|

Fourth Quarter 2004

|

|

|

Financial Results

|

|

|

|

[GRAPHIC]

|

|

Investor Conference Call

|

|

|

February 3, 2005

|

|

[LOGO]

Forward Looking Statements

This presentation contains statements that are

forward looking within the meaning of the Private Securities Litigation Reform Act of 1995. These statements should be considered as estimates only and actual

results may ultimately differ from these estimates. Except to the extent

required by applicable securities laws, CB Richard Ellis undertakes no obligation to update or

publicly revise any of the forward-looking statements that you may hear today. Please refer to our annual report

on Form 10-K and our quarterly

reports on Form 10-Q, which are filed with the SEC and available at the SEC’s website (http://www.sec.gov),

for a full discussion of the risks and other factors, that may impact any estimates that you may hear today. This is a public call and our responses to questions must be

limited to information that is acceptable for dissemination within the public domain. In addition, we may make certain statements during the course of this

presentation which include references to “non-GAAP financial measures,” as defined by SEC regulations. As required by these regulations, we have provided reconciliations

of these measures to what we believe are the most directly comparable GAAP measures, which are available in

the fourth quarter earnings

press release.

1

Conference Call Participants

Ray Wirta – Chief Executive Officer

Brett White – President

Ken Kay – Senior Executive Vice

President and Chief Financial Officer

Shelley Young – Director of

Investor Relations

2

Highlights

• Fourth

quarter and year-to-date 2004 revenue growth of 29% and 45%, respectively

• Strong

investment properties sales and improved leasing fundamentals in 2004

• Net

income, as adjusted for one-time items, of $117.9 million in 2004 versus $36.8

million in 2003, an increase of 220%

• Diluted

earnings per share of $1.65 in 2004

• Improved

earnings guidance for 2005

3

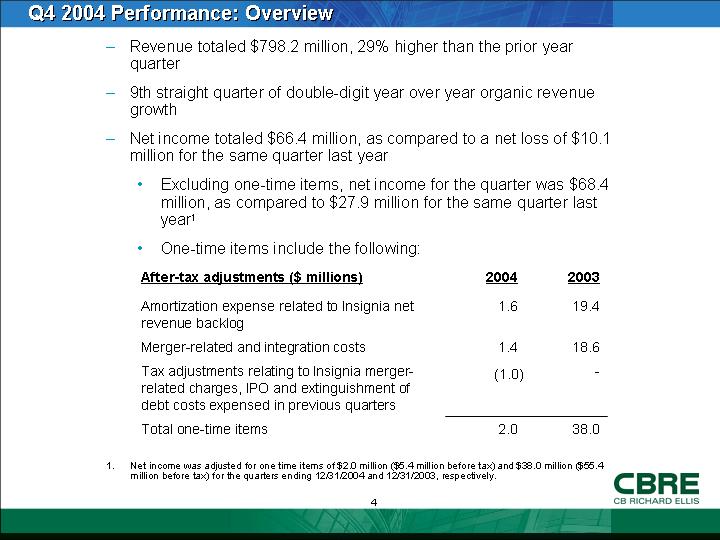

Q4 2004 Performance: Overview

• Revenue

totaled $798.2 million, 29% higher than the prior year quarter

• 9th

straight quarter of double-digit year over year organic revenue growth

• Net

income totaled $66.4 million, as compared to a net loss of $10.1 million for

the same quarter last year

• Excluding

one-time items, net income for the quarter was $68.4 million, as compared to

$27.9 million for the same quarter last year(1)

• One-time

items include the following:

|

After-tax adjustments ($ millions)

|

|

2004

|

|

2003

|

|

|

|

|

|

|

|

|

|

Amortization

expense related to Insignia net revenue backlog

|

|

1.6

|

|

19.4

|

|

|

|

|

|

|

|

|

|

Merger-related

and integration costs

|

|

1.4

|

|

18.6

|

|

|

|

|

|

|

|

|

|

Tax

adjustments relating to Insignia merger-related charges, IPO and

extinguishment of debt costs expensed in previous quarters

|

|

(1.0

|

)

|

—

|

|

|

|

|

|

|

|

|

|

Total

one-time items

|

|

2.0

|

|

38.0

|

|

(1) Net income was adjusted for one time items of $2.0 million ($5.4

million before tax) and $38.0 million ($55.4 million before tax) for the

quarters ending 12/31/2004 and 12/31/2003, respectively.

4

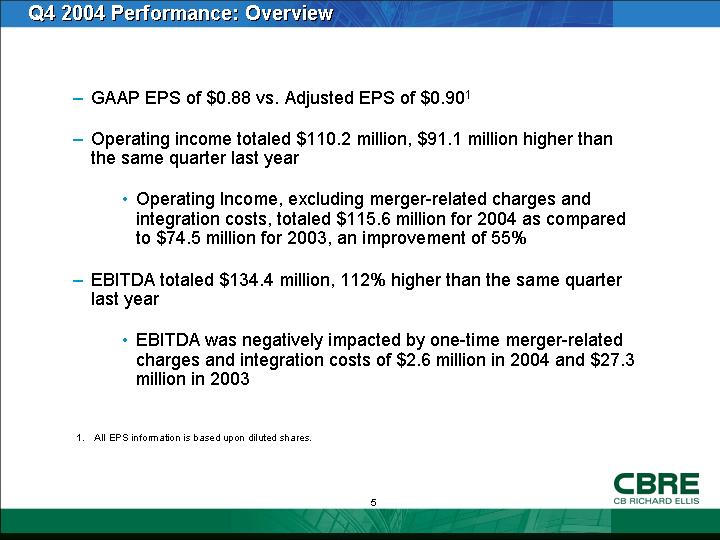

• GAAP EPS of $0.88 vs. Adjusted EPS of $0.90(1)

