SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ¨

Filed by a Party other than the Registrant x

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| x | Soliciting Material under Rule 14a-12 |

INSIGNIA FINANCIAL GROUP, INC.

(Name of Registrant as Specified In Its Charter)

CBRE HOLDING, INC.

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Filed by CBRE Holding, Inc.

Pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Insignia Financial Group, Inc.

Commission File No.: 001-14373

The following is the text of a joint press release issued by Insignia Financial Group, Inc. and CB Richard Ellis Services, Inc. on February 18, 2003:

| PRESS RELEASE |

CB Richard Ellis, Inc. | |||

| 970 W. 190th Street, Suite 700 | ||||

| Torrance, CA 90502 | ||||

| T 310 354 5064 | ||||

| F 310 380 5149 | ||||

| www.cbre.com |

FOR IMMEDIATE RELEASE

| For further information: |

||

| Victor Dominguez |

Steve Iaco | |

| CB Richard Ellis |

Insignia Financial Group | |

| 310 354 5064 |

212 984 6535 |

CB Richard Ellis

To Acquire Insignia Financial Group, Inc.

Planned Merger Would Create Global Market Leader

In Real Estate Services

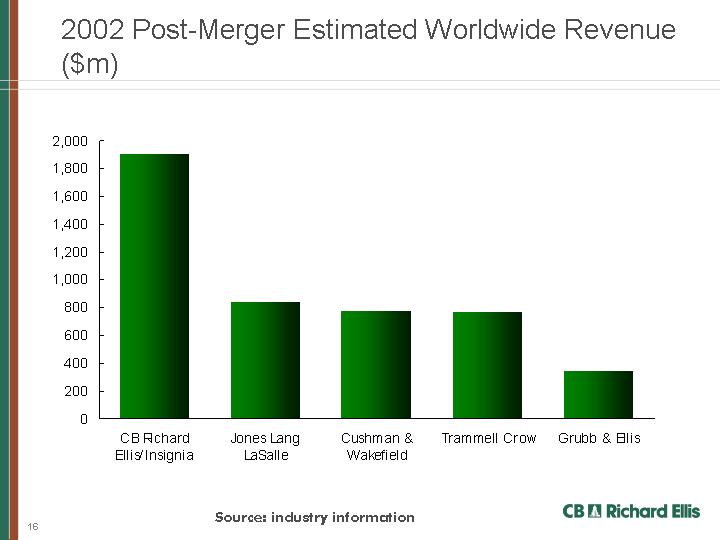

Los Angeles and New York, February 18, 2003 – CB Richard Ellis today announced it has entered into a definitive agreement to acquire Insignia Financial Group, Inc. (NYSE:IFS) for $11.00 per share of common stock in cash, plus the potential for incremental consideration. Upon completion, the transaction would create a real estate services company with revenues exceeding $1.8 billion, 16,000 employees in 47 countries, and market leadership positions in major business centers, including New York, Los Angeles, Chicago, London, Paris and Hong Kong.

The all-cash transaction is valued at approximately $415 million, including repayment of net debt and redemption of preferred stock, and is subject to Insignia shareholder approval and other conditions.

Insignia will endeavor to sell certain real estate assets prior to the closing of the transaction. To the extent that Insignia is able to realize more than $45 million in cash for these assets, the amount received over $45 million will be paid to shareholders, up to an additional $1.00 per

share of Insignia common stock. There can be no assurance that Insignia will achieve more than $45 million through the asset sales.

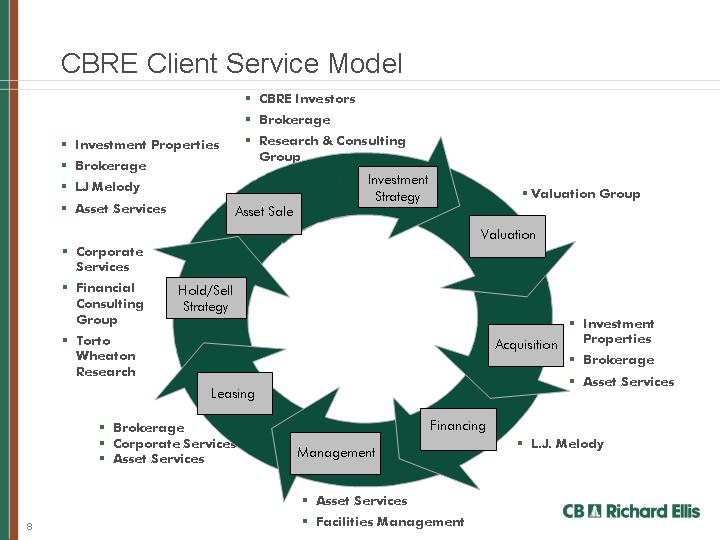

Upon closing, the combined company will operate globally as CB Richard Ellis, and is expected to:

