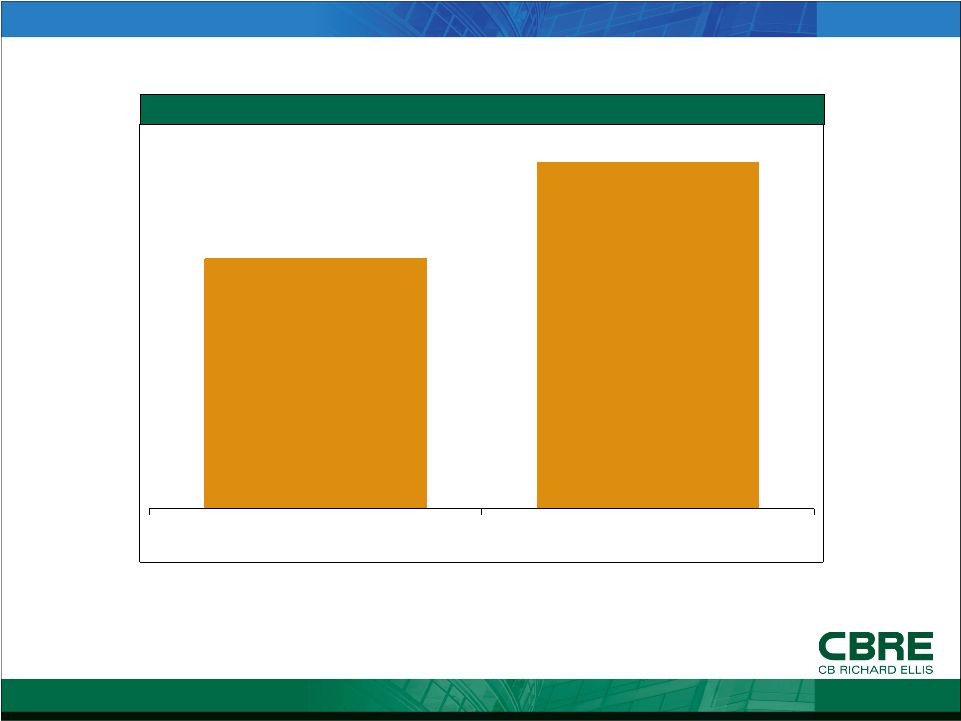

Page 20 TCC Synergies Have Exceeded Estimates $65.0 $90.0 Estimated Synergies¹ Actual Synergies 1. From CBRE press release at time of transaction. Synergies Achieved ($ in millions) |

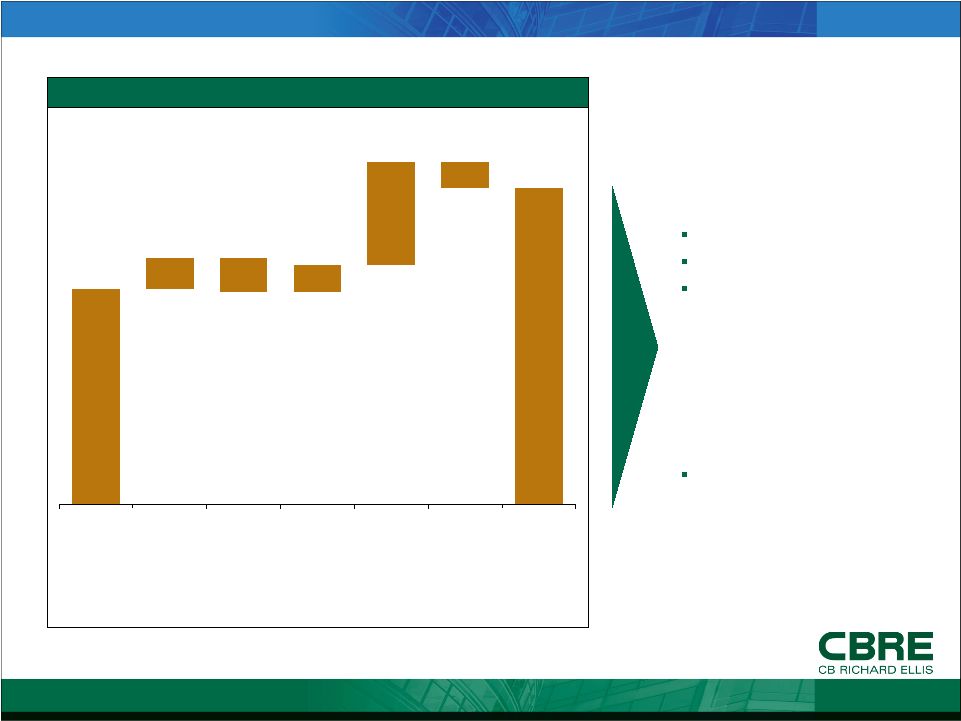

Page 21 Normalized Internal Cash Flow Normalized Internal Cash Flow Strong cash flow generator Low capital intensity Utilization of internal cash flow: • Co-investment activities • Development • In-fill acquisitions • Debt reduction • Share repurchases Capital expenditures of $80 million expected for 2008 Strong cash flow generator Low capital intensity Utilization of internal cash flow: • Co-investment activities • Development • In-fill acquisitions • Debt reduction • Share repurchases Capital expenditures of $80 million expected for 2008 1. Represents capital expenditures, net of concessions $732 $497 $240 $62 $72 $(61) $(78) Net income, as adjusted D&A Cap Ex Develop- ment gains impacted by purchase accounting Net Proceeds from Savills disposition Integration & merger related costs Internal Cash Flow 1 2007 Normalized Internal Cash Flow |

