Exhibit 99.3

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

|

Business Review Day |

|

|

CB Richard Ellis Investors |

|

|

|

|

|

Robert Zerbst |

|

|

President |

|

|

March 23, 2005 |

|

[GRAPHIC]

[LOGO]

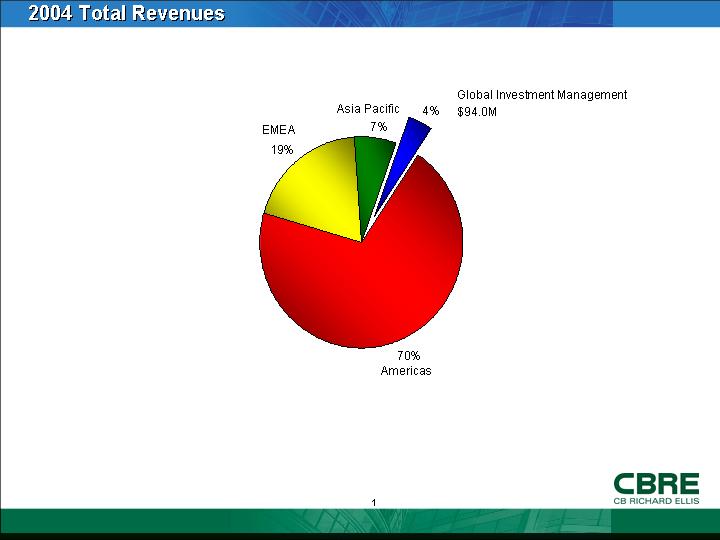

2004 Total Revenues

[CHART]

1

Overview

[GRAPHIC]

• Independently operated investment management affiliate of CB Richard Ellis Group, Inc.

• Founded in 1972

• Registered Investment Advisor

• Positioned at the center of the world’s leading real estate services company with 13,500 employees and 215 offices in 50 countries

• Investment programs spanning three continents and a range of risk/return alternatives

2

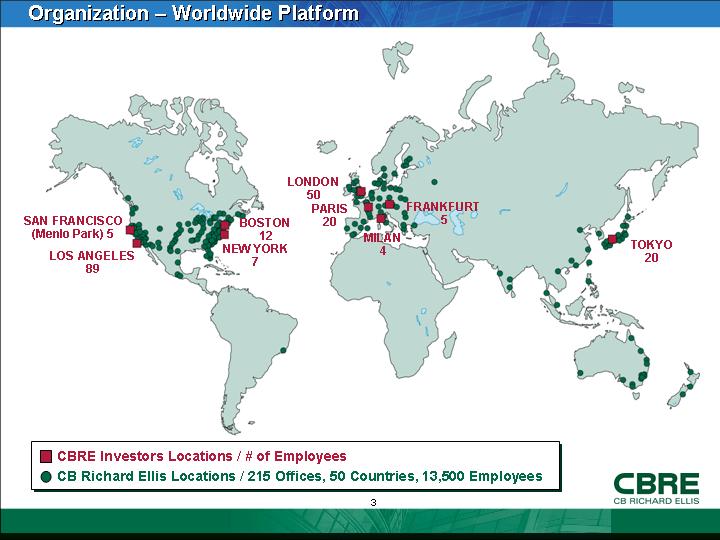

Organization – Worldwide Platform

[GRAPHIC]

3

Mission

[GRAPHIC]

“Our business is to capitalize on real estate investment opportunities for our partners and clients – across the risk/return spectrum and around the globe.”