• Operating

income totaled $110.2 million, $91.1 million higher than the same quarter last

year

• Operating Income, excluding merger-related

charges and integration costs, totaled $115.6 million for 2004 as compared to

$74.5 million for 2003, an improvement of 55%

• EBITDA

totaled $134.4 million, 112% higher than the same quarter last year

• EBITDA

was negatively impacted by one-time merger-related charges and integration

costs of $2.6 million in 2004 and $27.3 million in 2003

(1) All EPS information is based upon diluted shares.

5

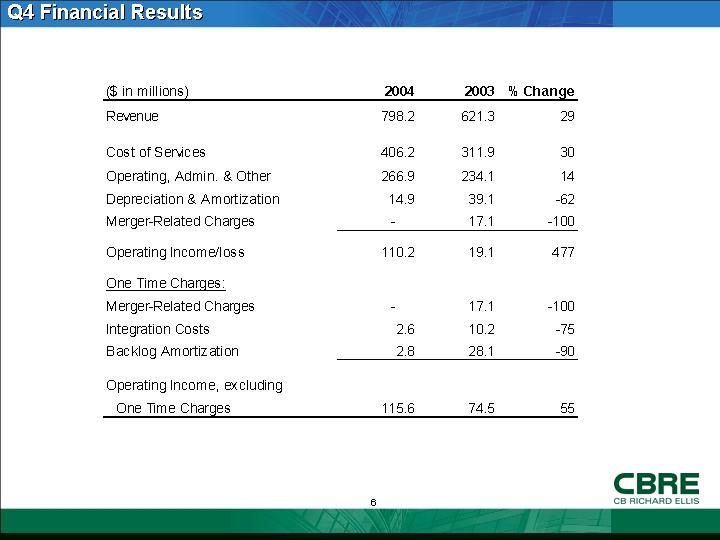

Q4 Financial Results

|

($ in millions)

|

|

2004

|

|

2003

|

|

% Change

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

798.2

|

|

621.3

|

|

29

|

|

|

|

|

|

|

|

|

|

|

|

Cost of

Services

|

|

406.2

|

|

311.9

|

|

30

|

|

|

Operating,

Admin. & Other

|

|

266.9

|

|

234.1

|

|

14

|

|

|

Depreciation

& Amortization

|

|

14.9

|

|

39.1

|

|

-62

|

|

|

Merger-Related

Charges

|

|

—

|

|

17.1

|

|

-100

|

|

|

|

|

|

|

|

|

|

|

|

Operating

Income/loss

|

|

110.2

|

|

19.1

|

|

477

|

|

|

|

|

|

|

|

|

|

|

|

One Time

Charges:

|

|

|

|

|

|

|

|

|

Merger-Related

Charges

|

|

—

|

|

17.1

|

|

-100

|

|

|

Integration

Costs

|

|

2.6

|

|

10.2

|

|

-75

|

|

|

Backlog Amortization

|

|

2.8

|

|

28.1

|

|

-90

|

|

|

|

|

|

|

|

|

|

|

|

Operating

Income, excluding One Time Charges

|

|

115.6

|

|

74.5

|

|

55

|

|

6

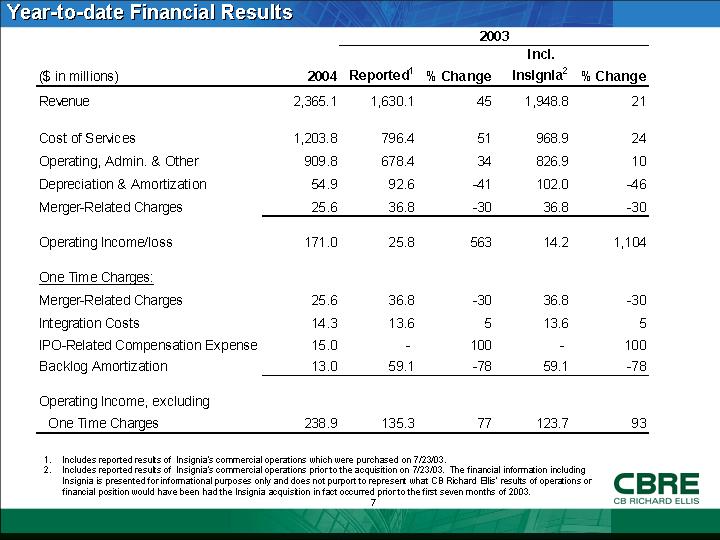

Year-to-date Financial Results

|

|

|

|

|

2003

|

|

|

|

|

|

|

|

|

|

|

Incl.

