Business Review

Day

Global Corporate

Services

May 17, 2006

Steve Swerdlow

President, Global Corporate Services

Exhibit 99.9

Business Review

Day Global Corporate Services May 17, 2006 Steve Swerdlow President, Global Corporate Services Exhibit 99.9 |

CB Richard Ellis |

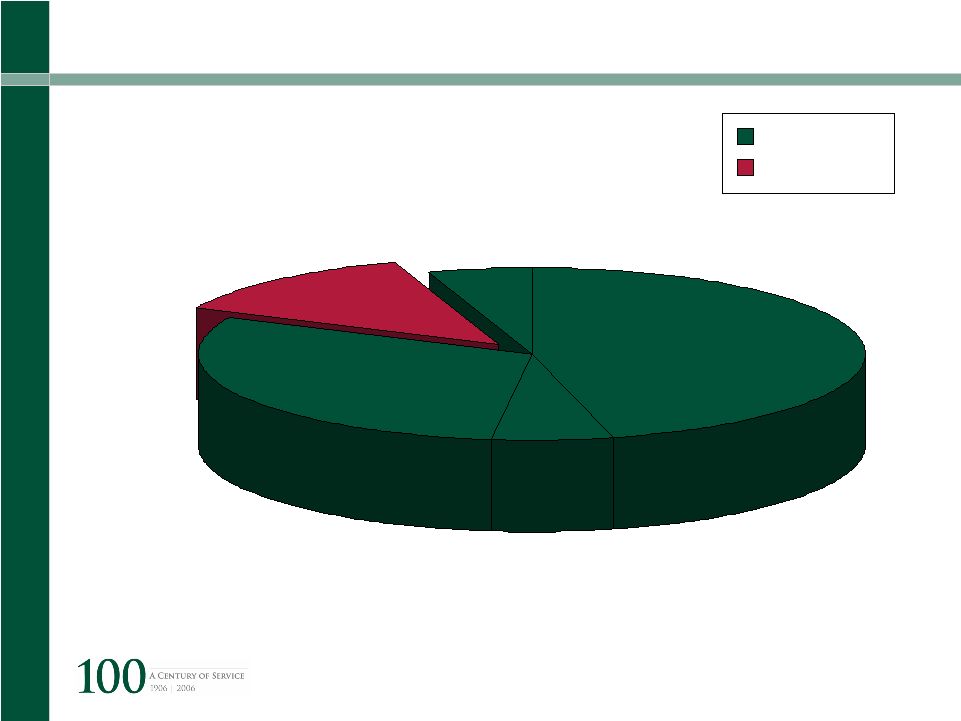

Page 1 CB Richard Ellis | Page 1 2005 Outsourcing % of Americas Revenue 5% 13% 30% 6% 46% Outsourcing $268m US Brokerage Valuation Capital Markets Advisory Outsourcing Canada & Latin America |

CB Richard Ellis |

Page 2 GCS’ business: securing and expanding account relationships with the world’s largest corporate occupiers GCS’ objective: to form long-term, contractual relationships, each of which would drive substantial recurring revenues GCS’ business: securing and expanding account relationships with the world’s largest corporate occupiers GCS’ objective: to form long-term, contractual relationships, each of which would drive substantial recurring revenues About Global Corporate Services (GCS) |

CB Richard Ellis |

Page 3 Transaction Management Facilities Management Portfolio Management & Lease Administration Project Management Consulting Transaction Management Facilities Management Portfolio Management & Lease Administration Project Management Consulting Global coverage Proprietary portfolio management tools Industry-leading account management Largest base of transaction professionals with execution track record Leading real estate technology platform Global coverage Proprietary portfolio management tools Industry-leading account management Largest base of transaction professionals with execution track record Leading real estate technology platform Overview GCS provides integrated real estate services to multinational corporations GCS services Key differentiators |

CB Richard Ellis |

Page 4 GCS as Integrator – Account Management Model BUSINESS UNITS “C” LEVEL EXECUTIVES SHARED SERVICES CORPORATE REAL ESTATE ORGANIZATION REAL ESTATE STRATEGY IMPLEMENTATION SERVICE DELIVERY TEAM INTEGRATED SERVICES Transaction Management Facilities Management Portfolio Management Project Management TECHNOLOGY & PROCESS PLATFORM Technical Services Appraisal Brokerage Asset Services Field Project Management Consulting |