4

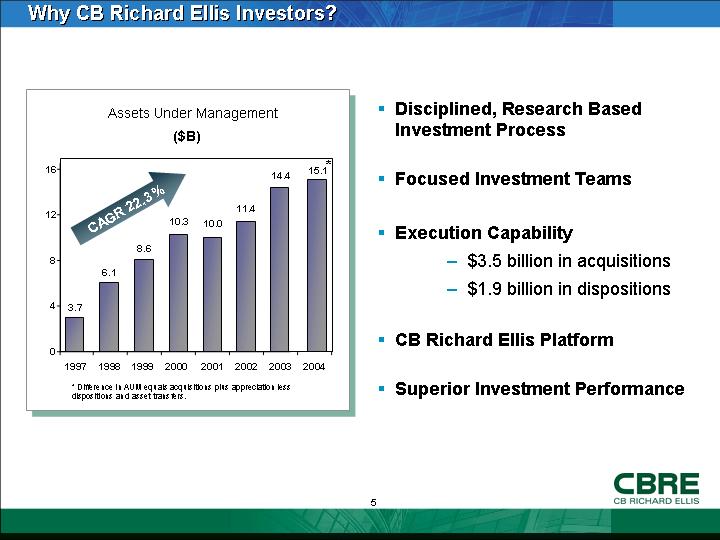

Why CB Richard Ellis Investors?

Assets Under Management

($B)

[CHART]

* Difference in AUM equals acquisitions plus appreciation less dispositions and asset transfers.