|

|

|

|

|

($ in millions)

|

|

2004

|

|

Reported(1)

|

|

% Change

|

|

Insignia(2)

|

|

% Change

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

2,365.1

|

|

1,630.1

|

|

45

|

|

1,948.8

|

|

21

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of

Services

|

|

1,203.8

|

|

796.4

|

|

51

|

|

968.9

|

|

24

|

|

|

Operating,

Admin. & Other

|

|

909.8

|

|

678.4

|

|

34

|

|

826.9

|

|

10

|

|

|

Depreciation

& Amortization

|

|

54.9

|

|

92.6

|

|

-41

|

|

102.0

|

|

-46

|

|

|

Merger-Related

Charges

|

|

25.6

|

|

36.8

|

|

-30

|

|

36.8

|

|

-30

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating

Income/loss

|

|

171.0

|

|

25.8

|

|

563

|

|

14.2

|

|

1,104

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One Time

Charges:

|

|

|

|

|

|

|

|

|

|

|

|

|

Merger-Related

Charges

|

|

25.6

|

|

36.8

|

|

-30

|

|

36.8

|

|

-30

|

|

|

Integration

Costs

|

|

14.3

|

|

13.6

|

|

5

|

|

13.6

|

|

5

|

|

|

IPO-Related

Compensation Expense

|

|

15.0

|

|

—

|

|

100

|

|

—

|

|

100

|

|

|

Backlog

Amortization

|

|

13.0

|

|

59.1

|

|

-78

|

|

59.1

|

|

-78

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating

Income, excluding One Time Charges

|

|

238.9

|

|

135.3

|

|

77

|

|

123.7

|

|

93

|

|

(1) Includes reported results of Insignia’s commercial operations which were

purchased on 7/23/03.

(2) Includes reported results of Insignia’s commercial operations prior to

the acquisition on 7/23/03. The financial

information including Insignia is presented for informational purposes only and

does not purport to represent what CB Richard Ellis’ results of operations or

financial position would have been had the Insignia acquisition in fact

occurred prior to the first seven months of 2003.

7

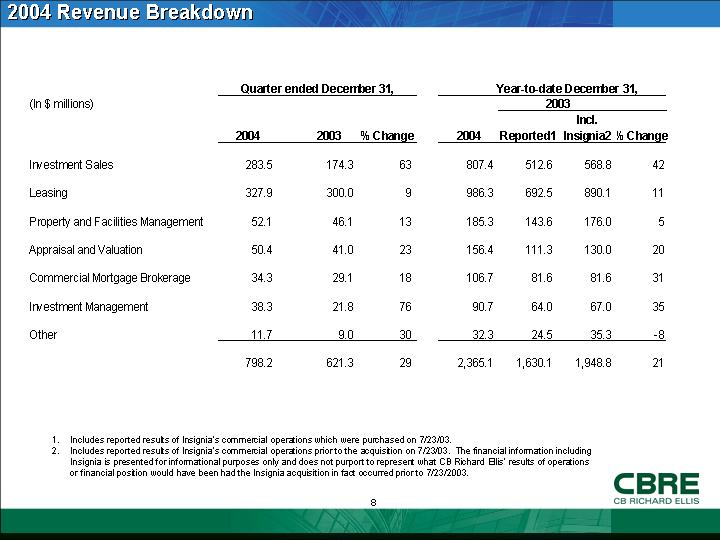

2004 Revenue Breakdown

|

|

|

Quarter ended December 31,

|

|

Year-to-date December 31,

|

|

|

|

|

|

|

|

|

|

|

|

|

2003

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Incl.

|

|

|

|

|

(In $ millions)

|

|

2004

|

|

2003

|

|

% Change

|

|

2004

|

|

Reported(1)

|

|

Insignia(2)

|

|

% Change

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment

Sales

|

|

283.5

|

|

174.3

|

|

63

|

|

807.4

|

|

512.6

|

|

568.8

|

|

42

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Leasing

|

|

327.9

|

|

300.0

|

|

9

|

|

986.3

|

|

692.5

|

|

890.1

|

|

11

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property and

Facilities Management

|

|

52.1

|

|

46.1

|

|

13

|

|

185.3

|

|

143.6

|

|

176.0

|

|

5

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Appraisal

and Valuation

|

|

50.4

|

|

41.0

|

|

23

|

|

156.4

|

|

111.3

|

|

130.0

|

|

20

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial

Mortgage Brokerage

|

|

34.3

|

|

29.1

|

|

18

|

|

106.7

|

|

81.6

|

|

81.6

|

|

31

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment

Management

|

|

38.3

|

|

21.8

|

|

76

|

|

90.7

|

|

64.0

|

|

67.0

|

|

35

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other

|

|

11.7

|

|

9.0

|

|

30

|

|

32.3

|

|

24.5

|

|

35.3

|

|

-8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

798.2

|

|

621.3

|

|

29

|

|

2,365.1

|

|

1,630.1

|

|

1,948.8

|

|

21

|

|

(1) Includes reported results of Insignia’s commercial operations which were

purchased on 7/23/03.

(2) Includes reported results of Insignia’s commercial operations prior to

the acquisition on 7/23/03. The

financial information including Insignia is presented for informational

purposes only and does not purport to represent what CB Richard Ellis’ results

of operations or financial position would have been had the Insignia

acquisition in fact occurred prior to 7/23/2003.

