As filed with the Securities and Exchange Commission on June 2, 2004

Registration No. 333-112867

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 4

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CB Richard Ellis Group, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 6500 | 94-3391143 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

865 South Figueroa Street, Suite 3400

Los Angeles, CA 90017

(213) 438-4880

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Kenneth J. Kay

Chief Financial Officer

CB Richard Ellis Group, Inc.

(formerly known as CBRE Holding, Inc.)

865 South Figueroa Street, Suite 3400

Los Angeles, CA 90017

(213) 438-4880

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| William B. Brentani Simpson Thacher & Bartlett LLP 3330 Hillview Avenue Palo Alto, CA 94304 (650) 251-5000 Fax: (650) 251-5002 |

Stephen L. Burns Cravath, Swaine & Moore LLP 825 Eighth Avenue New York, NY 10019 (212) 474-1000 Fax: (212) 474-3700 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are being offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. ¨

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JUNE 2, 2004

24,000,000 Shares

CB Richard Ellis Group, Inc.

Class A Common Stock

Prior to this offering, there has been no public market for our Class A common stock. The initial public offering price of our Class A common stock is expected to be between $20.00 and $22.00 per share. We have applied to list our Class A common stock on the New York Stock Exchange under the symbol “CBG.”

We are selling 7,142,857 shares of Class A common stock and the selling stockholders are selling 16,857,143 shares of Class A common stock. We will not receive any of the proceeds from the shares of Class A common stock sold by the selling stockholders.

The underwriters have an option to purchase a maximum of 3,600,000 additional shares of Class A common stock from the selling stockholders to cover over-allotments of shares.

Investing in our Class A common stock involves risks. See “ Risk Factors” beginning on page 9.

| Price to Public |

Underwriting Discounts and Commissions |

Proceeds to Ellis Group |

Proceeds to Selling Stockholders | |||||||||

| Per Share |

$ | $ | $ | $ | ||||||||

| Total |

$ | $ | $ | $ | ||||||||

Delivery of the shares of Class A common stock will be made on or about , 2004.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Credit Suisse First Boston | Citigroup |

| JPMorgan | Lehman Brothers | |

Bear, Stearns & Co. Inc.

Goldman, Sachs & Co.

Merrill Lynch & Co.

The date of this prospectus is , 2004.

| Page | ||

| 1 | ||

| 9 | ||

| 21 | ||

| 22 | ||

| 23 | ||

| 24 | ||

| 26 | ||

| 28 | ||

| 41 | ||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

43 | |

| 73 | ||

| 85 | ||

| 99 |

| Page | ||

| PRINCIPAL AND SELLING STOCKHOLDERS | 105 | |

| DESCRIPTION OF CAPITAL STOCK | 109 | |

| SHARES ELIGIBLE FOR FUTURE SALE | 115 | |

| 118 | ||

| 123 | ||

| UNDERWRITING | 126 | |

| LEGAL MATTERS | 130 | |

| EXPERTS | 130 | |

| CHANGE IN ACCOUNTANTS | 131 | |

| 131 | ||

| F-1 |

You should rely only on the information contained in this document or to which we have referred you. We have not authorized anyone to provide you with information that is different. This document may only be used where it is legal to sell these securities. The information in this document may only be accurate on the date of this prospectus.

“CB Richard Ellis” and the “CBRE CB Richard Ellis” corporate logo set forth on the cover of this prospectus are the registered trademarks of CB Richard Ellis Group, Inc. and its subsidiaries in the United States. All other trademarks or service marks are trademarks or service marks of the companies that use them.

Industry and market data used in this prospectus were obtained from our own research, publicly available studies conducted by third parties and publicly available industry and general publications published by third parties and, in some cases, are management estimates based on its industry and other knowledge. While we believe our research and management estimates are reliable, they have not been verified by independent sources.

Some figures in this prospectus may not total due to rounding adjustments.

Dealer Prospectus Delivery Obligation

Until , 2004, all dealers that effect transactions in these securities, whether or not participating in the offering, may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to unsold allotments or subscriptions.

This summary may not contain all of the information that may be important to you. You should read this summary together with the entire prospectus, including the information presented under the heading “Risk Factors” and the more detailed information in the financial statements and related notes appearing elsewhere in this prospectus, before making an investment decision. Unless the context indicates otherwise, (1) references in this prospectus to “common stock” mean our Class A common stock and (2) information presented on a “pro forma basis” gives effect to our acquisition of Insignia Financial Group, Inc. on July 23, 2003 and the related transactions and financings and the completion of the offering and the use of the net proceeds we receive, in each case as described in this prospectus under the heading “Unaudited Pro Forma Financial Information.”

CB Richard Ellis Group, Inc.

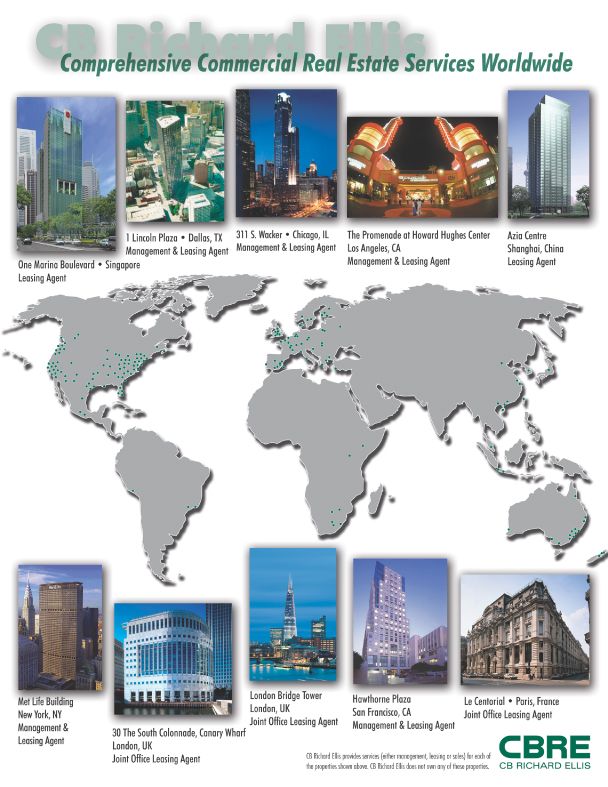

We are the largest global commercial real estate services firm, based on 2003 revenue, offering a full range of services to occupiers, owners, lenders and investors in office, retail, industrial, multi-family and other commercial real estate assets. As of December 31, 2003, we operated in 48 countries with over 13,500 employees in 220 offices providing commercial real estate services under the “CB Richard Ellis” brand name. Our business is focused on several service competencies, including strategic advice and execution assistance for property leasing and sales, forecasting, valuations, origination and servicing of commercial mortgage loans, facilities and project management and real estate investment management. We generate revenues both on a per project or transaction basis and from annual management fees.

We have a well-balanced, highly diversified base of clients that includes more than 60% of the Fortune 100. Many of our clients are consolidating their commercial real estate-related expenditures with fewer providers and, as a result, awarding their business to those providers that have a strong presence in important markets and the ability to provide a complete range of services worldwide. As a result of this trend and our ability to deliver comprehensive solutions for our clients’ needs across a wide range of markets, we believe we are well positioned to capture a growing percentage of our clients’ commercial real estate services expenditures.

Industry Overview

Our business covers all the various segments that compose the commercial real estate services industry, which includes leasing, sales, property management, facilities management, consulting, mortgage origination and servicing, valuation and appraisal services and investment management. Based upon our experience in these various segments and our management’s ongoing internally-generated assessment of the size of the addressable market within each such segment, we believe that the U.S. commercial real estate services industry, excluding investment management, generated approximately $22 billion in revenues during 2003.

In addition, we review on a quarterly basis various internally-generated statistics and estimates regarding both office and industrial space within the U.S. commercial real estate services industry, including the total available “stock” of rentable space and the average rent per square foot of space. Our management believes that changes in the addressable commercial rental market represented by the product of available stock and rent per square foot provide a reliable estimate of changes in the overall commercial real estate services industry because nearly all segments within the industry are affected by changes in those two measurements. We estimate that the product of available stock and rent per square foot grew at a compound annual growth rate of approximately 4.8% from 1993 through 2003.

1

During the next few years, we believe the key drivers of revenue growth for the largest commercial real estate services companies will be the following:

| • | Outsourcing. Motivated by reduced costs, lower overhead, improved execution across markets, increased operational efficiency and a desire to focus on their core competencies, property owners and occupiers have increasingly contracted out for commercial real estate services, including transaction management, facilities management, project management, lease administration, property management and property accounting. |

| • | Consolidation. The commercial real estate services industry remains highly fragmented, and we believe that major property owners and corporate users are motivated to consolidate their service provider relationships on a regional, national and global basis to obtain more consistent execution across markets, to achieve economies of scale and enhanced purchasing power and to benefit from streamlined management oversight and the efficiency of “single point of contact” service delivery. |

| • | Institutional Ownership of Commercial Real Estate. Institutional owners, such as real estate investment trusts, or REITs, pension funds, foreign institutions and other financial entities, increasingly are acquiring more real estate assets and financing them in the capital markets. We believe it is likely that these owners will outsource management of their portfolios and consolidate their use of commercial real estate services vendors. |

Our Regions of Operation and Principal Services

We have organized our business into, and report our results of operations through, three geographically organized segments: (1) the Americas, (2) Europe, Middle East and Africa, or EMEA, and (3) Asia Pacific.

The Americas

The Americas is our largest segment of operations and provides a comprehensive range of services throughout the United States and in the largest metropolitan regions in Canada, Mexico and other selected parts of Latin America. Our Americas segment accounted for 73.5% of our 2003 revenue.

Within our Americas segment, we organize our services into the following business areas:

Advisory Services. Our advisory services business line accounted for 59.7% of our 2003 revenue. We believe we are a market leader for the provision of sales and leasing real estate services in many U.S. metropolitan statistical areas (as defined by the U.S. Census Bureau), including New York, Philadelphia, Washington, D.C., Los Angeles, Atlanta, Chicago, Boston and Dallas.

| • | Real Estate Services. We provide strategic advice and execution assistance to owners, investors and occupiers of real estate in connection with leasing, disposition and acquisition of property. |

| • | Mortgage Loan Origination and Servicing. Our wholly owned subsidiary, L.J. Melody & Company, originates and services commercial mortgage loans without incurring principal risk. |

| • | Valuation. We provide valuation services that include market value appraisals, litigation support, discounted cash flow analyses and feasibility and fairness opinions. |

2

Outsourcing Services. Our outsourcing services business line accounted for 11.2% of our 2003 revenue. As of December 31, 2003, we managed approximately 422.8 million square feet of commercial space for property owners and occupiers, which we believe represents one of the largest portfolios in the Americas.

| • | Asset Services. We provide property management, construction management, marketing, leasing, accounting and financial services on a contractual basis for income-producing office, industrial and retail properties owned by local, regional and institutional investors. |

| • | Corporate Services. We provide a comprehensive set of portfolio management, transaction management, project management, strategic consulting, facilities management and other corporate real estate services to leading global companies and public sector institutions with large, geographically-diverse real estate portfolios. |

Investment Management Services. Our investment management services business line accounted for 2.6% of our 2003 revenue. Our wholly owned subsidiary, CB Richard Ellis Investors, L.L.C., provides investment management services to clients that include pension plans, investment funds, insurance companies and other organizations seeking to generate returns and diversification through investment in real estate and sponsors funds and investment programs that span the risk/return spectrum.

Europe, Middle East and Africa

Our EMEA segment has offices in 28 countries, with its largest operations located in the United Kingdom, France, Spain, The Netherlands and Germany. Operations within the EMEA countries generally include brokerage, investment properties, corporate services, valuation/appraisal services, asset management services, facilities management and other services similar to our Americas segment. We hold strong commercial real estate services market positions in a number of European metropolitan areas, including the leading market position in London in terms of 2003 leased square footage. The EMEA segment accounted for 19.2% of our 2003 revenue.

Asia Pacific

Our Asia Pacific segment has offices in 11 countries, with our principal operations located in China (including Hong Kong), Singapore, South Korea, Japan, Australia and New Zealand. The services we provide in our Asia Pacific segment are generally similar to those provided by our Americas and EMEA segments. We believe we are one of only a few companies that can provide a full range of commercial real estate services to large corporations throughout the Asia Pacific region. The Asia Pacific segment accounted for 7.3% of our 2003 revenue.

Our Competitive Position

We believe we possess several competitive strengths that position us to capitalize on the positive outsourcing, consolidation and globalization trends in the commercial real estate services industry. Our strengths include the following:

| • | Global Brand and Market Leading Positions. For nearly a century, we and our predecessors have built the CB Richard Ellis brand into the largest commercial real estate services provider in the world, based on 2003 revenue. |

| • | Full Service Capabilities. We provide a full range of commercial real estate services to meet the needs of our clients, and we believe this suite of services represents a broader range globally than nearly all of our competitors. |

| • | Strong Client Relationships and Client-tailored Service. We have forged long-term relationships with many of our clients. Our clients include more than 60% of the Fortune 100, with nearly half of these clients purchasing more than one service from us. |

3

| • | Attractive Business Model. Our business model features a diversified client base, recurring revenue streams, a variable cost structure, low capital requirements and strong cash flow generation. |

| • | Strong Management Team and Workforce. We have recruited a talented and motivated workforce of over 13,500 employees worldwide, who are supported by a strong and deep senior management team consisting of a number of highly-respected executives, most of whom have over 20 years of broad experience in the real estate industry. |

Although we believe these strengths will create significant opportunities for our business, you should also be aware of the risks that may impact our competitive position, which include the following:

| • | Significant Leverage. We have significant debt service obligations and the agreements governing our long-term debt impose operating and financial restrictions on the conduct of our business. |

| • | Geographic Concentration. A significant portion of our U.S. operations is concentrated in California and in the New York metropolitan area. Adverse effects on these local economies may affect us more than our competitors. |

| • | Exposure to Risks of International Operations. Because a significant portion of our revenue is derived from operations outside the United States, we are exposed to exchange rate and other foreign social, political and economic risks. |

| • | Smaller Presence in Some Markets than our Local Competitors. Although we have a large global presence, many of our competitors may be larger on a local or regional basis and devote more resources to these markets. |

Our Growth Strategy

We believe we have built an integrated, global services platform that is unparalleled in our industry. Our primary business objective is to use this platform to garner a disproportionate share of industry revenues relative to our competitors. We believe this will enable us to maximize and sustain our long-term cash flow and increase long-term stockholder value. Our strategy to achieve these business objectives consists of several elements:

| • | Increase Revenue from Large Clients. We plan to capitalize on our client management strategy for our large clients, by using relationship management teams to provide these clients with a full range of services globally while maximizing our revenue per client. |

| • | Capitalize on Cross-selling Opportunities. Because we believe cross-selling represents a large growth opportunity within the commercial real estate services industry, we have dedicated substantial resources and implemented several management initiatives to better enable our workforce to capitalize on these opportunities among our various lines of business. |

| • | Continue to Grow our Investment Management Business. Our growing investment management business provides us with an attractive revenue source through fees on assets under management and gains on the sale of assets. |

| • | Focus on Best Practices to Improve Operating Efficiency. In 2001, we launched a best practices initiative, branded “People, Platform & Performance,” to achieve operating cost reductions, and we continue to strive for efficiency improvements and cost savings in order to maximize our operating margins and cash flow. |

We were incorporated in Delaware on February 20, 2001. Our principal executive offices are located at 865 South Figueroa Street, Suite 3400, Los Angeles, California 90017 and our telephone number is (213) 438-4880. Our website address is www.cbre.com. The information contained on, or accessible through, our website is not part of this prospectus.