Page 22 Summary Terms and Timing Summary Terms and Timing |

Page 23 Indicative Terms for New $300 million Term Loan A – 1 Indicative Terms for New $300 million Term Loan A – 1 Borrower: CB Richard Ellis Services, Inc. (the “Borrower”) Facility Size $300 Million Senior Secured Term Loan A-1 (per $300 million accordion from December 2006 Credit

Agreement) Maturity December 20, 2013 Interest Rate Margin TBD Voluntary Amortization Schedule² Term Loan A-1: Year 1: $0 (0%) Year 2: $45 million (15%) Year 3: $60 million (20%) Year 4: $60 million (20%) Year 5: $60 million (20%) Year 6: $75 million (25%) Guarantees³ All obligations of the Borrower under the facility will be unconditionally guaranteed by Holdings, and by

each existing and subsequently acquired domestic subsidiary of Holdings (other than certain

investment, joint venture, securitization and immaterial subsidiaries to be agreed upon)

Security³ Below Baa3 / BBB- Stock only Baa3 / BBB- or above and no TLB outstanding Unsecured Financial Covenants³ Maximum Net Leverage Ratio: 3.75x Minimum Interest Coverage Ratio: 2.25x Affirmative Covenants³ Customary for facilities of this type Negative Covenants 3 Restricted Payments Basket: $300 million + 50% cumulative, Adjusted Consolidated Net Income¹ Investment Basket: $200 million + 20% cumulative, Adjusted Consolidated Net Income¹ Acquisition Basket: $300 million + 20% cumulative Consolidated EBITDA¹ Mandatory Prepayments³ (i) 50% of Excess Cash Flow (if leverage is greater than or equal to 2.0x) (ii) 100% of net cash proceeds of all asset sales (subject to exceptions and reinvestment

provisions) (iii) 100% of proceeds from debt issuances 1. As defined in the Credit Agreement. 2. Existing CA allows Borrower to apply voluntary prepayments as it chooses; prepayments for Term Loan A-1

will be based upon this concept. If the full voluntary payment is not made per the

schedule above, the spread over LIBOR will be increased by 200 bps. 3. Same as existing facility. |

Page 24 Transaction Timetable Transaction Timetable March 2008 S M T W T F S 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 Holiday Holiday March 11 th Launch Syndication March 18 th Distribute Documentation March 25 th Commitments due from Lenders Comments due on Credit Documentation (5 pm EDT) March 27 th Close and Fund the Transaction |

Page 25 Public Q&A Public Q&A |

Page 26 Appendix Appendix |

Page 27 Reconciliation of Normalized EBITDA to EBITDA to Net Income (Loss) Reconciliation of Normalized EBITDA to EBITDA to Net Income (Loss) 1. Includes interest income related to discontinued operations of $0.01 million for the

twelve months ended December 31, 2007. 2. Includes depreciation and amortization related to discontinued operations of $0.04

million for the twelve months ended December 31, 2007. 3. Includes interest expense related to discontinued operations of $1.8 million for the

twelve months ended December 31, 2007. 4. Includes provision for income taxes related to discontinued operations of $1.6 million

for the twelve months ended December 31, 2007. ($ in millions) Year Ended December 31, 2007 2006 2005 2004 2003 2002 Normalized EBITDA $970.1 $652.5 $461.3 $300.3 $183.2 $130.7 Less: Merger-related and other non-recurring charges 56.9 – – 25.6 36.8 – Gain (loss) on trading securities acquired in the TCC acquisition 33.7 (8.6) – – – – Integration costs related to acquisitions 45.2 7.6 7.1 14.4 13.6 – One-time compensation expense related to the IPO – – – 15.0 – – EBITDA $834.3 $653.5 $454.2 $245.3 $132.8 $130.7 Add: Interest income 1 29.0 9.8 9.3 4.3 3.8 3.2 Less: Depreciation and amortization 2 113.7 67.6 45.5 54.9 92.8 24.6 Interest expense 3 164.8 45.0 54.3 65.4 71.3 60.5 Loss on extinguishment of debt – 33.8 7.4 21.1 13.5 – Provision for income taxes 4 194.3 198.3 138.9 43.5 (6.3) 30.1 Net Income (Loss) $390.5 $318.6 $217.3 $64.7 ($34.7) $18.7 Revenue 6,036.3 4,032.0 3,194.0 2,647.1 1,810.1 1,361.8 Normalized EBITDA Margin 16.1% 16.2% 14.4% 11.3% 10.1% 9.6% |

Page 28 Reconciliation of Normalized EBITDA to EBITDA to Net Income (Loss) Reconciliation of Normalized EBITDA to EBITDA to Net Income (Loss) 1. Includes activity related to discontinued operations of $0.4 million of depreciation

and amortization, $1.8 million of interest expense, $1.6 million of provision for income taxes and $0.01 million of interest income. ($ in millions) Twelve Months Ended December 31, 2007 Global Investment Management Development Services¹ Normalized EBITDA $113.1 $12.3 Less: Merger-related and other non-recurring charges – 0.1 EBITDA $113.1 $12.2 Add: Interest income 1.3 5.5 Less: Depreciation and amortization 2.8 15.0 Interest expense 3.6 20.4 Royalty and management service (income) expense 1.2 – Provision (benefit) for income taxes 43.4 (6.2) Net Income (Loss) $63.4 ($11.5) |

Page 29 Reconciliation of Net Income to Net Income, As Adjusted Reconciliation of Net Income to Net Income, As Adjusted ($ in millions) Twelve Months Ended December 31, 2007 Net Income $390.5 Add: Amortization expense related to net revenue backlog, 24.9 incentive fees and customer relationships acquired, net of tax Integration costs related to acquisitions, net of tax 27.1 Loss on sale of trading securities acquired in the Trammel 20.1 Crow Company acquisition, net of tax Merger-related charges, net of tax 34.2 Net Income, as adjusted $496.8 |

|