8

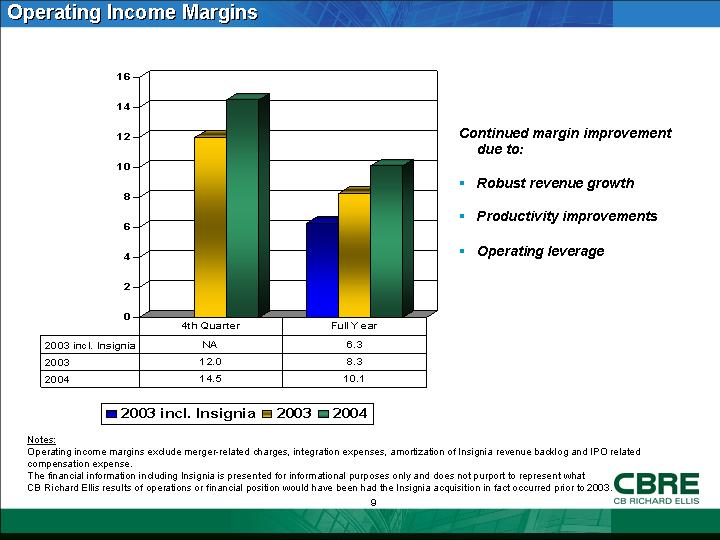

Operating Income Margins

[CHART]

|

|

|

4th Quarter

|

|

Full Year

|

|

|

2003 incl. Insignia

|

|

NA

|

|

6.3

|

|

|

2003

|

|

12.0

|

|

8.3

|

|

|

2004

|

|

14.5

|

|

10.1

|

|

Continued margin improvement due to:

• Robust

revenue growth

• Productivity

improvements

• Operating

leverage

Notes:

Operating

income margins exclude merger-related charges, integration expenses,

amortization of Insignia revenue backlog and IPO related compensation expense.

The

financial information including Insignia is presented for informational

purposes only and does not purport to represent what CB Richard Ellis results

of operations or financial position would have been had the Insignia

acquisition in fact occurred prior to 2003.

9

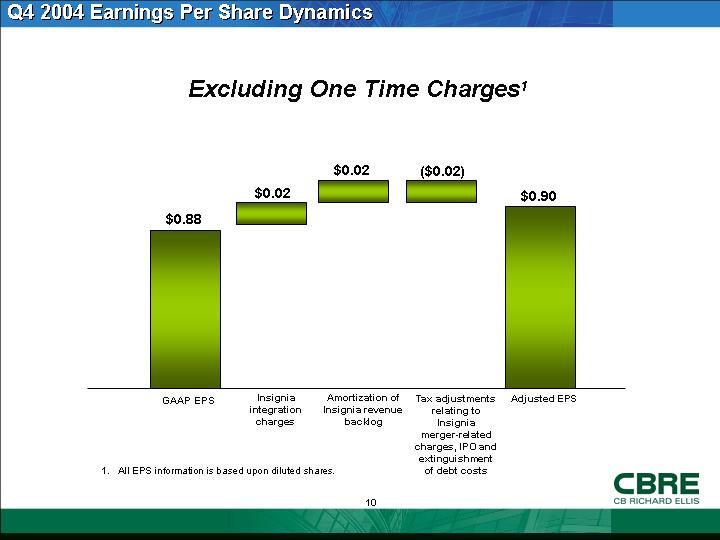

Q4 2004 Earnings Per Share

Dynamics

Excluding One Time Charges(1)

[CHART]

(1) All EPS information is based upon diluted shares.

10

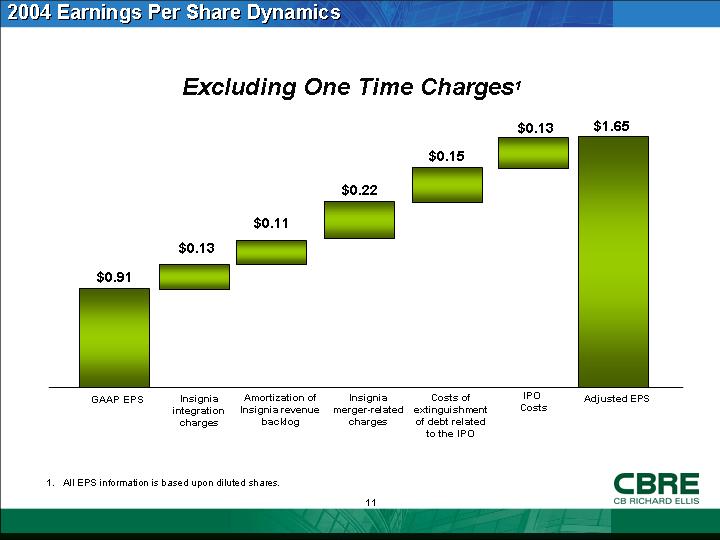

2004 Earnings Per Share Dynamics

Excluding One Time Charges(1)

[CHART]

(1) All EPS information is based upon diluted shares.