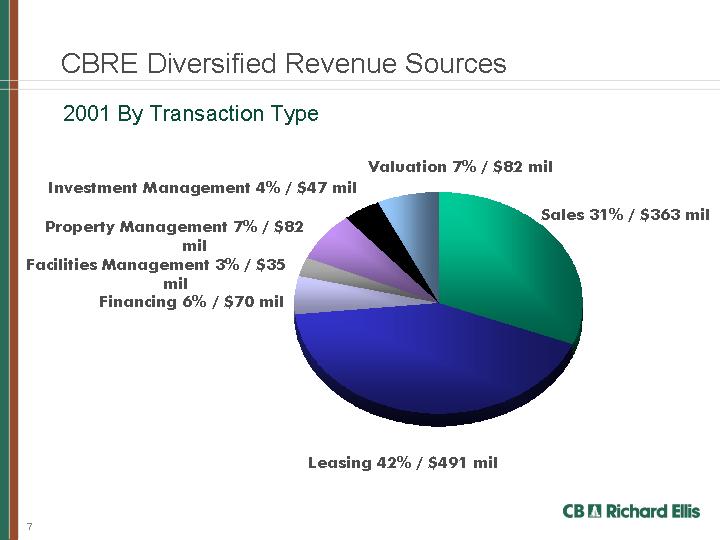

| • | generate $90 billion of annual sales and leasing transactions (based on 2001 activity) |

| • | rank as the world’s largest commercial property manager, with a combined portfolio of nearly 850 million sq. ft. on a worldwide basis |

| • | conduct $32 billion in capital markets transactions, including property sales and mortgage banking |

| • | manage more than $13 billion in assets, primarily for institutional partnerships |

| • | conduct in excess of $290 billion of appraisals |

| • | offer the industry’s largest proprietary market research infrastructure, including nearly 300 local market research professionals, complemented by the macro-analytical and forecasting capabilities of its Torto-Wheaton Research unit |

In addition to Insignia shareholder approval, the transaction, which is expected to close in June, is subject to the receipt of financing and regulatory approvals. The combination will reunite the Richard Ellis name and brand into one organization. In 1998, Insignia acquired the U.K. operations of Richard Ellis and CB Richard Ellis, then known as CB Commercial, acquired the international operations of Richard Ellis.

To finance the transaction, CB Richard Ellis will receive a cash contribution of up to $145 million from Blum Capital Partners. CB Richard Ellis has also received a commitment from Credit Suisse First Boston for the necessary debt financing. CB Richard Ellis was taken private in July 2001 in an $800 million management buyout transaction led by Blum Capital Partners.

Market Leader

“Insignia is the perfect, hand-in-glove complement for our global platform,” said Ray Wirta, chief executive officer of CB Richard Ellis. “The new entity will offer clients the optimal balance of worldwide reach and specialized services.”

“We always believed that CB Richard Ellis would be an important platform in a consolidating industry,” said Richard Blum, chairman, Blum Capital Partners, the company’s controlling shareholder. “This management team continues to deliver strong performance – which we know will be further enhanced by the combined enterprise. Blum Capital is pleased to provide the equity capital for the next stage of growth for CB Richard Ellis.”

Stephen B. Siegel, chairman of Insignia’s U.S. commercial real estate services operation, Insignia/ESG, said, “Insignia’s clients will be big winners in this marriage. CB Richard Ellis’ broad scope of services and leading position in major markets will provide my Insignia colleagues and me the opportunity to address client needs more comprehensively than ever before.”

“This will be a winning transaction for Insignia’s shareholders, clients and employees, and will fulfill the strategy we have been developing since the AIMCO transaction in 1998,” said Andrew L. Farkas, Insignia’s chairman and chief executive officer. “Particularly in the current weak environment, our shareholders will achieve solid value for an enterprise that the public markets consistently undervalue. We are pleased with the EBITDA multiple being paid.” Mr. Farkas will continue as chief executive officer of the Insignia businesses through the transaction’s closing in June.