4

The Offering

| Common stock offered by us |

7,142,857 shares |

| Common stock offered by the selling stockholders |

16,857,143 shares (or 20,457,143 shares if the underwriters exercise the over-allotment option in full) |

| Common stock to be outstanding after the offering |

68,068,459 shares |

| Proposed New York Stock Exchange symbol |

CBG |

| Use of proceeds |

We estimate that our net proceeds from the offering will be $138.7 million, based on an assumed initial public offering price of $21.00 per share, which is the of the range set forth on the cover page of this prospectus. We intend to use these net proceeds of the offering to redeem all $38.3 million of our outstanding 16% senior notes due 2011 and $70.0 million in aggregate principal amount of our 9 3/4% senior notes due 2010, and to prepay $19.9 million in principal amount of the term loan under our amended and restated credit agreement. We will not receive any of the proceeds from the sale of shares of our common stock by the selling stockholders. |

| Dividend Policy |

Following the consummation of the offering, we do not expect to pay any dividends on our common stock for the foreseeable future. |

| Risk Factors |

You should carefully read and consider the information set forth under the heading titled “Risk Factors” and all other information set forth in this prospectus before deciding to invest in shares of our common stock. |

The number of shares shown to be outstanding after the offering is based upon 60,582,550 shares outstanding as of April 30, 2004, reflects the automatic conversion at a 1-for-1 ratio of all outstanding shares of our Class B common stock into shares of Class A common stock in connection with the completion of the offering and excludes:

| • | 6,887,695 shares subject to options issued under our 2001 stock incentive plan at a weighted average exercise price of $5.77 per share, of which options to purchase 1,609,344 shares were then exercisable; |

| • | 3,129,279 shares underlying outstanding stock fund units under our deferred compensation plan, which shares are issuable in connection with future distributions under the plan pursuant to elections made by plan participants or distributions made by us and which shares include 1,948,133 underlying stock fund units that had vested; and |

| • | 6,928,406 additional shares available for future issuance under our 2004 stock incentive plan. |

The number of shares shown to be outstanding after the offering includes 343,052 shares that will be issued by us in connection with the automatic “cashless exercise” of outstanding warrants to acquire 708,019 shares of our common stock at an exercise price of $10.825 per share as a result of the completion of the offering. This number of shares issued upon exercise of these warrants assumes an initial public offering price of $21.00 per share, which is the mid-point of the range set forth on the cover page of this prospectus. For additional information regarding these warrants, including the “cashless exercise” terms, you should read the description of these warrants under the heading titled “Description of Capital Stock—Warrants.”

5

Except as otherwise indicated, all information in this prospectus assumes:

| • | no exercise by the underwriters of their option to purchase up to 3,600,000 additional shares from the selling stockholders to cover over-allotments of shares; |

| • | a 3-for-1 stock split of our outstanding Class A common stock and Class B common stock on May 4, 2004, which split was effected by a stock dividend, and a 1-for-1.0825 reverse stock split of our outstanding Class A common stock and Class B common stock to be effected prior to the completion of the offering; and |

| • | the amendment and restatement of our certificate of incorporation prior to the completion of the offering. |

6

Summary Historical and Pro Forma Financial Data

The following table is a summary of our historical consolidated financial data as of and for the periods presented, as well as pro forma financial data giving effect to our acquisition of Insignia Financial Group, Inc., or Insignia, the related transactions and financings for such acquisition and the offering and expected use of proceeds that we receive from the offering for the periods presented. On July 20, 2001, we acquired CB Richard Ellis Services, Inc. Except as otherwise indicated below, the statement of operations data, statement of cash flow data, other data and balance sheet data for the dates and periods ended prior to July 20, 2001 are derived from the consolidated financial statements of CB Richard Ellis Services, our “predecessor company.” You should read this data along with the information included under the headings titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Unaudited Pro Forma Financial Information” and the financial statements and related notes included elsewhere in this prospectus. The pro forma statement of operations data do not purport to represent what our results of operations would have been if the Insignia acquisition, the related transactions and financings and the offering had occurred as of the date indicated or what our results will be for future periods.

| Pro Forma |

CB Richard Ellis Group |

Predecessor Company |

||||||||||||||||||||||||||||||||||

| Three Months Ended March 31, |

Year Ended December 31, |

Three Months Ended March 31, |

Year Ended December 31, |

Period from February 20 (inception) to December 31, |

Period from |

|||||||||||||||||||||||||||||||

| 2004 |

2003 |

2003 |

2004 |

2003 |

2003 (1) |

2002 |

2001 (2) |

2001 |

||||||||||||||||||||||||||||

| (Dollars in thousands, except share data) | ||||||||||||||||||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||||||||||||||||||

| Revenue |

$ | 440,992 | $ | 393,624 | $ | 1,948,827 | $ | 440,992 | $ | 263,724 | $ | 1,630,074 | $ | 1,170,277 | $ | 562,828 | $ | 607,934 | ||||||||||||||||||

| Operating (loss) income |

(9,272 | ) | (39,078 | ) | 17,871 | (9,272 | ) | 7,779 | 25,830 | 96,736 | 61,178 | (17,048 | ) | |||||||||||||||||||||||

| Interest expense, net |

14,296 | 14,292 | 55,774 | 18,372 | 13,249 | 81,175 | 57,229 | 27,290 | 18,736 | |||||||||||||||||||||||||||

| Net (loss) income |

(13,862 | ) | (28,259 | ) | (23,525 | ) | (16,568 | ) | (1,347 | ) | (34,704 | ) | 18,727 | 17,426 | (34,020 | ) | ||||||||||||||||||||

| EPS (3)(4): |

||||||||||||||||||||||||||||||||||||

| Basic |

(0.20 | ) | (0.40 | ) | (0.34 | ) | (0.26 | ) | (0.03 | ) | (0.68 | ) | 0.45 | 0.80 | (1.60 | ) | ||||||||||||||||||||

| Diluted |

(0.20 | ) | (0.40 | ) | (0.34 | ) | (0.26 | ) | (0.03 | ) | (0.68 | ) | 0.44 | 0.79 | (1.60 | ) | ||||||||||||||||||||

| Weighted average shares (4)(5): |

||||||||||||||||||||||||||||||||||||

| Basic |

70,008,085 | 69,922,543 | 69,964,474 | 62,522,176 | 41,651,415 | 50,918,572 | 41,640,576 | 21,741,351 | 21,306,584 | |||||||||||||||||||||||||||