11

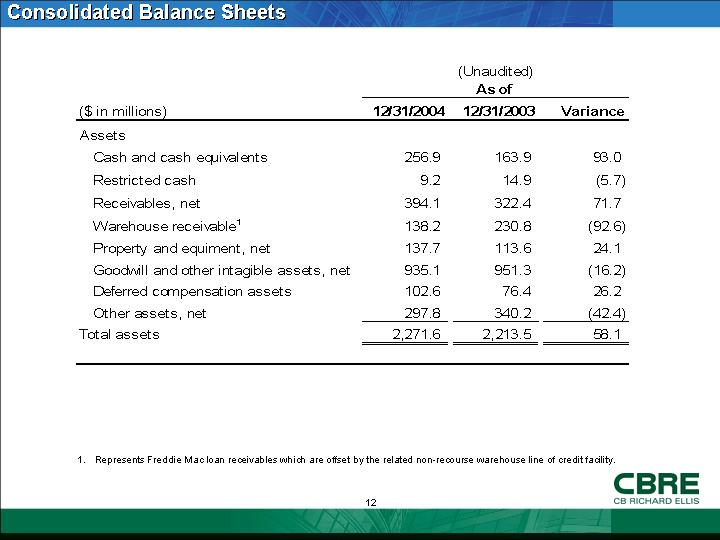

Consolidated Balance Sheets

|

|

|

As of

|

|

|

($ in millions)

|

|

12/31/2004

|

|

12/31/2003

|

|

Variance

|

|

|

|

|

|

|

(Unaudited)

|

|

|

|

|

Assets

|

|

|

|

|

|

|

|

|

Cash and

cash equivalents

|

|

256.9

|

|

163.9

|

|

93.0

|

|

|

Restricted

cash

|

|

9.2

|

|

14.9

|

|

(5.7

|

)

|

|

Receivables,

net

|

|

394.1

|

|

322.4

|

|

71.7

|

|

|

Warehouse receivable(1)

|

|

138.2

|

|

230.8

|

|

(92.6

|

)

|

|

Property and

equiment, net

|

|

137.7

|

|

113.6

|

|

24.1

|

|

|

Goodwill and

other intagible assets, net

|

|

935.1

|

|

951.3

|

|

(16.2

|

)

|

|

Deferred

compensation assets

|

|

102.6

|

|

76.4

|

|

26.2

|

|

|

Other

assets, net

|

|

297.8

|

|

340.2

|

|

(42.4

|

)

|

|

Total assets

|

|

2,271.6

|

|

2,213.5

|

|

58.1

|

|

(1) Represents Freddie Mac loan receivables which are offset by the related

non-recourse warehouse line of credit facility.

12

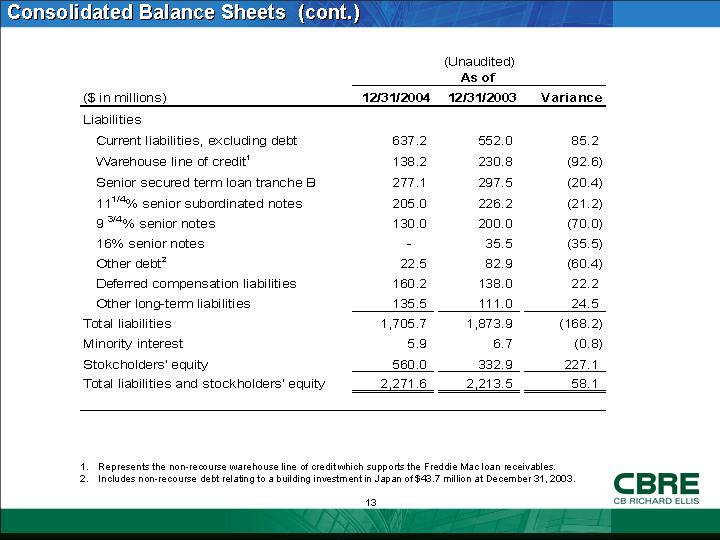

|

|

|

As of

|

|

|

($ in millions)

|

|

12/31/2004

|

|

12/31/2003

|

|

Variance

|

|

|

|

|

|

|

(Unaudited)

|

|

|

|

|

Liabilities

|

|

|

|

|

|

|

|

|

Current

liabilities, excluding debt

|

|

637.2

|

|

552.0

|

|

85.2

|

|

|

Warehouse

line of credit(1)

|

|

138.2

|

|

230.8

|

|

(92.6

|

)

|

|

Senior secured

term loan tranche B

|

|

277.1

|

|

297.5

|

|

(20.4

|

)

|

|

11 1/4%

senior subordinated notes

|

|

205.0

|

|

226.2

|

|

(21.2

|

)

|

|

9 3/4%

senior notes

|

|

130.0

|

|

200.0

|

|

(70.0

|

)

|

|

16% senior

notes

|

|

—

|

|

35.5

|

|

(35.5

|

)

|

|

Other debt(2)

|

|

22.5

|

|

82.9

|

|

(60.4

|

)

|

|

Deferred

compensation liabilities

|

|

160.2

|

|

138.0

|

|

22.2

|

|

|

Other

long-term liabilities

|

|

135.5

|

|

111.0

|

|

24.5

|

|

|

Total

liabilities

|

|

1,705.7

|

|

1,873.9

|

|

(168.2

|

)

|

|

Minority

interest

|

|

5.9

|

|

6.7

|

|

(0.8

|

)

|

|

Stokcholders’

equity

|

|

560.0

|

|

332.9

|

|

227.1

|

|

|

Total

liabilities and stockholders’ equity

|

|

2,271.6

|

|

2,213.5

|

|

58.1

|

|

(1) Represents the non-recourse warehouse line of credit which supports the

Freddie Mac loan receivables.

(2) Includes non-recourse debt relating to a building investment in Japan

of $43.7 million at December 31, 2003.

