Business Review

Day GCS Business Drivers Bill Concannon Vice Chairman May 18, 2007 Exhibit 99.4 |

Business Review

Day GCS Business Drivers Bill Concannon Vice Chairman May 18, 2007 Exhibit 99.4 |

CB Richard Ellis |

Page 2 CB Richard Ellis | Page 2 CB Richard Ellis | Page 2 CB Richard Ellis | Page 2 CB Richard Ellis | Page 2 Contents Key business drivers The evolution of outsourcing Our Win/Keep/Grow strategy |

CB Richard Ellis |

Page 3 CB Richard Ellis | Page 3 CB Richard Ellis | Page 3 CB Richard Ellis | Page 3 CB Richard Ellis | Page 3 Contents Key business drivers The evolution of outsourcing Our Win/Keep/Grow strategy |

CB Richard Ellis |

Page 4 CB Richard Ellis | Page 4 CB Richard Ellis | Page 4 CB Richard Ellis | Page 4 CB Richard Ellis | Page 4 Key Business Drivers Corporate real estate groups are centralizing and expect to centralize further 75% have centralized within the last three years (1) Only 5% have decentralized in the last three years (1) 65% expect to centralize further in the next five years (1) Only 2% expect to decentralize further in the next five years (1) (1) CoreNet, 2007 |

CB Richard Ellis |

Page 5 CB Richard Ellis | Page 5 CB Richard Ellis | Page 5 CB Richard Ellis | Page 5 CB Richard Ellis | Page 5 Key Business Drivers Centralized corporate real estate groups are being given increased responsibility All real estate and facilities functions housed in one organization Larger budgets and increased budget control Becoming strategic partner and service provider to business units Integration/collaboration with other shared services (finance, HR, etc.) |

CB Richard Ellis |

Page 6 CB Richard Ellis | Page 6 CB Richard Ellis | Page 6 CB Richard Ellis | Page 6 CB Richard Ellis | Page 6 Key Business Drivers Real estate leaders are increasingly from outside real estate 4m Strategy consulting Top 5 global insurance brokerage 250m Business unit U.S. Fortune 20 telecom firm 80m Financial management officer U.S. Fortune 15 telecom firm 150m Human resources Large software company 60m Field operations Top 5 global energy company 30m Risk management Top 3 global metal producer 22m Supply chain officer U.S. based top financial services firm 10m Accounting Top global media firm Example Corporate real estate executive background Portfolio size (s.f.) |

CB Richard Ellis |

Page 7 CB Richard Ellis | Page 7 CB Richard Ellis | Page 7 CB Richard Ellis | Page 7 CB Richard Ellis | Page 7 Key Business Drivers Increasing investor interest in owning corporate real estate $3.6 trillion in commercial real estate assets owned by corporations (1) $11.2 billion in sale-leasebacks in 2006 – a 15% increase from 2005 (2) High prices/valuations for corporate-owned real estate assets (1) Prudential Real Estate Investors, 2003 (2) Real Capital Analytics, 2006 |

CB Richard Ellis |

Page 8 CB Richard Ellis | Page 8 CB Richard Ellis | Page 8 CB Richard Ellis | Page 8 CB Richard Ellis | Page 8 Key Business Drivers High M&A and private equity buyout volume Real estate and facilities generally part of post-merger and post-LBO corporate transformations $3.7 trillion in global M&A volume in 2006 – up by 30% (1) $375 billion in U.S. private equity buyouts in 2006 – up by 250% (1) (1) Thomson Financial, 2006 |

CB Richard Ellis |

Page 9 CB Richard Ellis | Page 9 CB Richard Ellis | Page 9 CB Richard Ellis | Page 9 CB Richard Ellis | Page 9 Key Business Drivers Corporate focus on space utilization and environmental sustainability 45-60% of space in the average U.S. HQ/regional office is unoccupied each day (1) Leading firms experimenting with alternative workplace solutions (e.g. different design standards, hoteling) Environmental sustainability is a near-term critical issue for 79% of real estate departments - 78% are willing to pay a premium for sustainable real estate solutions (2) (1) Business Week, 2006 (2) CoreNet, 2007 |

CB Richard Ellis |

Page 10 CB Richard Ellis | Page 10 CB Richard Ellis | Page 10 CB Richard Ellis | Page 10 CB Richard Ellis | Page 10 Key Business Drivers Continued real estate outsourcing growth 90% expect outsourced corporate real estate spend to increase - with 45% expecting it to “increase greatly” (1) Outsourcing expected to “increase significantly” for all GCS services (1) Firms seek “speed to market”, “access to qualified personnel”, and “business process redesign” from outsourcing – in addition to cost savings (2) (1) CoreNet, 2007 (2) Duke University, 2006 |