| Diluted |

70,008,085 | 69,922,543 | 69,964,474 | 62,522,176 | 41,651,415 | 50,918,572 | 42,185,989 | 21,920,915 | 21,306,584 | |||||||||||||||||||||||||||

| Statement of Cash Flow Data: |

||||||||||||||||||||||||||||||||||||

| Net cash (used in) provided by operating activities |

$ | (87,367 | ) | $ | (70,761 | ) | $ | 63,941 | $ | 64,882 | $ | 91,334 | $ | (120,230 | ) | |||||||||||||||||||||

| Net cash used in investing activities |

(19,098 | ) | (2,494 | ) | (284,795 | ) | (24,130 | ) | (261,393 | ) | (12,139 | ) | ||||||||||||||||||||||||

| Net cash (used in) provided by financing activities |

(2,203 | ) | 11,756 | 303,664 | (17,838 | ) | 213,831 | 126,230 | ||||||||||||||||||||||||||||

| Other Data: |

||||||||||||||||||||||||||||||||||||

| EBITDA (6) |

$ | 10,085 | $ | 12,273 | $ | 135,621 | 10,085 | 17,013 | 132,817 | 130,676 | 74,930 | 11,482 | ||||||||||||||||||||||||

| Pro Forma |

CB Richard Ellis Group | ||||||||||||||

| As of March 31, |

As of March 31, |

As of December 31, | |||||||||||||

| 2004 |

2004 |

2003 |

2002 |

2001 | |||||||||||

| (In thousands) | |||||||||||||||

| Balance Sheet Data: |

|||||||||||||||

| Cash and cash equivalents |

$ | 39,254 | $ | 54,254 | $ | 163,881 | $ | 79,701 | $ | 57,450 | |||||

| Total assets |

1,910,784 | 1,919,735 | 2,213,481 | 1,324,876 | 1,354,512 | ||||||||||

| Long-term debt, including current portion |

676,106 | 801,744 | 802,705 | 509,715 | 517,423 | ||||||||||

| Total liabilities |

1,475,077 | 1,600,715 | 1,873,896 | 1,067,920 | 1,097,693 | ||||||||||

| Total stockholders’ equity |

428,847 | 312,160 | 332,929 | 251,341 | 252,523 | ||||||||||

(footnotes on following page)

7

(footnotes for previous page)

| (1) | The actual results for the year ended December 31, 2003 include the activities of Insignia from July 23, 2003, the date Insignia was acquired by our wholly owned subsidiary, CB Richard Ellis Services. |

| (2) | The results for the period from February 20 (inception) to December 31, 2001 include the activities of CB Richard Ellis Services from July 20, 2001, the date we acquired CB Richard Ellis Services. |

| (3) | EPS represents (loss) earnings per share. See (loss) earnings per share information in note 16 to our audited consolidated financial statements included elsewhere in this prospectus. |

| (4) | EPS and weighted average shares for our predecessor company do not reflect the 3-for-1 stock split of our outstanding Class A common stock and Class B common stock effected on May 4, 2004, or the 1-for-1.0825 reverse stock split of our outstanding Class A common stock and Class B common stock to be effected prior to the completion of the offering, because our predecessor was a different legal entity. |

| (5) | For the period from February 20 (inception) to December 31, 2001, the 21,741,351 and the 21,920,915 shares represent the weighted average shares outstanding for basic and diluted earnings per share, respectively. These balances take into consideration the lower number of shares outstanding prior to July 20, 2001, the date we acquired CB Richard Ellis Services. |

| (6) | EBITDA represents earnings before net interest expense, income taxes, depreciation and amortization. Our management believes EBITDA is useful to investors because it is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. In addition, our management believes that EBITDA is useful in evaluating our operating performance compared to that of other companies in our industry because the calculation of EBITDA generally eliminates the effects of financing and income taxes and the accounting effects of capital spending and acquisitions, which items may vary for different companies for reasons unrelated to overall operating performance. As a result, our management uses EBITDA as a measure to evaluate the performance of our various business lines and for other discretionary purposes, including as a significant component when measuring our performance under our employee incentive programs. |

| However, EBITDA is not a recognized measurement under U.S. generally accepted accounting principles, or GAAP, and when analyzing our operating performance, investors should use EBITDA in addition to, and not as an alternative for, operating income (loss) and net (loss) income, each as determined in accordance with GAAP. Because not all companies use identical calculations, our presentation of EBITDA may not be comparable to similarly titled measures of other companies. Furthermore, EBITDA is not intended to be a measure of free cash flow for our management’s discretionary use, as it does not consider certain cash requirements such as tax payments and debt service requirements. The amounts shown for EBITDA also differ from the amounts calculated under similarly titled definitions in our debt instruments, which are further adjusted to reflect certain other cash and non-cash charges and are used to determine compliance with financial covenants and our ability to engage in certain activities, such as incurring additional debt and making certain restricted payments. |

| EBITDA is calculated as follows: |

| Pro Forma |

CB Richard Ellis Group |

Predecessor Company |

||||||||||||||||||||||||||||||||

| Three Months Ended March 31, |

Year Ended December 31, |

Three Months Ended March 31, |

Year Ended December 31, |

Period From February 20 (inception) to December 31, |

Period From January 1 to July 20, |

|||||||||||||||||||||||||||||

| 2004 |

2003 |

2003 |

2004 |

2003 |

2003 |

2002 |

2001 |

2001 |

||||||||||||||||||||||||||

| (In thousands) | ||||||||||||||||||||||||||||||||||

| Net (loss) income |

$ | (13,862 | ) | $ | (28,259 | ) | $ | (23,525 | ) | $ | (16,568 | ) | $ | (1,347 | ) | $ | (34,704 | ) | $ | 18,727 | $ | 17,426 | $ | (34,020 | ) | |||||||||

| Add: |

||||||||||||||||||||||||||||||||||

| Depreciation and amortization |

16,831 | 48,288 | 103,385 | 16,831 | 6,171 | 92,622 | 24,614 | 12,198 | 25,656 | |||||||||||||||||||||||||

| Interest expense |

16,603 | 16,280 | 63,340 | 20,679 | 14,324 | 87,216 | 60,501 | 29,717 | 20,303 | |||||||||||||||||||||||||

| (Benefit) provision for income taxes |

(7,180 | ) | (22,048 | ) | (13 | ) | (8,550 | ) | (1,060 | ) | (6,276 | ) | 30,106 | 18,016 | 1,110 | |||||||||||||||||||

| Less: |

||||||||||||||||||||||||||||||||||

| Interest income |

2,307 | 1,988 | 7,566 | 2,307 | 1,075 | 6,041 | 3,272 | 2,427 | 1,567 | |||||||||||||||||||||||||

| EBITDA |

$ | 10,085 | $ | 12,273 | $ | 135,621 | $ | 10,085 | $ | 17,013 | $ | 132,817 | $ | 130,676 | $ | 74,930 | $ | 11,482 | ||||||||||||||||

8

Investing in our common stock involves risks. Before making an investment in our common stock, you should carefully consider the following risks, as well as the other information contained in this prospectus, including our consolidated financial statements and the related notes and the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The risks described below are those that we believe are the material risks we face. Any of the risk factors described below could significantly and adversely affect our business, prospects, financial condition and results of operations. As a result, the trading price of our common stock could decline and you may lose all or part of your investment.

