Exhibit 99.2

E

E

|

CB Richard Ellis Group, Inc. Second Quarter 2006 Earnings Conference Call July 27, 2006 |

Exhibit 99.2

E

E

|

CB Richard Ellis Group, Inc. Second Quarter 2006 Earnings Conference Call July 27, 2006 |

|

Forward Looking Statements This presentation contains statements that are forward looking within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding our growth momentum in 2006, future operations, the impact of acquisitions and future financial performance. These statements should be considered as estimates only and actual results may ultimately differ from these estimates. Except to the extent required by applicable securities laws, we undertake no obligation to update or publicly revise any of the forward-looking statements that you may hear today. Please refer to our current annual report on Form 10-K (in particular, Risk Factors) and our current quarterly report on Form 10-Q, which are filed with the SEC and available at the SEC’s website (http://www.sec.gov), for a full discussion of the risks and other factors that may impact any estimates that you may hear today. We may make certain statements during the course of this presentation which include references to “non-GAAP financial measures,” as defined by SEC regulations. As required by these regulations, we have provided reconciliations of these measures to what we believe are the most directly comparable GAAP measures, which are attached hereto within the appendix. |

|

Conference Call Participants Brett White President & Chief Executive Officer Ken Kay Senior Executive Vice President & Chief Financial Officer Calvin Frese President, The Americas Shelley Young Director, Investor Relations |

|

Q2 2006 Summary Strong performance across virtually all business lines and geographies Leasing markets continue to improve with higher occupancy and increased rental rates Strong gains in Asset Services and Corporate Services businesses, fueled by global outsourcing trend U.S. investment sales market continued to ease back to a more orderly and sustainable growth rate Repurchased $164.7 million of high yield debt with free cash flow and refinanced revolving credit facility with increased capacity to $600 million and more favorable terms |

|

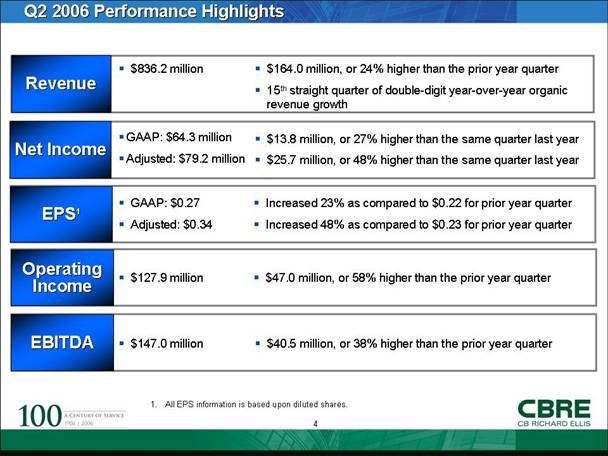

Q2 2006 Performance Highlights Revenue $836.2 million $164.0 million, or 24% higher than the prior year quarter 15th straight quarter of double-digit year-over-year organic revenue growth Net Income $13.8 million, or 27% higher than the same quarter last year $25.7 million, or 48% higher than the same quarter last year GAAP: $64.3 million Adjusted: $79.2 million EPS1 Increased 23% as compared to $0.22 for prior year quarter Increased 48% as compared to $0.23 for prior year quarter GAAP: $0.27 Adjusted: $0.34 Operating Income$127.9 million $47.0 million, or 58% higher than the prior year quarter EBITDA$40.5 million, or 38% higher than the prior year quarter $147.0 million 1. All EPS information is based upon diluted shares. |

|

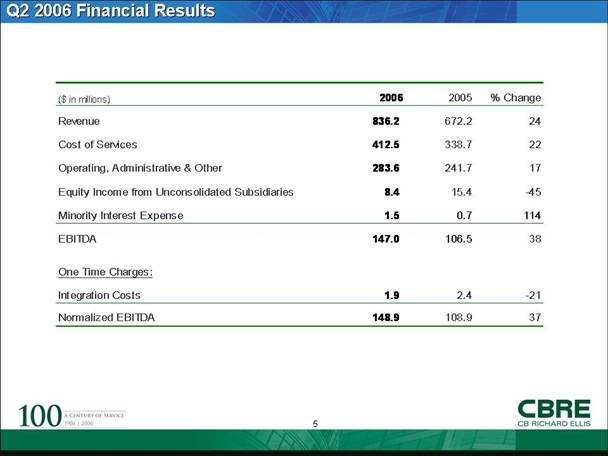

Q2 2006 Financial Results ($ in millions)20062005% ChangeRevenue836.2672.224Cost of Services412.5338.722Operating, Administrative & Other283.6241.717Equity Income from Unconsolidated Subsidiaries8.415.4-45Minority Interest Expense1.50.7114EBITDA147.0106.538One Time Charges:Integration Costs1.92.4-21Normalized EBITDA148.9108.937 |

