Exhibit 99.2

Second Quarter 2005

Earnings Conference Call August 3, 2005

Forward Looking Statements

This presentation contains statements that are forward looking within the meaning of the Private Securities Litigation Reform Act of 1995. These statements should be considered as estimates only and actual results may ultimately differ from these estimates. Except to the extent required by applicable securities laws, CB Richard Ellis Group, Inc. undertakes no obligation to update or publicly revise any of the forward-looking statements that you may hear today. Please refer to our annual report on Form 10-K and our quarterly reports on Form 10-Q, which are filed with the SEC and available at the SEC’s website (http://www.sec.gov), for a full discussion of the risks and other factors, that may impact any estimates that you may hear today. We may make certain statements during the course of this presentation which include references to “non-GAAP financial measures,” as defined by SEC regulations. As required by these regulations, we have provided reconciliations of these measures to what we believe are the most directly comparable GAAP measures, which are attached hereto within the appendix.

1

Conference Call Participants

Brett White, President and Chief Executive Officer

Ken Kay, Senior Executive Vice President & Chief Financial Officer

Mike Strong, President, EMEA

Shelley Young, Director of Investor Relations

2

Q2 2005 Summary

Market dominance

Strong top and bottom line results

Industry profit/margin leadership

3

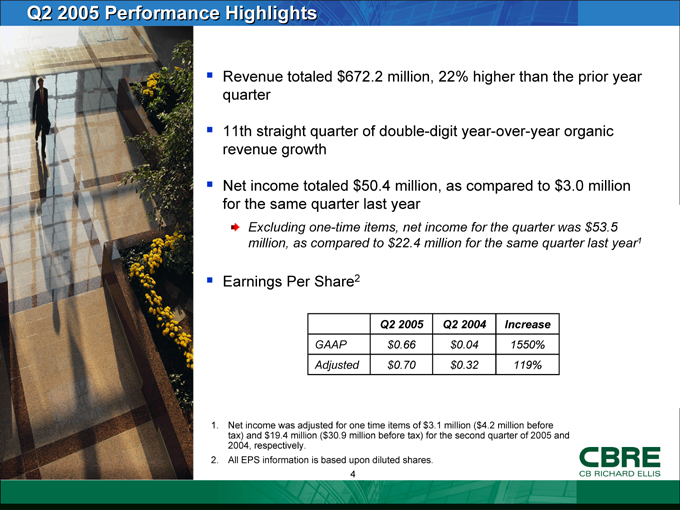

Q2 2005 Performance Highlights

Revenue totaled $672.2 million, 22% higher than the prior year quarter

11th straight quarter of double-digit year-over-year organic revenue growth

Net income totaled $50.4 million, as compared to $3.0 million for the same quarter last year

Excluding one-time items, net income for the quarter was $53.5 million, as compared to $22.4 million for the same quarter last year1

Earnings Per Share2

Q2 2005 Q2 2004 Increase

GAAP $0.66 $0.04 1550%

Adjusted $0.70 $0.32 119%

1. Net income was adjusted for one time items of $3.1 million ($4.2 million before tax) and $19.4 million ($30.9 million before tax) for the second quarter of 2005 and 2004, respectively.

2. All EPS information is based upon diluted shares.

4

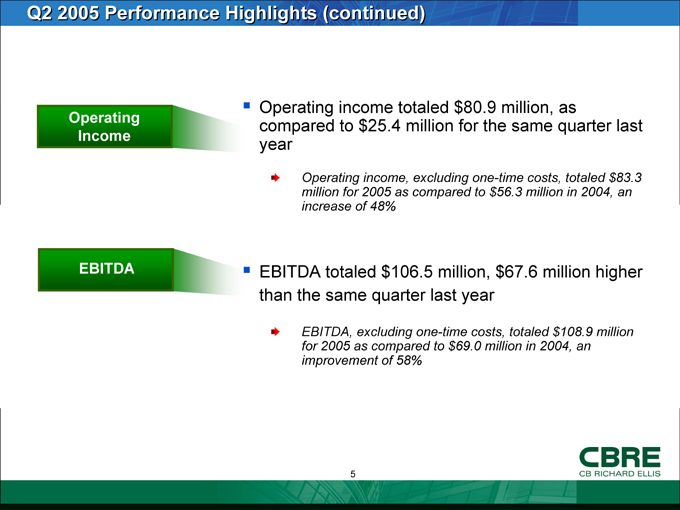

Q2 2005 Performance Highlights (continued)

Operating Income

Operating income totaled $80.9 million, as compared to $25.4 million for the same quarter last year

Operating income, excluding one-time costs, totaled $83.3 million for 2005 as compared to $56.3 million in 2004, an increase of 48%

EBITDA

EBITDA totaled $106.5 million, $67.6 million higher than the same quarter last year