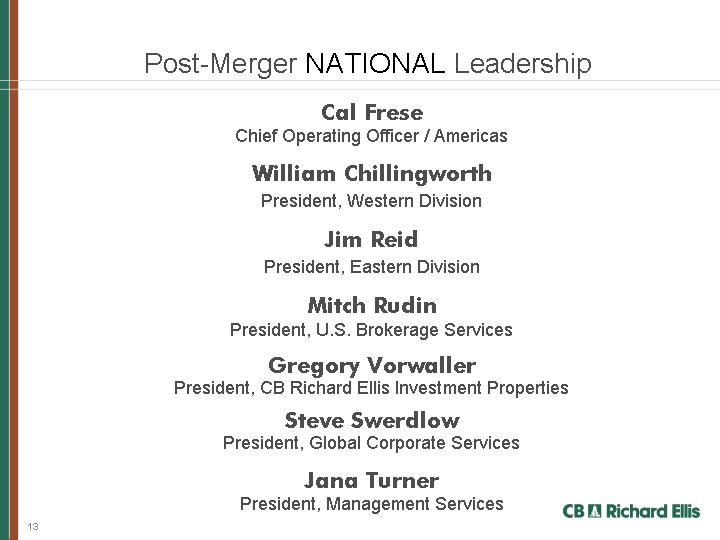

Leadership of Combined Company

Upon completion of the transaction, Mr. Wirta and Brett White, president of CB Richard Ellis, will continue in their current positions. Mr. Siegel will join CB Richard Ellis as chairman of global brokerage. In Europe, Insignia’s Alan Froggatt and Mike Strong will head CB Richard Ellis’ European operation.

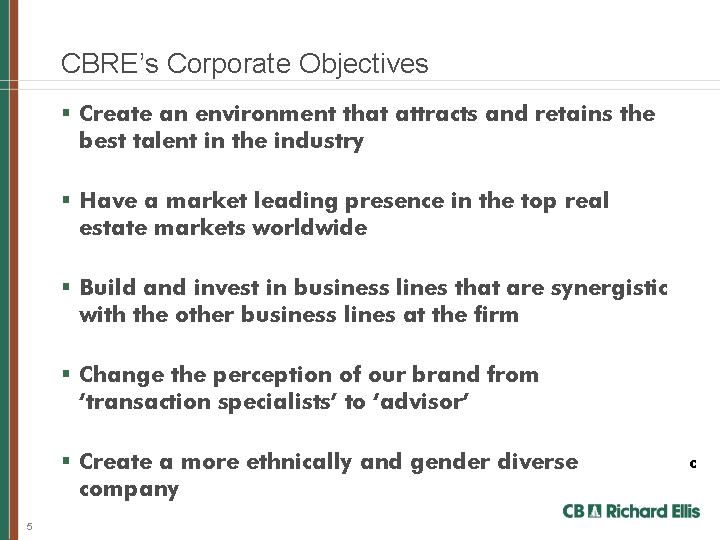

About CB Richard Ellis

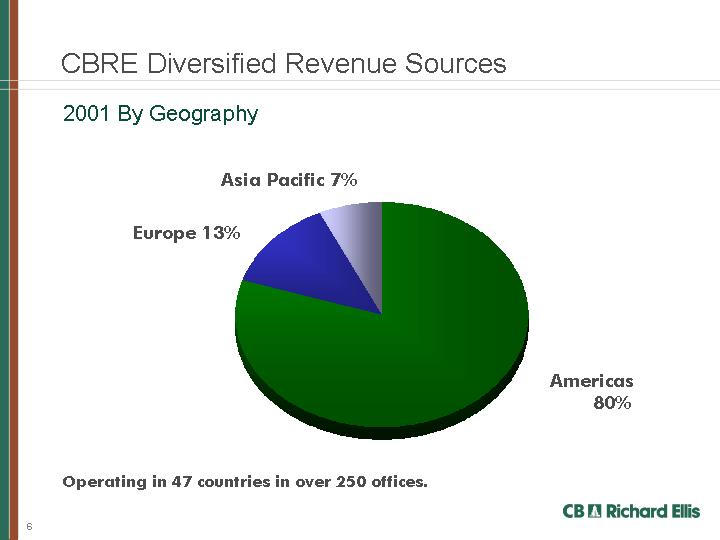

Headquartered in Los Angeles, CB Richard Ellis is one of the world’s leading real estate services companies. With approximately 10,000 employees, the Company serves real estate owners, investors and occupiers throughout approximately 250 owned and affiliated offices in 47 countries. The Company’s core services portfolio includes property sales, leasing and management, corporate services, facilities and project management, mortgage banking, investment management, capital markets, appraisal and valuation, research, and consulting. The Company reported net revenues of $1.17 billion in 2001. For more information about CB Richard Ellis, visit the Company’s Web site at www.cbre.com

About Insignia Financial Group, Inc.