13

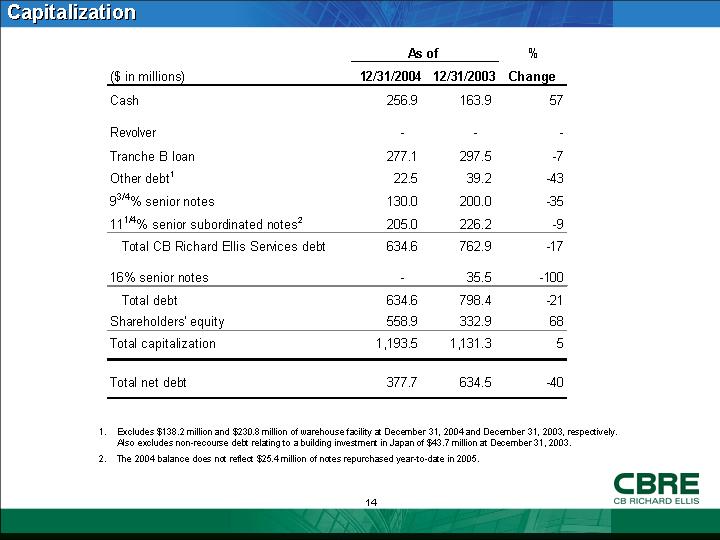

Capitalization

|

|

|

As of

|

|

%

|

|

|

($ in millions)

|

|

12/31/2004

|

|

12/31/2003

|

|

Change

|

|

|

Cash

|

|

256.9

|

|

163.9

|

|

57

|

|

|

|

|

|

|

|

|

|

|

|

Revolver

|

|

—

|

|

—

|

|

—

|

|

|

Tranche B

loan

|

|

277.1

|

|

297.5

|

|

-7

|

|

|

Other debt(1)

|

|

22.5

|

|

39.2

|

|

-43

|

|

|

9 3/4%

senior notes

|

|

130.0

|

|

200.0

|

|

-35

|

|

|

11 1/4%

senior subordinated notes(2)

|

|

205.0

|

|

226.2

|

|

-9

|

|

|

Total CB

Richard Ellis Services debt

|

|

634.6

|

|

762.9

|

|

-17

|

|

|

|

|

|

|

|

|

|

|

|

16% senior

notes

|

|

—

|

|

35.5

|

|

-100

|

|

|

Total debt

|

|

634.6

|

|

798.4

|

|

-21

|

|

|

Shareholders’

equity

|

|

558.9

|

|

332.9

|

|

68

|

|

|

Total

capitalization

|

|

1,193.5

|

|

1,131.3

|

|

5

|

|

|

|

|

|

|

|

|

|

|

|

Total net

debt

|

|

377.7

|

|

634.5

|

|

-40

|

|

(1) Excludes $138.2 million and $230.8 million of

warehouse facility at December 31, 2004 and December 31, 2003,

respectively. Also excludes non-recourse debt relating to a building investment

in Japan of $43.7 million at December 31, 2003.

(2) The 2004 balance does not reflect $25.4

million of notes repurchased year-to-date in 2005.

14

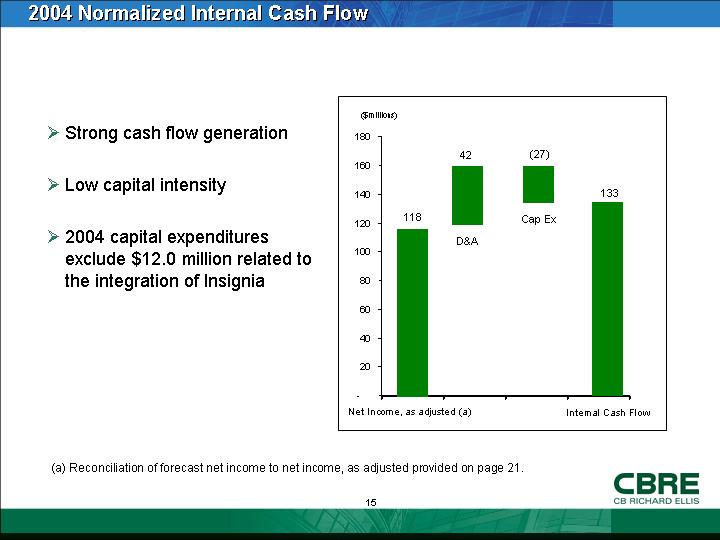

2004 Normalized Internal Cash Flow

|

|

•

|

Strong cash flow generation

|

|

|

|

|

|

|

|

|

•

|

Low capital intensity

|

[CHART]

|

|

|

|

|

|

|

|

•

|

2004 capital expenditures exclude $12.0 million related to the

integration of Insignia

|

|

(a) Reconciliation

of forecast net income to net income, as adjusted provided on page 21.

