Business Review

Day

Europe, Middle East & Africa

May 17, 2006

Michael Strong

President, EMEA

Exhibit 99.6

Business Review

Day Europe, Middle East & Africa May 17, 2006 Michael Strong President, EMEA Exhibit 99.6 |

CB Richard Ellis |

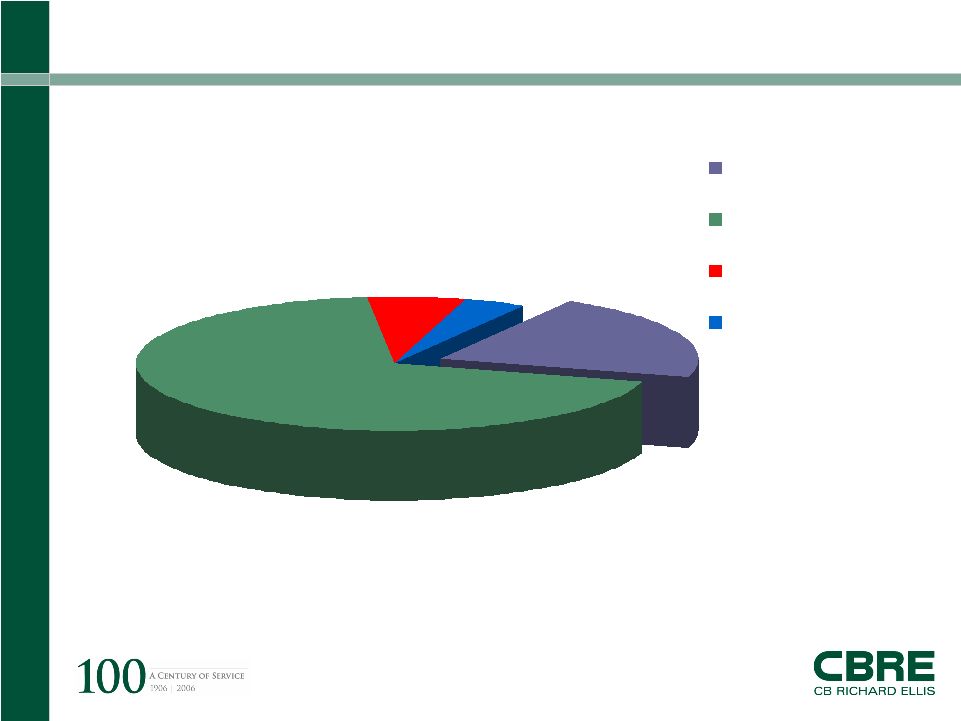

Page 2 CB Richard Ellis | Page 2 2005 EMEA % of Total Revenues 21% 4% 6% 69% EMEA Americas Asia Pacific Global Investment Management EMEA $594m |