Insignia Financial Group, Inc. (NYSE:IFS), based in New York, is among the world’s foremost real estate services and investment banking firms with leadership positions in the commercial and residential sectors. Its major operating units are: Insignia/ESG, one of the largest providers of commercial real estate services in the United States; Insignia Richard Ellis, one of the premier real estate services firms in the United Kingdom; Insignia Bourdais, one of France’s premier commercial real estate services companies; Insignia Douglas Elliman, one of the largest providers of residential sales and rental brokerage in the New York City market; and Insignia Residential Group, the largest manager of cooperative and condominium housing in the New York metropolitan area. Insignia also deploys its own capital, together with the capital of third-party investors, in principal investment activities, including co-investment in existing assets and real estate development, and provides investment management services to investment funds sponsored by the Company. Additional information about the Company is available on the corporate Web site at www.insigniafinancial.com.

###

In connection with the merger, Insignia will be filing a proxy statement and other relevant documents concerning the transaction with the Securities and Exchange Commission (SEC). STOCKHOLDERS OF INSIGNIA ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders can obtain free copies of the proxy statement and other documents when they become available by contacting Corporate Communications, Insignia Financial Group, Inc., 200 Park Avenue, New York, New York 10166 (Telephone: (212) 984-6515). In addition, documents filed with the SEC by Insignia will be available free of charge at the SEC’s web site at www.sec.gov.

Information regarding the identity of the persons who may, under SEC rules, be deemed to be participants in the solicitation of stockholders of Insignia in connection with the transaction, and their interests in the solicitation, will be set forth in a proxy statement that will be filed by Insignia with the SEC.

Certain items discussed in this press release constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Companies to be materially different from any future results, performance, or achievements expressed or implied by such forward-looking statements. Statements which make reference to the expectations or beliefs of the Companies or any of its management are such forward-looking statements, including statements concerning the performance of the Companies or any of its business units, and the business outlook for, and the Companies’ expected performance in 2003. Such forward-looking statements speak only as of the date of this press release. The Companies expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Companies’ expectations with regard thereto or any change in events, conditions or circumstances upon which any such statement is based.

Filed by CBRE Holding, Inc.

Pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Insignia Financial Group, Inc.

Commission File No.: 001-14373

The following is a transcript of the CBRE Holding, Inc. fourth quarter earnings conference call, held on February 20, 2003:

CB RICHARD ELLIS

February 20, 2003

2:30 p.m. CST

| Moderator |

Ladies and gentlemen, thank you for standing by and welcome to the CB Richard Ellis Fourth Quarter 2002 Earnings conference call. At this time all participants are in a listen-only mode. Later we will conduct a question and answer session and instructions will be given at that time. As a reminder, this conference is being recorded. |

| I would now like to turn the conference over to our host, Chief Financial Officer of CB Richard Ellis, Mr. Ken Kay. Please go ahead. |

| K. Kay |

Thank you for joining us today for CB Richard Ellis’s fourth quarter 2002 earnings conference call. It is my pleasure to welcome you to our call. On this call we will be covering our fourth quarter and full year results for 2002, and briefly discuss our recent announcement on Insignia. Participating on the call with me this afternoon will be Ray Wirta, our Chief Executive Officer; Brett White, our President; Ron Platisha, our Executive Vice President of Finance; Debbie Fan, our Treasurer; and Gil Borok, our Global Controller. |

1

| Before we get started I want to mention that we may make a number of forward-looking statements during the course of this call. These statements should be considered as estimates only, and actual results may ultimately differ from these estimates. CB Richard Ellis undertakes no obligation to update or publicly revise any of the forward-looking statements that you may hear today. Please refer to the company’s annual report on Form 10-K and our quarterly reports on Form 10-Q for a full discussion of the risks and other factors that may impact any estimates that you may hear today. |

| With that, I’d like to turn the call over to Ray Wirta, our Chief Executive Officer. |

| R. Wirta |

Thank you, Ken, and good afternoon to everybody on the call. I will make a few brief overview comments, and I’ll ask Brett to comment in more detail about our operations, and Ken to discuss our financial information. I will then conclude with some remarks on the recent announcement of our planned purchase of Insignia Financial Services. Our press release is out, so let’s talk about some of the highlights of the release. |