|

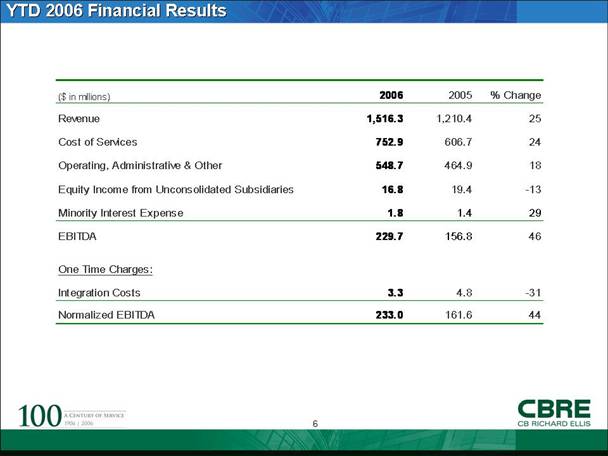

YTD 2006 Financial Results ($ in millions)20062005% ChangeRevenue1,516.31,210.425Cost of Services752.9606.724Operating, Administrative & Other548.7464.918Equity Income from Unconsolidated Subsidiaries16.819.4-13Minority Interest Expense1.81.429EBITDA229.7156.846One Time Charges:Integration Costs3.34.8-31Normalized EBITDA233.0161.644 |

|

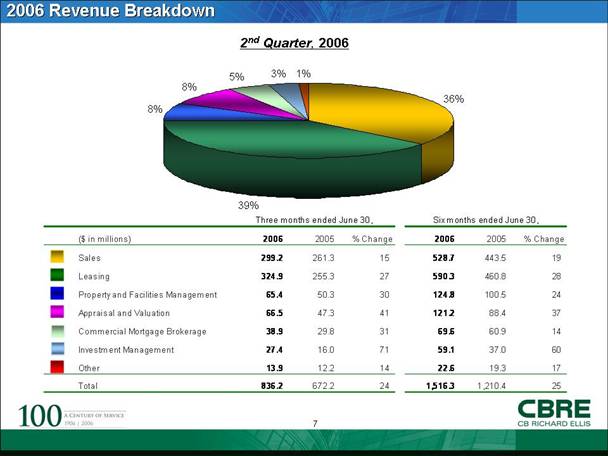

2006 Revenue Breakdown 2nd Quarter, 2006 ($ in millions)20062005% Change20062005% ChangeSales299.2261.315528.7443.519Leasing324.9255.327590.3460.828Property and Facilities Management65.450.330124.8100.524Appraisal and Valuation66.547.341121.288.437Commercial Mortgage Brokerage38.929.83169.660.914Investment Management27.416.07159.137.060Other13.912.21422.619.317Total836.2672.2241,516.31,210.425Three months ended June 30,Six months ended June 30,36%39%8%8%5%3%1% |

|

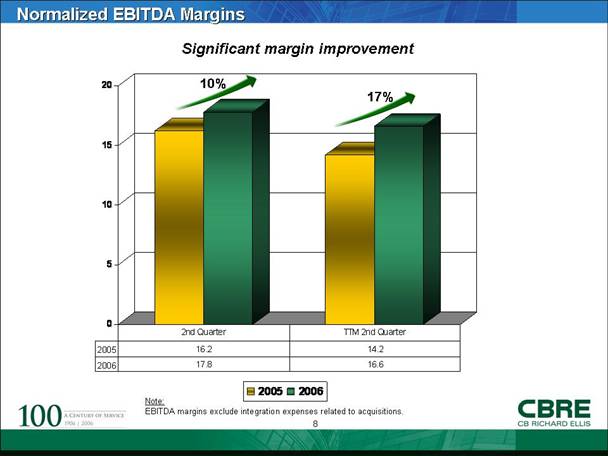

Normalized EBITDA Margins Significant margin improvement Note: EBITDA margins exclude integration expenses related to acquisitions. 10% 17% 0510152020052006200516.214.2200617.816.62nd QuarterTTM 2nd Quarter |