CB Richard Ellis |

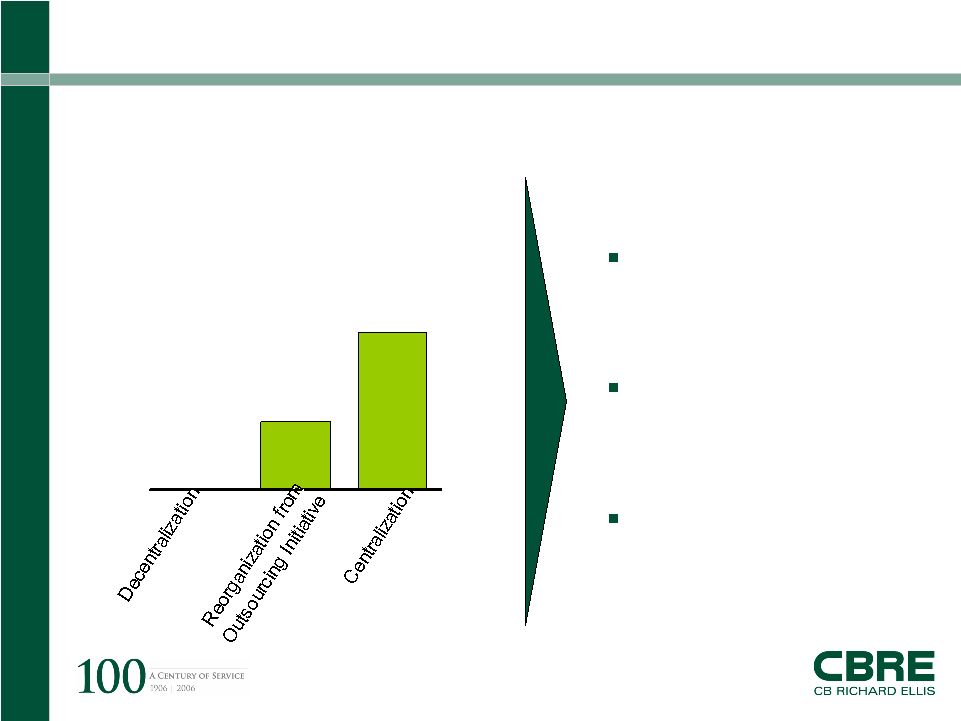

Page 5 Key Business Drivers Centralization of the corporate real estate function Corporations seeking cost reductions through real estate outsourcing Corporations seeking to monetize owned real estate assets Continued real estate consolidation following corporate mergers |

CB Richard Ellis |

Page 6 Key Business Drivers Corporate real estate reorganization reason (% of respondents) Corporate real estate reorganization reason (% of respondents) Source : Real Estate Executive Board research Source : Real Estate Executive Board research 58% 25% 0% Clients seek GCS… dominant global footprint full spectrum of services account management model Clients seek GCS… dominant global footprint full spectrum of services account management model Centralization of the Corporate Real Estate Function |

CB Richard Ellis |

Page 7 Key Business Drivers Real estate is among the top 3 expense categories for our clients 85% of companies indicate cutting costs is real estate’s top priority 25% increase in number of RFPs received in 2005 Cost Reductions through Outsourcing |

CB Richard Ellis |

Page 8 $3.6 trillion in commercial real estate assets owned by corporations 1 Abundant capital and low interest rates producing high prices/valuations for corporate-owned real estate assets 2 Sale-leasebacks and other structures allow corporate users to free up cash to reinvest in core business and maintain flexible control of corporate facilities 3 $11.6 billion in sale-leasebacks in 2005, growing by 45% annually 2 1. Prudential Real Estate Investors 2. Real Capital Analytics 3. Moody’s Investors Services Monetizing Owned Real Estate Assets Key Business Drivers |

CB Richard Ellis |

Page 9 $2.9 trillion in global M&A volume in 2005 – up by 37% 1 Real estate and facilities generally part of post- merger corporate consolidations Post-merger real estate consolidation fed all GCS service lines and are less fee sensitive 1. Dealogic Corporate Real Estate Consolidation Key Business Drivers |