2

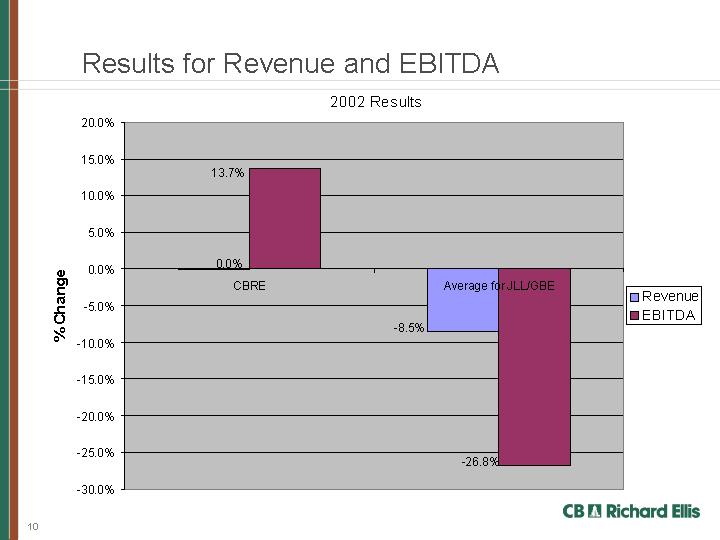

| In 2002 the commercial real estate service sector had an extremely slow start. Transaction velocity began to pick up in the second quarter and continued to improve throughout 2002. Fourth quarter 2002 revenue was up 12% over the previous year’s fourth quarter, leaving us to achieve full year revenue of $1.17 billion, which was almost exactly the same as the prior year. EBITDA was $130.7 million, approximately 14% higher than 2001. EBITDA margin improved to 11.2% compared to 9.8% in the prior year. These improvements were accomplished through gains in market share despite a challenging leasing market and through our cost containment efforts. |

| Low interest rates continue to have a positive impact on LJ Melody, our mortgage banking business. For 2002 both revenue and EBITDA were approximately 2% higher than the prior year. Revenue was especially strong in the fourth quarter and approximately 16% higher than the prior year quarter. |

| CBRE Investors, our investment management business, also performed well in 2002. Excluding a prior year one-time gain from the sale of a mortgage fund of $5.6 million, revenue for the year was up 26% over last year. This increase was due mainly to increased assets under management, activities in Asia, and ongoing co-investment returns. |

| That’s the overview. Now Brett will provide some additional detail on operations. Brett. |

3

| Brett White |

Thanks, Ray, and good afternoon, everybody. In the fourth quarter the number of sales transactions in the U.S. was 32% higher than the fourth quarter of 2001. As a result, U.S. sales revenues were also 33% higher than the same quarter last year. The number of lease transactions was up 8% from the same quarter of 2001. However, lower revenue per lease transactions offset the increased lease transaction counts, and consequently, overall leasing revenues decreased by approximately 13%. Despite this, total revenue for North America in the fourth quarter was higher by 7% as compared to the prior year’s similar quarter. |

| In Europe we also benefit from strong revenue performance. For the fourth quarter revenues improved by approximately 37%, while EBITDA was 56% higher for the same period last year. This increase in revenues was driven by higher overall sales transaction volume and consulting fees in the U.K. Our performance in France was exceptional in the fourth quarter, with revenues increasing by over 180% from the prior year due to robust leasing activity, and EBITDA increasing by over 400% on a comparative basis. |

| Asia Pacific’s results have also improved. Revenue for the fourth quarter was 20% above last year and EBITDA was 70% ahead of prior year, primarily due to increased sales and consulting revenues, and the reduction of overhead and administrative costs. With that I’ll turn the call back to Ken. |

4

| K. Kay |

Thanks, Brett. Revenue for the fourth quarter totaled $376.5 million. This was $39.2 million or 12% higher than the prior year due to the factors that Brett mentioned earlier. Commission expense for the quarter of $186.4 million was $28.7 million or 18% higher than the prior year, driven by higher sales transaction revenue. Producer costs in both Europe and Asia increased slightly as compared to the prior year as we expanded in both regions. |

| Operating expense for the fourth quarter totaled $134.3 million, which was $10.6 million or 9% higher than the prior year. The increase is primarily due to higher bonuses as a result of improved results. EBITDA for the quarter totals $58.7 million. This was an improvement of $2.1 million or 4% compared to the prior year. On a full-year basis revenue was essentially flat at $1.17 billion, while EBITDA increased by $15.7 million or 14% to $130.7 million. The improvement in EBITDA was primarily achieved through cost containment efforts, which yielded savings of $18.7 million. |