|

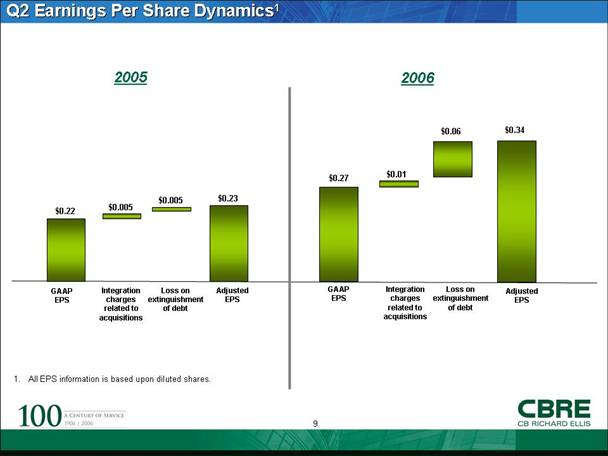

Q2 Earnings Per Share Dynamics1 1. All EPS information is based upon diluted shares. GAAP EPS Integration charges related to acquisitions Adjusted EPS $0.27 $0.01 $0.34 2005 2006GAAP EPS Integration charges related to acquisitions Adjusted EPS Loss on extinguishment of debt $0.22 $0.005 $0.005 $0.23 $0.06 Loss on extinguishment of debt |

|

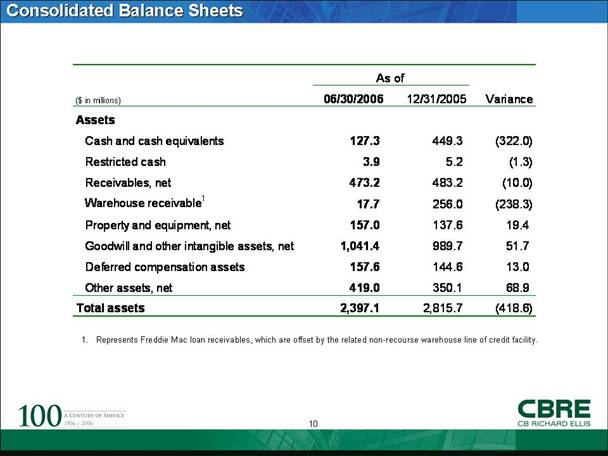

Consolidated Balance Sheets 1. Represents Freddie Mac loan receivables, which are offset by the related non-recourse warehouse line of credit facility. ($ in millions)06/30/200612/31/2005VarianceAssetsCash and cash equivalents127.3449.3(322.0)Restricted cash3.95.2(1.3)Receivables, net473.2483.2(10.0)Warehouse receivable117.7256.0(238.3)Property and equipment, net157.0137.619.4Goodwill and other intangible assets, net1,041.4989.751.7Deferred compensation assets157.6144.613.0Other assets, net419.0350.168.9Total assets2,397.12,815.7(418.6)As of |

|

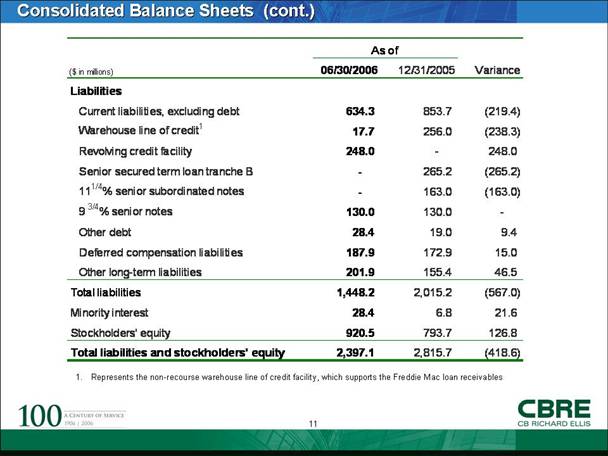

Consolidated Balance Sheets (cont.) Represents the non-recourse warehouse line of credit facility, which supports the Freddie Mac loan receivables ($ in millions)06/30/200612/31/2005VarianceLiabilitiesCurrent liabilities, excluding debt634.3853.7(219.4)Warehouse line of credit117.7256.0(238.3)Revolving credit facility248.0-248.0Senior secured term loan tranche B-265.2(265.2)111/4% senior subordinated notes-163.0(163.0)9 3/4% senior notes130.0130.0-Other debt28.419.09.4Deferred compensation liabilities187.9172.915.0Other long-term liabilities201.9155.446.5Total liabilities1,448.22,015.2(567.0)Minority interest28.46.821.6Stockholders' equity920.5793.7126.8Total liabilities and stockholders' equity2,397.12,815.7(418.6)As of |

