Business Review

Day

Global Investment Management

May 17, 2006

Robert Zerbst

President, CB Richard Ellis Investors

Exhibit 99.3

Business Review

Day Global Investment Management May 17, 2006 Robert Zerbst President, CB Richard Ellis Investors Exhibit 99.3 |

CB Richard Ellis |

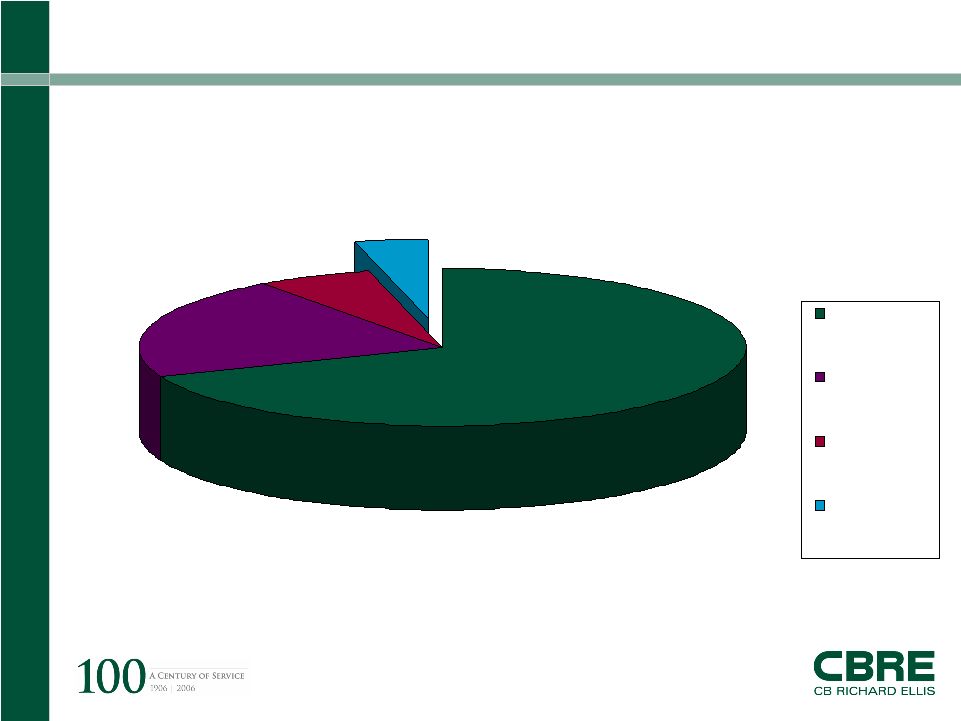

Page 2 CB Richard Ellis | Page 2 4% 6% 21% 69% Americas EMEA Asia Pacific Global Investment Management 2005 Investment Management % of Total Revenues Global Investment Management $127.3m |

CB Richard Ellis |

Page 3 CB Richard Ellis | Page 3 • Independently operated investment management affiliate of CB Richard Ellis Group, Inc. – Founded in 1972 – Registered Investment Advisor • Positioned at the center of the world’s leading real estate services company with 14,500 employees and 220 offices worldwide • Investment programs spanning three continents and a range of risk/return alternatives Global Investment Management CB Richard Ellis Investors |

CB Richard Ellis |

Page 4 CB Richard Ellis | Page 4 “Our business is to capitalize “Our business is to capitalize on real estate investment on real estate investment opportunities for our partners opportunities for our partners & clients - & clients - across the across the risk/return spectrum & around risk/return spectrum & around the globe.” the globe.” Mission |

CB Richard Ellis |

Page 5 CB Richard Ellis | Page 5 Real Estate has become a widely accepted asset class – Performance relative to equities and fixed income – Income and diversification – Increased transparency – Securitization • Accelerating cross-border investment flows – Globalization trend – Increased transparency, standardization – European Union and the Euro – Desire to increase investment universe – Expansion of REITs worldwide Key Business Drivers |

CB Richard Ellis |

Page 6 CB Richard Ellis | Page 6 Total New Investments $5.1B Total Dispositions $2.3B Assets Under Management $17.3B New Equity Capital Raised $4.7B, purchasing power $10.2B 2005 Milestones – Historical Highs |