CB Richard Ellis |

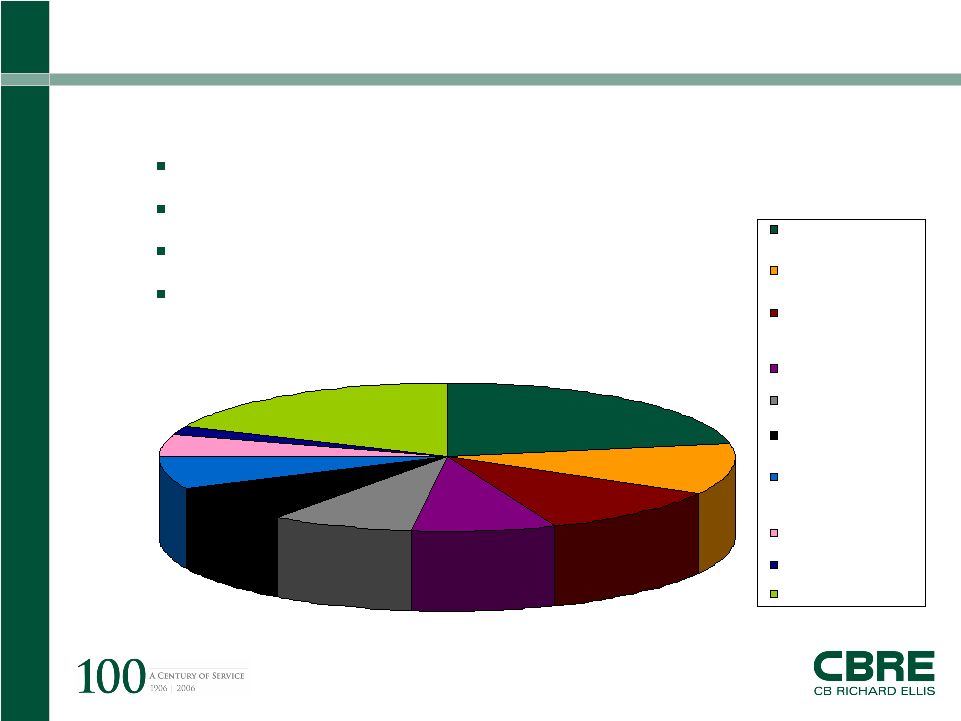

Page 10 Statistics – Strong, Diversified Client Base Diversified by industry 47% served in multiple global regions 64% purchase more than 1 service We have served >30% for at least 5 years 18% 2% 5% 7% 8% 8% 8% 11% 11% 22% Financial Services Technology Transportation, Aerospace, & Automotive Telecommunications Business Services Consumer Products Media, Entertainment & Publishing Energy Pharmaceutical Other |

CB Richard Ellis |

Page 11 Statistics Select 2005 New Client Wins & Expansions |

CB Richard Ellis |

Page 12 Recent Case Studies The 750,000 sq. ft. building containing Boeing’s worldwide HQ; owned by state pension fund and not up for sale CBRE account team and local CBRE transaction professionals worked together to demonstrate value of $165 million off-market purchase Deal possible through deep CBRE local market expertise combined with successful integration of multiple CBRE service lines – Brokerage, Asset Services and Appraisal |

CB Richard Ellis |

Page 13 Recent Case Studies Business needs evolving from manufacturing to service base – requiring both flexibility and control of strategic facilities Performed $152 million sale/leaseback of 3.8 million sq. ft. (24 properties) in U.S./Canada ~90 days from initial offering to signed contract Deal and rapid timing possible through breadth of CBRE’s geographic coverage and successful integration between GCS account team and CBRE’s Investment Properties |

CB Richard Ellis |

Page 14 Recent Case Studies Smaller corporate portfolio - ~2 million sq. ft. Engaged GCS to develop strategic plan for HQ and operations facility rationalization CBRE team executed six leases for ~650,000 sq. ft., managed construction and moves ~$150 million real estate commitment over duration; one of the largest lease transactions in Orange County, California in 2005 GCS management of “smaller” clients produces significant value |

CB Richard Ellis |

Page 15 2006 Strategic Initiatives Focus business development on clients with multi- national portfolios Pursue middle-market opportunities Differentiate through new, proprietary service offerings – CBRE Project Advantage, Client Dashboard, PortfolioIQ™, MarketStrike |