|

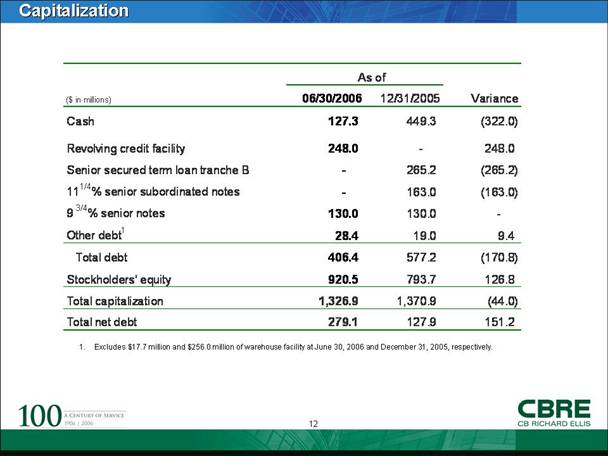

Capitalization Excludes $17.7 million and $256.0 million of warehouse facility at June 30, 2006 and December 31, 2005, respectively. ($ in millions)06/30/200612/31/2005VarianceCash127.3449.3(322.0)Revolving credit facility248.0-248.0Senior secured term loan tranche B-265.2(265.2)111/4% senior subordinated notes-163.0(163.0)9 3/4% senior notes130.0130.0-Other debt128.419.09.4Total debt406.4577.2(170.8)Stockholders' equity920.5793.7126.8Total capitalization1,326.91,370.9(44.0)Total net debt279.1127.9151.2As of |

|

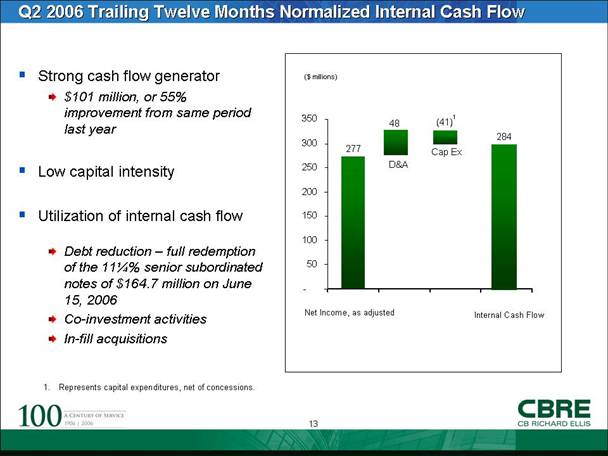

Strong cash flow generator $101 million, or 55% improvement from same period last year Low capital intensity Utilization of internal cash flow Debt reduction – full redemption of the 11¼% senior subordinated notes of $164.7 million on June 15, 2006 Co-investment activities In-fill acquisitions Q2 2006 Trailing Twelve Months Normalized Internal Cash Flow ($ millions) 48 277 Net Income, as adjustedD&A Cap Ex (41) 284 Represents capital expenditures, net of concessions. Internal Cash Flow 1 -50100150200250300350 |

|

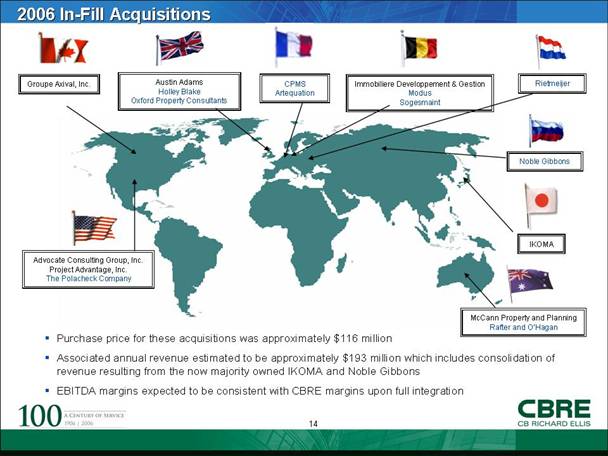

CPMS Artequation Austin Adams Holley Blake Oxford Property Consultants McCann Property and Planning Rafter and O’Hagan Advocate Consulting Group, Inc. Project Advantage, Inc. The Polacheck Company Rietmeijer Purchase price for these acquisitions was approximately $116 million Associated annual revenue estimated to be approximately $193 million which includes consolidation of revenue resulting from the now majority owned IKOMA and Noble Gibbons EBITDA margins expected to be consistent with CBRE margins upon full integration Groupe Axival, Inc. Immobiliere Developpement & Gestion Modus Sogesmaint Noble Gibbons IKOMA 2006 In-Fill Acquisitions |