CB Richard Ellis |

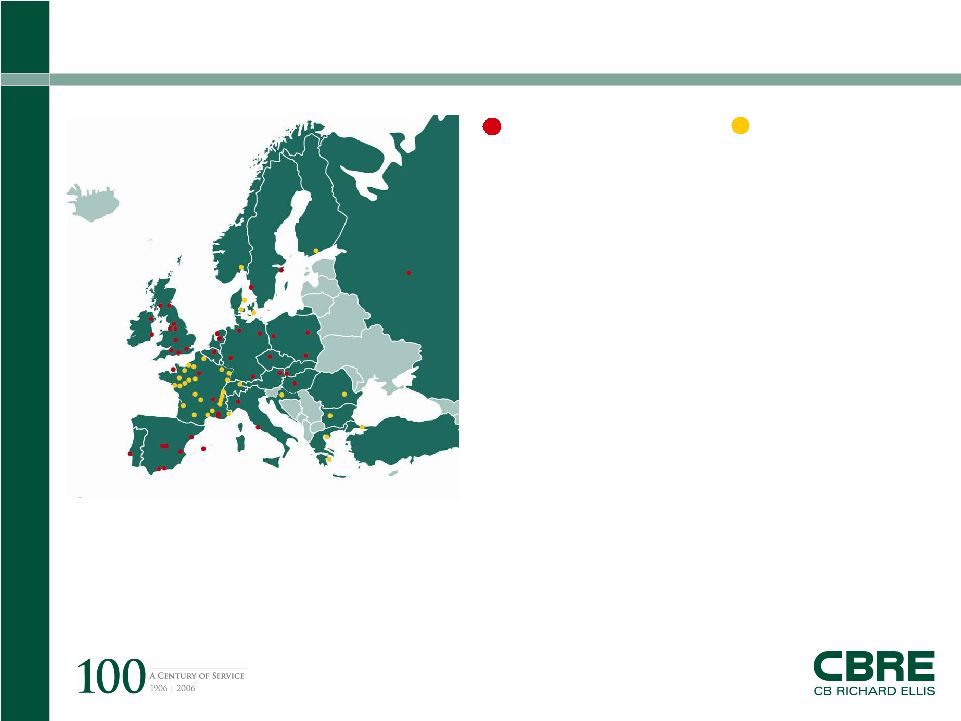

Page 3 CB Richard Ellis | Page 3 European Office Locations AUSTRIA Vienna BELGIUM Brussels CZECH REPUBLIC Prague FRANCE Aix-en-Provence Il-de-France Lyon Marseille Neuilly Sur Seine Paris Toulouse GERMANY Berlin Frankfurt Hamburg Munich HUNGARY Budapest IRELAND Dublin ITALY Milan Rome THE NETHERLANDS Amsterdam The Hague Hoofddorp POLAND Krakow Poznan Warsaw PORTUGAL Lisbon RUSSIA Moscow SLOVAKIA Bratislava SPAIN Barcelona Mardrid Malaga Marbella Palma de Mallorca San Fernando Valencia SWEDEN Gothenburg Stockholm UNITED KINGDOM Belfast Birmingham Bristol Edinburgh Glasgow Jersey Leeds Liverpool London Manchester Southampton CB Richard Ellis Offices BULGARIA Sofia CROATIA Zagreb DENMARK Aarhus Copenhagen Kolding FINLAND Helsinki GREECE Athens Thessaloniki NORWAY Oslo ROMANIA Bucharest SWITZERLAND Geneva Zurich TURKEY Istanbul Affiliate Offices |

CB Richard Ellis |

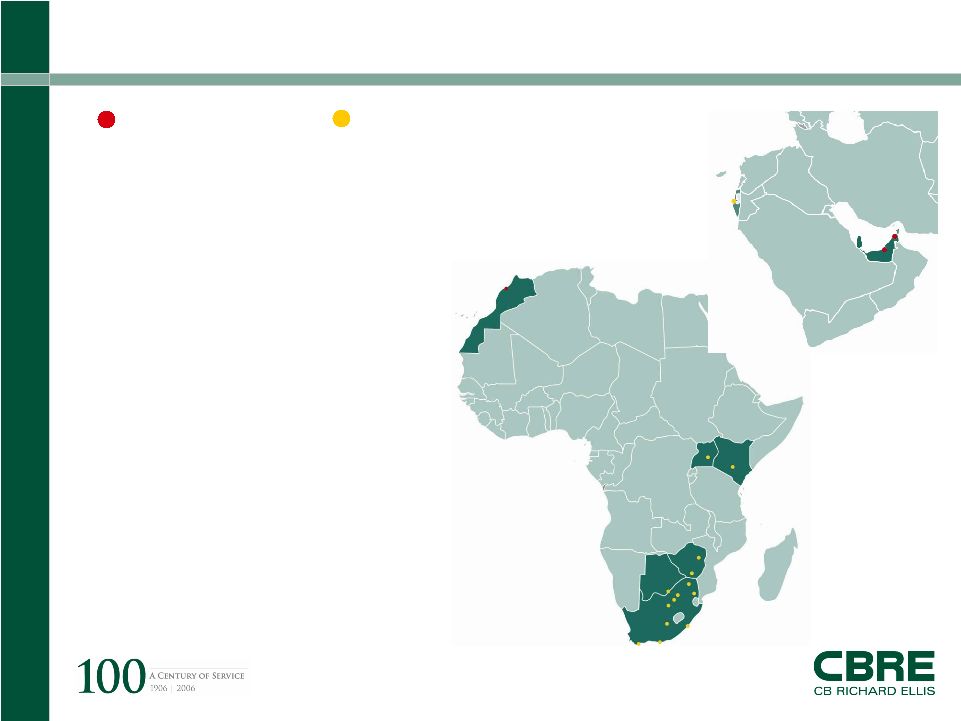

Page 4 CB Richard Ellis | Page 4 Middle East & Africa Office Locations MOROCCO Casablanca UNITED ARAB EMIRATES Abu Dhabi Dubai CB Richard Ellis Offices BOTSWANA Gaborone ISRAEL Tel Aviv KENYA Nairobi SOUTH AFRICA Durban Johannesburg Cape Town Port Elizabeth Pretoria Polokwane Bloemfontein Klerks Dorp Nelspruit UGANDA Kampala ZIMBABWE Bulawayo Harare Affiliate Offices |