CB Richard Ellis |

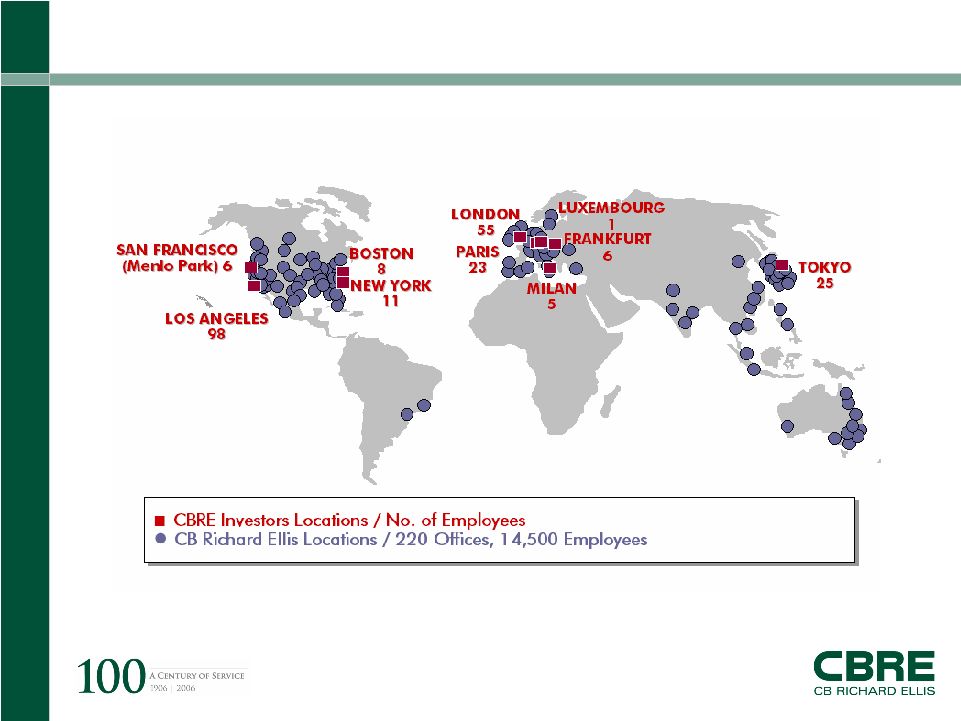

Page 7 CB Richard Ellis | Page 7 CB Richard Ellis Investors Worldwide Platform LONDON LONDON 55 55 MILAN MILAN 5 5 FRANKFURT FRANKFURT 6 6 LOS ANGELES LOS ANGELES 98 98 BOSTON BOSTON 8 8 TOKYO TOKYO 25 25 ¦ CBRE Investors Locations / # of Employees SAN FRANCISCO SAN FRANCISCO (Menlo Park) 6 (Menlo Park) 6 NEW YORK NEW YORK 11 11 LUXEMBOURG LUXEMBOURG 1 1 PARIS PARIS 23 23 |

CB Richard Ellis |

Page 8 CB Richard Ellis | Page 8 CB Richard Ellis Investors Worldwide Platform |

CB Richard Ellis |

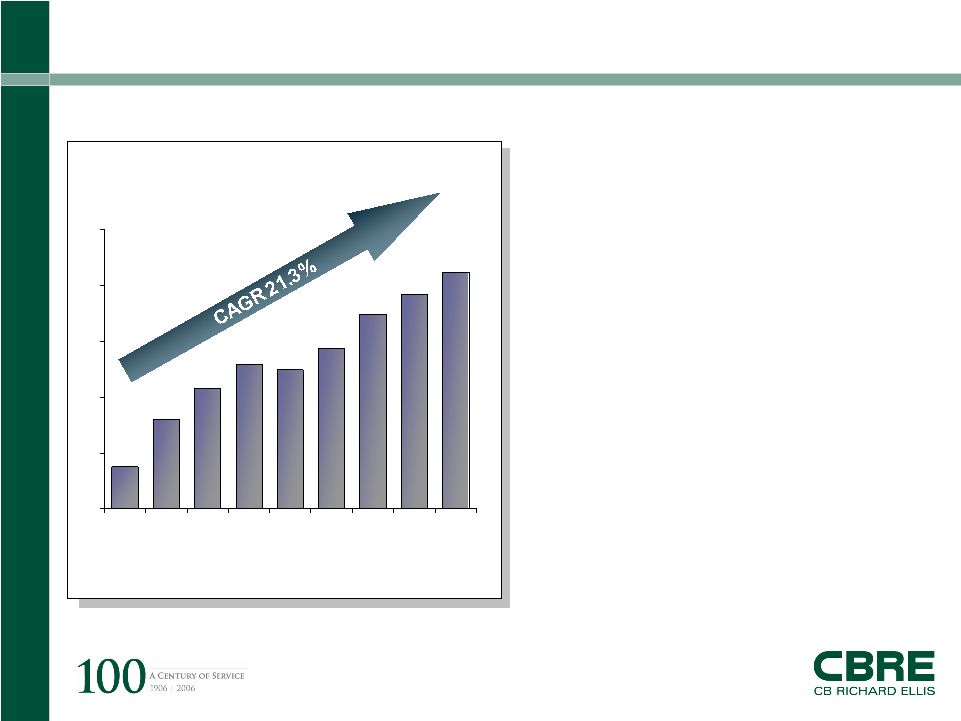

Page 9 CB Richard Ellis | Page 9 Why CB Richard Ellis Investors? • Disciplined, Research Based Investment Process • Focused Investment Teams • Execution Capability • CB Richard Ellis Platform • Superior Investment Performance 15.1 17.3 14.4 11.4 10.0 10.3 8.6 6.1 3.7 0 4 8 12 16 20 1997 1998 1999 2000 2001 2002 2003 2004 2005 * Difference in AUM equals acquisitions plus appreciation less dispositions and asset transfers. Assets Under Management* ($B) |