CB Richard Ellis |

Page 11 CB Richard Ellis | Page 11 CB Richard Ellis | Page 11 CB Richard Ellis | Page 11 CB Richard Ellis | Page 11 Contents Key business drivers The evolution of outsourcing Our Win/Keep/Grow strategy |

CB Richard Ellis |

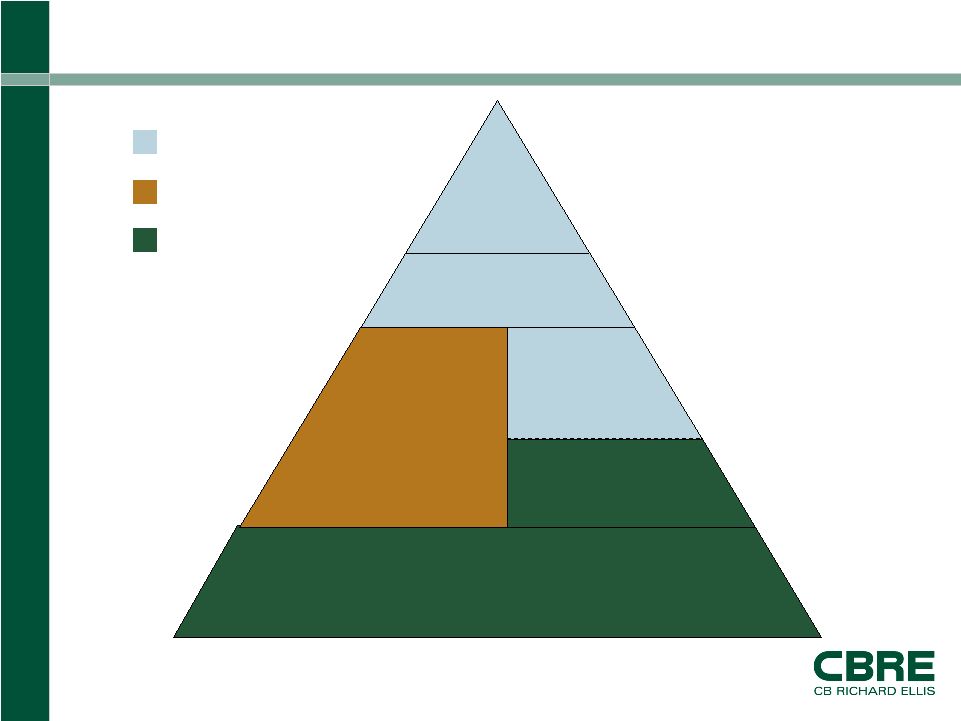

Page 12 CB Richard Ellis | Page 12 CB Richard Ellis | Page 12 CB Richard Ellis | Page 12 CB Richard Ellis | Page 12 Corporate Real Estate Outsourcing Continues to Evolve Up to 1980’s In-House 1980’s Out-Tasking In-House 1990’s Out-Sourcing In-House 2000’s Alliance Partnerships Today & Beyond VALUE DELIVERED |

CB Richard Ellis |

Page 13 CB Richard Ellis | Page 13 CB Richard Ellis | Page 13 CB Richard Ellis | Page 13 CB Richard Ellis | Page 13 Today and Beyond Favor Global, Full-Service Providers Clients seeking breadth of global coverage: #1 service provider criterion (1) Clients seeking breadth of services: #3 service provider criterion(1) Long, intensive business development cycles: often 9-12 months or more Clients demand global best practices and innovation Third party consultants and in-house procurement stress experience, credibility and track-record as buying criteria Significant technology, systems and infrastructure investments required (1) CoreNet, 2007 (#2 criterion: expertise in individual countries) |