|

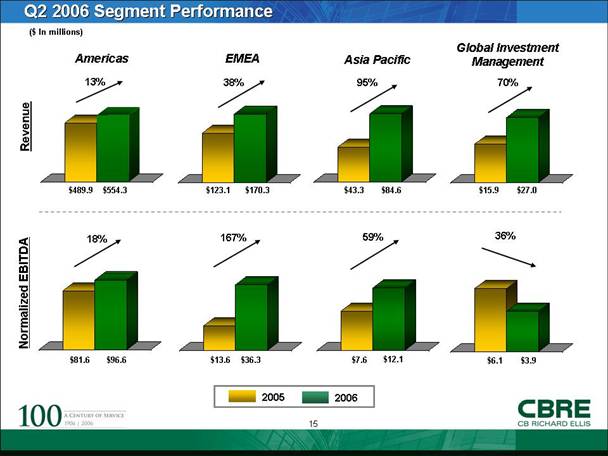

Q2 2006 Segment Performance $554.3 ($ In millions) Revenue Normalized EBITDA Americas EMEA Asia Pacific Global Investment Management $489.9 $170.3 $123.1 $84.6 $43.3 $27.0 $15.9 $96.6 $81.6 $36.3 $13.6 $12.1 $7.6 $3.9 $6.1 13% 38% 95% 70% 18% 167% 36% 2006 2005 59% |

|

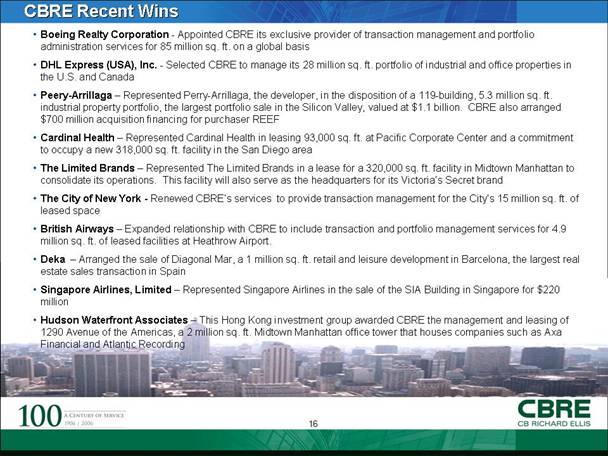

Boeing Realty Corporation - Appointed CBRE its exclusive provider of transaction management and portfolio administration services for 85 million sq. ft. on a global basis DHL Express (USA), Inc. - Selected CBRE to manage its 28 million sq. ft. portfolio of industrial and office properties in the U.S. and Canada Peery-Arrillaga – Represented Perry-Arrillaga, the developer, in the disposition of a 119-building, 5.3 million sq. ft. industrial property portfolio, the largest portfolio sale in the Silicon Valley, valued at $1.1 billion. CBRE also arranged $700 million acquisition financing for purchaser REEF Cardinal Health – Represented Cardinal Health in leasing 93,000 sq. ft. at Pacific Corporate Center and a commitment to occupy a new 318,000 sq. ft. facility in the San Diego area The Limited Brands – Represented The Limited Brands in a lease for a 320,000 sq. ft. facility in Midtown Manhattan to consolidate its operations. This facility will also serve as the headquarters for its Victoria’s Secret brand The City of New York - Renewed CBRE’s services to provide transaction management for the City’s 15 million sq. ft. of leased space British Airways – Expanded relationship with CBRE to include transaction and portfolio management services for 4.9 million sq. ft. of leased facilities at Heathrow Airport. Deka – Arranged the sale of Diagonal Mar, a 1 million sq. ft. retail and leisure development in Barcelona, the largest real estate sales transaction in Spain Singapore Airlines, Limited – Represented Singapore Airlines in the sale of the SIA Building in Singapore for $220 million Hudson Waterfront Associates – This Hong Kong investment group awarded CBRE the management and leasing of 1290 Avenue of the Americas, a 2 million sq. ft. Midtown Manhattan office tower that houses companies such as Axa Financial and Atlantic Recording CBRE Recent Wins |