CB Richard Ellis |

Page 10 CB Richard Ellis | Page 10 MARKET RESEARCH ACQUISITION/ DISPOSITION BROKERAGE FINANCING LEASING PROPERTY MANAGEMENT INVESTMENT COMMITTEES INVESTMENT COMMITTEES INFORMATION SYSTEMS, INFORMATION SYSTEMS, ACCOUNTING & ACCOUNTING & ADMINISTRATION ADMINISTRATION INVESTOR SERVICES INVESTOR SERVICES & REPORTING & REPORTING INVESTMENT INVESTMENT RESEARCH RESEARCH Quality Control • Strategy Development • Consistency of Process & Methodology • Investment Decisions • Benchmark Performance Enhanced • Alignment of Interests • Accountability • Investment Performance Infrastructure • All Dedicated Units Build on a Common World-Class Support System Unparalleled • Data and Research • Market Intelligence • Investment Sourcing Capability • Property Operational Efficiencies MANAGED ACCOUNTS MANAGED ACCOUNTS Core Strategies STRATEGIC PARTNERS STRATEGIC PARTNERS Value Added Strategies SPECIAL SITUATIONS SPECIAL SITUATIONS Specialty/Opportunistic MANAGEMENT & OVERSIGHT STRATEGIES/INVESTOR FOCUS • Dedicated Operating Units • Specialized Skill Sets • Significant Management Ownership • Co-Investment in Higher-Yield Funds • Performance-Based Compensation CBRE INVESTORS COMMON FOUNDATION CB RICHARD ELLIS GLOBAL PLATFORM • 14,500 employees • 220 offices DEDICATED TEAM/OPERATIONAL MODEL Focused Investment Teams |

CB Richard Ellis |

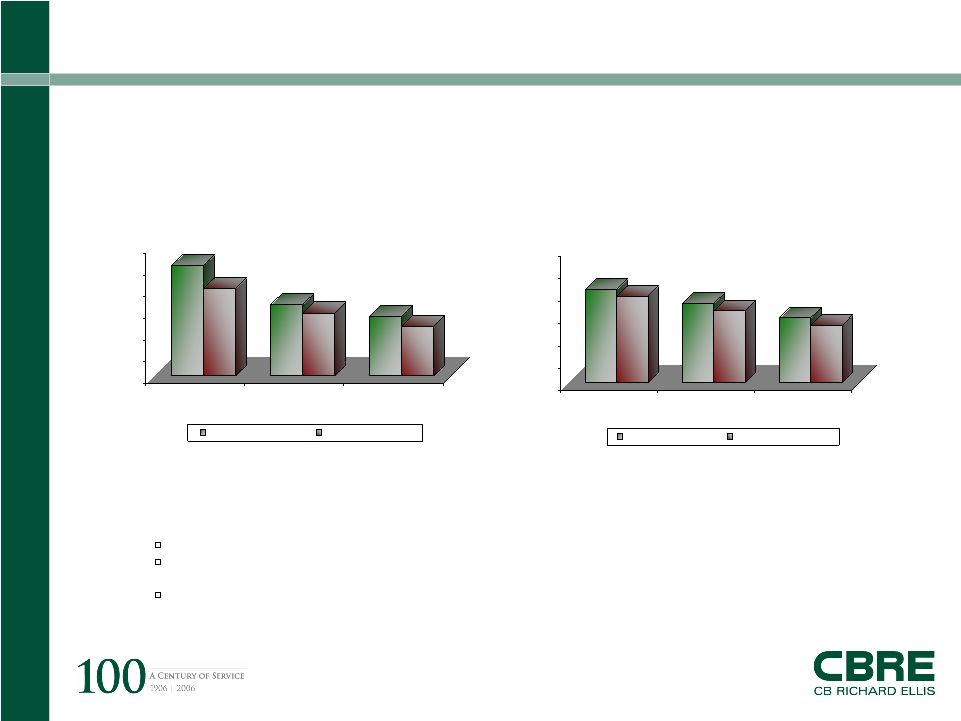

Page 11 CB Richard Ellis | Page 11 Investment Performance 20.9% 19.4% 17.7% 16.0% 14.5% 12.8% 0.0 0.1 0.1 0.2 0.2 0.3 0.3 One Year Three Years Five Years Total Gross Return IPD Index Benchmark December 31, 2005 U.K. DISCRETIONARY ACCOUNTS 25.4% 20.1% 16.4% 14.4% 13.7% 11.4% 0% 5% 10% 15% 20% 25% 30% One Year Three Years Five Years Total Gross Return NCREIF Benchmark December 31, 2005 U.S. DISCRETIONARY ACCOUNTS Notes on U.S. performance returns. • Performance results have been calculated in accordance with NCREIF methodology: Before the effect of leverage After deduction of acquisition fees but before deduction of asset management fees, performance incentive

