Business Review

Day Development Services Jim Groch Chief Investment Officer Trammell Crow Company May 18, 2007 Exhibit 99.5 |

Business Review

Day Development Services Jim Groch Chief Investment Officer Trammell Crow Company May 18, 2007 Exhibit 99.5 |

CB Richard Ellis |

Page 2 CB Richard Ellis | Page 2 CB Richard Ellis | Page 2 CB Richard Ellis | Page 2 CB Richard Ellis | Page 2 Business Overview What do we do? • We develop real estate • We acquire real estate often described as: » “Under-valued” » “In need of re-development” Who are our customers? • Investors in real estate • Users of real estate |

CB Richard Ellis |

Page 3 CB Richard Ellis | Page 3 CB Richard Ellis | Page 3 CB Richard Ellis | Page 3 CB Richard Ellis | Page 3 Unparalleled National Platform Powerful Brand (60 Years) Offices in 28 U.S. Cities, Canada & India Diverse Product Expertise Efficient Capital Programs |

CB Richard Ellis |

Page 4 CB Richard Ellis | Page 4 CB Richard Ellis | Page 4 CB Richard Ellis | Page 4 CB Richard Ellis | Page 4 Office | Industrial | Retail | Healthcare Airports | Residential | Mixed Use | Student Housing Property Types |

CB Richard Ellis |

Page 5 CB Richard Ellis | Page 5 CB Richard Ellis | Page 5 CB Richard Ellis | Page 5 CB Richard Ellis | Page 5 Experience? How much have we done? Over $50 Billion Developed Over 500,000,000 Square Feet #1 in “Under Development” in latest CPN Survey |

CB Richard Ellis |

Page 6 CB Richard Ellis | Page 6 CB Richard Ellis | Page 6 CB Richard Ellis | Page 6 CB Richard Ellis | Page 6 Synergy between TCC and CBRE TCC builds/buys a large volume of buildings that • Need to be leased • Need to be managed • Need to be appraised • Need to be sold CBRE provides a great platform for TCC: • Research, referrals, infrastructure, capabilities… |