15

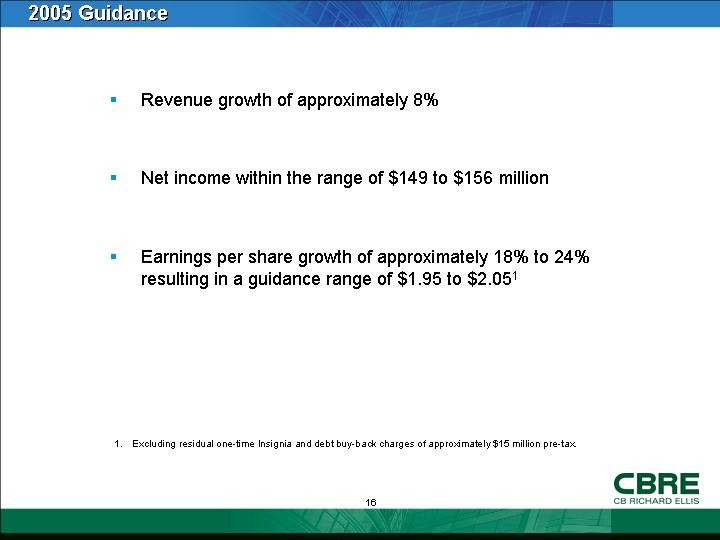

2005 Guidance

• Revenue

growth of approximately 8%

• Net

income within the range of $149 to $156 million

• Earnings

per share growth of approximately 18% to 24% resulting in a guidance range of

$1.95 to $2.05(1)

(1) Excluding residual one-time Insignia and debt buy-back charges of

approximately $15 million pre-tax.

16

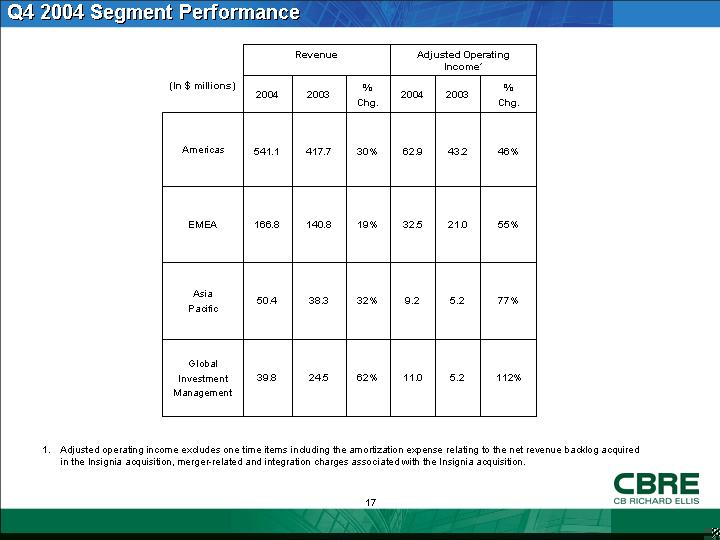

Q4 2004 Segment Performance

|

|

|

Revenue

|

|

Adjusted Operating

Income(1)

|

|

|

(In $ millions)

|

|

2004

|

|

2003

|

|

%

Chg.

|

|

2004

|

|

2003

|

|

%

Chg.

|

|

|

Americas

|

|

541.1

|

|

417.7

|

|

30

|

%

|

62.9

|

|

43.2

|

|

46

|

%

|

|

EMEA

|

|

166.8

|

|

140.8

|

|

19

|

%

|

32.5

|

|

21.0

|

|

55

|

%

|

|

Asia Pacific

|

|

50.4

|

|

38.3

|

|

32

|

%

|

9.2

|

|

5.2

|

|

77

|

%

|

|

Global

Investment Management

|

|

39.8

|

|

24.5

|

|

62

|

%

|

11.0

|

|

5.2

|

|

112

|

%

|

(1) Adjusted operating income excludes one time

items including the amortization expense relating to the net revenue backlog

acquired in the Insignia acquisition, merger-related and integration charges

associated with the Insignia acquisition.

17

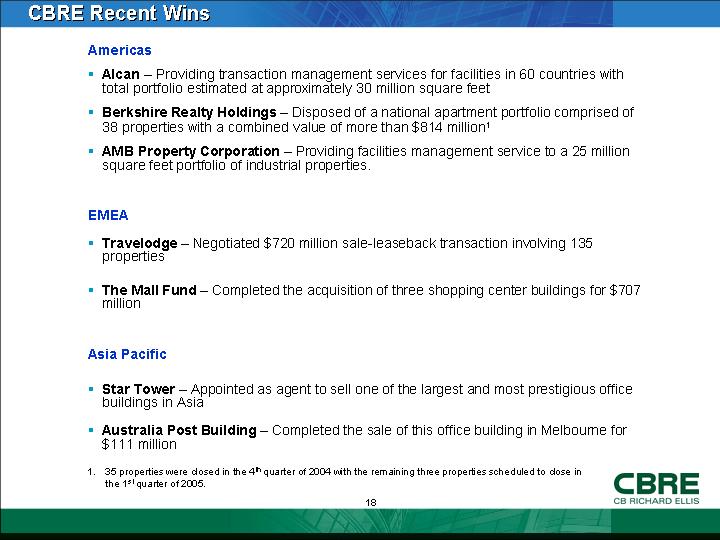

CBRE Recent Wins

Americas

• Alcan – Providing transaction management services

for facilities in 60 countries with total portfolio estimated at approximately

30 million square feet

• Berkshire Realty Holdings – Disposed of a national apartment portfolio

comprised of 38 properties with a combined value of more than $814 million(1)

• AMB Property Corporation – Providing facilities management service to

a 25 million square feet portfolio of industrial properties.