fees and carried interest Net cash flow is assumed to be distributed quarterly • The average, annual impact of asset management, performance incentive fees and carried interest over the

five year period shown is 2.2%. • The composition of CBRE Investors’ discretionary accounts may differ from the composition of the NCREIF Property Index due to current and historical differences in asset size, geographic location and property type. 0 5 10 15 20 25 30 % 0 5 10 15 20 25 30 % |

CB Richard Ellis | Page

12 CB Richard Ellis | Page 12 Global Strategy Fund Matrix • European Specialty Funds - Dynamique Bureaux I, II - Dynamique Residentiels I, II - Commerces Rendement • Residential JREIT – Japan • Separate Accounts – US, UK • CB Richard Ellis - Global Real Estate Securities - Property Trust – UK - Realty Trust - US PROGRAMS Yes Yes No Coinvestment Closed End Funds Joint Ventures Closed End Funds Separate Accounts Open End Funds Typical Structure SPECIALITY/OPPORTUNISTIC VALUE ADDED CORE/CORE + MAIN CHARACTERISTICS Strategy SPECIAL SITUATIONS STRATEGIC PARTNERS MANAGED ACCOUNTS DEDICATED TEAMS • CB Richard Ellis Strategic Partners - US I, II, III, IV - UK I, II - Europe I, II CBRE INCOME SOURCES Acquisition Fees Asset Management Fees Incentive Fees Acquisition Fees Asset Management Fees LP Profits Carried Interest Acquisition Fees Asset Management Fees LP Profits Carried Interest |

CB Richard Ellis |

Page 13 CB Richard Ellis | Page 13 Competitive Ranking Company Name 1 ING Clarion/Real Estate 2 RREEF/DB Real Estate 3 UBS Realty Investors 4 La Salle Investment 5 JP Morgan Asset Management 6 CB Richard Ellis Investors 7 Morgan Stanley Real Estate 8 INVESCO Real Estate 9 Principal Real Estate 10 Henderson Global Advisors 11 Goldman, Sachs & Co. 12 BlackRock Realty Advisors 13 Heitman 14 Kennedy Associates 15 General Motors Asset Management 16 Cornerstone Real Estate Advisers 17 AEW Capital 18 Blackstone Real Estate 19 Starwood Capital Group 20 GMAC Institutional Advisors Source: Pensions and Investments; October 17, 2005 |

CB Richard Ellis |

Page 14 CB Richard Ellis | Page 14 Case Study 22% % Offshore: 33 #LP’s: Domestic Value Added • Release / Reposition • Development / Redevelopment • Portfolio Accumulation Strategy: $1.2B, $3.6B Purchasing Power Equity: Strategic Partners US IV, December 2005 Fund: |

CB Richard Ellis |

Page 15 CB Richard Ellis | Page 15 CB Richard Ellis Strategic Partners II, L.P. McKinney Plaza Class “A” Office Dallas, TX McKinney Plaza Class “A” Office Dallas, TX 3500 Maple Class “A” Office Dallas, TX 3500 Maple Class “A” Office Dallas, TX Ontario Portfolio Industrial Los Angeles, CA Ontario Portfolio Industrial Los Angeles, CA The Montebello Luxury Residential Houston, TX The Montebello Luxury Residential Houston, TX Metrowest Class “A” Office Chicago, IL Metrowest Class “A” Office Chicago, IL Century Centre Class “A” Office Orange County, CA Century Centre Class “A” Office Orange County, CA The Californian Luxury Residential Los Angeles, CA The Californian Luxury Residential Los Angeles, CA 101 Arch Class “A” Office Boston, MA 101 Arch Class “A” Office Boston, MA The Metropolitan Luxury Residential New York, NY The Metropolitan Luxury Residential New York, NY Metropolitan Center Class “A” Office East Rutherford, NJ Metropolitan Center Class “A” Office East Rutherford, NJ |

CB Richard Ellis |

Page 16 CB Richard Ellis | Page 16 Co-Existing with Brokerage Business • Perception of conflict is a non-issue • CBRE affiliation is key attribute of success Today: • Separate line of business • Free to use or not use affiliates • Dedicated teams compensated only on portfolio performance • No referral fees, commission splits or stock in CBRE • Marketed importance of the CBRE Platform Changes: • Some investors thought conflicts existed 1998: |