Current

Activity |

CB Richard Ellis |

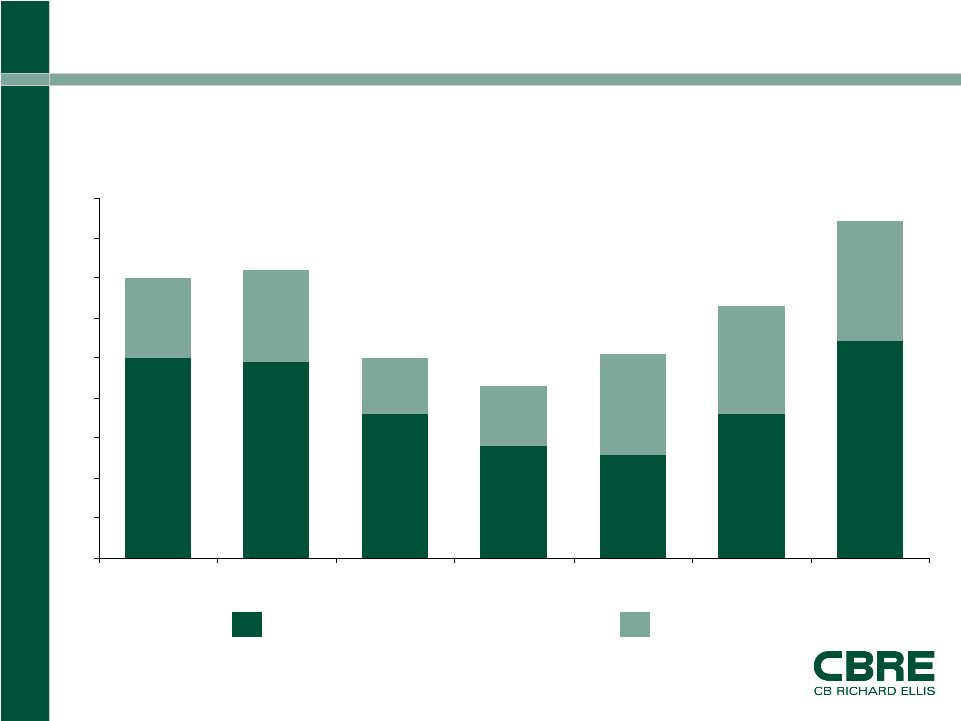

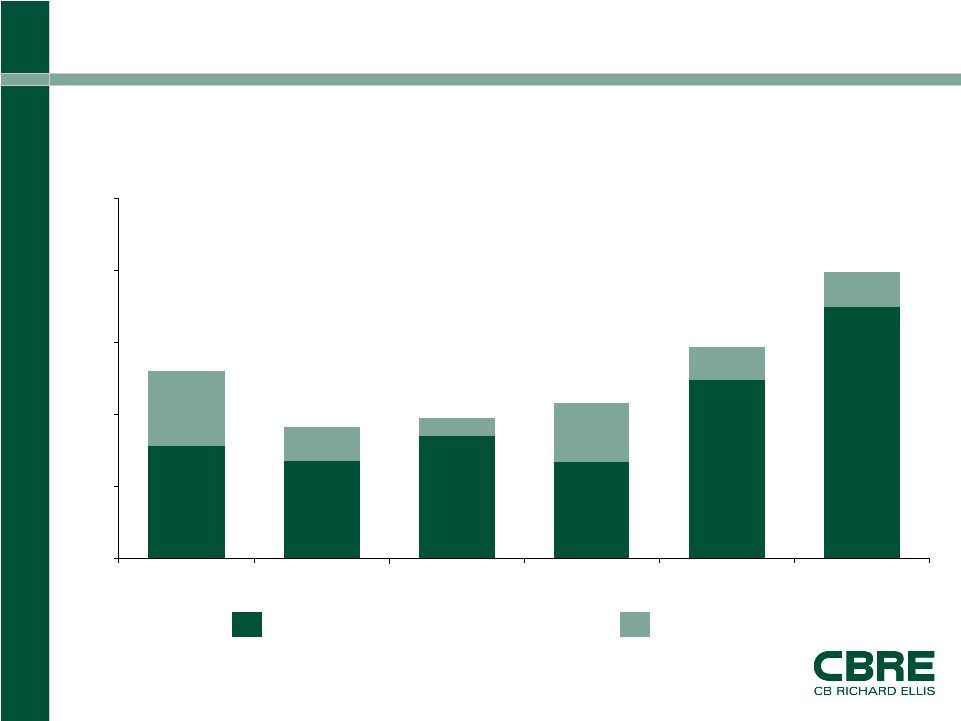

Page 8 CB Richard Ellis | Page 8 CB Richard Ellis | Page 8 CB Richard Ellis | Page 8 CB Richard Ellis | Page 8 Projects In Process/Pipeline $5.0 $4.9 $3.6 $2.8 $2.6 $3.6 $5.4 $2.0 $2.3 $1.4 $1.5 $2.5 $2.7 $3.0 0 1 2 3 4 5 6 7 8 9 2000 2001 2002 2003 2004 2005 2006 ($ in millions) In-Process Pipeline |

CB Richard Ellis |

Page 9 CB Richard Ellis | Page 9 CB Richard Ellis | Page 9 CB Richard Ellis | Page 9 CB Richard Ellis | Page 9 Real Estate Investment/Exposure 2001—2006 $78.0 $67.2 $84.7 $66.4 $124.3 $174.7 $52.0 $24.0 $12.4 $41.2 $22.3 $23.6 0 50 100 150 200 250 2001 2002 2003 2004 2005 2006 ($ in millions) Equity in RE Recourse Debt & Guarantees |

CB Richard Ellis |

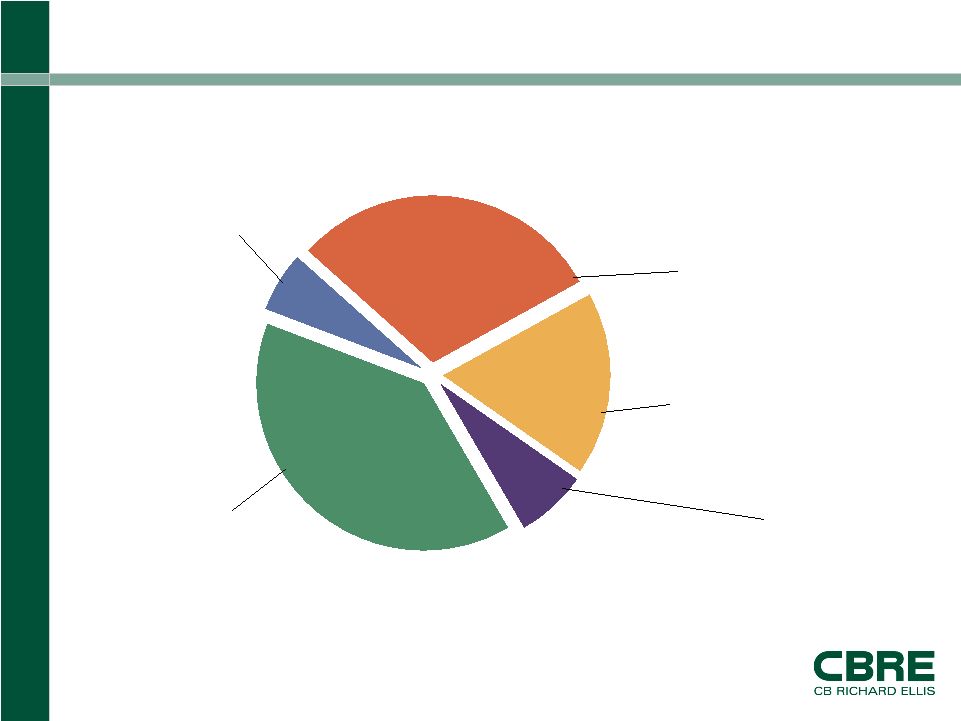

Page 10 CB Richard Ellis | Page 10 CB Richard Ellis | Page 10 CB Richard Ellis | Page 10 CB Richard Ellis | Page 10 165 Deals “In Process” (1) By Product Type Total Project Budgets—$5,500 (in millions) Notes: (1) As of March 31, 2007 (2) Initiatives include Healthcare, Residential/Mixed-Use, Acquisitions, Student Housing and

On-Airport Distribution Initiatives (2) $2,159 58 Deals Industrial $976 44 Deals Office $1,662 30 Deals Retail $381 20 Deals Land and Other $322 13 Deals |

CB Richard Ellis |

Page 11 CB Richard Ellis | Page 11 CB Richard Ellis | Page 11 CB Richard Ellis | Page 11 CB Richard Ellis | Page 11 Capital Programs Industrial Venture (J.V. w/ING) Medical Office Building Fund (J.V. w/State Pension) Retail Venture (J.V. w/Met Life) Discretionary Acquisition Funds (Opportunity) Airport Distribution Venture (Sub of Industrial J.V.) Office Development Programs (PFG & ING) Student Housing Venture |

CB Richard Ellis |

Page 12 CB Richard Ellis | Page 12 CB Richard Ellis | Page 12 CB Richard Ellis | Page 12 CB Richard Ellis | Page 12 Office Development Programs Targeting $2B in Incremental Class “A” Office Development • Two Programs: – Principal Financial Group – ING-Clarion • $1 Billion / 5 Year Investment Target for each Current Office Development Activity in Programs • Projects Committed to New Office Programs Total Over $620 Million • Additional $1.2 Billion of Non-Program Office Projects In-Process (Mostly Pre-Programs) |

CB Richard Ellis |

Page 13 CB Richard Ellis | Page 13 CB Richard Ellis | Page 13 CB Richard Ellis | Page 13 CB Richard Ellis | Page 13 Office Development: CBRE Opportunity Acquisition/Development Costs: $2,000,000,000 Leasing Commissions $60,000,000 Property Management Fees: $37,500,000 Investment Sales: $36,000,000 CBRE Service Fees: $133,500,000 |

CB Richard Ellis |

Page 14 CB Richard Ellis | Page 14 CB Richard Ellis | Page 14 CB Richard Ellis | Page 14 CB Richard Ellis | Page 14 Summary Significant Synergies between CBRE and TCC Recourse Debt Less Than 1% of “In Process” New Capital Programs Supporting Continued Growth in Risk Mitigated Structures Total Projects “In-Process” and in the “Pipeline” are Strong Indicators of Future Growth |