|

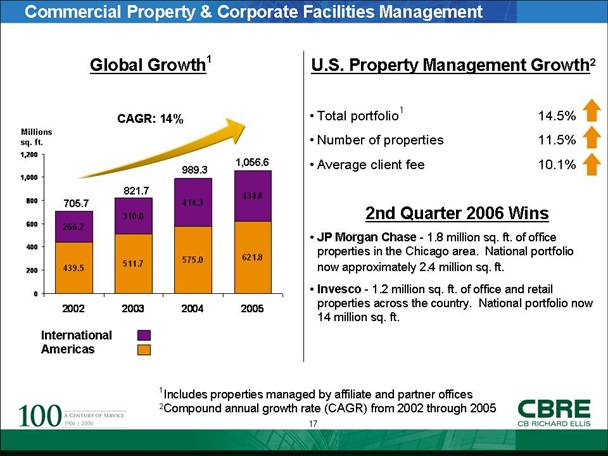

Commercial Property & Corporate Facilities Management U.S. Property Management GrowthTotal portfolio1 14.5% Number of properties 11.5% Average client fee 10.1% 2nd Quarter 2006 Wins JP Morgan Chase - 1.8 million sq. ft. of office properties in the Chicago area. National portfolio now approximately 2.4 million sq. ft.Invesco - 1.2 million sq. ft. of office and retail properties across the country. National portfolio now 14 million sq. ft. Global Growth1 CAGR: 14% 1Includes properties managed by affiliate and partner offices 2Compound Annual Growth Rate (CAGR) from 2002 through 2005 International Americas 705.7 821.7 989.3 1,056.6 Millions sq. ft. 439.5575.0310.0414.3434.8621.8511.7266.202004006008001,0001,2002002200320042005 |

|

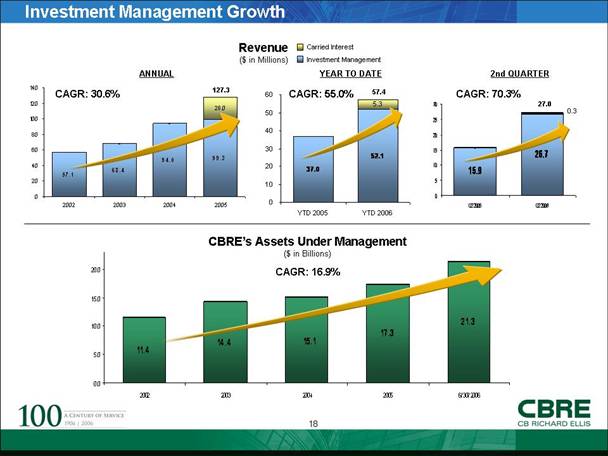

CAGR: 16.9%CBRE’s Assets Under Management ($ in Billions) Revenue ($ in Millions) CAGR: 30.6%CAGR: 70.3%CAGR: 55.0%ANNUAL YEAR TO DATE 2nd QUARTER 127.3 57.4 27.0 0.3 Carried Interest Investment Management Investment Management Growth ---57.1 68.4 94.0 99.328.0 0204060801001201402002200320042005-15.9 26.7 051015202530Q2 2005Q2 2006-52.1 37.0 5.3 0102030405060YTD 2005YTD 200617.3 15.1 11.4 14.4 21.3 0.05.010.015.020.020022003200420056/30/2006 |