• Disciplined, Research Based Investment Process

• Focused Investment Teams

• Execution Capability

• $3.5 billion in acquisitions

• $1.9 billion in dispositions

• CB Richard Ellis Platform

• Superior Investment Performance

5

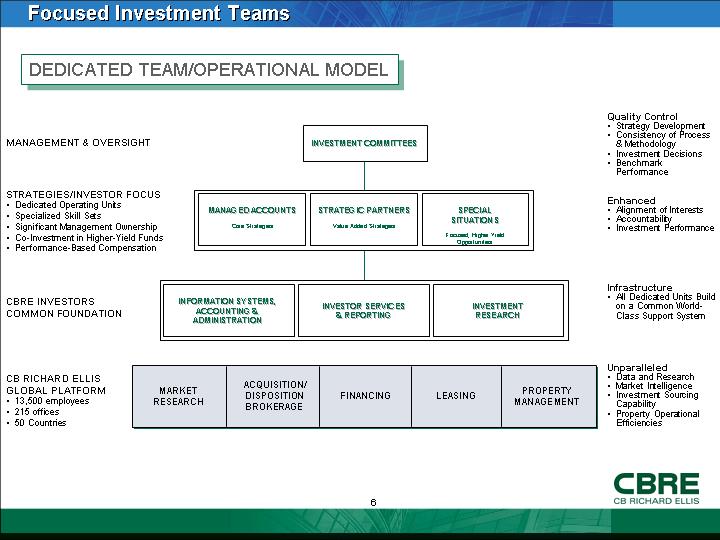

Focused Investment Teams

DEDICATED TEAM/OPERATIONAL MODEL

|

|

|

INVESTMENT COMMITTEES |

|

|

||||||||

|

|

|

|

|

|

||||||||

|

|

MANAGED ACCOUNTS |

STRATEGIC PARTNERS |

SPECIAL |

|

||||||||

|

|

|

|

|

|

||||||||

|

|

Core Strategies |

Value Added Strategies |

Focused, Higher Yield Opportunities |

|

||||||||

|

|

|

|

|

|

||||||||

|

|

INFORMATION SYSTEMS, |

INVESTOR SERVICES |

INVESTMENT |

|

||||||||

|

|

|

|

|

|

||||||||

|

MARKET |

ACQUISITION/ |

FINANCING |

LEASING |

PROPERTY |

||||||||

MANAGEMENT & OVERSIGHT

STRATEGIES/INVESTOR FOCUS

• Dedicated Operating Units

• Specialized Skill Sets

• Significant Management Ownership

• Co-Investment in Higher-Yield Funds

• Performance-Based Compensation

CBRE INVESTORS COMMON FOUNDATION

CB RICHARD ELLIS GLOBAL PLATFORM

• 13,500 employees

• 215 offices

• 50 Countries

Quality Control

• Strategy Development

• Consistency of Process & Methodology

• Investment Decisions

• Benchmark Performance

Enhanced

• Alignment of Interests

• Accountability

• Investment Performance

Infrastructure

• All Dedicated Units Build on a Common World-Class Support System

Unparalleled

• Data and Research

• Market Intelligence

• Investment Sourcing Capability

• Property Operational Efficiencies

6

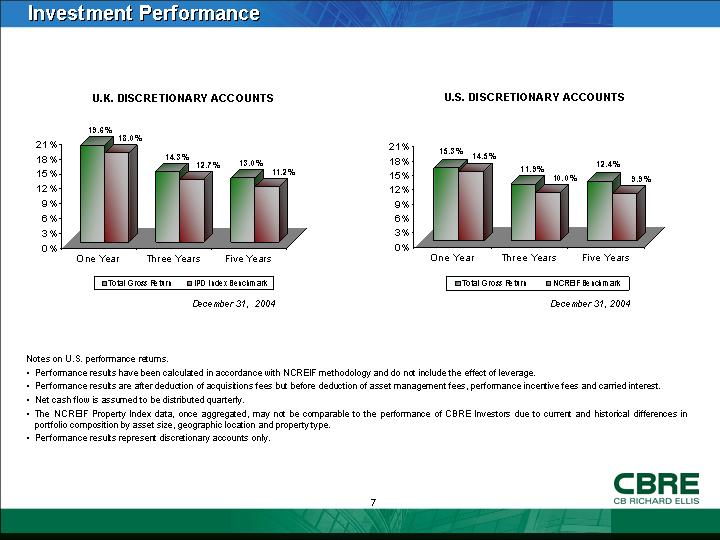

Investment Performance

U.K. DISCRETIONARY ACCOUNTS

[CHART]

U.S. DISCRETIONARY ACCOUNTS

[CHART]

Notes on U.S. performance returns.

• Performance results have been calculated in accordance with NCREIF methodology and do not include the effect of leverage.

• Performance results are after deduction of acquisitions fees but before deduction of asset management fees, performance incentive fees and carried interest.

• Net cash flow is assumed to be distributed quarterly.

• The NCREIF Property Index data, once aggregated, may not be comparable to the performance of CBRE Investors due to current and historical differences in portfolio composition by asset size, geographic location and property type.

• Performance results represent discretionary accounts only.

7

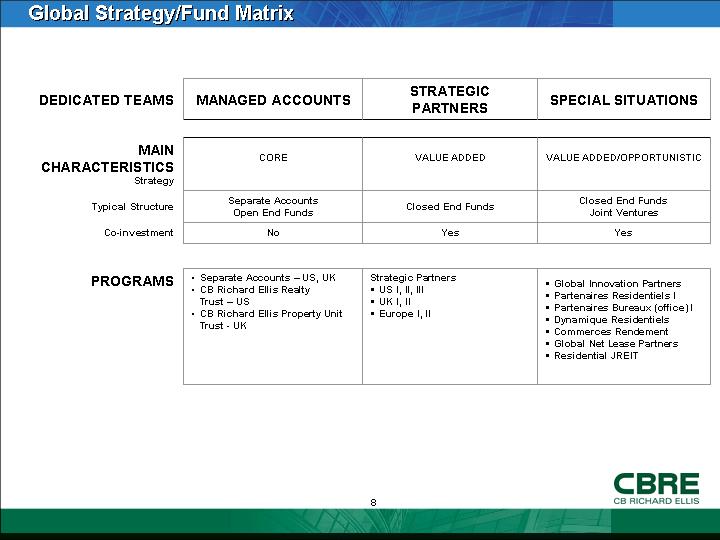

Global Strategy/Fund Matrix

|

DEDICATED TEAMS |

|

MANAGED ACCOUNTS |

|

STRATEGIC PARTNERS |

|

SPECIAL SITUATIONS |

|

|

|

|

|

|

|

|

|

|

|

MAIN |

|

CORE |

|

VALUE ADDED |

|

VALUE ADDED/OPPORTUNISTIC |

|

|

|

|

|

|

|

|

|

|

|

Typical Structure |

|

Separate Accounts |

|

Closed End Funds |

|

Closed End Funds |

|

|

|

|

|

|

|

|

|

|

|

Co-investment |

|

No |

|

Yes |

|

Yes |

|

|

|

|

|

|

|

|

|

|

|

PROGRAMS |

|

• Separate Accounts – US, UK • CB Richard Ellis Realty Trust – US • CB Richard Ellis Property Unit Trust - UK |

|

Strategic Partners • US I, II, III • UK I, II • Europe I, II |

|

• Global Innovation Partners • Partenaires Residentiels I • Partenaires Bureaux (office) I • Dynamique Residentiels • Commerces Rendement • Global Net Lease Partners • Residential JREIT |

|

8

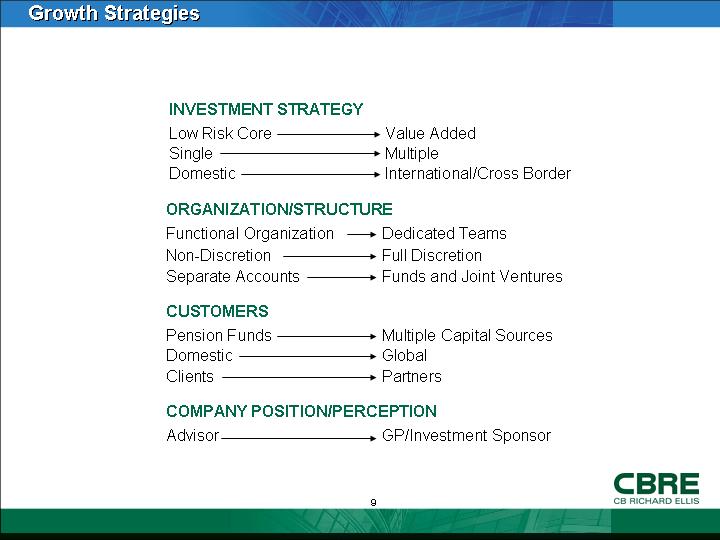

Growth Strategies

|

INVESTMENT STRATEGY |

|

|

|

|

|

|

|

Low Risk Core |

|

Value Added |

|

Single |

|

Multiple |

|

Domestic |

|

International/Cross Border |

|

|

|

|

|

ORGANIZATION/STRUCTURE |

|

|

|

|

|

|

|

Functional Organization |

|

Dedicated Teams |

|

Non-Discretion |

|

Full Discretion |

|

Separate Accounts |

|

Funds and Joint Ventures |

|

|

|

|

|

CUSTOMERS |

|

|

|

|

|

|

|

Pension Funds |

|

Multiple Capital Sources |

|

Domestic |

|

Global |

|

Clients |

|

Partners |

|

|

|

|

|

COMPANY POSITION/PERCEPTION |

|

|

|

|

|

|

|

Advisor |

|

GP/Investment Sponsor |

9

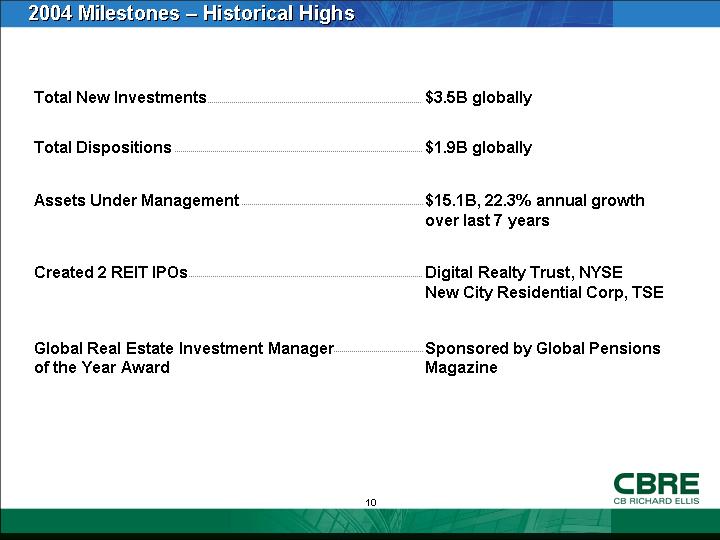

2004 Milestones – Historical Highs

|

Total New Investments |

|

$3.5B globally |

|

|

|

|

|

Total Dispositions |

|

$1.9B globally |

|

|

|

|

|

Assets Under Management |

|

$15.1B, 22.3% annual growth over last 7 years |

|

|

|

|

|

Created 2 REIT IPOs |

|

Digital Realty Trust, NYSE New City Residential Corp, TSE |

|

|

|

|

|

Global Real Estate Investment Manager of the Year Award |

|

Sponsored by Global Pensions Magazine |

10

[LOGO]

11