Business Review

Day

Asset Services

May 17, 2006

Jana Turner

President, Asset Services

Exhibit 99.10

Business Review

Day Asset Services May 17, 2006 Jana Turner President, Asset Services Exhibit 99.10 |

CB Richard Ellis |

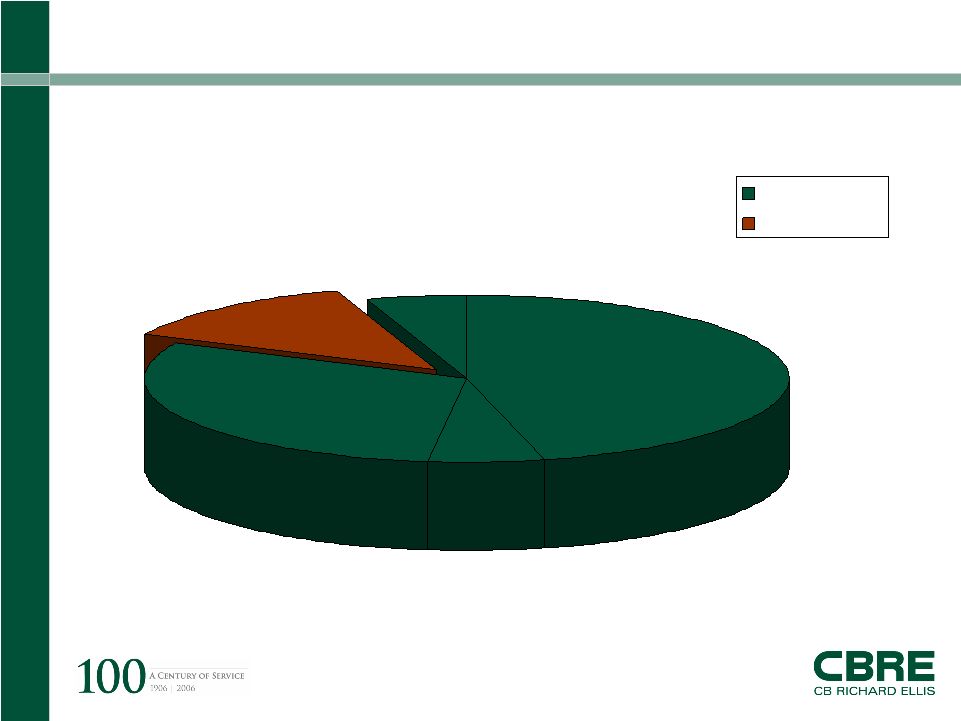

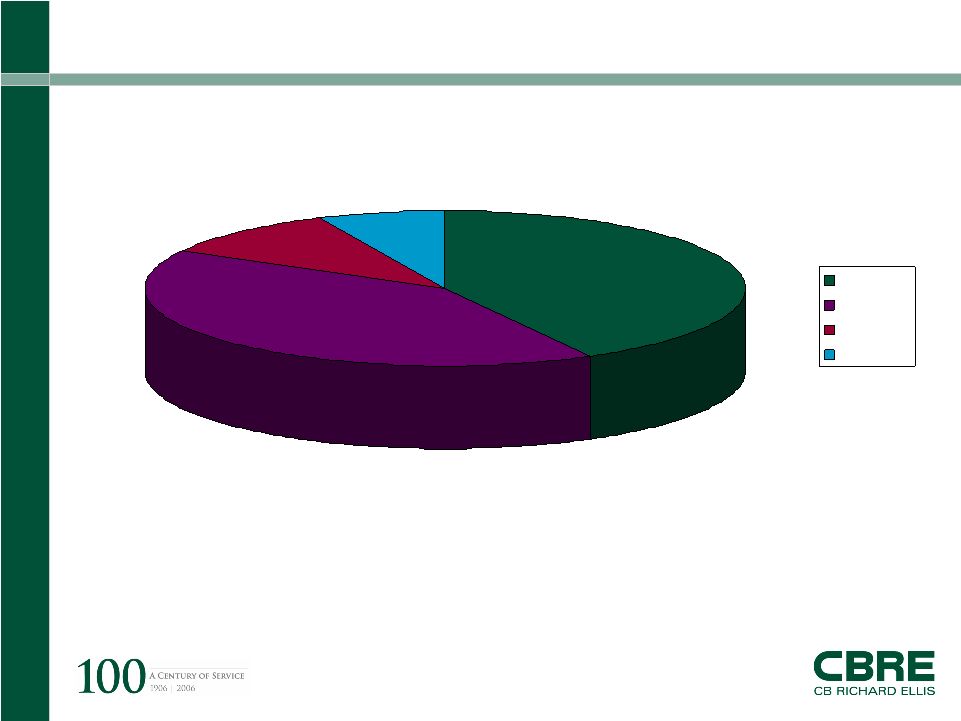

Page 1 CB Richard Ellis | Page 1 2005 Outsourcing % of Americas Revenue 5% 13% 30% 6% 46% Advisory Outsourcing Outsourcing $268m US Brokerage Valuation Capital Markets Canada & Latin America |

CB Richard Ellis |

Page 2 CB Richard Ellis | Page 2 What is Asset Services? Asset Services provides a strategic approach to maximizing the value of commercial assets for investment owners. • Technical/Engineering • Procurement • Financial/Accounting • Risk Management Services include: • Property Management • Leasing • Project Management • Marketing & Branding • Tenant Relations |

CB Richard Ellis |

Page 3 CB Richard Ellis | Page 3 Key Business Drivers Consolidation of Service Providers Outsourcing by Private Market Clients/REITS Active Investment Sales Environment |

CB Richard Ellis |

Page 4 CB Richard Ellis | Page 4 Key Business Drivers Consolidation of Service Providers • DDRS – 4.5 million sq. ft. portfolio consolidated to two providers (CBRE – East) • Portfolio consists of smaller, suburban office product |

CB Richard Ellis |

Page 5 CB Richard Ellis | Page 5 Key Business Drivers Outsourcing by Private Market Clients/REITS • Hampshire Properties – 9 million sq. ft. managed (1Q’06) • Dividend Capital – 8.8 million sq. ft. managed (1Q’06) |

CB Richard Ellis |

Page 6 CB Richard Ellis | Page 6 Key Business Drivers Active Investment Sales Environment • 1Q’06 – 46.5 million sq. ft. added • 1Q’05 – 27.4 million sq. ft. added |

CB Richard Ellis |

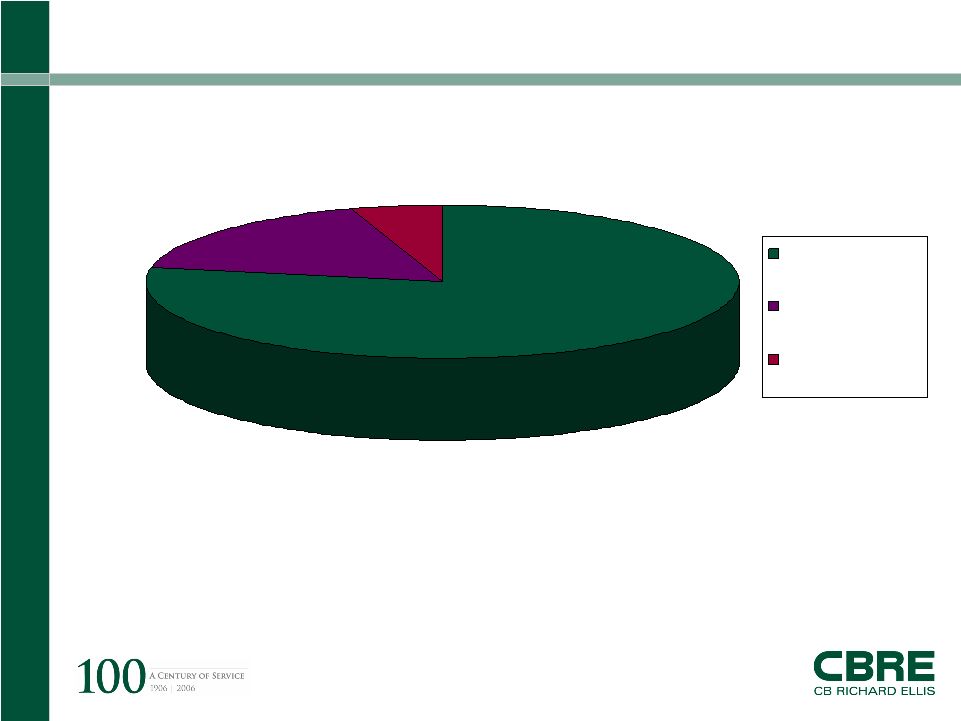

Page 7 CB Richard Ellis | Page 7 7% 10% 41% 42% Office Industrial Retail Other 473 Million Sq.Ft.* Statistics – Portfolio Distribution • Includes Partner and Affiliate Office Statistics • As of December 31, 2005 |

CB Richard Ellis |

Page 8 CB Richard Ellis | Page 8 5% 17% 78% Property/Project Management Fees Leasing Sales Statistics – Revenue Distribution • For the year ended December 31, 2005 |

CB Richard Ellis |

Page 9 CB Richard Ellis | Page 9 Asset Services’ Top Clients |

CB Richard Ellis |

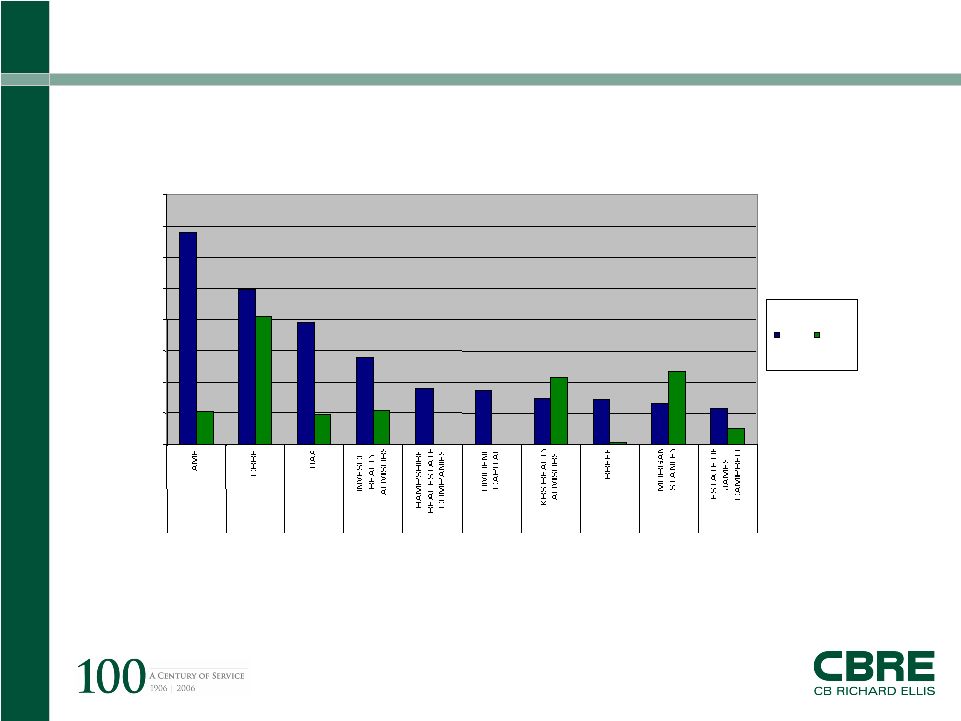

Page 10 CB Richard Ellis | Page 10 Growth – Top 10 Clients sq.ft. *Through March 31, 2006 * Top 10 Client CAGR of 20% 0 5,000,000 10,000,000 15,000,000 20,000,000 25,000,000 30,000,000 35,000,000 40,000,000 1 2 3 4 5 6 7 8 9 10 2006 2001 |

CB Richard Ellis |

Page 11 CB Richard Ellis | Page 11 Key Differentiators THE ASSET SERVICES PLATFORM • Axis Portal • CBRE Technical Services • Global Quality Standards • Procurement • Risk Management • Recruiting/Retention Program |

CB Richard Ellis |

Page 12 CB Richard Ellis | Page 12 2006 Strategic Initiatives Seek out Project Management growth through acquisition of companies or practice groups Achieve greater industry penetration with the Axis Portal Growth of Private Label initiative Continued focus on building a meaningful Account Management program and platform Further drive cost efficiencies from the shared services divisions |

CB Richard Ellis |

Page 13 CB Richard Ellis | Page 13 |