|

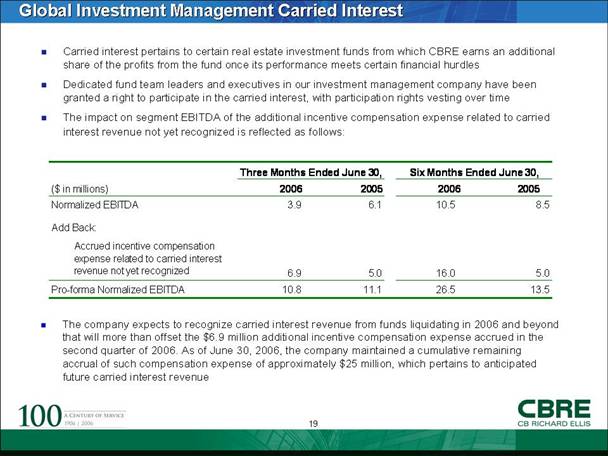

Global Investment Management Carried Interest Carried interest pertains to certain real estate investment funds from which CBRE earns an additional share of the profits from the fund once its performance meets certain financial hurdles Dedicated fund team leaders and executives in our investment management company have been granted a right to participate in the carried interest, with participation rights vesting over time The impact on segment EBITDA of the additional incentive compensation expense related to carried interest revenue not yet recognized is reflected as follows:The company expects to recognize carried interest revenue from funds liquidating in 2006 and beyond that will more than offset the $6.9 million additional incentive compensation expense accrued in the second quarter of 2006. As of June 30, 2006, the company maintained a cumulative remaining accrual of such compensation expense of approximately $25 million, which pertains to anticipated future carried interest revenue Three Months Ended June 30,Six Months Ended June 30,($ in millions)2006200520062005Normalized EBITDA3.96.110.58.5Add Back:Accrued incentive compensation expense related to carried interest revenue not yet recognized6.95.016.05.0Pro-forma Normalized EBITDA 10.811.126.513.5 |

|

Summary Diversity and breadth of global services platform provides company with strong and stable growth trajectory Improvement underpinned by recovery of leasing markets worldwide New milestones achieved by outsourcing businesses Growth in Investment Management business at a record pace Market share gains continue for investment property sales |

|

Appendix |

|

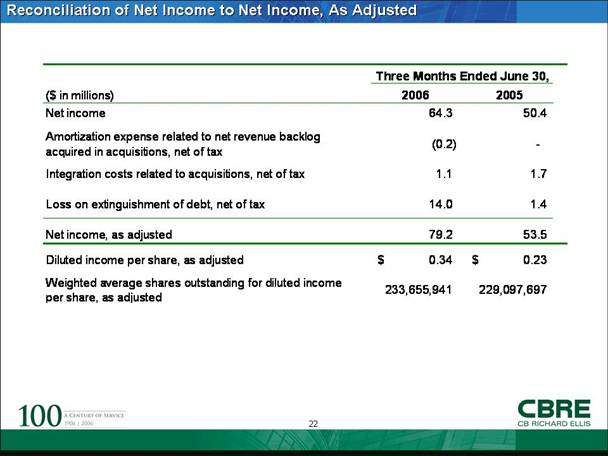

Reconciliation of Net Income to Net Income, As Adjusted ($ in millions)20062005Net income64.350.4Amortization expense related to net revenue backlog acquired in acquisitions, net of tax(0.2)-Integration costs related to acquisitions, net of tax1.11.7Loss on extinguishment of debt, net of tax14.01.4Net income, as adjusted79.253.5Diluted income per share, as adjusted0.34$ 0.23$ Weighted average shares outstanding for diluted income per share, as adjusted233,655,941229,097,697Three Months Ended June 30, |

|

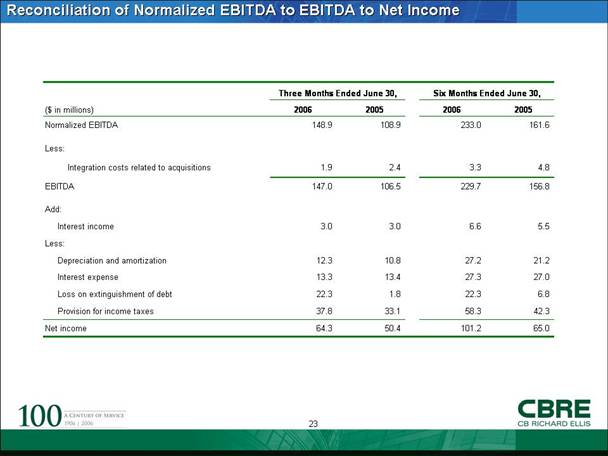

Reconciliation of Normalized EBITDA to EBITDA to Net Income Six Months Ended June 30,($ in millions)2006200520062005Normalized EBITDA148.9108.9233.0161.6Less:Integration costs related to acquisitions1.92.43.34.8EBITDA147.0106.5229.7156.8Add: Interest income3.03.06.65.5Less:Depreciation and amortization12.310.827.221.2Interest expense13.313.427.327.0Loss on extinguishment of debt22.31.822.36.8Provision for income taxes37.833.158.342.3Net income 64.350.4101.265.0Three Months Ended June 30, |

|

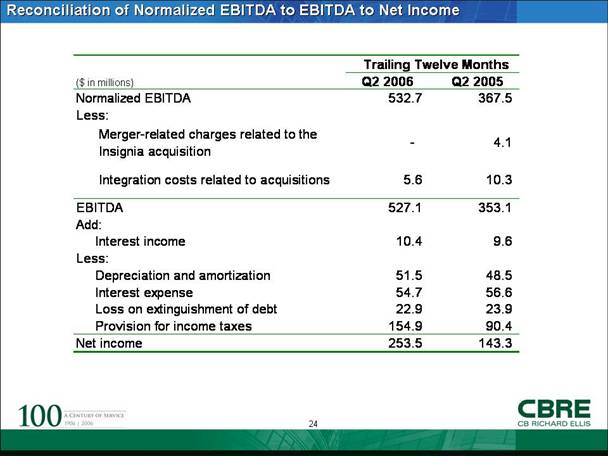

Reconciliation of Normalized EBITDA to EBITDA to Net IncomeTrailing Twelve Months ($ in millions) Q2 2006 Q2 2005 Normalized EBITDA532.7367.5Less:Merger-related charges related to the Insignia acquisition-4.1Integration costs related to acquisitions5.610.3EBITDA527.1353.1Add: Interest income10.49.6Less:Depreciation and amortization51.548.5Interest expense54.756.6Loss on extinguishment of debt22.923.9Provision for income taxes154.990.4Net income253.5143.3 |

|

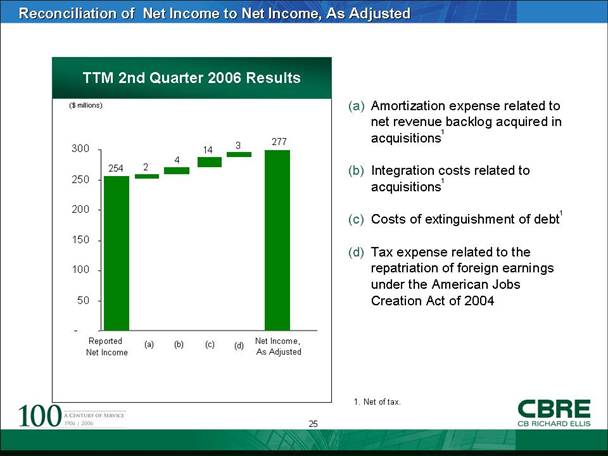

Amortization expense related to net revenue backlog acquired in acquisitions1 Integration costs related to acquisitions1 Costs of extinguishment of debt1 Tax expense related to the repatriation of foreign earnings under the American Jobs Creation Act of 2004 Reconciliation of Net Income to Net Income, As AdjustedNet Income, As Adjusted TTM 2nd Quarter 2006 Results ($ millions) 254 277 2 4 Reported Net Income (a) (b) (c) 1. Net of tax. 14 3 (d) -50100150200250300 |

|

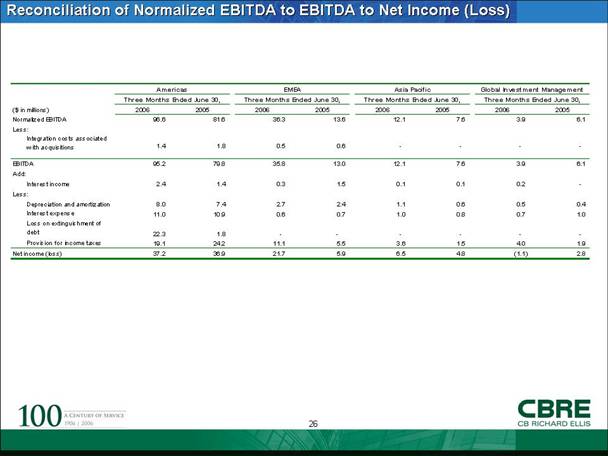

Reconciliation of Normalized EBITDA to EBITDA to Net Income (Loss) AmericasEMEAAsia PacificGlobal Investment ManagementThree Months Ended June 30,Three Months Ended June 30,Three Months Ended June 30,Three Months Ended June 30,($ in millions)20062005200620052006200520062005Normalized EBITDA96.681.636.313.612.17.63.96.1Less:Integration costs associated with acquisitions1.41.80.50.6----EBITDA95.279.835.813.012.17.63.96.1Add:Interest income2.41.40.31.50.10.10.2-Less:Depreciation and amortization8.07.42.72.41.10.60.50.4Interest expense11.010.90.60.71.00.80.71.0Loss on extinguishment of debt22.31.8------Provision for income taxes19.124.211.15.53.61.54.01.9Net income (loss)37.236.921.75.96.54.8(1.1)2.8 |

|

[LOGO] |