Brian Stoffers

President, Capital Markets May 18, 2007 Business Review Day Capital Markets Exhibit 99.8 |

Brian Stoffers

President, Capital Markets May 18, 2007 Business Review Day Capital Markets Exhibit 99.8 |

CB Richard Ellis |

Page 2 Capital Markets Progress Continued integration between Sales and Mortgage Brokerage Business Global connectivity/cross border business Buyer Representation Business Broker/Dealer TCC connectivity Perfecting/relying on the Matrix/Creating efficiencies |

CB Richard Ellis |

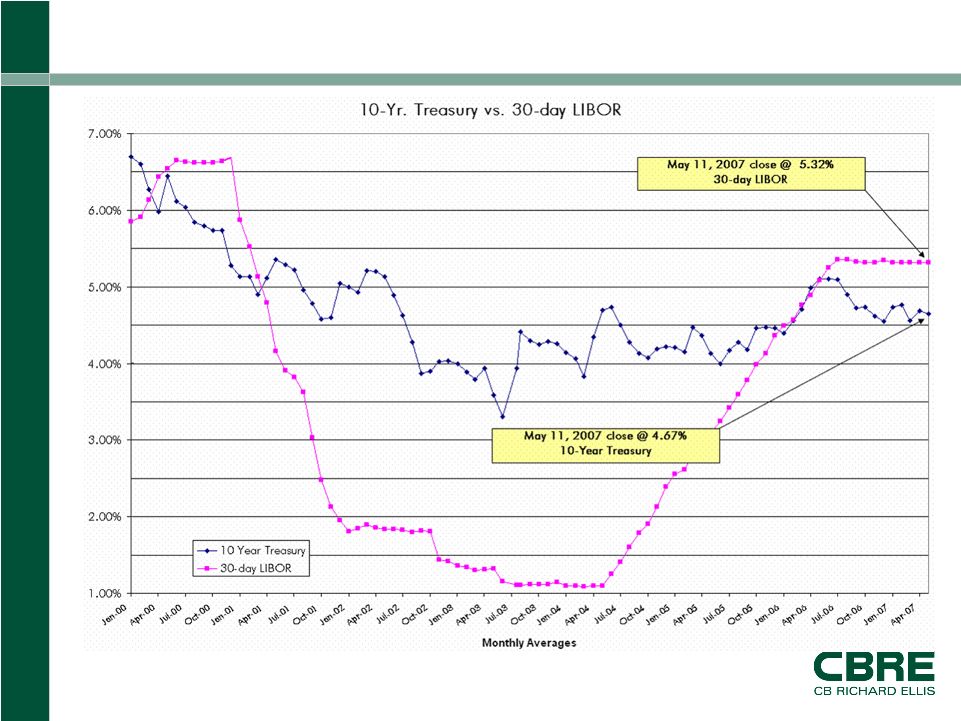

Page 3 Understanding the Capital Huge flows of debt and equity capital still in market Global capital flows moving rapidly in new markets Activity levels up across all product lines More capital than deals, new capital still entering “Priced to Perfection” environment Premium placed on creativity Very aggressive debt underwriting and incredibly thin debt spreads moderating |

CB Richard Ellis |

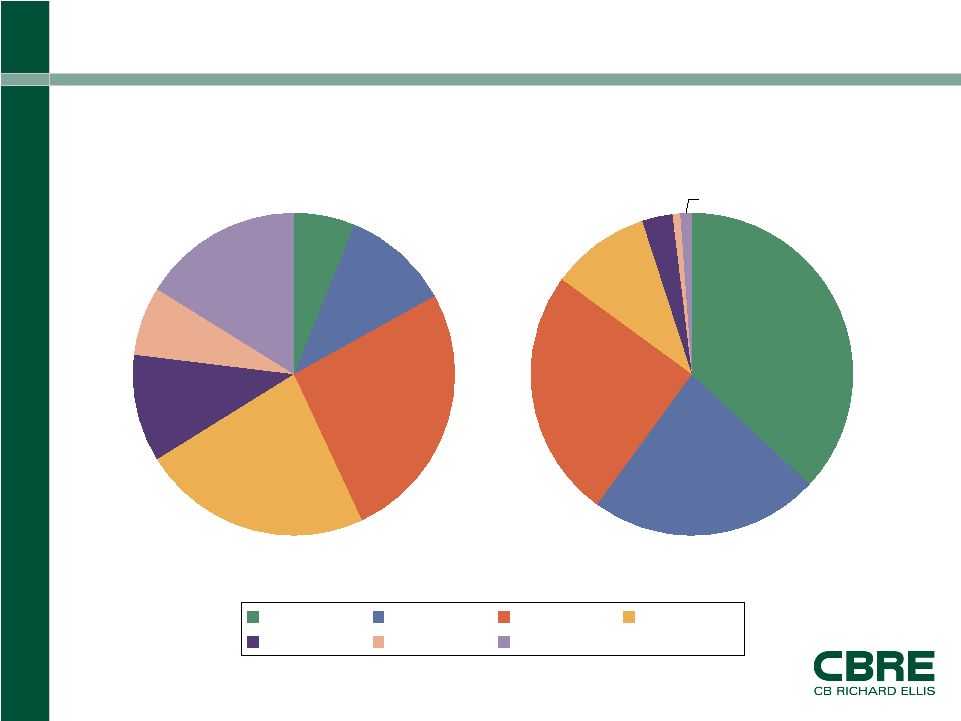

Page 4 2006 Loan Originations by Deal Size <$5M $5–$10M $10–$25M $25–$50M $50–$75M $75–$100M >$100M 37% 23% 25% 10% 3% 1% 1% $20.7 Billion 1,332 Loans 6% 11% 26 23% 11% 7% 16% |

CB Richard Ellis |

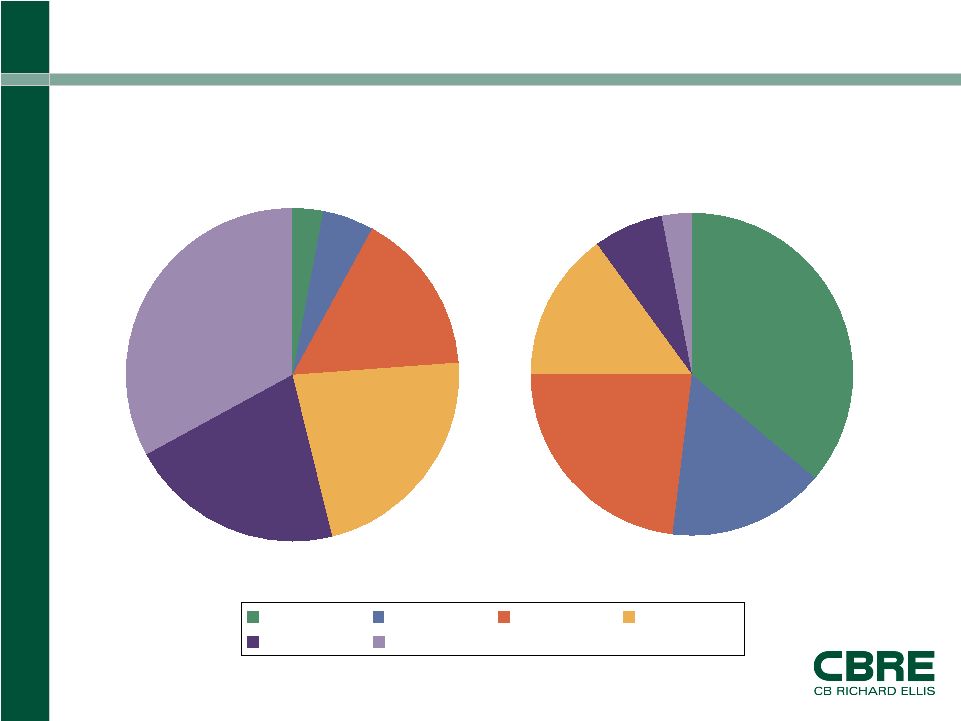

Page 5 2006 U.S. Property Sales by Deal Size <$5M $5–$10M $10–$25M $25–$50M $50–$100M >$100M 36% 16% 23% 15% 7% 3% $52.5 Billion 2,143 Transactions 3% 5% 16% 22% 21% 33% |

CB Richard Ellis |

Page 6 Interest Rate Environment Source: Wall Street |

CB Richard Ellis |

Page 7 CBRE’s Global Capital Markets Activity Levels 16.3% $17.8B $20.7B U.S. Loan Origination Volume 53.4% $43.5B $66.9B International Investment Sales Volume 27.1% $110.2B $140.1B Total Global Capital Activity 7.4% $48.9B $52.5B U.S. Investment Sales Volume % Change 2005 2006 Capital Markets Activity |

CB Richard Ellis |

Page 8 1st Quarter 2007 Capital Markets Activity 73.2% $12.7B $22.0B Total U.S. Capital Activity 87.9% $3.3B $6.2B U.S. Loan Origination Volume 68.1% $9.4B $15.8B U.S. Investment Sales Volume % Change Q1 2006 Q1 2007 U.S. Capital Markets Activity *reflects loans serviced by GEMSA, a joint venture between CBRE Capital Markets and GE Capital Real Estate Loan Servicing 50.9% $69.4B* $104.5B* Total Loan Servicing |

CB Richard Ellis |

Page 9 CBRE Referral Value 37% $3.1B $5.2B Referral Volume % Change 2005 2006 2006 vs. 2005 61% $501M $805M Referral Volume % Change 1Q06 1Q07 1Q 2007 vs. 1Q 2006 |

CB Richard Ellis |

Page 10 Case Study: The Magazine Portfolio Sawyer Realty Holdings, Onex Real Estate Partners and Morgan Stanley Maryland CBRE Capital Markets arranges $749 million disposition and $393 million acquisition financing CBRE’s Institutional Group (IG) had existing relationship with owner CBRE | Melody secured the high-leverage loan for the buyer and enabled the sale to close |

CB Richard Ellis |

Page 11 Case Study: Franklin Avenue Plaza Over 500,000 SF of Class A Office Space CBRE Brokerage & CBRE | Melody teamed together to arrange $97.0 million acquisition financing CBRE’s Tri-State Institutional Group arranged the sale of Franklin Avenue Plaza and referred them to CBRE | Melody for the acquisition financing opportunity The properties’ extraordinary central location within Nassau County and the Village of Garden City, viewed as being among the premier suburban office markets in the country |

CB Richard Ellis |

Page 12 Opportunities for Growth Continued Capital Markets integration U.S. Buy Side initiative EMEA Debt and Equity Finance Broker/Dealer business Global connectivity |