CB Richard Ellis |

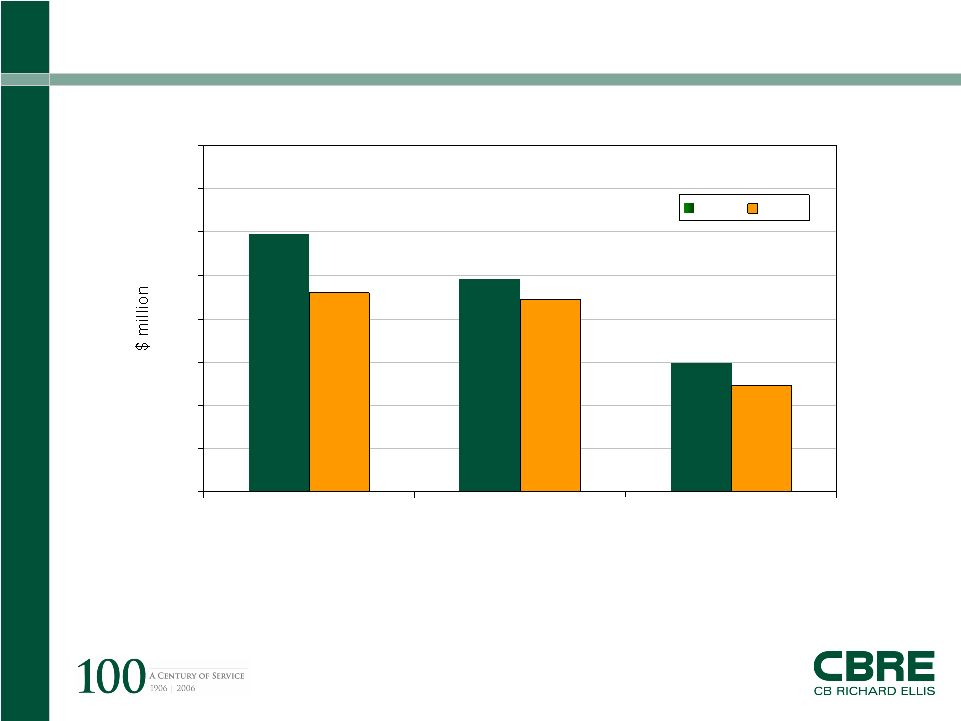

Page 5 CB Richard Ellis | Page 5 EMEA Revenue Comparison Source – Competitors’ websites, press releases and press articles 460 443 246 594 297 493 0 100 200 300 400 500 600 700 800 CB Richard Ellis Jones Lang LaSalle Cushman & Wakefield 2005 2004 +29% +11% +21% Annual Percentage Growth |