EBITDA, excluding one-time costs, totaled $108.9 million for 2005 as compared to $69.0 million in 2004, an improvement of 58%

5

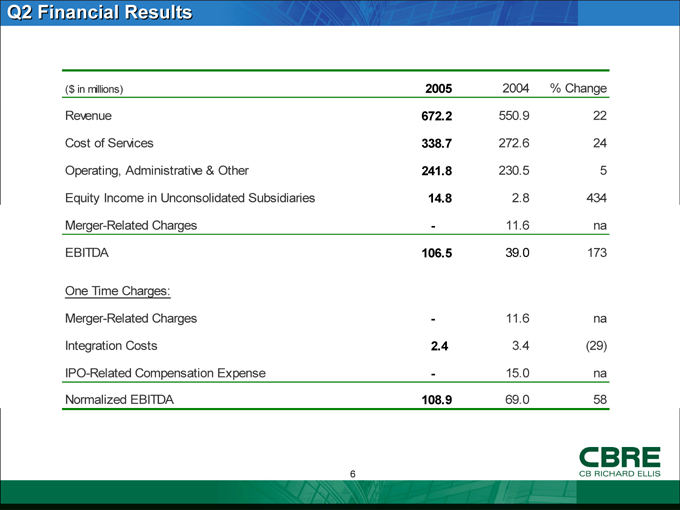

Q2 Financial Results

($ in millions) 2005 2004 % Change

Revenue 672.2 550.9 22

Cost of Services 338.7 272.6 24

Operating, Administrative & Other 241.8 230.5 5

Equity Income in Unconsolidated Subsidiaries 14.8 2.8 434

Merger-Related Charges - 11.6 na

EBITDA 106.5 39.0 173

One Time Charges:

Merger-Related Charges - 11.6 na

Integration Costs 2.4 3.4 (29)

IPO-Related Compensation Expense - 15.0 na

Normalized EBITDA 108.9 69.0 58

6

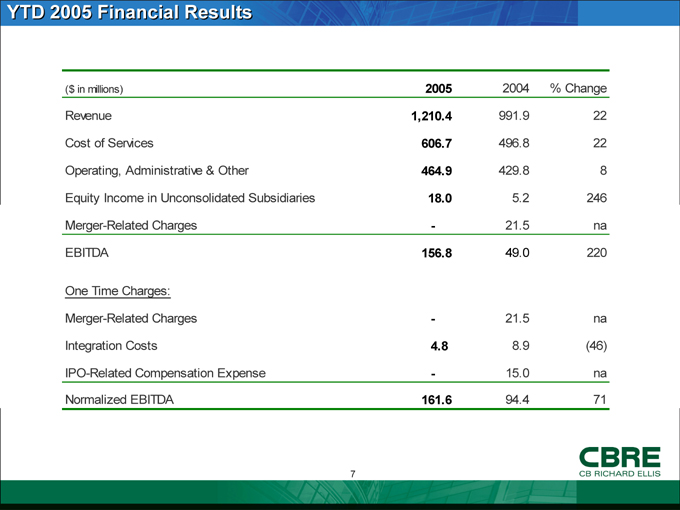

YTD 2005 Financial Results

($ in millions) 2005 2004 % Change

Revenue 1,210.4 991.9 22

Cost of Services 606.7 496.8 22

Operating, Administrative & Other 464.9 429.8 8

Equity Income in Unconsolidated Subsidiaries 18.0 5.2 246

Merger-Related Charges - 21.5 na

EBITDA 156.8 49.0 220

One Time Charges:

Merger-Related Charges - 21.5 na

Integration Costs 4.8 8.9 (46)