5

| Now let’s look at the balance sheet. The 12/31/02 cash balance was $79.6 million, which was $22.1 million or 38.5% higher than the prior year. This is consistent with our traditional peak at year-end as a result of our bonus payout structure. Bonuses are accrued throughout the year, but are mostly paid in the first quarter, and thus a sizable amount of cash outflow occurs at that time. |

| The warehouse receivable represents loans committed for purchase by Freddie Mac. These loans are funded via credit line, and the receivable and related debt balances fluctuate based upon pending loan closings. Other current assets, which include accounts receivable, were higher than prior year primarily because of higher sales transaction revenue. Goodwill and other intangible assets increased as a result of a reclassification from deferred taxes in connection with the tax impacts associated with the implementation of Statement of Financial Accounting Standards No. 141. |

6

| Current liabilities, excluding short-term debt, increased by $30.6 million due to higher bonus accruals resulting from improved revenues. Accrued liabilities increased as a result of a reclassification of lease termination reserves from long term to current. Long term liabilities, however, remained relatively flat due to a current year accrual for an additional minimum pension liability for the U.K. pension plan that resulted from planned asset value declines. The revolving credit facility did not have any outstanding borrowings at December 31, 2002. We do not anticipate borrowing from the revolver until mid March 2003. |

| In the fourth quarter total debt, excluding the LJ Melody warehouse line and the non-recourse debt related to co-investment activity, was $467.9 million, which is $16.4 million lower than last year. We reduced our debt by $14.9 million in the fourth quarter. We’ve completed our covenant calculations, and as of December 31, 2002 we are in compliance. The leverage ratio was the tightest calculation. Additionally, our 2003 plan assumes a stable interest rate environment throughout the year and that the U.S. economy will improve marginally. We continue to run covenant calculation models for 2003, and the results of these calculations show that we will be in compliance during 2003. |

| I’ll now turn the call back over to Ray. |

7

| R. Wirta |

Thank you, Ken. We had a strong fourth quarter and believe the momentum will carry us into 2003. We continue to see improvement in transaction velocity in U.S. sales and leasing, our most important business. |

| Now let’s talk about Insignia. On February 18th, two days ago, we announced that we intend to purchase Insignia Financial Services for approximately $415 million in cash, which includes $267 million for common equity at $11.00 per share and refinancing of approximately $148 million of Insignia net debt and preferred stock. The transaction will be funded with up to $145 million of cash equity from Blum Capital, additional indebtedness, and cash on hand at Insignia. |

| The transaction is scheduled to close in June, following the vote by Insignia’s shareholders and the receipt of regulatory approval. We’re having ongoing discussions with the key business leaders of Insignia, and all of the key employees at both CBRE and Insignia are very positive about the combination. We believe that the acquisition is compelling from both a financial and strategic perspective. The transaction will reduce our senior secured leverage and be neutral to deleveraging on a total debt to EBITDA basis. |

8

| Acquiring Insignia bolsters our scale, business line, and regional diversity. It strengthens our leadership position in the commercial real estate service industry worldwide, and will increase our annual revenues to in excess of $1.8 billion per year. Strategically the acquisition unites the powerful CB Richard Ellis brand globally and creates a company with nationwide U.S. presence, significant European operations, and market leadership positions in major business centers, including New York, Los Angeles, Chicago, London, Paris, and Hong Kong. |

| The combined company is expected to generate over $90 billion of annual sales and leasing transactions, rank as the world’s largest commercial property manager, manage more than $13 billion in assets, and offer the industry’s largest proprietary market research. All in all we’re quite excited about the prospects. |

| Operator, that ends our formal remarks. We’d like to open it up to questions, if you’d remind our participants about the need to pick up their handheld receivers. |

| Moderator |

Our first question today comes from the line of Larry Taylor with Credit Suisse First Boston. Please go ahead. |

9

| L. Taylor |

I have a couple of questions. I wonder if you could give us some sense of the geographic breakdown when you look at Insignia and how that fits in with your existing operations? |

| R. Wirta |

I might start by just describing their overall revenue allocation, and then I’ll be more specific in the major areas. As people on the call may be aware, Insignia is in really three businesses: the transaction and property management business, and the commercial area, which is the same business that we are in, and then also they are in the residential sales brokerage business in New York and the residential management business also in New York. Of their aggregate 2002 revenue, which they’ve published, of $711 million, their revenue allocation between really the two businesses, the residential business is $134 million approximately and the rest, roughly $575 million, is the brokerage and property management business. |

| So if you took that $575 million of business and you broke it down into geography, you’d have New York at roughly $180 million. You’d have the U.K. at roughly $122 million, France at $43 million, D.C. and Virginia at roughly $36 million, and then it trails down from there. |

| That’s basically the composite geographically where they are and by business line. So again, that just dealt with the commercial business. The residential business, which is that earlier $133 million, is all domiciled in New York. |