CB Richard Ellis |

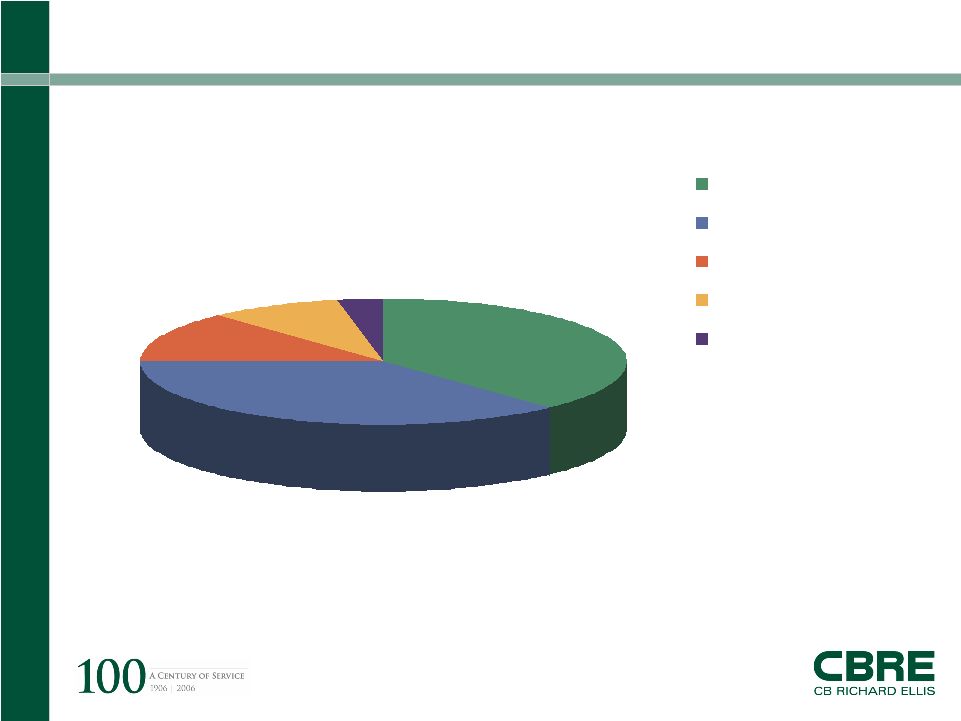

Page 6 CB Richard Ellis | Page 6 2005 EMEA Revenue by Service Line 38% 3% 9% 13% 37% Sales Leasing Valuation Asset Services Other Total EMEA Revenue $594 m |

CB Richard Ellis |

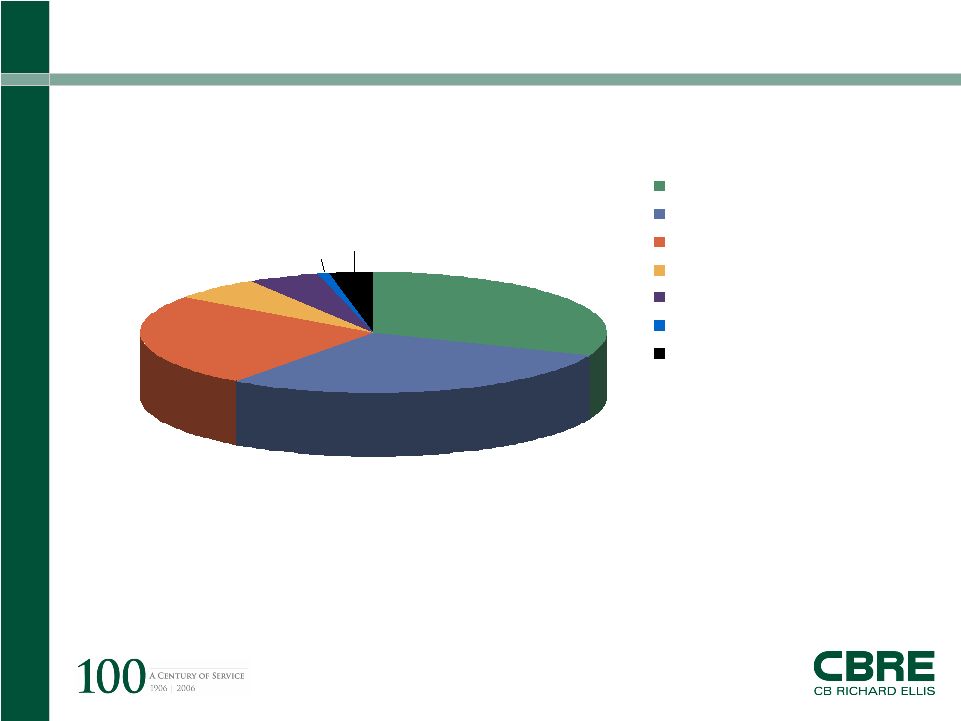

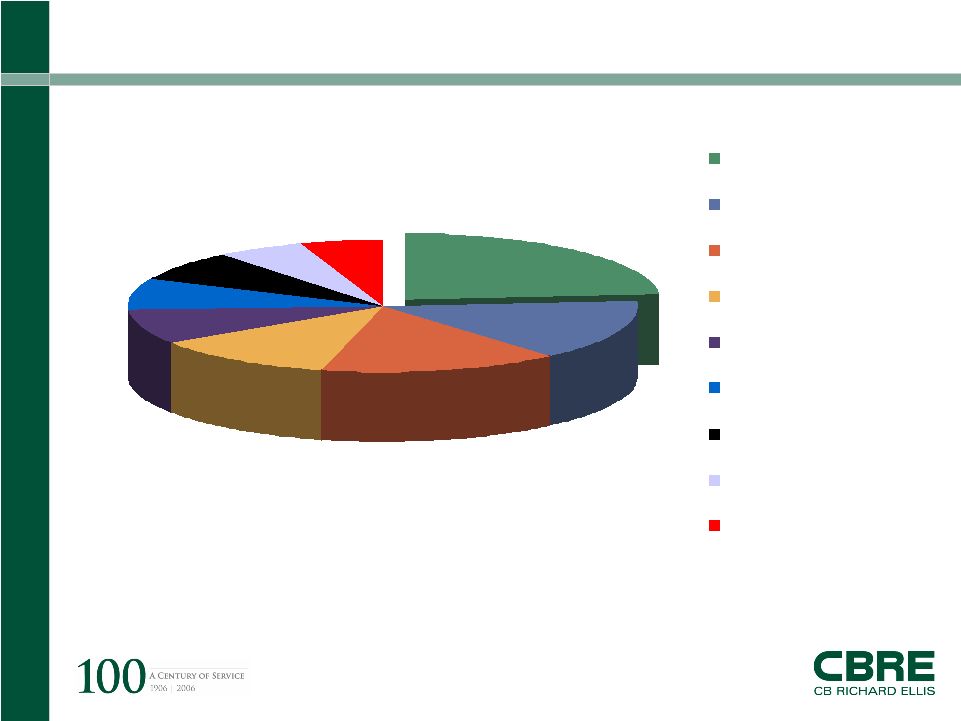

Page 7 CB Richard Ellis | Page 7 2005 EMEA Revenue by Client Total EMEA Revenue $594 m 1% 5% 6% 29% 31% 3% 25% Insurance Co's/Banks Property Companies Corporates Pension Funds Government Individuals/Partnerships Other |

CB Richard Ellis |

Page 8 CB Richard Ellis | Page 8 2005 London Market Share Source: EGI London Office Database 5% 5% 8% 8% 9% 12% 15% 15% 23% CB Richard Ellis Jones Lang LaSalle DTZ Knight Frank Cushman & Wakefield Healey & Baker Savills Atisreal BH2 GVA Increased lead over #2 firm by 8 percentage points from 2004. |

CB Richard Ellis |

Page 9 CB Richard Ellis | Page 9 2005 Strategic Initiatives Infrastructure Development Cross border programs Clients and CRM |

CB Richard Ellis |

Page 10 CB Richard Ellis | Page 10 2005 Strategic Initiatives – Infrastructure Development Acquisitions Affiliations Service Line Additions |

CB Richard Ellis |

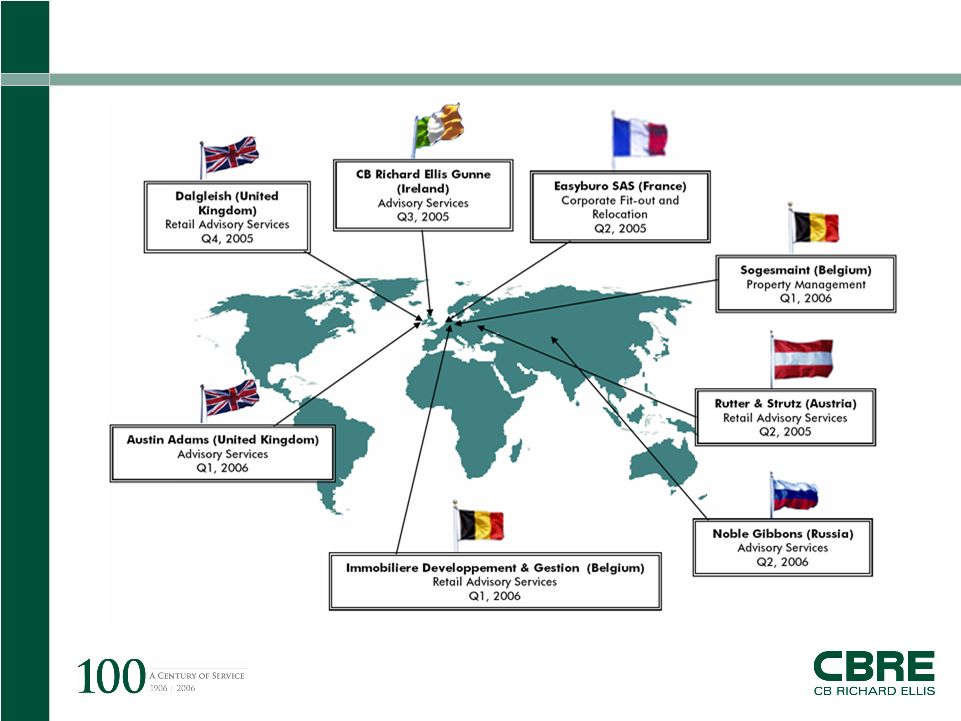

Page 11 CB Richard Ellis | Page 11 2005 & 2006 Acquisitions |

CB Richard Ellis |

Page 12 CB Richard Ellis | Page 12 New Offices Bratislava The Hague Abu Dhabi Casablanca Dubai |

CB Richard Ellis |

Page 13 CB Richard Ellis | Page 13 Cross Border Program Valuation Logistics Building Consultancy Corporate Services Retail Investment |

CB Richard Ellis |

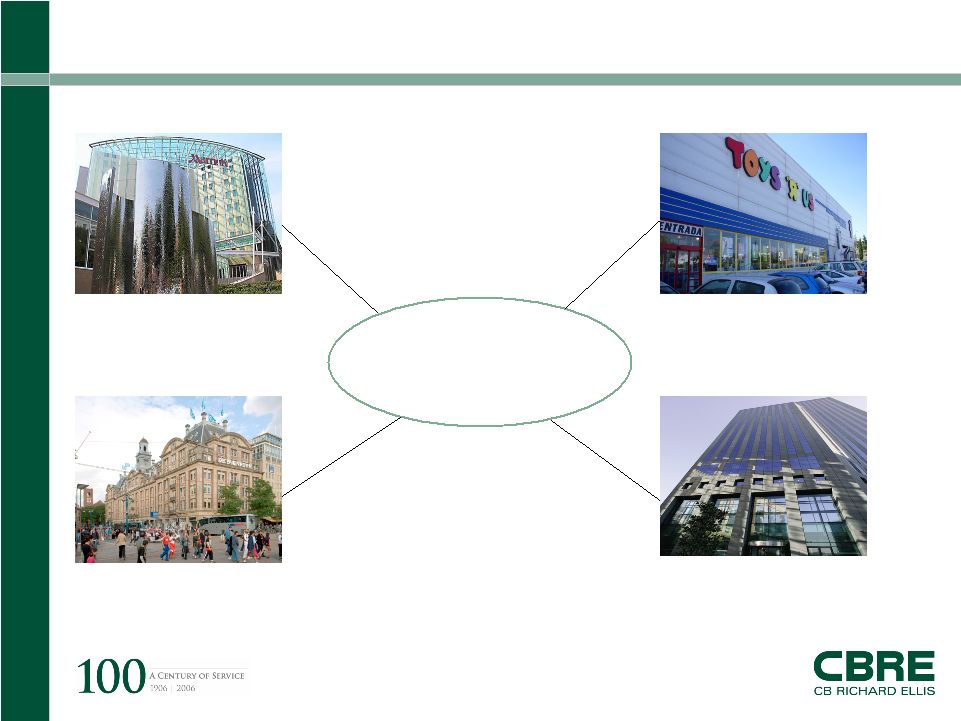

Page 14 CB Richard Ellis | Page 14 Client Case Study 46 hotels sold to Royal Bank of Scotland worth over £1 billion

Changing Nature of our Assignments Largest ever real estate transaction in Holland 3 stores comprising 5.8 million sq ft Largest ever single asset in Paris. 580,000 sq ft sales price of €560 million Sale of 78 stores, totalling 2 million sq ft in 5 countries Marriott Hotels UK Vendex KBB Netherlands Tour Adria, La Defense, Paris Toys R Us, France, Spain, UK, Germany |

CB Richard Ellis |

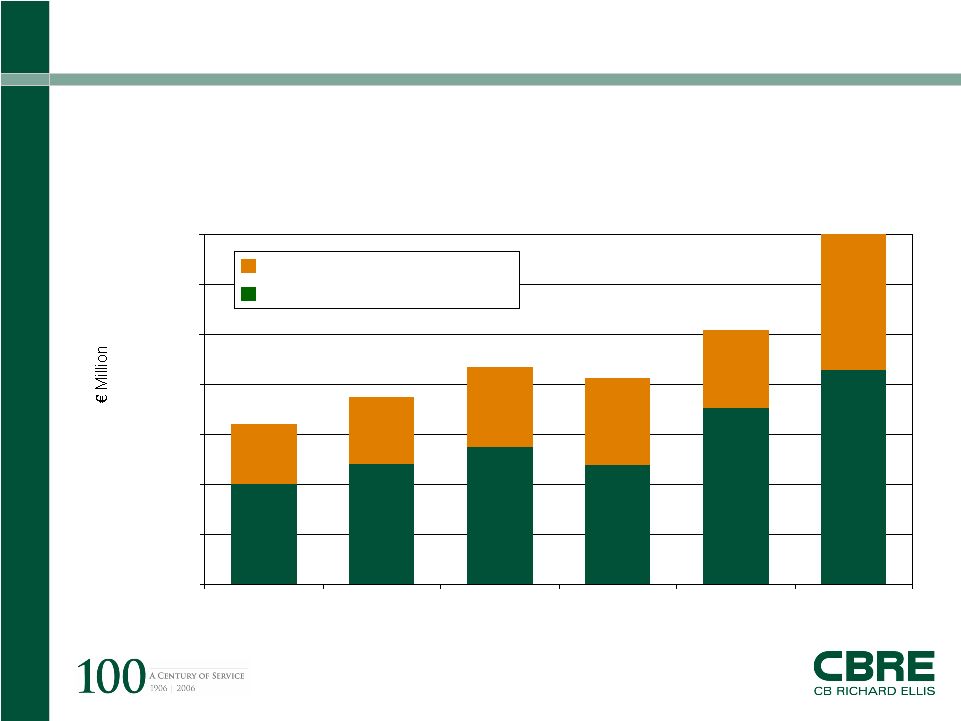

Page 15 CB Richard Ellis | Page 15 A Truly International Market 0 20,000 40,000 60,000 80,000 100,000 120,000 140,000 2000 2001 2002 2003 2004 2005 Source: CB Richard Ellis Cross-border purchases (+73%) Domestic purchases (+22%) Cross-border Investment Sales transactions have more than doubled in € terms since 2000 |

CB Richard Ellis |

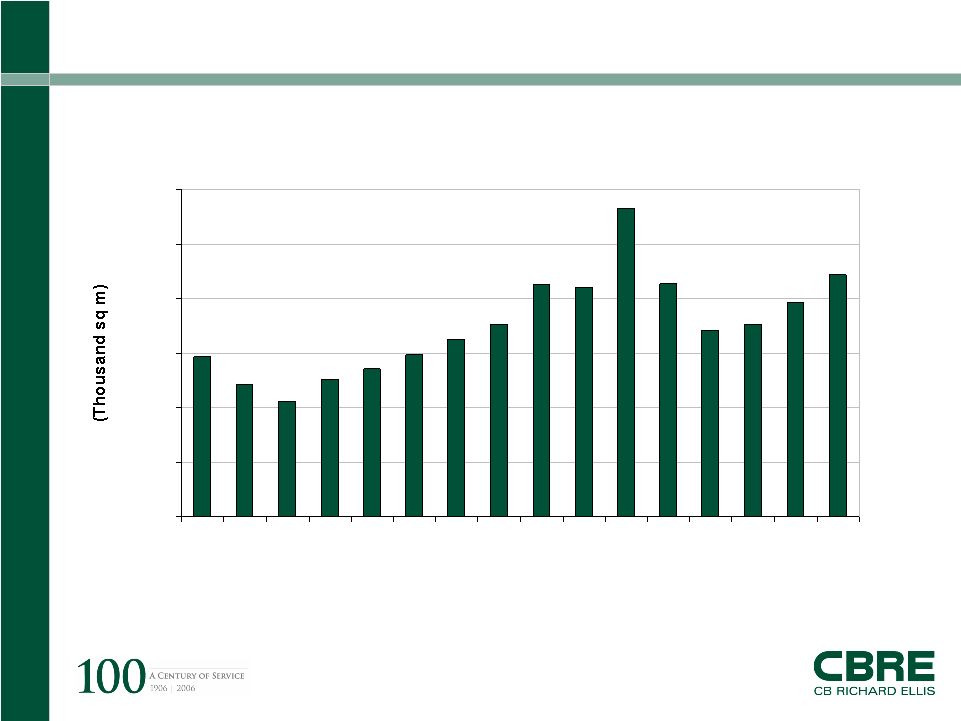

Page 16 CB Richard Ellis | Page 16 Source: CB Richard Ellis European Leasing Aggregate leasing in a sample of 16 markets The 16 markets in the sample are: Vienna, Brussels, Ile de France, Frankfurt, Munich, Hamburg, Berlin,

Dublin, Amsterdam, Rotterdam, The Hague, Utrecht, Barcelona, Madrid, Central London and UK

M25. 4,850 4,231 5,042 5,425 5,949 6,502 7,032 8,504 8,421 8,535 8,859 11,313 6,829 7,027 7,871 5,861 0 2,000 4,000 6,000 8,000 10,000 12,000 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 |

CB Richard Ellis |

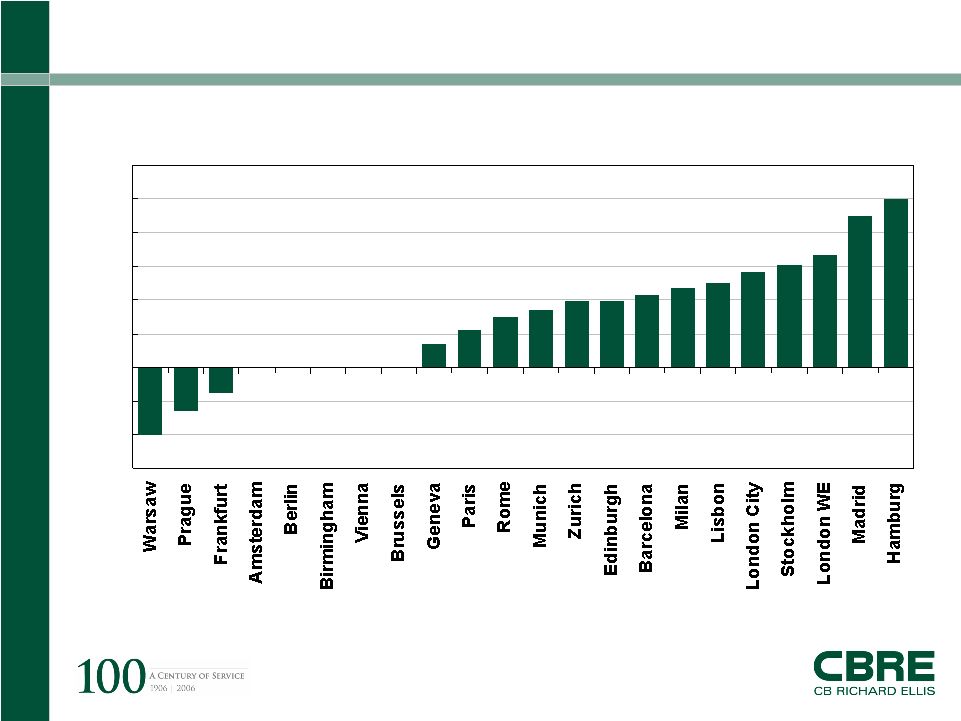

Page 17 CB Richard Ellis | Page 17 Annual Rental Rate Change -6% -4% -2% 0% 2% 4% 6% 8% 10% 12% (Q4 2004 – Q4 2005) Source: CB Richard Ellis |

CB Richard Ellis |

Page 18 CB Richard Ellis | Page 18 2006 Key Strategies Investment • Enhance retail and industrial capabilities • Exploit UAE & CEE opportunities Retail Leasing • Implement EMEA strategy by leveraging Dalgleish platform Valuation • Capitalize on the international opportunity |

CB Richard Ellis |

Page 19 CB Richard Ellis | Page 19 2006 Key Strategies Other Service Lines • EMEA logistics capability • Hotels capability • Office agency and corporate services coordination Continue Core Themes • Network growth and development • EMEA client management program • Cross border initiatives |

CB Richard Ellis |

Page 20 CB Richard Ellis | Page 20 |