IPO-Related Compensation Expense - 15.0 na

Normalized EBITDA 161.6 94.4 71

7

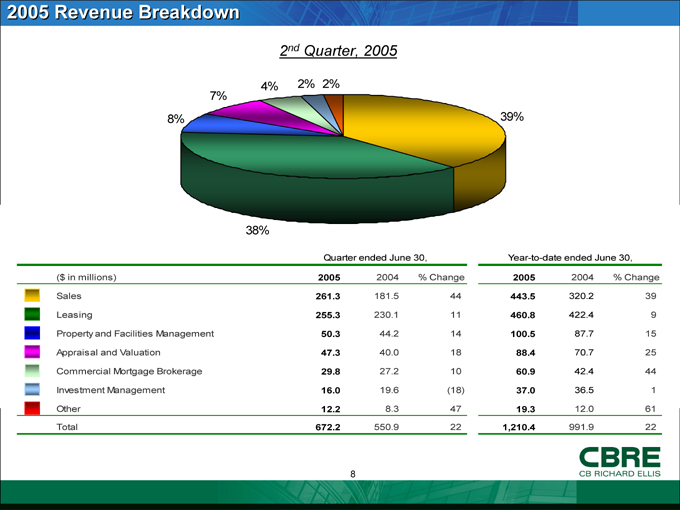

2005 Revenue Breakdown

2nd Quarter, 2005

8%

7%

4%

2%

2%

39%

38%

Quarter ended June 30, Year-to-date ended June 30,

($ in millions) 2005 2004 % Change 2005 2004 % Change

Sales 261.3 181.5 44 443.5 320.2 39

Leasing 255.3 230.1 11 460.8 422.4 9

Property and Facilities Management 50.3 44.2 14 100.5 87.7 15

Appraisal and Valuation 47.3 40.0 18 88.4 70.7 25

Commercial Mortgage Brokerage 29.8 27.2 10 60.9 42.4 44

Investment Management 16.0 19.6 (18) 37.0 36.5 1

Other 12.2 8.3 47 19.3 12.0 61

Total 672.2 550.9 22 1,210.4 991.9 22

8

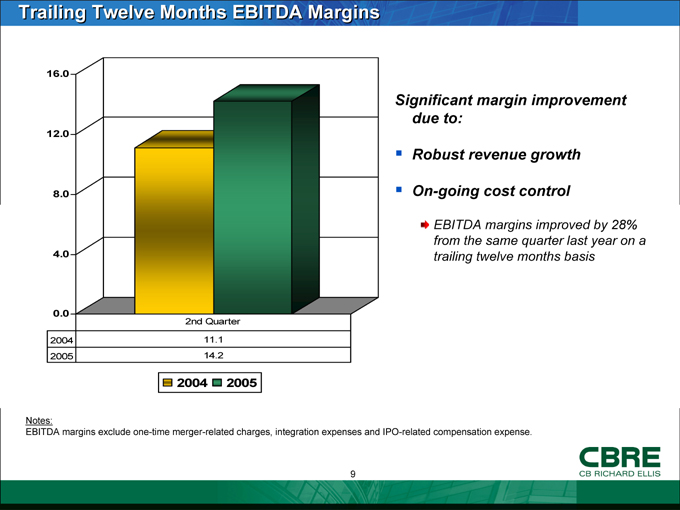

Trailing Twelve Months EBITDA Margins

16.0 . 12.0 . 8.0 . 4.0 . 0.0 .

2nd Quarter

2004 11.1 .

2005 14.2 .

2004

2005

Significant margin improvement due to:

Robust revenue growth

On-going cost control

EBITDA margins improved by 28% from the same quarter last year on a trailing twelve months basis

Notes:

EBITDA margins exclude one-time merger-related charges, integration expenses and IPO-related compensation expense.

9

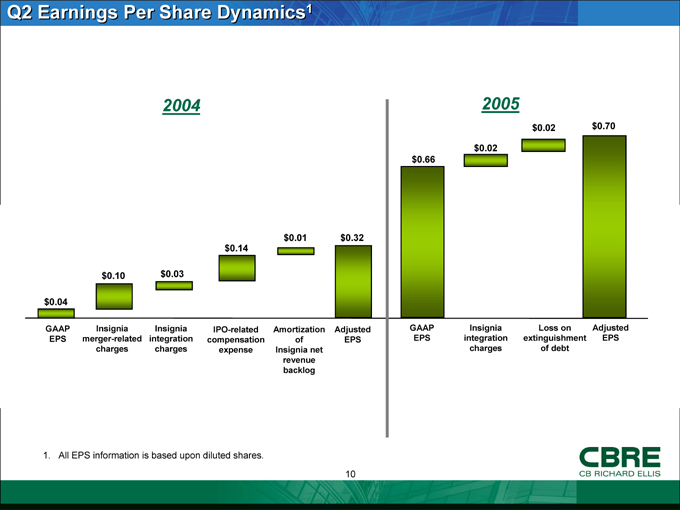

Q2 Earnings Per Share Dynamics1

2004 $0.04 $0.10 $0.03 $0.14 $0.01 $0.32

GAAP EPS

Insignia merger-related charges

Insignia integration charges

IPO-related compensation expense

Amortization of Insignia net revenue backlog

Adjusted EPS

2005 $0.66 $0.02 $0.02 $0.70

GAAP EPS

Insignia integration charges

Loss on extinguishment of debt

Adjusted EPS

1. All EPS information is based upon diluted shares.

10

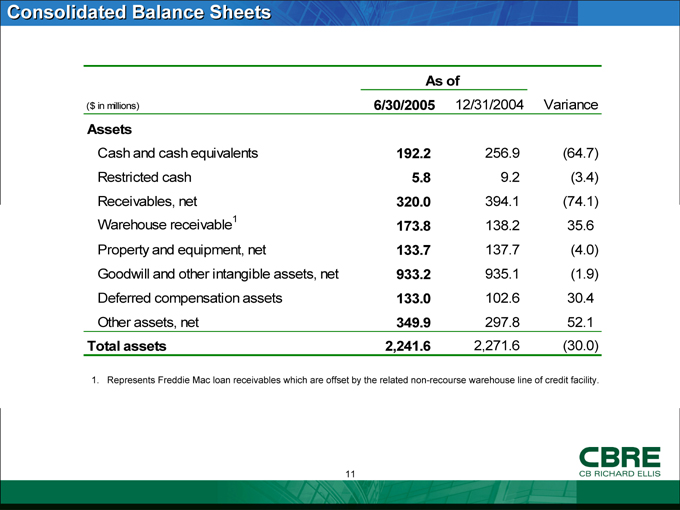

Consolidated Balance Sheets

As of

($ in millions) 6/30/2005 12/31/2004 Variance

Assets

Cash and cash equivalents 192.2 256.9 (64.7)