CB Richard Ellis |

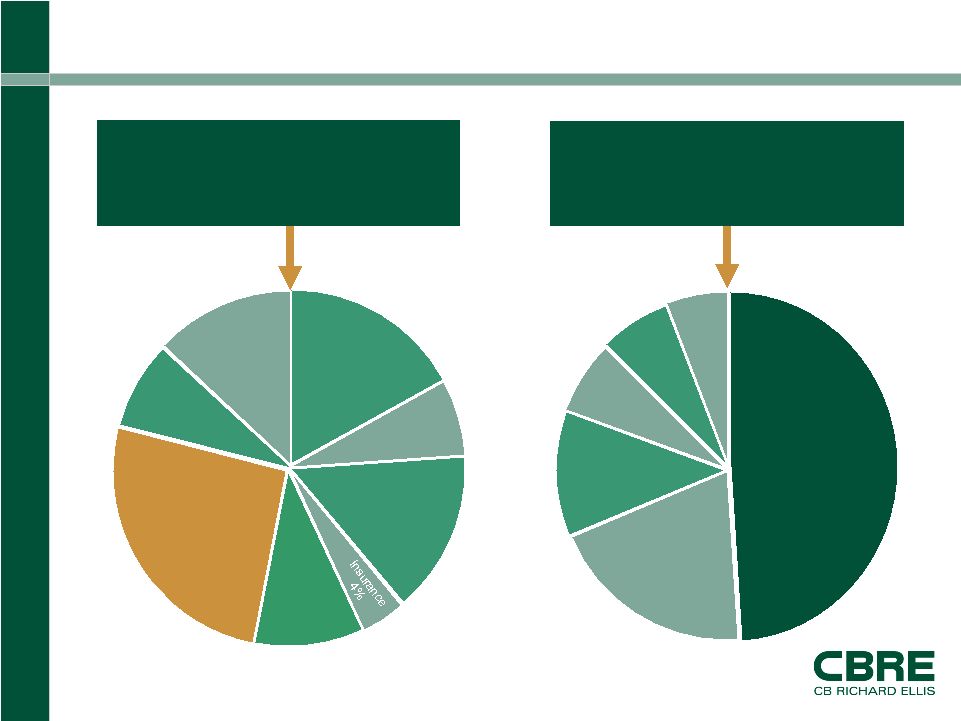

Page 14 CB Richard Ellis | Page 14 CB Richard Ellis | Page 14 CB Richard Ellis | Page 14 CB Richard Ellis | Page 14 GCS Addresses the Total Occupancy Cost Universe Repairs 8% Contracts 13% Utilities 15% Payroll 7% Depr/Amort 17% RE Tax 10% Rent 26% Annual Operating Expenses MIS, Telecom, Cabling 12% Furniture & Workstations 20% Construction Labor & Materials 49% Moving Expense 7% Architect/ Engineer 6% Project Mgmt 6% Annual Capital Expenses Note: not necessarily representative; based on sample of CBRE client data

|

CB Richard Ellis |

Page 15 CB Richard Ellis | Page 15 CB Richard Ellis | Page 15 CB Richard Ellis | Page 15 CB Richard Ellis | Page 15 Contents Key business drivers The evolution of outsourcing Our Win/Keep/Grow strategy |

CB Richard Ellis |

Page 16 CB Richard Ellis | Page 16 CB Richard Ellis | Page 16 CB Richard Ellis | Page 16 CB Richard Ellis | Page 16 Contract w/ Renewable Term Contract w/ Finite Term No Contract – Deal by Deal Brokerage One-off/Local “Programs” (e.g., Compliance, Operational Refit, Growth, Rebranding) (Single or Multiple Service) Full Service — Domestic “Portfolio” Full Service – Global “ Preferred” Brokerage – No Contract Single Transaction + PjM One-off/Local “Projects” How Our Clients Buy |

CB Richard Ellis |

Page 17 CB Richard Ellis | Page 17 CB Richard Ellis | Page 17 CB Richard Ellis | Page 17 CB Richard Ellis | Page 17 Our Win/Keep/Grow strategy Move CBRE “Project” & “Preferred” clients (usually Brokerage) to contracts Embed sales/consulting in select number of largest global opportunities Win outsourcing opportunities in the market (i.e. RFPs) Target key clients in Government and Healthcare verticals WIN KEEP GROW |

CB Richard Ellis |

Page 18 CB Richard Ellis | Page 18 CB Richard Ellis | Page 18 CB Richard Ellis | Page 18 CB Richard Ellis | Page 18 Our Win/Keep/Grow strategy Apply client satisfaction and operational excellence methodologies to clients Renewal of clients with expanded terms Embed sales/consulting in advance of large renewals KEEP WIN GROW |

CB Richard Ellis |

Page 19 CB Richard Ellis | Page 19 CB Richard Ellis | Page 19 CB Richard Ellis | Page 19 CB Richard Ellis | Page 19 Our Win/Keep/Grow strategy Target ~ 115 TCC clients for geographical expansion outside the U.S. Target ~ 90 TCC clients for cross-selling Transaction Management Target ~110 CBRE clients for cross-selling Project Management and Facilities Management GROW WIN KEEP |

CB Richard Ellis |

Page 20 CB Richard Ellis | Page 20 CB Richard Ellis | Page 20 CB Richard Ellis | Page 20 CB Richard Ellis | Page 20 Our Win/Keep/Grow differentiators Thousands of local CBRE relationships Globally integrated sales/marketing team Industry’s largest base of subject matter experts in each service line Industry’s largest base of global consulting professionals Industry-specific specialty groups (e.g. financial services, automotive, government, healthcare, etc.) |