Risks Relating to Our Business

The success of our business is significantly related to general economic conditions and, accordingly, our business could be harmed in the event of an economic slowdown or recession.

Periods of economic slowdown or recession, rising interest rates, a declining demand for real estate or the public perception that any of these events may occur, can harm many of our business lines. These economic conditions could result in a general decline in rents, which in turn would reduce revenue from property management fees and brokerage commissions derived from property sales and leases. In addition, these conditions could lead to a decline in sales prices as well as a decline in demand for funds invested in commercial real estate and related assets. An economic downturn or a significant increase in interest rates also may reduce the amount of loan originations and related servicing by our commercial mortgage banking business. If our brokerage and mortgage banking businesses are negatively impacted, it is likely that our other lines of business would also suffer due to the relationship among our various business lines. Further, as a result of our debt level and the terms of our existing debt instruments, our exposure to adverse general economic conditions is heightened.

As an example of this risk, during 2002 and 2001, we were adversely affected by the slowdown in the U.S. economy, which negatively impacted the commercial real estate market. This caused a decline in our leasing activities within the United States. Moreover, in part because of the terrorist attacks on September 11, 2001 and the subsequent conflict with Iraq, the economic climate in the United States became very uncertain, which had an adverse effect on commercial real estate market conditions and, in turn, our operating results for 2002 and 2001.

If the properties that we manage fail to perform, then our financial condition and results of operations could be harmed.

The revenue we generate from our asset services and facilities management lines of business is generally a percentage of aggregate rent collections from properties, although many management agreements provide for a specified minimum management fee. Accordingly, our success partially depends upon the performance of the properties we manage. The performance of these properties will depend upon the following factors, among others, many of which are partially or completely outside of our control:

| • | our ability to attract and retain creditworthy tenants; |

| • | the magnitude of defaults by tenants under their respective leases; |

| • | our ability to control operating expenses; |

| • | governmental regulations, local rent control or stabilization ordinances which are in, or may be put into, effect; |

| • | various uninsurable risks; |

| • | financial conditions prevailing generally and in the areas in which these properties are located; |

| • | the nature and extent of competitive properties; and |

| • | the real estate market generally. |

9

We have numerous significant competitors, some of which may have greater financial resources than we do.

We compete across a variety of business disciplines within the commercial real estate industry, including investment management, tenant representation, corporate services, construction and development management, property management, agency leasing, valuation and mortgage banking. In general, with respect to each of our business disciplines, we cannot give assurance that we will be able to continue to compete effectively or maintain our current fee arrangements or margin levels or that we will not encounter increased competition. Each of the business disciplines in which we compete is highly competitive on an international, national, regional and local level. Although we are the largest commercial real estate services firm in the world in terms of 2003 revenue, our relative competitive position varies significantly across product and service categories and geographic areas. Depending on the product or service, we face competition from other real estate service providers, institutional lenders, insurance companies, investment banking firms, investment managers and accounting firms, some of which may have greater financial resources than we do. Many of our competitors are local or regional firms. Although substantially smaller than us, some of these competitors are larger on a local or regional basis. We are also subject to competition from other large national and multi-national firms that have similar service competencies to ours.

Our international operations subject us to social, political and economic risks of doing business in foreign countries.

We conduct a significant portion of our business and employ a substantial number of people outside of the United States. During 2003, we generated approximately 30.2% of our revenue from operations outside the United States. Circumstances and developments related to international operations that could negatively affect our business, financial condition or results of operations include, but are not limited to, the following factors:

| • | difficulties and costs of staffing and managing international operations; |

| • | currency restrictions, which may prevent the transfer of capital and profits to the United States; |

| • | unexpected changes in regulatory requirements; |

| • | potentially adverse tax consequences; |

| • | the responsibility of complying with multiple and potentially conflicting laws; |

| • | the impact of regional or country-specific business cycles and economic instability; |

| • | the geographic, time zone, language and cultural differences among personnel in different areas of the world; |

| • | greater difficulty in collecting accounts receivable in some geographic regions such as Asia, where many countries have underdeveloped insolvency laws and clients are often slow to pay, and in some European countries, where clients also tend to delay payments; |

| • | political instability; and |

| • | foreign ownership restrictions with respect to operations in countries such as China. |

We have committed additional resources to expand our worldwide sales and marketing activities, to globalize our service offerings and products in selected markets and to develop local sales and support channels. If we are unable to successfully implement these plans, to maintain adequate long-term strategies that successfully manage the risks associated with our global business or to adequately manage operational fluctuations, our business, financial condition or results of operations could be harmed.

In addition, our international operations and, specifically, the ability of our non-U.S. subsidiaries to dividend or otherwise transfer cash among our subsidiaries, including transfers of cash to pay interest and principal on our debt, may be affected by limitations on imports, currency exchange control regulations, transfer pricing regulations and potentially adverse tax consequences, among other things.

10

Our revenue and earnings may be adversely affected by foreign currency fluctuations.

Our revenue from non-U.S. operations is denominated primarily in the local currency where the associated revenue was earned. During 2003, approximately 30.2% of our business was transacted in currencies of foreign countries, the majority of which included the Euro, the British Pound Sterling, the Hong Kong dollar, the Singapore dollar and the Australian dollar. Thus, we may experience fluctuations in revenues and earnings because of corresponding fluctuations in foreign currency exchange rates. For example, during 2003, the U.S. dollar dropped in value against many of the currencies in which we conduct business.

We have made significant acquisitions of non-U.S. companies, and, although we currently have no specific acquisition plans, we may acquire additional foreign companies in the future. As we increase our foreign operations, fluctuations in the value of the U.S. dollar relative to the other currencies in which we may generate earnings could adversely affect our business, financial condition and operating results. Due to the constantly changing currency exposures to which we will be subject and the volatility of currency exchange rates, we cannot predict the effect of exchange rate fluctuations upon future operating results. In addition, fluctuations in currencies relative to the U.S. dollar may make it more difficult to perform period-to-period comparisons of our reported results of operations.

From time to time, our management uses currency hedging instruments, including foreign currency forward and option contracts and borrows in foreign currencies. Economic risks associated with these hedging instruments include unexpected fluctuations in inflation rates, which impact cash flow relative to paying down debt, and unexpected changes in the underlying net asset position. These hedging activities also may not be effective.

Our growth has depended significantly upon acquisitions, which may not be available in the future.

A significant component of our growth has occurred through acquisitions, including our acquisition of Insignia on July 23, 2003. Although we currently have no specific acquisition plans, any future growth through acquisitions will be partially dependent upon the continued availability of suitable acquisition candidates at favorable prices and upon advantageous terms and conditions. However, future acquisitions may not be available at advantageous prices or upon favorable terms and conditions. In addition, acquisitions involve risks that the businesses acquired will not perform in accordance with expectations and that business judgments concerning the value, strengths and weaknesses of businesses acquired will prove incorrect. Future acquisitions and any necessary related financings also may involve significant transaction-related expenses. For example, through March 31, 2004, we have incurred approximately $175.0 million of transaction-related expenses in connection with our acquisition of Insignia in 2003.

Although we currently have no specific acquisition plans, if we acquire companies in the future, we may experience integration costs and the acquired business may not perform as we expect.

We have had, and may continue to experience, difficulties in integrating operations and accounting systems acquired from other companies. These difficulties include the diversion of management’s attention from other business concerns and the potential loss of our key employees or those of the acquired operations. We believe that most acquisitions will initially have an adverse impact on operating and net income. For example, in 2003 we incurred costs associated with integrating Insignia’s business into our existing business lines. Acquisitions also frequently involve significant costs related to integrating information technology, accounting and management services and rationalizing personnel levels. In connection with the Insignia acquisition, we recorded significant charges during 2003 and the first quarter of 2004 relating to integration costs.

In addition, we have several different accounting systems as a result of acquisitions we have made, including the accounting systems of Insignia. If we are unable to fully integrate the accounting and other systems of the businesses we own, we may not be able to effectively manage our acquired businesses. Moreover, the integration process itself may be disruptive to our business as it requires coordination of geographically diverse organizations and implementation of new accounting and information technology systems.

11

A significant portion of our operations are concentrated in California and New York, and our business could be harmed if the economic downturn continues in the California or New York real estate markets.

During 2003, approximately 23.8% of our revenue was generated from transactions originating in California and approximately 6.9% was generated from transactions originating in the greater New York metropolitan area. In addition, due to our acquisition of Insignia on July 23, 2003, we expect that the percentage of our revenue generated in the New York metropolitan area in future years will increase. As a result of the geographic concentrations in California and New York, any future economic downturn in the California or New York commercial real estate markets and in the local economies in San Diego, Los Angeles, Orange County or the greater New York metropolitan area could further harm our results of operations.

Our results of operations vary significantly among quarters during each calendar year, which makes comparisons of our quarterly results difficult.

A significant portion of our revenue is seasonal. Historically, this seasonality has caused our revenue, operating income, net income and cash flow from operating activities to be lower in the first two quarters and higher in the third and fourth quarters of each year. The concentration of earnings and cash flow in the fourth quarter is due to an industry-wide focus on completing transactions toward the fiscal year-end. This has historically resulted in lower profits or a loss in the first and second quarters, with profits growing (or losses decreasing) in each subsequent quarter. This variance among quarters during each calendar year makes comparison between such quarters difficult, but does not generally affect the comparison of the same quarters during different calendar years.

Our substantial leverage and debt service obligations could harm our ability to operate our business, remain in compliance with debt covenants and make payments on our debt.

We are highly leveraged and have significant debt service obligations. For 2003, on a pro forma basis, our interest expense was $63.3 million. Our substantial level of indebtedness increases the possibility that we may be unable to generate cash sufficient to pay when due the principal of, interest on or other amounts due in respect of our indebtedness. In addition, we may incur additional debt from time to time to finance strategic acquisitions, investments, joint ventures or for other purposes, subject to the restrictions contained in the documents governing our indebtedness. If we incur additional debt, the risks associated with our substantial leverage, including our ability to service our debt, would increase.

Our substantial debt could have other important consequences, which include, but are not limited to, the following:

| • | we could be required to use a substantial portion, if not all, of our cash flow from operations to pay principal and interest on our debt; |

| • | our level of debt may restrict us from raising additional financing on satisfactory terms to fund working capital, strategic acquisitions, investments, joint ventures and other general corporate requirements; |

| • | our interest expense could increase if interest rates increase because the loans under our amended and restated credit agreement governing our senior secured credit facilities bear interest at floating rates; |

| • | our substantial leverage could increase our vulnerability to general economic downturns and adverse competitive and industry conditions, placing us at a disadvantage compared to those of our competitors that are less leveraged; |

| • | our debt service obligations could limit our flexibility in planning for, or reacting to, changes in our business and in the commercial real estate services industry; |

| • | our failure to comply with the financial and other restrictive covenants in the documents governing our indebtedness, which, among others, require us to maintain specified financial ratios and limit our ability |

12

| to incur additional debt and sell assets, could result in an event of default that, if not cured or waived, could harm our business or prospects and could result in our filing for bankruptcy; and |

| • | from time to time, Moody’s Investors Service and Standard and Poor’s Ratings Service rate our outstanding senior secured term loan, our 9¾% senior notes and our 11¼% senior subordinated notes. These ratings may impact our ability to borrow under any new agreements in the future, as well as the interest rates and other terms of any such future borrowings and could also cause a decline in the market price of our common stock or changes in the interest rate for the term loan under our new amended and restated credit agreement. |

We cannot be certain that our earnings will be sufficient to allow us to pay principal and interest on our debt and meet our other obligations. If we do not have sufficient earnings, we may be required to refinance all or part of our existing debt, sell assets, borrow more money or sell more securities, none of which we can guarantee we will be able to do.

We will be able to incur more indebtedness, which may intensify the risks associated with our substantial leverage, including our ability to service our indebtedness.

Our new amended and restated credit agreement, as will be effective following this offering, governing our senior secured credit facilities and the indentures relating to our 9¾% senior notes due 2010 and our 11¼% senior subordinated notes due 2011 permit us, subject to specified conditions, to incur a significant amount of additional indebtedness, including up to $150.0 million of additional indebtedness under our revolving credit facility. Our new amended and restated credit agreement also will permit us to increase the term facility by up to $25.0 million, subject to the satisfaction of customary conditions. If we incur additional debt, the risks associated with our substantial leverage, including our ability to service our debt, would increase.

Our debt instruments impose significant operating and financial restrictions on us, and in the event of a default, all of our borrowings would become immediately due and payable.

The indentures governing our 9¾% senior notes due 2010 and our 11¼% senior subordinated notes due 2011 impose, and the terms of any future debt may impose, operating and other restrictions on us and many of our subsidiaries. These restrictions will affect, and in many respects will limit or prohibit, our ability and our restricted subsidiaries’ abilities to:

| • | incur or guarantee additional indebtedness; |

| • | pay dividends or make distributions on capital stock or redeem or repurchase capital stock; |

| • | repurchase equity interests; |

| • | make investments; |

| • | create restrictions on the payment of dividends or other amounts to us; |

| • | sell stock of subsidiaries; |

| • | transfer or sell assets; |

| • | create liens; |

| • | enter into transactions with affiliates; |

| • | enter into sale/leaseback transactions; and |

| • | enter into mergers or consolidations. |

In addition, the amended and restated credit agreement governing our senior secured credit facilities includes other and more restrictive covenants and prohibits us from prepaying most of our other debt while debt

13

under our senior secured credit facilities is outstanding. The amended and restated credit agreement governing our senior secured credit facilities also requires us to maintain compliance with specified financial ratios. Our ability to comply with these ratios may be affected by events beyond our control.

The restrictions contained in our debt instruments could:

| • | limit our ability to plan for or react to market conditions or meet capital needs or otherwise restrict our activities or business plans; and |

| • | adversely affect our ability to finance ongoing operations, strategic acquisitions, investments or other capital needs or to engage in other business activities that would be in our interest. |

A breach of any of these restrictive covenants or the inability to comply with the required financial ratios could result in a default under our debt instruments. If any such default occurs, the lenders under the senior secured credit facilities and the holders of our 9¾% senior notes due 2010 and our 11¼% senior subordinated notes due 2011, pursuant to the respective indentures, may elect to declare all outstanding borrowings, together with accrued interest and other fees, to be immediately due and payable. The lenders under our senior secured credit facilities also have the right in these circumstances to terminate any commitments they have to provide further borrowings. If we are unable to repay outstanding borrowings when due, the lenders under the senior secured credit facilities will have the right to proceed against the collateral granted to them to secure the debt, which collateral is described in the immediately following risk factor. If the debt under the senior secured credit facilities, our 9¾% senior notes due 2010 and our 11¼% senior subordinated notes due 2011 were to be accelerated, we cannot give assurance that these assets would be sufficient to repay our debt.