Restricted cash 5.8 9.2 (3.4)

Receivables, net 320.0 394.1 (74.1)

Warehouse receivable1 173.8 138.2 35.6

Property and equipment, net 133.7 137.7 (4.0)

Goodwill and other intangible assets, net 933.2 935.1 (1.9)

Deferred compensation assets 133.0 102.6 30.4

Other assets, net 349.9 297.8 52.1

Total assets 2,241.6 2,271.6 (30.0)

1. Represents Freddie Mac loan receivables which are offset by the related non-recourse warehouse line of credit facility.

11

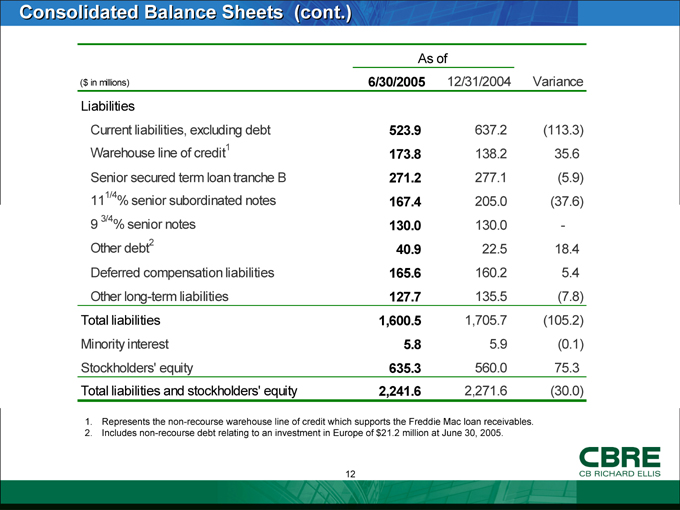

Consolidated Balance Sheets (cont.)

As of

($ in millions) 6/30/2005 12/31/2004 Variance

Liabilities

Current liabilities, excluding debt 523.9 637.2 (113.3)

Warehouse line of credit1 173.8 138.2 35.6

Senior secured term loan tranche B 271.2 277.1 (5.9)

111/4% senior subordinated notes 167.4 205.0 (37.6)

9 3/4% senior notes 130.0 130.0 -

Other debt2 40.9 22.5 18.4

Deferred compensation liabilities 165.6 160.2 5.4

Other long-term liabilities 127.7 135.5 (7.8)

Total liabilities 1,600.5 1,705.7 (105.2)

Minority interest 5.8 5.9 (0.1)

Stockholders’ equity 635.3 560.0 75.3

Total liabilities and stockholders’ equity 2,241.6 2,271.6 (30.0)

1. Represents the non-recourse warehouse line of credit which supports the Freddie Mac loan receivables.

2. Includes non-recourse debt relating to an investment in Europe of $21.2 million at June 30, 2005.

12

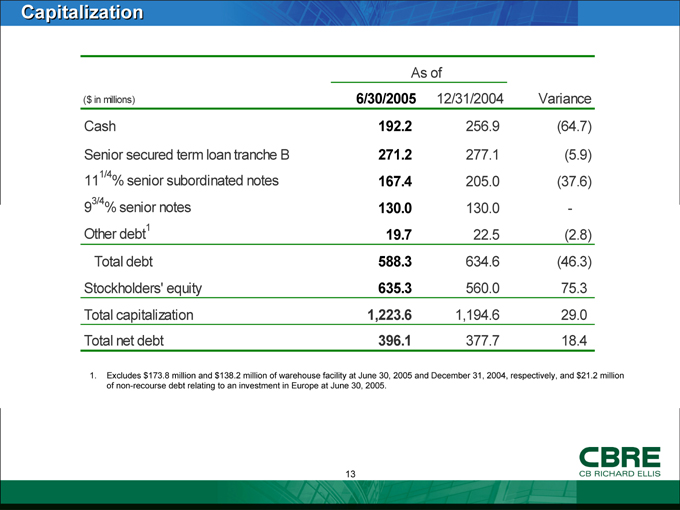

Capitalization

As of

($ in millions) 6/30/2005 12/31/2004 Variance

Cash 192.2 256.9 (64.7)

Senior secured term loan tranche B 271.2 277.1 (5.9)

111/4% senior subordinated notes 167.4 205.0 (37.6)

93/4% senior notes 130.0 130.0 -

Other debt1 19.7 22.5 (2.8)

Total debt 588.3 634.6 (46.3)

Stockholders’ equity 635.3 560.0 75.3

Total capitalization 1,223.6 1,194.6 29.0

Total net debt 396.1 377.7 18.4

1. Excludes $173.8 million and $138.2 million of warehouse facility at June 30, 2005 and December 31, 2004, respectively, and $21.2 million of non-recourse debt relating to an investment in Europe at June 30, 2005.