EMEA

• Travelodge – Negotiated $720 million sale-leaseback

transaction involving 135 properties

• The Mall Fund – Completed the acquisition of three

shopping center buildings for $707 million

Asia

Pacific

• Star Tower – Appointed as agent to sell one of the

largest and most prestigious office buildings in Asia

• Australia Post Building – Completed the sale of this office building

in Melbourne for $111 million

(1) 35 properties were closed in the 4th

quarter of 2004 with the remaining three properties scheduled to close in the 1st

quarter of 2005.

18

Favorable Trends

• Robust

investment sales market in the U.S. despite measured increases in short-term

interest rates in the second half of 2004

• Strong

investment sales activity is expected to continue into 2005

• Increased

corporate confidence and sustained employment growth have bolstered U.S.

leasing markets

• Proactive

business development strategy resulted in numerous new fortune 500 client

relationships

• Record

performance in mortgage brokerage

• Active

investment market in Europe and Asia Pacific

19

Summary

• Record Performance

• Strong

revenue, EBITDA, net income and earnings per share in the fourth quarter and

full year 2004

• Macro Trends

• Continued

strength in investment property sales market and higher capital allocations to

real estate

• Further

improvement in the global leasing market fueled by steady job growth

• Increased

industrial productivity and consumer spending

20

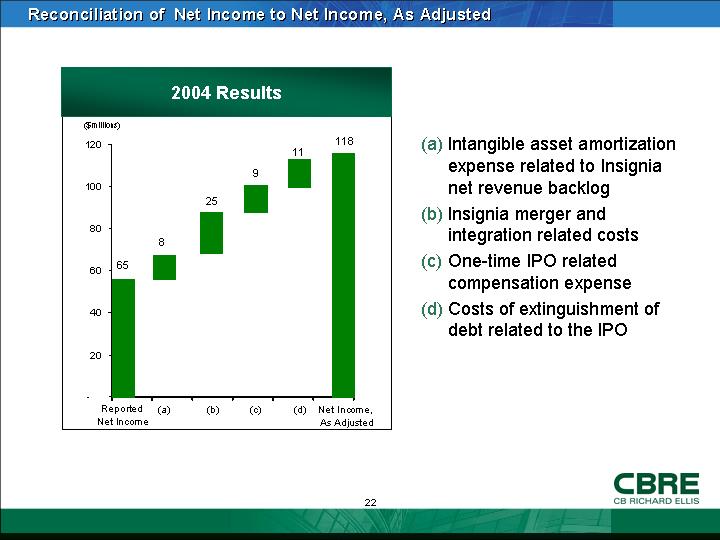

Reconciliation of Net Income to

Net Income, As Adjusted

2004 Results

[CHART]

(a) Intangible asset amortization expense related to Insignia net revenue

backlog

(b) Insignia merger and integration related costs

(c) One-time IPO related compensation expense

(d) Costs of extinguishment of debt related to the IPO

22

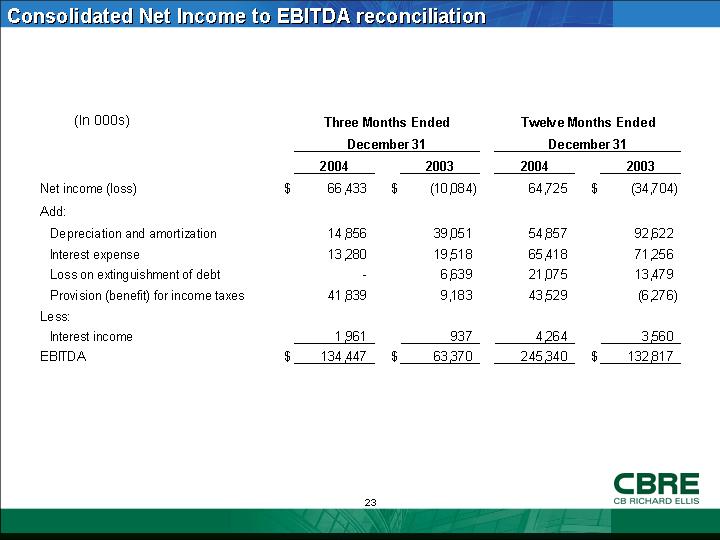

Consolidated Net Income to

EBITDA reconciliation

|

|

|

Three Months Ended

December 31

|

|

Twelve Months Ended

December 31

|

|

|

(In 000s)

|

|

2004

|

|

2003

|

|

2004

|

|

2003

|

|

|

Net income

(loss)

|

|

$

|

66,433

|

|

$

|

(10,084

|

)

|

64,725

|

|

$

|

(34,704

|

)

|

|

Add:

|

|

|

|

|

|

|

|

|

|

|

Depreciation

and amortization

|

|

14,856

|

|

39,051

|

|

54,857

|

|

92,622

|

|

|

Interest

expense

|

|

13,280

|

|

19,518

|

|

65,418

|

|

71,256

|

|

|

Loss on

extinguishment of debt

|

|

—

|

|

6,639

|

|

21,075

|

|

13,479

|

|

|

Provision

(benefit) for income taxes

|

|

41,839

|

|

9,183

|

|

43,529

|

|

(6,276

|

)

|

|

Less:

|

|

|

|

|

|

|

|

|

|

|

Interest

income

|

|

1,961

|

|

937

|

|

4,264

|

|

3,560

|

|

|

EBITDA

|

|

$

|

134,447

|

|

$

|

63,370

|

|

245,340

|

|

$

|

132,817

|

|

23