If we fail to meet our payment or other obligations under the senior secured credit facilities, the lenders under the senior secured credit facilities could foreclose on, and acquire control of, substantially all of our assets.

In connection with the incurrence of indebtedness under our senior secured credit facilities and the completion of our acquisition of Insignia, the lenders under our senior secured credit facilities received a pledge of all of our equity interests in our significant domestic subsidiaries, including CB Richard Ellis Services, Inc., CB Richard Ellis Investors, L.L.C., L.J. Melody & Company, Insignia and Insignia/ESG, Inc., which was subsequently renamed CB Richard Ellis Real Estate Services, Inc., and 65% of the voting stock of our foreign subsidiaries that is held directly by us or our domestic subsidiaries. Additionally, these lenders generally have a lien on substantially all of our accounts receivable, cash, general intangibles, investment property and future acquired material property. As a result of these pledges and liens, if we fail to meet our payment or other obligations under the senior secured credit facilities, the lenders under the senior secured credit facilities will be entitled to foreclose on substantially all of our assets and liquidate these assets.

Our co-investment activities subject us to real estate investment risks which could cause fluctuations in earnings and cash flow.

An important part of the strategy for our investment management business involves investing our capital in certain real estate investments with our clients. As of December 31, 2003, we had committed $26.6 million to fund future co-investments. We expect that approximately $23 million of these commitments will be funded during 2004. In addition to required future capital contributions, some of the co-investment entities may request additional capital from us and our subsidiaries holding investments in those assets and the failure to provide these contributions could have adverse consequences to our interests in these investments. These adverse consequences could include damage to our reputation with our co-investment partners and clients, as well as the necessity of obtaining alternative funding from other sources that may be on disadvantageous terms for us and the other co-investors. Providing co-investment financing is also a very important part of CBRE Investor’s investment management business, which would suffer if we were unable to make these investments. Although our debt instruments contain restrictions that will limit our ability to provide capital to the entities holding direct or indirect interests in co-investments, we may provide this capital in many instances.

14

Participation in real estate transactions through co-investment activity could increase fluctuations in earnings and cash flow. Other risks associated with these activities include, but are not limited to, the following:

| • | losses from investments; |

| • | difficulties associated with international co-investments described in “—Our international operations subject us to social, political and economic risks of doing business in foreign countries” and “—Our revenue and earnings may be adversely affected by foreign currency fluctuations;” and |

| • | potential lack of control over the disposition of any co-investments and the timing of the recognition of gains, losses or potential incentive participation fees. |

Our joint venture activities involve unique risks that are often outside of our control which, if realized, could harm our business.

We have utilized joint ventures for commercial investments and local brokerage and other partnerships both in the United States and internationally, and although we currently have no specific plans to do so, we may acquire minority interests in other joint ventures in the future. In many of these joint ventures, we may not have the right or power to direct the management and policies of the joint ventures and other participants may take action contrary to our instructions or requests and against our policies and objectives. In addition, the other participants may become bankrupt or have economic or other business interests or goals that are inconsistent with ours. If a joint venture participant acts contrary to our interest, it could harm our business, results of operations and financial condition.

Our success depends upon the retention of our senior management, as well as our ability to attract and retain qualified and experienced employees.

Our continued success is highly dependent upon the efforts of our executive officers and other key employees, including Ray Wirta, our Chief Executive Officer; Brett White, our President; Kenneth J. Kay, our Chief Financial Officer; Alan C. Froggatt, our President, EMEA; and Robert Blain, our President, Asia Pacific. In addition, Messrs. Wirta and White currently are not parties to employment agreements with us. If any of our key employees leave and we are unable to quickly hire and integrate a qualified replacement, our business, financial condition and results of operations may suffer. In addition, the growth of our business is largely dependent upon our ability to attract and retain qualified personnel in all areas of our business, including brokerage and property management personnel. If we are unable to attract and retain these qualified personnel, our growth may be limited and our business and operating results could suffer.

If we fail to comply with laws and regulations applicable to real estate brokerage and mortgage transactions and other business lines, we may incur significant financial penalties.

Due to the broad geographic scope of our operations and the numerous forms of real estate services performed, we are subject to numerous federal, state and local laws and regulations specific to the services performed. For example, the brokerage of real estate sales and leasing transactions requires us to maintain brokerage licenses in each state in which we operate. If we fail to maintain our licenses or conduct brokerage activities without a license, we may be required to pay fines or return commissions received or have licenses suspended. In addition, because the size and scope of real estate sales transactions have increased significantly during the past several years, both the difficulty of ensuring compliance with the numerous state licensing regimes and the possible loss resulting from non-compliance have increased. Furthermore, the laws and regulations applicable to our business, both in the United States and in foreign countries, also may change in ways that materially increase the costs of compliance.

15

We may have liabilities in connection with real estate brokerage and property management activities.

As a licensed real estate broker, we and our licensed employees are subject to statutory due diligence, disclosure and standard-of-care obligations. Failure to fulfill these obligations could subject us or our employees to litigation from parties who purchased, sold or leased properties that we or they brokered or managed. We could become subject to claims by participants in real estate sales claiming that we did not fulfill our statutory obligations as a broker.

In addition, in our property management business, we hire and supervise third-party contractors to provide construction and engineering services for our managed properties. While our role is limited to that of a supervisor, we may be subjected to claims for construction defects or other similar actions. Adverse outcomes of property management litigation could negatively impact our business, financial condition or results of operations.

We agreed to retain contingent liabilities in connection with Insignia’s sale of substantially all of its real estate investment assets in 2003.

Immediately prior to the completion of our acquisition of Insignia on July 23, 2003, Insignia completed the sale of substantially all of its real estate investment assets to Island Fund. Under the terms of the purchase agreement, we agreed to retain some contingent liabilities related to these real estate investment assets, including approximately $10.2 million of letters of credit support and a guarantee of an approximately $1.3 million repayment obligation. Island Fund is obligated to reimburse us for only 50% of any future draws against these letters of credit or the repayment guarantee, and there can be no assurance that Island Fund will be able to satisfy any future requests for reimbursement.

Also in connection with the sale to Island Fund, we agreed to indemnify Island Fund against any losses resulting from the ownership, use or operation of the real estate investment assets prior to the closing of the sale. Although this indemnification obligation to Island Fund is subject to a number of exceptions and limitations, future claims against us pursuant to this indemnification obligation may be material.

In addition, a number of the real estate investment assets that we agreed to sell to Island Fund required the consent of one or more third parties in order to transfer such assets to Island Fund, and some of these third party consents were not obtained prior to the closing and have not been obtained since then. As a result, we continue to hold these real estate investment assets pending the receipt of these third party consents. While we continue to hold these assets, we generally have agreed to provide Island Fund with the economic benefits from these assets, and Island Fund generally has agreed to indemnify us with respect to any losses incurred in connection with our continuing to hold these assets. There can be no assurance, however, that Island Fund actually will be able to provide such indemnification if required to do so at any future date.

Risks Relating to the Offering and Ownership of Our Common Stock

The price of our common stock may fluctuate significantly, and you could lose all or part of your investment.

The market price of our common stock could fluctuate significantly, in which case you may not be able to resell your shares at or above the initial public offering price. Fluctuations may occur in response to the risk factors listed in this prospectus and for many other reasons, including:

| • | our financial performance or the performance of our competitors and similar companies; |

| • | changes in estimates of our performance or recommendations by securities analysts; |

| • | failure to meet financial projections for each fiscal quarter; |

| • | technological innovations or other trends in our industry; |

16

| • | the introduction of new services by us or our competitors; |

| • | the arrival or departure of key personnel; |

| • | acquisitions, strategic alliances or joint ventures involving us or our competitors; and |

| • | market conditions in our industry, the financial markets and the economy as a whole. |

In addition, the stock market, in general, has historically experienced significant price and volume fluctuations. These fluctuations are often unrelated to the operating performance of particular companies. These broad market fluctuations may cause declines in the market price of our common stock. When the market price of a company’s common stock drops significantly, stockholders often institute securities class action lawsuits against the company. A lawsuit against us could cause us to incur substantial costs and could divert the time and attention of our management and other resources from our business.

There is no existing market for our common stock and we do not know if one will develop to provide you with adequate liquidity.

There has not been a public market for our common stock. We cannot predict the extent to which investor interest in our company will lead to the development of an active trading market on the New York Stock Exchange or otherwise or how liquid that market might become. If an active trading market does not develop, you may have difficulty selling any of our common stock that you buy. The initial public offering price for the shares will be determined by negotiations among us, the selling stockholders and the representative of the underwriters and may not be indicative of prices that will prevail in the open market following this offering. Consequently, you may not be able to sell shares of our common stock at prices equal to or greater than the price paid by you in this offering.

Future sales of common stock by our existing stockholders could cause our stock price to decline.

Our current stockholders will hold a substantial majority of our outstanding common stock after the offering. After the offering, shares owned by our current stockholders, holders of options and warrants to acquire our common stock and participants in our deferred compensation plan who have stock fund units, assuming the exercise of all options and warrants and the distribution of shares underlying all stock fund units, are expected to constitute approximately 69.3% of our total outstanding common stock. Sales of the shares in the public market, as well as shares we may issue upon the exercise of outstanding options and in connection with future distributions pursuant to stock fund units under our deferred compensation plan, could cause the market price of our common stock to decline significantly. The perception among investors that these sales may occur could produce the same effect.

Of the outstanding shares after completion of the offering, all of the 24,000,000 shares sold in the offering and 1,110,354 of our other currently outstanding shares will be freely tradable immediately without further registration under the Securities Act, except that any shares held by our “affiliates,” as that term is defined under Rule 144 of the Securities Act, may be sold only in compliance with the limitations under Rule 144. The remaining outstanding shares after completion of the offering will be “restricted securities” and generally will be available for sale in the public market as follows:

| • | 87,498 shares will be eligible for immediate sale on the date of the prospectus because such shares may be sold pursuant to Rule 144(k); |

| • | 182,069 shares will be eligible for sale at various times beginning 90 days after the date of this prospectus pursuant to Rules 144, 144(k) and 701; and |

| • | 42,688,538 shares, which are subject to lock-up agreements with the underwriters, will be eligible for sale at various times beginning 180 days after the date of this prospectus pursuant to Rules 144, 144(k) and 701. However, the underwriters may release all or a portion of these shares subject to lock-up agreements at any time without notice. |

17

In addition, as of April 30, 2004, 10,016,974 shares of common stock were issuable upon the exercise of outstanding stock options or in connection with distributions pursuant to our deferred compensation plan. We intend to file a registration statement on Form S-8 under the Securities Act of 1933 shortly after the date of this prospectus to register such shares.

After the offering, stockholders beneficially owning approximately 42.8 million shares of our common stock, including shares that will be issuable upon the automatic exercise of outstanding warrants in connection with the completion of the offering, will have rights, subject to conditions, to require us to file registration statements covering their shares or to include their shares in registration statements that we may file. By exercising these registration rights and selling a large number of shares, these holders could cause the price of our common stock to decline. Furthermore, if we were to include their shares in a registration statement, those sales could impair our ability to raise needed capital by depressing the price at which we could sell our common stock.

See the information under the heading titled “Shares Eligible for Future Sale” for a more detailed description of the shares that will be available for future sales upon completion of the offering.

For so long as affiliates of Blum Capital Partners, L.P. continue to own a significant percentage of our common stock they will have significant influence over our affairs and policies, and their interests may be different from yours.

After the completion of the offering, affiliates of Blum Capital Partners will beneficially own approximately 42.3% of our outstanding common stock. In addition, pursuant to a securityholders’ agreement, these affiliates of Blum Capital Partners, following the offering and subject to the applicable listing rules of the New York Stock Exchange, are entitled to nominate a percentage of our total number of directors that is equivalent to the percentage of the outstanding common stock beneficially owned by these affiliates, with this percentage of our directors being rounded up to the nearest whole number of directors. Also pursuant to this agreement, some of our other stockholders will be obligated to vote their shares in favor of the directors nominated by these affiliates of Blum Capital Partners. These other stockholders, collectively, will beneficially own approximately 13.8% of our outstanding common stock after completion of the offering. There are no restrictions in the securityholders’ agreement on the ability of these affiliates of Blum Capital Partners to sell their shares to any third party or to assign their rights under the securityholders’ agreement in connection with a sale of a majority of their shares to a third party.

For so long as these affiliates of Blum Capital Partners continue to beneficially own a significant portion of our outstanding common stock, they will continue to have significant influence over matters submitted to our stockholders for approval and to exercise significant control over our business policies and affairs, including the following:

| • | the composition of our board of directors and, as a result, any determinations of our board with respect to our business direction and policy, including the appointment and removal of our officers; |

| • | determinations with respect to mergers and other business combinations, including those that may result in a change of control; |

| • | sales and dispositions of our assets; and |

| • | the amount of debt financing that we incur. |

The significant ownership position of the affiliates of Blum Capital Partners could have the effect of delaying, deterring or preventing a change of control or other business combination that might otherwise be beneficial to our other stockholders. In addition, we cannot assure you that the interests of the affiliates of Blum Capital Partners will not conflict with yours. For additional information regarding the share ownership of, and our relationships with, these affiliates of Blum Capital Partners, you should read the information under the headings titled “Principal and Selling Stockholders” and “Related Party Transactions.”

18

Delaware law and provisions of our restated certificate of incorporation and restated by-laws contain provisions that could delay, deter or prevent a change of control.

The anti-takeover provisions of Delaware law impose various impediments to the ability of a third party to acquire control of us, even if a change of control would be beneficial to our existing stockholders. We are currently subject to these Delaware anti-takeover provisions. Additionally, our restated certificate of incorporation and our restated by-laws contain provisions that might enable our management to resist a proposed takeover of our company. These provisions could discourage, delay or prevent a change of control of our company or an acquisition of our company at a price that our stockholders may find attractive. These provisions also may discourage proxy contests and make it more difficult for our stockholders to elect directors and take other corporate actions. The existence of these provisions could limit the price that investors might be willing to pay in the future for shares of our common stock. The provisions include:

| • | advance notice requirements for stockholder proposals and nominations; and |

| • | the authority of our board to issue, without stockholder approval, preferred stock with such terms as our board may determine. |

For additional information regarding these provisions, you should read the information under the headings titled “Description of Capital Stock—Anti-Takeover Effects of Certain Provisions of our Restated Certificate of Incorporation and Restated By-Laws” and “—Delaware Anti-Takeover Statute.”

You will suffer immediate and substantial dilution because the net tangible book value of shares purchased in the offering will be substantially lower than the initial public offering price.