10

| L. Taylor |

Thanks. Looking at macro market conditions, I wonder well into the first quarter here if you can give us some sense. You say that transaction velocity is improving. In particular, are you guys seeing continued strong pace in terms of sales? Is that continuing to hold up, and any kind of pickup on the leasing side? |

| R. Wirta |

I might ask Brett White, our President, to respond to that question. Brett. |

| B. White |

Yes. I think the way that it seems to be shaping up is that we have seen improving trends in the velocity of lease transactions through the second half of 2002, and those trends continue for the time being. The sale transaction velocity has just been rock solid, very strong, the entire 2002 and remains so now. |

| L. Taylor |

Any comments geographically in terms of markets that are particularly strong or weak? |

11

| B. White |

The easy answer is this. Those markets that were strong in 2002 remain so now. Those that were weak are slowly improving. To be specific, the strongest markets for us generally have been, first, Europe. 2002 in Europe was just an exceptionally strong year across almost all the markets. We see currently no signs of that changing. In the States, as has been the case actually for almost two years, the strongest markets have been outside the major metropolitan centers on the coast so all the central markets have been quite good. The markets in Arizona, these types of places, have been good for us. |

| Then in the major marketplaces on the coast we’ve seen improving performance out of San Diego, Orange County, San Francisco. On the East Coast we’ve seen improving performance the last few quarters out of the lower East Coast, I call that kind of the Florida and Atlanta area. Boston had a decent, not a great, but a decent year. New York and D.C. probably at this point we would say are as bad as they’re going to get and are beginning to slowly improve. We see some fairly significant transactions getting ready to close in New York, which is quite encouraging. Our folks in D.C. have projected a pretty good increase in performance in 2003 over 2002. |

| L. Taylor |

Okay. Great. Thank you very much. Let me let somebody else have a chance to ask some questions. |

12

| R. Wirta |

Thanks, Larry. |

| Moderator |

Our next question is from the line of Brad Bousquet with Nomura Securities. Please go ahead. |

| B. Bousquet |

I just had a couple of questions with respect to the possible additional consideration for Insignia shareholders in connection with the asset sales over $45 million. The first was how is that $45 million figure arrived at? |

| R. Wirta |

The purchase and sale was filed today, which outlines the numbers, Brad, that are in the material. I think we’re somewhat limited in our disclosure ability because they are a public company. We’ve been counseled by their attorneys that they’re in “the quiet period.” I couldn’t describe in detail or even generally how we got there, but you could presume that was a price that was arrived at after some level of negotiation. |

| B. Bousquet |

It sounds like these are assets that the company isn’t determined to get. So if Insignia’s able to sell them that’s great, if not they would get a $45 million consideration. So would it be fair to assume that there is some sort of a discount implied there? |

13

| R. Wirta |

I wouldn’t look at it that way. I guess I’d think of it as an incentive to increase the stock price from $11.00 to something higher. |

| B. Bousquet |

Can you give any details on what exactly this asset package that’s up for sale encompasses? |

| R. Wirta |

Yes, I could certainly speak to that. Insignia has disclosed continuously in the past, and there are probably documents, a co-investment program where they, along with an equity partner, buy individual parcels of real estate with the intent of leasing them up and then harvesting profits over that based on that intensive management effort. So this portfolio is comprised of, I think there are 30 or 35 individual assets, where Insignia owns a general partnership position alongside an equity investor and, therefore, has a profit opportunities as that asset increases in value. |

| B. Bousquet |

In terms of the markets, where these are? |

| R. Wirta |

They’re generally all across the country and different property types. So they’re all in the U.S. |

14

| B. Bousquet |

Great. The last question is if the proceeds over $45 million on a pro rated basis exceed a dollar per share consideration, where does that additional money go? |

| R. Wirta |

It stays with the company. |

| B. Bousquet |

And you would basically assume that off the balance sheet? |

| R. Wirta |

Yes. The buyer would get the benefit above $12.00 a share. |

| B. Bousquet |

Great. Thank you. |

| R. Wirta |

Yes. My pleasure. |

| Moderator |

We have a question from the line of Chad Lu with Morgan Stanley. Please go ahead. |

| C. Lu |

You mentioned that the total leverage will remain unchanged or even decrease. Are you including any cost savings or other synergies in your calculation? |