13

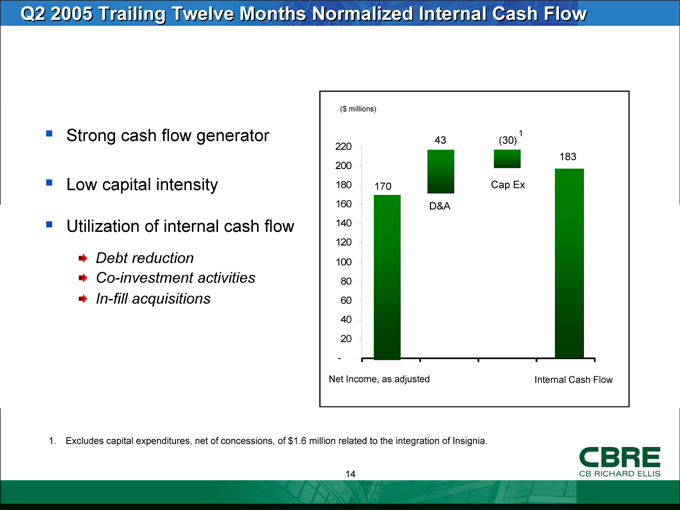

Q2 2005 Trailing Twelve Months Normalized Internal Cash Flow

Strong cash flow generator

Low capital intensity

Utilization of internal cash flow

Debt reduction

Co-investment activities In-fill acquisitions

($millions)

220 200 180 160 140 120 100 80 60 40 20 -

170

43

D&A

(30)1

Cap Ex

183

Net Income, as adjusted

Internal Cash Flow

1. Excludes capital expenditures, net of concessions, of $1.6 million related to the integration of Insignia.

14

2005 Full Year Guidance

Revenue of $2.7 billion

Net income, as adjusted, within the range of $183 to $191 million1

Diluted earnings per share, as adjusted, growth of approximately 45% to 52% resulting in a guidance range of $2.40 to $2.501

1. Excluding residual one-time Insignia and debt buy-back charges of approximately $14 million pre-tax.

15

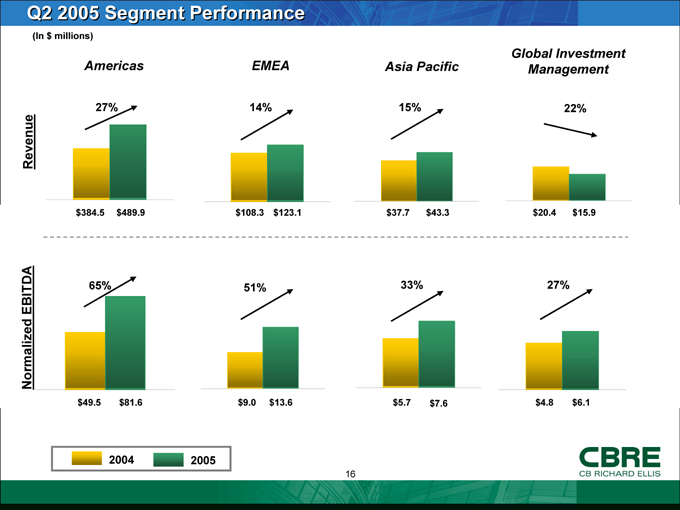

Q2 2005 Segment Performance

(In $ millions)

Revenue

Americas

27% $384.5 $489.9

EMEA

14% $108.3 $123.1

Asia Pacific

15% $37.7 $43.3

Global Investment Management

22% $20.4 $15.9

Normalized EBITDA

65% $49.5 $81.6

51% $9.0 $13.6

33% $5.7 $7.6

27% $4.8 $6.1

2004

2005

16

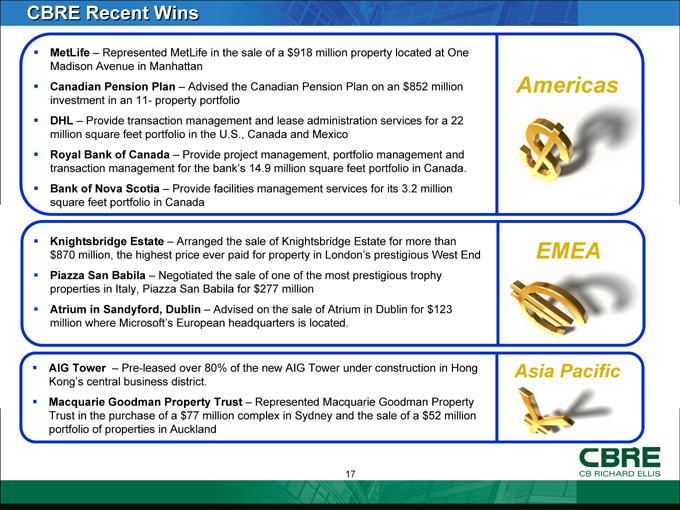

CBRE Recent Wins

MetLife – Represented MetLife in the sale of a $918 million property located at One Madison Avenue in Manhattan Canadian Pension Plan – Advised the Canadian Pension Plan on an $852 million investment in an 11- property portfolio DHL – Provide transaction management and lease administration services for a 22 million square feet portfolio in the U.S., Canada and Mexico Royal Bank of Canada – Provide project management, portfolio management and transaction management for the bank’s 14.9 million square feet portfolio in Canada. Bank of Nova Scotia – Provide facilities management services for its 3.2 million square feet portfolio in Canada

Americas

Knightsbridge Estate – Arranged the sale of Knightsbridge Estate for more than $870 million, the highest price ever paid for property in London’s prestigious West End Piazza San Babila – Negotiated the sale of one of the most prestigious trophy properties in Italy, Piazza San Babila for $277 million Atrium in Sandyford, Dublin – Advised on the sale of Atrium in Dublin for $123 million where Microsoft’s European headquarters is located.

EMEA

AIG Tower – Pre-leased over 80% of the new AIG Tower under construction in Hong Kong’s central business district.

Macquarie Goodman Property Trust – Represented Macquarie Goodman Property Trust in the purchase of a $77 million complex in Sydney and the sale of a $52 million portfolio of properties in Auckland

Asia Pacific

17

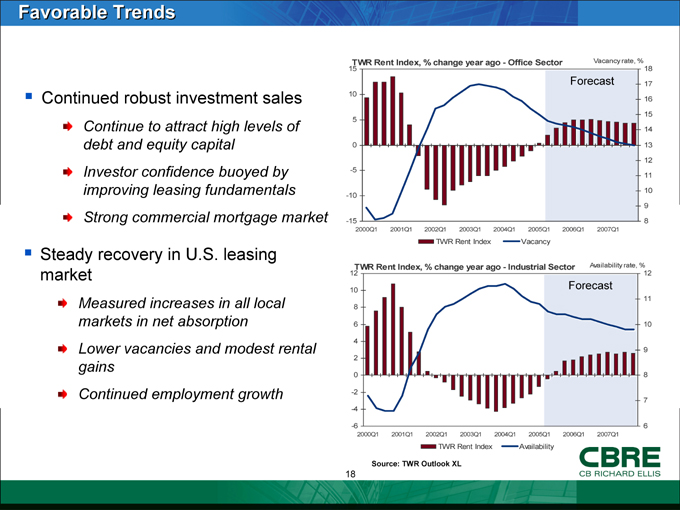

Favorable Trends

Continued robust investment sales

Continue to attract high levels of debt and equity capital Investor confidence buoyed by improving leasing fundamentals Strong commercial mortgage market

Steady recovery in U.S. leasing market

Measured increases in all local markets in net absorption Lower vacancies and modest rental gains Continued employment growth

TWR Rent Index, % change year ago - Office Sector

Vacancy rate, %

15 10 5 0 -5 -10 -15

2000Q1 2001Q1 2002Q1 2003Q1 2004Q1 2005Q1 2006Q1 2007Q1

Forecast

18 17 16 15 14 13 12 11 10 9 8

TWR Rent Index

Vacancy

TWR Rent Index, % change year ago - Industrial Sector

Availability rate, %

12 10 8 6 4 2 0 -2 -4 -6

2000Q1 2001Q1 2002Q1 2003Q1 2004Q1 2005Q1 2006Q1 2007Q1

Forecast

12 11 10 9 8 7 6

TWR Rent Index

Availability

Source: TWR Outlook XL

18

Summary

Record Performance

Strong revenue, EBITDA, net income and earnings per share as a result of improved performance from virtually all lines of business

Macro Trends

Investor confidence bolstered by the strengthening of leasing fundamentals and low long-term interest rates Demand for real estate investments increased due to changes in capital allocations by financial institutions Strong international investment sales markets

19

20

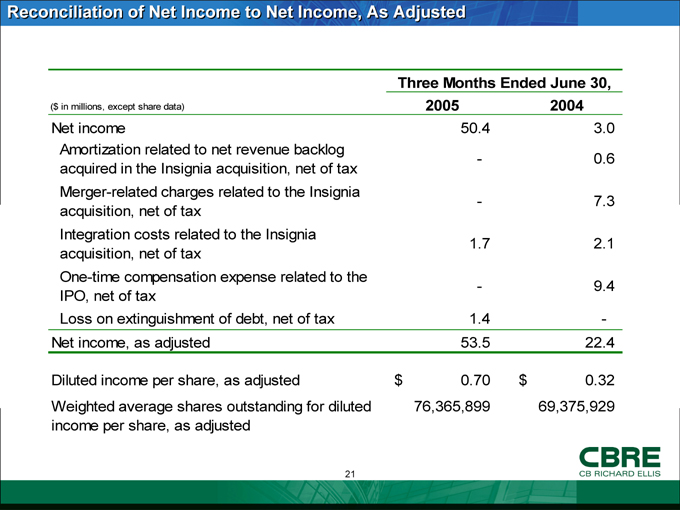

Reconciliation of Net Income to Net Income, As Adjusted

Three Months Ended June 30,

($ in millions, except share data) 2005 2004

Net income 50.4 3.0

Amortization related to net revenue backlog acquired in the Insignia acquisition, net of tax - 0.6

Merger-related charges related to the Insignia acquisition, net of tax - 7.3

Integration costs related to the Insignia acquisition, net of tax 1.7 2.1

One-time compensation expense related to the IPO, net of tax - 9.4

Loss on extinguishment of debt, net of tax 1.4 -

Net income, as adjusted 53.5 22.4

Diluted income per share, as adjusted $0.70 $0.32

Weighted average shares outstanding for diluted income per share, as adjusted 76,365,899 69,375,929

21

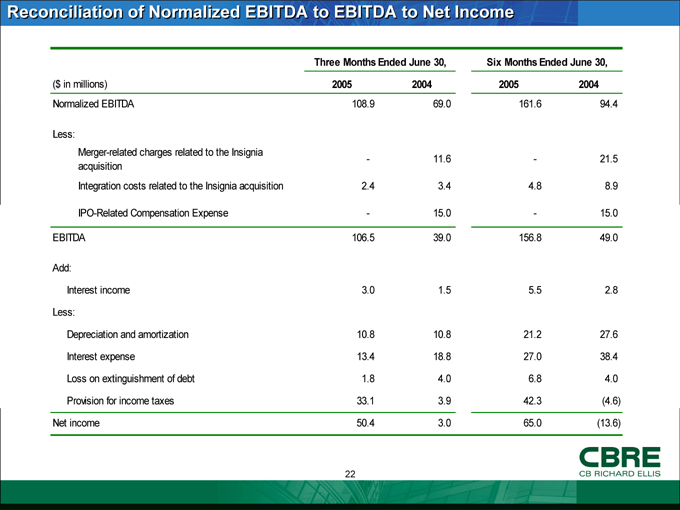

Reconciliation of Normalized EBITDA to EBITDA to Net Income

Three Months Ended June 30, Six Months Ended June 30,

($ in millions) 2005 2004 2005 2004

Normalized EBITDA 108.9 69.0 161.6 94.4

Less:

Merger-related charges related to the Insignia acquisition - 11.6 - 21.5

Integration costs related to the Insignia acquisition 2.4 3.4 4.8 8.9

IPO-Related Compensation Expense - 15.0 - 15.0

EBITDA 106.5 39.0 156.8 49.0

Add:

Interest income 3.0 1.5 5.5 2.8

Less:

Depreciation and amortization 10.8 10.8 21.2 27.6

Interest expense 13.4 18.8 27.0 38.4

Loss on extinguishment of debt 1.8 4.0 6.8 4.0

Provision for income taxes 33.1 3.9 42.3 (4.6)

Net income 50.4 3.0 65.0 (13.6)

22

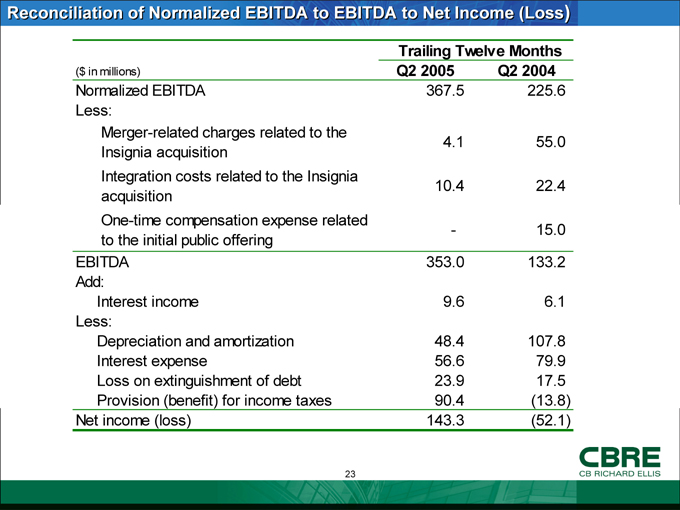

Reconciliation of Normalized EBITDA to EBITDA to Net Income (Loss)

Trailing Twelve Months

($ in millions) Q2 2005 Q2 2004

Normalized EBITDA 367.5 225.6

Less:

Merger-related charges related to the Insignia acquisition 4.1 55.0

Integration costs related to the Insignia acquisition 10.4 22.4

One-time compensation expense related to the initial public offering - 15.0

EBITDA 353.0 133.2

Add:

Interest income 9.6 6.1

Less:

Depreciation and amortization 48.4 107.8

Interest expense 56.6 79.9

Loss on extinguishment of debt 23.9 17.5

Provision (benefit) for income taxes 90.4 (13.8)

Net income (loss) 143.3 (52.1)

23

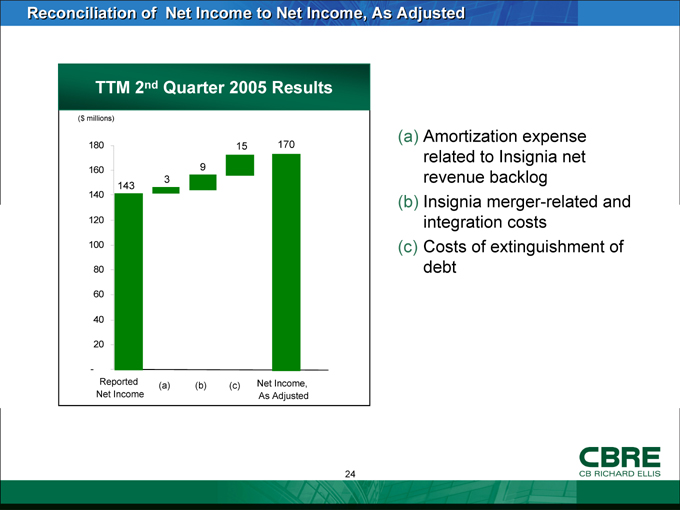

Reconciliation of Net Income to Net Income, As Adjusted

TTM 2nd Quarter 2005 Results

($ millions)

180 160 140 120 100 80 60 40 20 -

143

3

9

15

170

Reported Net Income

(a)

(b)

(c)

Net Income, As Adjusted

(a) Amortization expense related to Insignia net revenue backlog (b) Insignia merger-related and integration costs (c) Costs of extinguishment of debt

24

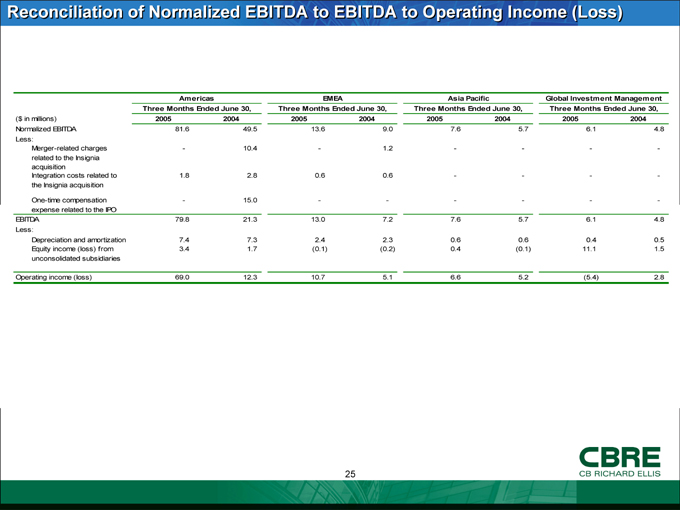

Reconciliation of Normalized EBITDA to EBITDA to Operating Income (Loss)

Americas EMEA Asia Pacific Global Investment Management

Three Months Ended June 30, Three Months Ended June 30, Three Months Ended June 30, Three Months Ended June 30,

($ in millions) 2005 2004 2005 2004 2005 2004 2005 2004

Normalized EBITDA 81.6 49.5 13.6 9.0 7.6 5.7 6.1 4.8

Less:

Merger-related charges related to the Insignia acquisition - 10.4 - 1.2 - - - -

Integration costs related to the Insignia acquisition 1.8 2.8 0.6 0.6 - - - -

One-time compensation expense related to the IPO - 15.0 - - - - - -

EBITDA 79.8 21.3 13.0 7.2 7.6 5.7 6.1 4.8

Less:

Depreciation and amortization 7.4 7.3 2.4 2.3 0.6 0.6 0.4 0.5

Equity income (loss) from 3.4 1.7 (0.1) (0.2) 0.4 (0.1) 11.1 1.5

unconsolidated subsidiaries

Operating income (loss) 69.0 12.3 10.7 5.1 6.6 5.2 (5.4) 2.8

25

26