Business Review

Day Global Investment Management Vance Maddocks Chief Executive Officer CB Richard Ellis Investors May 18, 2007 Exhibit 99.6 |

Business Review

Day Global Investment Management Vance Maddocks Chief Executive Officer CB Richard Ellis Investors May 18, 2007 Exhibit 99.6 |

CB Richard Ellis |

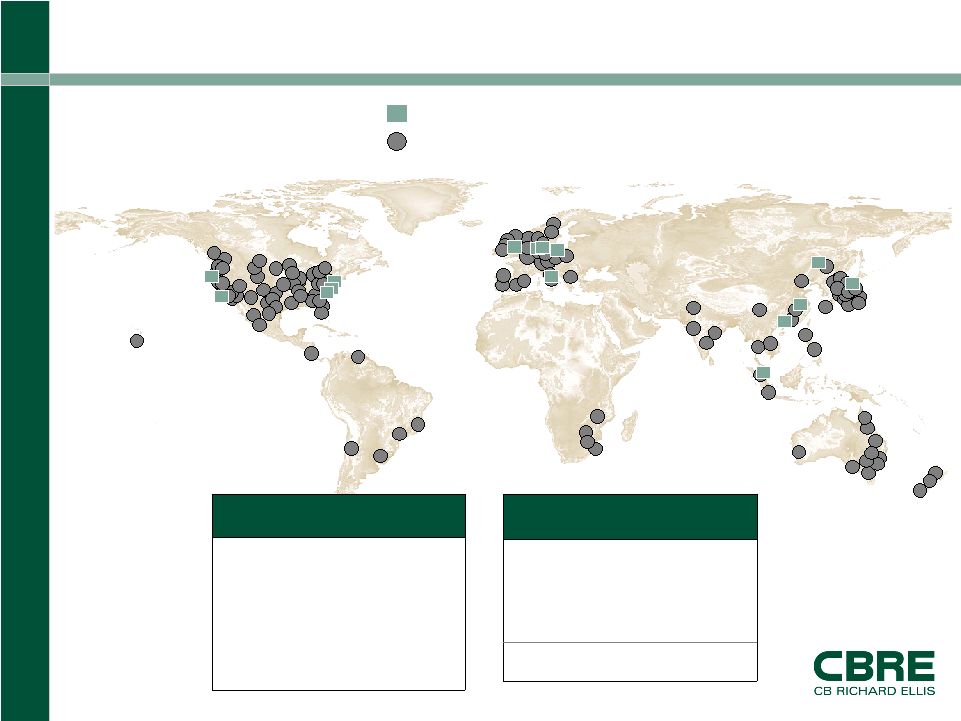

Page 1 CB Richard Ellis | Page 1 CB Richard Ellis | Page 1 CB Richard Ellis | Page 1 CB Richard Ellis Investors Global Real Estate Investment Manager • Founded in 1972 • Registered investment advisor • 272 employees • $30.6 billion (1) in assets under management • 120 institutional investor partners and clients Diversified Investment Programs • Focused investment teams executing worldwide • Diversified geographically and by investment style • Disciplined, research based investment process (1) As of March 31, 2007. |

CB Richard Ellis |

Page 2 CB Richard Ellis | Page 2 CB Richard Ellis | Page 2 CB Richard Ellis | Page 2 Global Platform LOS ANGELES LOS ANGELES BOSTON BOSTON PARIS PARIS LONDON LONDON TOKYO TOKYO MILAN MILAN CBRE Investors Locations CB Richard Ellis Locations FRANKFURT FRANKFURT SAN FRANCISCO SAN FRANCISCO NEW YORK NEW YORK LUXEMBOURG LUXEMBOURG SHANGHAI SHANGHAI HONG KONG HONG KONG BEIJING BEIJING BALTIMORE BALTIMORE SINGAPORE SINGAPORE Beijing, Singapore 2007 Hong Kong, Shanghai 2006 Frankfurt, Luxemburg, Baltimore 2005 New York, Milan 2002 Paris 2001 Office Openings 30.6 Total 1.8 Asia 14.1 Europe 14.7 Americas Assets Under Management (US $B) |

CB Richard Ellis |

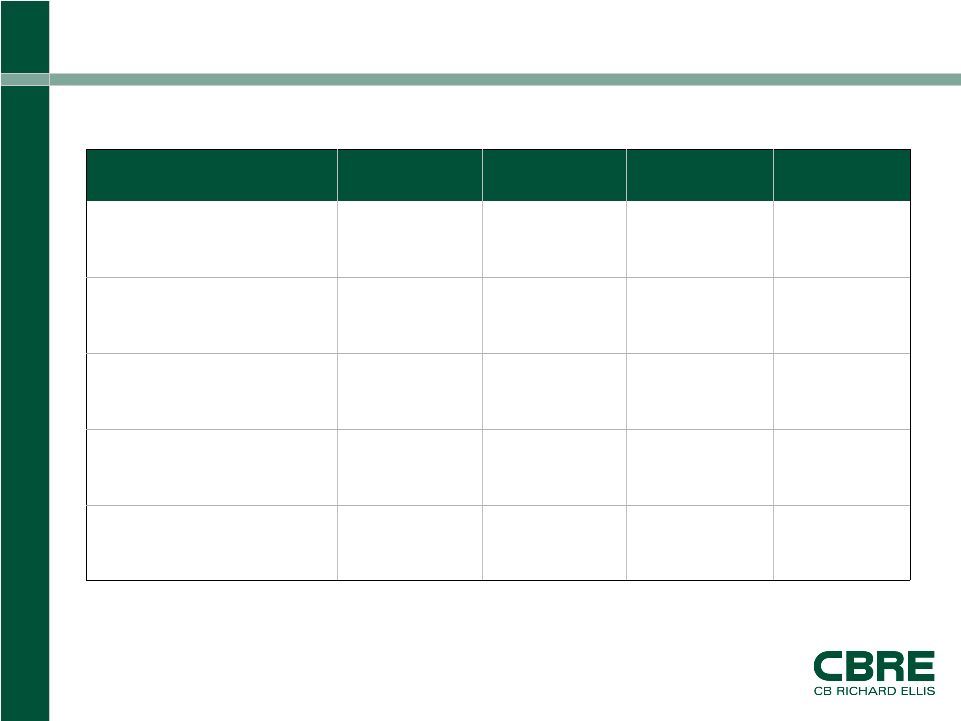

Page 3 CB Richard Ellis | Page 3 CB Richard Ellis | Page 3 CB Richard Ellis | Page 3 Key Investment Metrics (US $B) 0.6 +26% 2.9 2.3 Dispositions 16.3 +47% 15.0 10.2 Purchasing Power 30.6 +65% 28.6 17.3 Assets Under Management 1.8 +60% 8.0 5.0 Acquisitions 3.5 +61% 7.1 4.4 Equity Raised Q1 2007 % Change 2005 to 2006 2006 2005 |

CB Richard Ellis |

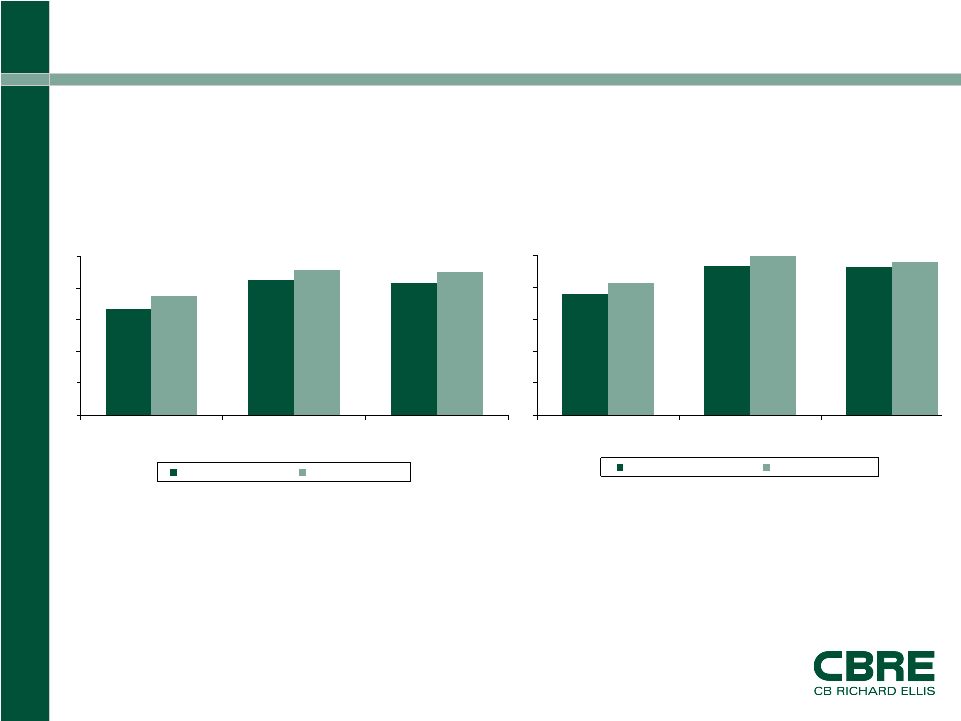

Page 4 CB Richard Ellis | Page 4 CB Richard Ellis | Page 4 CB Richard Ellis | Page 4 15.2% 18.6% 18.5% 19.2% 16.6% 19.9% 0 4 8 12 16 20 Five Years Three Years One Year IPD Index Benchmark Total Gross Return 16.6% 17.0% 13.3% 18.0% 18.3% 14.9% 0 4 8 12 16 20 Five Years Three Years One Year NCREIF Benchmark Total Gross Return December 31, 2006 U.K. Discretionary Accounts December 31, 2006 U.S. Discretionary Accounts (%) (%) Investment Performance |

CB Richard Ellis |

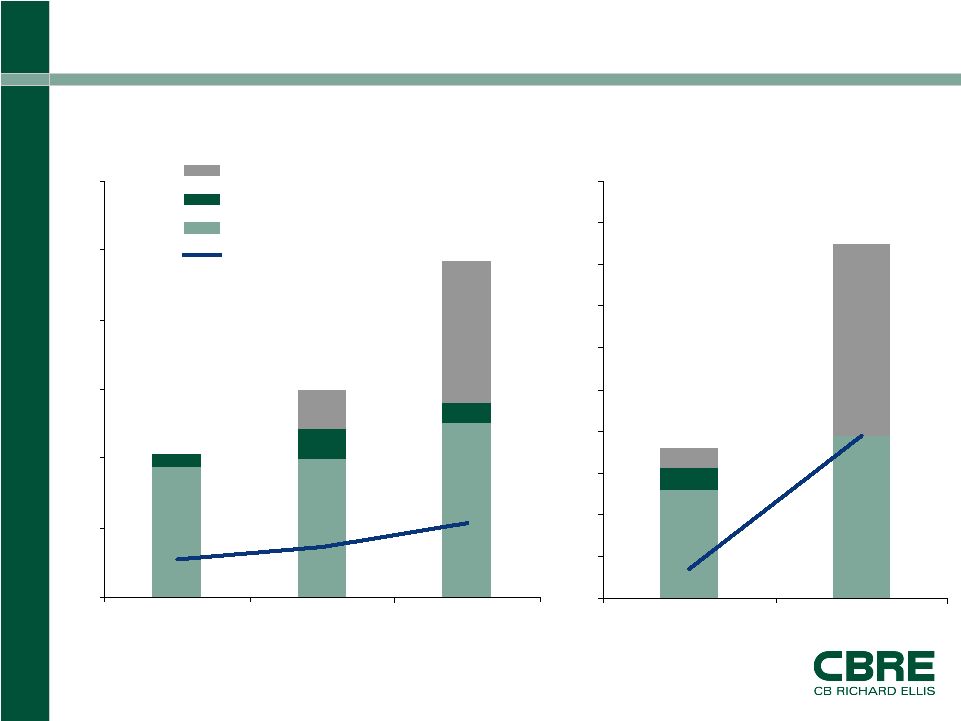

Page 5 CB Richard Ellis | Page 5 CB Richard Ellis | Page 5 CB Richard Ellis | Page 5 22 14 28 102 99 94 126 9 0 50 100 150 200 250 300 2004 2005 2006 Carried Interest Equity Earnings Operating Revenues EBITDA ($M) 103 149 242 39 46 26 5 5 0 10 20 30 40 50 60 70 80 90 100 2006 1Q 2007 1Q ($M) 36 85 Financial Performance (US $M) 27 36 53 7 39 |

CB Richard Ellis |

Page 6 CB Richard Ellis | Page 6 CB Richard Ellis | Page 6 CB Richard Ellis | Page 6 Investment Environment Solid Real Estate Fundamentals • Economy driven by job gains and robust global expansion • Sustained office and industrial demand support further rent growth • Retail and multi-family strategies targeting affluent households remain viable • Opportunities strongest in “global gateway” and “knowledge” markets Capital Market Shifts • Real estate has outperformed other asset classes • Substantial capital flows continue • Risk premiums have tightened • Investors’ return expectations are moderating |

CB Richard Ellis |

Page 7 CB Richard Ellis | Page 7 CB Richard Ellis | Page 7 CB Richard Ellis | Page 7 Programs Driving Growth Managed Accounts Group • $4.6 billion of capital raised in 2006 • Completed $6.2 billion of acquisitions and portfolio transfers in 2006 Strategic Partners Fund Series • Global program with funds investing in Asia, Europe, UK and US • $6.0 billion (1) of capital raised for 11 funds since 2000 • Marketing three funds targeting $2.5 billion in equity Global Real Estate Securities • $700 million (1) of capital raised in 2007 Global Multi Manager • European fund of funds products • $1.4 billion (1) of capital raised in 2007 (1) As of March 31, 2007. |