| R. Wirta |

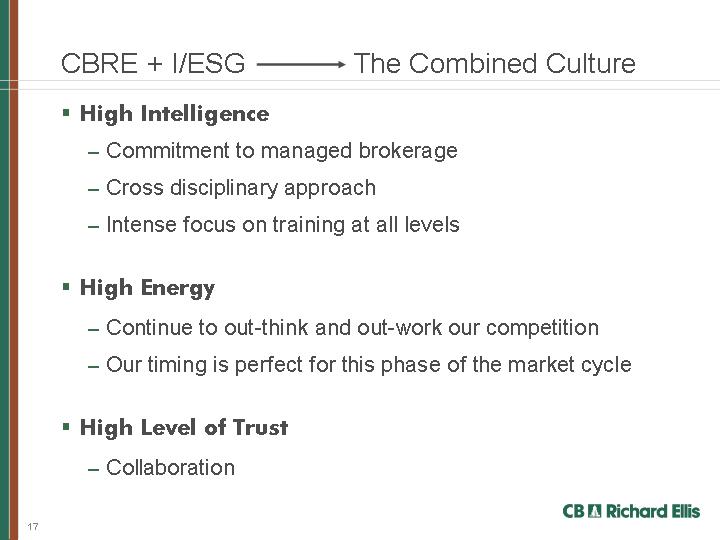

Yes. As you might imagine, where we have duplicate operations geographically there will be some opportunities in the management levels, and certainly in the back office support functions. As with any such integration areas, like accounting, IT, legal, and human relations, there will be some overlap of people, which present opportunities to reduce costs. |

15

| C. Lu |

Okay. Can you give us an estimate of what’s an upfront cost to realize those cost savings? |

| R. Wirta |

You mean the severance and other costs? |

| C. Lu |

Yes. |

| R. Wirta |

I’d really rather not at this point. We’re still in the midst of fine-tuning our own presentation on that. If you don’t mind, I’d like to wait on that. |

| C. Lu |

Okay. Thank you. |

| R. Wirta |

Yes. Thank you. |

| Moderator |

There are no additional questions at this time. Please continue. |

| R. Wirta |

Just in summary, I appreciate everyone being on the call. We’re actually quite pleased, as you might expect us to be, with our fourth quarter results. |

16

| We performed measurably better than last year, that is the ’01 fourth quarter, and we’re carrying, as Ken indicated, that momentum into 2003. |

| In addition, just an observation, three of the four major competitors we have at our size level have now reported, and we’re pleased to see relative to them that we were the only company that had at least flat revenue. They all had down revenue. We are the only company that had increased EBITDA. They all had decreasing EBITDA. So we’re quite proud of the job we did in both growing market share and improving our profitability and our margins, and hopefully we can continue to do that in 2003. Thanks for being on the call. Thank you, Tom. |

| Moderator |

Thank you. Ladies and gentlemen, this conference will be available for replay after 4:00 p.m. today until February 27th at midnight. You may access the AT&T Executive Playback Service at anytime by dialing 1-800-475-6701 and entering the access code of 675446. International participants may dial 1-320-365-3844. |

| That does conclude our conference for today. Thank you for your participation and for using AT&T’s Executive Teleconference Service. You may now disconnect. |

17

###

In connection with the merger, Insignia will be filing a proxy statement and other relevant documents concerning the transaction with the Securities and Exchange Commission (SEC). STOCKHOLDERS OF INSIGNIA ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders can obtain free copies of the proxy statement and other documents when they become available by contacting Corporate Communications, Insignia Financial Group, Inc., 200 Park Avenue, New York, New York 10166 (Telephone: (212) 984-6515). In addition, documents filed with the SEC by Insignia will be available free of charge at the SEC’s web site at www.sec.gov.

Information regarding the identity of the persons who may, under SEC rules, be deemed to be participants in the solicitation of stockholders of Insignia in connection with the transaction, and their interests in the solicitation, will be set forth in a proxy statement that will be filed by Insignia with the SEC.

Certain items discussed in this earnings conference call constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the companies to be materially different from any future results, performance, or achievements expressed or implied by such forward-looking statements. Statements which make reference to the expectations or beliefs of the companies or any of their management are such forward-looking statements, including statements concerning the performance of the companies or any of their business units, and the business outlook for, and the companies’ expected performance in 2003. Such forward-looking statements speak only as of the date of this earnings conference call. The companies expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the companies’ expectations with regard thereto or any change in events, conditions or circumstances upon which any such statement is based.

18

Filed by CBRE Holding, Inc.

Pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Insignia Financial Group, Inc.

Commission File No.: 001-14373

The following are slides from a presentation given by representatives of CB Richard Ellis Services, Inc. and Insignia Financial Group, Inc. to certain CB Richard Ellis employees on February 24, 2003: