Business Review

Day Americas Overview Cal Frese President, The Americas May 18, 2007 Exhibit 99.2 |

Business Review

Day Americas Overview Cal Frese President, The Americas May 18, 2007 Exhibit 99.2 |

Trammell Crow Company

Acquisition “The Perfect Fit” |

CB Richard Ellis |

Page 3 CB Richard Ellis | Page 3 CB Richard Ellis | Page 3 CB Richard Ellis | Page 3 Trammell Crow Company Business Overview Outsourcing Services • Full suite of services for comprehensive outsourcing solutions • Leading Global Corporate Services (GCS), Facilities Management, Project Management & Consulting capabilities • Legacy Asset Services depth and expertise • Extensive blue-chip corporate and institutional client roster Brokerage Services • Complementary leasing and sales expertise • $18+ billion transaction volume in 2006 • Formidable market presence in Texas & Southwest Development Services • Preeminent brand name • 2,500+ buildings worth $50 billion developed since 1948 • Success throughout market cycles • Now in cycle’s “sweet spot” |

CB Richard Ellis |

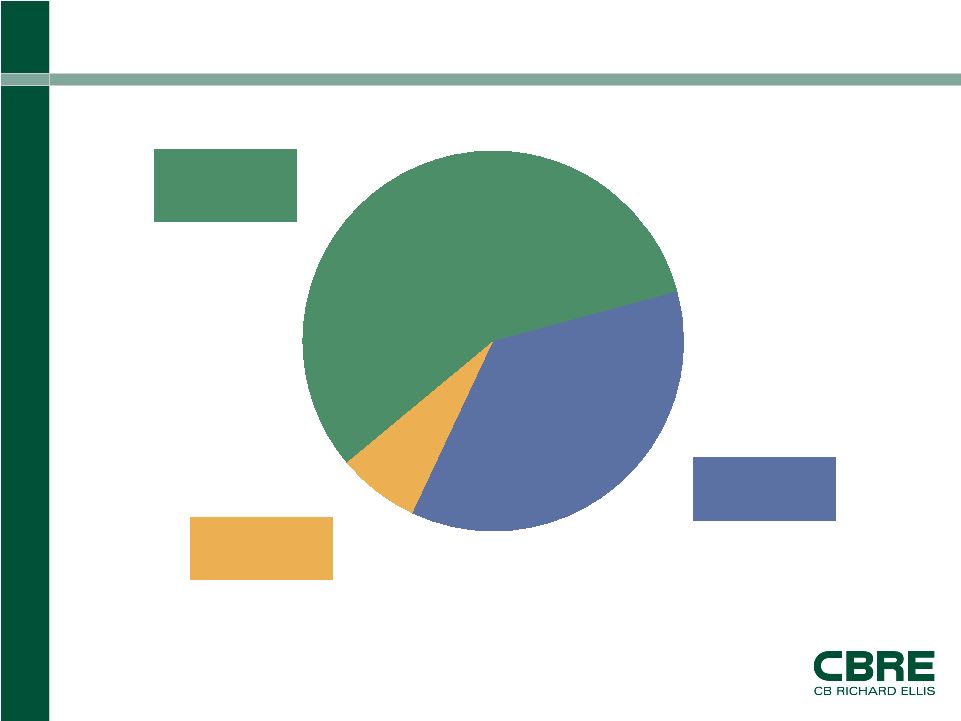

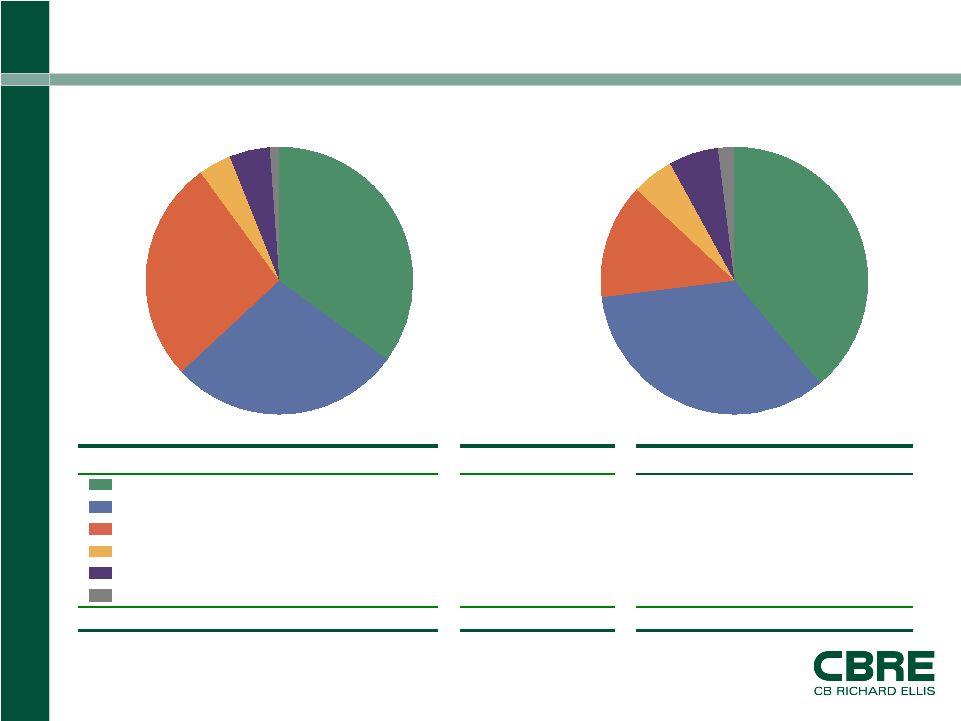

Page 4 CB Richard Ellis | Page 4 CB Richard Ellis | Page 4 CB Richard Ellis | Page 4 Trammell Crow Company—2006 Revenue Outsourcing Services 57% Development Services 7% Brokerage Services 36% |

CB Richard Ellis |

Page 5 CB Richard Ellis | Page 5 CB Richard Ellis | Page 5 CB Richard Ellis | Page 5 Strategic Rationale Business: Complementary alignment of business • In GCS, we combined CBRE’s Transaction Management strength and TCC’s outsourcing strength • Added Asset Services clients thus enhancing critical mass • In Brokerage, we strengthened our market position in Texas with very little domestic or global overlap • Added new line of business and capabilities with Development Services Financial: Substantially strengthens business mix • Diversifies revenue stream • Adds more contractual fee-based services • Scale provides both tools and resources as well as higher margin Culture: Viewed as high integrity and professional – a good match with CBRE Brand: A respected, industry-leading brand that will add value to the CBRE brand |

CB Richard Ellis |

Page 6 CB Richard Ellis | Page 6 CB Richard Ellis | Page 6 CB Richard Ellis | Page 6 Integration Status—Structure Quickly established leadership team Executive leadership in place by 12/20/06 Field leadership in place by 1/30/07 Shared Services leadership in place by 1/30/07 New management team actively engaged in integration process and direction Operational integration is substantially complete; Shared Services integration well underway Utilized “Best Athlete” approach throughout process |

CB Richard Ellis |

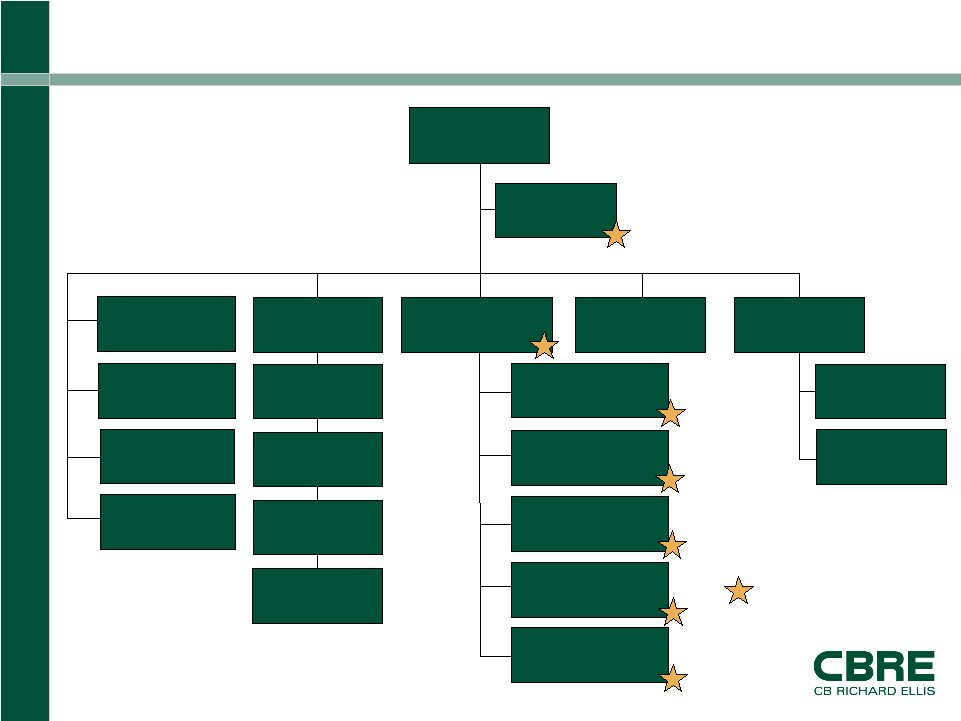

Page 7 CB Richard Ellis | Page 7 CB Richard Ellis | Page 7 CB Richard Ellis | Page 7 Americas: Organization Chart President Cal Frese Eastern Division President Jim Reid Western Division President Steve Swerdlow Canada/Latin America President Blake Hutcheson Tri-State Division Mary Ann Tighe, CEO Mitch Rudin, President Capital Markets President Brian Stoffers Institutional & Corporate Services President Mike Lafitte Client Strategies Vice Chairman Bill Concannon Asset Services President Jana Turner / Tony Long Global Corporate Services- Client Accounts President Diane Paddison Project Management Executive Managing Director Ken Loeber Facility Management Executive Managing Director Trevor Foster Brokerage–Americas President Chris Ludeman Investment Properties President Greg Vorwaller Mortgage Brokerage President Brian Stoffers Valuation President Doug Haney Transaction Management Executive Managing Director Steve Belcher Office Services President Chris Ludeman Industrial Executive Managing Director Jim Dieter Retail Executive Managing Director Anthony Buono Research Director Ward Caswell Former TCC employee |

CB Richard Ellis |

Page 8 CB Richard Ellis | Page 8 CB Richard Ellis | Page 8 CB Richard Ellis | Page 8 Integration Status—Revenue Strategic approach to revenue retention Revenue retention consistent with underwriting Retained all but one Corporate Services account Retained virtually all of Asset Services portfolio Maintained Development Services activity/pipeline at highest level historically |

Americas Organization

and Market Position |

CB Richard Ellis |

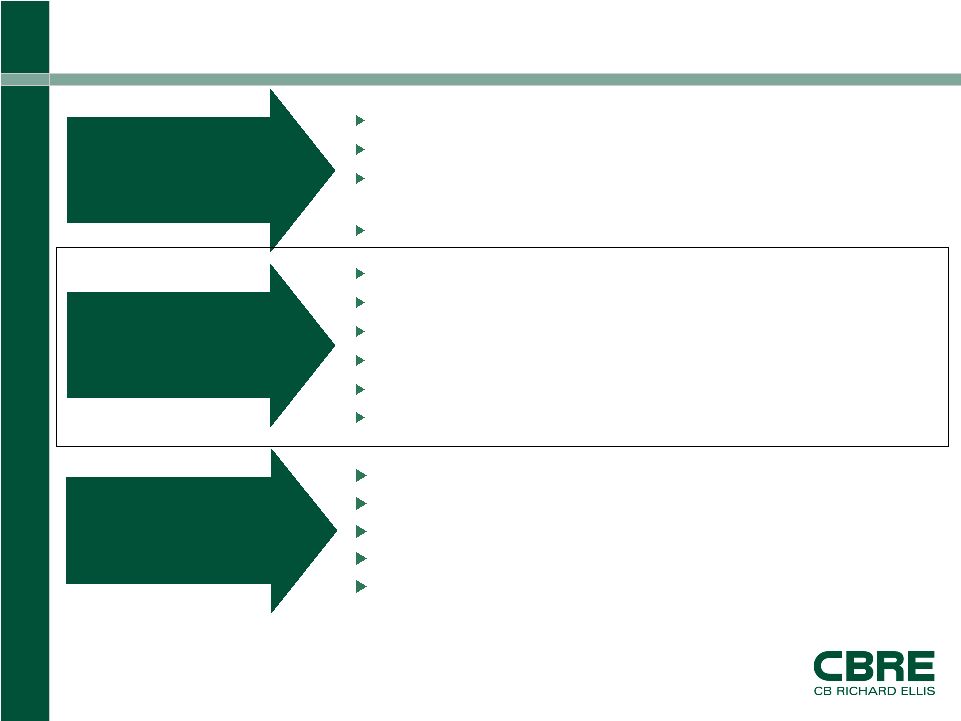

Page 10 CB Richard Ellis | Page 10 CB Richard Ellis | Page 10 CB Richard Ellis | Page 10 Americas Structure Drive Integration Throughout the Organization Large, Multi-Dimensional Business Managed As a Single Entity • Evolving from decentralized and autonomous Matrix Management • Geography • Lines of Business • Shared Services Functions “Interconnected and interdependent to achieve client goals” |

CB Richard Ellis |

Page 11 CB Richard Ellis | Page 11 CB Richard Ellis | Page 11 CB Richard Ellis | Page 11 2.5x nearest competitor Thousands of clients, 85% of Fortune 100 2006 combined CBRE & TCC Revenue of $3,428 million (4) 2006 combined CBRE & TCC EBITDA of $439 million (5) Strong organic revenue and earnings growth #1 commercial real estate brokerage: $130.7 billion in value (2) #1 appraisal and valuation: 25,000 assignments (2) #1 property and facilities management: 1.1 billion sq. ft. (1) #2 commercial mortgage brokerage: $20.7 billion in value (2) $15 billion in investment assets under management (3) $8 billion of development projects in process/pipeline (2) Leading Global Brand Broad Capabilities Scale, Diversity and Earnings Power 100+ years 200+ offices (1) #1 in key US cities: NY, LA, Atlanta, Washington, Chicago, Dallas, Miami, etc. #1 in Lipsey brand survey for five consecutive years (1) Includes partner and affiliate offices (2) As of 12/31/2006 (3) As of 3/31/2007 (4) Combined revenue includes $921 million for TCC for the period January 1, 2006, through December 20,

2006. (5) EBITDA excludes one-time items, including integration costs related to

acquisitions and income related to investment in Savills. Combined normalized EBITDA includes

$76 million for TCC for the period January 1, 2006, through December 20, 2006. Americas Platform

|

CB Richard Ellis |

Page 12 CB Richard Ellis | Page 12 CB Richard Ellis | Page 12 CB Richard Ellis | Page 12 2006 CBRE Standalone (2) 2006 Combined. (1) (1) CBRE and TCC revenue for the period January 1, 2006, through December 31, 2006. (2) CBRE standalone includes TCC revenue for the period December 20, 2006, through December 31, 2006. 2006 Americas Revenue Breakdown 35% 28% 27% 5% 1% 4% ($ in millions) 2006 Combined (1) 2006 (2) 2005 % Change Leasing 1,207.6 978.3 815.1 20 Sales 959.0 846.2 796.4 6 Property and Facilities Management 934.1 360.3 291.1 24 Appraisal and Valuation 127.8 127.8 103.7 23 Commercial Mortgage Brokerage 157.5 157.4 140.4 12 Other 42.4 36.9 26.1 41 Total 3,428.4 2,506.8 2,172.9 15 Year ended December 31, 39% 34% 14% 6% 2% 5% |

CB Richard Ellis |

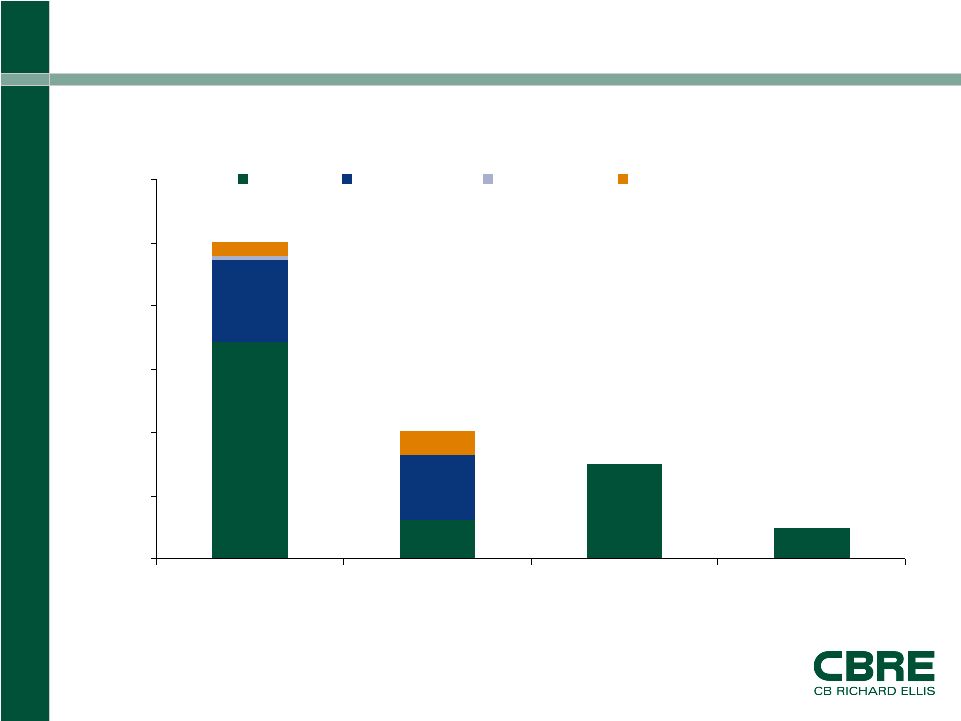

Page 13 CB Richard Ellis | Page 13 CB Richard Ellis | Page 13 CB Richard Ellis | Page 13 CBRE vs Competition $3,428 $620 $1,289 $1,010 228 380 $490 $1,500 67 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 CBRE & TCC Jones Lang LaSalle Cushman & Wakefield Grubb & Ellis Americas Europe & Asia Development Global Investment Management Revenues for the 12 months ended December 31, 2006. (Millions) Sources: Company Reports Financial Times, January 31, 2007 (for C&W) (1) Americas vs. International breakdown not available $5,012 $5,012 $2,010 (1) |

CB Richard Ellis |

Page 14 CB Richard Ellis | Page 14 CB Richard Ellis | Page 14 CB Richard Ellis | Page 14 Strategy Drive advantages of “new” platform to corporate clients Cross-sell unique array and depth of services throughout Americas and global footprint; focus on multiple services and share of wallet Export Outsourcing services to EMEA and Asia Pacific Source high-impact in-fill acquisitions and strategic recruitment Leverage world-class Shared Services organization |